Many traders in the forex market face the challenge of understanding how even the smallest price changes can affect the overall profit or loss of their trades. Using tools such as the pip value indicator provides an efficient way to gain a precise understanding of the value of each pip. Within MetaTrader, this indicator allows traders to instantly and accurately view the monetary impact of price movements, helping them make more informed decisions. In this article, we will review the process of downloading and installing the pip value indicator for MetaTrader 5, as well as explain how it can be combined with other analytical tools. We encourage you to stay with us until the end of this guide to explore the details of one of the most practical trading tools available.

- The pip value indicator displays the value of each pip directly on the chart instead of relying on manual calculations, resulting in greater speed and fewer errors.

- Knowing the pip value helps traders adjust position size and stop-loss levels more effectively, ensuring overall capital risk is kept under control.

- Combining the pip value indicator with tools such as ATR or MA allows for more accurate signals in volatile markets and helps refine risk-to-reward strategies.

- Always test the indicator in a demo account before applying it to live trading to confirm proper functionality and minimize potential mistakes.

What Is the Pip Value Indicator and How Does It Work?

Understanding the true value of every price movement in forex market is critical for many traders, which is why tools like the pip value indicator have been developed. This indicator clearly shows how much profit or loss a single pip movement represents, calculating everything based on the account currency, the chosen currency pair, and the trade volume. As a result, there is no need for manual calculations or external pip calculators, since results are displayed instantly on the chart.

It is also important to distinguish between a pip and a point when using this tool. A pip in forex is typically the smallest unit of price change for most currency pairs, equal to 0.0001, whereas a point is often considered one-tenth of a pip. Recognizing this difference helps ensure greater accuracy and avoids common calculation errors.

The formula for calculating pip value is straightforward:

Pip Value = (0.0001 ÷ Exchange Rate) × Lot Size

For example, in the EUR/USD pair with an exchange rate of 1.2000 and a standard lot size of 100,000 units, the value of one pip equals $8.33. If the price moves five pips, the profit or loss will amount to $41.65.

The applications of this indicator are wide-ranging, including:

- Accurately calculating position size before entering a trade

- Enhancing risk management and improving overall capital control

- Making faster decisions when adjusting trade volume in volatile markets

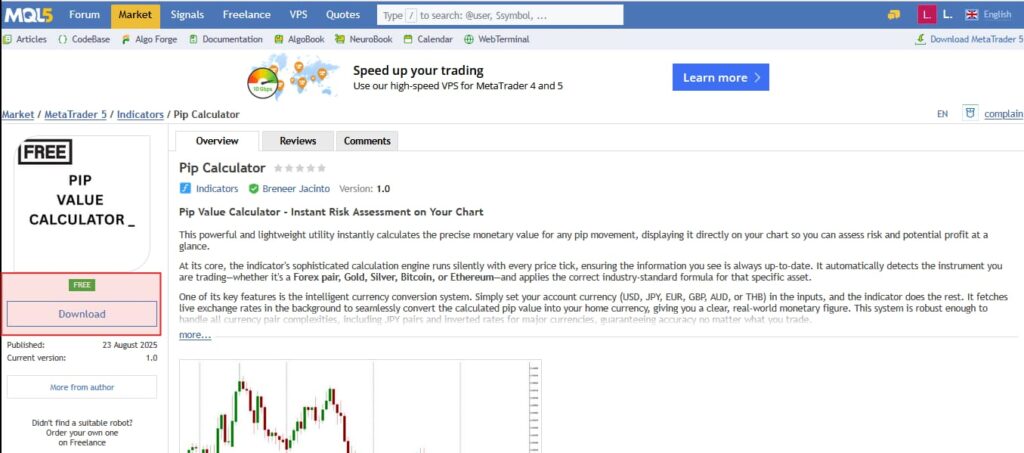

Free versions such as the Pip Value Calculator are also available for MetaTrader 5, providing traders with similar functionality directly within their platform.

Advantages of Using the Pip Calculation Indicator in MetaTrader

Many traders need a tool that can quickly calculate the real value of every price movement, which is why the pip value indicator has become one of the most widely used add-ons in MetaTrader. This indicator allows users to instantly see the exact value of each pip and adjust stop-loss and take-profit levels according to their account conditions. The result is higher accuracy and fewer errors compared to manual calculations.

Another key advantage of this tool is the time it saves. In fast-moving markets, manually entering data and performing calculations can cause traders to miss opportunities. With the pip calculation indicator displayed directly on the chart, all the required information is updated in real time.

In addition, newer versions of this add-on are not limited to currency pairs. They are also compatible with CFDs and even stocks, with MetaTrader 5 displaying the tick value directly on the chart. This gives traders clearer insight into trade volume and better control over their capital. Ultimately, using such a tool plays an important role in strengthening risk management and supporting more informed decision-making.

Some advanced versions of the pip value indicator also display the spread and trading commissions alongside the pip value. This feature allows traders to have a more accurate estimate of the net trading cost, making overall profit and loss calculations far more precise.

How to Download, Install, and Run the Pip Value Indicator in MetaTrader 5 (MT5)

To take advantage of the features of the pip value indicator for MetaTrader 5, the first step is to download the file from trusted sources such as the MQL5 Market or specialized forex tool websites. These files are usually provided in .ex5 or .mq5 format and must be placed in the correct directory of the platform.

The installation steps are as follows:

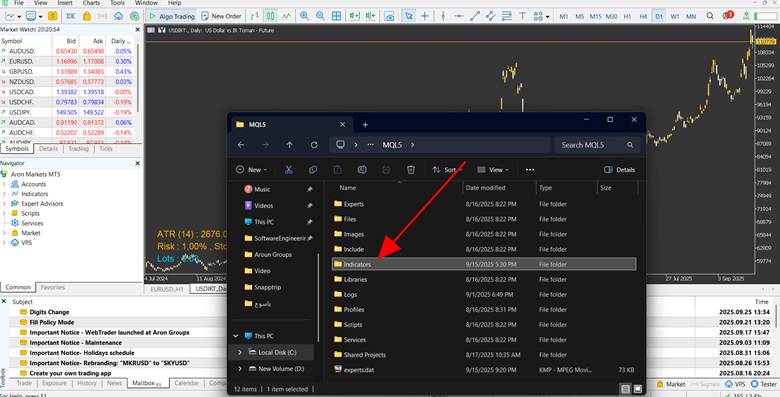

- Open MetaTrader 5, then go to the File menu and select Open Data Folder.

- Navigate to the MQL5 folder and then to the Indicators directory.

- Copy the downloaded indicator file into this folder.

- Restart MetaTrader 5, or from the Navigator window, click Refresh to apply the changes.

- In the Navigator under Indicators, find the pip calculation tool (pip value indicator MT5) and drag it onto the chart.

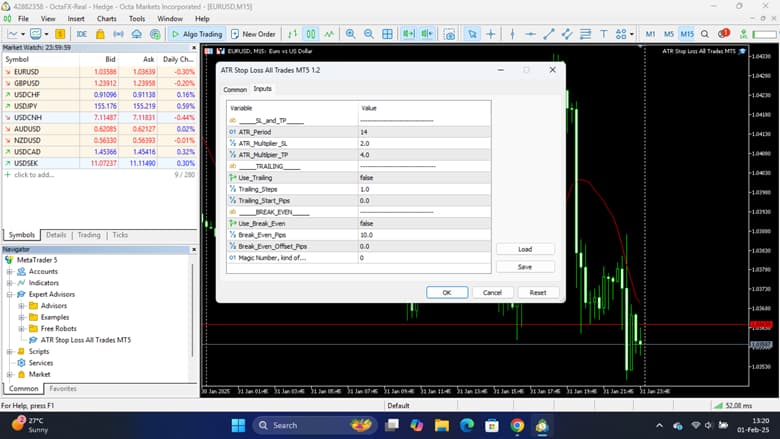

- In the settings window, you can configure various options such as defining the position size and displaying the tick value to ensure pip values are shown accurately according to your account conditions.

- For safety, it is recommended to first run the indicator on a demo account to verify proper functionality.

If you encounter issues while running the indicator, check for the following: update your MetaTrader 5 build, verify the file format (.ex5 or .mq5), and ensure no errors occurred during the installation process. Additionally, adjust the color and placement of the indicator display so that the values are clearly visible on the chart.

By following these steps, the indicator will be successfully activated on MetaTrader 5, allowing you to view pip values in real time. This process is also part of the broader MetaTrader learning experience, helping traders improve their efficiency in the market.

Difference Between the Pip Value Indicator and the Pip Value Calculator

Many traders use two different tools to determine pip value: the indicator and the calculator. The main difference lies in how the calculation is performed and the speed of displaying results. The pip value indicator for MetaTrader 5 shows the pip value automatically and in real time directly on the chart, while a pip value calculator requires manual input of information.

Easily calculate potential profits and losses for each trade using the Aron Groups pip value calculator.

This comparison can be outlined as follows:

- The indicator performs calculations automatically and immediately displays price changes (ticks).

- The calculator provides results only after you manually enter details such as the currency pair, trade size, and current rate.

- The indicator is better suited for active and fast-paced trading since it updates alongside market movements.

- The calculator is more useful when a simple, one-time calculation is needed.

The biggest advantage of the indicator is that it helps traders set stop-loss and take-profit levels instantly based on real market conditions. In addition, it allows for more precise determination of position size, since the pip value is always available in real time. Therefore, for traders who need quick decisions and handle multiple trades, the indicator is a much more practical option compared to the calculator.

Combining the Pip Value Indicator with the ATR Indicator

When it comes to measuring market volatility, the Average True Range (ATR) is one of the most widely used tools. If applied together with the pip value indicator, it can provide far more accurate insights for trade management. While ATR shows the average volatility of price over a given period, the pip value indicator calculates the monetary worth of each price movement. Combining these two tools allows traders to understand both how volatile the market is and what that volatility means in dollar terms.

For example, if the ATR on a chart shows 20 pips, a stop-loss could be set at 1.5 × ATR, or 30 pips. By using the pip value indicator, the trader can then determine the exact financial value of those 30 pips and know precisely how much they would lose if the stop-loss is hit.

This approach is especially useful in highly volatile markets, as it enables traders to align exit strategies with real market conditions. Ultimately, combining these two indicators helps traders make more logical decisions when setting position size and defining acceptable risk levels in their trades.

Combining the Pip Value Indicator with the Moving Average (MA)

Whenever price action follows a trend, the Moving Average (MA) serves as a reliable guide for identifying its direction. When used together with the pip value indicator, traders gain a clearer view of the monetary risk behind pullbacks or retracements within that trend.

Sample Strategy:

- When price makes a bullish crossover with the MA (moving upward through it), this generates a signal to enter in the direction of the trend.

- At that point, the depth of the retracement toward the MA is measured, and with the pip value indicator the monetary value of that retracement is calculated.

- Based on this, the stop-loss can be set slightly below the MA, while trade size is adjusted so that the risk remains within acceptable limits.

The main advantage of this combination is that position sizing is determined not only by the technical trend but also by the real pip value associated with it. This ensures traders know exactly how much each adverse movement could cost, making entries in trending markets more confident and risk-aware.

Combining the Pip Value Indicator with Fibonacci Retracement

In technical analysis, Fibonacci levels such as 38.2% and 61.8% are often seen as potential zones where price may retrace before continuing in the direction of the main trend. By combining the pip value indicator with these retracement levels, traders can calculate the monetary value of a move from their entry point to a specific Fibonacci level, making it easier to set realistic take-profit (TP) targets.

For example, suppose the price retraces toward the 38.2% level and the pip value indicator shows that each pip equals $5. If the distance between the entry point and the Fibonacci level is 20 pips, the total value of that move would be 20 × $5 = $100. The trader can then project a target at the 61.8% Fibonacci level and calculate the corresponding pip value to assess the potential reward.

With this approach, the trader not only identifies likely reversal zones but also knows the risk-to-reward ratio before entering the trade. This combination makes decision-making in volatile markets, especially around Fibonacci levels, more precise and data-driven.

According to BabyPips, some traders mistakenly assume that price will reverse exactly at Fibonacci levels such as 38.2% or 61.8%. In practice, however, these should be viewed as zones of potential reversal rather than precise lines, meaning price may react slightly above or below the exact Fibonacci level.

Common Mistakes When Using the Pip Value Indicator

Some traders make errors when working with the pip value indicator, which can reduce the accuracy of their analysis. One common issue occurs with brokers that quote prices to five decimal places. In such cases, many users fail to distinguish between a pip and a point, leading to miscalculations. To avoid this, it is essential to verify whether the displayed value refers to pips or points.

Another frequent mistake involves not setting the correct lot size. If trade volume is not aligned with the true pip value, even small price movements can result in significant losses. The solution is to calculate both the pip value and the acceptable risk before entering a trade.

Incorrectly combining the indicator with volatility tools such as ATR can also produce misleading results if timeframes and settings are not properly synchronized.

Finally, many traders skip testing the indicator on a demo account before applying it to live trades. Running demo tests helps identify potential errors early. It is also advisable to use backtesting to review the indicator’s performance under historical market conditions, providing greater confidence before committing real capital.

Conclusion

The pip value indicator is one of the most practical tools in forex trading, providing real-time pip values that enhance decision-making accuracy and give traders a clearer picture of how price movements affect profit and loss. By integrating this indicator into their strategy, traders can streamline risk management and pave the way for more sustainable long-term success. It is strongly recommended to download and test the indicator in a demo account before using it in live trading, and then share your experiences with others to contribute to collective learning and improvement.