Many traders, when analyzing charts, seek tools that can show both the direction and strength of market movement. This is where the Elder Impulse System comes in. It combines trend analysis with momentum, offering a clearer view of market conditions.

By using this method, traders can more easily identify the right moments to enter or exit a trade. This leads to more informed decisions based on precise data. If you’re looking for a simpler way to understand price behavior, keep reading. In this article, we’ll dive deeper into the practical applications of the Elder Impulse System.

- The Elder Impulse System doesn't analyze market volume; it highlights momentum shifts and trend reversal points.

- Its core philosophy emphasizes cautious entry and quick exits to minimize sudden risks.

- Elder Impulse System signals are more reliable when aligned with the long-term trend of the timeframe.

- In ranging or volatile markets, neutral candles appear more frequently, reducing the reliability of Elder Impulse System signals.

What is the Elder Impulse System?

Dr. Alexander Elder is a well-known name in technical analysis. With the introduction of the Elder Impulse System, he offered a fresh method for market analysis. In his book, Elder explained how combining a 13-period exponential moving average with the MACD histogram can identify moments when price or momentum accelerates or loses strength.

The core of the Elder Impulse System is to help traders simultaneously see both trend and momentum, leading to more informed decisions. This approach is designed for short-term trading and helps traders react quickly. The philosophy that Elder often emphasizes is to enter trades cautiously and exit without delay when conditions change. This practical mindset has made the Elder Impulse System strategy widely adopted by market participants.

According to Quantified Strategies, even if the trend and momentum align, at the final stages of the trend (such as slowing histogram growth or flattening EMA), this combination may produce false signals. Therefore, it’s essential to carefully monitor the market’s next reaction.

Key Components of the Elder Impulse System Strategy

In this section, we will introduce three key components of the Elder Impulse System. These components lay the foundation for understanding the details ahead. The Elder Impulse System strategy uses a 13-period exponential moving average (EMA) to define trend direction. It also includes the MACD indicator, focusing on the histogram to measure momentum. Additionally, a color-coded candle system displays signals to help traders. These components allow traders to easily identify entry and exit points.

Role of the MACD Histogram in the Elder Impulse System

The MACD histogram, calculated with the settings 12, 26, and 9, is a crucial part of the Elder Impulse System indicator. It highlights momentum shifts, helping traders gauge the strength of a trend. If the histogram rises and aligns with an uptrend, it indicates increasing buying power.

On the other hand, if the histogram decreases and aligns with a downtrend, it signals a potential selling opportunity. In the Elder Impulse System, the histogram serves as a momentum trading indicator, essential for assessing market momentum.

Role of the Exponential Moving Average (EMA) in the Elder Impulse System

The 13-period EMA is another vital element in determining the overall market trend. If the EMA slope is upward, it signals an uptrend. When it slopes downward, it indicates a downtrend. To ensure more reliable signals, many traders examine the EMA on higher timeframes as well.

This additional step helps align short-term signals with the broader market trend, improving decision-making. The Elder Impulse System indicator plays a crucial role in identifying trends accurately.

The Candle Color-Coding System for Displaying Signals in the Elder Impulse System

A standout feature of the Elder Impulse System is the candle color-coding system, which makes chart reading easier. When both the EMA and MACD are bullish, the candles turn green, signaling a buying opportunity.

If both are bearish, the candles turn red, indicating a sell signal. If the indicators are not aligned, the candles turn blue, showing a neutral market condition. This color-coded system functions like a trend indicator, allowing traders to quickly interpret market conditions without complexity.

How to Trade with the Elder Impulse System Strategy

To use the Elder Impulse System strategy effectively, ensure signals align with the larger trend. The larger trend typically comes from a timeframe five times longer than your trading timeframe. After confirming the trend direction, traders can act on the candle color in the trading timeframe. This framework helps traders make quick, informed decisions in the market.

How to Identify Buy and Sell Points in the Elder Impulse System

A buy signal occurs when the candles turn green and the long-term trend is bullish. A red candle with a downtrend signals a sell. For example, on platforms like Stockcharts, a green candle in the daily timeframe and a bullish weekly trend suggest a buy opportunity. This coordination between timeframes is key in the Elder Impulse System analysis.

Setting Stop Loss in the Elder Impulse System Strategy

To manage risk, set stop losses at support or resistance levels or when candle colors change (e.g., from green to blue or red). This method helps prevent significant losses while adding a protective layer to the Elder Impulse System strategy. Following this approach is essential for every professional trader using the Elder Impulse System indicator.

How to Install and Set Up the Elder Impulse System in MetaTrader and TradingView

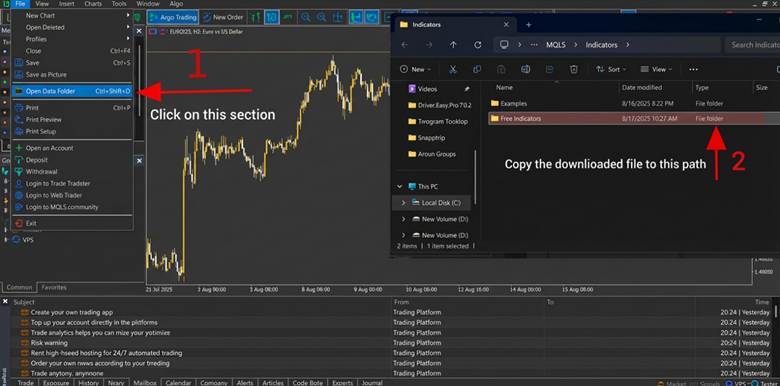

To use the Elder Impulse System, set it up on MetaTrader and TradingView platforms. First, in MetaTrader 4 or MT5, download the Elder Impulse System indicator from trusted sources like MQL5. Then, copy the file to the Indicators folder and restart the software.

Next, add the Elder Impulse System indicator to your chart. Apply the default Elder Impulse System settings, including a 13-period EMA and MACD with values of 12, 26, 9. These settings help identify market trends and momentum, fitting the Elder Impulse System strategy.

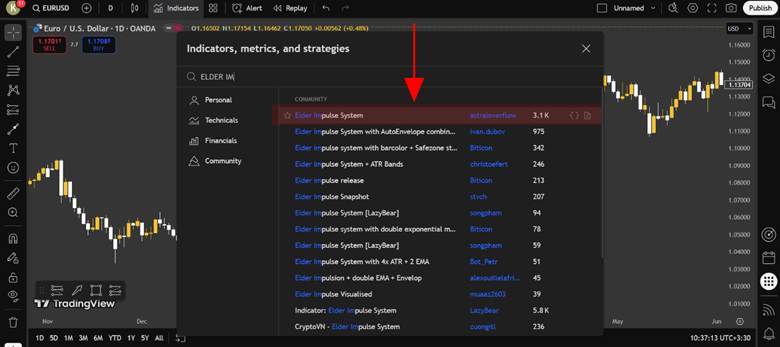

In TradingView, search for “Elder Impulse System” in the indicators section. Add the indicator to your chart and verify the EMA 13 and MACD (12, 26, 9) settings.

To improve accuracy, add a 65-period EMA on a higher timeframe (e.g., daily for hourly trades). This confirms the main trend, increasing the reliability of the Elder Impulse System.

Backtesting the Elder Impulse System

To trade effectively with the Elder Impulse System strategy, use the Elder Impulse System backtest feature on TradingView or MT4. Backtesting evaluates the system’s performance on historical data. It provides valuable insights into how the strategy works in different market conditions.

By backtesting, you can adjust the Elder Impulse System settings to optimize performance. This helps understand the system’s effectiveness and tailor it to your trading style.

Advantages and Disadvantages of the Elder Impulse System Strategy

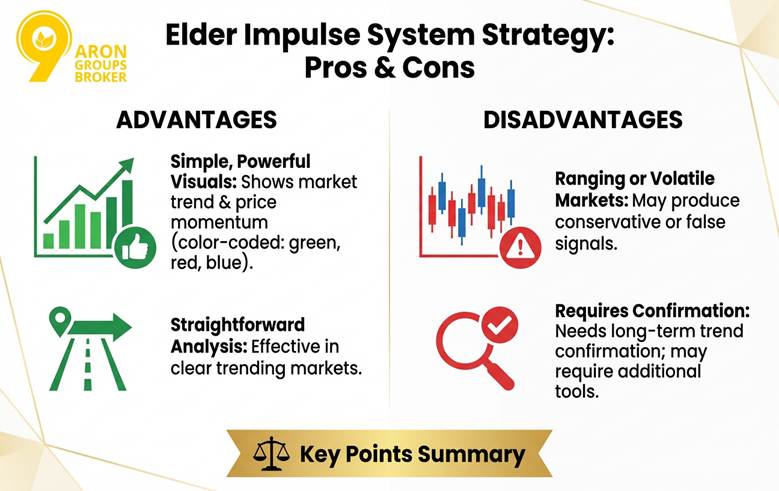

The Elder Impulse System strategy offers traders a simple yet powerful visual representation of the market. It shows both the market trend and price momentum using clear color-coding (green, red, blue). This structure makes analysis straightforward and works well for clear trends, especially in trending markets.

However, in ranging or volatile markets, it may produce conservative or false signals. In these cases, confirmation from the long-term trend is often needed. The Elder Impulse System indicator provides good insights but may require additional tools in certain market conditions.

Combining the Elder Impulse System Strategy with ADX

To increase the accuracy of signals, the Elder Impulse System can be combined with the ADX indicator. When the ADX value is above 25, it indicates that the market trend has strong momentum. In these conditions, the Elder Impulse System signals gain more reliability. This combination is particularly effective in filtering out weak signals and confirming trend direction.

According to StockCharts, a key advantage of using ADX with the Elder Impulse System is the ability to confirm a strong market move before the candle reaches a specific color (green or red). When ADX is high, traders can confidently enter the market with caution.

Combining the Elder Impulse System Strategy with Price Action

Combining the Elder Impulse System strategy with price action analysis improves the accuracy of trading signals. By using support and resistance levels, traders can filter out false signals. For example, if a green candle appears in the Elder Impulse System near a key support level, the chances of a successful buy trade increase.

Candlestick patterns like the pin bar or bullish engulfing can confirm a buy signal. On the other hand, a red candle near resistance with a bearish engulfing pattern provides a stronger sell signal. This combination helps traders enter trades with more confidence and avoid false signals.

Conclusion

Overall, the Elder Impulse System is a simple yet effective tool that combines trend and momentum to present market conditions more clearly. This feature makes the Elder Impulse System a popular choice for traders in identifying trading opportunities. However, no strategy will yield the desired results without practice and risk management. The best way to fully understand this system is to use it on a demo account and continuously test it under various market conditions. Consistent practice and adherence to capital management principles will pave the way for trading success.