In financial market trading, understanding price direction can significantly impact your overall trading success. Two key concepts, BOS and CHOCH, act as a roadmap for judging trend continuation or potential market reversal. The BOS versus CHOCH distinction is a core technical analysis topic that helps traders make more informed decisions.

This article explains both concepts simply and shows how they help identify high-probability entry and exit points. Follow along to gain a clearer, deeper understanding of how BOS and CHOCH guide market structure analysis.

- Break of Structure and Change of Character reveal shifts in market control and help anticipate where price is likely headed next.

- BOS and CHOCH reflect actual behaviour of buyers and sellers at critical price zones rather than being just abstract chart patterns.

- A valid interpretation of BOS and CHOCH should be supported by other factors like volume activity, liquidity zones and context from higher timeframes.

- Always confirm BOS and CHOCH signals on higher timeframes such as four‑hour or daily charts to filter out false signals that appear on lower timeframes.

What is BOS in Trading and What Does It Mean?

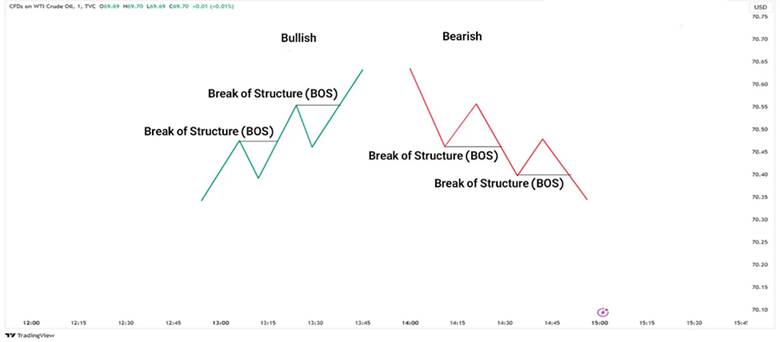

In Market Structure Trading, traders focus on identifying key points where the strength of buyers or sellers becomes evident. One of the primary signals in this analysis is the breakout of key levels, such as previous highs or lows, which is known as a Break of Structure (BOS). This concept is essential in techniques like Smart Money Concepts (SMC) because analyzing broken levels allows traders to assess the potential for trend continuation with greater confidence.

In many Price Action strategies, when the market breaks a significant structural area, such as a key high or low, in the opposite direction of the previous trend, it indicates a change in market structure. This occurrence, referred to as BOS, signals the start of a new phase in the market, whether it’s a trend reversal or a deeper correction. Traders use BOS as a key signal to evaluate the strength or weakness of the prevailing trend, helping them determine strategic entry or exit points.

When considering BOS vs CHOCH, it’s important to note that these breakouts hold more weight when they align with liquidity zones from previous levels. A confirmation candle should close in the direction of and beyond these liquidity areas. This integration ensures that the Break of Structure (BOS) is valid, rather than a mere line on a chart. By interpreting BOS within the broader context of market psychology and hidden liquidity, traders gain a clearer understanding of the dominant trend, allowing for more confident trading decisions.

BOS is not only a trend continuation signal but also serves as a tool for identifying liquidity accumulation zones, where major market players target the stop losses of smaller traders by breaking key levels.

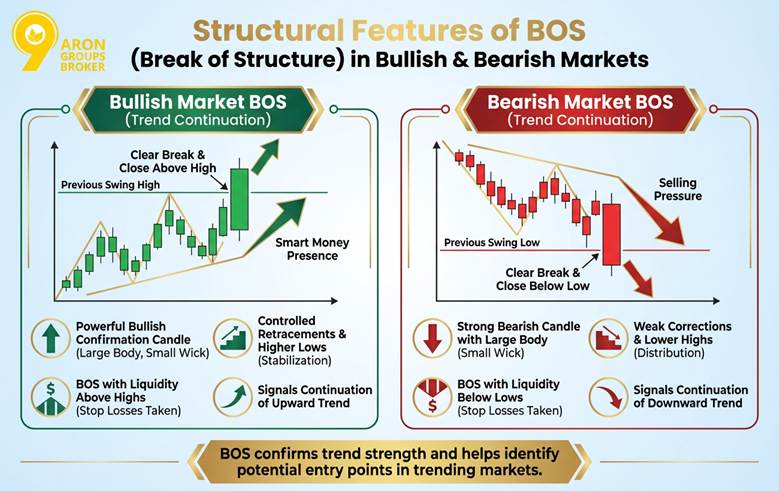

Structural Features of BOS in Bullish and Bearish Markets

In trending markets, one of the most important tools for analysis is the careful study of Break of Structure (BOS), which helps determine the strength of price movements in both bullish and bearish trends. Let’s explore the signs of BOS occurrence in both bullish and bearish markets.

Structural Features of BOS in a Bullish Market

- Clear Break of Previous High: In a bullish market, BOS occurs when the price breaks a previous Swing High with strength and closes above it. This breakout signals a continuation of the upward trend and the presence of strong buyers (Smart Money) in the market.

- Powerful Bullish Confirmation Candle: The candle that breaks the structure usually has a large body with a small upper shadow or no shadow at all, and closes above the liquidity zone, indicating complete dominance by buyers.

- Controlled Retracements and Higher Lows: Before BOS, the market typically undergoes a corrective phase, forming a Higher Low structure, followed by the BOS. This structure indicates trend continuation and the stabilization of the accumulation phase.

- BOS Combined with Liquidity Above Highs: A BOS is only valid when it breaks above areas of accumulated liquidity (such as highs where other traders’ stop losses are hidden).

Structural Features of BOS in a Bearish Market

- Clear Break of Previous Low: In a bearish market, BOS occurs when the price breaks previous Swing Lows. This breakout signals continued selling pressure and the market’s tendency to push prices lower.

- Strong Bearish Candle with Large Body: The BOS candle should close below the liquidity zone of the lows. A large body with little to no lower shadow indicates the strength of the sellers.

- Weak Corrections and Lower Highs: Before BOS, the market usually forms a brief corrective phase with a Lower High structure. This structure represents a distribution phase and reflects the inability of buyers to reverse the trend.

- BOS Combined with Liquidity Below Lows: Breakouts that occur with hidden liquidity below the previous lows (stop losses of buyers) usually lead to strong downward moves and confirm the continuation of the trend.

One important point to keep in mind is that to identify the correct trend, it’s essential to look at multiple time frames. BOS on larger time frames, such as the daily chart, is generally more reliable. Additionally, volume plays a significant role. If the breakout occurs with strong candles and high volume, it’s likely to be valid. However, if the volume is low, it could be a trap.

What is CHOCH and How Does It Differ from BOS?

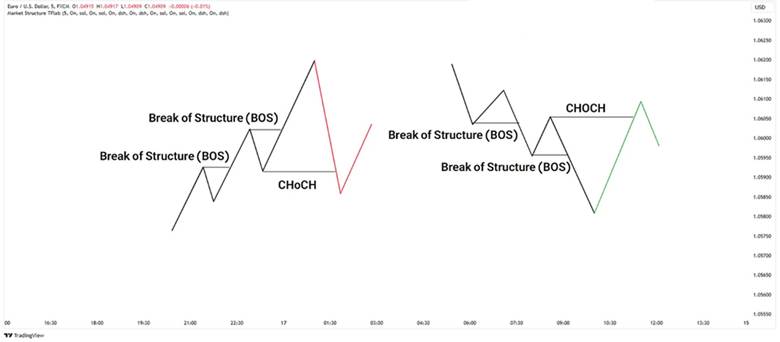

In Market Structure Trading, when a trend is established, such as prices consistently making new highs or lower lows, traders often look for signs that confirm the continuation of the trend. However, sometimes the price begins to move in the opposite direction and breaks one of the key previous levels in the opposite direction. This is where the question “What is Change of Character (CHOCH) in trading?” becomes significant.

The term Change of Character (CHOCH) refers to a shift in the market’s price structure. For instance, in a bullish trend, if the price breaks a previous low instead of creating a higher high, it serves as a warning sign. This can be the first indication that the market may be reversing. At this point, it is essential to differentiate CHOCH from a Break of Structure (BOS).

To put it simply, the main difference between BOS vs CHOCH lies in the direction of the breakout and the phase of the trend when they occur. BOS confirms that the current trend is continuing, while CHOCH indicates that the trend may be reversing.

Traders typically adjust their strategy when they observe CHOCH signals. For example, if they were buying, they would reassess whether it is time to exit or even consider selling. To make the most of these signals, having a specific CHOCH strategy is crucial. These strategies often integrate tools like Smart Money Concepts (SMC), Order Blocks, or confirmation candles to help identify reversal points more accurately.

CHOCH often signals a sudden shift in market sentiment, triggered by events like economic news or central bank decisions, and requires attention to fundamentals. Recognizing CHOCH in these moments can help traders anticipate potential trend reversals.

When Do We See BOS Without CHOCH?

In trading, there are times when a Break of Structure (BOS) occurs in Smart Money Concepts (SMC), but the market doesn’t reverse, and CHOCH does not happen. This often occurs in strong trends, where the price breaks a key high or low but continues in the previous direction. For example, in an uptrend, when the price breaks above the previous high (Higher High), a bullish BOS forms. However, if the Higher Lows are maintained, CHOCH does not occur because the market remains bullish.

Part of this phenomenon is related to Smart Money breaks, where institutional markets may use strategies like stop hunts to break the structure, but the price quickly returns to its original path. Such a break might be a false signal unless confirmed by high volume or a confirmation candle.

To avoid mistakes, traders must recognize stop hunts and false breakouts, and instead of reacting impulsively, confirm the structure across multiple time frames. A break alone isn’t enough; it’s essential to determine whether the market is truly changing direction (i.e., forming CHOCH) or if it’s just a regular BOS in the prevailing trend.

The Role of BOS and CHOCH in Trade Entry and Risk Management

When you’re trading in the market, knowing where to enter and how to manage risk is crucial. Break of Structure (BOS) helps you trade in the direction of the market trend. For example, in a bullish trend, when the price moves above the previous high, a BOS occurs, signaling that the market remains strong. In this case, you can enter a buy trade and place your Stop Loss below the most recent low to reduce risk.

But what’s the difference between BOS vs CHOCH? CHOCH occurs when the market intends to reverse its direction. For example, in an uptrend, if the price makes a lower low instead of a higher high, this indicates that a bearish trend might have started. Here, you can use Order Blocks, which are key institutional order zones, to find more precise entry points and enter a reversal trade.

For risk management, always set your Stop Loss near key levels, such as Order Blocks. Additionally, using a risk-to-reward ratio, such as 1:2, ensures that potential gains are greater than potential losses. Combining BOS and CHOCH with volume analysis and strong candles will help you make more confident trades.

Common Mistakes Traders Make in Identifying BOS and CHOCH

Traders sometimes mistake BOS for the first structure break and enter the market before full confirmation. This phenomenon is often the result of failing to identify false breakouts. Those who enter positions without checking volume or confirmation candles might end up trading on a fake BOS signal and subsequently exit the market. One of the most common mistakes is not waiting for the candle to close outside of the previous structure.

In other cases, traders focus solely on price and overlook technical confirmations, such as volume or reactions in higher time frames. Without sufficient volume or a check of higher time frames, a Break of Structure (BOS) may deceive traders into thinking the market is about to reverse or, conversely, continue in the wrong direction.

Another mistake is failing to recognize the difference between the signals. If the difference between BOS vs CHOCH isn’t properly understood, traders may confuse a trend continuation signal with a reversal and take positions in the wrong direction.

To better practice and reduce these mistakes, using a demo account is highly recommended. Regular practice with BOS and CHOCH signals in different market conditions will help you gain more experience and understand when a logical entry is appropriate. Resources like TradingFinder offer tools and guides that are useful for practicing and improving your market structure analysis skills.

One hidden mistake is overlooking the impact of spread in low liquidity markets, which can amplify fake BOS or CHOCH breakouts, especially in minor currency pairs.

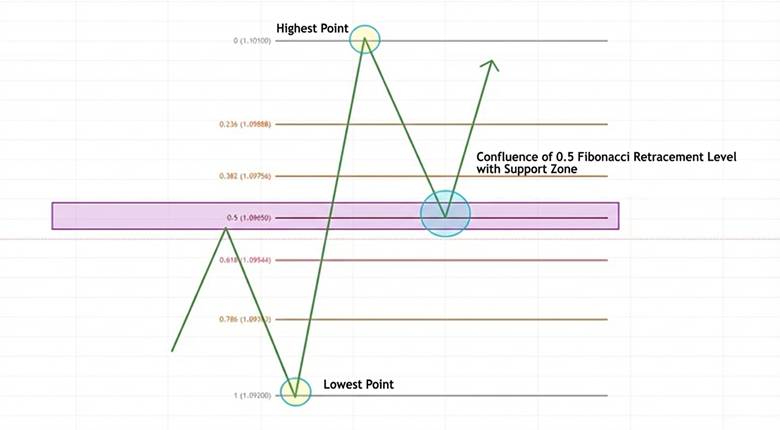

Best Technical Tools for Confirming BOS and CHOCH Structure

To confirm Break of Structure (BOS) in Smart Money Concepts (SMC), using complementary technical tools can enhance the accuracy of your analysis. Support and resistance levels are among the most important tools, as BOS often occurs at these zones, while CHOCH can indicate a shift in the role of these levels. Fibonacci Retracement is also highly useful. The 38.2%, 50%, and 61.8% levels can identify potential price reversal points that align with BOS or CHOCH.

Volume indicators, like Volume Profile, play a key role in confirming signals. High volume during a BOS indicates the strength of the breakout, while in CHOCH, it signals a potential trend change. Momentum indicators like RSI and MACD are also beneficial. For example, if RSI enters overbought or oversold territory during CHOCH, it strengthens the likelihood of a trend reversal.

The MACD indicator can also provide confirmation for BOS or CHOCH with its line crossovers. Smart Money Concepts (SMC) indicators, such as those available on the TradingView platform, automatically identify BOS, CHOCH, and Order Blocks, making analysis simpler. Combining these tools, such as checking Fibonacci alongside volume and confirmation candles, helps traders differentiate between valid and false signals, leading to better decision-making.

How to Filter Fake BOS and CHOCH Using Market Structure Knowledge

To avoid falling into the trap of false signals, it’s essential to accurately understand the difference between BOS and CHOCH and use confirming tools. One of the best methods is to analyze trading volume; a valid BOS or CHOCH is typically accompanied by high volume and strong candles (such as Engulfing Candles or Pin Bars), while fake breakouts often occur with low volume.

Multi-timeframe analysis also plays an important role. A BOS on a lower time frame may just be noise on higher time frames, so checking higher time frames (such as the 4-hour or daily charts) confirms stronger signals. Identifying liquidity zones, such as levels where stop losses accumulate, also helps in spotting market traps.

For example, if the price breaks a high but quickly reverses with low volume, it’s likely a fake breakout. Combining these tools, such as using Volume Profile indicators and confirmation candles along with multi-timeframe analysis, helps you separate valid signals from fake ones and make more accurate trades.

Conclusion

Understanding market structure and accurately identifying points of trend reversal or continuation is one of the key skills of any successful trader. Concepts like BOS and CHOCH are valuable tools for analyzing price movement and making better trading decisions. When a trader can distinguish between BOS vs CHOCH in different market conditions, they can enter or exit trades with more confidence.

Using complementary tools, such as volume analysis, confirmation candles, and higher time frames, helps provide more accurate signals. Additionally, considering the concept of Break of Structure (BOS) in Smart Money Concepts (SMC) ensures that traders are not misled by artificial or false market movements.