Choosing between MetaTrader 4 and MetaTrader 5 can sometimes feel confusing for forex traders, as both platforms are powerful but come with different features. Each has been in the market for years and is widely used, yet they deliver unique tools and trading experiences. Understanding the real differences in MetaTrader 4 vs 5 will help you decide which one fits your style and needs best.

Whether MetaTrader 4 or 5 is better truly depends on your individual trading approach. In this article, we’ll provide a complete comparison of MT4 and MT5, highlight their key differences, and guide you toward selecting the platform that works best for you. Stay with us until the end for straightforward and practical insights that will help you make a confident choice.

Choosing between MT4 and MT5 depends more on trading style and individual goals rather than one being absolutely better than the other.

The large user community and extensive educational resources of MT4 are the main reasons for its continued dominance in the market.

MT5, designed with the future of financial markets in mind, focuses more on diverse asset classes and advanced analytical tools.

Using a demo account is the best way to understand the differences and find the platform that matches each trader’s needs.

What is MetaTrader and Why is it the Most Popular Forex Platform?

For many years, MetaTrader has been the preferred trading platform for forex and CFD traders. It offers a combination of advanced charting tools, a wide range of technical indicators, and the ability to run automated strategies, which is why it is supported by the majority of brokers worldwide.

Its simple interface, free access, and large global community have made it the platform of choice for millions of traders. This widespread popularity also explains why so many beginners eventually ask which version suits them best, making MetaTrader 4 vs 5 one of the most common debates when starting a trading journey.

According to Brokerxplorer, MetaTrader is considered the market standard because nearly every broker offers it, and this widespread support has only reinforced its popularity.

The History of MetaTrader and the Development of Its Versions

MetaQuotes began its operations in 2000, developing its first trading software for forex users. In 2005, the company released MetaTrader 4, or MT4, which quickly became popular thanks to its MQL4 programming language, advanced charting, and automated trading features. Five years later, in 2010, MetaTrader 5 was introduced, expanding the platform beyond forex to include markets such as stocks and futures.

Many traders, however, continued using MT4 because indicators and Expert Advisors built for it were not compatible with the new version. This is one of the key reasons why the MetaTrader 4 vs 5 debate remains highly relevant today, as traders carefully weigh the differences to choose the platform that best suits their needs.

A Complete Overview of MetaTrader 4 (MT4)

For many years, MetaTrader 4 has been recognized as one of the most widely used trading platforms, thanks to its balance of simplicity and professional functionality. When comparing MetaTrader 4 vs 5, many traders acknowledge that both platforms have their strengths, but MT4 has retained its popularity due to its long history and large user community.

Key Features and Tools of MT4

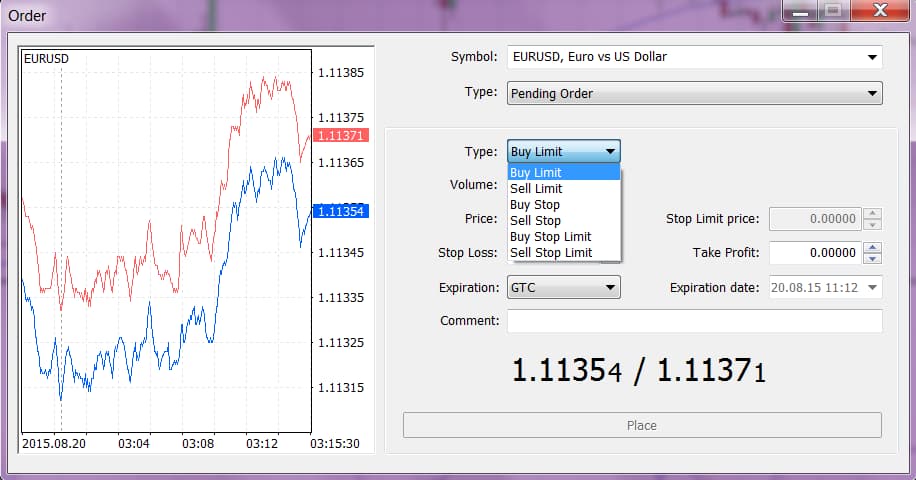

This version provides nine different chart timeframes and includes over 30 built-in technical indicators. It also supports four types of pending orders, giving traders more flexibility in managing their trades. One of MT4’s standout features is its support for Expert Advisors through the MQL4 programming language, allowing users to easily design and run automated strategies.

Advantages of Using MT4

Its straightforward interface and fast trade execution make MT4 particularly suitable for beginners. The platform also benefits from widespread broker support and a wealth of educational materials, scripts, and ready-made tools, which further strengthen its position in the trading community. This is why many new traders still ask themselves whether to start with MetaTrader 4 or 5, often choosing MT4 as their entry point.

Limitations and Drawbacks of MT4

MT4 was primarily built for forex and does not natively support other markets like stocks or futures. Strategy testing is limited to single instruments and runs more slowly compared to newer technology. Additionally, the absence of Depth of Market (DOM) functionality is a limitation for traders seeking more advanced insights. If you’re wondering what is backtesting?, it is the process of evaluating a strategy on historical data, and in MT4 this feature comes with more restrictions compared to MT5.

A Complete Overview of MetaTrader 5 (MT5)

MetaTrader 5 is the newer trading platform developed by MetaQuotes, designed to meet the needs of traders looking for broader features and access to more diverse markets. When comparing MetaTrader 4 vs 5, many traders consider MT5 the better choice for professionals who want to go beyond forex and trade assets such as stocks, cryptocurrencies, or commodities.

New Features and Capabilities of MT5

This version offers 21 chart timeframes and comes with 38 built-in technical indicators. It also supports six types of pending orders, giving traders more flexibility in managing positions. One of MT5’s standout features is its built-in economic calendar, which allows users to follow key events without leaving the platform. In addition, the MQL5 programming language provides greater power for creating Expert Advisors and advanced analytical tools.

Advantages of MT5 Compared to MT4

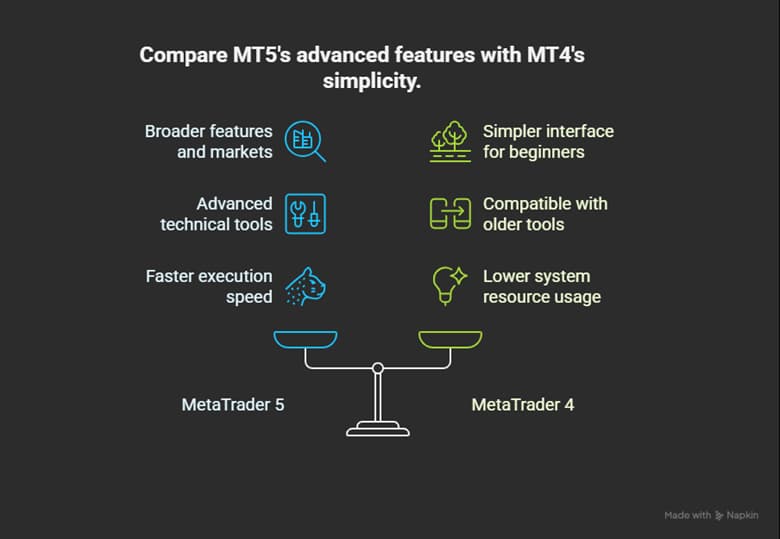

MT5 delivers faster execution and supports a wider range of asset classes, including equities and crypto. Its multi-threaded backtesting feature is a major improvement, allowing strategies to be tested with greater speed and precision. The Depth of Market (DOM) tool further enhances analysis by offering insights into order flow and liquidity, highlighting a significant part of the difference between the two platforms.

Potential Drawbacks of MT5 for Some Traders

For beginners, the interface of MT5 can feel more complex and requires extra time to master. Expert Advisors and indicators built for MT4 are not directly compatible with MT5, which can be a challenge for those relying on older tools. The platform also uses more system resources, which may be an issue for traders with weaker hardware. If you are still unsure, carefully reviewing the features can provide a clearer answer to the question of which platform is ultimately better: MetaTrader 4 or 5.

The Differences Between MetaTrader 4 and 5

Understanding the key differences between these two platforms helps traders make a more informed decision. Many users continue to rely on MT4 for its simplicity and strong community support, while MT5 offers a wider range of tools and features. This ongoing debate makes MetaTrader 4 vs 5 a central question for traders choosing their platform.

User Interface and Trading Experience

MT4’s straightforward design makes it well-suited for forex trading, whereas MT5 provides additional tabs and advanced analytical sections that are often preferred by professional traders.

Tools and Indicators for Technical Analysis

MT4 includes around 30 built-in indicators, while MT5 expands this to more than 38, along with additional graphical tools for more detailed market analysis.

Speed and Performance

MT5 uses multi-threaded processing, which improves the speed of order execution and backtesting. By contrast, MT4 is lighter but can slow down when handling large amounts of data.

Asset and Market Coverage

MT4 is primarily limited to forex and CFDs, whereas MT5 supports a broader range of markets, including stocks, futures, and cryptocurrencies. Choosing a broker that offers ECN account types can further enhance the professional use of MT5.

Cloudzy notes that MT5 supports a wider range of markets, including stocks, commodities, cryptocurrencies, and bonds, while MT4 remains largely limited to forex and CFDs.

Programming Languages and Development of Trading Tools

MQL4 is a simpler language suitable for forex-focused strategies, while MQL5 is object-oriented and more powerful, making it possible to develop more advanced and complex systems.

Backtesting and Strategy Testing

In MT4, backtesting is limited to single instruments and is relatively slow. MT5, however, allows simultaneous multi-currency testing at higher speeds, which is particularly useful for traders running diverse strategies.

According to BabyPips, MetaTrader 5 offers more tools and order types, but for beginners, the simplicity and lightweight nature of MT4 make it the easier choice.

MetaTrader 4 or MetaTrader 5 – Which is Better?

The choice between these two platforms largely depends on the trader’s needs and level of experience. Those who focus mainly on the forex market and prefer a simple, easy-to-use environment often go with MetaTrader 4. On the other hand, traders who want access to broader markets such as stocks, commodities, or cryptocurrencies usually benefit more from the extended features of MetaTrader 5. In reality, the answer to whether MT4 or MT5 is better comes down to trading style, which is why the MetaTrader 4 vs 5 comparison continues to matter.

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 | 21 |

| Built-in Indicators | Around 30 | More than 38 |

| Tradable Assets | Mainly Forex | Forex, Stocks, Crypto, Commodities |

In the end, deciding between MetaTrader 4 or 5 depends entirely on your trading goals. If your plan is to focus only on forex, MT4 will likely be enough. But if you want to expand into multiple markets and take advantage of more advanced tools, shifting to MT5 makes much more sense.

MetaTrader 4 vs 5 from the Perspective of Iranian Traders

Just like traders worldwide, Iranian traders also face the decision of choosing between MT4 and MT5. However, local factors such as broker accessibility and internet quality play an important role in shaping that choice. Looking at these conditions helps clarify which platform is more practical in real-world use.

Accessibility and Broker Support

Many international brokers serving Iranian clients still rely heavily on MT4. Well-known brokers like Alpari and HotForex remain popular in Iran largely because of their extensive support for this version. Some brokers also offer MT5, but its availability is not as widespread. In this context, being familiar with the best forex brokers can help traders make a more informed decision.

VPN Use and Connection Quality

Since access to trading servers generally requires a VPN, internet connection quality becomes a critical factor. Experience shows that MT4, due to its lightweight structure and lower resource usage, tends to perform more smoothly under weak or unstable internet connections. MT5, with its richer features, requires a stronger and more stable connection for optimal use.

Which Version Works Better for Iranian Traders?

Beginners who are just stepping into forex or plan to stick to currency pairs usually prefer MT4. Traders looking for more asset diversity, including stocks or cryptocurrencies, often find MT5 more appealing. Ultimately, carefully reviewing the MetaTrader 4 vs 5 comparison helps Iranian traders choose the version that best fits their specific needs and conditions.

Conclusion

The decision between MetaTrader 4 and 5 ultimately depends on your needs and trading style. Traders who focus solely on the forex market can benefit from the simplicity and stability of MT4, while those seeking access to broader markets and more advanced analytical tools may find MT5 a better fit.

Paying attention to the key differences in MetaTrader 4 vs 5 provides a clear picture of the strengths and limitations of each platform. The best approach is to test both versions with a demo account and then choose the one that aligns most closely with your personal trading goals. Making this informed choice can serve as a reliable starting point for long-term success in the markets.