Many traders look for ways to recoup their losses and eventually achieve consistent profits. One of the most controversial and hotly debated methods is the Martingale strategy. This approach has a long history in gambling and now has its own followers in financial markets as well. But can this strategy really help you recover losses, or does it simply expand your risk and pull you into a deeper hole?

In this article, we take a close look at the Martingale strategy in the forex market, analyse its advantages and disadvantages, and ask whether it can realistically be part of a rational trading plan. If you’re trying to balance risk and return in your trades, understanding this strategy can give you a new perspective.

- The Martingale strategy in forex can create short-term profits, but because risk grows exponentially, it may lead to heavy losses over the long term or even wipe out your entire account.

- Due to its complexity, the Martingale strategy requires substantial capital and very strict risk management.

- To reduce Martingale risk, some traders limit the number of position size increases and combine it with techniques such as price action and hedging.

What is the Martingale strategy and how does it work?

The Martingale strategy is originally a betting system that was later adopted in financial markets. The core idea is simple: after every loss, you double the size of your next bet (or trade) so that with the first winning trade, all previous losses are recovered and you earn a profit equal to the initial stake.

For example:

Imagine someone betting on heads or tails. They place USD 10 on “heads” and lose. Next round, they place USD 20 again on heads. If they lose again, their third bet will be USD 40.

As soon as heads appear and they win, they earn USD 40, which covers all previous losses (10 + 20 = 30) and leaves a net profit of USD 10. In this way, a single win is enough to offset all earlier losses.

The key difference between entering a trade with the Martingale strategy and a normal single entry is this: in Martingale, instead of opening the entire permitted position size in one order, the trader usually splits that maximum size into three to five smaller orders.

For example, assume that based on the trader’s rules, they are allowed to open a total of 1 lot in a sell position in their chosen price zone. Instead of one 1-lot order, they split it into four unequal parts:

- First entry: 0.1 lot with the largest distance to the stop-loss,

- Second entry: 0.2 lot, closer to the stop-loss than the first entry,

- Third entry: 0.3 lot, closer to the stop-loss than the second entry,

- Fourth entry: 0.4 lot, closer to the stop-loss than the third entry.

In the Martingale strategy, whenever a trade closes at a loss, the position size of the next trade is continuously increased, often doubled to compensate for the previous loss. In other words, after a losing trade, the trader must commit more capital to the next position so that, if it wins, it can cover all past losses and still generate a profit.

History of the Martingale Strategy

The Martingale strategy originates from 18th-century French gambling houses (Wikipedia). It was first introduced by the French mathematician Paul Pierre Lévy (Investopedia) and later studied and expanded in the 20th century by Joseph Leo Doob.

This strategy eventually entered financial markets when traders, especially in the stock and forex markets, began seeking ways to recoup trading losses. However, its risk in the face of market volatility and its need for substantial capital led it to be viewed mainly as a high-risk tool suitable only for professional traders.

How to Use the Martingale Strategy in Forex?

To apply the Martingale method in forex trading, traders usually follow these steps:

- Choose a trading instrument and set the initial position size

Select a trading instrument such as the EUR/USD currency pair and define a small initial position size (for example, 0.01 lot) for your first trade. This size must be small enough that you can multiply it several times if necessary and still have enough capital left. - Open the first trade

Open your first position in your desired direction (buy or sell).

For example, assume the trader opens a 1-lot buy position on EUR/USD at 1.2650. - Double the position size if the trade goes into a loss

If the market moves against your position and the first trade goes into a loss, you do not close it. Instead, you open a new trade in the same direction with a position size approximately double the previous one.

In our example, if EUR/USD falls to 1.2630 (the first trade is a loss), you open another 2-lot buy at 1.2630. - Continue adding positions

Each time the price moves further against you, you open another position with a size twice the previous one. By doing this, the average entry price of all open positions moves closer to the current market price, and the break-even level approaches the market. - Close all positions when the price retraces

Eventually, with even a small reversal in price in your favour, the market price moves closer to the average entry price of all buy positions.

As soon as the combined profit of all positions covers all accumulated losses and yields a profit equal to the initial position size, you close all trades and exit the market. In this way, the Martingale cycle ends with a single winning phase, and you earn a net profit equal to the initial stake.

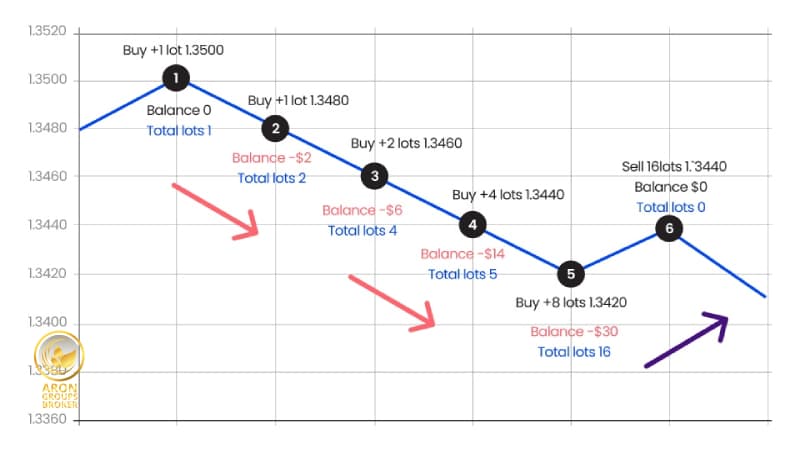

To make the mechanics clearer, the table below shows a hypothetical scenario where a trader is gradually buying EUR/USD and doubling the position size for every 20-pip drop:

| Market Price (EUR/USD) | Total Position Size (lots) | Average Entry Price | Cumulative Loss | Move Needed to Break Even |

|---|---|---|---|---|

| 1.2650 | 1 | 1.2650 | $0 | 0 pips |

| 1.2630 | 2 | 1.2640 | -$200 | +10 pips |

| 1.2610 | 4 | 1.2625 | -$600 | +15 pips |

| 1.2590 | 8 | 1.2605 | -$1,400 | +17 pips |

| 1.2570 | 16 | 1.2588 | -$3,000 | +18 pips |

| 1.2550 | 32 | 1.2569 | -$6,200 | +19 pips |

As you can see, with each step up in position size, the average buy price moves down (from 1.2650 to 1.2569), so the price needs a smaller upward move to reach break-even.

However, in return, the unrealised loss (floating loss) and total position size grow very quickly. In this example, by the time the price falls to 1.2550, the total position size has reached 32 lots, and the floating loss is around $6,200.

If there is not enough capital or margin in the account, the Martingale strategy can easily trigger a margin call and wipe out the account. Therefore, using Martingale requires a large capital buffer to withstand sharp market moves and wait for a potential reversal.

Advantages and Disadvantages of the Martingale Strategy in Forex

Advantages of the Martingale Strategy

The main advantages of the Martingale strategy are:- High probability of recovering losses: A single winning trade is theoretically enough to recover all previous losses. This gives the trader a sense of certainty that, sooner or later, losses will be recouped. In other words, even if several early trades close at a loss, one final winning trade can turn the overall result positive.

- High win rate: In most cases, a very long streak of consecutive losses is statistically less likely. As a result, many Martingale cycles end with profit or at least break-even, and only occasionally does a large loss occur. This makes the win rate (the percentage of winning trades versus losing trades) look high, which can be psychologically reassuring.

- Lower average entry price: By adding new positions at better prices, the average entry cost is reduced, and the price needed to exit at break-even moves closer to the current market level. This helps the trader exit the total basket of positions without loss, even with a relatively small price retracement.

- Simplicity in execution: The rules of Martingale are not complex, and any trader can easily understand and follow the idea of “doubling position size after a loss.” There is no need for complex real-time analysis or advanced technical indicators, which makes the strategy operationally attractive for many people.

- Potential for quick short-term profits: In quiet markets or when prices move within a limited range, this approach can quickly offset temporary drawdowns and generate a series of small, frequent profits. Especially during sideways, non-trending conditions, Martingale can show strong short-term performance.

- Leveraging market mean reversion: If we assume that markets eventually revert from price extremes (the principle of mean reversion), Martingale can exploit this by patiently holding positions and turning temporary drawdowns into profit. The strategy is essentially built on the belief that no trend continues forever and that prices will eventually reverse.

- Earning positive overnight interest (swap): One reason some forex traders use Martingale is the possibility of earning a positive swap on currency pairs where the interest rate differential is in their favour. For example, if Martingale is applied to a pair where the base currency has a higher interest rate than the quote currency, the trader may receive a positive swap by holding positions, which can partially offset floating losses.

Disadvantages of the Martingale Strategy

Alongside these advantages, the Martingale strategy suffers from several serious drawbacks:

- Very high risk and potential account wipe-out:

Losses can grow exponentially in a Martingale sequence, and if a strong trend moves against the trader’s positions, there is a real risk of losing the entire account. In practice, a series of small, steady gains is exchanged for the risk of one catastrophic loss. This is why many traders view Martingale as a highly dangerous strategy. - Need for substantial capital:

Successful implementation of the Martingale requires a very large capital or free margin to withstand repeated losses. Many retail traders simply do not have this capacity and may face a margin call and account wipe-out before the market reverses. For this reason, the method is generally unsuitable for small accounts or traders with limited capital. - Poor risk–reward profile:

In the Martingale strategy, the net profit at the end of each cycle (after a winning trade) is usually equal to the initial position size, while the losses accumulated along the way can become very large (Corporate Finance Institute). This imbalance between risk and reward is one of the strategy’s core weaknesses. Put simply, you may risk several thousand dollars to make, for example, USD 10. - Trading and holding costs:

As the number and size of positions increase, so do transaction costs such as commissions, spreads, and overnight interest (swap). If positions remain open for a long time, these costs can eat up a significant portion of the potential Martingale profit. As a result, even if the market eventually turns in the desired direction, the final profit may be small or even zero after costs.

- Psychological pressure on the trader:

Watching losses grow and repeatedly deciding to double the position size in stressful conditions creates intense psychological pressure. Each new Martingale step can be anxiety-provoking, and fear of an even larger future loss can make decision-making difficult. This can lead to emotional mistakes, such as entering earlier than planned or increasing the position size beyond the rules, which only worsens the situation. - Lack of long-term robustness:

While Martingale may produce good results in the short term, over a longer horizon, there is always a chance of a long losing streak that wipes out all previous gains in one go. For this reason, many experts do not consider Martingale a sustainable strategy for consistent long-term profitability and believe that its eventual failure is only a matter of time. - Unsuitable for beginner traders:

Using Martingale without solid knowledge of risk management and trading experience can be disastrous. This approach is more suited to professional traders with strict capital management plans. New traders who copy it blindly are very likely to suffer heavy losses. That’s why it is generally recommended that beginners first master lower-risk strategies and avoid Martingale, at least in the early stages of their trading journey.

Types of Martingale Strategies

Classic Martingale

In the classic Martingale method, as explained so far, the trader doubles the position size after each losing trade so that a single final winning trade can cover all previous losses. This approach is based on the assumption that sooner or later, the market will reverse from its current move and bring the trader back into profit.

Classic Martingale carries the highest level of risk because, in the worst case, position sizes can grow extremely large. If the market does not reverse, it can lead to massive losses. For this reason, many consider it an “all-or-nothing” strategy that either grows the account or drives it close to zero.

Anti-Martingale (Reverse Martingale) Strategy

Think of Anti-Martingale as Martingale flipped on its head: You press the gas when you’re right and hit the brakes when you’re wrong.

How it works

- After a winning trade, you increase the position size for the next trade (often x2).

- After a losing trade, you decrease the position size for the next trade (for example, cut it in half).

In simple terms:

More capital goes into winning streaks, less capital goes into losing streaks.

Why traders use it

- Boosts winning streaks: Instead of chasing losses, the strategy focuses on amplifying consecutive wins.

- Keeps losses smaller: When you’re in a drawdown, position sizes shrink, so each new loss hurts less.

- Aligned with sound risk management:

It follows the classic rule: “Let your profits run and cut your losses short.”

Note:

Anti-Martingale does not guarantee profit, but compared to classic Martingale,

It dramatically reduces the risk of a single, account-killing loss.

Where you see it in practice

Many traders already use a form of Anti-Martingale without naming it:

- Trend-following strategies,

- Pyramiding into winners (adding to positions that are already in profit).

They:

- Increase size after winning trades → to compound gains in strong trends

- Reduce size after losing trades → to keep drawdowns controlled

Soft or Adaptive Anti-Martingale

In the so-called soft or adaptive Martingale approach (Soft Martingale / Adaptive), position sizes are increased by a smaller multiplier (e.g., 1.5x) instead of doubling, or they are adjusted based on technical conditions and market analysis. This approach provides better risk control and is more often used in combination with technical analysis or modern algorithmic trading systems.

The use of any of these Martingale variants depends on the trader’s experience level, risk capital, and trading style. The most important principle is to fully understand the logic behind these strategies and be prepared to face complex, high-risk market scenarios.

Is the Martingale Strategy Profitable in Forex?

The core question is simple: Can Martingale lead to consistent, sustainable profit in the forex market? From a theoretical standpoint, the answer is NO.

In a fair system with no special edge, the Martingale strategy does not create a positive expected value. Its expected return is zero or even negative once you factor in spreads, commissions, and swaps (Wikipedia).

The reason is straightforward:

- The probability of a long losing streak is small,

- But it is not zero, and when it happens,

- That one event can generate a loss big enough to wipe out the profit from many small winning cycles.

In other words, as the number of trades increases, Martingale will eventually hit a scenario that erases all accumulated gains.

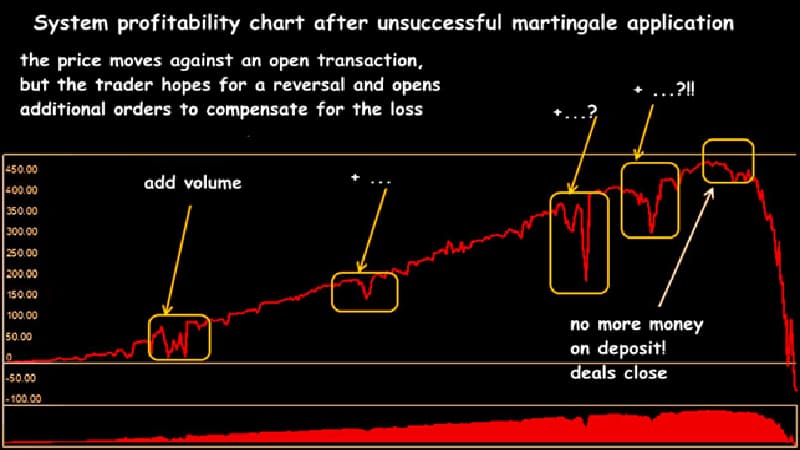

The Martingale strategy is not profitable over the long term. Although it may generate short-term gains, there is always a risk of a large, sudden loss that can wipe out all previous profits.

Both trader experience and research show that Martingale is not a reliable long-term strategy.

- A trader might make money with it for a period.

- Then an unexpected event or a strong one-way trend, for example, a major economic release or sudden market shock, can quickly destroy all previously accumulated profit.

Even if the probability of that “big loss event” is only 1%, hundreds or thousands of trades over time make its occurrence almost inevitable.

That’s why most professionals warn that Martingale has more risk than reward for most traders.

Dependence on market conditions

Yes, context matters:

- In range-bound or non-trending markets, a disciplined trader might manage to generate profit with Martingale for some time.

- But market conditions can change quickly. A strategy that “worked for months” can suddenly become dangerous when a strong trend starts.

To properly evaluate Martingale, you’d need to backtest it on historical data.

Most backtests show the same pattern:

- Early, attractive profits,

- Eventually, it is replaced by heavy losses when the market makes a sharp move against the positions.

Overall, the results lack stability and reliability.

Martingale cannot be considered a guaranteed or reliable method for making money in forex. A more realistic description is: Martingale is less a “profit strategy” and more a time bomb in the account, one that may tick quietly for a while, but can eventually explode and wipe out a trader’s capital.

Ways to Reduce Risk in a Martingale Strategy

The Martingale strategy is inherently high-risk, but professional traders use several techniques to manage that risk and apply it more controlably.

To reduce risk in a Martingale setup, experienced traders usually increase position size with smaller multipliers (for example, 1.2x or 1.5x instead of 2x) so that losses don’t grow explosively and the account is under less pressure.

Below are the main techniques and guidelines used to manage Martingale risk more carefully:

1. Set a hard limit on Martingale steps

Instead of extending the Martingale sequence indefinitely, decide in advance how many steps you are willing to take (e.g. 3 to 5 levels).

If, after the last step, the position is still in loss, you accept the loss and exit the trade, so the entire account is not destroyed.

Accepting a limited loss is far better than letting it grow into something unrecoverable.

2. Use hedging in extreme conditions

In critical situations where the market is moving strongly against your open positions, you can, instead of adding more size, open an opposite position (sell against existing buys or buy against existing sells) to neutralise further losses.

This is a form of hedging that:

- Helps you stop the loss from growing,

- Gives you time to reassess without adding more risk,

- Allows you to unlock and manage the “locked” positions later if the trend reverses.

However, proper hedging is a complex process that requires a clear, pre-defined plan, and, on top of that, many brokers impose restrictions on hedging or do not allow accounts to remain hedged for extended periods.

3. Combine Martingale with price action

Instead of adding positions purely based on a mechanical rule (e.g. every 20 pips), use price action and technical analysis to choose entry and add-on points.

For example, only add to the position when:

- Price reaches a strong support or resistance zone, or

- A reliable reversal pattern appears on the chart.

This reduces the risk of being trapped in a one-way trend and makes your Martingale approach more “intelligent” rather than blindly mechanical.

4. Follow strict risk and money management rules

You should have a clear capital management plan before using Martingale:

- Keep the initial position size very small (for example, less than 1% of total equity) so you can multiply it several times without wiping out your account after just a few losses.

- Never allocate all your capital to a Martingale strategy.

- Consider dedicating only a portion of your account (an amount you can mentally accept losing) to Martingale, and set a global stop for that portion (for example, 20% of the entire account). If losses reach that level, you stop using Martingale altogether.

5. Lower leverage and keep more free margin

The lower your leverage, the greater your account’s ability to absorb a series of losses.

With high leverage, even relatively small price movements can push your equity to the margin-call threshold very quickly.

So it is better to:

- Trade with more conservative leverage, or

- Keep position sizes small relative to account equity.

So that the probability of a margin call remains very low, a higher free margin acts like a safety cushion that lets you continue the Martingale sequence without immediate liquidation.

6. Be cautious using Martingale in fast trading (e.g. scalping)

At first glance, combining Martingale with short-term strategies like scalping may look attractive, because the trader aims to recover several small losses quickly.

In practice, this combination is extremely risky:

- In very short timeframes, you have less time to react and manage multiple open positions.

- The probability of execution errors or sudden spikes is higher.

For scalpers, it is usually safer to:

- Use traditional risk management (fixed stop-loss per trade), and

- After a sequence of losses, step away from the market for a while or reduce position size, rather than doubling up with Martingale.

7. Use swap-free accounts or low-interest pairs

If your strategy requires holding positions for several days or weeks, it’s better to:

- Use swap-free accounts, or

- Choose currency pairs with a small interest rate differential.

This prevents overnight swap costs from piling up and eating into your potential profit. For example, a swap-free account can be useful for long-term Martingale strategies.

8. Backtest and practice thoroughly

Before applying Martingale on a live account, you should:

- Backtest it on historical data, and

- Practise it on a demo account for a sufficient period.

A backtest over several years (ideally across multiple timeframes) shows:

- How the strategy behaves in different market conditions,

- How it performs in pessimistic scenarios (e.g. 8-10 consecutive losses).

You must check whether your capital can realistically survive those scenarios. Only consider using Martingale on a live account if you are prepared for all such cases and have a clearly defined exit and risk management plan.

9. Don’t rely solely on Martingale

Finally, Martingale should never replace a solid trading system or proper market analysis. Use it, at most, as an additional position-management tool alongside a strategy that is already profitable on its own, not as your primary source of profit.

Remember:

- Accepting a certain amount of loss is a normal, healthy part of trading.

- Trying to eliminate losses completely (as Martingale effectively attempts to do) can push a trader into a very dangerous situation.

Conclusion

In forex trading, the Martingale strategy is far from a guaranteed path to profit; it is a high-risk tool that should only be used with a full understanding of its risks and very tight capital control. While it can generate profits in the short term, over the long run, it carries a serious risk of wiping out a significant portion of your capital.

If you plan to use Martingale, you should not treat it as a standalone trading strategy. Instead, it should function as a secondary, complementary tool alongside a well-defined trading plan. If you are a beginner, it is strongly advisable to focus first on lower-risk approaches, such as fixed stop-losses and sensible position sizing, rather than on Martingale.

Even if you are an experienced trader, you should only consider Martingale after putting strict safeguards in place: combine it with solid technical analysis, clearly define the maximum number of Martingale steps, and apply rigorous risk management to keep its inherent dangers under control.