Alerts on TradingView are one of the most essential tools for helping traders identify optimal trading opportunities and manage risk effectively. By using these notifications, traders can stay instantly informed about market movements and make more informed, timely decisions.

This article explores the importance of alerts in TradingView, how to use them efficiently, and the differences between various types of alerts. It also provides step-by-step guidance on how to set up effective alerts that align with your trading strategy. If you’re interested in mastering this feature, stay with us until the end of this guide.

- An alert on TradingView is an efficient tool that enables traders to execute more effective trades based on their technical analysis.

- In the paid versions of TradingView, traders have access to a greater number and wider variety of alerts, allowing for more flexibility and precision in their trading strategies.

What Is an Alert on TradingView and How Does It Work?

An alert or notification on TradingView is one of the platform’s most powerful features, designed to inform traders about specific market events they’ve defined. These alerts can be set based on price levels, technical indicators, trendlines, or even fully custom conditions.

By using alerts, traders can identify ideal entry or exit opportunities without constantly monitoring charts, saving both time and mental energy while maintaining precision in execution.

Why Are TradingView Alerts Essential for Traders?

Using alerts on TradingView is crucial for every trader, as they provide both efficiency and emotional discipline in the trading process. By setting alerts:

- The trader doesn’t have to sit in front of the charts all day to track market changes.

- Alerts help traders make decisions based on predefined analysis rather than impulsive emotions.

- Dozens of alerts can be created simultaneously for multiple assets — whether forex pairs, cryptocurrencies, or stocks.

- In both short-term trades and long-term strategies, alerts are an invaluable tool for monitoring market conditions and reacting at the right moment.

In short, TradingView alerts empower traders to stay informed, disciplined, and efficient; even when they’re away from the screen.

The Difference Between Manual Alerts and Indicator-Based Alerts

In general, there are two main types of alerts on TradingView:

- Manual Alerts:

These alerts are set directly by the trader on the chart at a specific price level or point of interest. For example, a trader may set an alert to trigger when the EUR/USD price reaches 1.1759. Manual alerts are straightforward and ideal for traders who want to monitor specific price levels or chart patterns. - Indicator-Based Alerts:

These alerts are automatically triggered based on predefined conditions derived from technical indicators; for instance, when the MACD lines cross, or when the RSI moves above the 70 level. Such alerts tend to be more precise and are typically aligned with technical analysis–driven trading strategies, allowing traders to automate parts of their monitoring process.

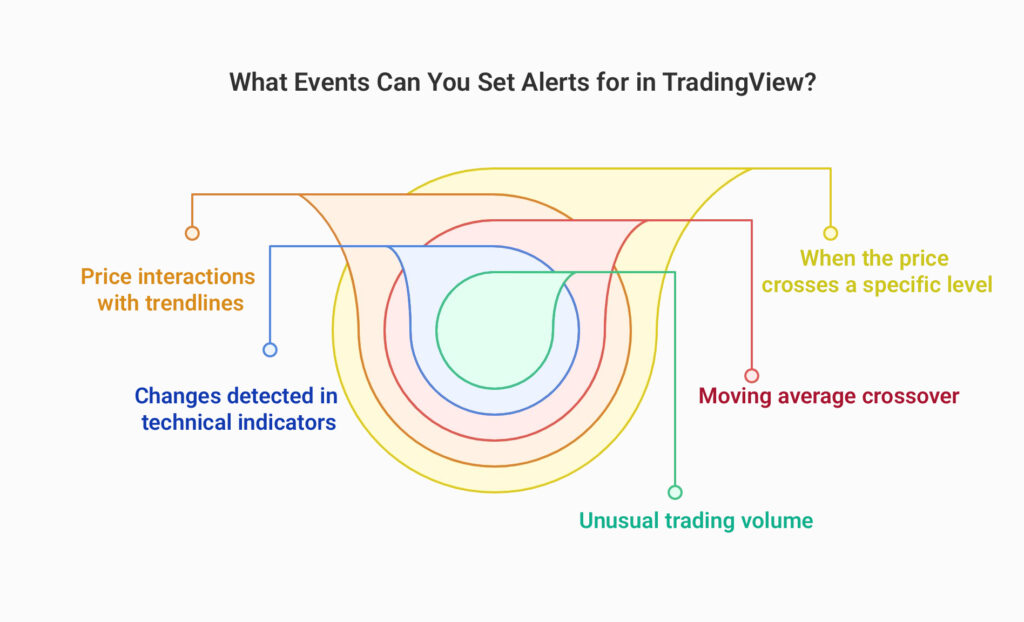

What Types of Market Events Can Be Covered with Alerts?

On TradingView, alerts can be configured to track a wide range of market events, including:

- Price breaking through a specific level;

- Price touching a trendline or a price channel;

- Crossovers between moving averages;

- Specific changes in indicators such as RSI, MACD, or Bollinger Bands;

- Unusual volume spikes;

- Candle open or close conditions across different timeframes, and more.

Types of Alert Creation Methods in TradingView

There are three main ways to create alerts in TradingView:

- Setting a simple price alert on a specific level in TradingView;

- Using technical indicators to configure alerts;

- Creating conditional alerts using Pine Script in TradingView.

Let’s take a closer look at each of these methods.

Creating a Simple Price Alert in TradingView

In its simplest form, you can set an alert to notify you when the price of an asset reaches or crosses a specific level. This type of alert is particularly useful for monitoring support and resistance levels, or for identifying potential entry and exit zones in your trading strategy.

You can set dynamic alerts that move along with indicators such as moving averages or Bollinger Bands. This is done by defining a variable condition within Pine Script, allowing the alert to automatically adjust as market conditions evolve.

Using Technical Indicators to Set Alerts in TradingView

With this method, you can create alerts based on specific conditions of technical indicators such as the Exponential Moving Average (EMA), MACD, RSI, and more.

For example, you can set an alert to trigger when the RSI crosses above 70, which typically signals overbought conditions in the market.

Creating Conditional Alerts with Pine Script in TradingView

For professional traders, TradingView allows the creation of custom, advanced alerts using Pine Script.

This feature is ideal for traders who use complex strategies, custom conditions, or algorithmic trading systems.

By leveraging Pine Script, you can define multi-layered conditions that go far beyond standard alert options, giving you complete control over how and when notifications are triggered.

How to Set Alerts in TradingView

Let’s now look at how to activate and configure alerts in TradingView.

Enabling a Price Alert

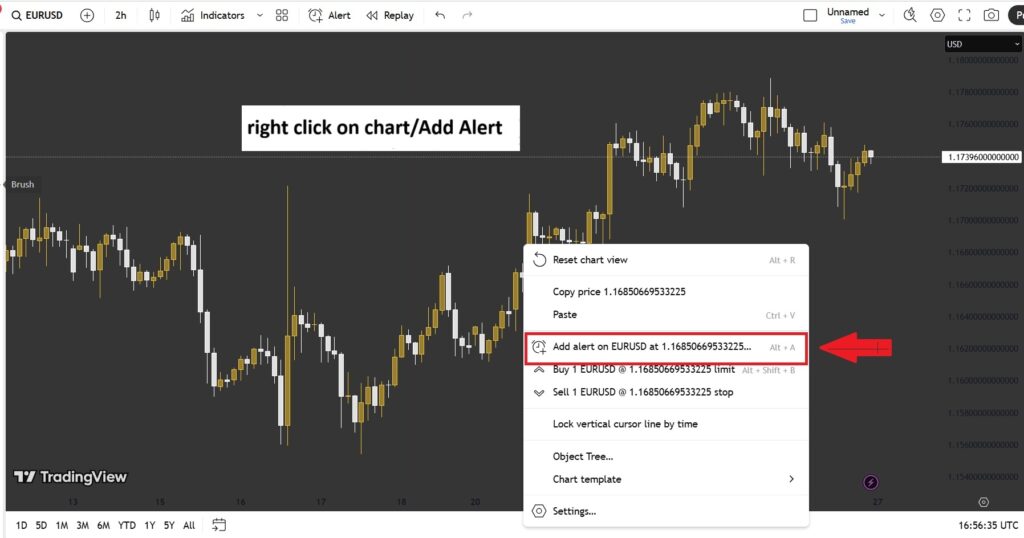

To set an alert on a specific price level, follow these steps:

- On the price chart, right-click on the desired level;

- Select “Add Alert” from the context menu.

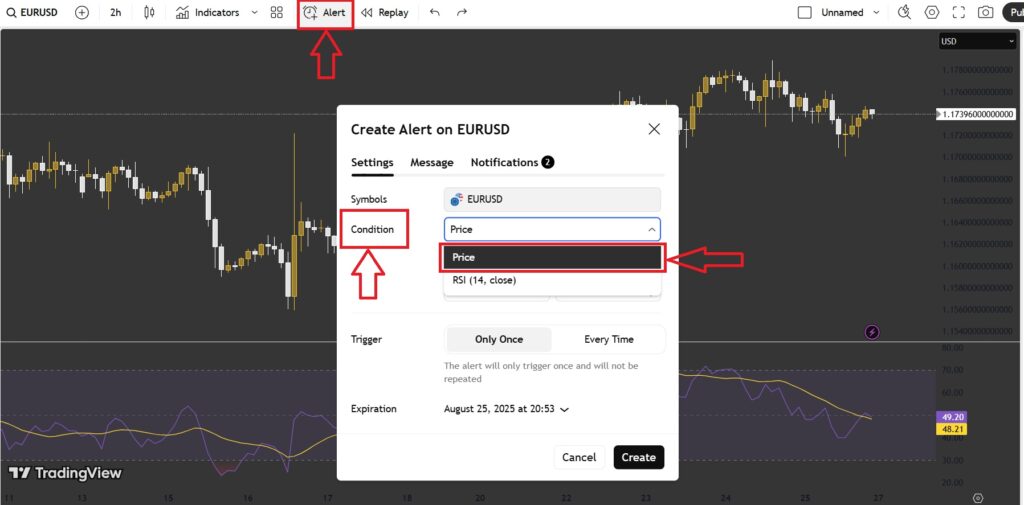

- Or, in the Alert tab, click on the Price option.

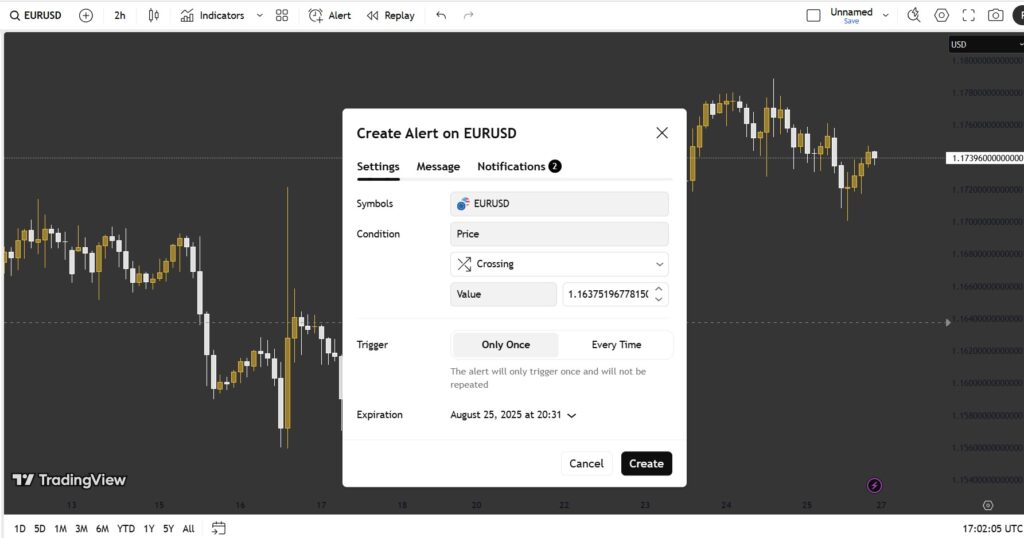

- Now, in the pop-up window, set the required parameters — including the symbol, price level, the trigger condition (when the alert should activate), the frequency and timing of the alert, and its expiration date.

- Then, under the Notification tab, choose your preferred alert type (such as sound notification, mobile push alert, or email) and finally, click the Create button to activate the alert.

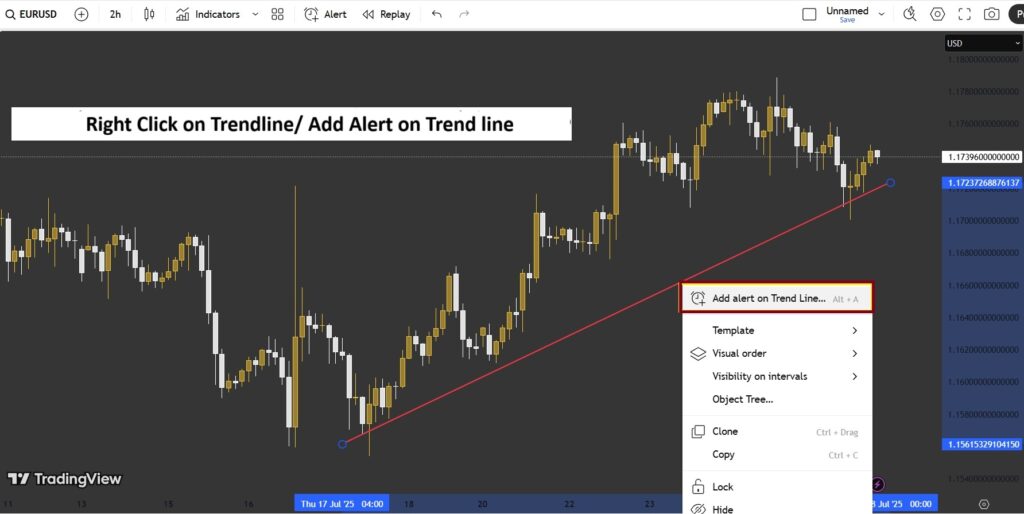

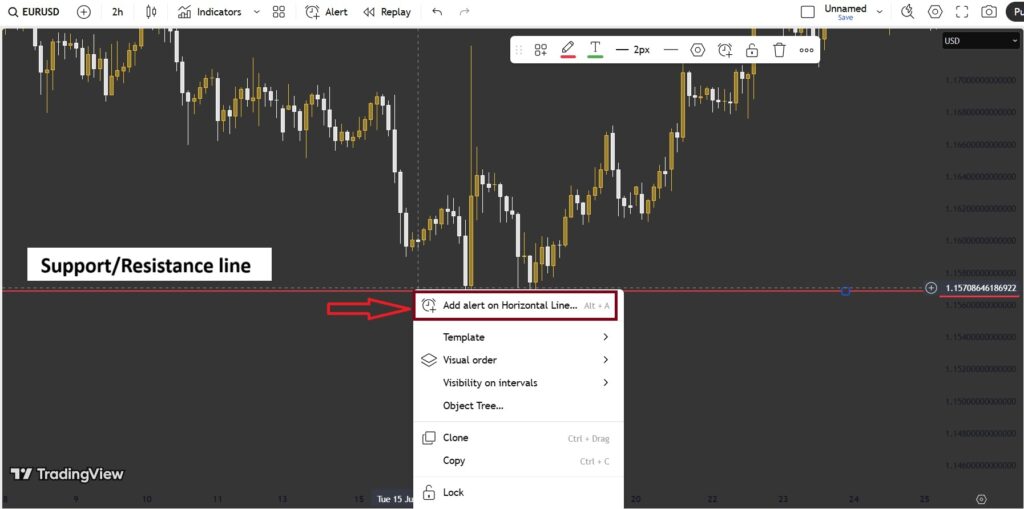

Setting Alerts Based on Trendlines, Support, or Resistance Levels

The steps to set an alert based on a trendline or support and resistance levels are as follows:

- First, draw the trendline (or the support/resistance line) on your chart.

- Then, click on the line, and select “Add Alert on Trend Line” or “Add Alert on Horizontal Line.”

Finally, in the Alert window, you can specify the type of notification (such as sound alert, mobile push notification, or email) and adjust the related settings. You can also create a custom alert message to describe exactly what event has occurred when the alert is triggered.

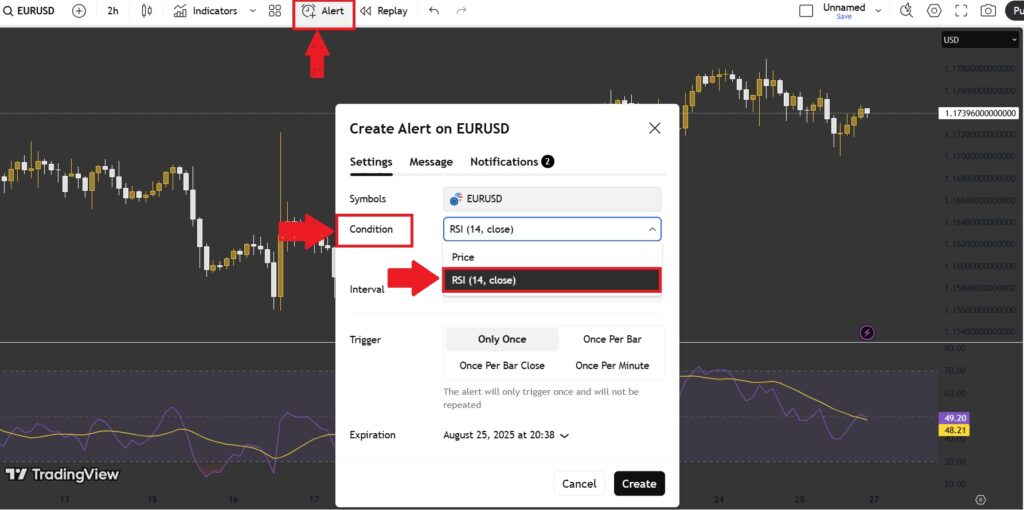

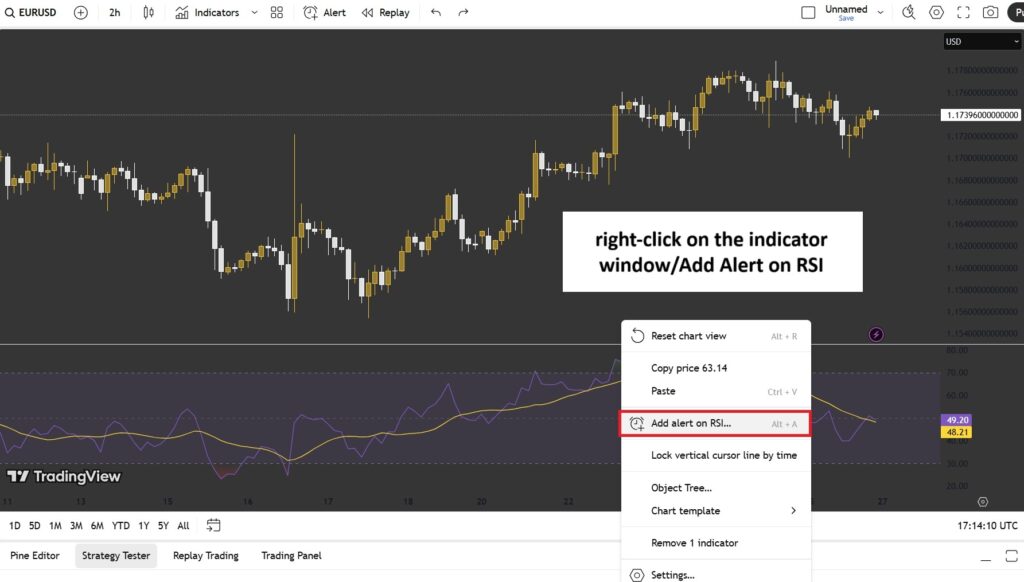

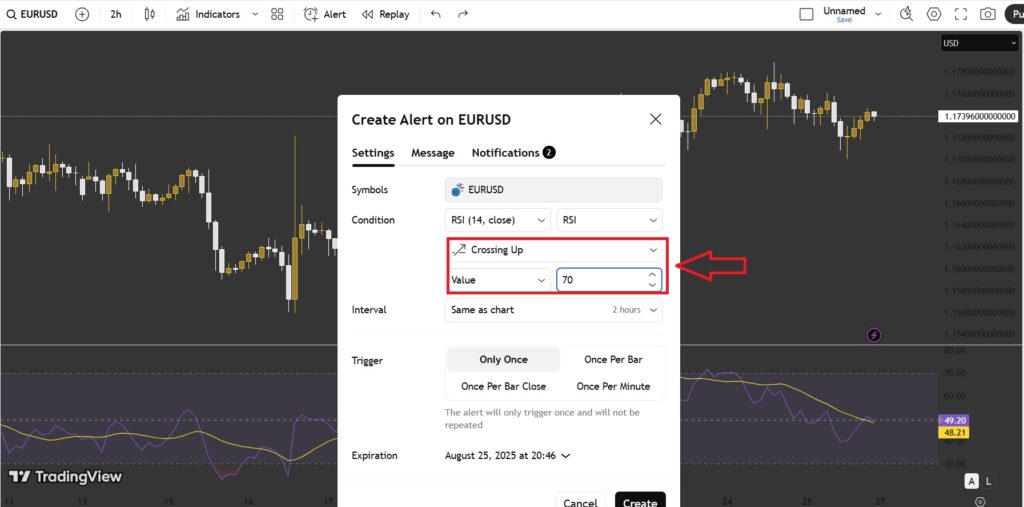

Steps to Set an Alert Based on Indicators

- First, activate the desired indicator on your chart (for example, the RSI indicator).

Then, click on Alert and choose to set the alert on the indicator’s name (in this case, RSI).

- Or, right-click on the indicator window and select “Add Alert on RSI.”

- Now, define the desired condition (for example, RSI crosses above 70) along with any other relevant parameters.

- Finally, configure your notification settings and click the Create button to activate the alert.

By keeping a list of disabled alerts in the “Manage Alerts” section, you can reuse them as ready-made templates for similar conditions in the future. This technique is particularly efficient for multi-market traders, allowing them to save time and maintain consistency across different trading instruments.

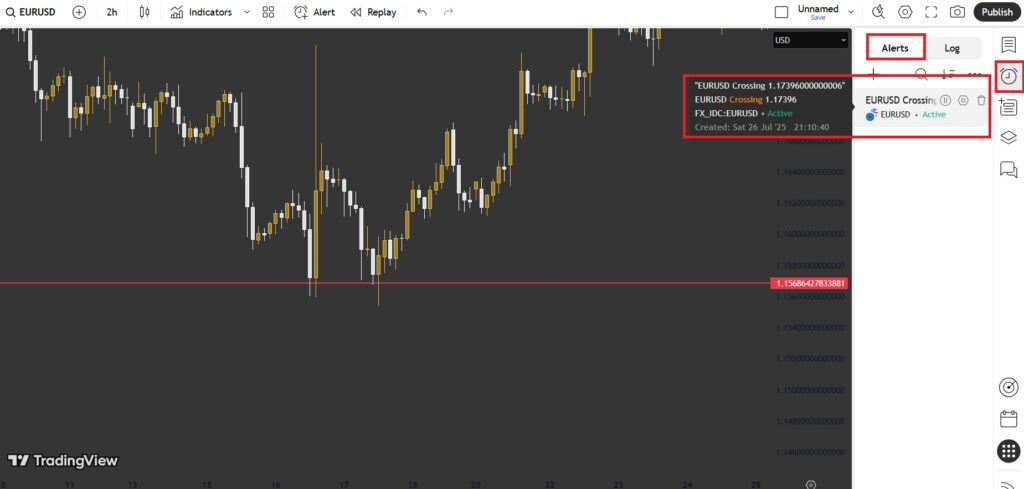

Managing Alerts in the Alert Manager Panel

In TradingView, once you’ve created your first alert, you can access the Alert Manager panel.

To do this, simply click on the “Alert” icon located in the toolbar at the top of the screen, or go to the “Alerts” menu in the upper-right corner and select “Manage Alerts.”

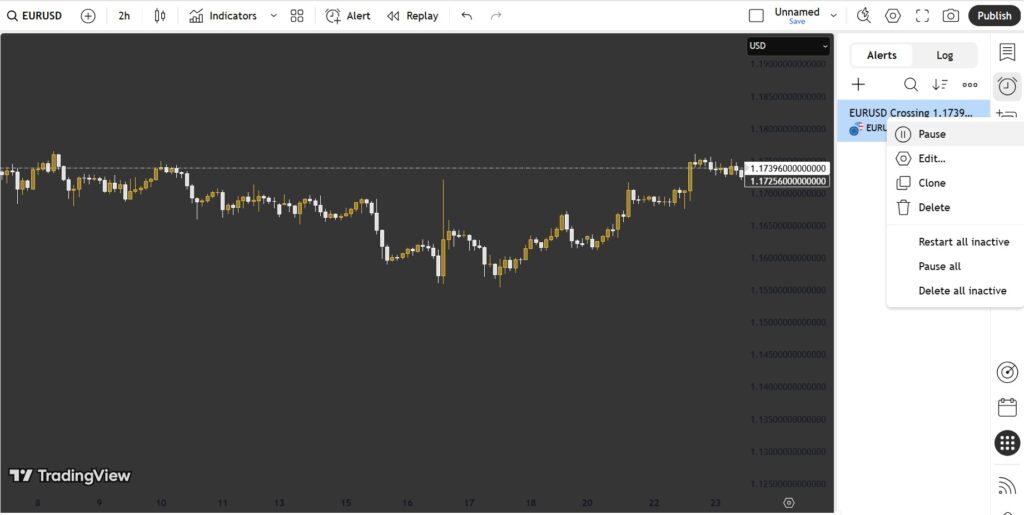

How to Edit or Delete Existing Alerts

- Once you open the Alert Manager, simply hover your mouse pointer over any alert to edit, pause, or delete it.

- Or, right-click on any alert to open a window that allows you to manage your alerts.

The Difference Between Alerts in the Free and Premium Versions of TradingView

TradingView offers its users several account types, each with different features and limitations. One of the key areas where the Free and Premium versions differ significantly is in the alert system. Let’s take a closer look at these differences.

Alert Limitations in the Free Version of TradingView

In the Free plan, alert-related features are quite limited. For example:

- In the Free version, users can only set two active alerts simultaneously — one price alert and one technical alert.

- Free users cannot use conditional alerts based on Pine Script strategies or custom conditions.

- Alerts in the Free version expire automatically after two months.

The ability to use a Webhook URL allows users to connect TradingView alerts to external systems such as Telegram bots or automated trading software, enabling them to create customized automatic responses or execute trades based on alert triggers.

Advanced Alert Features in TradingView Paid Plans

In the paid versions of TradingView (such as Pro, Pro+, and Premium), users gain access to a range of advanced alert functionalities designed for professional traders who need precision and flexibility. These features include:

- In the paid plans, users can create a larger number of simultaneous alerts — up to 40 alerts in the Pro plan, 200 alerts in Pro+, and 800 alerts in the Premium version.

- Paid users can use Pine Script to design custom and conditional alerts, allowing for more sophisticated trading automation.

- Paid versions also support personalized alert messages and multiple notification types for different market conditions.

- In paid plans, alerts do not expire, offering uninterrupted monitoring of market setups.

Comparison Table of TradingView Plans for Creating Alerts

The table below provides a brief comparison of the alert capabilities across different TradingView subscription plans:

| Feature / Plan | Free Plan | Pro Plan | Pro+ Plan | Premium Plan |

|---|---|---|---|---|

| Number of Alerts | 2 alerts | 40 alerts | 200 alerts | 800 alerts |

| Price-Based Alerts | Yes | Yes | Yes | Yes |

| Indicator-Based Alerts | No | Yes | Yes | Yes |

| Conditional Alerts via Pine Script | No | Yes | Yes | Yes |

| Advanced Notification Settings | Limited | Yes | Yes | Yes |

| Multiple Alerts per Condition | No | Yes | Yes | Yes |

| SMS Notifications | No | Yes | Yes | Yes |

Pro Tips for Using Alerts Smartly in TradingView

To make the most of TradingView alerts, combining them with your trading strategies and risk management plans can significantly enhance your performance in the market. Below, we’ll explore some professional techniques for using alerts more effectively.

How to Combine Alerts with Your Trading Strategies

In strategies such as support and resistance trading, moving average crossovers, or even price pattern setups, using price alerts can be extremely beneficial.

You can also set alerts to notify you of important indicator crossovers or significant technical changes. For example, if you use the RSI or MACD indicator to identify buy and sell signals, you can configure alerts to trigger when these indicators enter overbought or oversold zones, helping you stay ahead of key market movements.

How to Use Price Alerts for Risk Management in Trading

To effectively use price alerts as part of your risk management strategy, consider the following points:

- Set clear stop-loss and take-profit levels: You can use alerts to monitor when the price approaches your stop-loss or take-profit targets, allowing you to take timely action if needed.

- Manage risk exposure: Price alerts help you stay aware of potential risk escalation in open trades. For instance, you can set an alert to trigger when the price reaches a level where your risk exceeds your acceptable limit, prompting you to close or adjust your position.

How to Set Alerts for News Events and the Economic Calendar in TradingView

By setting alerts for news events such as economic data releases, employment reports, or interest rate decisions, you can anticipate market movements and stay aligned with major developments.

- To do this, first navigate to the Economic Calendar in TradingView.

- After selecting the specific news events you want to monitor, you can manually set alerts for them—either through Pine Script or by using simple alert functions.

- For example, you can open the currency pair affected by the upcoming news and, based on your technical and fundamental analysis, configure a price alert to notify you when market conditions meet your predefined criteria.

Conclusion

In TradingView, alerts are an exceptionally powerful tool that help traders stay informed about market developments without the need for constant monitoring. By properly configuring alerts, you can identify optimal entry and exit points, avoid emotional decision-making, and manage risks more effectively.

Moreover, the ability to set advanced alerts (whether based on indicators, price levels, or even major news events) allows you to fine-tune your trading strategies with greater precision and stay one step ahead in the market.