In technical analysis, candlesticks are considered the language of the market, with each one telling a story about the struggle between buyers and sellers. One of the most important of these patterns is the Gravestone Doji candlestick. This candle forms when the price opens at the beginning of the trading session, rises significantly, and is then pushed back down by sellers to the opening level. As a result, a candlestick shaped like an inverted T forms, often a sign of weakening bullish momentum and a possible market reversal.

- Traders use the Gravestone Doji to identify potential exit points for long positions or entry points for short trades.

- It is crucial to use this pattern alongside other technical analysis tools to improve the accuracy of predictions.

- The opposite pattern of the Gravestone Doji is the Dragonfly Doji, which may indicate a potential bullish reversal.

What Is a Gravestone Doji Candlestick?

The Gravestone Doji is a bearish reversal pattern. In this formation, the open, close, and low prices are all at or near the same level, with only a long upper shadow visible. According to Investopedia, this upper shadow represents buyers’ attempts to push the price higher, which are ultimately overpowered by selling pressure.

Key Characteristics of the Gravestone Doji:

- Shaped like an inverted T;

- Features a long upper shadow and no lower shadow;

- Holds greater significance when it appears in an uptrend or near price tops.

Comparing the Gravestone Doji with Other Doji Patterns

In this section, we will explore the differences between the Gravestone Doji and other types of Doji patterns, such as the Dragonfly, Neutral, and Four-Price Doji, to help you better understand the unique characteristics and applications of each.

If a Gravestone Doji forms after an upward gap, the likelihood of a trend reversal becomes significantly higher than usual, as it indicates an exhaustion of buying momentum and emotional overextension by buyers.

Dragonfly Doji

The Dragonfly Doji is the opposite of the Gravestone Doji and appears as a regular T shape. In this case, the long lower shadow represents initial selling pressure followed by strong buying activity that pushes the price back up.

Neutral Doji

The Neutral Doji forms a simple cross, where the open, close, high, and low prices are nearly identical. This pattern indicates market indecision and a balance between buyers and sellers.

Four-Price Doji

The Four-Price Doji is the rarest type of Doji pattern and signals that there has been virtually no significant price movement during the session. It appears as a single horizontal line on the chart.

Psychology Behind the Gravestone Doji

The Gravestone Doji represents the ongoing battle between buyers and sellers. Initially, buyers push the price to new highs, but sellers step in with strong selling pressure, driving the market back to its opening level. This shift in momentum serves as a serious warning to traders that the prevailing uptrend may be coming to an end.

Using the Gravestone Doji in conjunction with the VWAP indicator can help determine whether a bullish breakout is genuine or merely the result of short-term buying pressure.

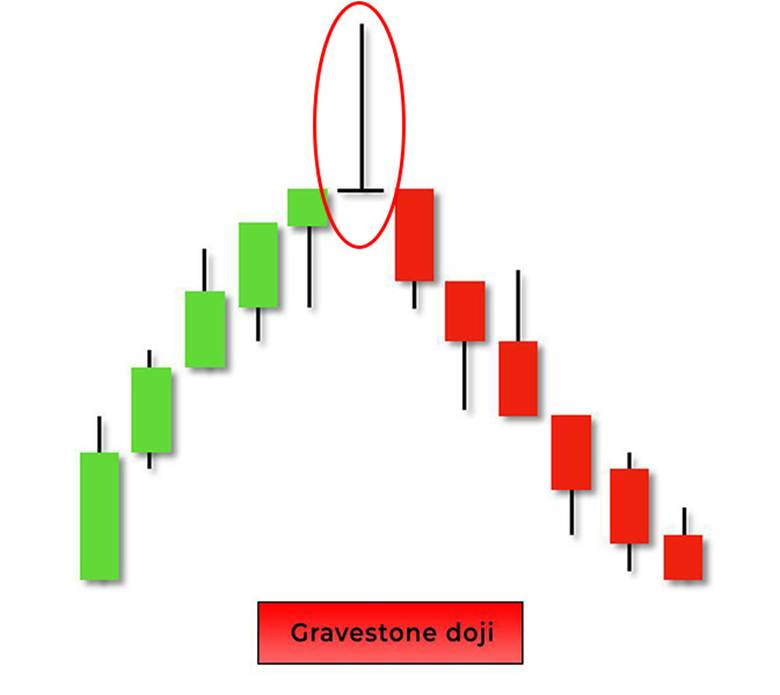

Using the Gravestone Doji as a Reversal Signal in an Uptrend

When a Gravestone Doji appears at the end of an uptrend, it serves as a strong indication of weakening buying pressure and a potential price reversal. This candlestick warns traders that sellers are starting to dominate the market and that the upward momentum may be coming to a halt.

Therefore, it is used as a bearish reversal signal, especially when accompanied by high trading volume or a confirming bearish candlestick.

The example above illustrates a typical scenario where a Gravestone Doji forms right at the top of an uptrend, just before the beginning of a downward move.

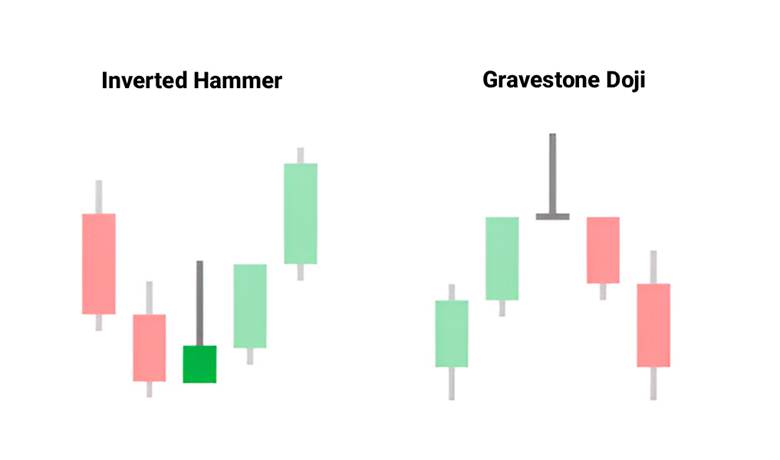

Difference Between the Gravestone Doji and the Inverted Hammer Candlestick

Although the two patterns look quite similar, their key difference lies in where they form on the chart:

- The Inverted Hammer typically appears at the bottom of a downtrend and signals a potential bullish reversal.

- The Gravestone Doji, on the other hand, forms at the top of an uptrend and indicates bearish sentiment in the market.

Combining the Gravestone Doji with Support and Resistance Levels

When the Gravestone Doji is analyzed along with key support and resistance levels, its effectiveness increases significantly. If this candlestick forms exactly at a major resistance level, it shows that buyers, despite their efforts, failed to push the price higher. This often means the market is getting ready for a correction or a decline.

If the same pattern appears near a broken support level, it may confirm that the support has turned into resistance and the downtrend is likely to continue. Using this pattern together with important price action zones can give traders more reliable reversal signals.

In the example, the Gravestone Doji formed right in the resistance area, which included a previous high and the 78.6 Fibonacci retracement level. Shortly after, a sharp drop in price followed. This shows how combining the Gravestone Doji with resistance levels can create a strong bearish signal.

Combining the Gravestone Doji with Other Candlestick Patterns

In this section, we will explore how combining the Gravestone Doji with other candlestick patterns can create stronger and more reliable reversal signals.

Gravestone Doji with a Bearish Engulfing Candle

When a strong bearish candle (Bearish Engulfing) forms right after a Gravestone Doji, it generates a highly reliable reversal signal.

The Bearish Engulfing pattern is a powerful reversal formation that, when it follows a Gravestone Doji, greatly strengthens the bearish confirmation.

Large Candle

The candle is large and red, showing strong selling pressure.

Full Engulfing

The body of this bearish candle completely covers the body of the previous Gravestone Doji. Its opening price is higher than the Doji’s close, and its closing price is lower than the Doji’s open.

When these two candles appear consecutively, they send a clear message to traders:

- The Gravestone Doji indicates that buyers are losing strength and can no longer keep prices elevated.

- The Bearish Engulfing candle confirms that sellers have fully taken control of the market, suggesting that the previous uptrend is likely turning into a downtrend.

In thin markets, the formation of a Gravestone Doji may result from price manipulation rather than a genuine shift in supply and demand.

Gravestone Doji with a Bearish Pin Bar

When a Gravestone Doji appears at the end of an uptrend and is immediately followed by a bearish Pin Bar with a long upper shadow, this combination serves as a strong warning to traders.

The presence of a bearish Pin Bar right after the Gravestone Doji confirms buyer weakness and reflects intense selling pressure in the market. As a result, the probability of a trend reversal or price decline increases sharply, offering traders a more confident signal to enter short positions.

Conclusion

The Gravestone Doji is one of the most powerful reversal patterns that reveals weakness in an uptrend. Traders should analyze it alongside tools such as price action, support and resistance levels, and indicators like MACD and RSI to make more accurate trading decisions.