Capital management and risk control are two inseparable concepts for a trader’s success. Many traders, even with a profitable trading strategy, suffer significant losses due to poor money management. It is for this reason that Money Management Expert Advisors (EAs) were developed. Contrary to the popular belief that EAs are only designed for automated trading, some have the vital role of managing risk and capital.

In this comprehensive article, we will examine these tools and help you understand their principles, types, and how to use them on popular platforms like MetaTrader and TradingView.

- Before using any Expert Advisor, be sure to backtest it on historical data and then forward test it on a demo account for a period of time.

- Even the best EAs require continuous monitoring so you can update their settings in case of sudden market changes.

- If you're using multiple EAs simultaneously, make sure they don't have any functional conflicts.

- An EA's performance depends on the stability of your platform and internet connection. If the connection is lost, the EA may stop working, and trades will not be managed.

What Is a Money Management Expert Advisor and Why Is It Important?

A money management Expert Advisor (EA) is an automated program that runs on trading platforms like MetaTrader or TradingView. The primary function of this program is to minimize your trading risk. Simply put, a money management EA performs critical tasks for you, such as calculating your position size (lot size), and setting your stop-loss and take-profit levels. This program operates based on the rules you define in advance.

Why Is It Important to Use These Expert Advisors?

- High Accuracy: These programs perform calculations without any human error, which means the probability of making a mistake when determining trade size or lot size is nearly zero.

- Speed: In volatile markets, speed is crucial. An EA can perform the necessary calculations and execute commands in the blink of an eye.

- Adherence to Rules: EAs prevent emotional and impulsive decisions. While a trader might impulsively increase their position size or leverage in a moment of excitement, the EA will always stick to the rules you set, which helps you maintain trading discipline.

The Difference Between Money Management, Trading, and Signal-Providing Expert Advisors

The key difference between a Money Management Expert Advisor and Trading or Signal-Providing EAs lies in their function. While all three are automated tools, they have entirely different objectives.

Trading Expert Advisor

This type of EA is a complete trader in its own right. Its function is to fully execute a trading strategy. It automatically identifies buy or sell signals, opens a trade, and closes it at the right time. You only need to code the strategy into the EA.

Example: Suppose your strategy states, “Buy whenever the 50-period Moving Average crosses the 200-period Moving Average from below.” A Trading EA will perform this action automatically without any intervention from you.

Some expert advisors can detect hidden correlations between currency pairs or assets and prevent taking overly aligned positions.

Signal-Providing Expert Advisor

This type of EA acts only as an intelligent assistant. Instead of executing trades themselves, they simply notify you of entry or exit signals. The final decision to place a trade is entirely up to you.

Example: Your Signal-Providing EA might alert you, “The EUR/USD pair is at a good entry point.” However, you must log into the platform yourself to place the trade.

Money Management Expert Advisor

This EA neither opens trades nor provides signals. Its sole function is to manage and control your existing trades. The main goal of these EAs is to automatically adjust risk and ensure your money management rules are followed correctly.

Example: You want to enter a trade but don’t want to risk more than 2% of your total capital. A Money Management EA will automatically calculate the exact position size (lot size) in real time based on your current account balance and your defined risk tolerance. It can even automatically set your stop-loss and take-profit levels for you. This prevents emotional decision-making and helps you trade with greater discipline.

Types of Money Management Expert Advisors

In this section, we’ll discuss the three main types of Expert Advisors (EAs), each of which uses a different approach to risk control.

Fixed Fractional Expert Advisor

This is the most popular and widely used money management method. With this approach, you specify a fixed percentage of your total capital to risk on each trade. The EA then automatically calculates the position size based on this percentage and your stop-loss distance.

Example: Let’s say you have a balance of $1,000 and want to risk a maximum of 1% on each trade. If your stop-loss is 50 pips away, the EA will calculate the position size so that if the stop-loss is triggered, you lose only $10 (1% of $1,000). This method allows your position sizes to automatically increase as your capital grows.

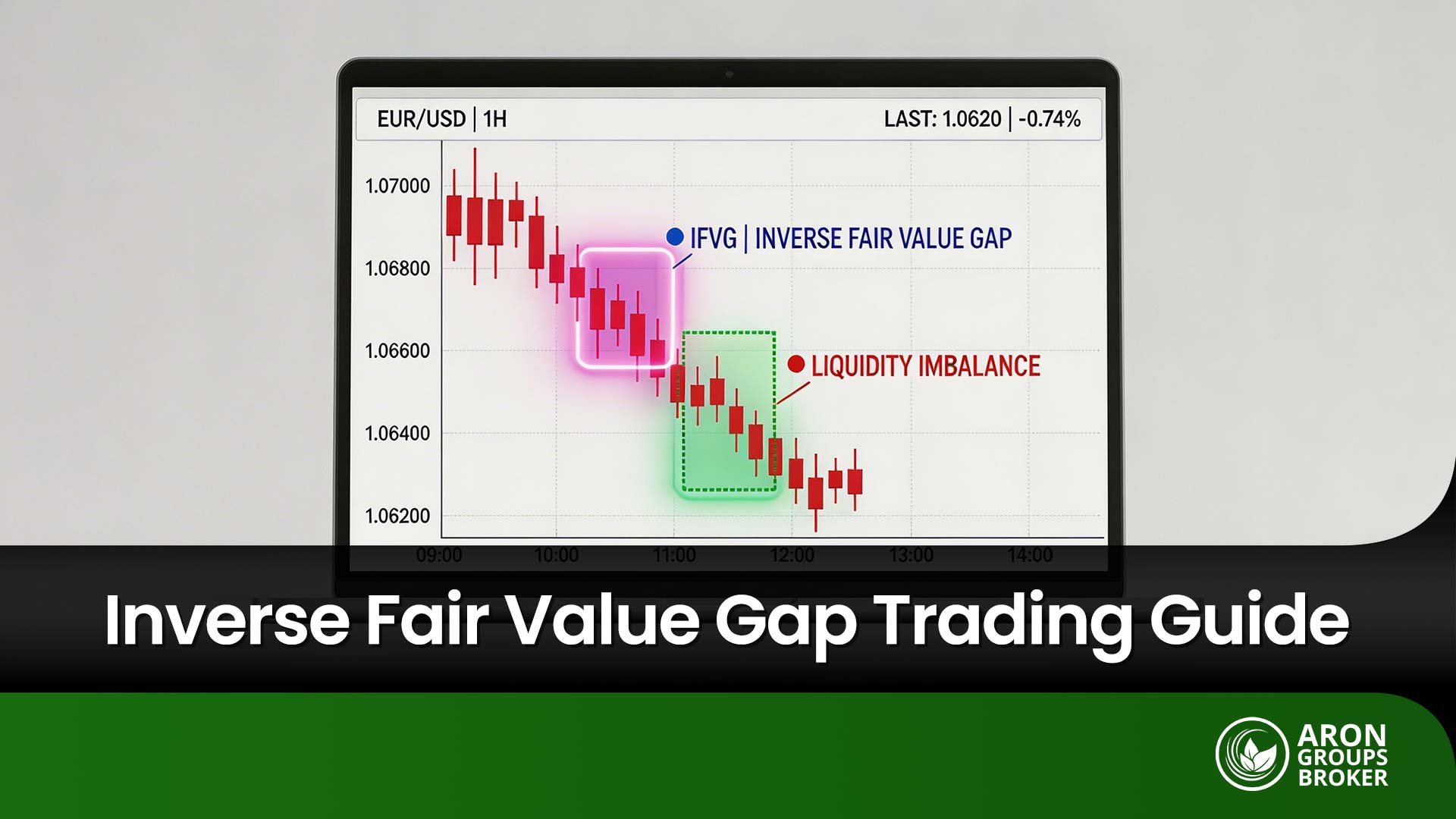

Volatility- and Indicator-Based Expert Advisor

This type of EA uses market volatility to determine position size. EAs using this approach measure volatility with technical indicators like the Average True Range (ATR). When the market is highly volatile, your required stop-loss distance increases. In such cases, the EA automatically reduces your position size to keep your risk constant. Conversely, in less volatile markets, it will increase your position size.

Example: On a day when a major news event is released, market volatility increases. The EA will detect this condition and reduce your position size. This way, even though your stop-loss is wider, your potential loss remains within a safe range, protecting your capital from sudden market movements.

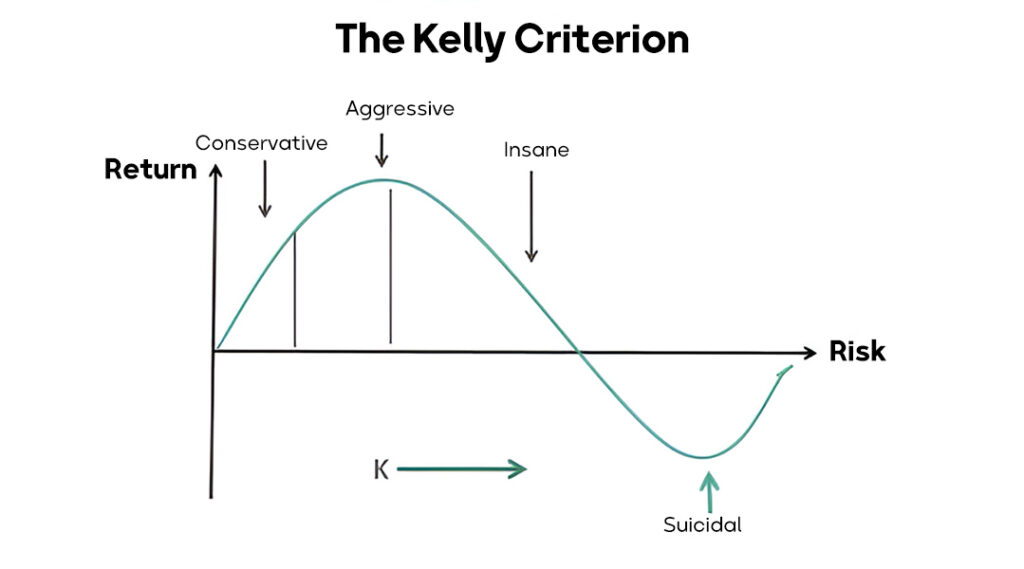

Statistical and Kelly Criterion-Based Expert Advisor

The Kelly Criterion is an advanced mathematical formula designed to optimize capital growth over the long term. EAs that use this method determine position size based on your strategy’s statistical data, such as its win rate and risk-to-reward ratio.

Example: If your trading history shows that 60% of your trades are profitable and your average profit is twice your average loss, the Kelly formula will tell you the optimal percentage of your capital to risk on each trade to maximize long-term growth. This method is highly useful for professional traders who have precise data on their performance.

Some expert advisors use artificial intelligence to identify traders’ behavioral mistakes and correct high-risk decisions.

Core Components and Functionality of a Money Management Expert Advisor

A money management Expert Advisor (EA) is composed of several key components, each with a specific function to ensure your trades are executed with complete discipline and in accordance with your capital management rules.

Inputs

This section acts as the EA’s dashboard. Here, you define the main parameters, such as the percentage of your capital you wish to risk on each trade (e.g., 1%), or the distance of your stop-loss and take-profit in pips.

Lot Size Calculator Module

This is the core of the EA. Based on the information you provide in the Inputs section (account balance, risk percentage, and stop-loss distance), this module automatically calculates the appropriate trade size. This ensures that even in the event of a sudden price movement, your loss will not exceed the predetermined percentage.

Stop-Loss & Take-Profit Manager Module

This section becomes active after a trade is opened. This module automatically places stop-loss and take-profit levels on your position. Additionally, some advanced EAs have the ability to set a trailing stop-loss.

Overall Risk Control Module

This component is designed to provide extra protection for your capital. This module monitors the total risk of all open trades in your account. If the total risk exceeds a predefined limit, it prevents new trades from being opened to protect your margin and your entire account.

Advantages and Disadvantages of a Money Management Expert Advisor

Every automated tool has its pros and cons, and a money management Expert Advisor (EA) is no exception. Let’s look at the most important advantages and disadvantages of using these EAs.

Advantages

- Trading Discipline: A trader’s biggest enemy is their emotions. By completely removing emotion from the decision-making process, these EAs help you stick to your rules and avoid impulsive decisions that often lead to losses.

- High Speed and Accuracy: Complex capital management calculations are done in a fraction of a second, without any human error. This speed and accuracy are a crucial advantage in volatile markets.

- Time Savings: With these EAs, you no longer need to manually calculate position size or set stop-loss and take-profit levels. This frees up more of your time to analyze the market and improve your strategy.

- Sustainable Account Growth: By strictly following money management rules, these EAs help you avoid blowing up your account, even when you have losses, and allow your capital to grow steadily over the long term.

Disadvantages

- Reliance on Code Quality: The effectiveness and accuracy of an EA are entirely dependent on its code. If the programmer made errors or wrote it in a non-standard way, the EA may not perform correctly and could lead to losses instead of helping you.

- Complex Initial Setup: For novice traders, the initial setup of an EA can be confusing. Incorrectly entering parameters can lead to faulty calculations and unexpected risks.

- Inflexibility in Abnormal Market Conditions: An EA operates based on pre-programmed rules and can’t analyze unpredictable or exceptional market conditions like a human can. During times of major news releases or economic crises, an EA may not perform as expected.

- Cost and Support: Most free EAs have limited features, while professional versions require a purchase. It’s also possible that adequate support may not be available to help you if technical issues arise.

Specialized versions of money management expert advisors can time trade entries and exits by analyzing real-time market liquidity, minimizing slippage.

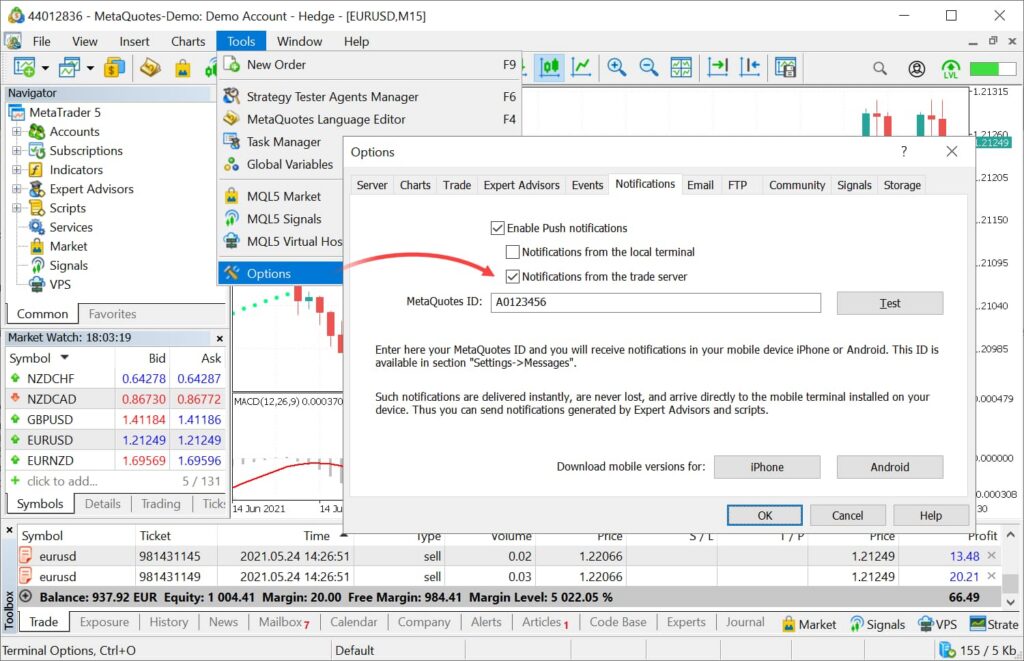

How to Install, Activate, and Configure a Money Management Expert Advisor in MetaTrader 4 and 5

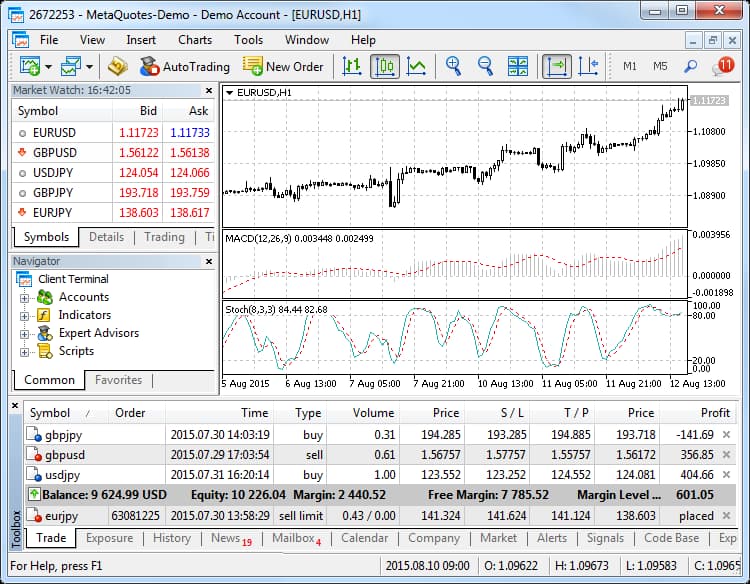

Step 1: Launch the MetaTrader 5 or 4 Platform

First, open the MetaTrader 5 or 4 application on your computer.

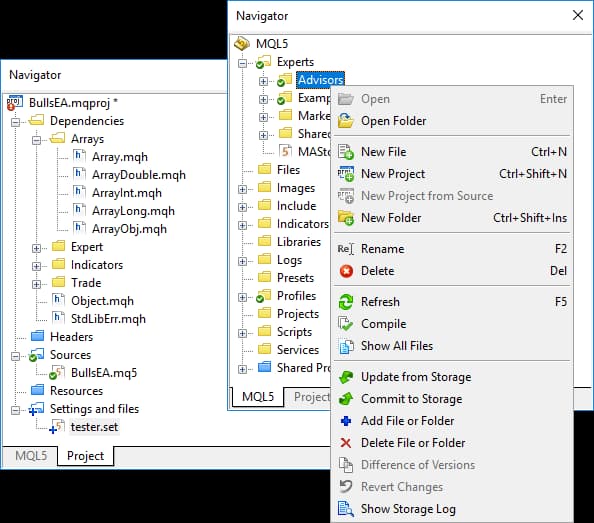

Step 2: Open the Navigator Window

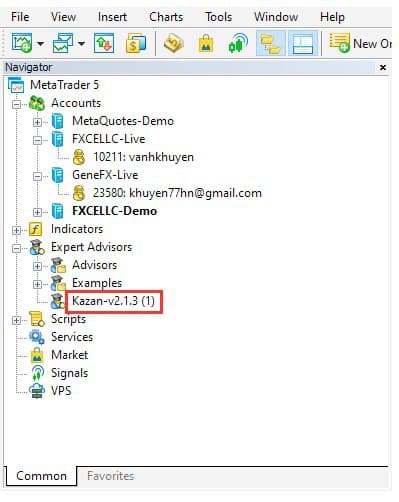

After logging into your account, locate and click on the “Navigator” window. You can usually find it in the toolbar or by pressing Ctrl+N on your keyboard.

Step 3: Open the Expert Advisors Folder

In the “Navigator” window, you will see various folders, including Expert Advisors, Indicators, and Scripts. To view the contents of the Expert Advisors folder, click the small arrow or plus sign (+) next to it.

Step 4: Copy or Move the Expert Advisor File

Expert Advisor files are typically distributed with a .ex5 or .ex4 extension. First, find the desired EA file on your computer. Then, right-click on it and choose either Copy or Cut, depending on whether you want to keep a copy of the file in its original location.

Step 5: Close the Folder Window

Once you have copied or moved the EA file, close the Expert Advisors folder window to return to the main MetaTrader 5 or 4 interface.

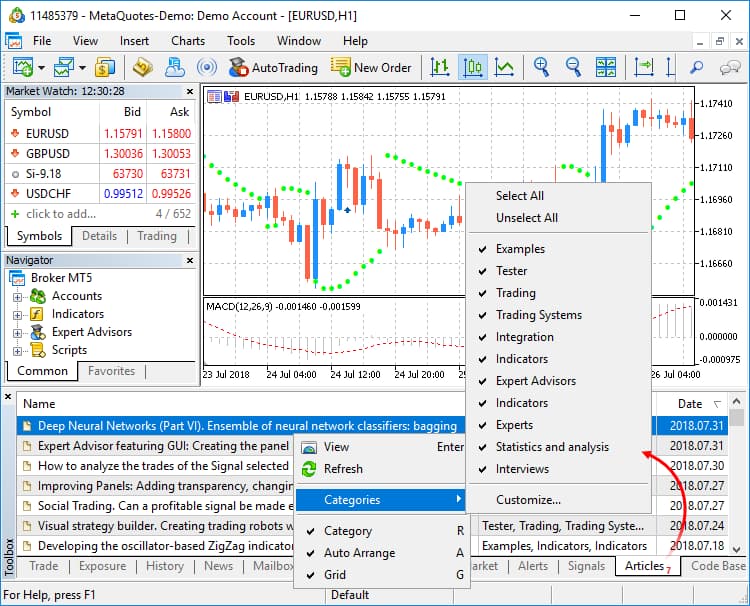

Step 6: Refresh the Navigator Window

Right-click anywhere within the Navigator window to open a context menu. From this menu, select Refresh to update the list of your EAs and other components. Your new EA should now be visible in the list.

Step 7: Locate the Installed Expert Advisor

Now, go back to the Expert Advisors folder in the Navigator window to confirm that the copied or moved EA is correctly displayed in the list and is accessible.

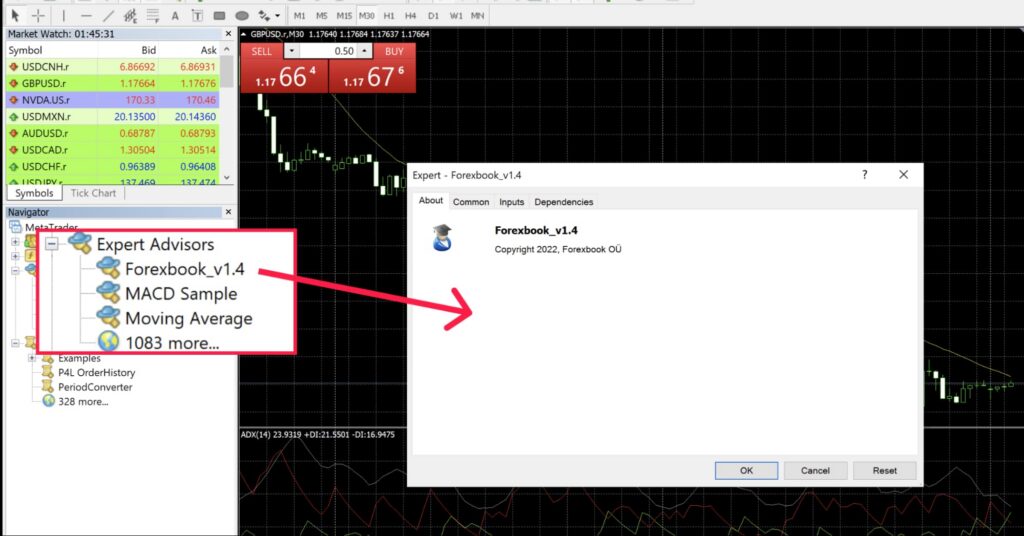

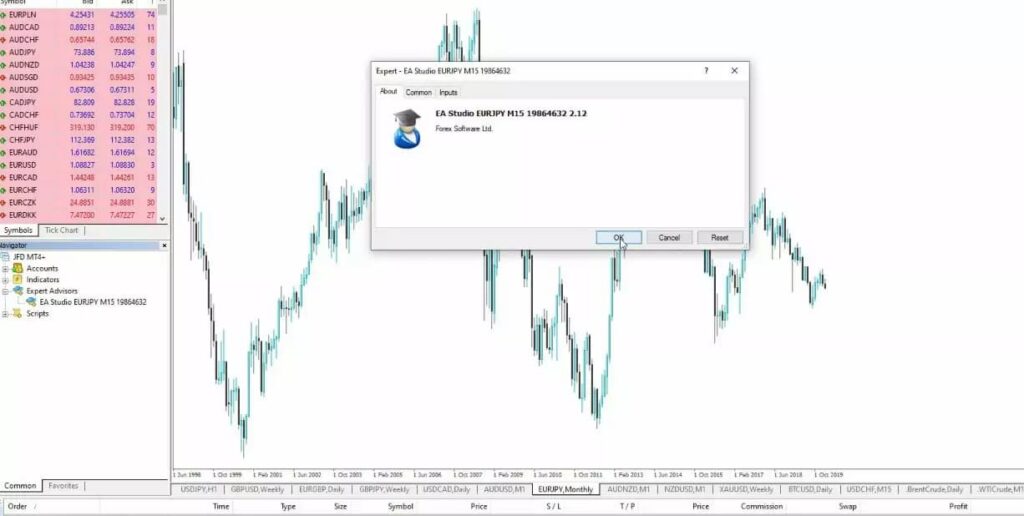

Step 8: Apply the Expert Advisor to a Chart

You now need to place the EA on your desired chart. You can do this by dragging and dropping it from the Navigator window onto the chart. Alternatively, you can right-click on the EA’s name and select “Attach to a chart” from the menu that appears.

Step 9: Configure the Expert Advisor Settings

After you attach the EA to a chart, a settings window will open. In this window, you can configure various parameters such as lot size, stop-loss, take-profit, and other trading conditions based on your strategy.

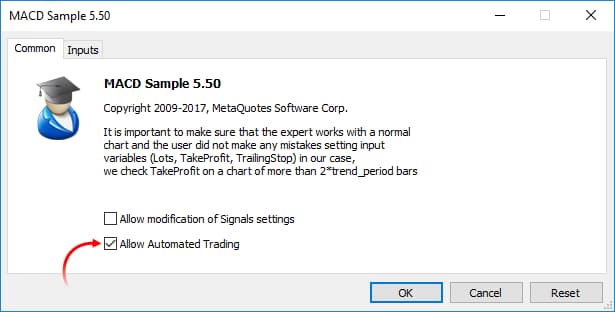

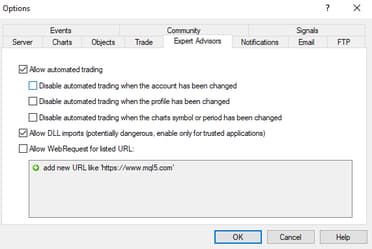

Step 10: Enable Automated Trading

Now, you need to enable the “Auto Trading” button in the toolbar at the top of the platform. This allows the EA to automatically execute trades based on its programmed logic.

Step 11: Confirm Permissions

In some cases, you may need to confirm permissions to allow external programs to run on your MetaTrader 5 or 4 platform. Follow any on-screen prompts to grant the necessary permissions for the EA to function correctly.

Step 12: Monitor the Expert Advisor’s Performance

To ensure the EA is working properly, keep an eye on the Terminal window. In this section, you can see notifications for trade entries and exits, profit or loss updates, and error messages. You can also use the Experts and Journal tabs to monitor the EA’s activity and performance in more detail.

Step 13: Adjust Expert Advisor Settings as Needed

Regularly review the EA’s performance and adjust its settings if necessary. Using the Inputs tab in the EA’s settings window, you can modify parameters like stop-loss, take-profit, and other trading conditions. This allows you to adapt your EA to changing market conditions and improve its overall performance.

How to Install, Activate, and Configure a Money Management Expert Advisor on TradingView

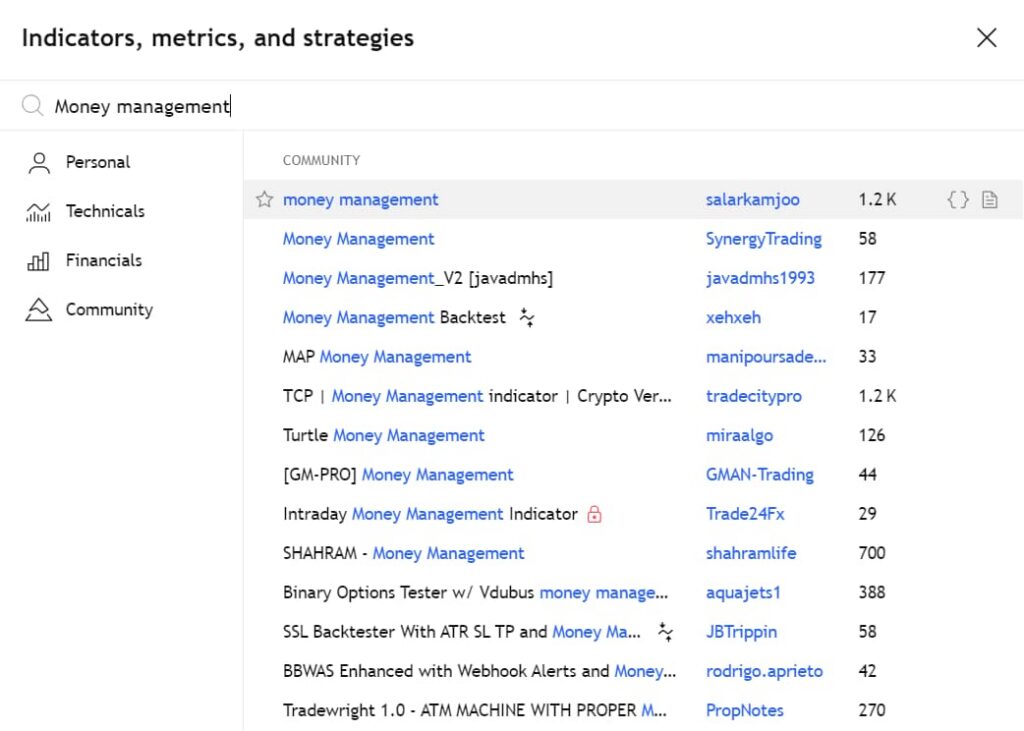

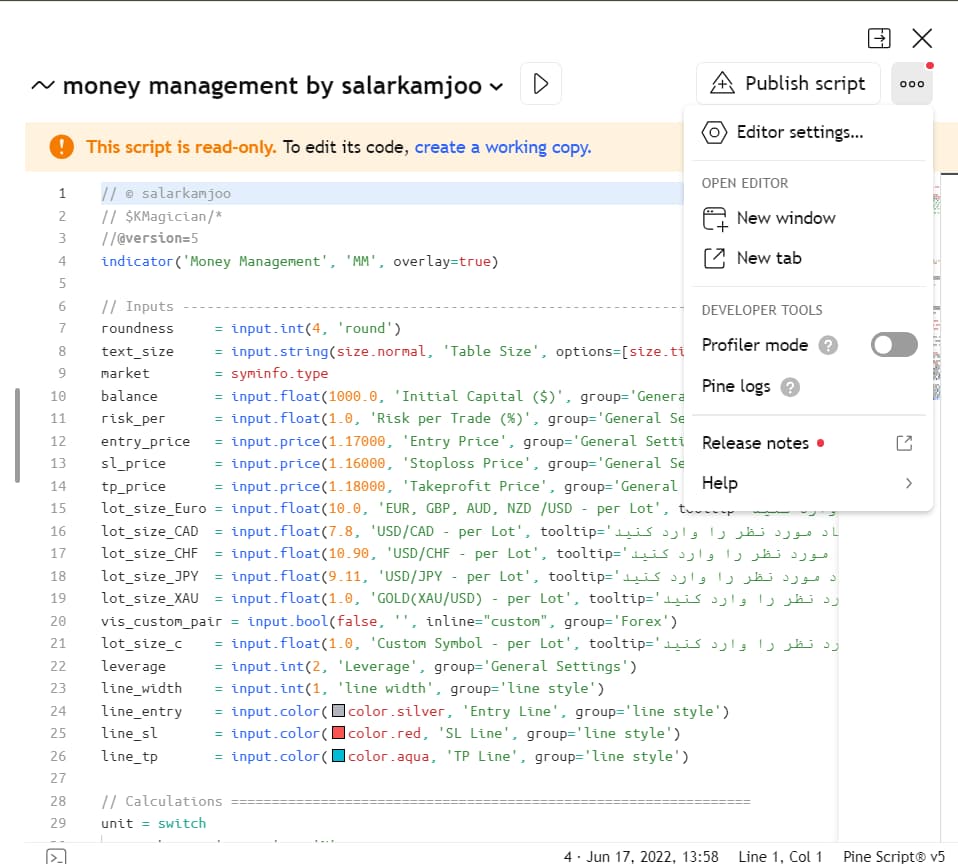

To use money management tools on the TradingView platform, you need to use scripts. In fact, what are known as Expert Advisors on other platforms are written in Pine Script on TradingView.

Finding and Adding the Script

Searching for a Script: In the Indicators menu, go to the Community Scripts section and search for money management scripts. You can also access exclusive scripts from the Invite-only Scripts section if you have an invitation link.

- Adding to a Chart: Once you’ve found the desired script, simply click on it to add it to your chart.

Configuring the Script

Clicking the gear icon (⚙️) next to the script’s name will open its settings window. Here, you can adjust the input parameters to match your strategy and needs.

Automating Trades

This is the most significant difference between TradingView and MetaTrader. TradingView does not directly execute trades on your account. To automate trades, you must use third-party services. These services transfer the signals generated by the script to your trading account via webhooks or your broker’s API. This allows your EA to manage trades on the broker’s platform.

How to Choose the Best Money Management Expert Advisor

Choosing the right Money Management Expert Advisor (EA) is a crucial step toward your success. Given the wide variety available on the market, it’s best to consider a few key points before making a decision.

Check the EA’s Compatibility with Your Platform and Broker

The first and most important step is to ensure the EA is compatible with your trading platform. If you use MetaTrader 4 or MetaTrader 5, you must choose an EA designed for that specific version. Furthermore, some brokers may have restrictions on the use of EAs. Therefore, before purchasing or installing, be sure to familiarize yourself with your broker’s rules.

Customization and Advanced Settings

The best EAs are those that allow you to customize the settings to fit your personal strategy. An EA that offers only one risk management method has less flexibility. Look for an EA that provides various options for controlling trade size, automatically setting stop-loss and take-profit levels, and managing your account’s overall risk.

Developer Reputation and Technical Support

An EA’s success depends on the reputation and track record of its developer. Before trusting an EA, read reviews from other users and ensure the developer regularly provides updates and offers reliable technical support.

Here you can see a list of the best EAs for MetaTrader 5.

Costs, Licenses, and Updates

Some EAs are available for free, while professional versions require a fee. Although paid versions generally offer more features, you can start with a free version. Also, make sure that the purchase price includes future updates.

Conclusion

A Money Management Expert Advisor is a powerful tool that can bring discipline and accuracy to your trading. This tool helps you avoid emotional decisions and focus on the sustainable growth of your account.

With the right choice and proper settings, an EA can be an invaluable assistant for any trader, whether a beginner or a professional. However, remember that even the best EA in the world can’t perform miracles without a solid trading strategy.

FAQ

1. Can a money management EA prevent losses?

No, a money management EA does not prevent losses; it manages them. Its goal is to ensure your losses don’t exceed a certain limit, thereby preventing your account from being wiped out.

2. Is it permissible to use a money management EA with all brokers?

Most brokers allow the use of EAs, but it’s always best to check your own broker’s rules and regulations before you start using one.

3. Is it possible to directly execute trades with an EA on TradingView?

No, not directly. TradingView is an analysis platform. To execute automated trades, you must use a broker’s API or a third-party intermediary service.

4. Are free money management EAs reliable?

Some free EAs can be very useful, but you should always use them with caution. It’s best to test them on a demo account first and download them from a reliable source.