In the world of investing, Modern Portfolio Theory is a tool that helps you create a portfolio with low risk and high return. Instead of focusing on a single asset, you should select a combination of assets that reduces the overall risk of the portfolio while providing a desirable return.

By applying the principles of “diversification” and examining the correlations between assets, you can achieve “portfolio optimization.” In the following article, we will introduce you to the key concepts and methods of using this theory, so stay with us.

- Modern Portfolio Theory (MPT) helps investors find the best combination of assets to maximize return while minimizing risk.

- This theory is based on quantitative analysis and the use of historical data to determine the principles of "portfolio optimization" to reduce risk and increase return.

- Diversification within the portfolio is a key principle of MPT that reduces unsystematic risk and optimizes portfolio performance.

- While MPT offers many advantages, it also has limitations and should be used alongside other models and tools for more informed decision-making.

What is Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT) is a core concept in investing that helps investors maximize expected return relative to a specified level of risk by selecting a combination of assets. Unlike focusing on a single asset, this theory emphasizes that risk should be reduced by looking at the combination of assets.

In simpler terms, instead of buying a specific stock, an investor should choose a portfolio of assets that each have different risk and return characteristics. MPT shows that by making intelligent asset selections and combining them effectively, investors can take advantage of “portfolio diversification” and achieve “portfolio optimization.” This approach not only reduces risk but can also help enhance the overall return on investment.

The principles of this theory emphasize that combining assets (rather than simply selecting individual assets) can reduce the overall risk of the portfolio by lowering the correlation between the assets and improve the expected return.

History and Origins of MPT: From Harry Markowitz to Today

Modern Portfolio Theory (MPT) was introduced by Harry Markowitz in 1952. In this theory, he demonstrated that instead of focusing on a single asset, investors should select assets in combination to maximize expected return relative to managed risk. This idea, known as “portfolio optimization,” emphasizes that asset diversification can reduce risk while simultaneously yielding higher returns. To achieve this, Markowitz used the concepts of “variance” and “correlation.”

Over time, MPT evolved, and models such as the Capital Asset Pricing Model (CAPM) were added, which provided a more accurate calculation of market risk and return. These developments led to the emergence of postmodern theories that challenged some of the core assumptions of MPT. Ultimately, Markowitz’s efforts in this field earned him the Nobel Prize in Economics in 1990.

The Main Goal of Modern Portfolio Theory in Investment Management

The main goal of Modern Portfolio Theory (MPT) is to help investors maximize expected return for a given level of risk or, conversely, reduce risk to achieve a specific return. This theory shows that instead of focusing on a single asset, investors should focus on the combination of assets in an investment portfolio.

Portfolio optimization means selecting assets with different characteristics that can reduce the overall risk of the portfolio while still providing a desirable return. This process is directly related to risk management, as the goal is to manage investment risks effectively to achieve the highest possible return. MPT is a powerful tool that helps investors create a balanced and optimized portfolio.

Key Concepts in Modern Portfolio Theory (MPT)

In Modern Portfolio Theory, four main concepts expected return, risk (volatility), asset correlation, and diversification form the foundation for decision-making in selecting and managing an investment portfolio. Below, we will explore each of these key concepts in detail to gain a deeper understanding of the underlying logic of MPT.

What is Expected Return in Modern Portfolio Theory?

Expected return represents the average anticipated return for an asset or an entire investment portfolio in the future. In Modern Portfolio Theory, this return is calculated based on the probabilities of different market scenarios occurring.

In simpler terms, if we know the likelihood of an asset yielding a profit or loss in various market conditions, we can consider the weighted average of these outcomes as the expected return.

In the formulation of Modern Portfolio Theory (MPT), each asset in the portfolio has a specific weight, and the expected return of the portfolio is the sum of the products of each asset’s weight and its expected return. This concept is the most fundamental component for calculating portfolio efficiency, as it forms the basis for comparing risk and return.

How is Risk or Volatility Measured in a Portfolio in Modern Portfolio Theory?

In Modern Portfolio Theory (MPT), risk is typically measured as the standard deviation of returns, which indicates the degree of dispersion of returns around the mean. The greater the deviation of actual returns from the expected value, the higher the risk or volatility of the investment.

However, at the portfolio level, risk is not only dependent on the risk of individual assets but also on how the assets move together. For this reason, Modern Portfolio Theory divides total risk into two components:

- Systematic Risk (Unavoidable): Caused by macroeconomic conditions or market-wide factors.

- Unsystematic Risk (Avoidable): Related to the specific characteristics of a company or industry.

By combining assets that do not move in the same way, the avoidable portion of risk can be reduced.

What Role Does Correlation Between Assets Play in Modern Portfolio Theory?

Correlation is a statistical measure that indicates how two assets move in the same or opposite direction. Its value ranges between +1 and -1:

- +1 means the two assets move exactly in the same direction.

- -1 means they move in completely opposite directions.

- 0 means there is no specific relationship between their movements.

In the context of MPT, the goal is to select assets that have low or negative correlation. In this case, the poor performance of one asset can be offset by the better performance of another. This feature is the cornerstone of the concept of portfolio diversification, which we will discuss next.

How Does Diversification Reduce Total Risk in Modern Portfolio Theory?

Diversification is the process by which an investor includes a variety of assets from different industries, countries, or asset classes in their portfolio to avoid concentrated risk. In Modern Portfolio Theory (MPT), diversification directly arises from the concept of low or negative correlation between assets. When assets do not behave similarly, potential losses in one area can be compensated by gains in another. As a result, the overall volatility of the portfolio is reduced without diminishing the expected return.

In other words, diversification allows the investor to eliminate unsystematic risk and remain exposed only to systematic risk (the portion of risk that cannot be eliminated even in the most diversified portfolios).

Efficient Frontier in Modern Portfolio Theory

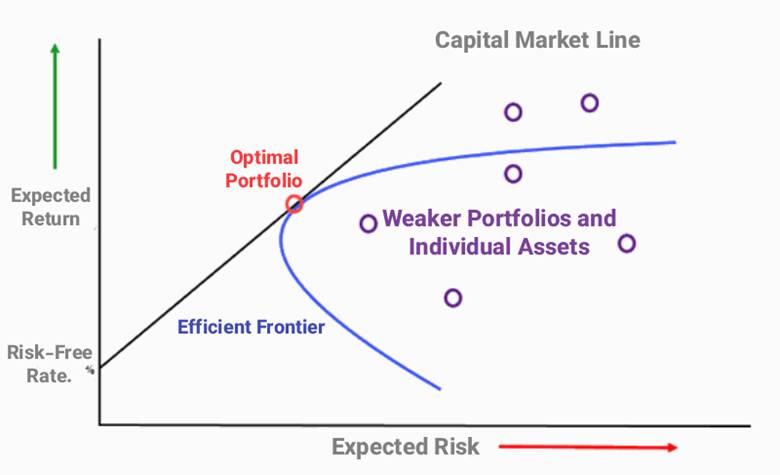

The Efficient Frontier in Modern Portfolio Theory is one of the key concepts for assessing the balance between risk and return. Simply put, this frontier is a line that shows how one can achieve the highest possible return for a given level of risk by combining assets optimally.

The Efficient Frontier helps investors decide where they want to position themselves in terms of risk and return: Are they seeking minimum risk or maximum return? To gain a deeper understanding of this concept, we first need to know how the Efficient Frontier is plotted, how it differs from inefficient portfolios, and where the optimal portfolio lies on it.

What is the Efficient Frontier and How is it Plotted?

The Efficient Frontier is a set of portfolios that offer the highest possible return for each level of risk. This frontier is drawn as a curve on a risk-return graph. In this graph, the horizontal axis represents risk (standard deviation) and the vertical axis represents expected return. This frontier tells us which portfolio will provide the best return for each level of risk. In essence, portfolio optimization means selecting portfolios that lie on this frontier.

To plot this frontier, the following steps are usually taken:

- Identifying investable assets (stocks, bonds, etc.);

- Estimating the expected average return and standard deviation (risk) of each asset;

- Calculating the correlation between the assets to measure the effect of diversification;

- Creating hundreds or thousands of different combinations of assets and plotting them on the risk-return graph.

The result of this process is a cloud of points that represents all possible portfolios. The points that are at the top and left of this cloud form the Efficient Frontier because they have the maximum return-to-risk ratio.

Difference Between Efficient and Inefficient Portfolios

In the risk-return graph, all portfolios that fall below the Efficient Frontier are considered inefficient because they provide lower returns for the same level of risk. In other words, a rational investor should never choose an inefficient portfolio because they can achieve higher returns with the same risk through an efficient portfolio.

On the other hand, portfolios that lie on the Efficient Frontier are called efficient. These portfolios result from an optimal combination of assets that, by applying the principles of diversification and minimizing variance, provide the highest possible return for the chosen level of risk.

The Concept of the “Optimal Portfolio” on the Efficient Frontier

Among the infinite number of efficient portfolios on the frontier, only one is considered the optimal portfolio. This is the point that exactly matches the investor’s preferences and utility function.

If the risk-free rate is also considered, a line called the Capital Market Line (CML) is drawn from the risk-free return axis, touching the Efficient Frontier at one point. That point is the Tangency Portfolio, or the optimal portfolio according to Markowitz.

At this point:

- The ratio of excess return to risk (Sharpe Ratio) is maximized;

- The asset mix offers the best possible balance between risk and return;

- And the investor can adjust their position along the Capital Market Line by changing the weight of risky and risk-free assets.

Thus, the Efficient Frontier not only serves as a guide for building rational portfolios but also provides a foundation for optimal decision-making and quantifying risk in professional investing.

According to CFI, the Efficient Frontier indicates that an increase in risk is not always proportional to an increase in return. In other words, as you move towards higher risk, the additional return increases at a decreasing rate (diminishing marginal return), which makes the graph curve.

Portfolio Optimization Process Based on Modern Portfolio Theory (MPT)

In Modern Portfolio Theory (MPT), the main goal of the portfolio optimization process is to select a combination of assets that provides the highest possible return for a given level of risk. In other words, the portfolio should lie on the Efficient Frontier.

Next, we will examine the technical steps and factors that influence this optimization in detail:

Determining the Optimal Weights of Assets Using the Covariance Matrix

In the first step, to calculate the total risk of the portfolio, the correlation between the returns of the assets must be measured. This correlation is calculated using the covariance matrix, which shows how the returns of two assets move in relation to each other. Then, using this matrix and the historical average return of each asset, the MPT model solves a mathematical optimization problem:

The goal is to find the weights for each asset that minimize the portfolio’s variance for a given return or maximize the return for a specific level of risk. In simpler terms, the optimal weight of each asset in the portfolio is chosen in such a way that the effect of diversification is maximized in reducing total risk, not just increasing the individual return of each asset.

Role of Systematic and Unsystematic Risk in Optimization

In risk analysis, it is important to distinguish between systematic risk and unsystematic risk. Systematic risk arises from macroeconomic factors (such as interest rates, inflation, and government policies) and cannot be eliminated, whereas unsystematic risk is related to specific conditions of a company or industry and can be significantly reduced through diversification.

Modern Portfolio Theory is based on this very principle: by combining assets with low correlation, unsystematic risk can be reduced, and the portfolio can remain exposed only to systematic risk. Therefore, when determining the optimal portfolio, the analyst must use historical data to account for the impact of these two types of risks in the asset weight structure.

Using Software and Numerical Models for Calculating the Optimal Portfolio

Portfolio optimization typically requires complex mathematical calculations that are difficult to perform manually. For this reason, analysts and investment managers use specialized software and numerical models to find the optimal combination.

Programs like Excel (Solver), MATLAB, R, Python (libraries such as NumPy and PyPortfolioOpt), and even online financial platforms allow for the input of return data, calculation of the covariance matrix, and execution of the Markowitz model.

These tools solve multivariate optimization problems, plot the Efficient Frontier, and show which asset combination provides the best return at each level of risk. Ultimately, the investor or portfolio manager can select the most suitable point on this frontier based on their risk tolerance.

In portfolio optimization using the covariance matrix, the weighting of assets is not only based on their individual returns but also on how they move together (covariance/correlation) between the assets. In other words, the interaction between assets is as important as their individual characteristics.

Key Assumptions of Modern Portfolio Theory

Modern Portfolio Theory (MPT) is based on several key assumptions that help investors optimize their portfolios. These assumptions define investor behavior and decision-making processes and play an important role in portfolio optimization. Below, we review the most important of these assumptions.

Rational Investor Behavior

In Modern Portfolio Theory, it is assumed that all investors behave rationally and logically. This means that, under equal conditions, an investor will choose the investment option with lower risk when two options offer the same expected return.

In other words, investment decisions are based purely on optimizing risk and return, not on emotional, psychological, or irrational factors. This assumption allows the theory to model investor behavior in a predictable way and use statistical and mathematical concepts to analyze their choices.

Returns Follow a Normal Distribution

The second assumption of Modern Portfolio Theory is that the returns of assets follow a normal distribution. This means that the average return is the central measure, and the standard deviation represents the level of dispersion or risk. In such a case, the probability of extreme returns (either very high or very low) is minimal, and most returns fall within a predictable range around the mean.

This assumption makes it possible to use simpler statistical models, such as calculating covariance and variance, and forms the basis of Markowitz’s Efficient Frontier calculations. Although in reality returns are not always exactly normal, this assumption provides high efficiency for theoretical analysis and portfolio modeling.

Investors Make Decisions Based Only on Risk and Return

In MPT, it is assumed that investors make decisions based solely on risk and return, ignoring other factors like transaction costs, taxes, or liquidity. The model assumes simply that all investment decisions are made based on the risk and return analysis of each asset, with no additional factors considered.

According to Wikipedia: One of the main limitations of these assumptions is that the model is single-period and does not address investor decision-making over multiple periods. This means that in conditions of time or multi-period changes, its applicability may be limited.

Advantages and Limitations of MPT

Modern Portfolio Theory (MPT) is one of the most important tools for optimizing a portfolio, helping investors choose the best combination of assets. However, like any other model, it has both advantages and limitations.

Advantages of Modern Portfolio Theory (MPT)

One of the greatest advantages of MPT is that it helps investors build an optimal investment portfolio by considering both risk and return. This model shows how diversifying the portfolio can reduce overall risk while achieving a suitable return. Modern Portfolio Theory offers a scientific approach to portfolio management, where decisions are based on precise mathematical calculations rather than guesswork.

Limitations of Modern Portfolio Theory (MPT)

However, this model also has several limitations. One of the main limitations is that MPT assumes returns follow a normal distribution, which is not always true in the real world. Additionally, the model relies on past data, and if the market experiences sudden changes, the model may not perform accurately.

Moreover, portfolio management based on this model does not account for factors such as taxes, transaction costs, or investors’ irrational behaviors. These are factors that can influence the performance of an investment portfolio.

Ultimately, Modern Portfolio Theory is a useful tool for constructing investment portfolios, but it should be used alongside other tools and analyses to make better-informed decisions.

Practical Applications of Modern Portfolio Theory in Today’s World

Modern Portfolio Theory (MPT) has many practical applications in various areas of finance today. Here are a few examples of its real-world applications:

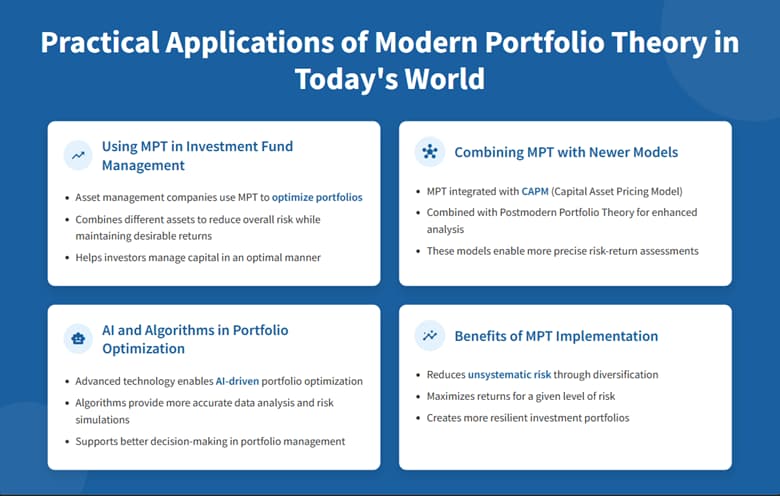

Using MPT in Investment Fund Management

Many investment funds and asset management companies use MPT to “optimize their portfolios.” These institutions use this model to combine different assets in a way that reduces overall risk while achieving a desirable return. This helps investors optimally manage their capital.

Combining MPT with Newer Models like CAPM and Postmodern Portfolio Theory

Modern Portfolio Theory has been combined with newer models like CAPM (Capital Asset Pricing Model) and Postmodern Portfolio Theory. These models can help investors make more precise analyses of risk and return. While MPT remains a key tool for selecting asset combinations, these models are especially useful in certain market conditions.

The Role of Artificial Intelligence and Algorithms in Portfolio Optimization

With the advancement of technology, the use of artificial intelligence (AI) and algorithms in portfolio optimization has increased. These advanced tools can help with more accurate data analysis and simulate the returns and risks of assets. Using these tools in “portfolio management” allows investors to make better decisions and build more optimal portfolios.

Conclusion

Modern Portfolio Theory (MPT) is one of the key tools in portfolio optimization, helping investors maximize expected return for a specific level of risk by combining assets. This theory aids in reducing risk and increasing portfolio efficiency by using concepts such as diversification, correlation, and return.

Despite limitations such as simplified assumptions that may not always be applicable in the real world, Modern Portfolio Theory remains one of the foundational principles in portfolio management and risk management. For individual investors or asset managers, using this theory alongside awareness of its limitations can be an effective tool for decision-making and constructing an optimal portfolio.