If you are on the path to becoming a professional market analyst, you have probably heard about the CMT designation and the process for obtaining it. This is a recognised, specialised credential that gives you a deep understanding of the tools, structures, and strategies of technical analysis. The program not only tests mastery of chart-based concepts, but also evaluates your ability to analyse market behaviour, assess risk, and build decision-making models.

If you are not sure what the CMT exam is or how this path differs from the CFTe designation, this comprehensive guide is for you. In the following sections, we will walk through the steps, resources, costs, and benefits of the program to help you make a more informed decision about your career future.

- The CMT designation connects you to a network of more than 4,500 financial professionals in 135 countries, expanding your opportunities for collaboration and career growth.

- CMT is the only technical analysis designation that grants a regulatory exemption from the U.S. Series 86 exam.

- Unlike CMT, the CFTe designation is recognised primarily by European and Asian institutions rather than Wall Street.

- The CMT exams are administered worldwide through Prometric testing centres, allowing candidates to choose convenient locations and exam dates.

What Is the CMT Designation and Why Does It Matter?

The CMT designation is a professional certification that takes financial analysts to a higher level in technical analysis. It is awarded by the CMT Association (formerly the Market Technicians Association) and signals mastery of charting tools, indicators, and market behaviour. Professionals such as traders, analysts, and portfolio managers use the CMT charter to demonstrate that they can interpret market trends and support investment decisions. This credential is recognised in more than 135 countries and helps its holders stand out in key roles across the financial industry.Key Benefits of the CMT Designation

- Proves advanced technical skills A Chartered Market Technician has passed three levels of rigorous exams and shown strong ability in chart analysis, market structure, and risk management.

- Builds professional credibility The designation reassures employers, clients, and colleagues that you work according to recognised professional and ethical standards.

- Differentiates you in the job market In competitive roles such as trading, research, and portfolio management, a respected certification can be a clear differentiator.

- Connects you to a global network The CMT Association, active since 1973, has built an international community of market professionals, providing education, events, and ongoing resources.

Key Insight:

The official statement of the CMT Association describes this credential as “a global benchmark for technical analysis professionals,” noting that it upholds high standards in education, financial conduct, and market research.

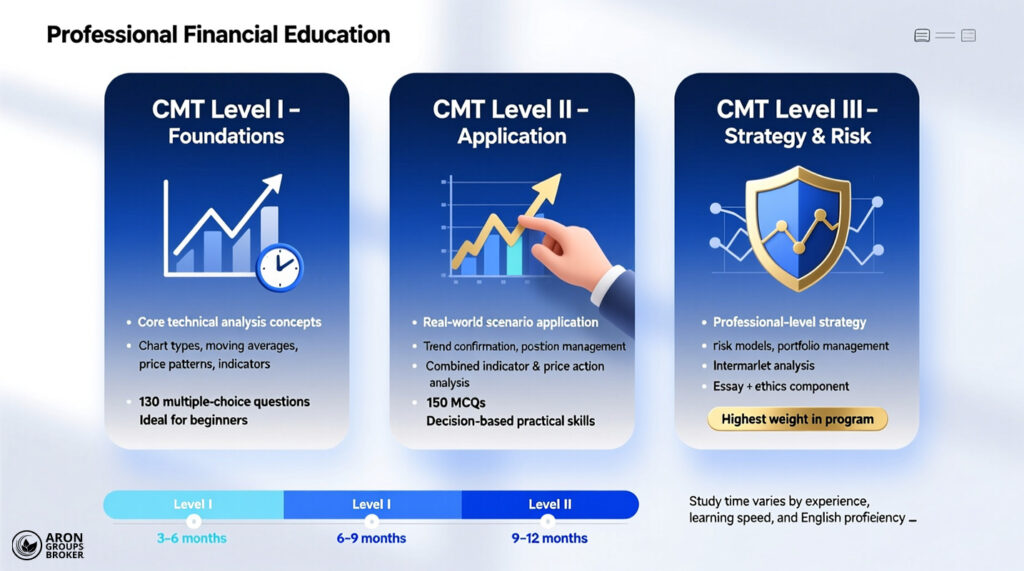

The Different Levels of the CMT Exam and What Each One Covers

If you are unsure what the CMT designation is or how it enhances market analysis skills, it is helpful to know it requires three exams. These exams are designed to evaluate a core dimension of professional market analysis, from understanding basic concepts to risk management and building real-world strategies. The structure of this path fully covers the needs of a market analyst.

In practice, taking the CMT exams is not just about memorising material. It helps you become a better analyst, understand price behaviour more deeply, and make more accurate decisions in real market conditions. Below is a brief overview of what each level includes so you can get a clear picture of the journey.

CMT Level I: Foundations of Technical Analysis

At Level I, the main focus is on basic concepts and the fundamental structure of market analysis. You are introduced to essentials such as:

- Chart types and chart construction;

- Moving averages;

- Price patterns;

- Common technical indicators.

This level is particularly suitable for those who have little market experience and have only recently become familiar with the CMT designation.

The exam format is multiple choice and typically includes around 130 questions. The goal at this stage is to assess the candidate’s initial understanding of simpler tools and their ability to use them in basic analysis. For this level, books such as Technical Analysis of the Financial Markets by John Murphy are considered standard references.

CMT Level II: Applying Technical Tools in Decision-Making

At Level II, things become more serious. Unlike Level I, which focuses more on recognition and understanding, in this level, you must be able to apply different tools in real market conditions. The exam includes around 150 multiple-choice questions, and the questions are more complex.

At this stage, candidates work with topics such as:

- Trend confirmation;

- Position management;

- Market behaviour analysis;

- Combined use of indicators.

More advanced concepts, such as price action, are also analysed in greater depth, and you must be able to identify these patterns on charts and make decisions based on them. This stage moves you closer to the role of a senior market technician, and a strong command of market structure is essential for success.

CMT Level III: Risk Management and Professional Strategies

At Level III, the exam focuses on qualitative analysis, professional decision-making, and capital management. Unlike the first two levels, here you also face constructed-response (essay-style) questions, in which you must provide a structured analysis, present your reasoning, and explain your designed strategy.

This level carries the greatest weight in the overall CMT process and tests your ability to:

- Design risk models;

- Manage portfolios;

- Understand market correlations;

- Conduct intermarket analysis.

In addition, part of the exam covers professional ethics. If you successfully pass this stage, you officially join the community of holders of this globally recognised credential.

How Much Time Do You Need to Prepare for Each Level?

Time planning is crucial for success across all three levels. On average:

- Level I: about 3 to 6 months of study

- Level II: about 6 to 9 months

- Level III: about 9 to 12 months

Of course, these time frames depend on factors such as your prior experience, learning speed, and level of English proficiency.

From the outset, it’s better to structure your study plan around official sources and use practice questions to strengthen your knowledge in a targeted way. If your goal is to pass the CMT exams and enter the world of professional market analysis, this preparation time is a necessary investment.

Reference Box:

According to Investopedia: “The CMT designation is the most widely recognized and respected global credential for technical analysts.”

CMT Exam Registration Requirements and Fees

When working toward the CMT designation, it’s important first to understand what is required to register for the exams. This section acts as an introduction to the next subsections and gives you an overview of prerequisites, registration steps, fees, and the 2025 exam schedule.

Prerequisites for Taking the CMT Exam

For the Level I exam, there is no formal requirement for a university degree or prior professional experience. Even beginners can enter the learning pathway.

However:

- Having relevant work experience or a bachelor’s degree can increase your chances of success in the CMT exams.

- It also makes the transition into more professional roles easier once you progress through the programme.

- After passing all three levels, you must provide at least three years of relevant professional experience for the charter to be formally awarded.

Q: Can beginners with no prior market experience attempt the CMT exams?

A: Yes. Level I does not require a degree or prior work experience. Beginners can start studying foundational concepts and chart analysis. Prior experience helps, but it is not mandatory.

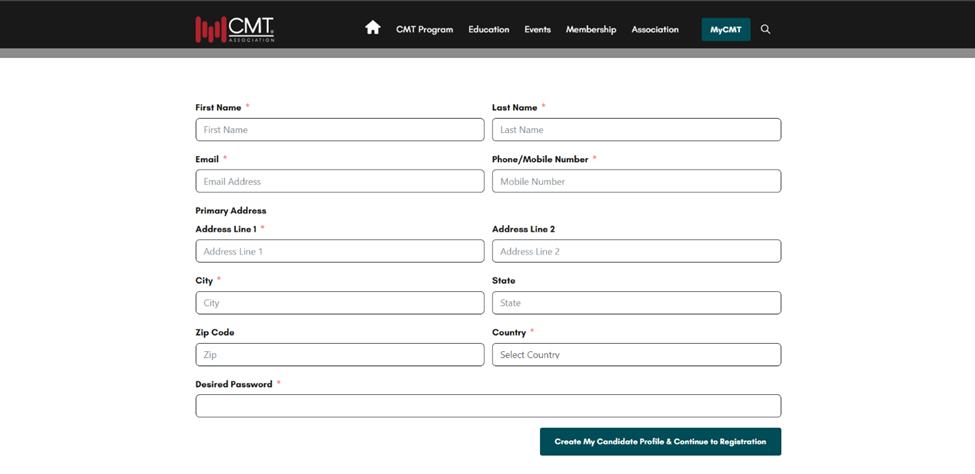

Registration Process via the CMT Association Website

To sit for the CMT exams, you must first create a MyCMT account on the CMT Association website (cmtassociation.org). After that, you follow the exam registration process:

- Choose the exam level (Level I, II, or III).

- Pay the exam fee online.

- Schedule your exam date and location through Prometric.

You can choose between in-person or online (remote) testing options, depending on availability.

CMT Exam Fees by Level (in USD)

CMT exam fees depend on your CMT Association membership status and the registration window (early, standard, or late). The table below shows the fees for 2025:

| Exam Level | Early Registration | Standard Registration | Late Registration |

|---|---|---|---|

| Level I | $875 | $1,075 | $1,475 |

| Level II | $875 | $1,075 | $1,475 |

| Level III | $875 | $1,075 | $1,475 |

In addition:

- There is a one-time CMT program enrollment fee of $250.

- An optional annual membership in the CMT Association is around $325.

For non-members who plan to take all three levels, the minimum total cost with early registration, excluding study materials, language support, or translation costs, is approximately $2,700.

Pro Tip:

Early registration for the CMT exams can save you up to $600 in total costs, especially if you plan ahead for all three levels.

CMT Exam Schedule for 2025

The CMT exams are held twice a year: in June and December.

According to official information:

- Level I and Level II

- 10-26 June 2025;

- 1-16 December 2025.

- Level III

- 12 June 2025,

- 4 December 2025.

You can select your exam centre through the Prometric system from locations around the world. To secure your preferred time and location, it is recommended to register for the CMT exam at least three months in advance.

How Does the CMT Differ from the CFTe, and Which Is More Suitable?

For many people interested in market analysis, a common question is: What is the difference between CMT and CFTe, and which path is right for me?

Both credentials focus on technical analysis, but they differ in structure, content emphasis, and career applications.

Candidates who want to move into advanced portfolio and risk management typically gravitate towards the CMT designation. The CMT programme has three levels and, beyond core technical concepts, covers behavioural finance, trading strategies, and capital management.

By contrast, the two-level CFTe (Certified Financial Technician) places more emphasis on foundational concepts and chart reading. It is better suited to those who are mainly interested in candlestick patterns, trend analysis, and classical chart techniques.

Key Differences Between CMT and CFTe

- Number of levels and depth of content

- CMT: Three levels, going from basics to advanced topics such as risk management, behavioural finance, and strategy design.

- CFTe: Two levels, with a stronger focus on core chart-reading skills and pattern recognition.

- Content focus

- CMT: Broader coverage of markets, portfolio management, risk models, and trading system design.

- CFTe: More concentrated on price patterns, trends, and visual chart analysis.

- Professional positioning and recognition

- Both CMT and CFTe are recognised worldwide, but CMT often holds greater professional weight at major financial institutions. It is particularly valued for those seeking senior technical analyst or market technician roles internationally.

For many professionals, the CMT is seen as a global standard in technical analysis, with a strong emphasis on advanced risk management and strategy design.

If you want a credential focusing specifically on chart patterns and precise reading, the CFTe may be a better choice. It is particularly suitable for those seeking a shorter, more focused pathway in technical analysis.

Ultimately, the choice between these two routes depends on your career goals:

- If you want to be recognised as a professional analyst with a focus on capital and risk management, the CMT is the stronger option.

- If your priority is to build a solid foundation in chart patterns and price analysis, the CFTe can be more suitable.

Q: How does the CMT designation differ from CFTe in terms of career opportunities?

A: CMT covers advanced risk management, strategy design, and behavioural finance, making it more suitable for senior analyst or portfolio management roles. CFTe focuses on charting and pattern recognition.

Career Opportunities After Earning the CMT

Earning the CMT designation can transform your career path in financial markets. This respected credential, awarded by the CMT Association, helps you work as a senior market technician in key roles such as technical analyst, fund manager, or financial advisor. With this designation, your ability to analyse charts, forecast market trends, and manage risk is demonstrated to employers, opening new doors for you across the financial industry.

The CMT designation is recognised in more than 135 countries and is especially valued in major financial centres such as:

- New York,

- London,

- and Hong Kong.

Leading institutions such as Bank of America, Wells Fargo, Morgan Stanley, Bloomberg, Charles Schwab, Fidelity, and UBS actively seek CMT holders.They value these professionals for their expertise in technical analysis and portfolio management, using their skills to make informed investment decisions.

This global recognition enables CMT charterholders to work in:

- International financial institutions,

- Hedge funds,

- Asset management firms,

- Brokerage and trading firms.

The roles a senior market technician can take on are diverse. For example, as a technical analyst, they can analyse market data and forecast trends. As a portfolio manager, they can design investment strategies. In addition, financial advisors with the CMT designation can help clients make informed investment decisions.

Key Insight:

According to reports, the average annual income of CMT charterholders in 2024 is around $107,000, though in certain roles it can exceed $200,000.

Q: Can CMT holders leverage their designation for non-trading careers in finance?

A: Yes. Beyond trading or analysis, the CMT credential helps in roles like risk consulting, fintech advisory, and financial education, demonstrating credibility in technical analysis globally.

Conclusion

In conclusion, the CMT designation remains one of the most respected credentials in technical analysis, elevating analysts’ careers professionally, internationally, and with specialised expertise. Far beyond a mere title, it signifies verified competence in chart analysis, interpreting market behaviour, and creating trading strategies valued across global financial markets.

For professionals looking to advance in careers like analysis or capital management, successfully passing the CMT exams can be a pivotal milestone. By carefully planning your studies, using trusted resources, and practising consistently, you can join the CMT charterholders community and become a highly skilled market technician.