If you’ve been trading without setting take-profit and stop-loss levels, you’ve essentially been playing with fire. Financial markets are never fully predictable, and the only thing that can truly protect your capital from sudden price swings is a well-structured plan for closing trades at the right time.

In this article, you’ll learn what take-profit and stop-loss levels are, how to set them correctly, which common mistakes to avoid, and how to manage your trades more professionally using tools like the ATR indicator or a trailing stop. If you’re aiming for long-term survival and consistent growth in the markets, this is a must-read.

- Setting an optimal risk-to-reward ratio alone is not enough, and the probability of reaching the take-profit (TP) level should also be considered.

- Placing the stop-loss (SL) behind an area where liquidity has accumulated (such as slightly below local lows) reduces the chance of a fake breakout.

- Some professional traders track the behavior of large algorithms (such as Iceberg Orders or Sniper Bots) and set their take-profit (TP) just before the areas those algorithms target to take advantage of their entries.

What Are “take-profit” and “stop-loss” Levels?

In the forex trading and cryptocurrency markets, take-profit and stop-loss are two very common concepts. These levels are predetermined points that a trader sets to close a trade either to secure profit or to prevent further loss.

take-profit is the level at which the trade closes once the price reaches the desired profit target. stop-loss is the level at which the trade automatically closes if the market moves in the opposite direction, helping to limit potential losses.

Why Using take-profit and stop-loss Is Essential

According to CFI, in real trading, accurate analysis alone is never enough. Markets are unpredictable and can change direction at any moment. Trading without take-profit and stop-loss levels is like trading without a safety net.

Using TP and SL helps you make important decisions in advance. This way, profits are secured on time and losses stay under control. A trader who does not use a stop-loss will sooner or later face heavy losses during strong market movements.

These levels also create mental stability. When you know that your potential loss is already limited, you avoid emotional or rushed decisions. This calm mindset helps you stick to your trading plan and avoid revenge or high-risk trades.

Not setting stop-loss or take-profit levels turns trading into gambling. TP and SL are not a choice; they are a necessity for staying alive in the market.

Types of Take-Profit and Stop-Loss in the Forex and Crypto Markets

In financial markets, especially forex and cryptocurrency, take-profit and stop-loss levels are usually set in two common ways: fixed and dynamic. Understanding these two methods helps traders choose the most suitable one based on market conditions and their trading strategy.

Fixed Take-Profit and Stop-Loss

In this method, the trader sets predefined levels. For example, the trade will close at 1.10 for take-profit or at 1.05 for stop-loss. This approach is more suitable for stable markets with moderate volatility.

Traders who use a specific risk to reward ratio often set fixed take-profit and stop-loss levels. For instance, they may always set their take-profit to be twice the risk amount. This method is simple, measurable, and easy to backtest.

Dynamic Take-Profit and Stop-Loss

When the market is highly volatile and active, using dynamic take-profit and stop-loss levels becomes more effective. In this case, TP and SL levels are adjusted according to current market conditions rather than a fixed number. For example, during news releases, a trader might move the stop-loss closer or further away.

This approach requires more experience, but in fast-reacting markets like crypto, it can help prevent unexpected losses and protect profits more effectively.

Methods for Setting TP and SL Levels

Setting accurate take-profit (TP) and stop-loss (SL) levels is an analytical skill that requires a thorough understanding of the market, experience, and the right tools. There are several methods for determining these levels, including:

- Setting TP and SL based on price action;

- Setting TP and SL using indicators;

- Setting TP and SL with the risk-to-reward ratio;

- Setting TP and SL using a trailing stop.

Each of these methods can be applied in different market conditions. Below are explanations and practical examples for each one.

Setting Take-Profit and Stop-Loss Based on Price Action

In the price action method, traders make decisions by analyzing price movements and candlestick structures. For example, in a buy position, if the price bounces from a strong support area and forms a bullish engulfing candle, the stop-loss can be placed below that support, and the take-profit can be set near the next resistance. This approach is simple but precise and is commonly used in most price action strategies.

Setting Take-Profit and Stop-Loss Using Indicators

Indicators are one of the most popular tools for determining TP and SL levels. For instance, the moving average (MA) can act as a dynamic support or resistance, and traders often place their stop-loss slightly below or above it. In the case of the RSI indicator, if a trade is entered in an overbought or oversold area, the TP can be set around the expected reversal level.

Setting Take-Profit and Stop-Loss with the Risk-to-Reward Ratio

This method is based on precise calculations. A trader decides how much of their account they are willing to risk for a trade, for example, risking 1% to aim for a 2% profit. If the entry price is 1.0000 and the stop-loss is at 1.0050 (a 50-pip risk), the take-profit should be at least 1.0100 (a 100-pip gain). Ratios like 1:2 or 1:3 are common and form the foundation of most professional risk management plans.

Some professional traders prefer to set their take-profit around imbalance zones, which are the unfilled spaces between candles. These areas often have a high chance of causing price reversals, so targeting them can lead to more accurate exits.

Setting Take-Profit and Stop-Loss Using a Trailing Stop

In the trailing stop method, the stop-loss moves dynamically as the price moves in the profitable direction. Suppose you open a buy position and the price rises from 1.0000 to 1.0200. If you set a 50-pip trailing stop, your stop-loss will move from 0.9950 to 1.0150. This method is effective in strong trends as it prevents the market from reversing into a loss. Even in volatile conditions, a trailing stop helps lock in most of the profit if the market suddenly turns around. It is one of the most powerful techniques for managing floating profits and securing gains.Common Mistakes When Setting TP and SL

Many traders, despite having accurate analysis, suffer heavy losses simply because they set their take-profit and stop-loss incorrectly. The most common mistakes include the following:- Placing the stop-loss too close to the entry point. Markets have natural fluctuations, and if the stop-loss is set too tight, the trade might close due to normal price noise even when the analysis is correct.

- Not setting a stop-loss and leaving the trade open, hoping for a reversal. Many traders avoid using stop-losses and keep their positions open when the price moves against them. This emotional behavior can easily lead to a complete account liquidation.

- Setting unrealistic and overly ambitious take-profit levels. If the take-profit is not based on logical analysis or real market levels, the price is unlikely to reach it. As a result, the trade may reverse before hitting the target and end up in a loss.

- Constantly changing TP and SL without clear analysis or logic. Traders who frequently move their levels during an open position usually lack a consistent trading system. These impulsive changes replace logic with emotion and destroy strategy consistency.

- Ignoring real market conditions when setting stop-loss distance. In highly volatile markets, using a fixed stop-loss without considering the price range can trigger it too early. Using the ATR indicator helps to better understand volatility and set more realistic levels.

Smart traders place their stop-loss behind order blocks where there is a high concentration of orders, not just behind a single candle or a swing low. This approach reduces the chances of being trapped by smart liquidity movements.

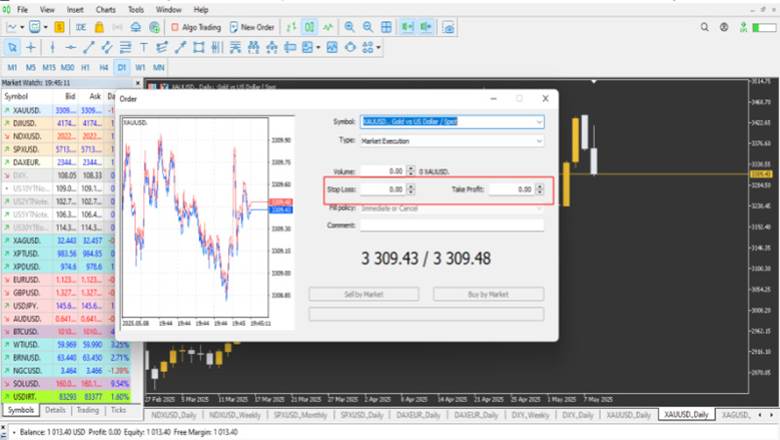

How to Set Take-Profit and Stop-Loss in MetaTrader

To use take-profit and stop-loss in MetaTrader (MT4 or MT5), open the New Order window and enter your desired TP and SL levels. When placing a trade, simply fill in the numbers for stop-loss and take-profit before confirming the order. If the trade is already active, right-click on it in the Trade tab and select Modify or Delete Order to adjust the levels.

You can also set TP and SL visually on the chart by clicking and dragging the trade line to the desired levels. This method is more convenient for traders who prefer a visual approach.

For precise adjustment, you can use pip distance. For example, if you want a 50-pip stop-loss, simply add or subtract that amount from your entry price.

There are also special plugins and scripts available that automatically calculate the risk-to-reward ratio when setting orders, helping traders manage their positions more efficiently.

ATR Indicator for Setting Take-Profit and Stop-Loss

According to quantifiedstrategies, the ATR indicator is one of the most accurate tools for determining take-profit and stop-loss levels. It shows the average market volatility over a specific period and helps traders set logical TP and SL levels based on real market movement.

For example, if the ATR value on the current timeframe is 0.0025, it means the average price volatility during that period is about 25 pips. In this case, setting a stop-loss only 10 pips away would be a big mistake because it is very likely to get triggered.

A practical method is to multiply the ATR value by a factor such as 1.5 or 2 and use the result as a suitable stop-loss distance. Similarly, for take-profit, the ATR value can be multiplied by 3 or more to maintain a proper risk-to-reward ratio.

Conclusion

In this article, we explored the full concept of take-profit and stop-loss, their different types, professional methods for setting levels, common mistakes, how to adjust them in MetaTrader, and how to use the ATR indicator effectively.

No trading system can remain stable without clearly defined TP and SL levels. The most successful traders are those who know their expected profit and acceptable loss before entering any position and make decisions based on that knowledge.