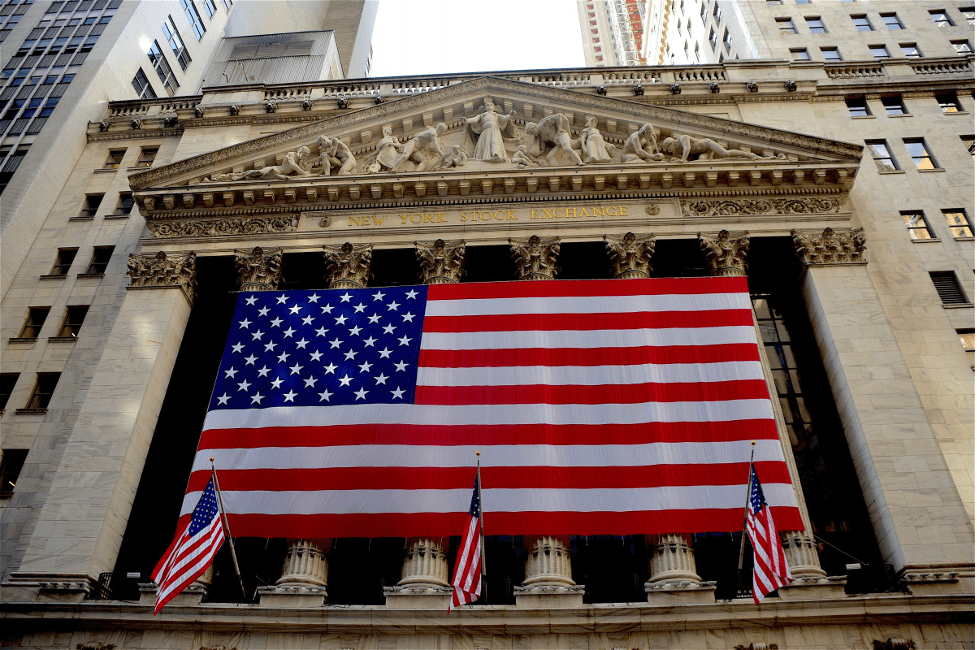

New York Stock Exchange (NYSE) is one of the biggest stock exchanges in the world, located in New York City. It is considered to be the largest equities-based exchange in the world. The total market capitalization of this exchange is $22.46 trillion in 2023. It is one of the most active marketplaces all around the world, which attracts so many institutional and individual investors from all around the world. If you are interested in this huge market, you must read this article. At Aron Groups, we have provided you with all the information necessary for getting involved with NYSE in one place.

Table of Contents

What is an exchange?

Before talking about New York Stock Exchange, you should get familiar with the term Stock Exchange which is called the stock market or Bourse in Europe. It’s an organized market designed for selling and buying Securities such as shares, stocks, and bonds.

It is first a liquid Market that encourages people to invest and channel their savings into corporate investment. On the other hand, it is a perfect tool as a pricing mechanism that determines prices and demonstrates the true investment value of company stock.

Different countries use different methods for membership, and trading is done in different ways. Investors may attend auctions, broker might buy and sell stocks to dealers.

The History of the New York Stock Exchange

The beginning of the NYSE goes back to 1792 when a group of 24 stock brokers met on the Buttonwood tree, what is now Wallace Street in New York City, and created an exchange. It was considered the first formalized exchange in the United States in 1817. Investors and traders refer to this Stock Exchange as “Big Board,” Which is the nickname for the NYSE. At first, the name of this exchange was New York Stock, and in 1863, the name changed to New York Stock Exchange.

The membership of this exchange was exclusive till 1868. At that time, an investor could only obtain a membership by purchasing a seat from another member, and limited members were on board.

Commercial activity after the War of 1812 increased, and news on railroad stock in the 1830s created a huge demand for capital and increased trade at the exchange. The New York Stock Exchange provided the capital for industrialization in the United States after the Civil War.

After the economic recession of 1837, the exchange required companies to provide public information about their finances. The famous incident of the Crash of the stock market in 1929 started a Great Depression in the economy of the United States, which led to the beginning of investigations by the federal government and conducting regulation by the Securities and Exchange Commission.

Since then, any company must meet a defined requirement to be listed on the New York Stock Exchange. In 2003 The Exchange created a corporate governance standard that implies that every company listed on the exchange must have a majority of independent directors on the board, and the audit compensation and the nomination committees should not be of dependent directors.

In 2006 New York Stock Exchange merged with Archipelago Holdings, and NYSE Group Inc. was created. At that time, some seats were sold for as much as $4 million.

In 2007 Another merger happened with Euronext N.V. which was a group of European security exchanges, and the holding company NYSE Euronext was created. A year later, the NYSE Euronext bought the American Stock Exchange, and in 2013, the NYSE Euronext was bought by International Exchange (ICE).

How does New York Stock Exchange work?

The New York stock exchange is located on Wall Street in New York City, a two-floor Exchange Building consisting of one trading floor for Equity traits and another for American options Exchange.

The exchange has relied on floor trading for years, but many Traders prefer electronic systems over traditional trading. Today the New York Stock Exchange is active for trading from Monday 9:30 a.m. to Friday 4:00 p.m.

Investors from all around the world set their strategies according to the opening and closing bells of The Exchange Market which marks the beginning and the end of a trading day. As previously noted, democratic starts at 9:30 a.m. and closes at 4:00 p.m. At this time, people will hear the opening and closing bell.

Until 1995, the trading floor manager rang the bell, but later, it became a daily event.

Sometimes ringing the exchange bell coordinates with marketing events such as introducing a new product or launching innovative services. Sometimes you might even see public figures, such as celebrities ringing the bell.

NYSE in modern days

Technological developments has greatly changed the nature of trading in the world. As of the beginning of the 21st Century and with the increased access to the internet, electronic trading or e-trading has become more popular.

Today market makers can match the orders of buyers and sellers without the intervention of a specialist, and investors do not need to spend their time on the exchange floor.

In Aron Groups, you can enter an order directly online, and your order will be matched with the best price available. In these circumstances, you don’t need to be present at the NASDAQ or New York Stock Exchange location to trade in a bigger market.

Top NYSE Companies List by Market Cap

Here we will talk about the leading companies on the New York Stock Exchange index by market capitalization as of April 2023.

- Berkshire Hathaway Inc. with a $773.01 billion market cap.

- TSM Taiwan Semiconductor Manufacturing with a $523.02 billion market cap.

- UnitedHealth Group Incorporated with a $468.30 billion market cap.

- JPMorgan Chase (JPM) with a $458.57 billion market cap.

- Johnson & Johnson (JNJ) with a $453.50 billion market cap.

- Visa with $441.82 billion market cap.

- Eli Lilly and Company (LLY) with a $435.22 billion market cap.

- Walmart (WMT) with a $430.48 billion market cap.

- Exxon Mobil (XOM) with a $420.92 billion market cap.

- Mastercard (MA) with a $372.47 billion market cap.

- Procter & Gamble (PG) with a $368.61 billion market cap.

- Novo Nordisk A/S (NVO) with a $354.11 billion market cap.

- Home Depot (HD) with a $333.12 billion market cap.

- Oracle (ORCL) with a $314.83 billion market cap.

- Chevron (CVX) with a $301.00 billion market cap.

- Coca-Cola (KO) with a $270.20 billion market cap.

- Merck & Co., Inc. (MRK) with a $269.83 billion market cap.

- Alibaba Group (BABA) with a $269.83 billion market cap.

- AbbVie (ABBV) $266.14 billion market cap.

- Bank of America (BAC) with a $254.14 billion market cap.

The bottom line

the New York Stock Exchange is the biggest and oldest security Exchange in New York City. The NYSE is the biggest Stock Exchange in the world by a total list of company market cap. It started from a meeting under a tree in Manhattan and is now considered a landmark of Wall Street. You can trade on the most important publicly traded American companies on this exchange. Here at Aron Groups, we provide useful information about trading opportunities worldwide to help you become a professional trader.

Read More: The Most Important Factors Affecting Japan Yen In 2023