Many traders assume that since they aren’t risking their own capital in prop trading, they face no real danger. But the reality is far more complex. Prop trading is a legitimate model, yet it operates in an entirely unregulated space, meaning some firms may use questionable practices while still staying within the law.

In this article, we will take a clear and practical look at whether prop trading can be considered a scam, what you should check before choosing a reputable prop firm, whether prop trading is truly legal, and the major red flags that indicate a fraudulent company, including real examples of known scam prop firms.

If this topic interests you, stay with us through the end.

- The absence of regulatory oversight in prop trading means traders must treat due diligence as a necessity, not a choice.

- Because not all prop firms operate with aligned incentives, it’s critical for traders to independently assess a firm’s structure, transparency, and credibility.

- A sustainable prop firm is built on long-term trust, operational stability, and a responsible business model, not on aggressive marketing or unrealistic promises.

- Traders who approach prop trading with a risk-aware mindset and a clear verification process are far less likely to fall victim to fraudulent practices.

How Prop Trading Scams Work

Legitimate prop trading firms provide real capital, evaluate traders through structured challenges, and share profits generated from actual market performance. In a scam model, however, the firm relies almost entirely on evaluation fees rather than on real trading activity, creating a misalignment between the trader and the firm.

Evaluation Challenges Used as a Cover

Scam prop firms give traders a demo account after they pay an evaluation fee. Even if the trader passes the challenge, they continue trading on a demo account without ever accessing real capital, despite believing they have a “funded” account.

Payouts Funded by New Participants

Since there are no real trading profits, the firm pays profitable traders with fees from newly registered traders. This creates a Ponzi-like structure where:

- Losing traders generate pure profit for the firm;

- Profitable traders are paid from incoming fees;

- No genuine market performance supports payouts.

Why Scam Prop Firms Eventually Collapse

Profitable traders become a financial burden because their payouts grow over time. Once evaluation fees slow down or the number of successful traders increases, the firm cannot sustain payouts. This leads to:

- delayed withdrawals;

- sudden rule changes;

- unjustified account closures;

- or complete shutdown.

Why These Scams Still Attract Traders

Scam firms survive in the short term because:

- Evaluation fees are high.

- Most traders naturally fail challenges.

- Only a few traders require payouts.

- and aggressive marketing promises unrealistic profit splits.

As long as new registrations continue, scam firms appear legitimate, until the model eventually collapses.

Is Prop Trading Legal?

Before the rise of online prop trading firms, the largest proprietary trading operations were run by banks and major financial institutions. This model remained dominant until the 2008 financial crisis, when traders at these institutions engaged in numerous unethical trades to profit from the distressed market, ultimately intensifying the crisis into a full-scale collapse.

In response, the Volcker Rule was introduced, effectively removing major banks and institutional investors from the proprietary trading industry and prohibiting their direct involvement in such trading activities.

However, the Volcker Rule did not regulate online prop trading firms, meaning that while the industry itself is legal, it remains largely unregulated. The main reason regulators initially refrained from oversight is that prop firms trade with their own capital rather than client funds. Hence, the firm, rather than outside investors, theoretically bears the financial risk.

Despite this reasoning, many financial authorities argue that a lack of regulation can expose traders to significant risks, suggesting that prop firms may face stricter oversight in the future.

Today, the absence of regulatory supervision leaves trader protection extremely limited, making it the trader’s responsibility to identify scams and choose reputable firms carefully. Unlike the pre-Volcker Rule era, when traders were employed full-time by bank-operated prop programs, modern prop traders often work on a temporary or contractual basis, increasing their vulnerability to fraud and unethical practices.

Signs of a Prop Trading Scam You Should Watch Out For

If you are planning to start trading with a prop firm, it’s crucial to be aware of potential scams. Unfortunately, fraudulent firms often disguise themselves as legitimate prop trading companies. Below are the key warning signs that indicate a prop firm may be a scam and should be avoided.

A legitimate prop firm always prioritizes trader longevity over rapid expansion. Any firm that aggressively pushes sign-ups or emphasizes growth over risk controls usually operates on unstable or deceptive foundations.

Running the Challenge on a Real Account

Legitimate prop firms conduct trading challenges to evaluate a trader’s skills, but these challenges should always take place on a demo account. If a firm asks you to open and fund a real trading account to participate in the challenge, this is a clear sign of a prop trading scam.

Note: This is different from a registration or entry fee required to take the challenge, which is normal.

Allowing Traders to Retake the Challenge Repeatedly

If you fail a challenge and the firm easily lets you retake it multiple times, be cautious. Legitimate prop firms usually have strict rules and limits on retries. Excessive leniency often signals a scam designed to lure more fees or personal information.

Hidden Penalty Charges

Many scam prop firms reveal themselves during the payout of profits. For example, when requesting your profit share, you may receive a document claiming penalties from a “liquidity provider” that far exceed your earnings. This can result in receiving nothing and, at times, even owing money to the firm.

Unclear or Tiny-Font Rules

Fraudulent prop firms often penalise traders for rules that were never clearly communicated. These rules might be missing from the documents or hidden in tiny print that’s hard to read. Always ensure a prop firm provides transparent and easily understandable rules before you trade.

Charging Fees for Access to a Funded Account

Passing a trading challenge should grant you access to a funded account without additional fees. If a firm asks you to pay even a small fee to access your account, this is a major red flag—most likely, you will lose that money.

Phishing and Account Security Risks

Some scam firms create fake websites or phishing pages to steal your trading credentials and financial information. Always verify the authenticity of a prop firm’s website and never share sensitive data unless you are certain it’s legitimate.

Unrealistic Success Stories

Scam prop firms often showcase overly dramatic success stories of ordinary traders becoming millionaires overnight. These testimonials are designed to lure new traders. Remember: if it sounds too good to be true, it probably is.

Charging for Training

Providing educational resources or training is part of a prop firm’s responsibility. If a firm asks for additional payment for training, consider it a serious warning sign of a scam.

Final Advice

Always research a prop firm thoroughly before committing. Look for transparent rules, legitimate challenges, and verified reviews. Avoid firms asking for real account funding, extra fees, or personal information upfront. Staying vigilant is your best defence against prop trading scams.

What to Do If You Have Been Scammed

If a prop firm scammed you before reading this article, you can take the following steps:

- The scam firm may tell you that if you pay a certain penalty fee, your profit will be fully credited to your account. You must be aware that you should never transfer any money to the firm under any circumstances. They are scammers trying to take even more of your money.

- Collect and archive all communication records with the prop firm, including payment receipts, messages, and even feedback from other participants. These documents may help you in future complaints or legal actions.

- File a complaint with regulatory organisations. Even if you cannot recover your money, placing the scam prop firm on a blacklist will help protect others.

- Write an honest and detailed review on relevant websites about the scam prop firm and its fraudulent practices to inform and protect other traders.

Top Prop Trading Scams to Watch Out for in 2024

In this section, we highlight some of the most notorious proprietary trading firms involved in scams in 2024, helping traders identify red flags and avoid potential losses.

Fidelcrest Trading Company

The chief executive officer of Fidelcrest was the person who created and operated a Ponzi scheme that scammed thousands of traders. His method was to pay the profits of older traders using the registration fees of new participants. Until the year 2022, everything appeared normal. However, in that year, many users, especially those with substantial profits, reported sudden and unexplained account closures.

This triggered official investigations, which revealed fraud and account manipulation. Before its shutdown, Fidelcrest had collected nearly eight billion dollars from traders all around the world. Although the chief executive officer and his associates were arrested and charged with money laundering and fraud, the reality is that more than fifty thousand traders permanently lost their money.

True Forex Funds

This prop trading scam company began its activity in the year 2021 as a forex broker offering low spreads and high leverage. Over time and by the year 2023 complaints grew. Across various platforms, traders reported difficulty in withdrawing funds, manipulation of trades artificial slippage and large trader losses. Legal investigations began and the fraud was confirmed. Eventually, True Forex Funds announced bankruptcy on its website and its operations were halted.

Funded Academy

Funded Academy was launched in Australia and is still operating in the prop trading industry. However there is evidence suggesting that this is a prop trading scam.

The first warning sign is the complete lack of regulation which creates a favorable environment for fraud. In addition this firm offers a two million dollar account with an eighty percent profit split which is highly attractive but also very suspicious.

Users have also occasionally reported sudden shutdowns of payment channels and extremely limited access to customer support.

Auto Prop Trader

This prop firm was founded in the year 2018 and attracted many traders by offering automated trading tools and promising high profits. However from the year 2019 reports began to surface regarding lack of responsiveness hidden fees withdrawal issues suspicious activities and platform manipulation against traders which drew regulatory attention.

Investigations revealed that the firm was entirely unregulated. In the year 2020 it was placed on the blacklist and officially declared a scam. The company abruptly shut down leaving many individuals with significant financial losses.

SurgeTrader

Negative attention toward the broker and prop trading provider Surgetrader began in the year 2021. This broker attracted traders with promises of large profits but soon traders faced unauthorized withdrawals lack of support and sudden account closures without warning which caused widespread concern.

Investigations found that the broker had been operating entirely without oversight and was manipulating its trading platform and market data to mislead and financially harm traders. It was also revealed that the broker had created a complex network of individuals and foreign accounts for money laundering. Surgetrader was finally blacklisted as a prop trading scam in the year 2024 and its operations were terminated.

Scam prop firms often show rapid changes in policies, sudden platform upgrades, or unusual maintenance announcements just before collapsing. These operational inconsistencies are early markers of financial instability.

Important Points When Choosing a Prop Firm

As mentioned earlier, prop firms are fundamentally legal, but that does not mean there are no scammers in this industry. In particular, because there is no comprehensive oversight and because many traders mistakenly believe that prop trading carries no risk for them, it has become even easier for scammers to operate.

Therefore, to avoid becoming a victim of a prop trading scam and losing your money possibly forever, keep the following points in mind when choosing a prop firm:

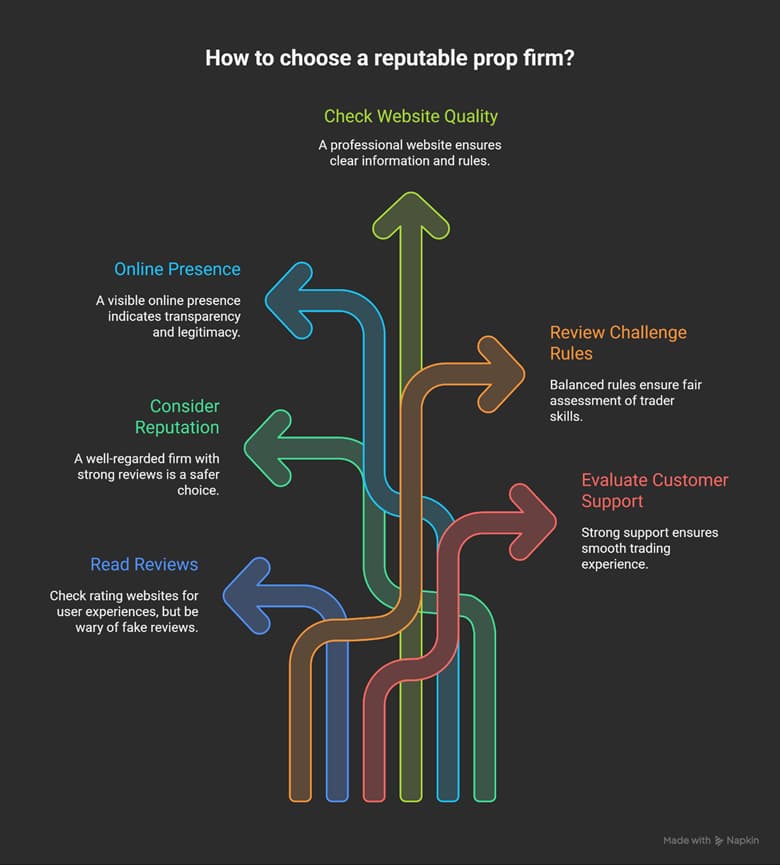

Read What Others Say

Visit rating websites and find a list of reputable prop firms. Carefully read user reviews and see what traders say about their experience with each firm. Be aware that some reviews are not real and are written to mislead readers. One way to detect fake reviews is that they are excessively positive and are posted within a very short time frame.

On the other hand, be cautious of both positive and negative reviews. Sometimes, individuals leave negative comments about a prop firm only because they had unsuccessful trades.

According to topstep: Look for independent payout proof and not only positive testimonials. Firms whose users consistently show verifiable profit withdrawals and mention delays or refusals are more trustworthy.

Consider the Firm’s Reputation

Although the reputation and good standing of a prop firm do not guarantee that it is not a scam, a well regarded firm with strong user reviews can be a safer choice.

Online Presence Matters

Avoid joining a prop firm that has no visible presence on the internet or social media. Reviews, the official website, an Instagram page, a YouTube channel, or mentions on social platforms can all be positive signs when evaluating a prop firm.

Likewise, the people who run and manage the firm should not be hidden from the public, and there should be some level of transparency about them.

Check the Company Website

Simply having a website is not enough. What matters is the quality of the site and the information it provides.

Check whether the website is professional and well designed, or if it looks amateur, poorly written, and full of spelling and grammar mistakes. A low quality website often indicates a prop trading scam.

It is also essential that the rules and restrictions of the firm’s challenge as well as legal terms and conditions are clearly presented on the website. Any lack of information or unclear statements should be a serious concern because prop firms can close trading accounts for rule violations even without warning.

Review the Prop Firm Challenge Rules and Restrictions

If the rules and restrictions are too many or too few, both situations are red flags.

If the requirements are excessively strict to the point that passing the challenge becomes nearly impossible, the firm is likely a prop trading scam that only wants to collect registration fees from traders.

On the other hand, if the rules are too relaxed and winning the challenge is very easy, this may also indicate a scam firm that intends to attract as many people as possible to collect registration fees. A legitimate prop firm never gives its capital to just anyone. It looks for skilled traders capable of managing its funds. Clearly, an overly easy challenge cannot reliably assess trader’s ability.

Evaluate Customer Support

Does the firm you want to work with offer strong and twenty four hour customer support? If you ask a question and must wait many hours for a response, you should know that even if the firm is not a prop trading scam, it is still a weak company that may cause serious issues during your trading process.

Reliable prop firms always demonstrate risk discipline internally, they limit their own exposure, manage liquidity carefully, and avoid unrealistic scaling offers. A firm that promises unlimited growth or exaggerated funded amounts typically lacks real capital backing.

Conclusion

Although prop trading firms are legal, they are completely unregulated. This lack of oversight has caused prop trading scams to grow rapidly. Because there is no regulatory protection, traders themselves must be alert when choosing a prop trading firm and must take the necessary steps to avoid falling into the trap of scammers.

Among the most important actions traders should take are paying attention to the warning signs of prop trading scams and considering the key points involved in selecting a reliable prop firm. Both of these topics were discussed in detail throughout this article.