A Trading Psychology Checklist is a valuable tool for identifying the emotions of a trader and managing their impact on trading decisions. Emotions such as fear and greed can easily override rational thinking, affecting a trader’s performance. This is particularly true in markets that are volatile and uncertain, where inherent risks can easily trigger emotional reactions from traders.

In this article, we will explore the importance of a Trading Psychology Checklist, discuss the emotions that can negatively impact trading, and guide you through the steps to create an effective trading checklist template. If you’re interested in mastering your emotions and improving your trading performance, stay with us until the end of the article.

- Use a personalized trading checklist template to maintain discipline and avoid emotional trading.

- A pre-trade checklist helps assess risk and strategy, ensuring you're fully prepared before entering any trade.

- A solid risk management checklist keeps you from falling into FOMO trading and making impulsive decisions.

- Stick to your trading plan checklist to stay rational and avoid revenge trading after losses.

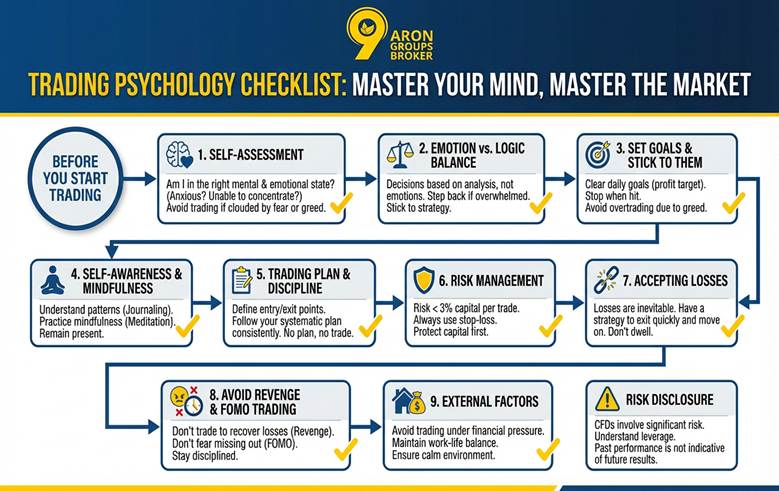

How to Create a Trading Psychology Checklist

When creating a Trading Psychology Checklist, it’s essential to understand the key factors that influence trading psychology. A well-structured trading checklist template should address several critical elements that impact a trader’s emotional state and decision-making. Here are some of the key factors to consider:- Recognizing and Controlling Emotions: Understanding the emotions you experience during trading and knowing how to manage them is crucial for maintaining focus and discipline.

- Self-Assessment: Regularly evaluating your mental and emotional state helps ensure that you are in the right mindset to make sound trading decisions.

- Balancing Emotions and Logic: Striking the right balance between emotional impulses and logical analysis is key to making informed decisions.

- Goal Setting (Short-Term and Long-Term): Setting both daily and long-term goals helps maintain focus and direction in your trading journey.

- Self-Awareness and Mindfulness: Practicing mindfulness allows you to stay aware of your emotional triggers and manage stress during trading.

- Regular Journaling and Review: Keeping a trading journal allows you to track your emotional responses and reflect on your past trades, helping improve your decision-making process.

- Having a Trading Plan and Strategy: A well-defined forex trading plan checklist ensures you approach each trade with a clear strategy and avoids impulsive decisions driven by emotions.

- Staying Organized: Consistency and organization in your trading approach help reduce mental clutter and increase focus.

- Risk Management: Implementing a risk management checklist helps ensure that you are always trading within your risk tolerance.

- Acceptance of Losses: Understanding that losses are a part of trading and learning to accept them without emotional backlash is critical for long-term success.

- Avoiding Revenge Trading: Revenge trading occurs when traders make reckless decisions in an attempt to recover losses. A good checklist helps prevent this.

- Financial Concerns: Managing financial worries helps you focus on your strategy rather than letting stress influence your decisions.

- Work-Life Balance: Maintaining a healthy balance between your professional and personal life is vital for mental clarity and focus during trades.

- Creating a Calm Workspace: A peaceful and organized trading environment promotes focus and reduces stress.

According to ig.com: comprehensive trading checklist template works like a roadmap so you make decisions based on analysis, not emotion.

Mastering Emotions in Trading

Controlling and understanding emotions is one of the most essential aspects of a Trading Psychology Checklist. Emotions like fear, greed, and impatience often influence traders’ decisions and can lead to mistakes. Here are the key emotions that traders need to manage for successful trading:Fear (Fear of Loss)

Fear is one of the most powerful emotions that traders face. In trading, the fear of losing money is particularly prominent. This fear can lead traders to close positions too early or avoid entering trades altogether, potentially causing missed opportunities.- Tip: To avoid making decisions driven by fear, include this factor in your pre-trade checklist. By defining your risk levels and setting stop-loss orders, you can reduce the emotional impact of fear on your trades.

Greed (Desire for More Profit)

Greed in trading arises when a trader becomes too comfortable after a series of profitable trades. It leads them to expect more profits and hold onto positions longer than they should, which can ultimately cause them to lose their gains and even their capital.- Tip: Incorporating clear goals and limits into your Trading plan checklist helps avoid emotional trading driven by greed. Always stick to your predefined profit targets and don’t let your desire for more overtake your discipline.

Impatience (Rash Decisions)

Impatience often arises from overconfidence or a lack of preparation. Traders may jump into trades without thorough analysis, which often leads to unnecessary losses. Similarly, impatience can show up when a trader opens a position but closes it too soon, not allowing the market enough time to move in their favor.- Tip: To avoid impulsive decisions, ensure that patience is part of your Forex trading checklist. It’s crucial to wait for the right trade setups and avoid rushing into positions without fully analyzing the market.

How to Avoid FOMO Trading (Fear of Missing Out)

FOMO trading is a common psychological pitfall where traders feel the urge to enter a trade out of fear of missing out on a potential profit. This often leads to making rash decisions and trading too frequently. To combat FOMO trading, stick to your trading checklist template and remember that there will always be new opportunities.

Always remind yourself that patience is key. The market will present more opportunities, and sticking to your plan will help you avoid FOMO trading.

Revenge Trading: How to Avoid It

Revenge trading happens when a trader tries to recover losses by taking high-risk trades. This Behaviour often leads to even greater losses, as decisions are driven by emotion rather than a solid strategy.

By understanding and managing these emotions, you can develop a Trading Psychology Checklist that helps you stay focused, disciplined, and successful in your trading journey. A clear strategy, combined with the ability to control emotions, is key to long-term success in any trading environment.

| Emotion | Trigger | How to Fix It |

|---|---|---|

| Fear (Loss) | Lack of confidence or large position size | Stick to your plan & reduce position size |

| Greed (More Profit) | Winning streaks & overconfidence | Set strict Take-Profit targets & walk away |

| Impatience (FOMO) | Watching the chart too closely | Wait for the candle close before entering |

| Revenge | Suffering a big loss | Stop trading for 24 hours immediately |

Incorporate emotional control measures into your Risk management checklist. When you experience a loss, step back, reflect, and avoid trading out of frustration. Your Trading plan checklist should include guidelines for when to take breaks and avoid making emotional decisions.

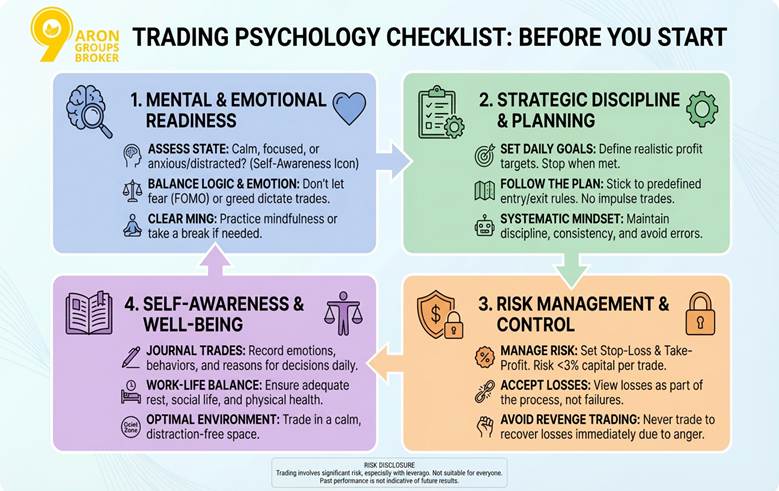

Trading Psychology Checklist Before You Start Trading

Have you entered a trade due to the fear of missing out, or has greed made you hold a profitable trade longer than necessary? These are important questions to ask yourself. If your answer is yes, you may be influenced by emotions, and it’s time to take control.

Am I in the Right Mental and Emotional State?

Continuous self-assessment of your mental and emotional state is a key component of any Trading Psychology Checklist. As a successful trader, it’s crucial to be aware of your thoughts, emotions, and trading habits. Every day, before you start trading, take a moment to evaluate yourself.

Are you feeling anxious today? Are you unable to concentrate? Are fear or greed clouding your judgment? If so, it might be best to take a break and avoid trading for the day. Alternatively, take a few minutes to clear your mind before entering any positions.

Do I Have a Balance Between Emotions and Logic?

Balancing emotions and logic is essential in trading. Emotions can serve as warning signals, but your decisions should ultimately be based on logical analysis and your trading strategy.

If your emotions are overwhelming your decision-making process, take a step back. Review your technical and fundamental analysis to ensure your strategy still aligns with the market conditions. Only act when your analysis supports the trade.

Have I Set My Goals for the Day and Stuck to Them?

Having clear goals helps you stay motivated and focused. Ensure that your goals are realistic but challenging. Set long-term goals and break them down into daily targets. Without goals, it becomes easy to lose focus and direction.

For instance, set a profit target for the day. If you reach that target, stop trading immediately and exit the market. If you’ve hit your target but feel the urge to continue trading, check if your emotions are controlling your actions.

How Self-Aware and Mindful Am I?

Self-awareness is understanding your own trading patterns and Behaviours. It helps you recognize which mental and emotional patterns are beneficial and which are harmful. Self-awareness allows you to identify when your emotions or thoughts may be negatively affecting your trades.

To improve self-awareness, be honest with yourself and maintain a trading journal. Record your emotions, Behaviours, trades, and the reasons behind your decisions. This will give you insights into your strengths and areas for improvement.

Mindfulness helps you remain present and avoid making impulsive decisions based on emotions. To improve mindfulness, consider practicing a few minutes of meditation before each trading day to help calm your mind and enhance your focus.

Am I Committed to Journaling My Trades?

Journaling and regularly reviewing your trading journal are crucial tools for self-awareness. If you want to understand why you are making profits or losses and uncover patterns in your emotional and mental Behaviour, make daily journaling a habit. A well-maintained journal gives you valuable insights into your strengths, weaknesses, and overall trading strategy.

Do I Have a Trading Plan and Stick to It?

In your Trading Psychology Checklist, don’t overlook the importance of planning. Define your entry and exit points before each trade. A solid trading plan helps you stay focused and disciplined.

Before entering any trade, ask yourself: Does this trade align with my analysis and strategy? Have I defined clear rules for entering and exiting the market in my trading plan checklist?

If you answer “no,” you’re likely being influenced by emotions. In this case, exit the trade immediately or revise your plan.

Do I Have a Systematic Mindset?

Discipline is key to becoming a successful trader. It helps you stick to your plan, avoid impulsive actions, and reduce errors. Ask yourself: Do I have a Trading plan checklist? Do I follow my strategy consistently? Do I journal my trades daily?

If you answer “yes” to these questions, you are maintaining a systematic mindset—an essential trait of a disciplined trader.

Am I Paying Attention to Risk Management?

Risk management is one of the most important elements that distinguishes traders from gamblers. A trader’s success depends on managing risk, not on chasing high returns. Always set stop-loss and take-profit orders to protect your capital.

Before starting a trade, ask yourself: Is the amount I’m risking less than 3% of my total capital? Have I set a stop-loss to limit potential losses? If not, revisit your risk management checklist and revise your strategy.

Am I Ready to Accept Losses?

While profits are the goal of every trader, losses are inevitable. It’s essential to accept that losses are a part of trading and to have a strategy in place for dealing with them. Always ask yourself: Am I ready to accept a loss? If my trade hits the stop-loss, can I quickly exit and move on?

If the answer is “no,” you may not be emotionally ready to trade.

Is This Trade a Revenge Trade?

Some traders react to losses by ignoring them, while others try to recover quickly by trading impulsively. Both approaches are dangerous because they lead to revenge trading, where decisions are made based on emotions like anger or frustration.

After a loss, before entering a new trade, ask yourself: Am I trying to recover from my recent loss? If you feel anger or frustration, it’s a sign that you might be about to make a revenge trade. In such cases, stop immediately and avoid acting on emotional impulses.

Risk Disclosure

CFD trading and other financial derivatives involve significant risk, especially due to leverage. These complex financial instruments are not suitable for every investor. Over 67% of retail investor accounts lose money when trading CFDs, and they may lose more than their initial investment. Additionally, investors do not own the underlying assets.

Before starting to trade, ensure that you fully understand how CFDs work and assess whether you can afford to bear the risk of substantial losses. Past performance is not indicative of future results, and tax laws may change, affecting your financial outcomes.

Am I Financially Pressured?

If you’re trading to relieve financial stress, be aware that this will only amplify your problems. Traders who are financially stressed often feel pressured to make a profit, leading to poor decision-making and increased anxiety.

Always ask yourself: Am I under financial pressure? Do I need to make a profit from this trade? If the answer is “yes,” refrain from trading.

Do I Have a Work-Life Balance?

Trading is demanding, and without proper rest, social connections, and physical well-being, you may become burned out. Ask yourself regularly: Have I been trading excessively? Have I taken breaks or enjoyed healthy leisure activities? Am I taking care of my diet?

Addressing these questions can help reduce stress and improve your trading performance.

Is My Work Environment Calm and Suitable?

It’s crucial to trade in an environment that is calm, well-lit, and free of distractions. A quiet and focused space will help you remain organized and minimize errors.

If you’re in a distracting or uncomfortable environment with poor internet connectivity, it’s best to postpone trading for another time.

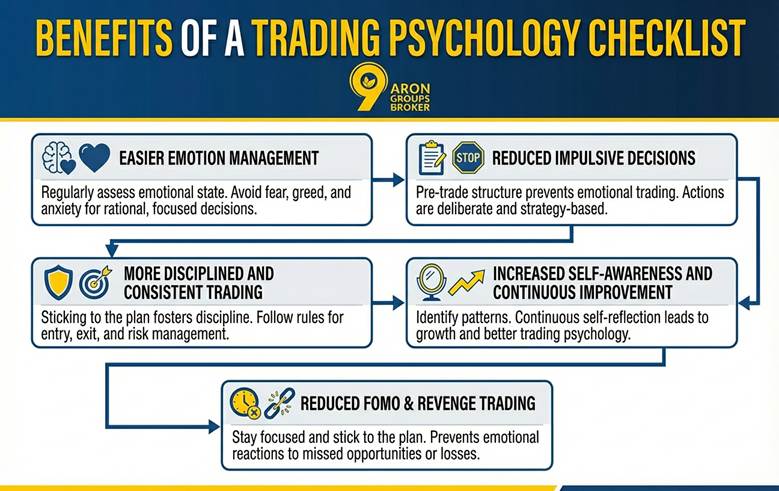

Benefits of a Trading Psychology Checklist

A Trading Psychology Checklist can be your key to success in the market. Trading is not only about technical knowledge but also about mastering your mind. A Trading Psychology Checklist helps you manage emotions and maintain control over your thoughts, which is essential for successful trading.

By creating and using a Trading Psychology Checklist, you can achieve several benefits:

Easier Emotion Management

Using a Trading Psychology Checklist makes it easier to manage your emotions while trading. It allows you to regularly assess your emotional state before and during trades, helping you avoid being influenced by fear, greed, or anxiety. This helps you stay focused and make rational decisions.

Reduced Impulsive Decisions

A Pre-trade checklist helps you avoid impulsive decisions driven by emotions. By following a structured set of guidelines, you ensure that your trading actions are deliberate and based on your strategy, rather than reacting impulsively to market movements. This significantly reduces emotional trading and helps you trade more effectively.

According to tradefundrr: Completing a pre‑trade checklist before every trade fosters confidence and reduces uncertainty. It helps you avoid jumping into trades based on impulse or noise, especially when markets are volatile.

More Disciplined and Consistent Trading

A well-structured Trading plan checklist enables traders to stay disciplined and consistent. It encourages you to stick to your trading plan, ensuring that you follow the rules for entry and exit, risk management, and profit-taking. This consistency leads to better outcomes and a reduced likelihood of deviating from your strategy due to emotions.

Increased Self-Awareness and Continuous Improvement

A Trading Psychology Checklist promotes self-awareness, allowing you to identify patterns in your emotional and mental state. Regularly reviewing your checklist helps you spot areas for improvement and develop your trading psychology. This self-reflection encourages continuous growth and learning, which are crucial for long-term trading success.

Incorporating a Trading Psychology Checklist into your trading routine can help reduce FOMO trading (fear of missing out) and revenge trading, making it easier to stay focused and stick to your plan. This process will help you grow both as a trader and as an individual, improving your overall trading strategy.

Conclusion

A Trading Psychology Checklist helps traders gain better self-awareness and emotional control, enabling them to avoid making decisions driven by emotions. By following the Trading Psychology Checklist, traders can stay focused on the factors that influence their Behaviour, helping them make rational decisions rather than impulsive ones.

The checklist includes key elements that assist in controlling your mindset and managing emotions. By consistently practicing and adhering to this checklist, traders can improve their decision-making, avoid emotional trading, and ultimately ensure long-term success. With a structured approach like a pre-trade checklist or risk management checklist, you can stay on track, avoid FOMO trading, and keep revenge trading in check, boosting your chances of sustained success.