Imagine if, instead of trying to predict the market’s direction, you could profit from every price movement—whether up or down. This very idea forms the foundation of Grid Trading, a strategy that systematically turns the market’s constant fluctuations into profitable opportunities. The appeal of grid trading lies in its simplicity. Yet, it also involves specific technical details, and paying attention to them can make the difference between success and failure with this strategy.

Join us at Aron Groups in this article to learn more about grid trading and how to apply it effectively in your trading.

- Grid Trading allows you to profit from market fluctuations without the need to predict the market's direction.

- This strategy is more effective in markets with high volatility, such as Forex and cryptocurrencies.

- For successful Grid Trading, effective risk management and precise grid level settings are crucial.

What is Grid Trading?

According to TradingView, Grid Trading is one of the most commonly used strategies in financial markets, which can be executed either automatically or semi-automatically. The core idea behind this method is simple: the trader places a series of buy and sell orders at predetermined price intervals, forming a “grid” on the chart.

This way, every time the price fluctuates within the defined range, orders are triggered, and the trader profits from the market’s volatility, without the need to constantly predict the market’s exact direction.For a more detailed overview of how grid trading works, check out this guide from Blueberry Markets

The importance of Grid Trading lies in its reliance on utilizing the natural market fluctuations instead of focusing on trend prediction. This characteristic has made the grid strategy especially popular in highly volatile markets, such as major Forex currency pairs or cryptocurrencies like Bitcoin and Ethereum.

Principles and Working Mechanism of Grid Trading Strategy

In the Grid Trading strategy, the trader defines a price range and divides it into several levels, then places automatic orders at specified intervals. As a result, whenever the market fluctuates within this range, some of the orders are triggered, generating small but recurring profits. This method is widely used in platforms like TradingView or cryptocurrency exchanges with the ability to use trading bots.

What is the Grid in Financial Trading?

A Grid refers to a network of horizontal lines on a price chart that are drawn at regular intervals. Each of these lines represents a buy or sell order level. For example, if we consider the price range of EUR/USD between 1.0790 and 1.0990 dollars, and design the grid with a 5-pip interval, buy and sell orders will be placed at levels such as 1.0790, 1.0795, 1.0800, and so on.

Buying and Selling in Predetermined Price Ranges

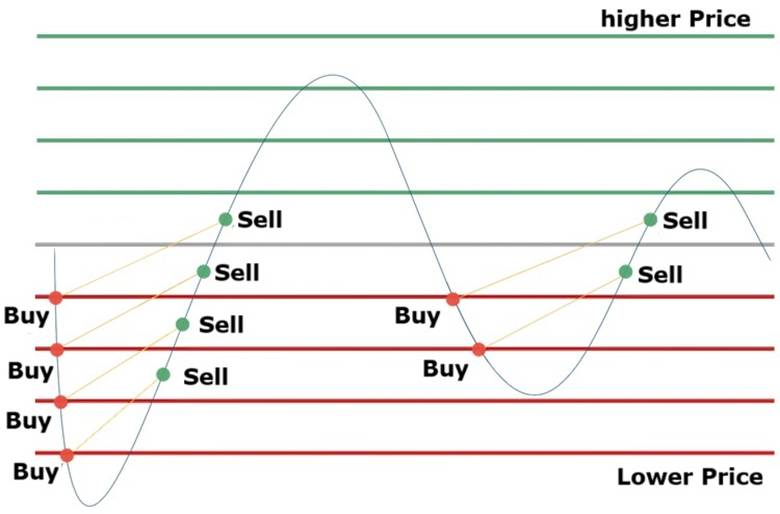

In Grid Trading, orders are pre-planned within specified price ranges, and with each small price fluctuation, one of these orders is triggered. For example, look at the image below. In this example:

- When the price moves to the lower level, the buy order is activated.

- When the price moves back to the higher level, the sell order is executed.

The activation of buy and sell orders due to market fluctuations has made Grid Trading highly effective in range-bound markets.

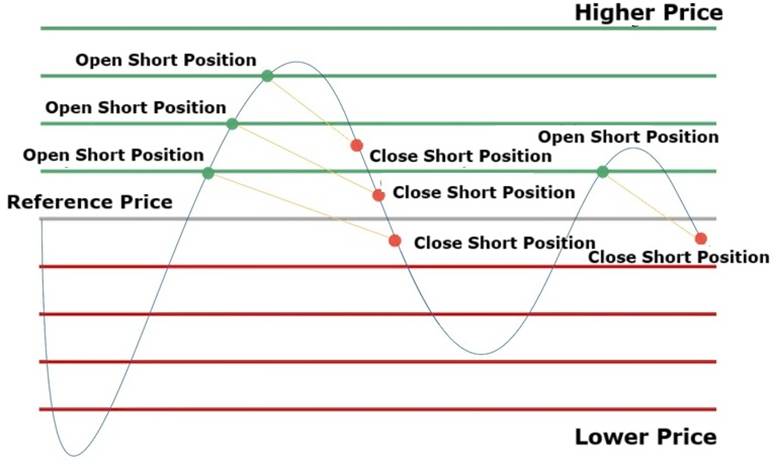

Additionally, inverse trades can be executed during the price growth of an asset or currency pair. This involves opening a short position every time the price increases (when the price reaches the green grid lines in the image below) and closing the trade when the price moves a set distance lower than the entry point, reaching the predetermined take-profit level.

The Importance of Market Volatility in the Performance and Profitability of Grid Trading

Grid trading is only profitable when the market exhibits enough volatility. The larger the range of price fluctuations and the more price retracements occur, the more opportunities arise for orders to be activated. For this reason, this strategy is more effective in inherently volatile markets. In contrast, in low-activity markets or strong one-way trends, grid trading can lead to losses.

For example, if EUR/USD fluctuates between 1.08 and 1.10, and your grid is set with 20-pip intervals, several trades may be activated in a single day, each contributing a small profit to your account. However, if a strong bullish trend starts and the price rises without retracing, your sell orders will start incurring losses one by one.

Types of Grid Trading Strategies

Grid trading strategies can be divided into two main categories: manual execution by the trader and automated execution with the help of robots. Each of these methods has its advantages and limitations, and the choice between them depends on the trader’s experience, available time, and trading style. For a comprehensive look at different grid trading strategies and examples, you can visit Quantified Strategies

Manual Grid Trading

In the manual method, the trader places a network of buy and sell orders at specified price levels on the trading platform. This method requires high levels of knowledge and precision, as the trader must constantly monitor the market and adjust the orders when market conditions change.

The advantage of this method is its flexibility; the trader can quickly adjust the strategy. However, its downside is the time-consuming nature of the process and the possibility of human error.

Automated Grid Trading with Robots

In the automated method, trading robots or algorithms take on the task of executing the grid. The trader only needs to define parameters such as the price range, distance between orders, and trading volume. Then, the robot opens and closes orders 24/7 without human intervention.

The primary advantage of this method is time efficiency and the elimination of human emotions. However, robots can also experience losses in one-sided trends if proper risk management is not applied.

Steps to Implement a Grid Trading Strategy

Successfully executing a grid trading strategy requires following specific and well-planned steps. First, the trader must choose the appropriate asset, then design the price range, align trading volume with risk management, and finally, have predefined exit scenarios for the trades. Let’s dive deeper into each step.

How to Choose the Right Currency Pair or Asset for Grid Trading

Grid trading performs best in markets that exhibit sufficient volatility and a clear price range. Forex pairs like EUR/USD or GBP/JPY, as well as highly traded cryptocurrencies such as Bitcoin and Ethereum, are ideal options. Assets with high liquidity and low spreads make executing the grid trading strategy easier while minimizing costs for the trader.

How to Determine Price Range (Grid Levels) in the Market

Once an asset has been chosen, the trader must determine the price range and the distance between the levels. First, the highest and lowest prices of the range are identified. Then, the midpoint of this range is chosen as the reference price to set the buy and sell orders.

In this strategy, the price range can be determined based on support and resistance levels or Fibonacci tools. The distance between grid levels should also match the market’s volatility, with smaller intervals for a quiet market and larger intervals for a volatile one. Another method to determine the distance between the grid levels is to divide the distance between the highest and lowest price by the total number of orders the trader plans to set in the grid.

For example, if the highest price in the grid trading range for asset X is $100 and the lowest price is $90, and the trader wants to place 10 buy and sell orders within this range, they can set the grid levels at a $1 interval.

How to Manage Capital and Set Trade Volume in Grid Trading

Capital management is the key to success in this strategy. The trade volume should be set in a way that even if multiple orders are activated, it does not put excessive pressure on the account. It is recommended that a maximum of 1 to 2 percent of the capital be allocated to each grid trade. Additionally, using the ATR indicator to estimate volatility can assist in selecting the volume and distance between orders. For example, if the ATR for the USD/JPY pair is around 30 pips, setting the grid distance to 30 or 40 pips would be a reasonable choice.

Methods and Strategies for Exiting Grid Trades

Exiting grid trades is just as important as entering them. There are several common methods for exiting grid trades:

- Exit at Key Levels: Close the trades near the next resistance or support level.

- Time-Based Exit: Close the entire grid after a specified time period (e.g., one week).

- Profit Target Exit: Close the grid when the total profits from all trades reach a predetermined percentage.

- Emergency Exit: If the price moves beyond the grid range and a strong breakout occurs, closing the trades to prevent significant losses is essential. For example, if a grid range of 1.08 to 1.10 for EUR/USD has been selected and the price rises above 1.1050, an emergency exit from the grid would be a reasonable decision.

Risk Management in Grid Trading Strategy

Risk management is the most crucial factor for success in grid trading. Since this strategy involves multiple trades simultaneously, neglecting risk can lead to significant losses.

Importance of Using Stop Loss and Take Profit in Grid Trades

Stop loss prevents large losses, and take profit secures small, repeated profits. Let’s assume a trader opens a buy position on Bitcoin at $108,000 using a grid trading strategy:

- The stop loss can be placed 500 dollars lower, at approximately $107,500, to limit potential losses.

- The take profit is set around 500 dollars higher, at $108,500, to lock in a small but secure profit.

This approach ensures that even in volatile markets, profits are made with the least risk involved.

Margin Management and Methods to Prevent Margin Call in Grid Trading

Due to the multiple trades involved in grid trading, excessive use of leverage can lead to a margin call. The best approach is to engage only a portion of the capital, set reasonable grid distances, and choose trade volumes that match the account size. This way, your account remains stable even during significant market movements.

Advantages and Disadvantages of Grid Trading Strategy

Like any other trading strategy, Grid Trading has its own unique advantages and disadvantages, which we will discuss below.

Advantages of the Grid Trading Strategy

- No Need for Market Direction Prediction: Grid trading works based on natural market fluctuations and is even profitable in range-bound markets.

- Generating Small, Repeated Profits: With each activation of an order, the trader earns small but consistent profits.

- Automation with Bots: The strategy can be executed without direct trader involvement on platforms like TradingView or cryptocurrency exchanges.

- Compatibility with Volatile Markets: This method performs better in assets like forex and cryptocurrencies, where frequent price swings occur.

Disadvantages of the Grid Trading Strategy

- High Risk in One-Way Trends: If the market continuously trends upward or downward, orders in the opposite direction can lead to significant losses.

- Need for Sufficient Capital and Margin: Since multiple trades are opened, the pressure on the account increases, and the risk of margin calls rises.

- Complexity in Risk Management: Without proper stop loss and precise capital management, controlling losses can be difficult.

- High Trading Fees: Executing a large number of orders increases transaction fees, especially in exchanges or brokers with high spreads.

The Best Markets for Using Grid Trading

Grid Trading strategy is not suitable for all markets; it performs best when the market exhibits back-and-forth fluctuations or consistent wave-like movements. Choosing the right market can make a significant difference between profitability and loss.

Grid Trading in Forex

The forex market, with its high liquidity, frequent short-term volatility, and low spreads, is one of the best options for implementing grid trading. Many major currency pairs, such as EUR/USD or GBP/JPY, typically oscillate within defined ranges, providing a great opportunity for executing a grid trading strategy.

Grid Trading in the Cryptocurrency Market

The cryptocurrency market is inherently volatile, making it an attractive option for grid trading. Cryptocurrencies like Bitcoin and Ethereum frequently experience price swings within certain ranges, allowing traders to capture small profits from these fluctuations.

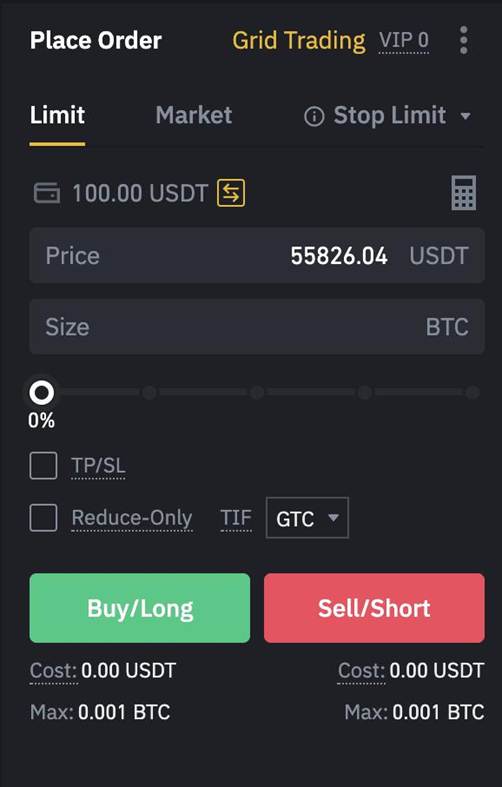

Many prominent exchanges, such as Binance or OKX, even offer pre-configured grid trading bots that automatically execute this strategy.

Is Using Grid Trading in the Stock Market Logical?

The stock market is generally less volatile than Forex and cryptocurrency markets, and often exhibits longer one-directional trends. This characteristic makes the grid strategy less effective in stocks. However, certain stocks with high daily volatility or ETFs that move within specific ranges can be suitable for grid trading.

The Best Bots and Popular Grid Trading Tools

One of the key factors for successfully implementing a grid trading strategy is the use of trading tools and bots. Below, we will explore some of the most commonly used tools and bots in various markets.

Best Grid Trading Bots in the Forex Market

In Forex, grid trading bots are typically implemented as Expert Advisors (EAs) on platforms like MetaTrader. These bots can operate based on predefined price ranges, the number of layers, and trading volumes.

Specialized Grid Trading Bots for Cryptocurrencies

The crypto market, due to its high volatility, is the most popular place for using grid trading bots. Many exchanges and third-party platforms offer dedicated bots for this purpose. Commonly used examples include Pionex Grid Bot, Bitsgap, and 3Commas.

Reputable Platforms and Exchanges with Grid Trading Capabilities

Some reputable exchanges and trading platforms offer built-in grid trading capabilities, eliminating the need for installing separate bots. Exchanges like Binance, KuCoin, OKX, and platforms such as TradingView with API connectivity to brokers or exchanges are among the popular choices for implementing grid trading strategies.

Optimal Settings in Grid Trading Strategy

One of the main challenges traders face when implementing grid trading is selecting the optimal settings. These settings refer to parameters such as the price range, the number of grid levels, and the size of each order, all of which collectively determine the strategy’s effectiveness. When configuring the strategy, consider the following:

- If the grid spacing is too small, the number of trades will increase, and the commission costs will rise.

- If the spacing is too large, profit opportunities will be missed.

- The order sizes should be set in a way that even if multiple trades are activated, there is no excessive pressure on the account margin.

The best grid trading strategy settings are typically determined based on market volatility and the trader's capital.

Combining Grid Trading with Bollinger Bands

Grid Trading is inherently based on market volatility, but it does not always pinpoint optimal entry and exit points. Bollinger Bands help position grid orders precisely near the overbought (upper band) and oversold (lower band) levels. This increases the likelihood of orders being triggered at reversal points, thereby enhancing the overall profitability of the strategy.

Combining Grid Trading with Ichimoku

One powerful method to enhance the effectiveness of a Grid Trading strategy is the use of the Ichimoku indicator. Combining this indicator with Grid Trading allows traders to not only set price grids at optimal levels but also align their trades with the overall market trend.

The image below demonstrates an example of combining the Grid Trading strategy with Ichimoku.

Since the price is above the Kumo Cloud (indicating an uptrend), buy orders are placed on the lower grid lines to be activated during market corrections. Conversely, sell orders are positioned on the upper grid lines to act as profit-taking points.

Combining Grid Trading with Price Action

By combining Grid Trading with Price Action, you can place the grid lines exactly near support levels, resistance levels, or strong price reaction areas. This not only increases the likelihood of activating orders but also aligns the trades more closely with market psychology.

The image below demonstrates an example of combining Grid Trading with Price Action. In this chart, support and resistance levels are identified using Price Action, and the grid lines are placed in these areas to take advantage of the natural price reactions.

Combining Grid Trading with Moving Averages

Grid Trading naturally performs well in markets with high volatility, but these fluctuations can often shift suddenly in a strong direction (either upward or downward). In such situations, using a moving average to determine the overall market trend can help position the grid orders only in the direction of the primary trend, avoiding trades that go against the trend, thereby increasing the effectiveness of the grid strategy.

Conclusion

The Grid Trading strategy, by leveraging market fluctuations and precisely setting buy and sell levels, can be an effective method for profiting in various markets, especially in volatile ones.

Choosing the right market and fine-tuning the grid parameters can significantly impact the success of the Grid Trading strategy.