One of the trading costs that is often overlooked is the spread, and this factor alone can make a significant difference in your profits or losses. To better manage this cost, many traders rely on the Spread Indicator, which allows them to monitor the real-time difference between the bid and ask prices directly on the chart. This tool is available in older versions as the Spread Indicator for MetaTrader 4 and in the newer version as the Spread Indicator for MetaTrader 5, helping traders choose more favorable conditions for entering and exiting the market. If you want to learn how this indicator works and what advantages it offers, keep reading.

- The Spread Indicator makes it possible to view the bid–ask difference in real time on the chart, helping traders avoid sudden spread spikes that could otherwise lead to significant losses (investopedia).

- When spreads are high, traders can reduce position size or adjust stop-loss and take-profit levels so that the cost of the spread does not prematurely close a trade.

- Compared to MT4, the MT5 version is more advanced, supporting multiple asset classes, providing enhanced strategy testing, and offering more precise spread display in backtesting (forexfactory).

- The most effective times to use the Spread Indicator are during high-liquidity sessions (such as the London–New York overlap), while avoiding trading around major news releases when spreads tend to widen sharply.

What is the Spread Indicator and How Does It Work?

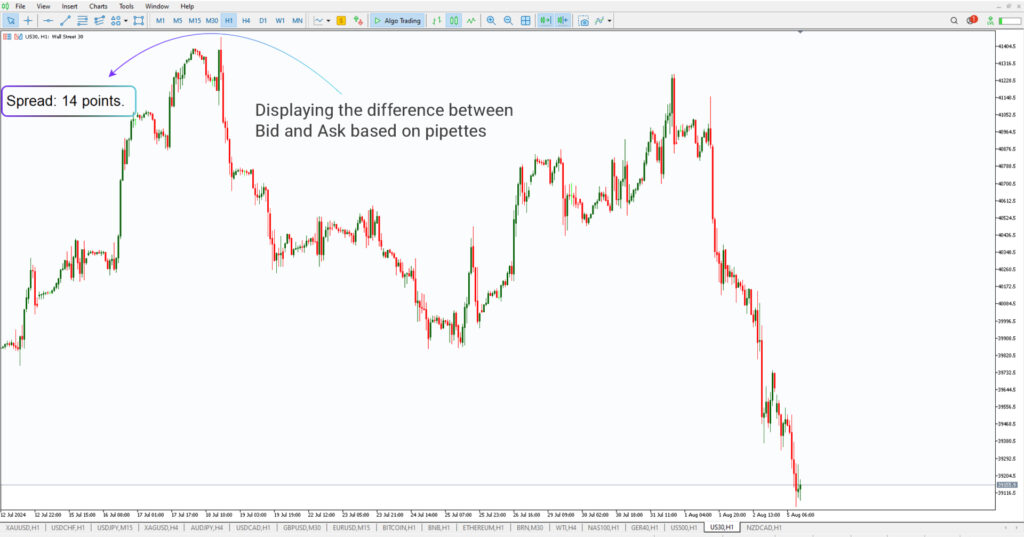

In forex trading, there is always a difference between the bid and ask prices, which essentially answers the question of what a spread is and why it is considered one of the trader’s primary costs. While this difference may appear small at first glance, in practice it can significantly affect profits and losses. Using the Spread Indicator allows traders to monitor spreads in real time directly on the chart and make more informed trading decisions.

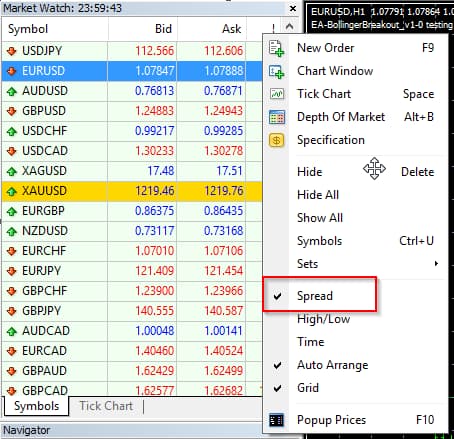

This becomes particularly important in fast-paced strategies like scalping or during major economic news releases, when spreads tend to widen quickly and can completely change the outcome of a trade. Although MetaTrader provides a basic spread display in the Market Watch window, it is limited, and for precise on-chart monitoring, the Spread Indicator is by far the more effective choice.

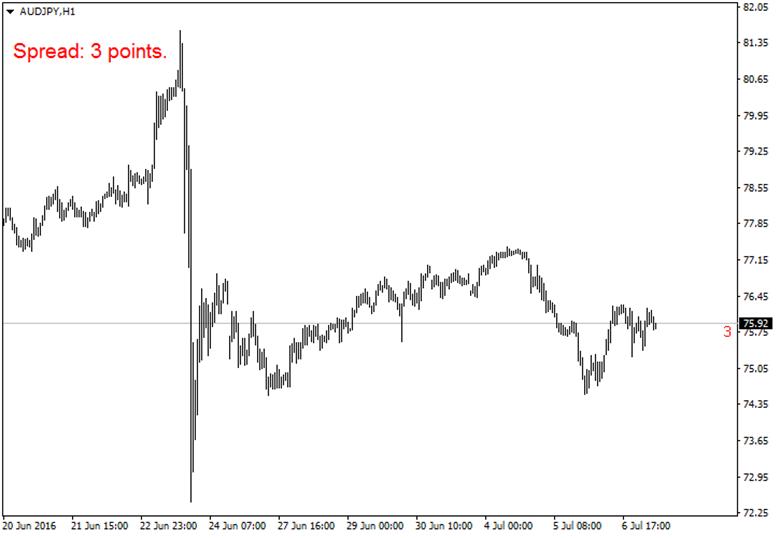

According to IndicatorsPot, many versions of the Spread Indicator offer the ability to record and display historic spread values. This feature allows traders to analyze how spreads have changed over different time periods and identify patterns, such as the hours when spreads typically widen or narrow.

Advantages and Disadvantages of Using the Spread Indicator

One of the biggest advantages of the Spread Indicator is that it displays the real-time difference between bid price and ask price directly on the chart, allowing traders to always see the true cost of entering a trade without relying on side panels.

This feature becomes especially valuable during volatile conditions such as major economic news releases, when spreads can widen rapidly. Having alerts for sudden spread changes can prevent traders from rushing into unfavorable trades. In addition, being able to compare spreads across different instruments helps in choosing a broker with tighter spreads, ultimately lowering trading costs over the long run.

On the downside, the indicator depends entirely on broker-provided data and cannot generate independent trading signals. To overcome this limitation, many traders combine it with other tools, such as the Candle Time Indicator, so they can monitor both transaction costs and precise candle closing times, leading to more accurate and informed decisions.

According to TheForexGeek, constantly monitoring and focusing too much on spread changes can cause traders to miss important trend signals or better entry points. In other words, overemphasis on the spread may lead to getting “caught up in cost details” while overlooking bigger trading opportunities.

How to Use the Spread Indicator in MetaTrader 4 (MT4)

To get a clearer view of the bid–ask difference directly on the chart, traders can use the Spread Indicator for MetaTrader 4. This tool allows users not only to see the spread in the Market Watch window but also to track it in real time on the chart, leading to more informed trading decisions.

Features of the Spread Indicator in MT4

The indicator can display spreads either as numeric values or as a histogram. Some versions include sound alerts for sudden spread widening and offer a setting to show spreads in pips instead of pipettes. These features give traders greater control over their trading costs and market timing.

Steps to Install and Activate the Spread Indicator in MT4

To install, download the indicator file in .ex4 format and place it in the MQL4/Indicators folder. After restarting the platform, the indicator will appear in the Navigator panel, and you can drag it onto your chart to activate it. At this stage, using the Spread Indicator is straightforward and does not require advanced technical steps.

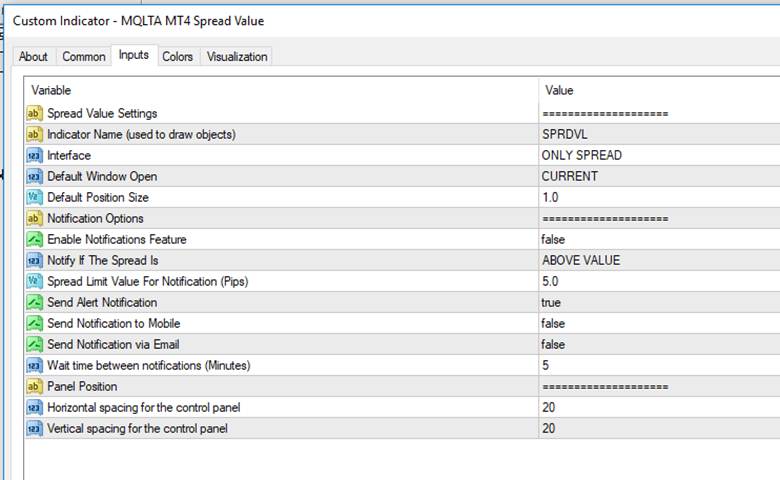

Practical Settings for Accurate Spread Display in MT4

Once installed, you can adjust parameters such as font size, color, and chart corner placement of the spread value, as well as set a threshold for alerts when spreads exceed certain levels. This customization ensures that the spread display remains clear without interfering with other analytical tools. For this reason, many traders prefer to use it alongside the other tools available in MetaTrader to maintain better control over their trades.

How to Use the Spread Indicator in MetaTrader 5 (MT5)

The newer version of the platform offers more advanced features, which makes using the Spread Indicator for MetaTrader 5 a more complete experience compared to MT4. This tool is not only designed to display the bid–ask difference, but it also comes with enhanced capabilities that make trading smoother and more efficient.

Key Features of the Spread Indicator in MT5

In this version, spreads can be monitored across multiple assets simultaneously, and they can even be tracked during strategy testing with the built-in strategy tester. The indicator also provides more precise spread values in pips, giving traders a clearer picture of their actual transaction costs and improving decision-making.

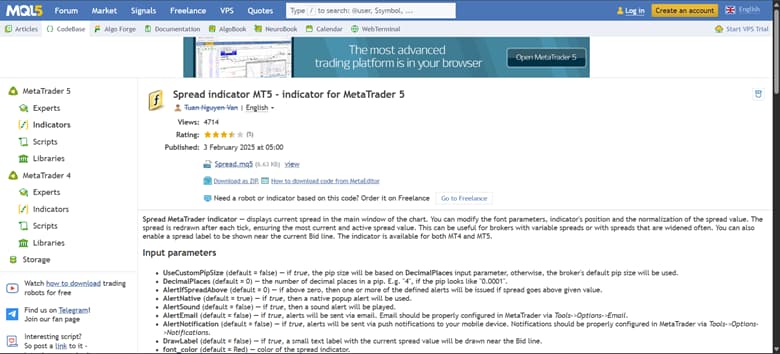

How to Install and Run the Spread Indicator in MT5

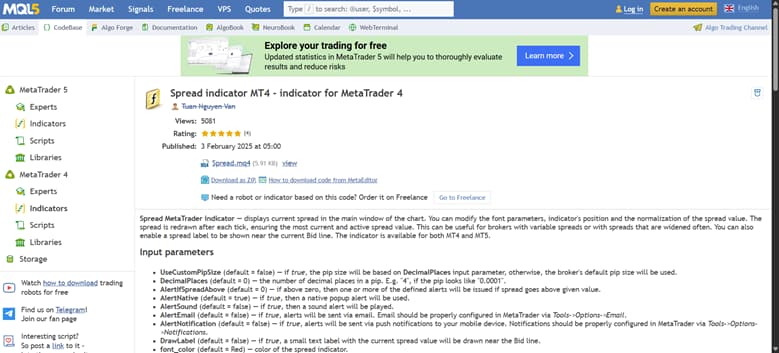

To install, download the indicator file in .mq5 format from MQL5.COM and place it in the MQL5/Indicators folder.

Then, compile it using MetaEditor to prepare it for use. Finally, locate the indicator under Custom Indicators in the Navigator and drag it onto the chart. Running the Spread Indicator in MT5 is quick and only takes a few minutes.

Advanced Settings and Customization in MT5

Once the indicator is active, you can choose the corner of the chart where spreads are displayed, adjust colors and font size, and even set alerts for when spreads exceed a predefined threshold. These customization options make the Spread Indicator for MetaTrader 5 adaptable to your trading style, ensuring you maintain maximum control over your trades.

In the MT5 version, many Spread Indicators include an option called DrawLabel, which displays the spread value right next to the price line (Bid or Ask). This feature places the spread figure very close to the current market price, making it much easier for traders to read and interpret at a glance.

Differences Between the Spread Indicator in MetaTrader 4 and MetaTrader 5

There are clear differences in how each platform handles display and functionality, which makes working with the Spread Indicator a unique experience in each version. The Spread Indicator for MetaTrader 4 is primarily focused on forex markets, with files running in the .ex4 format and offering a simpler structure.

On the other hand, the Spread Indicator for MetaTrader 5 delivers higher accuracy, supports monitoring multiple assets at once, and integrates directly with the strategy tester for more reliable backtesting. In this version, files use the .mq5 format, and the normalization option calculates spreads with greater precision, making it especially useful for strategy testing and replicating real market conditions.

How to Use the Spread Indicator for Better Risk Management

One of the smartest ways to manage risk is to integrate spread information into position sizing. When the Spread Indicator shows that the spread on a particular instrument has widened, you can reduce your trade size to ensure that higher transaction costs do not magnify your losses. For example, if the spread exceeds 2 pips, many traders choose to cut their risk exposure by 50%. It is also important to factor the spread into your stop-loss and take-profit levels so that extra spread costs do not trigger premature exits. In this way, the Spread Indicator becomes an essential component of any risk management checklist.

Best Market Times to Use the Spread Indicator

The most effective times to use the Spread Indicator are during high-liquidity sessions when spreads are typically at their lowest. During the London–New York overlap, trading volume peaks and spreads usually narrow to their tightest levels. In contrast, during major economic news releases, spreads often widen sharply, making it wiser to avoid trading in those moments. For strategies like scalping, applying the Spread Indicator during active yet liquid sessions offers better trading conditions, especially when combined with volatility tools that help identify the most favorable setups.

Conclusion

Using the Spread Indicator helps you stay constantly aware of the actual cost of entering and exiting trades, allowing you to make decisions based on real market conditions. By displaying the bid–ask difference in real time, it brings greater transparency to your trading and is especially valuable for short-term and high-volatility strategies. It is recommended to first install and test the indicator on a demo account to get familiar with its settings and features before applying it to a live account. Experience shows that traders who take transaction costs seriously tend to achieve better long-term performance, and the Spread Indicator can serve as a reliable companion on that path.