In forex, a lot refers to the position size, the standardized unit used to measure the volume of a trade. Understanding this concept is essential for every trader, as it directly determines how much you gain or lose with each price movement. This guide explains the different types of lots in forex and helps you choose the right lot size for your trading strategy.

- Brokers may impose minimum or incremental lot sizes, so always check your platform’s contract specifications before placing orders.

- Changing lot size can alter how spreads and commissions impact your total trading cost per pip.

- Using a position-sizing calculator helps align lot size with your stop-loss distance and acceptable percentage risk per trade.

- Lot size selection influences emotional control; oversized lots often trigger impulsive exits during volatility.

- Practicing with micro or nano lots on a live account bridges the gap between demo confidence and real-market psychology.

Understanding the Concept of a Lot in Forex

In the forex market, the world’s largest financial market, currencies are traded in pairs. Traders buy one currency while simultaneously selling another, aiming to profit from changes in the exchange rate.

To quantify the size of a trade, the market uses a standard measurement unit called a lot. The lot defines how many units of the base currency (the first currency in a pair) are being traded.

For more precise trade management, traders can use conditional orders such as Buy Stop Limit to control position sizes and entry points.

Types of Lots

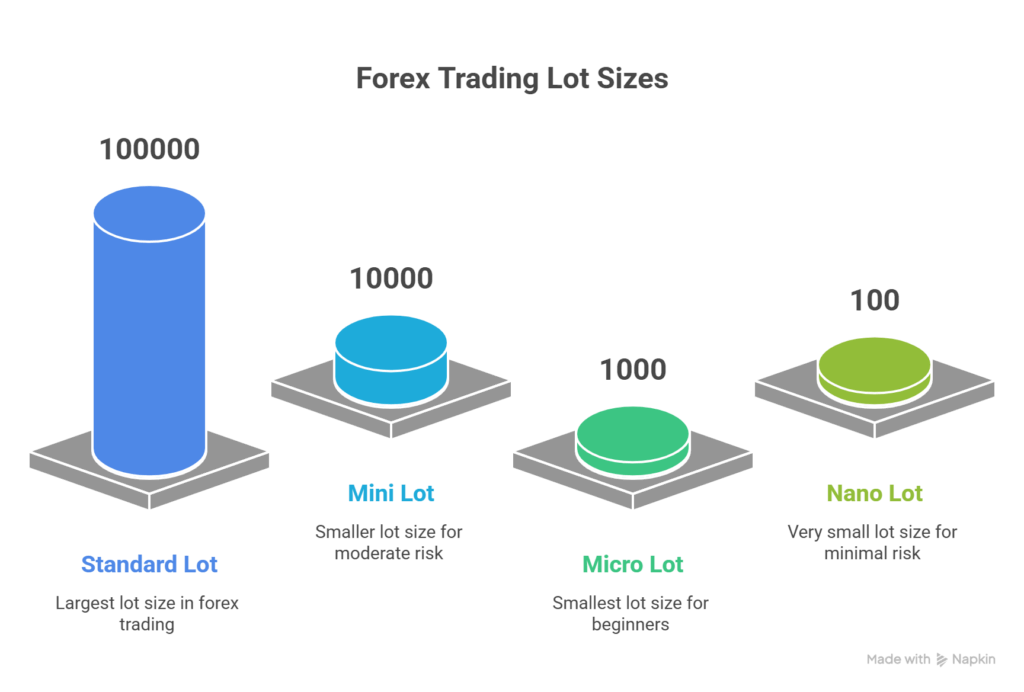

There are several common lot sizes used in forex trading:

- Standard Lot: 100,000 units of the base currency;

- Mini Lot: 10,000 units of the base currency;

- Micro Lot: 1,000 units of the base currency;

- Nano Lot: 100 units of the base currency.

Among these, standard and mini lots are the most widely used by professional and intermediate traders. Micro and nano lots are typically used by beginners or traders who prefer to minimize risk or trade with smaller capital.

The key takeaway is that the larger the lot size, the greater both the potential profit and the risk. For instance, in a standard lot, even a small price fluctuation can significantly affect your balance, while in smaller lots, the impact is more limited. Choosing the right lot size should align with your capital, leverage, and trading strategy, as it directly affects your risk exposure.

| Lot Type | Units of Base Currency | Volume | Suitable For |

|---|---|---|---|

| Standard Lot | 100,000 units | 1.00 | Professional traders with large capital who can manage high risk. |

| Mini Lot | 10,000 units | 0.10 | Intermediate traders seek lower risk and moderate exposure. |

| Micro Lot | 1,000 units | 0.01 | Beginners testing strategies with limited capital and lower risk. |

| Nano Lot | 100 units | 0.001 | New traders are exploring the market with minimal investment and risk. |

Standard Lot

A standard lot is the largest and most commonly referenced unit of trade volume in forex. Each standard lot equals 100,000 units of the base currency.

The base currency is the first currency in a pair. For example, in the EUR/USD pair, the base currency is the euro. Therefore, trading one standard lot of EUR/USD means you are trading €100,000 (approximately $108,000).

When trading a standard lot, each one-pip movement in price is typically worth $10. This means that a 10-pip move in your favor or against you translates to a $100 gain or loss.

A pip (short for percentage in point) represents the smallest standard price movement in a currency pair.

- For most pairs like EUR/USD = 1.11421, the fourth decimal place represents a pip, and the fifth is a pipette (1/10 of a pip).

- For pairs involving the Japanese yen (e.g., USD/JPY = 144.421), the second decimal place is the pip, and the third is the pipette.

As highlighted by BabyPips, the pip value changes with the currency pair and lot size. For example, a standard lot on EUR/USD may be about $10 per pip, while on USD/JPY, it can differ (around $12.50 in one scenario).

Because of the large trade size, standard lots are typically used by professional traders or those with sufficient account equity to handle significant swings in profit or loss. A standard lot can generate larger gains, but it also magnifies risk, so sound risk management is critical.

In summary, the standard lot represents a high-volume position that reacts sharply to price movements. It’s suitable for experienced traders familiar with volatility and capital management.

Mini Lot

A mini lot represents 10,000 units of the base currency.

For example, if you trade one mini lot of EUR/USD, you’re buying or selling €10,000 against the U.S. dollar.

Each one-pip movement in a mini lot equals $1, meaning that a 10-pip move equals a $10 change in profit or loss. Mini lots are ideal for traders who want smaller exposure than a standard lot provides, offering a balance between meaningful returns and manageable risk.

They’re also commonly used by traders transitioning from demo accounts or micro accounts to live trading, providing a more controlled way to build experience before scaling up position sizes.

Understanding the Difference Between a Lot and a Mini Lot in Forex

The difference between a lot and a mini lot in forex revolves around several key factors that directly affect risk management:

- Trade volume;

- Profit and loss potential;

- Required capital;

- Transaction costs;

- Suitability for different types of traders.

Let’s explore each of these aspects in more detail

Trade Volume

A standard lot equals 100,000 units of the base currency, meaning each trade involves buying or selling 100,000 units of that currency. In contrast, a mini lot is smaller, equal to 10,000 units of the base currency.

Because of its smaller size, the mini lot allows traders to enter the market with less capital and lower exposure to risk.

Profit and Loss Potential

The next major distinction lies in the profit and loss impact per pip (percentage in point):

- In a standard lot, each one-pip movement equals $10. A single pip change in price can therefore add or subtract $10 from your position. This makes standard lots highly responsive so that small price changes can lead to significant profit or loss.

- In a mini lot, each pip equals $1. Price movements have a much smaller effect on your overall balance, making mini lots more suitable for traders who prefer lower-risk trades or are still learning market dynamics.

Required Capital

Since standard lots represent a larger trade volume, they require significantly more capital to open a position. For many retail traders, this can create a financial barrier.

Mini lots, however, require less margin, allowing traders with smaller accounts to participate in the forex market while keeping their risk controlled. This makes mini lots especially appealing to beginner and intermediate traders.

As IG notes, lot size also affects your margin flexibility. Larger lots tie up more of your available margin, while smaller ones keep funds free for other positions or hedging strategies.

Transaction Costs

The larger the trade volume, the higher the transaction costs, such as spreads and commissions.

For example, if a broker charges a commission of $7 per standard lot, trading one full lot would cost you $7. But if you trade one mini lot, the commission would be just $0.70 for the same currency pair.

This difference is significant for traders who execute multiple positions daily and aim to minimize trading costs.

Risk Management

With standard lots, risk management becomes crucial, as even small market fluctuations can lead to large gains or losses. Using risk control tools like stop-loss orders is essential to limit potential downside.

In contrast, trading with mini lots inherently reduces risk because each pip movement has a smaller dollar impact. This gives traders greater control and helps them build a better understanding of market behavior without facing substantial losses.

For deeper insight into trade sizing, see the related article on “Contract Size in Forex”.

Conclusion

Choosing the right lot size depends on your experience level, available capital, and trading strategy.

- Beginner traders and those seeking lower-risk opportunities often benefit from using mini lots, which offer flexibility and safety.

- Professional traders or those with higher capital may prefer standard lots for larger potential returns, provided they employ strict risk management.

In any case, maintaining proper risk control remains essential to sustainable trading success.