The Forex market is known for its unpredictability; a single economic announcement or interest rate shift can cause sudden trend reversals, catching traders off guard. In such conditions, many traders turn to hedging, a strategy akin to opening an umbrella in a storm. Hedging allows you to control potential losses and manage your trading positions without undue stress. This article will explain exactly what hedging is, how it’s applied in the Forex market, and when it’s a worthwhile strategy to consider.

- Many brokers have different internal policies and do not permit direct hedging on a single currency pair.

- Hedging doesn't completely eliminate risk; instead, it transforms or transfers it into a more manageable form.

- Executing a hedge requires significant psychological discipline, as simultaneously seeing one position in profit and another in loss can be confusing for novice traders.

- Some traders use hedging as a temporary measure to buy themselves time to reassess their market outlook and strategy.

What is Hedging in Forex and Why is it Important?

According to investopedia, hedging is a risk management strategy that traders use to protect their positions from adverse price movements. Put simply, hedging is like taking out an insurance policy on your trades. The primary goal of a hedge is not to generate profit, but rather to reduce or limit potential losses.

The importance of this strategy becomes clear when the market experiences high volatility or unexpected events, such as major economic news releases. In these situations, an open position can quickly become unprofitable. Hedging allows a trader to neutralize the negative effects of such fluctuations by opening an opposing or related position.

Example: Imagine you anticipate that the EUR/USD currency pair will increase in value, so you open a long position (a buy order). However, you are also concerned about an upcoming unemployment data release in the United States, which could strengthen the dollar and cause the EUR/USD to fall. To hedge this risk, you could open a short position (a sell order) on the same pair. If your initial forecast is incorrect and the price drops, the profit from your short position would offset or limit the loss from your long position.

How Hedging in Forex Differs from Other Markets

- High Liquidity: With its massive daily trading volume, the forex market is the most liquid market in the world. This allows traders to open and close hedge positions easily and at a low cost (i.e., tight spreads).

- 24-Hour Access: The forex market operates 24 hours a day, five days a week. This gives traders the flexibility to react to global news and events and implement their hedging strategies at any time.

- Lower Costs: Compared to the stock or commodity markets, the cost of opening a hedge position in forex is typically lower due to tighter spreads and the absence of commissions on many account types.

- Use of Leverage: Leverage in forex allows traders to control larger positions with a smaller amount of capital. While this can amplify gains, it can also magnify losses, so careful risk management is essential when using it in a hedging strategy.

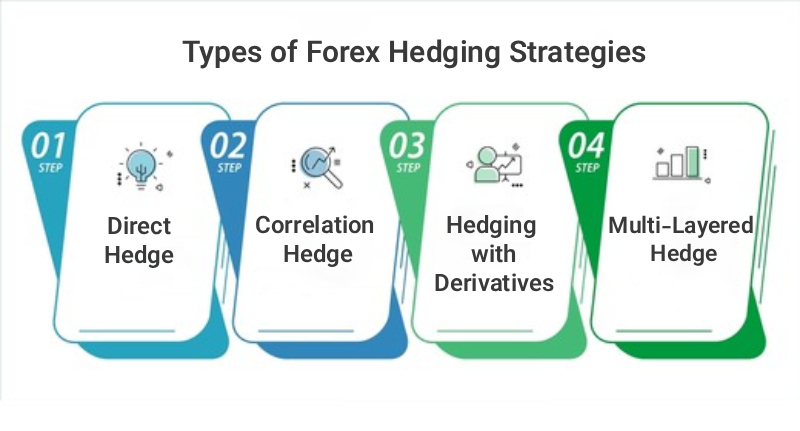

Types of Forex Hedging Strategies

Various trading strategies can be used for hedging in forex, each suitable for different market conditions.

Direct Hedge

The simplest form of hedging is a direct hedge. This method involves simultaneously opening a long position (buy) and a short position (sell) on the same currency pair. This effectively locks in your profit or loss, as your net equity will remain constant as long as both positions are open.

Example: Suppose you have bought 1 lot of EUR/USD at a price of 1.0750. To implement a direct hedge, you would simultaneously sell 1 lot of EUR/USD at the same price. In this state, any price fluctuation will not affect your account’s balance. This strategy is commonly used to lock in gains or limit losses in the short term, especially ahead of a major news event.

Correlation Hedge

This strategy involves using two currency pairs that are correlated with each other. A correlation can be positive (the pairs move in the same direction) or negative (they move in opposite directions).

- Positive Correlation: To hedge a long position on currency pair A, you would open a short position on currency pair B, which has a high positive correlation with A.

Example: The EUR/USD and GBP/USD pairs have a high positive correlation because both are traded against the US Dollar. If you hold a long position on EUR/USD and are concerned about potential Euro weakness, you could hedge your risk by opening a short position on GBP/USD.

- Negative Correlation: To hedge a long position on currency pair C, you would open another long position on currency pair D, which has a strong negative correlation with C.

Example: The EUR/USD and USD/CHF pairs have a strong negative correlation. If you have a long position on EUR/USD, you can hedge it by also opening a long position on USD/CHF. An increase in the value of EUR/USD is typically accompanied by a decrease in the value of USD/CHF.

Hedging in low-liquidity markets can itself cause price fluctuations, so hedge sizes should be aligned with market liquidity.

Hedging with Derivatives (Options, Futures/Forwards)

Professional traders and large institutions often use derivative instruments like options and futures contracts for hedging.

- Options: An options contract gives the holder the right, but not the obligation, to buy or sell an asset at a specified strike price on or before a certain expiration date.

Example: If you hold a large long position on EUR/USD and are worried about a price decline, you could purchase a put option. If the price of EUR/USD falls, the value of your put option will increase, offsetting the loss on your primary position.

- Futures Contracts: These contracts obligate the trader to buy or sell an asset at a predetermined price on a specific date in the future. Example: A European importing company that needs to pay a supplier in US dollars in three months can protect itself against a rise in the EUR/USD exchange rate by entering into a short futures contract for the pair.

Complex or Multi-Layered Hedge

A complex hedge is an advanced strategy that combines two or more hedging methods simultaneously to manage multifaceted risks. This approach is typically used by large corporations, financial institutions, and professional traders who face multiple types of risk concurrently.

The goal of a multi-layered hedge is to create a customized “defensive shield” that protects not only against adverse movements in a single currency pair but also against a broader set of risks, such as volatility across different currencies, interest rate changes, or commodity price fluctuations.

Example: Consider a German company that receives revenue in US Dollars (USD) from sales in America and pays for components from Japan in Japanese Yen (JPY).

This company faces a dual currency risk:

- Revenue Risk: If the dollar weakens against the euro, its USD revenue will be worth less when converted.

- Cost Risk: If the yen strengthens against the euro, its component costs will increase.

To manage this, the company uses a multi-layered hedge:

- For its USD Revenue (Lower Risk): It enters into a forward contract to “lock in” the USD to EUR exchange rate for a future date. This guarantees its revenue stream against currency fluctuations.

- For its JPY Costs (Higher Risk): It purchases an options contract. This acts like an insurance policy by setting a “price ceiling” for buying yen.

- If the yen becomes more expensive, the company exercises the option to control its costs.

- If the yen becomes cheaper, the company lets the option expire and buys yen at the more attractive, lower market price.

By combining these two instruments, the company secures its revenue and caps its costs while retaining the flexibility to benefit from favorable market movements.

Using non-currency instruments like gold, oil, or indices can hedge market risk even when they aren’t directly correlated with the main currency pair.

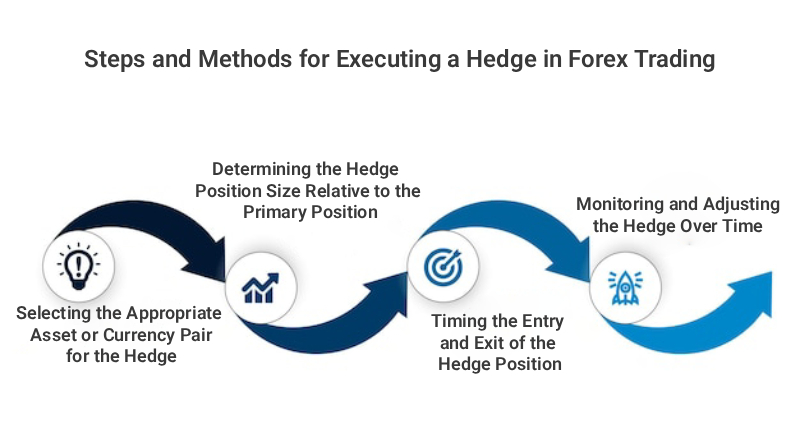

Steps and Methods for Executing a Hedge in Forex Trading

Implementing a successful hedging strategy requires careful planning.

Selecting the Appropriate Asset or Currency Pair for the Hedge

Based on your chosen strategy, you must decide whether to use the same currency pair (for a direct hedge) or a correlated pair (for a correlation hedge). Your choice should be based on a thorough analysis of correlations and current market conditions.

Determining the Hedge Position Size Relative to the Primary Position

The size of the hedge position should be proportional to your primary position. Typically, for a full hedge, the volume of the hedge position is equal to the volume of the primary position (e.g., a 1 lot buy versus a 1 lot sell). However, it’s also possible to implement a partial hedge, where only a portion of the risk is covered.

Timing the Entry and Exit of the Hedge Position

The timing of your entry into a hedge position is critical. This is usually done just before a high-risk event or when your analysis suggests a probable market move against your position. You must also have a clear plan for when to exit both the primary and the hedge positions.

Monitoring and Adjusting the Hedge Over Time

Markets are dynamic, and correlations can change. Therefore, it is essential to continuously monitor your hedging strategy and adjust it as necessary to remain effective.

Advantages and Disadvantages of Hedging in Forex

Let’s review the pros and cons of hedging.

Advantages of Hedging

- Risk Reduction: This is the primary reason for using a hedge. By opening an opposing position, you effectively create a defensive shield for your main trade, protecting your capital from sudden and severe market movements.

- Peace of Mind: Knowing that your trade is insured against significant losses allows you to make decisions with less stress. This composure helps you avoid emotional decision-making during periods of market volatility.

- Flexibility in Uncertain Conditions: Hedging gives you the option to keep a protected position open instead of closing it prematurely. This allows you to wait for market conditions to become clearer before deciding whether to continue with the trade or exit.

- Better Management During News Events: You can hedge your position before major economic news releases, which often cause sharp price swings. This allows you to weather the “storm” of the news without having to exit the market.

Disadvantages of Hedging

- Reduced Profit Potential: Hedging is a double-edged sword. Just as it limits your losses, it also caps your potential profits. If the market moves in favor of your primary trade, the gains will be neutralized by the losses on the hedge position.

- Transaction Costs: Opening a new position to hedge is not free. You will incur costs such as the spread, commissions (on some accounts), and swaps (overnight financing fees) for the second trade, all of which can eat into your profits.

- Complexity in Execution: Hedging strategies, especially methods like correlation hedging, require knowledge, detailed analysis, and experience. Improper execution can lead to greater losses or confusion in managing your trades.

- Regulatory and Broker Restrictions: Not all brokers permit direct hedging (simultaneously opening a long and short position on the same instrument). Some regulatory frameworks, such as the FIFO (First-In, First-Out) rule in the United States, prohibit this practice, so it’s essential to be aware of your broker’s policies.

Golden Rules for Successful Forex Hedging

To succeed in hedging, you need to consider several key points:

How to Maintain a Healthy Risk-to-Reward Ratio in a Hedging Strategy

The goal of hedging is to ensure a trade, not to generate profit. You must accept that to reduce risk, you are sacrificing some of your potential profit. Always factor the costs of hedging, such as spreads and swaps, into your calculations.

Think of hedging like buying car insurance. You pay a premium every month. 99% of the time, you don’t have an accident, and that money might seem “wasted.” However, you pay that cost to protect yourself against the 1% chance of a catastrophic event.

A practical way to maintain a good risk-to-reward ratio is to use hedging intelligently instead of constantly applying full hedges:

- Temporary Hedging: Only use a hedge during high-risk periods, such as before major economic news releases, central bank speeches, or over weekends. Remove the hedge once the uncertainty has passed.

- Partial Hedging: Instead of opening a hedge position of equal volume, hedge only a portion of your primary position (e.g., 50%). This way, you reduce your risk while still allowing for some profit potential if the market moves in your favor.

The Role of Liquidity and Spreads in Hedging Efficiency

Choosing the right instrument for hedging is as important as the strategy itself. A hedge’s efficiency is directly tied to its costs, which are determined by liquidity and the spread.

- Liquidity: This refers to the presence of a large number of buyers and sellers in the market. In highly liquid markets (like major currency pairs such as EUR/USD or USD/JPY), you can open or close your position at any moment at a fair price and without delay. However, in an exotic pair with low liquidity, opening a hedge position may result in slippage, increasing your overall cost.

- Spread: The difference between the bid and ask price is the primary cost of entering any trade. Since hedging requires opening a new trade, you must pay another spread.

Example: If the spread on EUR/USD is around 0.5 pips, the cost of hedging is negligible. But if you try to hedge an exotic pair with a 50-pip spread, you incur a significant cost from the outset, which could render the entire strategy ineffective.

Practical Tip: Always use major currency pairs or pairs with the highest liquidity and tightest spreads for hedging. This ensures that your “insurance cost” remains as low as possible.

In volatile markets and around major news events, improper hedging can trigger small flash crashes in your portfolio, so always adjust your hedge position size according to market volatility.

Aligning Hedging with Your Overall Forex Trading Strategy

Hedging should not be an emotional reaction driven by fear. If a trade moves into a loss and you open an opposing position out of panic, that isn’t hedging, it’s locking in a loss and creating more confusion.

A successful hedging strategy is predefined in your trading plan. Your plan should answer these questions:

- When will I hedge? (e.g., “Only when I have a profitable position and a major data release is imminent.”)

- What method will I use? (e.g., “I will use a direct hedge for EUR/USD trades and the correlated USD/CHF pair for other trades.”)

- What will the hedge position size be? (A full or partial hedge?)

- When will I exit the hedge? (This is the most critical part. Will it be after the news release? Based on a technical signal? Will I close both positions simultaneously?)

Practical Tip: View hedging as a “tool” in your trading toolbox, not a “panic button.” Its use should be based on logic and predetermined rules, not on spur-of-the-moment emotions.

The Importance of Using a Demo Account to Practice Hedging

Managing two opposing positions (one long, one short) at the same time can be psychologically and technically challenging. A demo account is the best and safest environment to master this skill.

In a demo account, you can practice various scenarios without financial risk:

- Execution Speed: Learn how to open a hedge position quickly and accurately during critical market moments.

- Observing Costs: See firsthand how spreads and swaps affect the net outcome of two open positions.

- Psychological Management: Get accustomed to seeing one position in profit while the other is in loss.

- Testing Exit Strategies: You can experiment with different ways to unwind your positions. Is it better to close the hedge first or the primary trade? The answer depends on market conditions, and practicing on a demo account will help you make the best decision.

Practical Tip: Before even considering using hedging in a live account, implement at least 10 to 15 different hedging scenarios in a demo account. Document and analyze the results to gain a deep, practical understanding of the strategy.

Conclusion

Hedging in forex is a powerful risk management tool, but it is not a magic solution for profitability. This strategy enables traders to protect their capital in volatile markets, but it also limits potential profits. A deep understanding of different strategies, accurate cost calculation, and alignment with an overall trading plan are the keys to using hedging successfully.

Remember that you use hedging to ensure your survival in the market, not necessarily to profit from the hedge strategy itself.