The COT Report in Forex is an important analytical tool that can help traders identify market direction. This report, published weekly by the Commodity Futures Trading Commission, includes information on the buy and sell positions of various groups, including commercial traders, large speculators, and retail traders. By examining changes in these positions, market trends can be better understood and better trading decisions made. In this article, we will show you how to use the Commitments of Traders Report to analyze market direction and identify turning points. Stay with us to learn how to interpret the COT Report.

- The COT Report can provide a snapshot of large positions and smart money in financial markets, helping traders gain better insights into market sentiment and trends.

- The data in the COT Report is delayed and is typically published three days after the report date, so it cannot be relied upon as a real-time tool or for short-term trading.

- The COT Report is primarily focused on futures markets and does not provide detailed information on spot Forex or cryptocurrency markets. Therefore, for analyzing non-futures markets, additional resources and tools may be required.

- For accurate analysis of the COT Report, it should be combined with technical and fundamental analysis tools to get a complete picture of market trends and turning points.

What is the COT Report and What is Its Purpose?

You might be wondering, what is the COT Report or Commitments of Traders report? The COT Report is a weekly report published by the Commodity Futures Trading Commission (CFTC). This report shows the open positions of traders in futures markets, including Forex, commodities, gold, and indices. The main purpose of this report is to increase market transparency and help traders better understand market sentiment.

According to Investopedia, this report helps traders understand where different groups, such as commercial traders and large speculators, are positioned in the market.

The COT Report is particularly useful for preventing market manipulation and enhancing transparency. For example, when large speculators or commercial traders take heavy buy or sell positions, it can signal a potential market trend change. In the Forex trading market, analyzing this report can help predict future currency movements and assist traders in identifying market turning points and making better decisions.

So, if you’re looking for a tool to better understand market movements and improve your trading strategy, make sure to use the COT Report in Forex. This report helps you observe different trading positions and make more informed decisions.

When volatility is high, the interpretation of the COT Report should be done with caution, as significant changes in positions may be more due to risk management rather than a shift in price outlook.

The Commodity Futures Trading Commission (CFTC) and Its Role in the COT Report

Since its establishment in 1974, the Commodity Futures Trading Commission (CFTC) has played an important role in overseeing futures markets. The commission is responsible for collecting data from brokers and exchanges to provide accurate and transparent information about traders’ open positions to the public. One of the key reports published by the CFTC is the Commitments of Traders (COT) Report, which includes buy and sell positions in various futures markets, including Forex, gold, and commodities.

The purpose of publishing this report is to provide greater market transparency and prevent price manipulation. This report is especially important in the Forex market as it helps traders understand the behavior of different trading groups and make better decisions. Specifically, analyzing the Commitments of Traders Report can assist in predicting future currency trends.

The role of the CFTC as a market regulator and the publication of reliable reports such as the Commitments of Traders (COT) Report is vital for increasing transparency and ensuring the proper functioning of financial markets.

What is the Commitments of Traders (COT) in the COT Report and Why is It Important?

In the COT Report for Forex, “Commitments of Traders” refers to the total open positions (Long/Short) in the futures markets. This data is published weekly by the Commodity Futures Trading Commission (CFTC) and includes information on the buy and sell positions of various groups, including commercial traders, large speculators, and retail traders. The report helps traders gain a better understanding of market sentiment and analyze the behavior of different trading groups.

One important application of the COT Report is the analysis of “Smart Money” positions. When institutional groups or commercial traders hold large buy or sell positions, it can indicate the market trend. In the Forex market, when these positions change, it may signal a potential market reversal. This information helps traders adjust their strategies based on reliable and trustworthy data.

Therefore, this report is a very useful tool that can assist traders in predicting market trends and making better decisions in their trading positions.

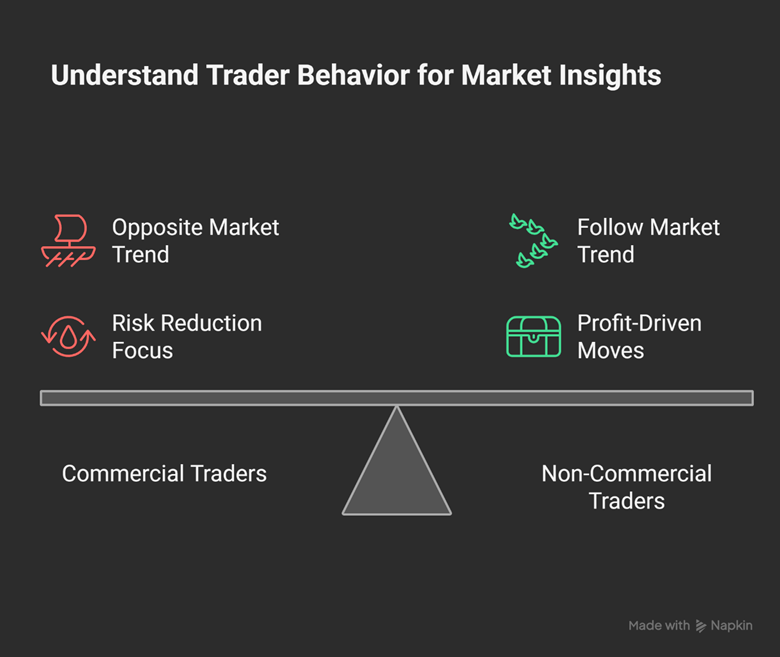

Main Groups in the COT Report

In the COT Report, traders are divided into three main groups, each playing a specific role in the market. These groups include:

- Commercial Traders;

- Non-Commercial Traders;

- Retail Traders.

Each group behaves differently in the market, and these behaviors can help traders better identify market trends and make more informed trading decisions. Let’s dive into the details of each of these groups.

Commercial Traders

Commercial traders include banks, corporations, and financial institutions that use futures contracts to manage their risk. This group typically takes positions opposite to the market trend to avoid price fluctuations.

For example, a bank may open positions like selling EUR/USD to protect the value of its assets from currency volatility. This group is primarily focused on risk reduction and maintaining stability.

Non-Commercial Traders (Large Speculators)

Non-commercial traders, or large speculators, generally include hedge funds and large investors who seek to profit from price changes in the market. This group tends to lead the market trends and takes large positions.

In the Forex market, if this group turns to buy EUR/USD, it could be a sign of an upward trend. The “smart money” associated with these groups is typically able to drive market trends and create significant shifts.

Retail Traders

Retail traders, as the name suggests, consist of small traders and individuals who typically engage in the Forex market. This group usually holds smaller positions and often acts against the prevailing market trend.

Therefore, in the interpretation of the COT Report, retail traders can be identified as a group that tends to trade against the main market movement. This behavior may expose them to higher risks.

Timing and Access to the COT Report

The COT Report, published by the Commodity Futures Trading Commission (CFTC), provides information on various trading positions in the futures markets. This report is valuable for traders and analysts each week to help them better identify market trends. Below is an explanation of the exact timing of its release and how to access the report.

Timing of the COT Report Release by the CFTC

The COT Report is released every Friday at 3:30 PM Eastern Time (ET) in the United States. The data in the report corresponds to the positions as of the previous Tuesday. In other words, the report is usually published with a three-day delay. On some occasions, especially during federal holidays, the report release may be delayed.

How to Access the Official COT Report via the CFTC Website

To access the official COT Report for Forex, you can visit the CFTC website. On this site, the reports are available in various formats such as CSV and Excel. You can easily download these reports and use them for market analysis.

Other Trusted Sources for Accessing the COT Report

In addition to the CFTC website, platforms such as Barchart and Myfxbook also provide access to the Commitments of Traders (COT) reports. These sites offer analytical tools and accurate charts to review the data, helping traders make better analyses of market trends.

Structure of the COT Report and Its Key Components

The COT Report provides information on buy and sell positions (Long/Short) in the futures markets, helping traders and analysts better understand the behavior of different groups in the market. Below, we explain the key components of the COT Report for Forex with examples.

Breakdown of Long, Short Positions, and Open Interest

In the COT Report, buy (Long) and sell (Short) positions are displayed separately for each trading group. Additionally, Open Interest is provided, which indicates the total number of open positions in the market.

For example, in the EUR/USD market, if the Commercial group has 50,000 contracts long and 150,000 contracts short, this suggests that they are more inclined to sell. A high level of open interest indicates significant market activity, which can signal potential future changes.

Weekly Changes in the COT Report

One of the important aspects of this analytical tool is the weekly changes. These changes can indicate shifts in the market trend. If, in a specific week, the number of buy or sell positions for a group increases significantly, it may suggest a change in market direction. Analyzing these weekly changes can help you identify new trends and use them in your decision-making.

Review of Net Positioning (Buyers vs. Sellers)

Net Positioning, or the ratio of buyers to sellers, is another component of the COT Report. This ratio is derived from the difference between buy and sell positions. For example, if the Commercial group holds 50,000 contracts long and 150,000 contracts short, their net position is -100,000 contracts.

This indicates a stronger inclination towards selling. Interpreting the COT Report by looking at these ratios can help you understand market sentiment and make better decisions in your trades.

Importance of Position Changes Over Consecutive Weeks

Changes in positions over several consecutive weeks can serve as an important signal for predicting long-term market trends. For instance, if the Commercial group increases their long positions over several weeks, this could indicate the beginning of an upward trend. Monitoring the trend of position changes over a few weeks can give you a better outlook on the market’s future direction.

Ultimately, using the COT Report can help you gain a clearer understanding of various market positions and use that insight to make more informed decisions in your trading.

How to Interpret the COT Report in Forex Analysis

The COT Report includes buy and sell positions (Long/Short) for various groups and is typically published weekly by the Commodity Futures Trading Commission (CFTC). This section explains how to interpret the COT Report for Forex market analysis and introduces methods for using this report in trend analysis.

Analyzing the Behavior of Commercial Traders and Large Speculators

The COT Report highlights two main groups: Commercials (Commercial Traders) and Non-Commercials (Large Speculators). Commercial traders typically seek to reduce risk and usually take positions opposite to the market trend.

This means that when the market is rising, they might open short positions. On the other hand, non-commercial traders, or large speculators, aim to profit from price changes and generally move in the direction of the market trend. If this group takes long positions, it can indicate the continuation of an upward market trend.

Identifying Market Turning Points from Non-Commercial Position Changes

One of the key signals in interpreting the COT Report is to monitor significant changes in the positions of non-commercial traders. When large speculators drastically change their buy or sell positions, it can be a sign of the beginning or end of a trend.

For example, if the number of long positions in a market increases significantly, it could indicate the start of an upward trend. Sudden changes in this group’s positions can help identify potential market turning points.

Using the COT Report to Identify Long-Term Trends

To identify long-term trends, combining COT data in Forex with other information, such as Open Interest, is highly useful. When open interest is consistently rising, and at the same time, speculators are increasing their long positions, this can indicate a long-term bullish trend.

Using the Commitments of Traders (COT) Report in this context helps you make decisions based on long-term analysis.

Combining COT Data with Technical and Fundamental Analysis

While the COT Report in Forex can provide valuable information on its own, it’s best to combine this data with technical and fundamental analysis for more precise insights. For instance, if the COT Report shows heavy buying by large speculators and indicators such as the RSI also confirm overbought conditions, you can feel more confident entering the market. Additionally, combining this data with economic news can help you make better decisions when faced with changing market conditions.

The analysis of the divergence in views between commercial traders and large speculators in the disaggregated COT data often appears before changes in spot prices, revealing the direction of smart money flow.

COT Report in Crypto Markets, Gold, and Indices

The COT Report in Forex can also be used for analyzing other markets such as gold, commodities, and cryptocurrencies. This report helps traders identify the behavior of different groups in these markets and use it for predicting trends and making trading decisions.

Applying COT Concepts to Commodities and Indices Trading

In commodity markets such as gold and indices like the S&P 500, the concepts in the COT Report are similar. In these markets, there are two main groups: Hedgers (commercial traders) and Speculators. For example, in the gold market, producers or companies that use gold hedge against price fluctuations by opening short positions. Speculators, on the other hand, enter the market by following trends and predicting price movements.

Are Similar COT Data Available in the Crypto Market?

In the cryptocurrency market, there are no direct equivalents of the COT Report. However, exchanges and platforms like CME offer “Synthetic COT” data for Bitcoin. This data is derived from positions in Bitcoin futures contracts and can assist in analyzing the behavior of traders in this market.

Thus, although precise COT data is not directly available in the crypto market, such information can still help analysts simulate market trends.

Comparing Trader Behavior in Forex, Commodities, and Cryptocurrencies

In the Forex market, speculation is often high, and traders are more focused on profiting from short-term market fluctuations. In commodity markets like gold, trading behavior is driven more by large producers and consumers who enter the market to manage risk.

In the cryptocurrency market, price volatility is greater, and traders typically exhibit different behaviors due to the lack of clear regulations and the extreme price swings. Therefore, in each of these markets, analyzing the COT Report can help traders understand the behavior of different groups and make better decisions.

Tools and Trusted Resources for Analyzing the COT Report

To better analyze the COT Report data and make more accurate trading decisions, it’s essential to use tools and resources that present the information more transparently and simply. These tools help you better visualize the behavior of different trader groups and identify potential market trends. Below are some practical methods.

Trusted Websites and Data Feeds for Analyzing the COT Report

The first reliable source is the official CFTC website, which publishes the raw COT report files. If you’re looking for a more straightforward display and ready-made charts, websites like Barchart and Tradingster are excellent options. These sites categorize the data and allow for easy comparison between different groups, making the information much more accessible.

COT-Based Indicators and Plugins for MetaTrader and TradingView

If you use MetaTrader, plugins like MetaCOT display COT data directly on your charts. On TradingView, you can find indicators like the COT Index, which visually represents the behavior of large traders. These tools are ideal for combining the COT Report with technical analysis.

How to Create a Custom Dashboard for Analyzing COT in Excel and Google Sheets

To create a custom COT analysis dashboard, simply import the weekly CFTC report data into Excel or Google Sheets either manually or automatically. Here’s how:

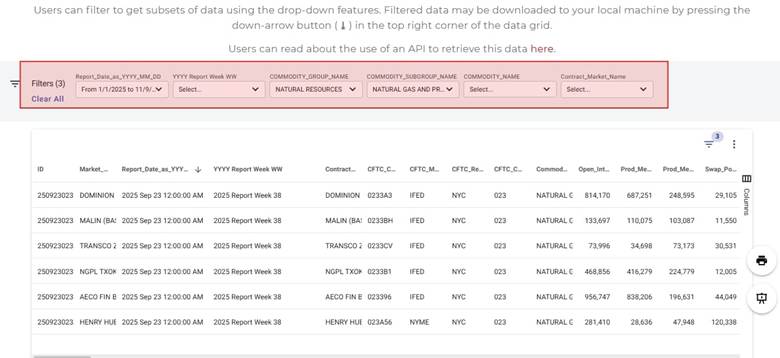

- Visit the CFTC official website.

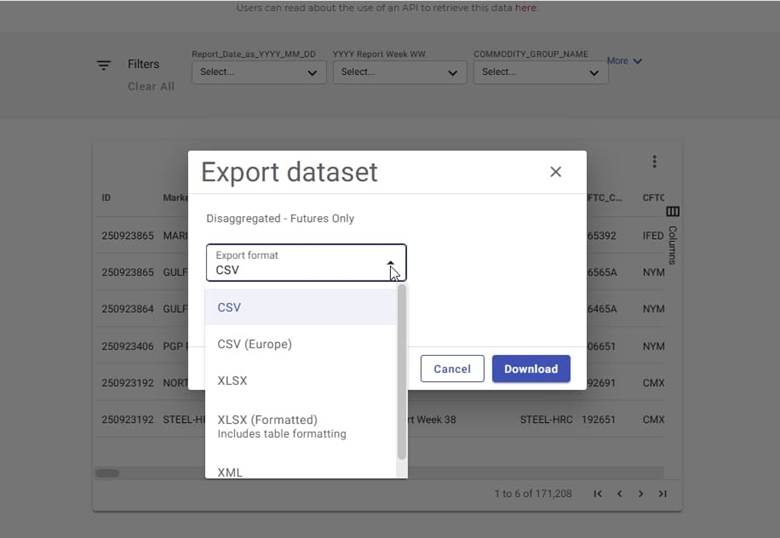

- Click on “Commitments of Traders” and then select “COT Public Reporting Environment”.

- On the open page, click on one of the links related to the Disaggregated Report according to your needs.

- Apply filters based on your desired timeframe, symbol type, group, and subgroup.

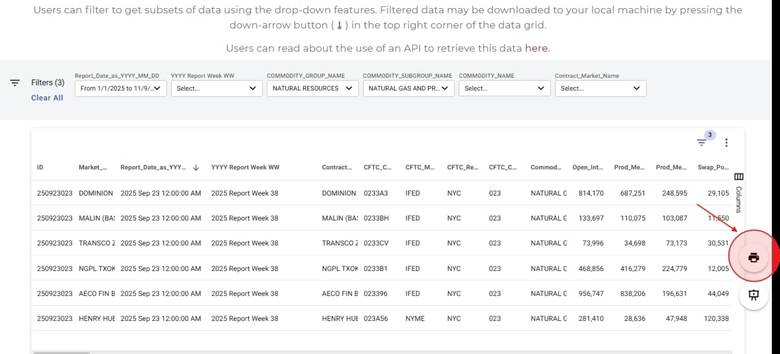

- After applying filters, click the printer icon to export the data.

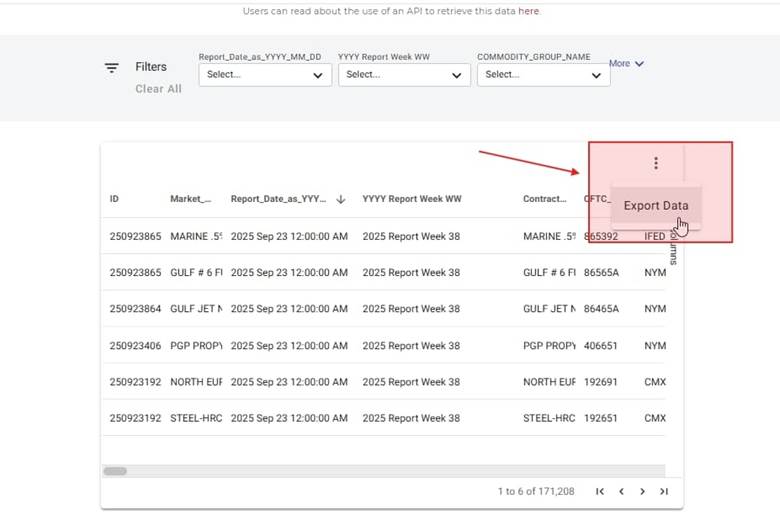

- In the export window, click on the three dots in the top right corner and then select “Export Data”.

- Choose the output format (such as CSV or XLSX) and download the file.

- Enter the data in a sheet called Raw_Data.

Next, create a new sheet (for example, Dashboard_Data) and include the following key columns:

- Date;

- Commercial Long;

- Commercial Short;

- Non-Commercial Long;

- Non-Commercial Short;

- Small Trader Long;

- Small Trader Short.

Use functions like VLOOKUP or INDEX + MATCH to extract data from the Raw_Data sheet. For example:

=VLOOKUP(A2, Raw_Data!A:H, 3, FALSE)

Create a column to calculate Net Position. Then, for each group (Commercials, Non-Commercials, Small Traders), create this column.

In a new column, calculate and display the weekly percentage change. Adding the percentage change formula helps assess the momentum of smart money inflows or outflows.

Next, create the following charts:

- Line chart for Commercial Net Positions;

- Line chart for Non-Commercial Net Positions;

- Bar chart for Week-over-Week Change.

To highlight positive and negative changes, use conditional formatting:

- Green for increased long positions;

- Red for increased short positions.

Finally, depending on your needs, generate analytical reports from the file. This approach allows you to automate the extraction and analysis of COT data, offering you a personalized dashboard to make better trading decisions.

Advantages and Limitations of Using the COT Report

The COT Report is a valuable tool that helps traders make better decisions by examining large positions in the market. One of the main advantages of this report is the transparency it provides regarding trading positions, which can assist in predicting market trends and analyzing market sentiment. By using the COT Report, traders can better determine market direction, making it a useful tool for decision-making when analyzing various markets.

However, there are limitations to how the COT Report can be used. First and foremost, the data is published with a three-day delay, as the reports are based on Tuesday’s data but updated on Friday. Additionally, this report only covers futures markets and may not be directly useful for analyzing spot Forex markets. Furthermore, the report lacks detailed information about retail traders in the market.

Finally, it’s important to remember that the COT Report should always be used as one component of analysis and should not be relied on solely. While it can aid in risk management and better decision-making, it should be used in conjunction with other analytical tools.

The COT Report is particularly useful in futures markets, but due to data limitations for spot markets and the delay in publication, it should be used with caution.

Conclusion

The COT Report is a powerful tool for analyzing financial markets, particularly in Forex, that can help traders better identify market direction and make more informed decisions. By using this report, traders can gain transparency in large positions, analyze market sentiment, and forecast both short-term and long-term trends. However, it’s important to consider its limitations, such as the data delay and focus on futures markets. The best approach to using the COT Report is to combine it with other technical and fundamental analysis tools to provide a more comprehensive analysis.