Market conditions can shift dramatically following the release of major economic news or an unexpected market shock. During these times, quickly closing your positions (both long and short) is no longer a choice but a necessity for capital preservation.

Attempting to close multiple trades manually one by one is not only time-consuming but also significantly increases the risk of forfeiting profits or incurring greater losses. These risks are why traders use a powerful tool known as a Close All Trades Expert Advisor (EA).

In this article, we will explain why this tool is essential and how you can use it to close all trades in MetaTrader 4 & 5 simultaneously with a single click, thereby elevating your trade management strategy.

- For EAs set to trigger based on overall account profit or loss, using a Virtual Private Server (VPS) ensures the expert advisor remains operational even when your local computer is turned off.

- Before major news events, verify that your EA includes an option to cancel all pending orders (such as Buy Stops and Sell Limits) to prevent unintended execution in volatile conditions.

- Advanced EAs may offer a partial close feature, allowing you to close a specific percentage (e.g., 50%) of all open trades. This partial close feature will enable you to mitigate risk while maintaining some market exposure.

What is a Close All Trades Expert Advisor and Why is it Essential?

A Close All Trades Expert Advisor is a small software script installed on the MetaTrader platform. Its primary function is to execute a command to close all open trades with a single click. Instead of the slow and laborious manual process of closing each position individually, this tool offers traders both speed and precision. However, the true power of this tool lies in the versatile options it provides for enhanced trade management:- Instantly Close All Trades: All open positions (both long and short) are closed immediately.

- Close Profitable Trades Only: You can configure the EA to close only the trades that are currently in profit, allowing you to lock in gains.

- Close Losing Trades Only: As a risk management strategy, you can close only the trades that are in a loss to prevent further drawdowns.

- Close by Specific Symbol: If you are trading multiple tools, you can set the EA to close only the trades associated with a specific symbol (e.g., EUR/USD).

- During Major News Events: Before high-impact news releases, such as the Non-Farm Payroll (NFP) report or interest rate decisions, the market becomes highly unpredictable. Quickly closing all positions is a prudent measure to protect your capital from extreme volatility.

- In Response to Sudden Volatility: A sharp, unexpected market move can invalidate your entire trade setup. This EA allows you to exit the market and reassess instantly.

- Reaching Daily Targets: Once you have reached your daily profit target or maximum loss limit, you can close all trades with a single click, allowing you to step away from the market with your goals met.

The Challenges of Manual Trade Execution

Imagine you have 10 open positions across various instruments, and the market is rushing against you. To close them manually, you must click on each trade individually and confirm the close order. Repeating this process, even for an experienced trader, can take a significant amount of time. In this brief period, you face several critical problems:- Time Lag and Latency: The market doesn’t wait. In just those few seconds, the price can move by dozens of pips, potentially multiplying your losses.

- Slippage and Requotes: In volatile markets, the price you click to close at will often differ from the actual execution price. This discrepancy, managed by the broker, can either erode your profits or increase your losses.

- Human Error Under Pressure: Under stressful conditions, the probability of forgetting a trade, closing the wrong position, or making a poor decision increases significantly.

MT4 vs. MT5: Which Platform Is Better for Bulk Trade Management?

A key difference between these two popular platforms lies in their capabilities for bulk trade management, and understanding this will help you choose the right tool for your needs.

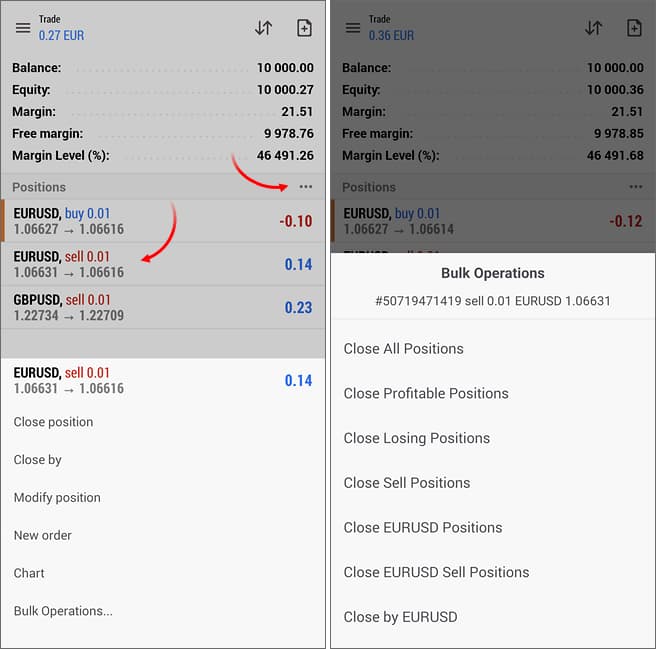

MetaTrader 5 (MT5): Built-in but Limited Functionality

The newer version, MetaTrader 5, includes a native feature called “Bulk Operations” for managing trades in groups. Within the “Trade” tab, a right-click will reveal options such as “Close All Positions,” “Close Profitable Positions,” or “Close Losing Positions.”

However, this native tool lacks more advanced filtering options, such as closing trades based on a specific symbol or by trade type (e.g., closing only long or only short positions).

MetaTrader 4 (MT4): An Expert Advisor is Required

In contrast, MetaTrader 4 has no native functionality for closing trades simultaneously. Therefore, using a “Close All Trades” Expert Advisor is not an option but a necessity for users of this platform.

Even for MT5 users, a dedicated EA provides far greater control. It typically offers a graphical interface directly on the chart, which significantly speeds up execution compared to right-clicking through menus.

Best Practices for Safely Closing Positions with an EA

Using this powerful tool requires adhering to several key guidelines to prevent errors and unintentional losses:

Always Test on a Demo Account First

This is the most important rule. Before deploying an EA on a live account, run it on a demo account to become thoroughly familiar with its speed, settings, and behavior under various market conditions. Nearly all top forex brokers offer free demo accounts, providing the ideal environment for testing.

Download from Reputable Sources

Only download EAs from well-known sources, such as the official MQL5 Marketplace or reputable forex forums, to ensure your account’s security and the tool’s proper functionality.

Carefully Review the EA’s Settings

Before activation, check the “Inputs” tab in the settings. Verify that the EA is configured to perform the exact action you intend, such as closing only profitable trades or canceling pending orders.

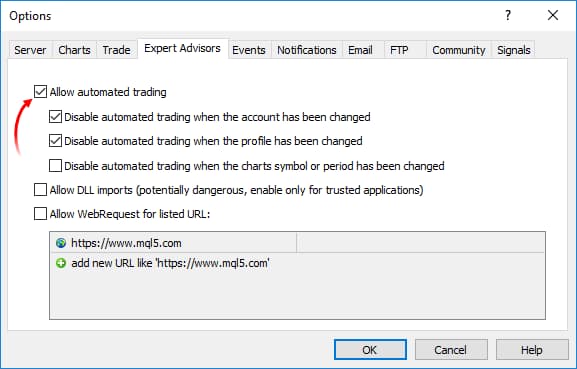

Enable AutoTrading (Especially for MetaTrader 4)

For an EA to function in MT4, you must navigate to Tools > Options > Expert Advisors and check the “Allow automated trading” box. You must also ensure the “AutoTrading” button in the main toolbar is enabled (displayed in green).

Avoid Conflicts with Other Expert Advisors

If you are running other automated trading strategies (EAs), ensure their operations do not conflict with the “Close All Trades” EA. This will prevent contradictory orders and potential execution errors.How to Download and Install a Close All Trades EA for MetaTrader 4 & 5

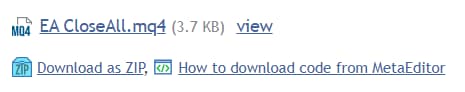

- Go to the MQL5.com marketplace and download the appropriate EA file. For MetaTrader 4, the file will have a .mq4 or .ex4 extension. For MetaTrader 5, look for .mq5 or .ex5 files.

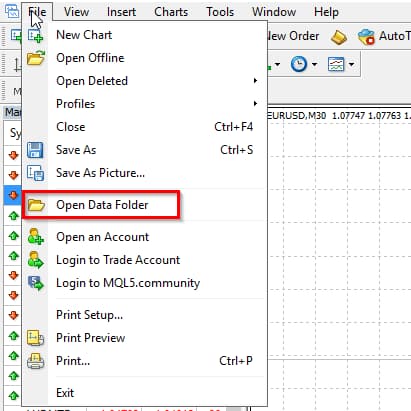

- Open your MetaTrader 4 or 5 platform. From the main menu, navigate to File > Open Data Folder.

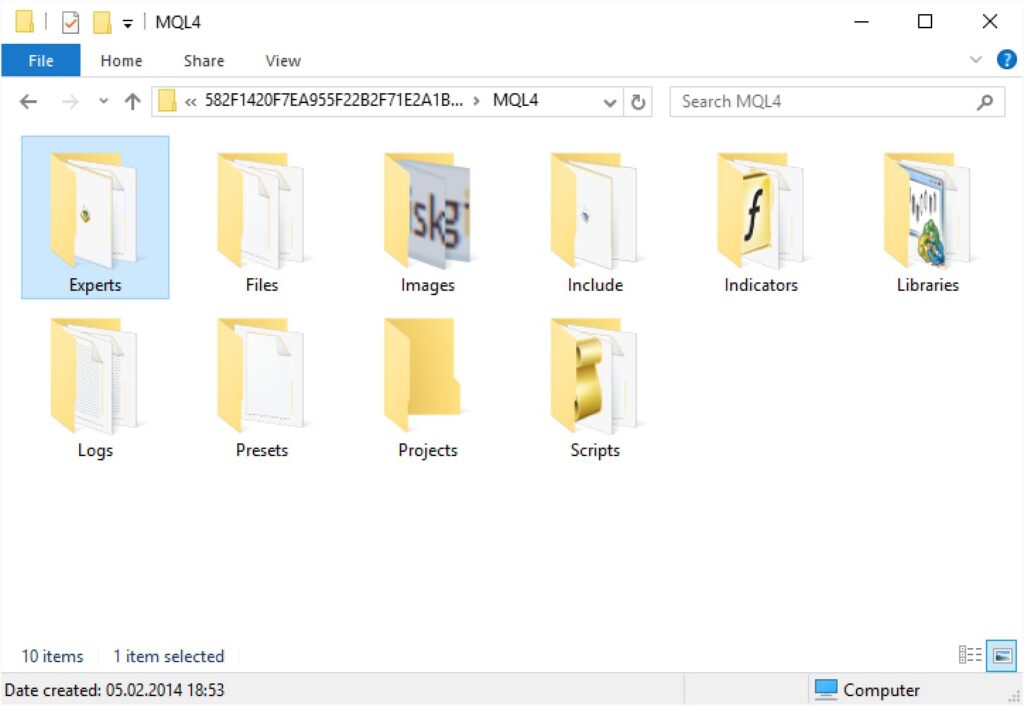

- In the folder that opens, navigate to the appropriate directory:

- For MT4: MQL4 > Experts

- For MT5: MQL5 > Experts

- Paste the downloaded EA file (.ex4 or .ex5) into this folder.

- Restart the MetaTrader platform. Alternatively, you can right-click on the “Expert Advisors” section in the Navigator panel and select “Refresh.” Your new EA will then appear in the list.

Configuring and Using a Close All Trades EA in MetaTrader 4 & 5

Once the EA has been installed according to the previous guide, the next step is to attach it to a chart and configure its parameters.

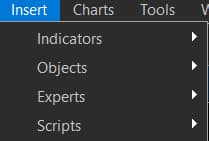

Step 1: Attach the EA to a Chart. Locate your Expert Advisor in the Navigator panel. Click and drag the EA onto any open chart of your choice.

Step 2: Enable Automated Trading. When the EA’s properties window appears, navigate to the “Common” tab. Ensure that the checkbox for “Allow automated trading” (or “Allow live trading”) is enabled. Without this permission, the EA cannot execute any trade functions.

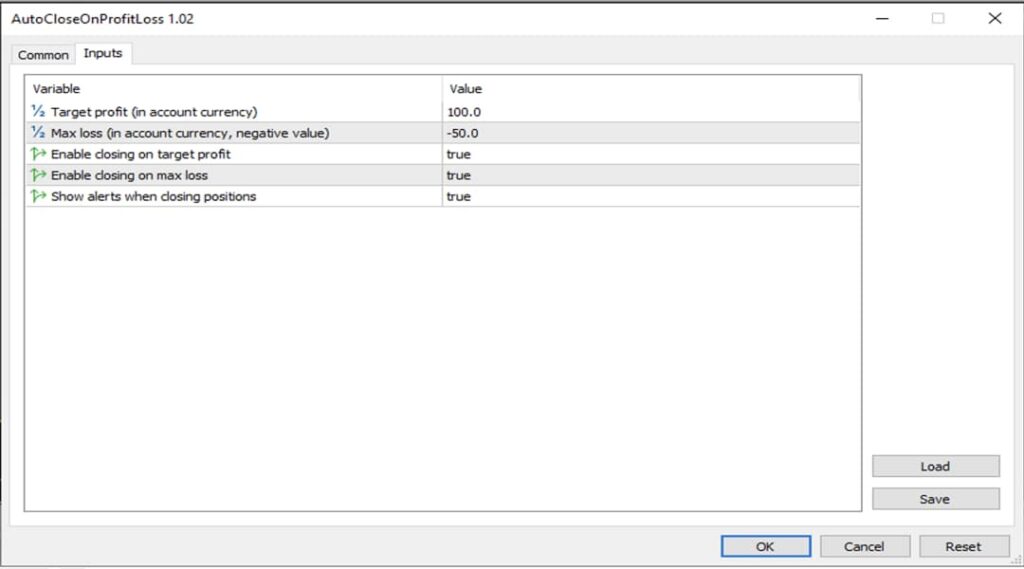

Step 3: Configure the Input Parameters. The most critical section is the “Inputs” tab, where you will define the EA’s operational behavior. For instance, in the example image below, the parameters are defined as follows:

- Target profit: This is the aggregate profit level across all open positions. If the total floating profit reaches this value (e.g., $100 in this example), the EA will automatically close all trades.

- Max loss: This sets the aggregate loss limit for all open positions. If the total floating loss reaches this threshold (e.g., -$50), the EA will close all trades to prevent further drawdown. (Note: This value must be entered as a negative number).

- Enable closing on target profit/loss: By setting these options to true, you authorize the EA to execute the close commands once the specified profit or loss levels are met.

- Show alerts: If set to true, the platform will display a pop-up notification after the EA has closed the positions.

Step 4: Confirm and Run. After configuring your desired values, click the “OK” button. The EA will be activated immediately and will continuously monitor your account’s total floating P/L (Profit and Loss). As soon as one of your predefined conditions is met, the EA will execute the command to close all open positions.

Unlike a script (which runs only once), an Expert Advisor runs continuously until it is manually removed from the chart. Remember to always test any EA on a demo account before deploying it on a live account.

Best Practices for Rapid Position Closing in MetaTrader (With Scenarios)

The optimal method for quickly closing trades depends on your platform (MT4 or MT5) and the specific market scenario. Below are a few practical examples:

Scenario 1: Risk Management Ahead of Major News Events

This is the most common and critical use case for a trade closing EA.

- Situation: Imagine you have multiple open trades across different currency pairs, and a high-impact economic news release is scheduled in a few minutes, which is likely to cause significant volatility.

- Incorrect Method (Manual): Attempting to close trades one-by-one is time-consuming and exposes you to the risk of slippage, leading to profit erosion or magnified losses.

- Correct Method (with EA): Using the EA’s on-chart panel, you click the “Close All Trades” button. In under a second, all your trades are closed at the current market price, protecting your account from the unpredictable risk of the news event.

Scenario 2: Securing Profits by Closing Profitable Trades

This is an intelligent approach to profit management.

- Situation: Imagine the total floating profit from your open trades has reached your daily target (e.g., $200).

- Method: Instead of closing all trades (as some may still have upside potential), you can use the “Close Profitable Trades” option in your EA. This allows you to instantly lock in your gains while leaving any losing trades open for further management or until they hit their stop-loss.

Scenario 3: Using the Fast, Native Functionality of MetaTrader 5

If you are an MT5 user and do not require the advanced filtering options of an EA, this is the fastest method.

- Situation: You have eight open positions across four different symbols and need to close all of them instantly.

- Method: On the MT5 desktop or mobile platform, simply right-click within the “Trade” tab (or open the context menu) and select your desired option from the “Bulk Operations” menu, such as “Close All Positions.”

Conclusion

Ultimately, when the market moves faster than you can react, a “Close All Trades” Expert Advisor becomes an indispensable tool for every trader, from novice to professional. By providing unparalleled speed, precision, and control, this tool helps you secure profits and prevent substantial losses during critical market conditions.

As we have discussed, simultaneously closing trades in MetaTrader 4 is only possible with an EA, making it a necessity for users of that platform. While MetaTrader 5 has native functionality, its users can still benefit from the advanced features and convenience of a dedicated Expert Advisor.

To master the process of rapid position closing in MetaTrader, we recommend downloading a reputable EA and testing it thoroughly on a demo account. Incorporating this tool is a vital component of a robust risk management strategy.