Predicting market behaviour has always been a key concern for traders. Some methods combine logic and patterns for better analysis accuracy. One such approach is the Harmonic Elliott Wave, which uses multiple tools simultaneously instead of relying on just one. This approach offers a fresh perspective on the structure of market movements.

In this article, we will examine the Harmonic Elliott Wave and how it can help you analyse financial markets. If you want to learn more about this method, stay with us until the end.

- The Harmonic Elliott Wave combines wave structure and geometric patterns to identify price reversal zones early.

- Success depends on practice in demo environments to improve pattern recognition skills.

- Correct use of Fibonacci ratios with wave analysis strengthens entry points, stop-loss, and target setting.

- This method works well with indicators like RSI, MACD, price action analysis, and various timeframes to enhance analysis credibility.

What is Harmonic Elliott Wave (H.E.R)?

Market analysts have always sought methods to predict future price movements more accurately. One approach gaining attention is Harmonic Equilibrium Routing (H.E.R). Developed by renowned analyst Elizabeth Nersisian, it combines Elliott Waves and harmonic patterns.

In the Harmonic Elliott Wave style, price movement is analysed by considering both market wave behaviour and Fibonacci ratios found in reversal patterns. This approach helps identify market direction and pinpoint entry and exit points more accurately. Concepts like “nodes” (key price points) and clustering of reversal levels are also used.

The harmonic pattern, combined with Elliott Wave structure, provides a more precise analytical view. This style is helpful for those who combine mathematical accuracy with market psychology.

Differences Between Harmonic Elliott Wave and Classic Elliott Waves

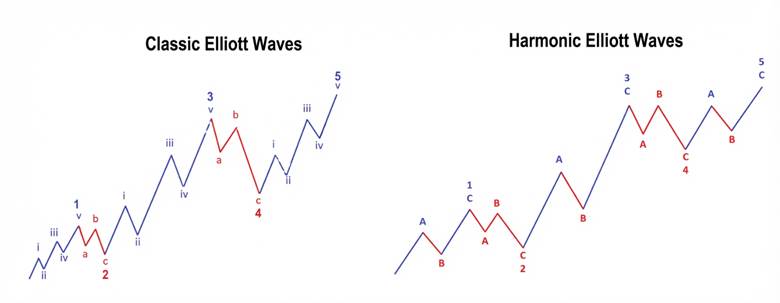

Both methods analyze recurring price structures, but Harmonic Elliott Wave (H.E.R) and Classic Elliott Waves differ in counting, entry accuracy, and tools.

Wave Counting and Structure

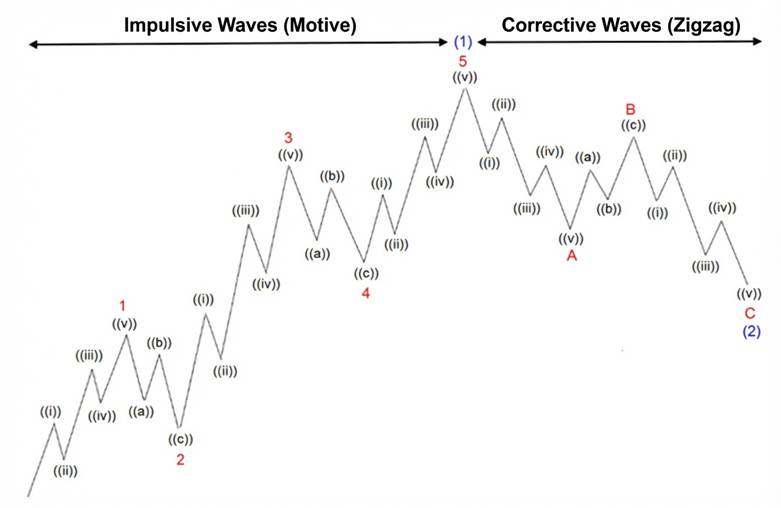

- Classic Elliott: Impulsive waves have 5 sub-waves, and corrective waves have 3. It focuses on wave patterns like zigzags and triangles.

- Harmonic Elliott: Instead of a 5-wave structure, it simplifies to a 3-step (A-B-C) pattern. This reduces errors and identifies reversals faster.

Auxiliary Tools and Ratios

- Classic Elliott: Relies on wave frequency and price-time relationships. Fibonacci is secondary, and ratios are more flexible.

- Harmonic Elliott: Uses precise Fibonacci ratios (0.618, 0.786, 1.27, 1.618). Harmonic patterns, like Gartley or Bat, help identify potential reversal zones (PRZ).

Accuracy in Identifying Entry and Exit Points

- Classic Elliott: Entries appear after confirming corrective waves’ end (Wave 2 or Wave 4), but confirmation often comes with delay.

- Harmonic Elliott: Synchronizing wave structure with harmonic patterns identifies entry points earlier, with Fibonacci precision, reducing risk.

Complexity and Learning Curve

- Classic Elliott: Various corrective wave structures require experience and practice for implementation.

- Harmonic Elliott: Geometric patterns and fixed ratios make it easier for beginners, though mastery of Fibonacci is still necessary.

In conclusion, Classic Elliott emphasizes market psychology and price cycles, while Harmonic Elliott uses precise ratios and patterns for reduced error. Many traders prefer Harmonic Elliott for short- and medium-term trades.

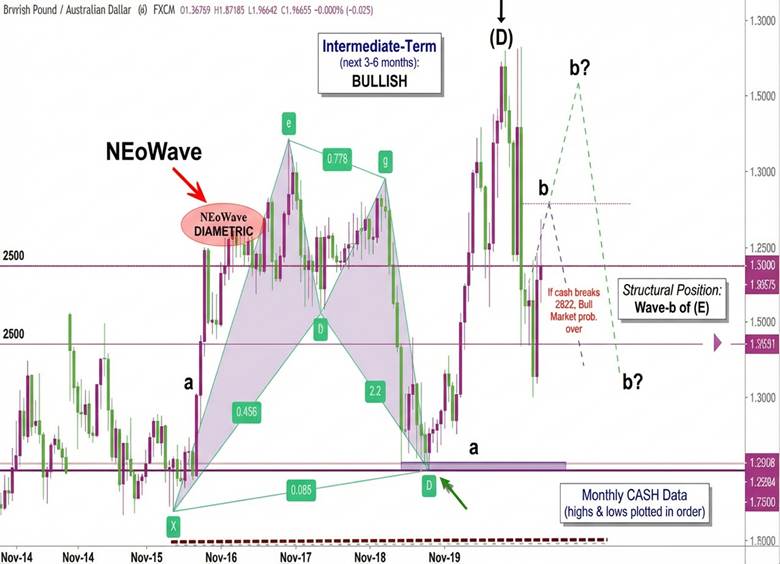

Similarities and Differences Between Harmonic Elliott Wave and Neowave

Traders looking for advanced methods often choose between Neowave and Harmonic Elliott Wave. Both analyse market wave behaviour and use Elliott Wave and Fibonacci principles. Despite similarities, their execution and logic differ significantly.

The Neowave method, created by Glenn Neely, analyses wave structure with high precision and complex rules. It addresses ambiguities in classic Elliott Wave analysis. Analysts focus on time relationships, internal wave confirmations, and market psychology.

Harmonic Elliott Wave, however, uses precise geometry combined with Elliott wave patterns such as the Gartley and Bat. It emphasises identifying price reversal zones (PRZ) from overlapping Fibonacci ratios and specific waves. If you’re new, studying Fibonacci can improve your understanding of combining Elliott wave and harmonic patterns.

In summary, Neowave requires more experience due to its complexity, while Harmonic Elliott Wave is more manageable for beginners. The choice depends on market type and your strategy.

Source Box

According to CastawayTrader, while Neowave, created by Glenn Neely, focuses on strict analytical rules, structure, and market psychology, H.E.R. offers more flexibility by emphasizing geometric patterns and precise ratios for better adaptability.

Tools Needed for Harmonic Elliott Wave Analysis

For accurate Elliott wave analysis, precise tools are necessary. TradingView is a popular software choice for drawing waves and patterns. Fibonacci tools are essential for measuring corrective and extension ratios. Complementary indicators like RSI or MACD can confirm Elliott wave correction. For example, RSI divergence in the PRZ increases the likelihood of a trend change.

Q: How can traders adapt Harmonic Elliott Wave analysis to high-frequency or algorithmic trading?

A: For algorithmic strategies, H.E.R patterns can be coded to detect overlapping Fibonacci clusters in real-time. By setting alerts for Potential Reversal Zones (PRZ) and integrating micro timeframes, traders can automate entries and exits while maintaining risk controls. Combining H.E.R with machine learning models for pattern recognition can further enhance predictive power.

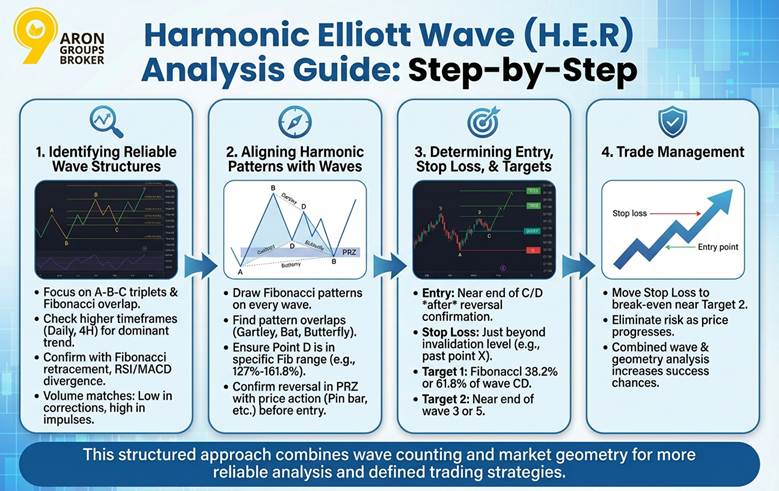

Step-by-Step Guide to Harmonic Elliott Wave Analysis

Harmonic Elliott Wave (H.E.R) is a step-by-step approach that helps traders identify the market structure and entry/exit points. Below are the main steps in this style. For real examples, check Forex Factory.

Identifying Reliable Wave Structures

In Harmonic Elliott Wave, the accuracy of analysis depends on identifying the wave structure correctly. Unlike Classic Elliott, which divides impulsive waves into five parts, Harmonic Elliott Wave focuses on A-B-C triplets and their overlap with Fibonacci patterns.

To avoid errors in counting:

- Check higher timeframes (daily or 4-hour) to determine the dominant trend.

- Identify waves in clear, low-noise movements.

- Measure the second wave’s retracement ratio using Fibonacci retracement. Confirm the end of the wave using RSI or MACD divergence.

- A valid wave structure often matches trading volume. Reduced volume in corrections and increased volume in impulsive waves confirm the count.

Aligning Harmonic Patterns with Waves

After identifying the wave structure, check if the waves overlap with known harmonic patterns (Fibonacci clusters). This step helps find reliable reversal points.

To do this:

- Draw Fibonacci patterns on every corrective and impulsive wave. For example, if wave B corrects wave A and stops at 61.8%, it might start a Gartley or Bat pattern.

- Examine multiple ratios at once. For instance, in the Butterfly pattern, point D typically falls within the 127%-161.8% range of wave XA.

- Ensure the pattern is complete, and point D is confirmed before entering the trade.

- Use secondary confirmations, like price action (Pin bar, Engulfing) in the PRZ (Potential Reversal Zone).

This step ensures your wave analysis is more reliable in both price and geometry.

Pro Tip

Use Harmonic Elliott Wave as a confirmation tool rather than a standalone signal. Always check higher timeframes, market volatility, and session context. When H.E.R setups align with these factors, trade quality improves and risk exposure decreases.

Determining Entry Points, Stop Loss, and Targets

Once the wave count and harmonic pattern are confirmed, create your entry and exit strategy. Here’s how:

- Entry Point: Usually near the end of wave C or D (depending on the pattern) and after price reversal confirmation. Entering before confirmation carries higher risk.

- Stop Loss: Set slightly below (for buys) or above (for sells) the invalidation level of the pattern or wave. For example, in a Gartley pattern, place the stop loss just after point X.

- Take Profit Targets:

- First target: Fibonacci 38.2% or 61.8% of wave CD.

- Second target: Near the end of wave 3 or 5 after correction.

Trade Management: As the price approaches the second target, move the stop loss to break-even to eliminate risk.

With this approach, both wave counting and market geometry support your analysis, increasing the chances of success.

Q: Can Harmonic Elliott Wave help determine the optimal time to switch timeframes in market analysis?

A: Yes. By analysing PRZs and harmonic patterns within a single timeframe, traders can decide whether moving to a higher or lower timeframe clarifies wave structures. Switching timeframes helps refine entry and exit points and reduces false signals, especially in volatile or noisy markets. Using multi-timeframe H.E.R analysis can improve accuracy and confidence in trade decisions.

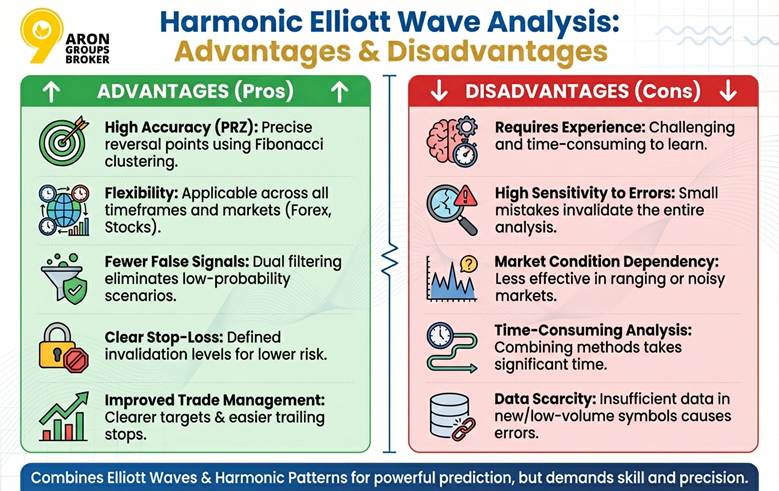

Advantages and Disadvantages of Using Harmonic Elliott Wave in Market Analysis

Using Harmonic Elliott Wave in technical analysis has specific advantages and disadvantages that traders should consider. This method combines Elliott Waves and harmonic patterns, providing a powerful way to predict price movements, but requires skill and precision.

Advantages of Using Harmonic Elliott Wave:

- High accuracy in identifying reversal points (PRZ): Using Fibonacci ratios and clustering, it marks key price zones with high success.

- Flexibility: Harmonic Elliott Wave works across different timeframes and markets, from Forex to stocks.

- Reduction in false signals: Combining both filters (Elliott and harmonic) eliminates low-probability scenarios and enhances entry quality.

- Clear stop-loss placement: With invalidation levels in both methods, stop-loss levels are clearer and carry lower risk.

- Improved trade management: Clearer price targets and reversal points make trailing stops and profit-taking easier.

Disadvantages of Using Harmonic Elliott Wave:

- Requires experience and skill: Counting waves and identifying harmonic patterns is challenging and time-consuming for beginners.

- High sensitivity to errors: Small mistakes in wave counting or Fibonacci levels can invalidate the entire analysis.

- Market condition dependency: In ranging or noisy markets, this method is less effective.

- Time-consuming analysis: Combining two methods requires more time to examine and confirm signals.

- Data scarcity in some symbols: In low-volume or new symbols, insufficient data may cause errors in pattern recognition.

Q: Can Harmonic Elliott Wave be applied to market sentiment analysis?

A: Yes. By combining H.E.R patterns with order flow or social sentiment data, traders can confirm whether a potential reversal has backing from market participants. For example, a PRZ coinciding with bullish sentiment spikes strengthens entry confidence, while mismatches signal caution. This integration bridges technical structure with behavioural finance insights.

Common Mistakes in Using Harmonic Elliott Wave Analysis

Learning Harmonic Elliott Wave can be valuable for traders, but common mistakes can reduce accuracy. Avoiding these errors improves success.

Wave Counting Mistakes and Incorrect Patterns

A common mistake in Harmonic Elliott Wave analysis is miscounting waves or misidentifying Elliott wave patterns. Traders may confuse Gartley patterns with Bat patterns. This happens due to incorrect interpretation of Elliott wave rules or improper use of Elliott wave and Fibonacci ratios.

To avoid this, traders should carefully study Elliott wave rules and patterns. Practicing on demo accounts and reviewing historical charts helps improve accuracy.

Overuse of Fibonacci

Relying too much on Fibonacci ratios without considering price action is another mistake in Harmonic Elliott Wave. Some traders focus only on Fibonacci levels like 61.8% or 127.2%.

They ignore signals from RSI or confirmation indicators. This leads to false signals. To avoid this, combining Elliott wave and harmonic patterns with other tools ensures accurate signals.

Neglecting Complementary Timeframes

Ignoring multiple timeframes is another mistake in Harmonic Elliott Wave analysis. Focusing only on one timeframe, like 1-hour charts, can make analysis incomplete.

For example, a harmonic pattern on a lower timeframe could be part of a larger wave on a higher timeframe. Traders should review Elliott wave triangles and use multiple timeframes for more comprehensive analysis.

Source Box

According to MyCryptoParadise, analysts must avoid misinterpreting wave B in corrective waves as the start of a trend. This mistake leads to premature entries or exits. The best approach is to wait for structure confirmation and check higher timeframes.

Conclusion

Learning and applying Harmonic Elliott Wave goes beyond memorising rules or identifying patterns. It’s a new approach to market behaviour that requires practice and decision-making based on real data. Its combined nature provides clear insights, even when single-method approaches fail.

To reach this skill level, focus on learning Harmonic Elliott Wave while practising in risk-free environments, such as demo accounts. This helps improve pattern recognition and trading discipline.