If you are seeking multiplied returns on your investments and want to benefit from the power of leverage without directly engaging in high-risk trades, leveraged investment funds can be an attractive option.

A leveraged fund (also known as a leveraged ETF in many markets) is a financial instrument that magnifies both profits and losses in the market. This means that while it can create golden opportunities for high-return investing, it also carries the possibility of significant losses.

In this article, you will become familiar with the mechanism of leveraged funds, the different types of fund units, and the key criteria for choosing the best leveraged fund for your portfolio.

- Leveraged funds are primarily designed for short-term trading strategies, and holding them for the long term may produce results that differ significantly from the performance of the underlying index.

- The management fees and expenses of leveraged funds are usually higher than those of regular funds, and these costs must be considered when calculating the final net return.

- Inverse leveraged funds provide investors with the opportunity to profit even when the market declines.

What Is a Leveraged Investment Fund?

A leveraged investment fund is a type of mutual fund or exchange-traded fund (ETF) that uses borrowed capital or leverage (commonly 1.5X, 2X, or 3X) to increase returns.

Here, leverage refers to using borrowed money to create larger market positions. According to Investopedia, a leveraged fund may use 2X or 3X leverage to purchase more assets, or employ instruments such as futures contracts, swaps, and derivatives to generate higher returns compared to the index or stock it tracks.

As a result, if the market moves upward, the leveraged fund can achieve greater profits. However, if the market declines, the losses will also be magnified to the same extent.

For example, imagine the S&P 500 Index rises by 2% in a single day. A 2X leveraged ETF would deliver a 4% gain instead of just 2%. Now, if the index drops by 1% the following day, the leveraged fund would incur a 2% loss. Over these two consecutive days, although the index has only gained around 1% overall, the leveraged fund shows a 2% return.

This simple example demonstrates how leveraged funds amplify daily returns, both positively and negatively.

Leveraged funds are complex. They are designed for single-day holding periods. If not reset daily, their risk can increase significantly, and their performance may diverge from the benchmark.

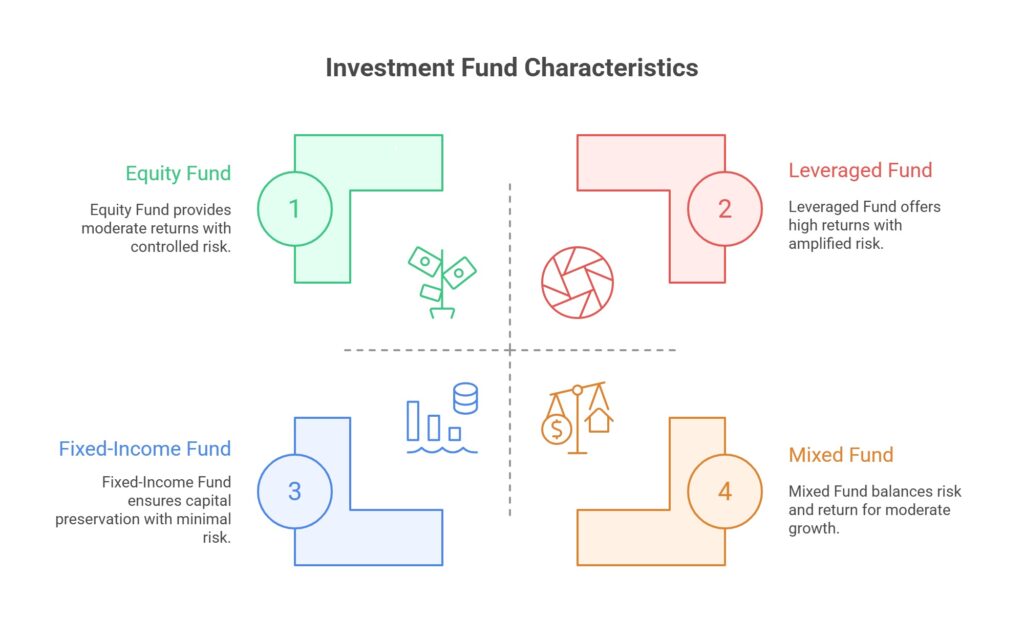

Leveraged Investment Funds Vs. Other Types of Funds

Because leveraged investment funds use financial leverage, they have significant differences compared to other types of funds. In the following sections, we will examine the differences between a leveraged fund and equity funds, fixed-income funds, and balanced funds.

Difference Between Leveraged Funds and Equity Funds

Equity funds, as the name suggests, are based on purchasing company stocks with the goal of earning profits from stock price appreciation. In these funds, investors allocate their capital across various companies’ shares to benefit from the growth of those stocks. Equity funds typically offer a balanced level of return and risk.

In contrast, a leveraged investment fund uses leverage to magnify its returns. This means that if the market moves upward, the returns of a leveraged fund can be several times higher than those of an equity fund. However, if the market declines, the losses of the leveraged fund will also be magnified to the same extent.

Therefore, leveraged funds are more appropriate for investors with higher risk tolerance, as they are willing to accept the possibility of larger losses in exchange for potentially amplified gains.

Difference Between Leveraged Funds and Fixed-Income Funds

Fixed-income funds focus on investing in securities with a fixed return, such as bonds or bank deposits. The main objective of these funds is capital preservation and earning profit with the lowest possible risk.

As a result, the returns of fixed-income funds are usually stable, predictable, and lower compared to equity funds or leveraged funds. These funds are suitable for investors with a low risk tolerance, who prefer fixed and reliable income streams rather than exposure to high market volatility.

Difference Between Leveraged Funds and Balanced Funds

Balanced funds are a mix of stocks, bonds, and various asset classes with the goal of balancing risk and return. These funds generally seek to achieve a reasonable level of profit by diversifying across multiple asset categories, and they carry less risk compared to equity funds and leveraged funds.

For this reason, balanced funds are more appropriate for investors who prefer lower risk and more stable returns. In contrast, leveraged funds amplify both gains and losses through financial leverage, making them better suited for short-term, risk-seeking investors who are looking for higher potential returns despite the risk of greater losses.

| Fund Type | Mixed Fund | Fixed-Income Fund | Equity Fund | Leveraged Fund |

|---|---|---|---|---|

| Feature | Balance between risk and return | Capital preservation and fixed income | Profit from stock growth | Enhanced returns through leverage |

| Main Objective | Combination of stocks and bonds | Fixed-income securities(e.g., bonds) | Stocks | Stocks /derivatives |

| Asset Type | Moderate to low | Very low | Moderate | High (amplified profits and losses) |

| Risk Level | Reasonable and stable | Stable and predictable | Dependent on stock growth | Multiple times the base index |

| Return | Moderate and sustainable | Fixed and predictable | Linked to stock growth | Magnified relative to the benchmark |

| Best Suited For | Investors with a balanced outlook | Conservative, risk-averse investors | Long-term investors | Short-term, high risk-tolerant investors |

Preferred Units of a Leveraged Fund and Their Role in Investment

Leveraged investment funds issue special units called preferred units (high-risk) as well as ordinary units (risk-free) in order to attract investors with different levels of risk tolerance.

Preferred units, which serve as the backbone of the fund’s capital structure and play a crucial role in risk and return distribution among investors, are divided into two main categories: Type I Preferred Units and Type II Preferred Units.

Type I Preferred Units (Capital Committers)

Type I preferred units are allocated to the founders of the fund and are issued at the time of its establishment. These units are structured as ETFs and are non-redeemable. Holders of Type I preferred units also have voting rights in the fund’s general assemblies.

Type II Preferred Units (Leverage Seekers)

Type II preferred units are designed for investors seeking higher returns while accepting greater levels of risk. Holders of these units gain exposure to financial leverage, which allows them to experience amplified profits or losses in relation to the underlying index or asset.

These units are also structured as exchange-traded funds (ETFs) and are non-redeemable, but unlike Type I, their holders do not have voting rights in the fund’s assemblies.

Difference Between Preferred Units and Ordinary Units in a Leveraged Fund

Ordinary units are the Risk-free units in a leveraged investment fund that provide a fixed range of returns regardless of the overall fund performance (for example, between 25% and 30%).

If the fund delivers a negative return, holders of ordinary units still receive the minimum guaranteed return of 25%. However, if the fund generates a return above 30%, ordinary unit holders do not receive more than the maximum return cap of 30%.

In contrast, preferred units have neither a minimum guaranteed return nor a maximum return cap.

If the performance of the leveraged investment fund falls below the minimum guaranteed return set for the ordinary (Risk-Free) units, the profit for those units is covered by the pool of preferred units. Conversely, if the fund’s return exceeds the maximum return cap, the excess profit is allocated to the holders of preferred units.

A leveraged inverse ETF seeks to generate profits when the underlying index is declining. In other words, when the benchmark index falls, the value of the leveraged inverse fund increases, allowing investors to benefit from a bearish market or a general decline in asset prices.

How a Leveraged Fund Works in Practice

Leveraged investment funds are designed to multiply the return of an underlying index or asset by using financial leverage. Their primary goal is to replicate the daily or periodic performance of an index (such as a stock market index or a commodity asset) with a multiplier, typically 2x or 3x.

Practical Example of Leveraged Fund Performance

Suppose a stock market index rises by 2% in a single day:

- If you are a shareholder in a regular equity fund, your return will be about 2%;

- But if you are an investor in a 2x leveraged fund, your return will be 4%.

Now, imagine the index falls by 2% the following day:

- The ordinary equity fund will lose 2%;

- But the 2x leveraged fund will suffer a 4% loss.

Over these two days, the index has essentially returned close to its initial level (net change near zero). However, the investor in the leveraged fund ends up with a net loss.

This simple example highlights that leveraged funds are more efficient for short-term trading strategies, while in longer investment horizons they should be approached with caution due to the compounding effect of daily returns and increased volatility.

Mechanism of Leverage Creation in a Fund

The creation of leverage in leveraged funds is usually carried out in two main ways:

- Use of Derivative Instruments: The fund can purchase futures contracts or options to take positions whose value is several times greater than the fund’s actual assets.

- Issuance of Preferred Units: A significant portion of the capital in a leveraged investment fund is raised through preferred units. This capital is then used to create credit capacity and purchase additional assets.

The leverage ratio of a leveraged investment fund is derived from the proportion of ordinary units to preferred units. For example, if the number of ordinary units in the fund is twice the number of preferred units, the fund’s leverage ratio is considered to be 3x.

How Profits and Losses Are Distributed Among Investors

In a leveraged fund, profits and losses are distributed unevenly between holders of preferred units and holders of ordinary units:- Preferred units receive variable profits and losses that depend directly on market performance. Because of leverage, these units can generate multiple times the gains or losses of the underlying index.

- Ordinary units generally provide fixed, low-risk returns. Even if the market declines, ordinary units have repayment priority.

Advantages and Disadvantages of Investing in a Leveraged Fund

Like any other investment method, a leveraged investment fund also comes with its own advantages and limitations. Below, we’ll explain them in detail.Advantages of Investing in a Leveraged Fund

The advantages of investing in a leveraged fund are:- Amplified returns: Potential for 2x or 3x profits relative to the underlying asset in the short term;

- Easy access: Investors can gain leveraged exposure without engaging directly in margin trading or futures contracts;

- Strategy diversification: Availability of both bull (long) leveraged funds and inverse leveraged funds, enabling profit opportunities in all market conditions.

Disadvantages of Investing in a Leveraged Fund

The disadvantages of investing in a leveraged fund are:- High risk of loss: Just as profits are amplified, so are losses when the market moves against you;

- Unsuitable for long-term investing: Because of daily or periodic resets, the performance of a leveraged fund may diverge from its benchmark index over longer horizons;

- Complex risk management: Due to the need for frequent rebalancing and resets, leveraged funds require advanced knowledge of investing and effective risk management strategies.

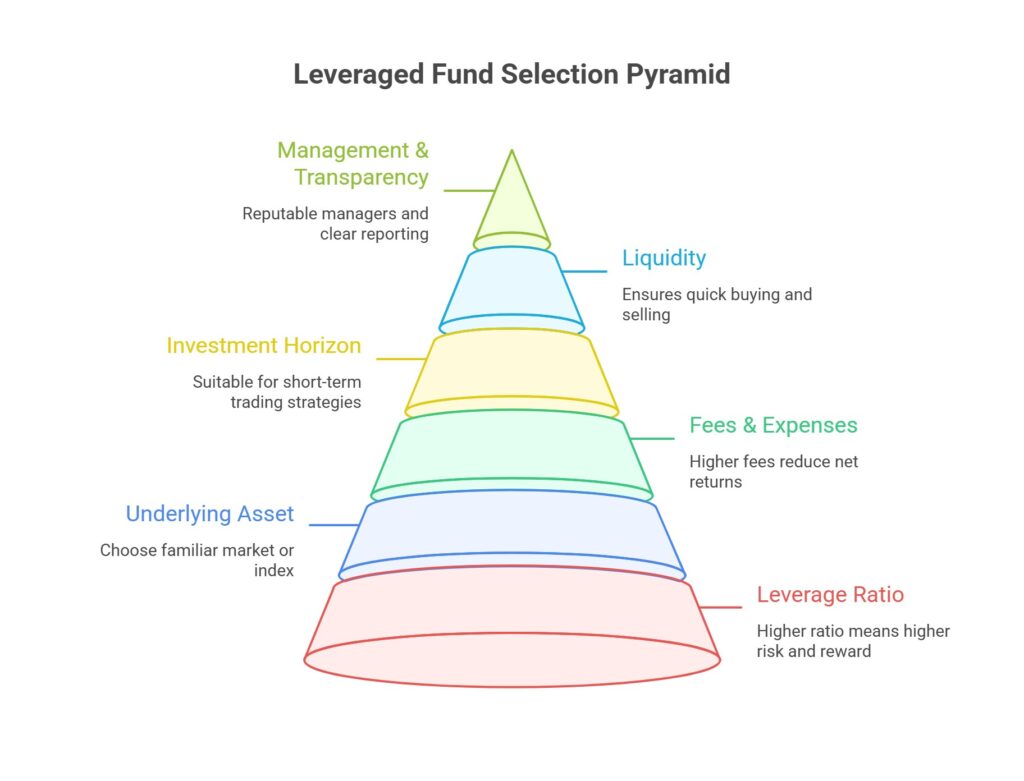

Criteria for Choosing the Best Leveraged Fund

Selecting the right leveraged investment fund requires evaluating several key criteria so that investors can strike a balance between higher returns and proper risk management. These criteria include:

- Leverage ratio: Check whether the fund is 2x or 3x. The higher the ratio, the greater both potential profits and losses.

- Underlying index or asset: It is best to choose a fund that tracks an index or market you are already familiar with.

- Fees and expenses: Leveraged funds generally charge higher fees compared to regular funds; excessive costs can reduce your net returns.

- Investment horizon: These funds are primarily designed for short-term trading strategies. If you have a long-term outlook, they may not be the right choice.

- Liquidity: Review the trading volume and number of investors in the fund. Higher liquidity ensures you can quickly buy or sell when needed.

- Management and transparency: Funds with transparent reporting, reputable managers, and a verifiable track record of performance are generally better options.

Conclusion

Leveraged funds are powerful financial instruments that provide investors with the opportunity to achieve multiplied profits by using financial leverage. However, the high risks and complexity involved mean that only those with sufficient knowledge of leverage, risk management, and short-term strategies should consider them.

Making a smart and informed choice of fund can ultimately determine the difference between a successful investment and a costly experience.