When a company decides to repurchase its own shares from the market or existing investors, something interesting happens in the world of the stock market. This process, commonly known as a share buyback (or stock repurchase), can drive the stock price higher and even signal the company’s confidence in its future performance.

However, buybacks don’t always benefit everyone and can sometimes create challenges as well. If you’d like to understand how share buybacks work and why they matter for both investors and companies, stay with us until the end of this article.

- Allocating excessive resources to buybacks may restrict a company’s ability to pursue significant growth opportunities and future investments.

- Share buybacks can be one of the most important ways to return capital to shareholders while simultaneously sending a message of management’s confidence to the market.

- The success of a buyback program depends on timing and market conditions, and executing it at the wrong price levels can lead to the opposite effect.

- The impact of buybacks is not limited to financial figures and ratios; they often act as a psychological signal that influences investor behavior.

What Is a Share Buyback?

Sometimes companies decide to repurchase a portion of their outstanding shares, a practice commonly known in financial markets as a share buyback. The primary goal of this strategy is to reduce the number of shares in circulation, which in turn allows a greater portion of profits to be distributed among the remaining shareholders, thereby increasing the intrinsic value of their holdings.

Company executives usually opt for this method when they believe the stock is trading below its true intrinsic value. By doing so, they send a positive signal of confidence to the market.

A well-known example of this was Apple’s massive buyback program in 2018, during which the company allocated over $100 billion to repurchase its own shares. This decision significantly boosted investor confidence and contributed to the rise in Apple’s stock price.

In financial education resources such as Investopedia, this process is introduced as one of the key tools of capital management, since it can improve a company’s financial ratios and provide greater flexibility compared to paying cash dividends.

The Difference Between Share Buybacks and Dividend Payments

When companies have sufficient cash resources, they are generally faced with two main choices: distributing cash dividends or conducting a share buyback. Cash dividends provide shareholders with immediate income, but they are taxable in the same year and may place additional pressure on the company’s liquidity.

In contrast, buybacks manage the company’s cash flow in a more flexible way, and shareholders only pay capital gains tax if they decide to sell their shares. This makes buybacks an attractive option for many executives, particularly when they want to signal confidence to the market or improve the company’s financial ratios.

Read more: Top Stock market Expressions To Know

According to CFI: “Compared to dividends, share buybacks can be a more efficient way of returning value to shareholders, as they provide greater flexibility to the company and are also more attractive to investors from a tax perspective.”

Methods of Share Buybacks

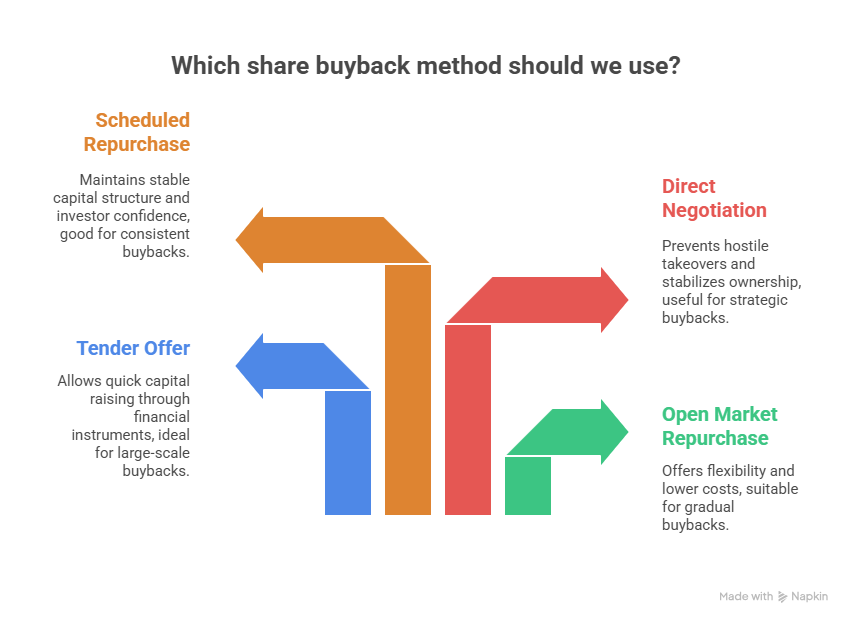

When companies decide to repurchase a portion of their shares, they can choose different methods depending on their financial situation and management objectives. Each method carries its own implications and outcomes, which can directly affect the company’s stock value and investor confidence. Understanding these approaches helps explain why and how a company executes a buyback program.

The main methods of share repurchases include:

- Open Market Repurchase;

- Tender Offer;

- Direct Negotiation with Major Shareholders;

- Scheduled Repurchase Programs.

In the following sections, we will explain each of these methods in detail.

Open Market Repurchase

In this method, the company gradually buys back its shares from the open market over time. These purchases are usually made based on the stock’s average market price, allowing the company to repurchase shares incrementally without any immediate obligation. High flexibility and lower costs are among the key advantages of this approach.

Tender Offer

In this case, the company invites shareholders to sell their shares at a specified price. For example, Home Depot carried out such a program in 2007. Companies sometimes finance these programs through financial instruments like U.S. bonds, which enable them to raise capital quickly.

Direct Negotiation with Major Shareholders

At times, companies directly negotiate with large shareholders to repurchase a significant portion of shares. This method is often used to prevent hostile takeovers or to stabilize the ownership structure. Market liquidity—similar to conditions observed in overnight forex trading—can influence how quickly such agreements are executed.

Scheduled Repurchase Programs

Here, the company sets up a structured plan to repurchase shares at predetermined intervals. This approach, somewhat similar to managing open trades, helps the company maintain a stable capital structure without causing sudden price fluctuations, while also preserving investor confidence.

Benefits of Share Buybacks for Companies and Shareholders

Share buybacks are a strategy companies use to enhance stock value and build investor confidence. This approach can improve financial performance, optimize resources, and strengthen a company’s position in the market.

Improving Financial Ratios and Increasing Earnings Per Share (EPS)

When a company repurchases its shares, the number of outstanding shares decreases. As a result, earnings per share (EPS) rises because the company’s total profit is divided among fewer shares. For example, Apple significantly boosted its EPS in recent years through large-scale buybacks, making its stock more attractive to investors. This dynamic can also be analyzed using tools such as impulse system strategies.

Managing Capital Structure and Reducing the Cost of Capital

Share repurchases help companies optimize their capital structure. With fewer outstanding shares, the debt-to-equity ratio becomes more balanced. Some companies even finance their buyback programs through debt in order to reduce the cost of capital and manage financial resources more effectively.

Sending a Positive Signal to the Market About Intrinsic Value

Buybacks send a strong signal to the market that management believes in the company’s true intrinsic value. For instance, technology firms like Microsoft use share repurchases to indicate that their stock is undervalued, thereby attracting greater investor confidence.

Creating Incentives for Long-Term Investors

Share buybacks are appealing to long-term investors because they increase the value of their holdings and expand their ownership stake in the company. This reduces investment risk, aligning with effective risk management principles. Loyal Apple shareholders, for example, have benefited from the company’s buyback programs as their investments have grown in value over time.

Drawbacks and Risks of Share Buybacks

Although share repurchases can increase stock value, they also carry risks that may create challenges for both companies and shareholders. These disadvantages often involve the misallocation of financial resources and reduced ability to handle future uncertainties.

Misuse of Company Cash Reserves

When companies allocate significant cash to buybacks, they may miss growth opportunities such as developing new products. This limits long-term expansion, especially if resources are diverted away from innovation and redirected toward repurchasing shares.

Short-Term Price Bubbles

Buybacks can sometimes artificially inflate stock prices, creating short-term bubbles. For instance, poorly timed or excessive repurchases may temporarily push prices higher, but if the company’s fundamentals are weak, this increase will not be sustainable.

Read More: What Is Fundamental Analysis?

Reduced Financial Flexibility During Crises

Repurchasing shares decreases liquidity and can pose serious problems during economic downturns, such as the 2008 financial crisis. For example, Home Depot faced liquidity shortages in 2007 due to its aggressive buyback program, which weakened its financial flexibility.

Negative Impact on Future Investments

Directing too many resources toward share buybacks can restrict budgets for research and development. Companies that focus excessively on buybacks risk neglecting new technologies or innovative projects, which may harm their long-term growth potential.

Executing a share buyback at peak market prices can waste company resources and fail to create real value for shareholders.

The Impact of Share Buybacks on Price and Market Value

By executing a share repurchase program, companies can significantly influence supply and demand dynamics in the market, with effects that differ in the short term and the long term. Below, we examine four key aspects of this impact.

Short-Term Impact on Stock Price

When a buyback is implemented, the number of outstanding shares decreases, reducing supply in the market while demand may create upward pressure on the stock price. This trend has been observed in companies like Apple, where announcing or executing a buyback program led to a noticeable price increase. In addition, buybacks can boost earnings per share (EPS), making the stock more attractive to short-term traders.

Long-Term Impact on Company Valuation

If a buyback is supported by strong fundamentals and the company is on a growth path, it can strengthen the firm’s intrinsic value. Companies with consistent buyback programs and sustainable cash flows often see their market value grow over time.

The Role of Buybacks in Reducing Outstanding Shares

Fewer floating shares mean that each remaining share represents a larger portion of the company’s profits. This mechanism, particularly common in technology companies with large market share, highlights stronger financial ratios such as EPS and per-share value.

Investor Behavior in Response to Buybacks

Share repurchases are often interpreted as a sign of management’s confidence, which can encourage investor sentiment and drive stock prices upward. However, if buybacks stem from a lack of genuine investment opportunities or are executed at inflated prices, investors may respond with skepticism or distrust.

Read More: Forex vs. Stock

Conclusion

Research shows that share buybacks can serve as both a valuable opportunity and a source of risk for companies and investors. On one hand, they can increase earnings per share (EPS), improve financial ratios, and send a strong signal of confidence to the market. On the other hand, if executed without proper planning, buybacks may reduce a company’s liquidity and limit future investment opportunities.

Therefore, it is essential for executives to carefully evaluate financial conditions and long-term strategies before making any decisions. Likewise, investors should thoroughly assess each company’s buyback policy and avoid reacting impulsively, making well-informed choices instead.