If you’ve only been using TradingView to analyze charts up until now, it’s time to take the next step. This platform is not just a charting tool—it’s a complete environment for placing and managing orders that can make a significant difference in your trading results.

In this guide, you’ll learn how to place Market and Limit orders in TradingView, set up Stop Loss levels, manage open positions, and even adjust your orders with more professional precision. If your goal is to move from being just an analyst to becoming a skilled trader, you won’t want to miss what comes next.

- On TradingView, everything from placing orders to setting Take Profit and Stop Loss levels is done visually and can be edited directly on the chart.

- Before entering the live market, you can test your strategies with TradingView’s Paper Trading account and build practical skills without financial risk.

- In TradingView, active positions can be monitored and modified either from the Order List or directly on the chart.

Why Is Learning Order Placement on TradingView Important?

TradingView is not just a trading platform; it’s a comprehensive ecosystem that combines powerful trading and analytical tools, covering all major financial markets—including forex, cryptocurrencies, stocks, and more.

As noted on TradingView, the platform is available on mobile, desktop, and web versions, giving traders the ability to place and manage orders directly from the chart. This feature allows traders to execute both technical analysis and order placement in a single, integrated environment, eliminating the need to switch between multiple platforms.

The primary advantage of mastering order placement in TradingView is the speed and accuracy of execution. With just a few clicks, traders can open buy or sell orders straight from the chart, reducing the risk of errors in entering price levels, trade size, or order types. In fast-moving markets like forex or crypto, those few extra seconds can be the difference between securing profit and suffering a significant loss.

TradingView also offers advanced functionalities such as setting Stop Loss, Take Profit, and pending orders directly on the chart. This ensures more precise risk management and more professional trade planning.

Additionally, tools like Supercharts and the Order Panel give traders the ability to place trades while analyzing, visualize orders graphically on the chart, and even adjust entry or exit points by simply dragging and dropping lines. These features simplify the trading process and make decision-making faster, smoother, and more efficient.

The Difference Between Order Placement on Brokers and TradingView

While placing orders directly through brokers is always possible, TradingView serves as an advanced interface that makes the process more intuitive, faster, and seamlessly integrated thanks to its robust graphical environment and user-friendly design.

If your broker supports the TradingView trading platform, you can connect your trading account to your broker or exchange directly through the Trading Panel. This allows you to execute trades straight from TradingView without switching between platforms.

However, it’s important to understand that TradingView itself is not a broker or an exchange; it only acts as a frontend interface. This means that when you connect your account via the Trading Panel, all orders are executed and stored on your broker’s servers, not on TradingView’s servers.

The Trading Panel acts as a bridge between TradingView’s analytical platform and the trading infrastructure of your broker or exchange.

Types of Orders in TradingView

One of TradingView’s key advantages is that it allows you to place and manage different types of Forex orders directly from the chart. Below, we’ll review the four main types of orders supported on the platform.

If your goal is to practice and test strategies, you can use TradingView’s Paper Trading account. This feature lets you simulate order placement without the need for MetaTrader or a live broker account, helping you refine your trading skills in a risk-free environment.

Market Order in TradingView

A Market Order is one of the simplest and most widely used order types in financial markets. With this order, a trader buys or sells an asset at the current market price. In other words, once a market order is placed, it is executed immediately at the best available price in the market.

Place a Market Order in TradingView is as follows:

- In the Trading Panel (or the Paper Trading page), click on Trade.

- The Order panel and Depth of Market (DoM) will open on the right side of the chart.

- Choose whether you want to place a Buy or Sell order.

- Set the Order Type to Market.

- Define your Take Profit and Stop Loss levels.

- Finally, click on the Buy or Sell button at the bottom of the column to execute the order.

Limit Order in TradingView

A Limit Order is an order type where the trader specifies that the trade should only be executed once the asset’s price reaches a predefined level or better. Put simply, you set your desired entry or exit price, and the order will only be filled if the market touches that price or offers a more favorable one.

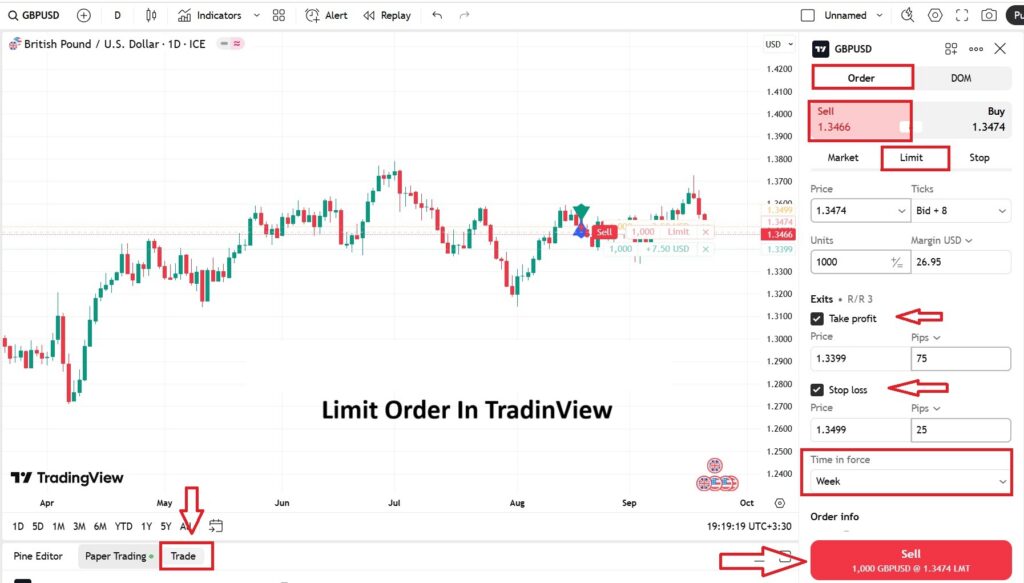

How to Place a Limit Order in TradingView?

- Open the Order Panel on the price chart, or click on Paper Trading to enable trading in the simulated environment.

- Click on Trade to display the order column on the right side of the chart.

- Under Order, choose whether you want to place a Buy or Sell order.

- Change the Order Type to Limit.

- Enter your Limit Price and Order Size.

- Optionally, set your Take Profit and Stop Loss levels for better risk management.

- In the Time in Force (TIF) field, define how long the order should remain active.

- Finally, click Buy or Sell to activate the order, which will be executed once the market reaches your specified price.

Stop Order in Tradingview

A Stop Order is an order type that becomes active once the market price reaches a specific level defined by the trader.

According to Tradingview, when the price hits that level, the stop order is automatically converted into a Market Order and executed immediately at the best available price. This type of order is commonly used either to control risk (by placing a stop-loss) or to enter trades on a breakout.

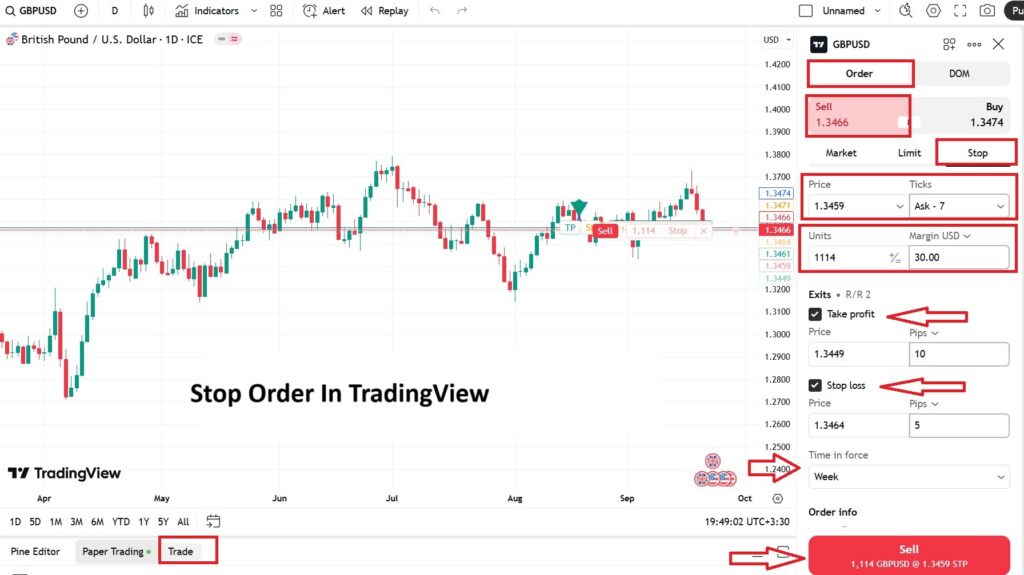

Place a Stop Order in TradingView is as follows:

- Open the Trading Panel or go to the Paper Trading page in TradingView.

- Click on Trade to open the order window.

- Under Order, select the trade direction (Buy or Sell).

- Change the Order Type to Stop.

- Enter the Stop Price (the trigger level at which the order will be activated).

- Optionally, set Take Profit and Stop Loss levels to better manage risk.

- In the Time in Force (TIF) field, specify how long the order should remain valid.

- Finally, confirm the order. Once the market price reaches the stop level, the order will be triggered and executed as a market order.

Stop Limit Order in TradingView

A Stop Limit Order is a combination of a stop order and a limit order. Once the market price reaches the specified stop level, the order is triggered and converted into a Limit Order. This means the trade will only be executed if the market price reaches the limit price or better. While this method gives the trader more control over the execution price, it carries the risk that if the market moves quickly past the limit price, the order may remain unfilled.

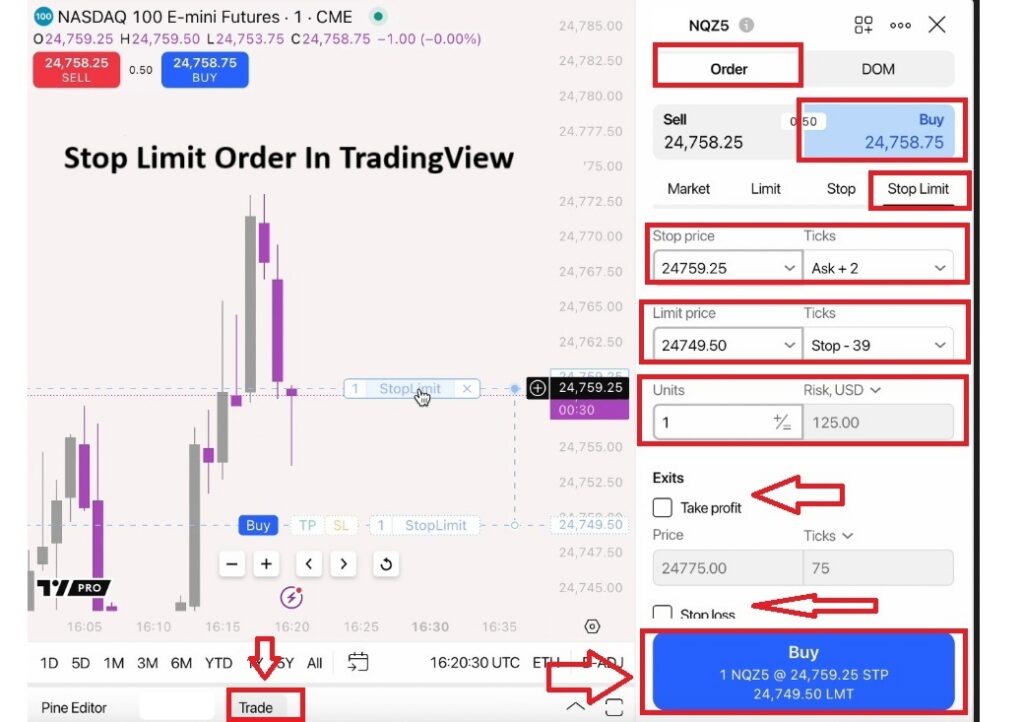

Place a Stop Limit Order in TradingView is as follows:

- After opening the Trading Panel, click on Trade to display the order window.

- Under Order, choose the trade direction (Buy or Sell).

- Change the Order Type to Stop Limit.

- Set the Stop Price, which acts as the trigger. Once the market reaches this level, the order will be activated.

- Define the Limit Price, which is the level at which the order will actually be executed if the market reaches it.

- Optionally, set Take Profit and Stop Loss levels for better risk management, and specify the order duration in the Time in Force (TIF) field.

- Finally, confirm the order. Once the stop is triggered, the order will convert into a limit order and will only be executed if the market price is at or better than your limit.

How to Set Stop Loss and Take Profit in TradingView When Placing Orders

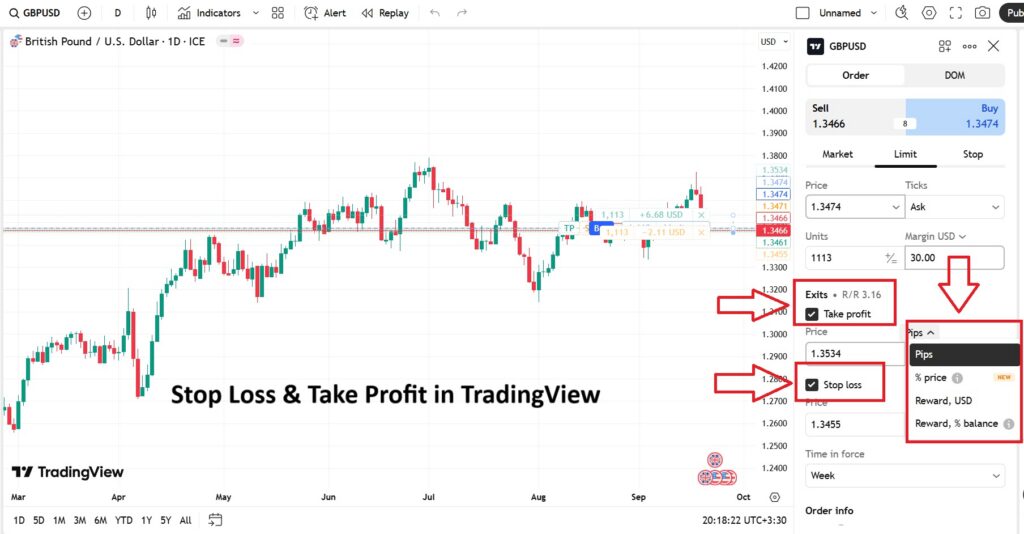

In TradingView, you can define your Stop Loss and Take Profit in four different ways. These methods provide flexibility depending on your trading style and account size:

- Ticks: Setting stop loss based on ticks, which represent the smallest unit of price movement for an asset. This method is most commonly used by scalpers and short-term traders.

- Asset Price: Defining stop loss and take profit at a specific price level of the asset. This is useful for scalping or day trading strategies, as it allows for precise entry and exit levels.

- Currency: Setting profit or loss in terms of the account’s base currency. This is particularly practical for smaller accounts, as it lets you predefine the exact dollar (or base currency) amount you are willing to risk on a trade.

- Percent: Defining stop loss and take profit as a percentage of your account balance or the position’s value. This method is especially suitable for beginners since it ensures consistent risk exposure across trades.

In TradingView, you only need to enter one of these values (for example, setting your stop loss in pips). The system will then automatically calculate and display the equivalent values in the other three formats (price, account currency, and percentage) making the process faster, more accurate, and more transparent.

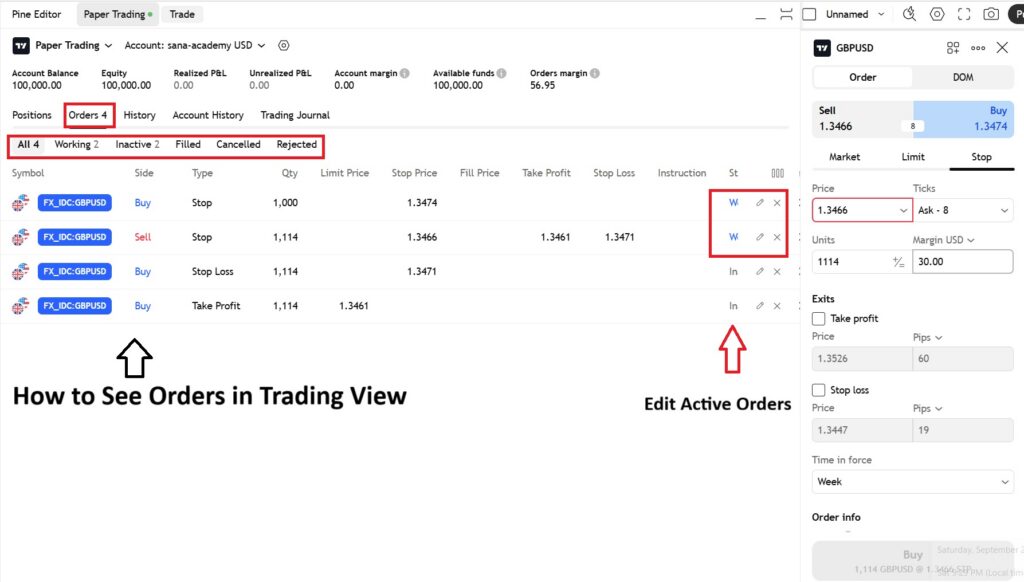

How to Review Active Orders in the Order List

The Order List in TradingView is the section where all pending orders—those that have not yet been executed and are currently in a Working / Active status—are displayed. This feature allows traders to view all their open orders in one place without switching between windows, check their status, and modify or cancel them if needed.

To access the active order list:

- Log in to your TradingView account and ensure that you are either connected to a broker or using a Paper Trading account.

- From the bottom-left corner of the Trading Panel, select your trading account, then click on the designated icon (as shown in the platform’s interface) to open your account page and view your active orders.

- In the Orders tab, all placed orders (both active and inactive) are displayed.

- Within this section, you can edit or cancel any active (Working) orders.

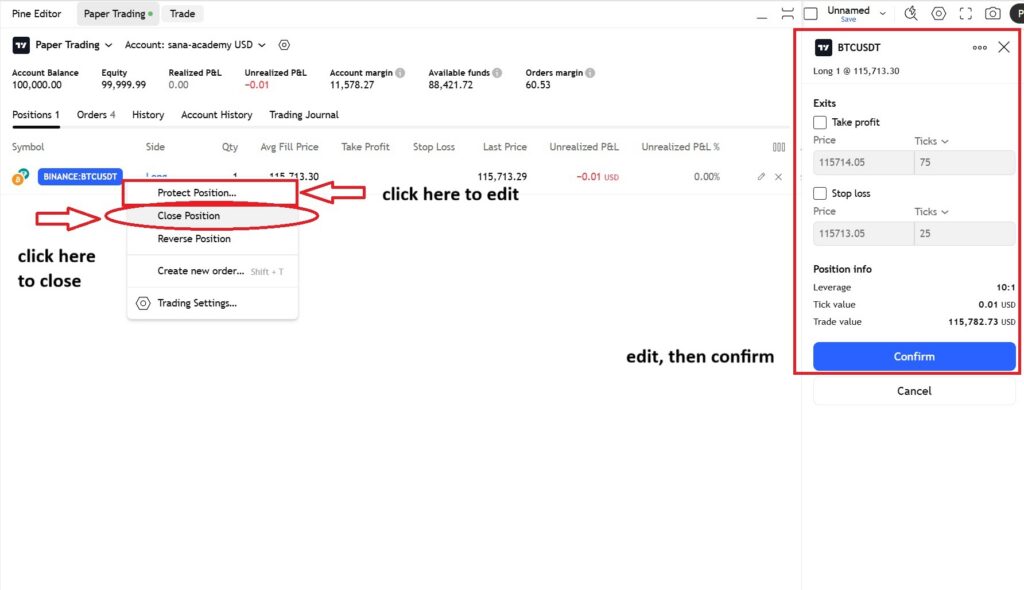

How to Manage and Close Open Trades in TradingView

Managing an open trade (Position) involves monitoring it, adjusting Stop Loss or Take Profit levels, and closing all or part of the position.

Steps to Close an Open Trade:

- Go to the chart of the asset and ensure the open position is visible.

- Right-click on the open position icon on the chart, or access it from Positions / Account Manager.

- Click on Close Position.

- A confirmation window will appear asking you to confirm the closure.

- Once confirmed, the position will be closed, and its status in the Positions section will update to Closed.

To Manage a Position:

- On the trading chart or in the Account Manager, right-click on the position.

- Select Modify Position to open the adjustment panel for Stop Loss and Take Profit.

- Make the desired changes and click Confirm to apply the modifications.

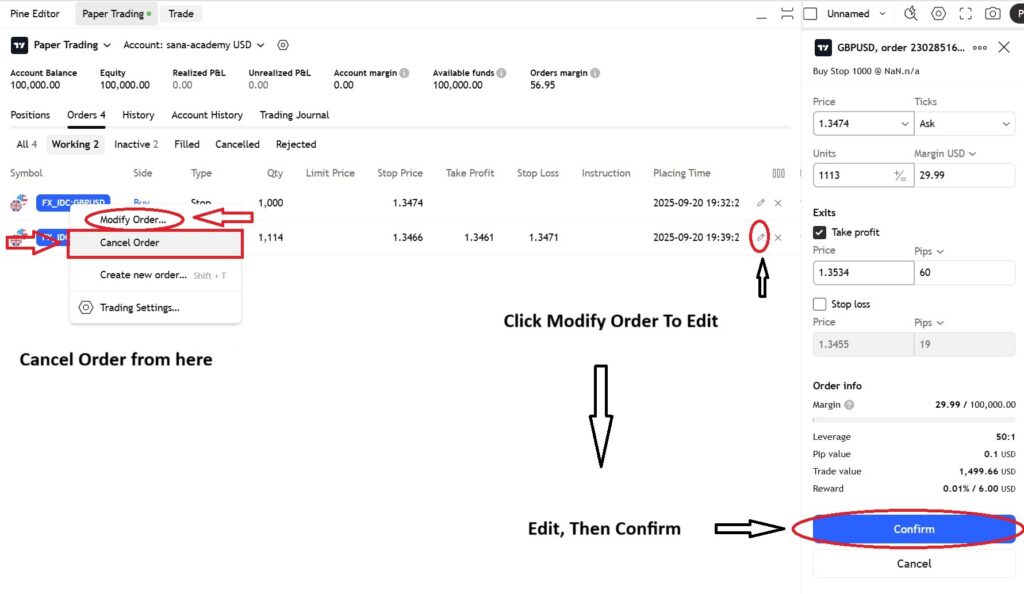

How to Cancel or Modify Orders in TradingView?

Orders may need to be adjusted before execution—whether it’s changing the price, volume, or order type—or sometimes canceled altogether. Order cancellation or modification is managed through the Order List.

To cancel or modify an order:

- Right-click on the order you wish to adjust.

- To edit, click on Modify Order. This will open the order panel on the right side of the screen. (Alternatively, you can click the pencil icon next to any active order.)

- Apply the necessary changes and then click Confirm to save them.

- To cancel an order, select Cancel Order and confirm the action to remove it from the list.

To place instant buy and sell orders in TradingView, you can use the following keyboard shortcuts:

- Shift + B for a Buy Order

- Shift + S for a Sell Order

Common Issues with Order Placement on TradingView and Their Solutions

Some of the most common problems traders face on TradingView include:

- Stop Order not being placed

If the stop price for a buy order is set below the current Ask, or for a sell order above the current Bid, TradingView will reject the order as invalid.

Solution:

Set the stop price correctly and in line with the order direction. For example, in a buy stop order, the stop price must be above the current Ask. You can also enable the Instant Order Placement option to reduce unnecessary confirmations. - Order not executing even when the chart price reaches the level

Sometimes charts are displayed based on the Mid-price, while orders are triggered by Bid or Ask prices. As a result, reaching the price level on the chart doesn’t necessarily mean the order will be filled.

Solution:

Always check the actual Bid and Ask prices in the order panel before placing an order, and set your stop or limit levels accordingly. - Delay or slippage in stop order execution

In live trading, stop orders may be executed with delays or at different prices than specified, especially during periods of high market volatility or when using heavy indicators.

Solution:

Remove unnecessary indicators, use simpler chart types, and select a broker with strong execution speed. - Issues with canceling or modifying orders

Sometimes an order cannot be canceled or modified immediately because the broker’s server has not yet updated the order status.

Solution:

Use the Refresh option in the order list, check your internet connection, and contact your broker’s support if the problem persists. - One-click Trading not enabled

If the One-click Trading option is disabled, every order placement or modification will require additional confirmation, which can slow you down and cause missed opportunities in fast markets.

Solution:

Enable One-click Trading in your account settings to speed up execution, but use it with caution.

The Difference Between Order Placement on TradingView and MetaTrader

While TradingView, with its modern and integrated design, is ideal for beginners and traders seeking a smooth and simplified trading experience, MetaTrader (MT4/MT5) remains a powerful choice for professional traders who require advanced tools, faster execution, and more precise control.

In the table below, you can see the key differences between order placement on TradingView and MetaTrader (MT4 / MT5).

| Feature | TradingView | MetaTrader (MT4 / MT5) |

|---|---|---|

| User Interface & Integration of Analysis and Trading | Analysis, order placement, and trade management are all combined in a single graphical environment accessible via web and mobile; orders can be placed directly on the chart. | Both analysis and trading are available in one platform, but order placement is usually handled through a separate order window with less flexible chart-based tools. |

| Order Variety & Pricing Options | Supports multiple order types with a visual interface; orders can be dragged and adjusted directly on the chart. | Greater variety of order types, especially in MT5; supports pending orders, OCO (One-Cancels-the-Other), and Expert Advisors (EAs) with more precise control. |

| Execution Speed & Latency | Possible delays in highly volatile markets or when using heavy indicators; discrepancies may occur between chart prices and actual Bid/Ask prices. | Generally faster execution across most brokers; greater control over slippage and more stable performance in high-liquidity conditions. |

| Learning Curve & Ease of Use | Modern, intuitive interface—ideal for beginners and chart-focused traders. | More advanced but complex features; requires time to learn and is better suited for professional traders. |

To use the direct trading feature in TradingView, you need to choose a broker that officially supports integration with the platform. Otherwise, you can still conduct your analysis on TradingView, but you will have to switch back to your broker’s software to execute trades.

Conclusion

Mastering order placement in TradingView means faster execution, fewer errors, and more professional risk management. With its trading panel and intuitive graphical tools, you can streamline your workflow from analysis to execution—place precise market and limit orders, set Stop Loss and Take Profit levels effectively, and manage open trades intelligently. And for risk-free practice, Paper Trading is your best companion, allowing you to test your strategies before stepping into live markets.