The People’s Bank of China (PBoC), with its decisions on interest rates, foreign reserves, and exchange rate controls, plays a critical role in determining the direction of the Yuan symbol in Forex. When this institution changes its reference rate or alters its intervention strategy in the currency market, the effects ripple from the domestic Chinese market to global Forex markets. In this article, we will simplify how China’s monetary policies affect the value of the yuan and why traders around the world are closely watching it. Stay with us until the end of the article.

- The People’s Bank of China (PBoC) was established in 1948.

- This bank is responsible for overseeing China’s monetary and financial policies and is considered one of the most powerful banks in the world.

- The PBoC has regional branches throughout the country and is supervised by a board of directors.

- In 2022, the PBoC took significant actions to stabilize China’s economy, including multiple reductions in the required reserve ratio.

Introduction to the People’s Bank of China (PBoC) and Its Main Functions

When we talk about the People’s Bank of China (PBoC), we refer to the institution that directs monetary policy, interest rates, and exchange rate management for the world’s second-largest economy. This bank is the financial backbone of China and is responsible for:

- Controlling inflation;

- Maintaining financial stability;

- Supporting economic growth.

Given that China holds over $3.2 trillion in foreign reserves, the decisions made by this bank impact not only the value of the yuan but also the global foreign exchange market and even the trends in forex trading. The PBoC’s policies can affect global interest rates and change the course of currency pairs like USD/CNH.

According to Investopedia: The People's Bank of China was recognized in 2016 as a leading central bank in the world for digital currency initiatives and began a project to develop a Central Bank Digital Currency (CBDC). This move signifies China’s effort to innovate within monetary policies and strengthen the global influence of the yuan.

History and Position of the People’s Bank of China in China’s Economic Structure

The People’s Bank of China (PBoC) was established in 1948 and initially had a simple role in distributing money and controlling the banking system. However, in 1995, with the enactment of the Central Bank Law, it became a more independent institution that operates directly under the State Council of China. Since then, the PBoC’s role in coordinating with China’s socialist market economy has grown, making it a key player in the country’s GDP growth and economic stability. This position has made its monetary decisions subject to close global monitoring.

Main Missions of the People’s Bank of China

As the primary monetary authority and financial regulator in the country, the PBoC has extensive responsibilities in maintaining economic stability and controlling liquidity. The main missions of the bank can be summarized in several key areas:

- Formulating and Implementing Monetary Policies: The most important role of the PBoC is controlling the money supply and interest rates to achieve price stability and sustainable economic growth. The bank uses tools such as the required reserve ratio, open market operations, and interbank interest rates to manage liquidity.

- Supervising the Banking and Financial System: The PBoC is responsible for maintaining the health of China’s banking system. It monitors financial institutions to prevent systemic risks, liquidity crises, and financial misconduct.

- Managing Foreign Reserves and Exchange Rates: One of the PBoC’s strategic missions is managing the country’s foreign reserves and maintaining the stability of the yuan in global markets. The bank intervenes in the foreign exchange market when necessary to prevent excessive volatility.

- Issuing and Managing the National Currency (Yuan): The PBoC is the only entity authorized to issue money in China. This mission includes designing, printing, distributing, and controlling the money supply to maintain public confidence in the yuan.

- Ensuring Financial Stability and Supporting Economic Growth: With precautionary policies and market regulation tools, the PBoC ensures the financial stability of the country while creating favorable conditions for economic growth and employment.

- Developing Financial Innovations and the Central Bank Digital Currency (e-CNY): In recent years, one of the PBoC’s new missions has been developing and overseeing the digital yuan (e-CNY) to strengthen China’s position in the global digital economy.

The People's Bank of China (PBoC) sets the daily reference rate for the USD/CNY exchange rate, which serves as the starting point for daily fluctuations. This rate can have a significant impact on market direction and trading decisions.

Policy Tools of the People’s Bank of China (PBoC)

The People’s Bank of China (PBoC) uses a range of policy tools to achieve its objectives, which can be broadly divided into two main categories:

- Price Tools;

- Quantity Tools.

Price tools include interest rates and open market operations, while quantity tools involve the reserve requirement ratio for banks and liquidity management. These tools help the PBoC control the money supply, lending rates, and ultimately the exchange rate of the yuan.

Interest Rates

One of the key tools of the People’s Bank of China (PBoC) is setting short-term rates, such as the seven-day repo rate and the Loan Prime Rate (LPR). For example, in 2020, during the COVID-19 pandemic, the PBoC reduced interest rates to stimulate the economy. Such actions typically lead to the depreciation of the yuan against the dollar and affect the PBoC’s influence on the USD/CNH currency pair.

Foreign Reserves

With more than $3 trillion in foreign reserves, the PBoC is one of the largest players in the global forex market. These reserves allow the PBoC to intervene in the market during periods of extreme volatility and maintain the yuan’s value within its target range. This approach ensures the stability of the CNY and prevents sudden fluctuations in the market.

Exchange Rate Control

The People’s Bank of China (PBoC) operates a managed float exchange rate system, where a daily reference rate for the yuan is set, and trading is allowed only within a 2% band of this reference rate. This policy helps stabilize the market and prevents sharp fluctuations.

China’s Currency: The Difference Between Onshore (CNY) and Offshore Yuan (CNH)

In the world of Chinese finance, CNY and CNH are two different versions of the yuan, each used under specific circumstances. The fundamental differences between CNY and CNH stem from capital controls and the way the currency is managed by the People’s Bank of China (PBoC).

According to Worldfirst, while CNY is used for domestic transactions in China and is controlled by the PBoC, CNH is freely traded in international markets such as Hong Kong and London. This key distinction between CNY and CNH is particularly important for forex traders and those analyzing the yuan symbol in the forex market.

| Feature | Onshore Yuan (CNY) | Offshore Yuan (CNH) |

|---|---|---|

| Trading Location | Only in Mainland China | Global markets (Hong Kong, London, Singapore) |

| Regulating Authority | People’s Bank of China (PBoC) | Supply and demand forces in global markets |

| Degree of Control | Strict control and daily reference rate set | More free fluctuation with less intervention |

| Volatility | Lower and within a defined range (±2%) | Higher and influenced by global news and events |

| Liquidity | Limited and controlled | High and accessible to international traders |

| Primary Use | Domestic business and trade | Forex trading, speculation, and investment |

| Primary Audience | Chinese businesses and citizens | Forex traders and international investors |

Definition and Use of Onshore Yuan (CNY) in Mainland China

CNY, or Chinese Yuan Onshore, refers to the yuan used within China (Mainland). This currency is tightly controlled by the People’s Bank of China (PBoC), and its exchange rate fluctuates daily within a defined range.

The primary use of CNY is for domestic transactions, such as business payments and exchanges between Chinese companies. Due to the government’s capital controls, foreign investors cannot freely buy and sell CNY on the international market, and for this purpose, they use the offshore version, CNH.

The Concept of Offshore Yuan (CNH) and Its Role in the Global Forex Market

CNH, or Chinese Yuan Offshore, is the version of the yuan traded outside the borders of Mainland China, especially in major financial hubs such as Hong Kong, London, and Singapore. CNH was introduced in 2010 to help China internationalize its currency and facilitate global trade using the yuan.

Unlike CNY, the offshore yuan is not directly controlled by the PBoC. Its exchange rate is determined by supply and demand in the free market, making it one of the important currencies in the global forex market. CNH is a popular instrument for traders who wish to speculate on China’s monetary policies and economic data.

For those looking to trade exotic currency pairs like USD/CNH, understanding the differences between CNY and CNH can significantly impact trading strategies.

Why Does China Have Two Exchange Rates for the Same Currency?

By creating two versions of the yuan, China has sought to strike a balance between controlling its internal economy and increasing the global influence of its national currency. On one hand, the government aims to manage the domestic exchange rate (CNY) to keep exports competitive and maintain financial stability.

On the other hand, to develop international trade relations, there was a need to make a version of the yuan (CNH) available to global markets, allowing foreign investors to trade it without the restrictions of domestic capital controls. In other words, CNY serves as a tool for domestic monetary policy, while CNH serves as a tool for the yuan’s global presence.

Differences Between CNY and CNH in Terms of Liquidity, Volatility, and Trading Freedom

CNH has higher liquidity because it is freely traded in international markets, while CNY is heavily controlled by the Chinese government and mainly used in the domestic market. One of the key differences is that CNH typically experiences more volatility. For example, in 2015, the spread between CNY and CNH was about 2%. These differences can affect the volatility of the yuan symbol in the forex market and impact exotic currency pairs, which in turn shapes trading strategies.

The exchange rate differential between CNY and CNH is considered an indicator of market expectations regarding China's monetary policies. When selling pressure on CNH increases and the gap between its rate and CNY widens, it may signal investor concerns about the weakening of the yuan's value.

How the People’s Bank of China Intervenes in the Currency Market

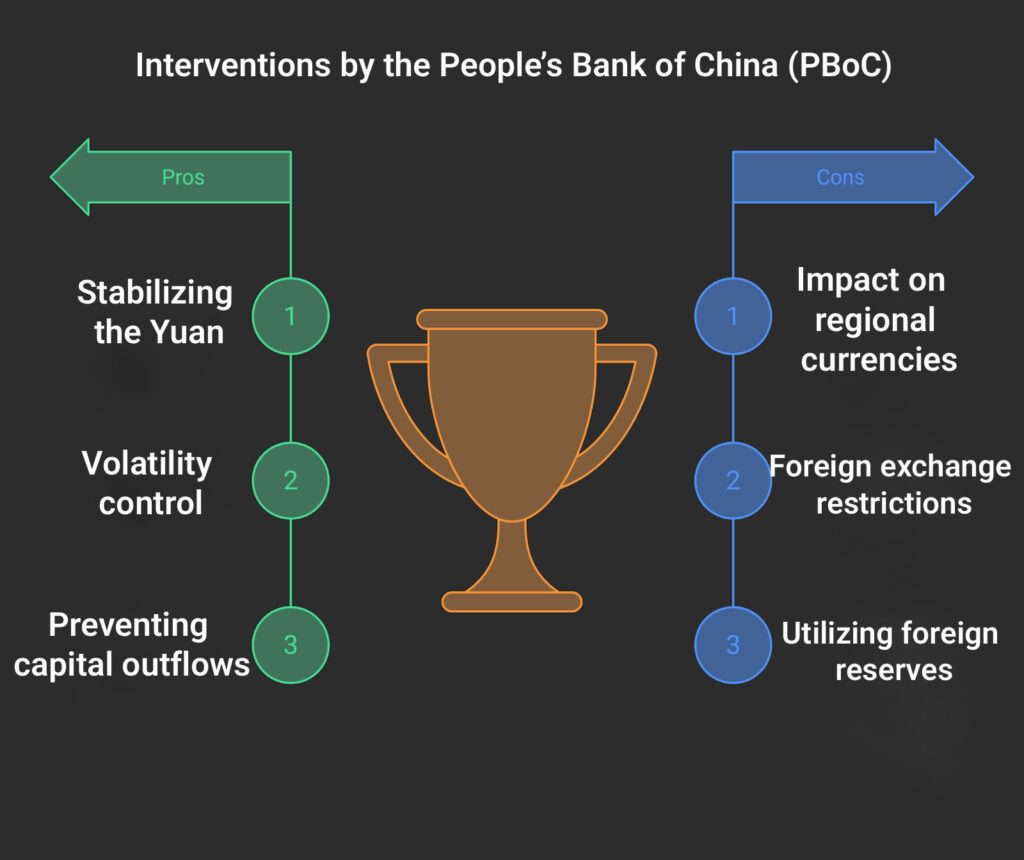

The People’s Bank of China (PBoC) employs various methods to maintain the stability of the yuan and control currency market fluctuations. These interventions can have a significant impact on the forex market, particularly on USD/CNH. By adjusting the daily reference rate of the yuan, using foreign exchange reserves, and implementing currency restrictions, the PBoC helps manage the supply and demand for the currency. These measures not only affect the value of the yuan but also influence other currency pairs.

Setting the Daily Reference Rate and Its Impact on the Market

One of the key tools used by the PBoC to control the exchange rate is setting the daily reference rate for the yuan. Every morning, the PBoC announces the official exchange rate of the yuan against the dollar and other major currencies. Market fluctuations typically occur within a specified range (e.g., ±2%) around this rate.

By changing this reference rate, the PBoC can indirectly influence the value of the yuan. For example, if the reference rate is set higher, the yuan’s value decreases, boosting China’s exports. This action sends clear signals to both domestic and international investors and often indicates the direction of China’s monetary policy.

Using Foreign Exchange Reserves and Direct Intervention in Supply and Demand

With one of the largest foreign exchange reserves in the world, the PBoC uses these reserves to directly intervene in the currency market. When pressure to either strengthen or weaken the yuan becomes excessive, the PBoC steps in to buy or sell foreign currencies to maintain its desired exchange rate. For instance, in 2015 and 2016, China spent billions of dollars from its reserves to prevent the yuan’s further depreciation.

Capital Flow Controls and Currency Transfer Restrictions

Another effective tool used by the Chinese government is controlling capital flows and placing restrictions on currency transfers. Unlike many free-market economies, China does not allow unrestricted movement of capital in and out of the country. Chinese companies and citizens require approval to transfer funds abroad, and there are specific limits on converting yuan into foreign currencies.

These policies allow the PBoC to maintain better control over the yuan’s value and prevent sudden shocks from capital inflows or outflows. However, such controls can sometimes raise concerns among foreign investors regarding market transparency and freedom.

Impact of China’s Monetary Policies on Asia-Pacific Currencies

The monetary policies of the People’s Bank of China (PBoC) have a significant impact on currencies in the Asia-Pacific region, such as the Australian dollar (AUD) and the Japanese yen (JPY). These effects typically occur through changes in interest rates or liquidity policies. For example, in 2025, China’s monetary policies helped strengthen the Australian dollar against the US dollar. Such interventions directly affect currency pairs like USD/CNH and other regional currencies.

To better analyze the effects of the PBoC’s policies on USD/CNH, the China Economic Health Index published by CFETS can be useful. This index provides insights into China’s economic status and its impact on the yuan’s exchange rate.

Impact of the People’s Bank of China (PBoC) Actions on USD/CNH and Other Major Currencies

The People’s Bank of China (PBoC) has a significant impact on USD/CNH and other major currencies. The monetary policies of this bank can influence the value of the yuan and control its fluctuations. USD/CNH is one of the most important currency pairs in the forex market and is highly sensitive to the decisions made by the PBoC. Changes in exchange rates can create numerous opportunities for traders.

The Relationship Between China’s Interest Rates and USD/CNH Volatility

Interest rates are the primary monetary policy tool used by the People’s Bank of China to manage liquidity and control inflation. A reduction in interest rates typically increases credit availability within the domestic economy and boosts liquidity. This puts downward pressure on the yuan as the return on dollar-denominated assets becomes more attractive relative to yuan-based assets. In such cases, investors tend to move capital into dollar assets, causing USD/CNH to rise.

On the other hand, when the PBoC raises interest rates, the yield on yuan-denominated assets becomes more attractive, boosting capital inflows into China. This strengthens the CNH and leads to a decline in USD/CNH.

Thus, the interest rate differential between China and the US is a key factor in determining the direction of USD/CNH.

The Effect of Chinese Economic Data Releases on the USD/CNH Direction

Chinese economic data serves as an indicator of the health of the country’s economy and the main drivers of the yuan’s value. Indicators such as GDP, the Purchasing Managers’ Index (PMI), trade balance, and Consumer Price Index (CPI) directly influence market expectations about the PBoC’s policies, and, in turn, affect the movement of USD/CNH.

- When stronger-than-expected economic data (e.g., industrial production or exports higher than forecasted) is released, positive sentiment towards the yuan increases, and investors are inclined to buy CNH, causing USD/CNH to decrease.

- Conversely, when weak data or signs of an economic slowdown emerge, concerns over reduced growth and the possibility of expansionary policies by the PBoC tend to increase. In such cases, USD/CNH generally rises.

Therefore, professional traders often track Chinese economic data alongside US reports to gain a broader understanding of the relative strength of the two currencies.

The Role of Market Expectations and PBoC Policy in Determining CNH Value

Price movements in the USD/CNH pair often precede the implementation of monetary policy, as market expectations of future PBoC decisions play a pivotal role in market direction.

Suppose investors expect the PBoC to implement expansionary policies (such as lowering interest rates or injecting liquidity) in the near future. In that case, the pressure to sell the yuan typically increases, driving USD/CNH higher.

Conversely, if the market anticipates the PBoC tightening monetary policy or strengthening the yuan, investors will close their USD/CNH long positions, leading to CNH appreciation.

This behavior demonstrates that forward-looking market sentiment often has a greater impact than current data, and investor sentiment regarding future PBoC policies can shift the direction of the currency pair before an official announcement.

Correlation Between USD/CNH and Gold, Oil, and Copper

China is the world’s largest consumer of commodities. Therefore, the value of the yuan often exhibits an inverse correlation with global commodity prices. An increase in the price of oil, gold, or copper raises China’s import costs, leading to greater demand for US dollars to pay for these imports. This, in turn, puts downward pressure on the yuan and strengthens USD/CNH.

Conversely, when commodity prices fall, China’s trade balance improves, and there is an increase in dollar inflows into the country, which supports the value of the yuan.

Additionally, gold, as a safe-haven asset, tends to gain attention during times of geopolitical risk or increased volatility in USD/CNH. In such situations, gold and USD/CNH typically do not move in tandem—meaning that rising gold prices often correspond with a decrease in USD/CNH.

Overall, tracking the simultaneous movements of commodity prices and USD/CNH can provide deeper insights into China’s economic conditions and global capital flows.

Forex Traders’ Views on the People’s Bank of China (PBoC) Policies

Professional traders often interpret decisions by the People’s Bank of China (PBoC) as signals regarding the direction of China’s economic growth and the global risk appetite. When the PBoC adopts expansionary policies, such as reducing interest rates or injecting liquidity through open market operations, traders view these actions as signs that the government is attempting to stimulate economic growth. In such cases, there is usually an increase in demand for higher-risk assets like the New Zealand dollar (NZD), the Australian dollar (AUD), and Asian equities.

However, when the PBoC adopts contractionary policies or raises interest rates, traders tend to shift toward safe-haven assets like the US dollar or the Japanese yen. This makes the PBoC’s policy direction highly relevant for many international traders, especially in pairs such as USD/CNH, AUD/USD, and NZD/USD.

How Traders Incorporate PBoC Decisions into Fundamental Analysis

Traders closely monitor the decisions of the People’s Bank of China to forecast USD/CNH and other major currency pairs. One of the most important factors in market analysis is the daily fixing rate of the yuan, which is set by the PBoC. For instance, when the PBoC changes the USD/CNH reference rate, this adjustment can trigger significant volatility in the forex market. Traders, by carefully analyzing these changes and combining them with fundamental analysis, can craft optimal trading strategies.

For example, in 2023, when the PBoC reduced the one-year Loan Prime Rate (LPR) by 10 basis points, the market expected a boost to China’s economic growth. As a result, the AUD/USD pair (which is highly sensitive to China’s demand for commodities) increased by more than 1.5% within a few days. Many traders saw this as a signal to go long on AUD, as the interest rate cut implied future growth in demand for raw materials.

Impact of China’s Currency Policies on Carry Trade Strategies and Risk Appetite

China’s currency policies, especially those controlling the yuan’s volatility range, have a significant effect on global capital flows and the attractiveness of carry trade strategies. In carry trading, traders sell low-interest rate currencies and buy high-interest rate currencies to profit from interest rate differentials.

When the PBoC implements policies that stabilize or strengthen the yuan, the market interprets this action as a sign of confidence in China’s economy. In such cases, investors are more likely to enter carry trades and buy riskier currencies such as the Australian dollar (AUD), New Zealand dollar (NZD), or even currencies from emerging markets.

However, when the PBoC weakens the yuan or intervenes in ways that suggest concerns about economic growth, risk aversion rises, and capital flows shift from emerging markets to safe-haven assets like the US dollar or Japanese yen.

Practical Example:

In August 2015, when the PBoC unexpectedly devalued the yuan, it triggered a wave of global risk aversion. As a result, the AUD/JPY pair, one of the most well-known carry trade pairs, dropped by over 500 pips in just a few days. This event showed how even minor changes in China’s currency policy can directly influence traders’ risk appetite.

Changes in the Shanghai Interbank Offered Rate (SHIBOR) are one of the early signals of the People's Bank of China's monetary policy direction, and many professional traders closely monitor it to predict the movement of USD/CNH.

Conclusion

The policies of the People’s Bank of China (PBoC) have a significant impact on USD/CNH and other currency pairs. The distinction between CNY and CNH is especially important for currency controls and for how these currencies are traded both inside and outside China. By monitoring PBoC policies, such as the daily reference rate of the yuan and interest rate changes, traders can forecast how these actions will affect the forex market.

Looking ahead, particularly with the ongoing internationalization of the RMB, this trend could have an even greater impact on the volatility of CNY and CNH. Therefore, it is recommended that traders consistently monitor the PBoC’s decisions to update their trading strategies and capitalize on market opportunities.