There is no simple answer to the question, “What is the best Forex backtesting software?” because there is no single one-size-fits-all solution. The best tool for you depends directly on your trading style (manual or automated), the data accuracy you require, and your budget.

But before we dive into comparing popular platforms like MetaTrader, TradingView, or other specialized software, we first need to understand what exactly backtesting is and why it is considered so crucial for any serious trader.

This process helps you identify the strengths and weaknesses of your trading system before risking real capital. In this article, we will answer all of these questions.

- When using backtesting software, focusing on the security and confidentiality of your trading data is paramount.

- The software should provide offline testing capabilities or complete control over the data.

- The ability to provide detailed analysis and reporting on the strategy's strengths and weaknesses is vital for optimization.

- The choice of software should be based on the trader's trading style, requirements, and budget.

What is Backtesting in Forex and Why Does It Matter?

Backtesting is the process of testing a trading strategy against historical price data. The objective is to determine how the strategy would have performed in the past, enabling you to deploy it in the future with greater confidence.

This process allows you to identify the strengths and weaknesses of your trading system before risking real capital. Its significance lies in transforming trading from an activity based on guesswork and intuition into a data-driven approach.

Key Features of the Best Forex Backtesting Software

Choosing the right tool depends on your specific needs and trading style. However, the best software platforms share several key features.

Access to High-Quality Historical Data

The quality of your backtesting results is directly dependent on the quality of the historical data you use. This reflects the core computing principle of “Garbage In, Garbage Out” (GIGO).

- Low-Resolution Data (e.g., M1): This data records only the Open, High, Low, and Close (OHLC) prices for each one-minute candle. It does not capture the price volatility within that minute. This leads to inaccurate simulations, as your stop-loss could have been triggered by a rapid price spike that this data type fails to register.

- High-Fidelity Data (Tick Data): This data type records every single price change (a “tick”). This granular level of detail allows the simulation to mirror real market behavior much more closely, resulting in highly reliable backtest outcomes.

In short, to truly understand how your strategy would have performed, you need the most accurate data available. Otherwise, your test results can be completely misleading.

Ability to Test Multi-Asset and Multi-Time-Frame Strategies

The Forex market is highly interconnected. A robust strategy might require the simultaneous analysis of multiple currency pairs or time frames. The backtesting software must be capable of simulating such complex scenarios seamlessly.

- Multi-Time-Frame Analysis: A common example is using the daily (D1) time frame to identify the primary trend and then using the one-hour (H1) time frame to find a precise entry point in the direction of that trend. Basic software might force you to analyze these separately, but a powerful tool will allow you to access both time frames simultaneously and base trading decisions on their combined signals.

- Multi-Asset Analysis: Some strategies are based on inter-market correlations between currency pairs. For instance, a strategy might identify strength in the Australian Dollar (AUD), prompting a long position in AUD/JPY while simultaneously opening a short position in EUR/AUD. Your backtesting software must be able to accurately simulate such complex logic involving multiple assets.

Realistic Simulation of Market Conditions

A strategy that appears profitable on a “clean” price chart (without costs) may be entirely unprofitable in the real world. This feature is the crucial “reality check” that translates raw performance into practical, net results.

- Variable Spreads: The spread (the gap between the bid and ask price) is not fixed. It can widen significantly during major news releases or periods of low liquidity. If your software only uses a low, fixed spread, your results will be unrealistically optimistic. A good simulator must model variable spreads to see how your strategy survives volatile conditions.

- Slippage: This occurs when you place an order at one price, but it gets filled at a different (usually worse) price. This is common in fast-moving markets. The software must be able to simulate slippage to calculate your profits more realistically.

- Commissions: This fee is typically charged by ECN brokers and is a fixed cost per lot traded. For scalping strategies that execute a high volume of trades, commissions can erode a significant portion of the profits. Ignoring this in a backtest is a critical error.

Intuitive User Interface (UI) and Advanced Reporting Tools

Even the most powerful software is useless if you cannot operate it easily or interpret its results.

- User Interface: You should be able to input your strategy’s rules simply, without needing complex programming knowledge (unless you choose to). An intuitive UI lets you focus on the strategy itself, not the tool.

- Reporting: The final report provides your strategy’s key performance metrics. A good report goes far beyond “total profit” and answers the following critical questions:

- Maximum Drawdown: This is the most important risk metric. It shows the largest percentage decline your account experienced from a peak to its subsequent low. Can you psychologically tolerate a 30% drawdown, even if you know the strategy is ultimately profitable?

- Profit Factor: This metric (Gross Profit divided by Gross Loss) shows how much money the strategy made for every dollar it lost. A value above 1.5 is generally considered robust.

- Detailed Trade Analysis: The report should allow you to examine individual trades. Perhaps your strategy is only profitable on Tuesdays, or it performs poorly on the GBP/JPY pair. These details are vital for strategy optimization.

The best Forex backtesting software must support plugins and custom scripts. This allows you to test proprietary indicators and custom automated trading robots (Expert Advisors) against real market data. This flexibility is essential for developing, optimizing, and testing professional algorithmic strategies.

The Best Forex Backtesting Software

In this section, we will review the most popular and effective tools available.

MetaTrader Strategy Tester (MT4/MT5): Automated Backtesting with Historical Data and Realistic Simulation

The MetaTrader Strategy Tester is available for free as a built-in feature within the MetaTrader software. Its primary application is testing automated trading robots (known as Expert Advisors or EAs). You can run an EA on historical data to see how it would have performed and to optimize its parameters.

- Best for: Traders who use or intend to develop automated robots (EAs).

- Pros:

- Free: No additional cost; it comes with the platform.

- Integrated: Fully seamless with your trading environment.

- Optimization Capable: You can test various robot settings to find the best results.

- Cons:

- Data Quality: Test accuracy is entirely dependent on the historical data provided by your broker, which is not always precise.

- Weak for Manual Testing: This tool is not designed for simulating manual trades, and using it for this purpose is difficult.

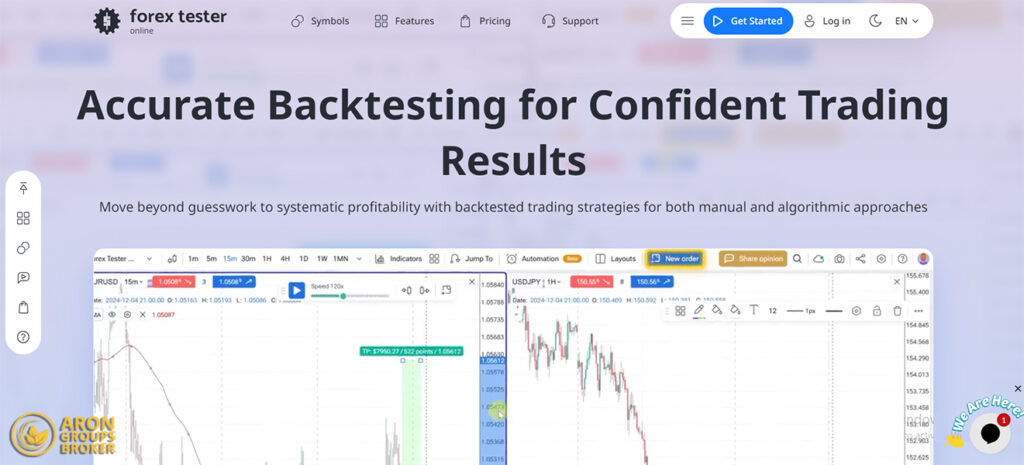

Forex Tester: Dedicated Training and Practice Software with an Advanced Simulation Environment

This software is a complete, dedicated simulation environment. Imagine you could rewind time and trade the market again, but at your own desired speed. Forex Tester does exactly that. This tool is unparalleled for practicing, trial-and-error testing of manual strategies, and honing decision-making skills in near-realistic conditions.

- Best for: Manual traders who want to improve their skills without real-world risk.

- Pros:

- Highly Realistic Simulation: Accurately simulates variable spreads, slippage, and other real market conditions.

- High-Quality Data: Provides the option to acquire highly accurate historical tick data.

- Time-Saving: You can practice several years of market data within a few hours or days.

- Cons:

- Paid Software: Both the software itself and its high-quality data require purchase.

NinjaTrader: Professional Platform with Advanced Reporting and High-Fidelity Simulation

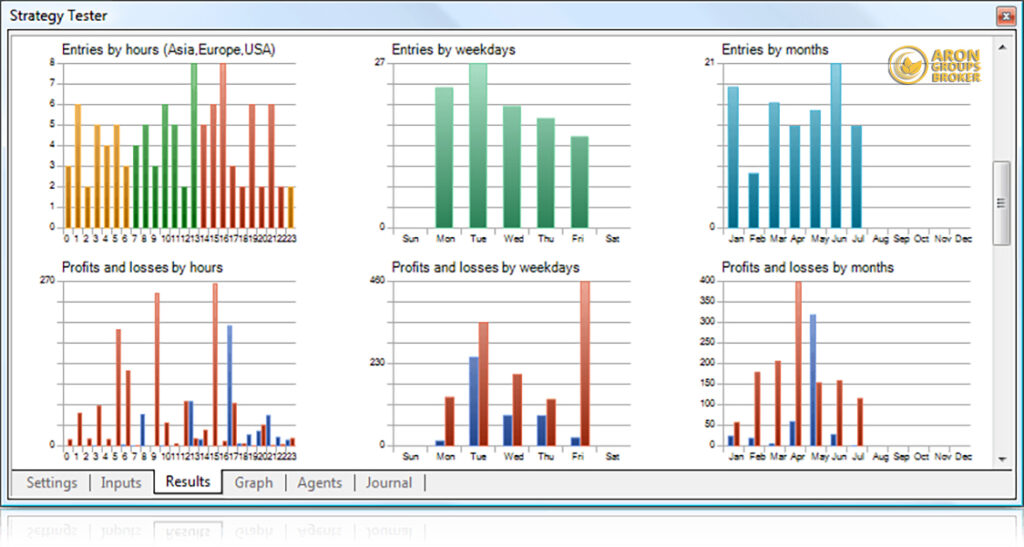

NinjaTrader is a comprehensive trading platform for professional traders, offering powerful backtesting tools. Its main differentiator is its highly detailed and comprehensive analytical reports. The software allows you to deeply analyze your strategy’s performance from multiple angles (such as risk/reward analysis, performance during different trading sessions, etc.).

- Best for: Professional traders and strategy developers who require precise and advanced statistical analysis.

- Pros:

- Exceptional Reporting: Provides comprehensive statistical analysis of performance.

- Accurate Simulation: Replicates market conditions with high fidelity.

- High Flexibility: Suitable for both automated and manual backtesting.

- Cons:

- Complex: The user interface and features can be overwhelming for beginners.

- Cost: Accessing full capabilities requires purchasing a license or subscription.

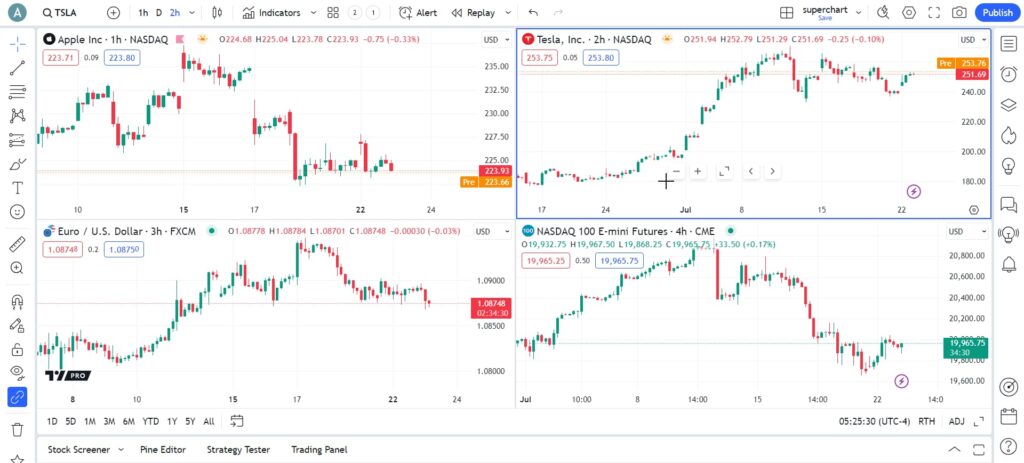

TradingView (Bar Replay Mode): Online Backtesting Focused on Technical Analysis

This tool is one of the simplest and most accessible methods for visual backtesting. The “Bar Replay” feature in TradingView allows you to go to any point in the chart’s history and then advance the market candle by candle. This method is excellent for practicing technical analysis, price action, and identifying chart patterns.

- Best for: Traders whose strategies rely heavily on visual chart analysis.

- Pros:

- Very Simple and Fluid: Extremely easy to use.

- Quick Access: Available on any browser; no heavy software installation is required.

- Ideal for Learning: The best way to “train your eye” to recognize trading setups.

- Cons:

- No Statistical Reporting: This tool doesn’t provide detailed reports on profit, loss, or drawdown; it’s primarily for visual practice.

- Limited Free Version: Using it on intraday time frames (lower than Daily) requires a paid subscription.

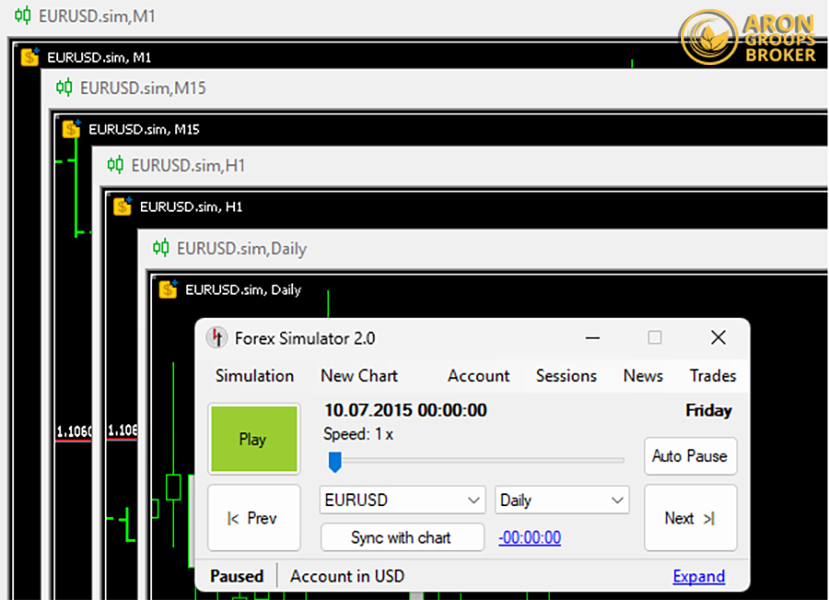

Soft4FX Simulator: A Trade Simulator Focused on Practice and Realistic Market Experience

This software is a plugin for MetaTrader that solves its weakness in manual backtesting. In effect, Soft4FX brings the simulation capabilities of Forex Tester into the familiar MetaTrader environment. If you are comfortable with MT4/MT5 but need a powerful tool for practicing manual trading, this is an excellent, cost-effective option.

- Best for: Users who want to stay within the MetaTrader ecosystem but require professional manual simulation features.

- Pros:

- Lower Cost: More affordable than standalone software like Forex Tester.

- Full Integration: Works directly with your charts and indicators in MetaTrader.

- Cons:

- MetaTrader-Dependent: As a plugin, it cannot function as a standalone application.

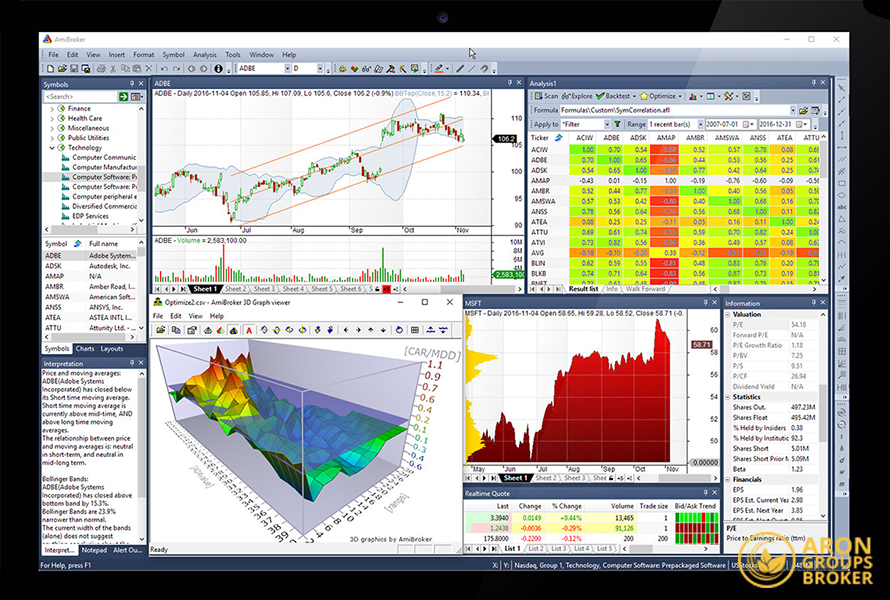

Amibroker: Advanced Analysis and Backtesting Software with Full Customization

Amibroker is a tool for professional-level traders. Its primary focus is on processing speed and power. With Amibroker, you can test complex strategies across a large portfolio of assets (e.g., all major currency pairs) in a matter of seconds. This tool is designed for heavy statistical analysis, not manual practice.

- Best for: Algorithmic traders and quantitative analysts (Quants) who deal with large datasets and require high-speed processing.

- Pros:

- Exceptional Speed: The fastest software for conducting extensive portfolio-level backtests.

- Unmatched Customization: Its simple programming language (AFL) allows you to implement almost any idea.

- Cons:

- Steep Learning Curve: Not suitable for beginners and requires technical knowledge.

- Focus on Analysis, Not Simulation: It is not designed for the practical simulation of trading.

Forex Backtesting Software Comparison Table

| Feature | MetaTrader Tester | Forex Tester | NinjaTrader | TradingView Replay |

|---|---|---|---|---|

| Primary Test Type | Automated (EAs) | Manual | Auto & Manual | Visual & Manual |

| Simulation Accuracy | Medium | Very High | High | Low (no costs) |

| Reporting | Good (for EAs) | Comprehensive | Very Advanced | None |

| Cost | Free | One-Time Fee | Subscription/License | Subscription |

| Best For | Algorithmic Traders | Manual Traders | Professional Traders | Technical Analysts |

When selecting the best Forex backtesting software, maintaining the security and confidentiality of your trading data is critical. Software that stores data on external servers or requires a constant internet connection may carry the risk of exposing your proprietary strategy. It is preferable to choose software that performs backtesting offline or gives you complete control over your data to ensure the confidentiality of your trading logic.

How to Effectively Use Backtesting Software

Having powerful backtesting software is only half the battle. True success lies in how you use it. If your testing process is flawed or unrealistic, your results will be equally flawed. Effectively using these tools is a three-step process: data preparation, meticulous test setup, and in-depth analysis of the results.

Selecting Suitable and Accurate Historical Data

Your results are only as reliable as the data you feed the software.

- Data Accuracy: The best data type is tick data, which records every single price change. If you use lower-resolution data (like M1 or H1), the software does not know what happened within that candle, leading to inaccurate simulations.

- Data Duration: You need a sufficient volume of data for the results to be statistically significant. Backtesting on only 3 months of data is insufficient. You must test your strategy over several years at a minimum (e.g., 3-5 years).

- Market Condition Variety: Your data must cover all market cycles: bull markets, bear markets, and ranging (sideways) markets. If you test your trend-following strategy only during a strong bullish period, you will get fantastic results, but the strategy will fail as soon as the market enters a ranging phase.

Defining Strategy Parameters and Test Configuration

In this step, you must define your strategy’s rules and configure the test environment to be as realistic as possible.

- Precise Strategy Definition: Before starting, all rules must be clearly defined. Nothing can be ambiguous:

- The exact entry trigger (e.g., 5-period Moving Average crossing the 20-period Moving Average).

- The exact stop-loss placement.

- The exact take-profit target.

- Risk management rules (e.g., risking no more than 1% of the total account per trade).

- Simulating Transaction Costs: A proper test must account for all trading costs. If you set these to zero, your results will be unrealistically optimistic:

- Spread: Input the spread. It is best to use an average or variable spread, not zero.

- Commission: If your broker charges commissions, they must be factored into the calculations.

- Slippage: In volatile markets, your execution price may differ from the price you intended. Professional software allows you to simulate a degree of slippage.

Analyzing Backtest Results and Identifying Strengths and Weaknesses

This is the most critical step. Many novice traders make the mistake of only looking at the final “Net Profit” figure. The backtest report is your strategy’s performance report and must be analyzed deeply.

- Reviewing Key Profitability Metrics:

- Profit Factor: Total profit divided by total loss (e.g., a factor of 2.0 means you made $2 for every $1 lost).

- Win Rate: What percentage of your total trades were profitable? (Note: A strategy with a low win rate, e.g., 40%, can still be highly profitable if its average wins are significantly larger than its average losses).

- Focusing on Risk Metrics (The Weaknesses):

- Maximum Drawdown (Max DD): This is the most important number in your report. It shows the largest peak-to-trough decline your account equity experienced. This figure represents the real “pain” of the strategy. If the net profit is 500% but the Max DD is 60%, can you psychologically tolerate losing 60% of your account?

- Maximum Consecutive Losses: In the worst-case scenario, how many losing trades did the strategy have in a row? Can you maintain discipline and stick to the strategy after 10 consecutive losses?

Analyzing these numbers helps you understand not only if the strategy is profitable, but also if executing it is compatible with your personality and risk tolerance.

Advantages and Limitations of Backtesting in Forex

Here, we outline the key benefits and drawbacks of Forex backtesting:

Key Benefits of Backtesting in Forex

- Elimination of Financial Risk: You can test trading strategies repeatedly on historical data without risking even a single dollar of your real capital.

- Time Efficiency: Instead of waiting months or years to observe a strategy’s performance in a live market, you can simulate several years of historical data in just a few hours or days.

- Objective Strategy Optimization: Backtesting allows you to make data-driven adjustments to various parameters (such as take-profit levels, stop-loss levels, or indicator settings) to find the optimal configuration for your strategy.

- Identifying Weaknesses and Managing Risk: Backtest results reveal critical risk metrics like Maximum Drawdown (Max DD) and maximum consecutive losses. This helps you understand the strategy’s risk profile before live deployment.

- Building Confidence and Discipline: When you see that your strategy has proven successful over the long term in historical tests (despite inevitable losing streaks), you gain the confidence needed to adhere to it during difficult periods in the live market.

Limitations of Backtesting in Forex

- Past Performance Does Not Guarantee Future Results: This is the most critical limitation. The fact that a strategy was profitable in the past offers no guarantee it will perform the same way in the future, as market conditions and dynamics are constantly changing.

- Over-Optimization (Curve-Fitting): This is a common pitfall where a strategy’s parameters are manipulated so much that they are perfectly tailored to past historical data. Such a curve-fit strategy typically fails in a live market environment.

- Poor Data Quality: If you use low-quality, incomplete, or gappy historical data, your backtest results will be completely inaccurate and misleading.

- Ignoring Real Market Conditions: Many simplistic backtests do not account for real transaction costs like variable spreads (especially during news releases), slippage, and commissions. These costs can turn a strategy that appeared “profitable” in the test into a losing one in practice.

- Disregarding the Psychological Factor: A backtest cannot simulate human emotions like fear, greed, and hesitation. Adhering to a strategy in a simulation is simple, but executing that same strategy flawlessly in a live market, under psychological pressure, is far more difficult.

Conclusion

Selecting the best Forex backtesting software ultimately depends on your trading style and goals. If you are an algorithmic trader, MetaTrader is an excellent starting point. If you aim to sharpen your manual trading skills, Forex Tester is an invaluable tool. For quick, visual analysis, TradingView is unparalleled.

The most important takeaway is to view backtesting as an integral part of your strategy development process. It is the tool that allows you to approach the financial markets with a realistic, data-driven perspective.