Why can a legal dispute over aircraft subsidies (like the long-standing Boeing-Airbus case) directly impact the EUR/USD currency pair? How can a decision made in Geneva determine whether an all-out trade war between economic giants like the US and China erupts or is stopped in its tracks?

Behind these major economic events and financial market volatility lies a powerful yet often complex institution: the World Trade Organization (WTO). This organization is not merely a diplomatic forum for discussion; it is a set of binding rules, a powerful trade court, and a system for managing the vital arteries of the global economy.

But how exactly does this institution work? What power does it have to prevent unilateralism and tariff wars? And most importantly, why should an economist or a financial market trader meticulously follow its news and rulings? In this article, we will answer all of these questions.

- The WTO is the governing body for global trade rules and the official successor to GATT.

- The WTO's dispute settlement mechanism prevents unilateral trade wars and provides legal resolutions.

- WTO decisions (such as rulings on tariffs and subsidies) directly impact the Forex markets and major currencies.

- Membership in the WTO requires a commitment to transparency, tariff reduction, and aligning domestic laws with global standards.

What is the World Trade Organization (WTO)?

The World Trade Organization (WTO) is the only international organization dedicated to the global rules of trade between nations. The organization was established on January 1, 1995, but its roots trace back to 1948 with the signing of the General Agreement on Tariffs and Trade (GATT).

In effect, the WTO is the evolved and permanent successor to GATT. While GATT focused primarily on trade in goods, the WTO’s framework is far broader, encompassing trade in services (such as banking and tourism) and intellectual property rights (such as patents and copyrights).

Alongside institutions like the International Monetary Fund (IMF), the WTO is considered a cornerstone of global economic governance.

The WTO’s Role in the Global Economy and International Trade

The WTO is central to the global trading system. It functions as a forum for negotiating trade agreements and as a dispute settlement body. Its primary objective is to ensure that trade flows as smoothly, predictably, and freely as possible.

Its fundamental principles include:

- Non-discrimination: This includes the Most-Favored-Nation (MFN) principle (any special favor granted to one member must be extended to all other members) and the National Treatment principle (imported goods must be treated no less favorably than domestically-produced goods once they enter the market).

- Freer trade: Gradually reducing trade barriers through ongoing negotiations. This includes tariffs and non-tariff barriers (NTBs).

- Fair competition: Discouraging “unfair” practices such as dumping (exporting at a price below cost to gain market share) and prohibited subsidies.

The Objectives and Missions of the World Trade Organization

The WTO’s core mission is to simplify and liberalize global trade, but its objectives are far more extensive. In the following sections, we outline the organization’s primary missions.

Promoting Global Free Trade

The foremost mission of the WTO is trade liberalization. This is achieved through periodic rounds of negotiations aimed at reducing customs tariffs and eliminating non-tariff barriers (NTBs), such as quotas or cumbersome technical standards, to allow goods and services to cross borders more easily.

Maintaining Market Stability and Reducing Trade Risks

By establishing transparency and predictability, the WTO’s rules contribute to global market stability. When nations are confident that their trading partners will not suddenly and arbitrarily erect trade barriers, businesses and investors can plan for the future with greater certainty.

Enhancing Transparency and Improving International Trade Regulations

WTO members are obligated to publish their trade rules and regulations transparently, making them available to other members and the public. This transparency reduces corruption and enables fair competition for all players, especially smaller companies.

The WTO’s Role in Resolving Trade Disputes and Preventing Trade Wars

This is one of the WTO’s most critical functions. If a member country believes another member is violating an agreed-upon rule, it can file a complaint with the Dispute Settlement Body (DSB). Instead of resorting to a “trade war” (such as imposing unilateral retaliatory tariffs), the DSB provides a formal, legally binding adjudication process.

Members of the World Trade Organization

The WTO’s strength and scope depend on its members. Below, we examine which countries are part of the organization, what the joining process entails, and what membership signifies for them.

Number of Members and Member Countries of the WTO

As of 2025, the World Trade Organization has 164 members, which include countries and customs unions (such as the European Union). These members collectively account for over 98% of global trade.

The Process for New Member Accession

Joining the WTO is a highly complex, lengthy, and negotiation-driven process known as “Accession.” On average, this process takes 5 to 10 years, though it has been much longer for some countries (e.g., China’s accession took 15 years, and Russia’s took 19).

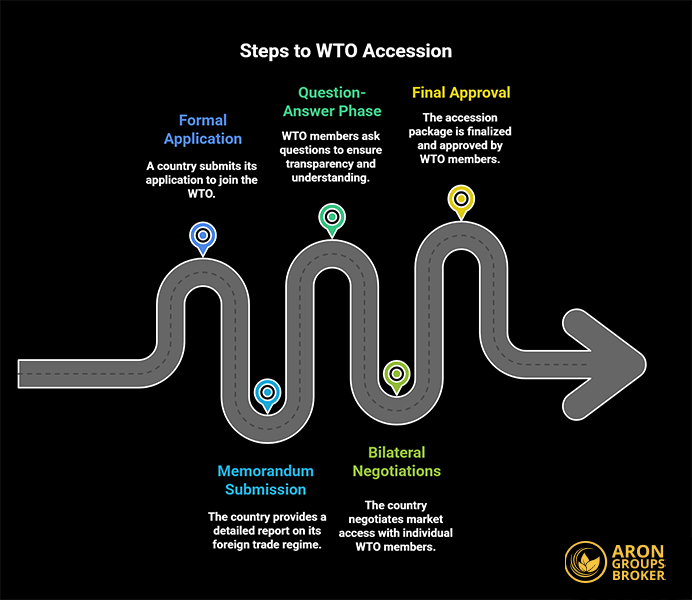

The process is divided into two main tracks: multilateral negotiations (reviewing the legal framework) and bilateral negotiations (on market access). It involves the following steps:

- Formal Application and Establishment of a Working Party

The applicant country first submits a formal request to the WTO General Council. A “Working Party,” composed of interested WTO members, is then established to manage the review process. - Submission of the Memorandum on the Foreign Trade Regime (Multilateral Track)

The applicant must prepare a comprehensive document known as the “Memorandum on the Foreign Trade Regime.” This document must detail all aspects of its trade and economic policies (including tariffs, subsidies, sanitary and phytosanitary (SPS) measures, customs valuation, intellectual property rights, etc.). - The Question-and-Answer Phase (Transparency)

Members of the Working Party review the memorandum and pose hundreds, or even thousands, of technical questions regarding the compliance of the applicant’s laws with WTO rules. This phase, which is the core of the multilateral negotiations, often takes years and requires the applicant to amend many of its domestic laws to align them with WTO standards. - Bilateral Market Access Negotiations

Simultaneously, the applicant must enter into bilateral negotiations with any WTO member that requests them. The goal is to agree upon the “Schedules of Commitments.” These schedules specify:- The maximum tariff rates (tariff bindings) the country will apply to thousands of imported goods.

- Which sectors of its services market (e.g., banking, insurance, telecommunications) it will open to foreign competition and to what extent.

- Finalizing the Accession Package and Approval

Once all bilateral and multilateral negotiations are concluded, the Working Party drafts a final Accession Package, which includes three parts:- The Working Party Report (summarizing the negotiations and commitments).

- The Protocol of Accession (the legal document outlining the terms of membership).

- The Schedules of Commitments (compiling all bilateral agreements on tariffs and services). This final package must be approved by the WTO General Council (or Ministerial Conference), typically by consensus (or a two-thirds majority). The applicant country must then ratify the package in its domestic parliament to officially become a member.

Benefits and Obligations of WTO Membership

WTO members enjoy key benefits, the most important of which is guaranteed and non-discriminatory access (based on the Most-Favored-Nation principle) to the markets of over 160 other members. They also gain access to legal tools to protect domestic industries from unfair competition (like dumping and prohibited subsidies) and can use the binding dispute settlement mechanism to prevent unilateral trade wars.

In return, they have significant obligations: Members must align their domestic laws with all WTO agreements. They are obligated to maintain full transparency in their trade policies (notifying regulations) and cannot raise tariffs above their “bound tariff rates” (the ceilings agreed upon during negotiations).

The Role of Large Countries and Emerging Economies in WTO Decision-Making

Decision-making at the WTO typically operates by consensus, meaning, in theory, a single member can block a decision. In practice, however, major economic powers like the United States, the European Union, and China (as well as coalitions of emerging economies) hold significant influence in setting the negotiating agenda and advancing discussions.

The Impact of the World Trade Organization (WTO) on Forex and Financial Markets

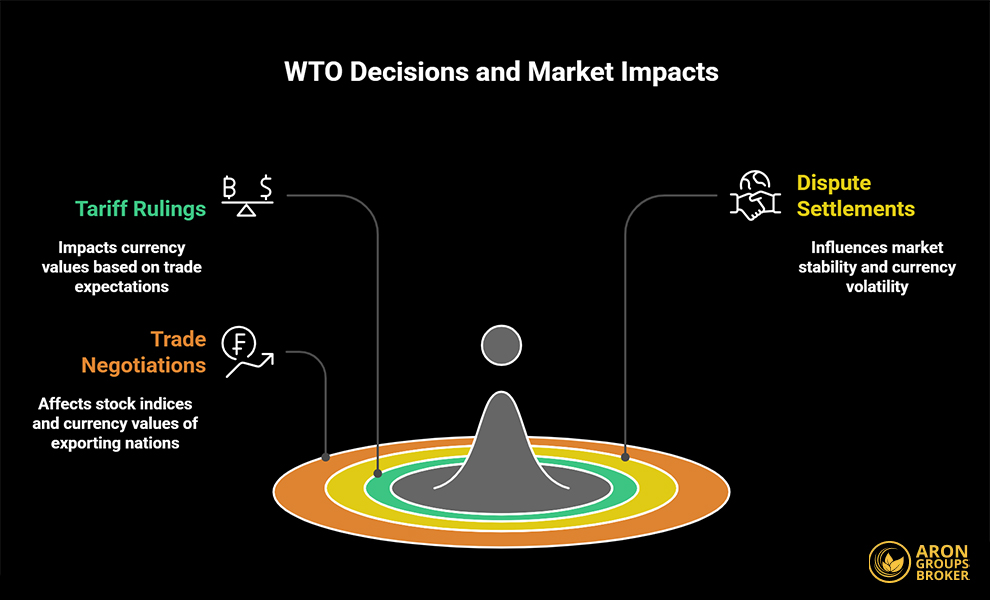

This section is particularly important for market participants. WTO decisions and news directly impact the economic health of nations and, consequently, the value of their national currencies in the Forex market.

- Tariff Rulings: Imagine the WTO issues a ruling against tariffs imposed by the US on Chinese goods. Market expectations for de-escalating trade tensions would rise. This news could be bullish for the Chinese Yuan (CNY) and temporarily bearish for the US Dollar (USD), as China’s exports would be expected to increase.

- Dispute Settlements: A prolonged trade dispute (like the Boeing-Airbus case between the US and Europe) can create uncertainty in key industries and affect volatility in the EUR/USD pair. The resolution of such cases sends a signal of stability.

- Trade Negotiations: The failure or success of a new round of WTO trade talks can influence global stock indices and the currencies of exporting nations, such as the Australian Dollar (AUD) or the Canadian Dollar (CAD).

Traders conducting fundamental analysis closely follow WTO-related news, negotiations, and rulings as reflected in the economic calendar. These events directly impact a country’s trade balance, inflation, and economic growth.

The WTO Boeing-Airbus Case

What was the issue? It was the longest dispute settlement case in WTO history. Both the US (for Boeing) and the EU (for Airbus) accused each other of providing illegal government subsidies to their respective aircraft manufacturers to gain an unfair competitive advantage.

What was the WTO's ruling? After years of investigation, the WTO validated the claims of both sides, meaning both Boeing and Airbus had received illegal subsidies.

What was the result? The WTO authorized both sides to impose billions of dollars in retaliatory tariffs on each other's goods. This directly impacted prices and volatility in the EUR/USD pair until a temporary truce was called in 2021.

Can the WTO Limit a Country’s Domestic Policies?

The WTO does not directly dictate domestic policies (such as public health, food safety, or environmental standards). However, its rules require that these domestic policies are not “discriminatory” against trading partners and do not act as disguised barriers to trade. This is sometimes interpreted as interference with national sovereignty, although the WTO’s stated goal is merely to ensure fair trade based on mutually agreed-upon rules.

The Impact of WTO Membership on Foreign Direct Investment (FDI)

WTO membership is typically a strong positive signal for Foreign Direct Investment (FDI). This membership signifies a country’s commitment to the rule of law, transparency, open markets, and regulatory predictability. Investors know their assets are protected under international rules and that they will not face unexpected or discriminatory barriers.

Conclusion

The World Trade Organization (WTO) is far more than just a building in Geneva; it is a set of rules and a system for overseeing the vital arteries of the global economy. Understanding the WTO’s objectives and monitoring its decisions is crucial, not only for policymakers but for anyone active in the financial markets. The stability (or instability) stemming from WTO actions is directly reflected in currency market volatility and stock indices. Institutions like central banks also adjust their policies, in part, with these rules in mind.