Inflation is one of the most influential concepts in macroeconomics. It affects purchasing power, household welfare, and long-term financial planning. Yet not all inflation is visible. Some forms of inflation remain concealed, which raises an important question: What is hidden inflation?

Hidden inflation occurs when the price of a good or service remains the same, but its quality, volume, or weight decreases. In the following sections, we explain this phenomenon in detail and outline practical ways to recognise it.

- Hidden inflation in healthcare may appear as shorter consultation times, reduced service quality, or the use of cheaper substitute medications.

- Even digital products experience hidden inflation, such as mobile phones sold without chargers or earphones while keeping the same retail price.

- Hidden inflation gradually undermines consumer trust and can lead to long-term shifts in brand preference.

- The psychological impact of hidden inflation is often more severe than visible inflation because consumers feel misled, which affects their buying behaviour.

What Is Hidden Inflation?

According to Wikipedia, Hidden Inflation (or Stealth inflation) refers to a rise in the cost of living without any obvious increase in prices. This usually happens in markets where governments or regulatory bodies tightly control prices. To offset rising production costs, manufacturers reduce the quality, quantity, or usefulness of a product instead of raising its price.

For example, a yoghurt sold at the same price as before may appear unchanged, but the actual weight has been reduced from 500 g to 450 g.

Why Does Hidden Inflation Matter for Both Policymakers and Consumers?

For policymakers, identifying hidden inflation allows for more accurate monetary and fiscal policy decisions and helps prevent stagflation. For consumers, understanding hidden inflation makes it easier to evaluate real purchasing power and make more informed financial decisions.

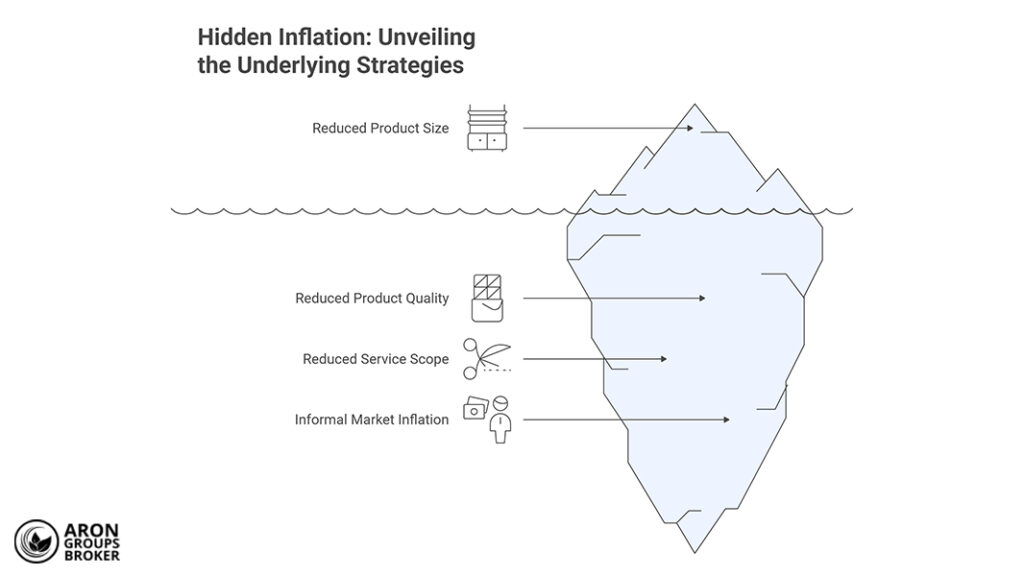

Types of Hidden Inflation

Hidden inflation can appear in several forms and is not limited to reduced product size. In practice, it reflects a set of strategies that manufacturers or service providers use to offset rising costs without visibly increasing the final price. Here are four common forms of hidden inflation.

Hidden inflation caused by price controls and shortages

When governments fix the prices of essential goods such as bread, dairy products, or fuel to protect consumers, manufacturers face a mismatch. Production costs (including raw materials, energy, and wages) continue to rise, while the selling price remains unchanged.

In these conditions, producers often have no option but to reduce weight, volume, or quality to avoid operating at a loss.

For example, a cooking oil bottle that previously contained 900 ml is now sold in an 810 ml container at the same price.

Hidden inflation caused by reduced product quality

In this form, manufacturers keep the weight or volume constant while lowering ingredient quality or production standards. Although the change is not immediately noticeable, it negatively affects consumer welfare over time.

A chocolate bar that was once made with natural butter may now be produced with cheaper vegetable oils, yet the retail price remains unchanged.

Hidden inflation driven by taxes, tariffs, and indirect costs

Governments sometimes impose indirect taxes, such as value-added tax, or raise customs tariffs. These charges increase the overall cost of goods. Instead of adjusting the sticker price, producers pass the cost on to consumers by removing included services or reducing added benefits.

For instance, a car may still be sold at the same price, but its warranty period drops from three years to two years.

Hidden inflation in services and the informal market

This form of inflation is more common in service sectors and freelance professions. Instead of raising prices, service providers may limit the scope or reduce the quality of their offerings.

A hairdresser who previously included washing and blow-drying in the price may now charge the same amount but remove those added services.

In the informal market, such as unlicensed taxis or the black market, costs often rise subtly while service quality decreases.

The Difference Between Visible Inflation and Hidden Inflation

Visible inflation occurs when the prices of goods and services increase directly, and everyone can easily observe these changes in the market. When the exchange rate rises or energy costs increase, the prices of consumer goods adjust quickly. This form of inflation is fully reflected in official indicators such as the Consumer Price Index (CPI).

Examples of visible inflation

- The price of one litre of petrol increases from USD 0.70 to USD 1.10.

- A kilogram of rice that previously cost USD 4.50 is now sold for USD 6.20.

Hidden inflation, however, is much harder to detect. This is why official statistics often fail to capture it accurately, even though consumers feel its effects directly.

Examples of hidden inflation:

- A pack of pasta still costs USD 1.20, but its weight drops from 500 g to 450 g.

- A car manufacturer keeps the same price point but removes features such as the audio system or side airbags.

- A subscription-based online service charges the same monthly fee but reduces 24/7 customer support to standard working hours.

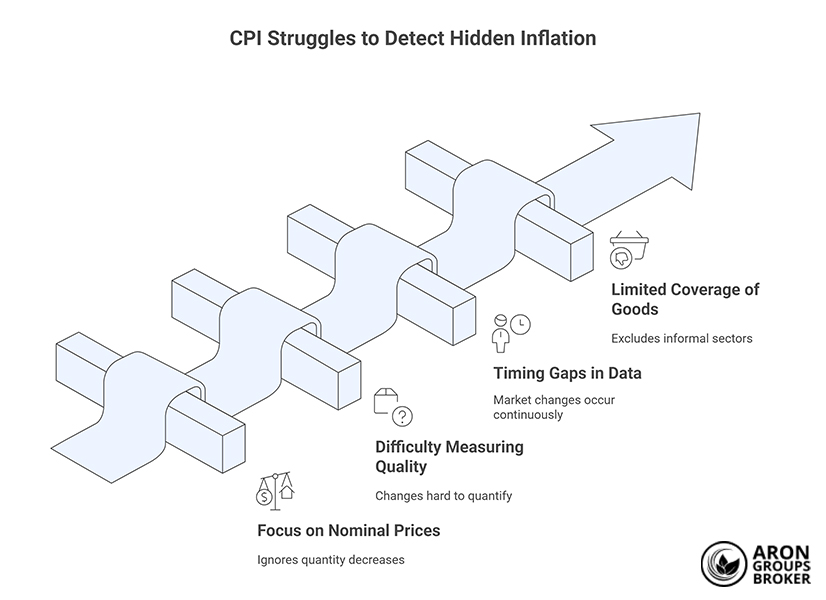

Why CPI and Other Official Indicators May Fail to Capture Hidden Inflation

The Consumer Price Index measures inflation by tracking changes in the average price of a fixed basket of goods and services over time.

However, the CPI focuses on numerical prices, not on changes in quality or quantity. When producers reduce weight, volume, or performance instead of raising prices, these adjustments are only partially reflected or not reflected at all in official inflation figures.

In simple terms, the CPI is like a thermometer that only measures temperature. It does not measure humidity or air quality, even though both affect how people feel.

Companies sometimes hide inflation by changing the unit of measurement. For example, they switch from displaying weight in “grams” to listing the number of “pieces”, making it harder for consumers to notice a reduction in quantity.

Key Reasons CPI Struggles to Detect Hidden Inflation

Focus on nominal prices

If a yoghurt container still costs USD 2.00, but its weight decreases from 1,000 g to 800 g, the CPI records this as “price stability”. Yet the consumer is effectively paying 25% more for the same product.

Difficulty measuring quality changes (Quality Adjustment)

Changes in raw materials, reduced product performance, or removal of included features such as slower internet speeds for the same package price rarely appear in official statistics because they are hard to quantify.

Timing gaps between market changes and official data

CPI data is collected monthly or quarterly, while reductions in quality or quantity occur continuously in real time.

Limited coverage of goods and services

Many informal sectors, such as unlicensed taxis or black-market goods, are not included in the CPI basket. As a result, hidden inflation in these areas remains outside official reporting.

Because of these limitations, the inflation rates published by central banks or national statistics offices are often lower than the actual inflation households experience.

Methods for Measuring and Detecting Hidden Inflation

Measuring hidden inflation is more challenging than measuring visible inflation, because price changes are not shown directly and are usually not captured fully in official statistics. For this reason, economists and statistical agencies use complementary indicators and modern data-mining tools to provide a more realistic picture of the cost of living.

Alternative Indicators and Data Sources

Beyond the CPI, several additional indicators can reveal parts of hidden inflation more effectively:

- PCE (Personal Consumption Expenditure): An index used by the US Federal Reserve that tracks household spending patterns with greater precision.

- GDP Deflator: This indicator covers all goods and services produced within the economy and can reflect hidden price changes across broad sectors.

- Local and regional indices: Data collected by municipalities or trade unions that highlight more granular changes in goods and services.

- POS transaction data: Payment information from in-store point-of-sale systems or online purchases. These daily records can reveal small, frequent changes in consumers’ shopping baskets faster than monthly surveys.

Econometric Methods

Advanced statistical modelling techniques are used to detect hidden changes in quality and price:

- Hedonic Regression: This method estimates the value of each attribute of a product, such as engine power in a car or screen quality in a smartphone. If the quality of any component decreases, the model identifies it as a form of hidden inflation.

- Chained Indices: These indices track shifts in household purchasing behaviour over time. If consumers switch to cheaper goods due to hidden price increases, the index reflects this substitution effect more accurately.

Using Field Data

One of the simplest yet most effective approaches is observing markets directly:

- Price-tracking tools and apps: Real-time recording of prices across different stores.

- Packaging and weight comparison: Monitoring changes in product weight or volume (e.g., reductions in chocolate bars or cooking oil).

- Crowdsourced reports: Consumer feedback on declining quality or reduced quantities.

How to Quantify Quality Reduction (Sampling and Specification Analysis)

Quality reduction is not always easy to recognise. Detecting it requires sampling and comparing technical specifications:

- Measuring protein levels in dairy products or the cocoa percentage in chocolate.

- Comparing changes in warranty periods or after-sales services with previous offerings.

- Laboratory testing of products such as detergents or beverages to detect changes in formulation.

The Role of Big Data and Real-Time Analytics in Revealing Hidden Inflation

With technological advances, large-scale datasets (Big Data) have become one of the main tools for monitoring hidden inflation:

- Analysing millions of daily bank-card transactions and online purchases.

- Real-time data from food-delivery apps and e-commerce platforms.

- AI-based algorithms that detect changes in product quality or shifts in consumer behaviour.

If transaction data show that households purchase smaller quantities with the same budget, or increasingly switch to cheaper brands, these patterns signal hidden inflation.

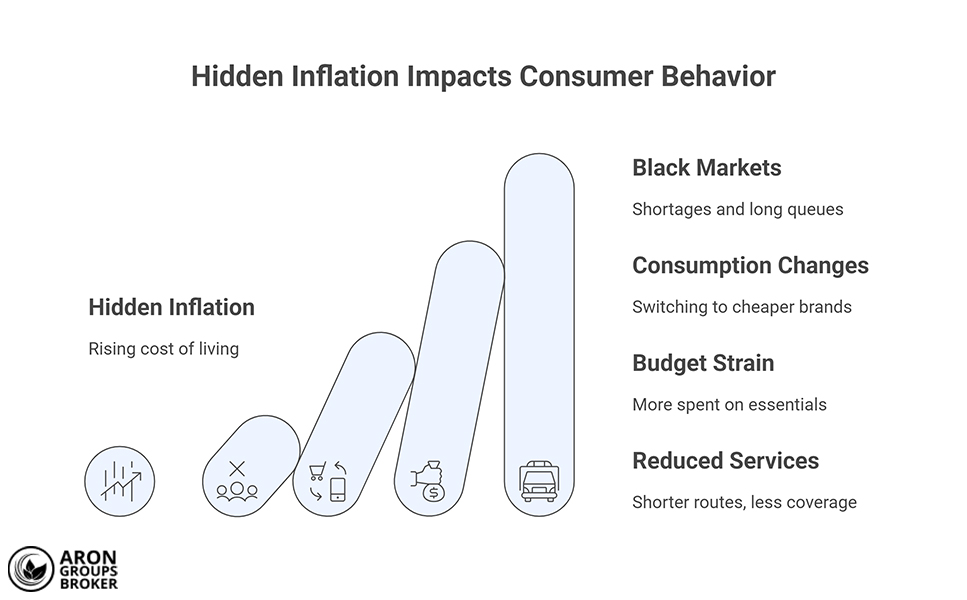

Warning Signs and Indicators of Hidden Inflation

The effects of hidden inflation often appear in consumer behaviour and market conditions. Both economists and households can identify warning signals that suggest the real cost of living is rising faster than official statistics indicate.

Black markets, queues, and repeated shortages

When governments or regulators keep the prices of essential goods artificially low, supply decreases. This leads to long queues, periodic shortages, and the emergence of black markets.

In recent years, some countries have tightly controlled the prices of fuel or poultry. In practice, people had to wait in line for hours or buy the same goods on the black market at several times the official price.

Changes in consumption patterns (switching products or brands)

When product quality declines or package sizes shrink, households gradually adjust their consumption basket. Instead of buying premium or well-known brands, they shift to cheaper brands or substitutes.

For example, if dairy prices appear unchanged but package sizes shrink, consumers may reduce their milk consumption and buy cheaper beverages to balance their budget.

A rising share of food and energy expenses in the household budget

A clear sign of hidden inflation is the growing share of essential items such as food and energy within a household’s total expenses. When income remains the same but necessities take a larger portion of the budget, real purchasing power declines.

If a household spent 30% of its income on food and energy last year but must allocate 45% of the same income to these essentials this year, they are experiencing the impact of hidden inflation.

Indirect effects: higher transport costs, reduced services, and more expensive repairs

Hidden inflation does not appear only in consumer goods. It also affects services and related expenses:

- Transport services: A taxi driver may charge the same fare but offer shorter routes or fewer services.

- After-sales services: Warranty periods or maintenance coverage may be reduced.

- Repairs: The quality of spare parts may decline while repair costs remain the same or even increase.

A more concealed consequence of hidden inflation is the shift of costs into the future. For example, construction companies may use lower-quality materials or cut corners in infrastructure projects. The building appears unchanged in price today, but the cost of repairs will be transferred to the buyer in the coming years.

Economic and Social Impacts of Hidden Inflation

The following sections explain the main dimensions of hidden inflation and its broader effects.

Impact on Household Welfare and Real Purchasing Power

When hidden inflation occurs, households receive fewer goods and services for the same income. The gradual reduction in quantity or quality lowers real purchasing power and ultimately reduces living standards.

For example, a household that could previously buy 10 essential items such as bread, rice, dairy, and cooking oil with USD 50, may now receive only eight items, often in smaller sizes or lower quality, for the same USD 50. Prices appear unchanged, yet actual welfare declines.

How Hidden Inflation Increases Income Inequality and Reshapes Consumption Patterns

According to the Institute for Fiscal Studies (IFS), hidden inflation disproportionately harms low-income households, because a large share of their income goes toward essential items such as food and energy. When quantities shrink or quality decreases, they have limited ability to switch to higher-quality alternatives. Higher-income groups, by contrast, can continue purchasing premium products, maintaining their standard of living.

A low-income household might replace red meat with poultry or even soy-based products while a high-income household continues buying high-quality cuts of red meat. Over time, these shifts deepen nutritional and welfare inequalities across income groups.

Effects of Hidden Inflation on Monetary and Fiscal Policy

Hidden inflation can distort policymakers’ understanding of economic conditions. Because official indicators such as the CPI do not fully capture it, central banks and governments may design policies based on incomplete data.

If the official inflation rate is reported at 20%, but households effectively experience 30% inflation due to hidden increases, the central bank may raise interest rates less than necessary. This underreaction can lead to excessive borrowing, increase liquidity pressure, and worsen stagflation.

Impact on Businesses, Pricing Strategies, and Long-Term Investment

Hidden inflation also harms the business environment. To survive rising costs, producers may reduce product quality or eliminate included services. While this may temporarily offset expenses, it damages consumer trust and reduces the attractiveness of long-term investment.

For example, a dairy company may lower the fat content of its yoghurt to cut production costs. Consumers might not notice initially, but over time, their satisfaction declines, leading them to switch brands. As sales fall and transparency weakens, investors become less willing to commit capital to sectors where quality erosion is common.

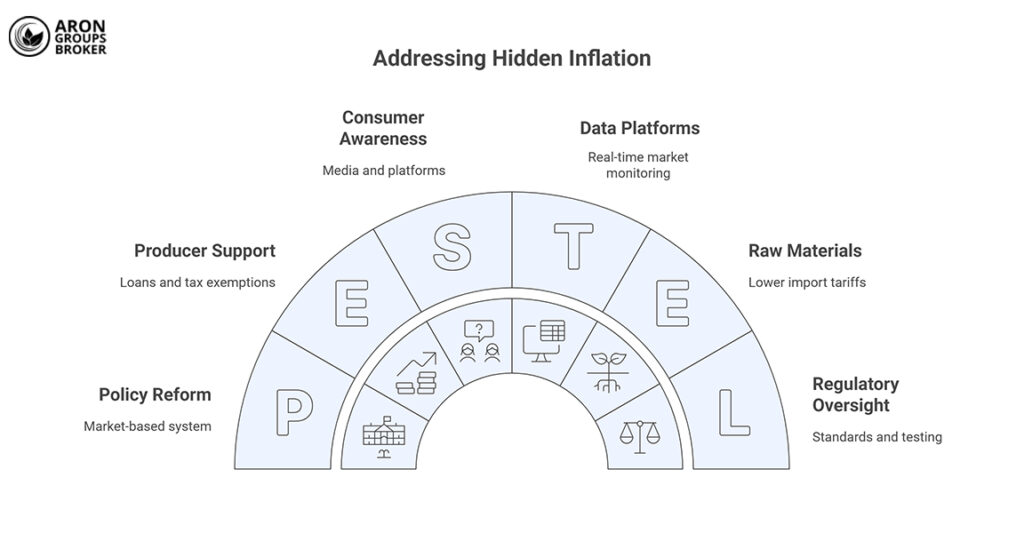

Strategies and Policies for Addressing Hidden Inflation

Although hidden inflation does not appear fully in official statistics, its impact can be reduced through greater transparency, policy reform, and more informed consumer behaviour. Solutions fall into two levels: macro-level policies (government and regulators) and micro-level actions (consumers and businesses).

Reforming Price-Control Policies

When governments artificially keep prices low, producers compensate by reducing quality or quantity. A more effective approach is shifting toward a market-based or semi-market system, where prices reflect real costs and subsidies are delivered directly to households.

Example:

Instead of setting a fixed price for bread, the government can provide direct subsidies to households so bakeries do not reduce the size of each loaf.

Transparency in Labelling and Packaging Standards

One of the simplest ways to reduce hidden inflation is to require manufacturers to display accurate weight, volume, ingredient percentages, and formula changes clearly on product packaging.

Example:

If the weight of yoghurt decreases from 1,000 g to 900 g, this reduction must be clearly printed on the packaging so consumers can make accurate comparisons.

Expanding Data Platforms and Real-Time Market Monitoring

Using Big Data and POS transaction records can reveal hidden changes more quickly. This requires cooperation between banks, retail chains, and statistical agencies.

Example:

In some countries, mobile apps collect daily prices of essential goods from multiple stores and notify users when a brand reduces its product size.

Consumer Education and Awareness

An informed consumer is one of the strongest pressures on producers to maintain quality. Media outlets and specialised platforms can raise awareness about hidden product changes and encourage smarter purchasing decisions.

Example:

Public campaigns on social media showing reduced product sizes at unchanged prices can erode trust in a brand and ultimately force manufacturers to adjust their behaviour.

Strengthening Regulatory and Laboratory Oversight

Standards agencies and consumer protection organisations should regularly test product quality and publish the results.

Example:

If the protein content of milk declines compared with previous years, this reduction should be publicly announced as a form of quality-based inflation, enabling consumers to make informed decisions.

Supportive Policies for Producers

In some cases, producers genuinely face rising costs for energy or raw materials. Governments can support them through loans, tax exemptions, or reduced import tariffs, helping them maintain product quality without shifting the burden onto consumers.

Example:

Lowering import tariffs on raw materials can prevent factories from replacing inputs with lower-quality alternatives.

In technology industries, hidden inflation may appear through shorter battery life, reduced device durability, or slower software updates. These subtle changes push users toward early upgrades and effectively increase long-term replacement costs.

How Can Consumers Detect Hidden Inflation?

Practical ways consumers can identify hidden inflation include:

- Comparing current product weight or volume with previous packaging: For example, a one-kilogram yoghurt that now sells at the same price but contains only 900 g.

- Checking quality and ingredients: A chocolate bar previously made with cocoa butter may now be produced with cheaper vegetable oils while the price remains unchanged.

- Paying attention to after-sales services and warranties: A company that once offered a 12-month warranty may now provide only six months for the same product.

- Monitoring packaging and content changes: A juice bottle may appear to be the same size, but the bottle walls become thicker, and the actual liquid volume is reduced.

- Comparing the quality of everyday services: A restaurant may keep menu prices unchanged but reduce portion size or use lower-quality ingredients.

Conclusion

Unlike visible inflation, hidden inflation does not appear through direct price increases. Instead, it shows up through reductions in quality, quantity, or included services. Because of its subtle nature, it is often underreported in official statistics, even though its impact on purchasing power, household welfare, and economic decision-making is significant.

Understanding this phenomenon helps policymakers develop a more accurate view of economic conditions and avoid ineffective policy choices.

For consumers, recognising the warning signs of hidden inflation enables smarter choices and better household budgeting.

Ultimately, addressing hidden inflation requires a combination of transparency, regulatory oversight, producer support, and public awareness. Only with these measures can prices reflect the true value of goods and services, not just their appearance.