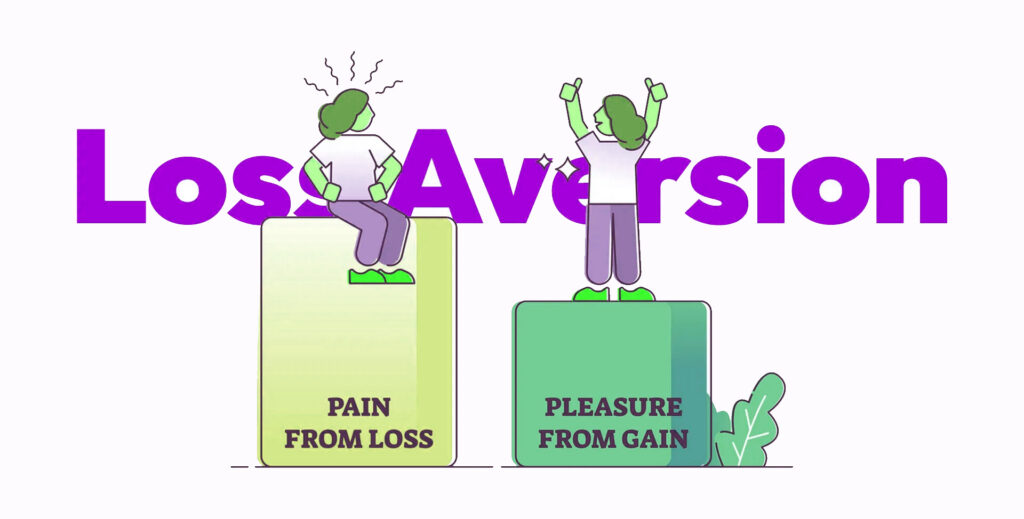

Why is it so difficult to close a losing trade, but so easy to cash in on a small gain? The answer lies in a concept called “loss aversion bias.” This is a cognitive tendency where the pain of a loss feels approximately twice as intense as the pleasure of an equivalent gain. This feeling pushes our market decisions away from a logical path.

This concept is the foundation of “Prospect Theory,” and it explains why humans exhibit different and sometimes irrational behavior when faced with a loss.

- Loss aversion has its roots in human evolution, helping us avoid deadly dangers. However, in financial markets, it has become a significant obstacle.

- Novice traders, due to their lack of experience and emotional control, are more susceptible to this bias.

- Visualizing a potential loss before entering a trade can help improve emotional management and adherence to your plan.

- Using trading bots or semi-automated strategies can reduce emotional interference in critical decisions.

- Constantly checking a trade's profit and loss amplifies loss aversion and leads to impulsive decision-making.

What Is Loss Aversion Bias?

Loss aversion bias is when our minds view losses much more seriously than gains of the same size Simply put, the pain of losing $10K is usually about twice as intense as the pleasure of gaining the same amount. For this reason, people often won’t accept an even-money risk unless the potential gain is roughly double the potential loss.

Imagine someone offers you a coin flip: you either win $100 or lose $100. Most people would reject this gamble. However, if they offer you $200 for a win versus a $100 loss, many more people would be willing to accept it. This example clearly illustrates how potential losses loom larger than gains in our minds.

Why Is Loss Aversion Important in Trading?

Loss aversion impacts traders’ performance for three main reasons:

The Destruction of the Risk/Reward Ratio

Loss aversion causes two destructive behaviors in traders: “letting losses run” and “cutting winners short.” As a result, your average losses become large while your average gains become small.

Even with a high win rate, this behavior can undermine the overall profitability of your strategy. This pattern, known as the “disposition effect,” has been documented repeatedly in financial studies and shows how ignoring stop-loss and take-profit levels ruins the risk/reward ratio.

Emotional and Excessive Trading

When the fear of loss combines with overconfidence, a trader is driven to “overtrading” to make up for their losses quickly. These emotional and impulsive entries and exits not only reduce portfolio efficiency but also increase trading costs.

Extensive research on brokerage accounts shows that the most active traders generally have lower returns than the market and other investors.

Irrational Risk Judgment

According to Prospect Theory, people become more cautious when they are in profit and are quick to cash in their gains (loss aversion in gains). However, when they are in a loss, they become more adventurous and take on greater risks (risk-seeking in losses).

For example, they might move their stop-loss or “average down” on a losing trade. This behavioral shift causes them to deviate from their risk management plan and make irrational decisions.

Loss aversion bias often leads traders to exit profitable trades too early in the short term, and over the long term, it causes psychological burnout.

Signs You Are Caught in the Trap of Loss Aversion

Loss aversion manifests itself through the following behaviors. If you notice these signs in yourself, you have likely fallen prey to this bias:

- Manipulating your stop-loss: You move or completely remove your stop-loss because you believe the market “has to” turn around.

- Cutting profits short: You quickly close a profitable trade, even if it has the potential for further growth.

- Fixating on the breakeven point: Instead of focusing on market trends and structure, your main goal becomes simply exiting the trade at breakeven.

- Engaging in wishful thinking: You tell yourself things like, “This trade is definitely going to come back,” instead of looking at it logically.

- Averaging down without a plan: When a trade is in a loss, you add to your position size without a clear strategy to lower your average price.

- Relying on a mental stop-loss: Instead of using a real, automated stop-loss, you tell yourself, “I’ll close it if it reaches that price,” which often doesn’t happen.

- Increasing position size for revenge: After a few losses, you suddenly increase your lot size to make up for the losses.

- Cherry-picking information: You only look for news and analysis that confirm your own viewpoint and ignore conflicting evidence.

The Link Between Loss Aversion and Other Cognitive Biases in Trading

Loss aversion rarely acts alone; it usually combines with several other cognitive biases that push our decisions away from our trading plan. This combination of biases with loss aversion typically leads to two destructive behaviors: “letting losses run” and “cutting winners short.”

Changing the physical trading environment (such as lighting, sound, or distance from the monitor) can to some extent reduce the intensity of loss aversion.

Confirmation Bias and Its Role in Amplifying Loss Aversion

Confirmation bias is the tendency to seek out and interpret information that confirms your existing beliefs while ignoring contradictory evidence.

In the market, this cycle works as follows:

- When a position moves into a loss, loss aversion makes the pain of closing the trade feel immense.

- To lessen this pain, your mind seeks out favorable evidence, such as news or indicators that confirm the price will likely reverse.

- As a result, signals that invalidate your scenario (like a broken support level) are downplayed, and you stay in a bad trade for too long.

Countermeasures

- Before entering a trade, define your “invalidation criteria,” the conditions that would make your trade idea invalid.

- Add a section for “contradictory evidence” to your trading journal and always record at least two opposing data points.

- Use a pre-exit checklist and exit the trade without hesitation if you see conflicting signals.

The Difference Between Anchoring Bias and Loss Aversion

These two concepts are often confused, but they have key differences:

- Anchoring Bias: This is when you cling to a specific reference point, such as your purchase price or a previous all-time high, and base all your judgments on it.

Example: “I won’t sell until it gets back to my entry price.”

- Loss Aversion: This is when your behavior changes due to the “pain of loss,” making you more risk-seeking when you are in a loss and more risk-averse when you are in profit.

Example: “I’m removing my stop-loss so my loss doesn’t become final.”

How to Tell Them Apart

- If your decision changes when you hide your entry price, the dominant issue is anchoring.

- If the data remains the same but the fear of a loss becoming final is what keeps you in the trade, the dominant issue is loss aversion.

Solution

- Hide your entry price on your chart or watch list. Instead, use key market structure points (like highs and lows) for analysis.

- Use automatic, tamper-proof stop-loss orders.

- Regularly review your trading journal, analyzing metrics like the number of times you’ve adjusted your stop-loss and the ratio of time you hold winning trades versus losing ones.

How to Overcome Loss Aversion

Overcoming loss aversion isn’t about fighting your emotions; it’s about building a disciplined trading system. There are three main strategies to achieve this:

Disciplined Stop-Loss and a Pre-Planned Exit Strategy

- Set your stop-loss before you enter: Before entering any trade, clearly define your stop-loss, position size, and risk/reward ratio. Don’t let emotions interfere with your decision-making.

- Use automated orders: Use limit or stop orders. This delegates the execution of your stop-loss to the system, minimizing the chance of manual interference.

- Establish mechanical rules: Use rules like a trailing stop or a staged exit to prevent impulsive, moment-to-moment decisions from derailing your plan.

Research on trader behavior shows that experiencing past losses—even in simulations without real money—can trigger the loss aversion bias.

Analyze Your Trading Journal for Behavioral Biases

- Log every trade: For each trade, record the initial plan, your risk management strategy, the actual execution, and any potential biases (like loss aversion) that may have influenced your decisions.

- Generate periodic reports: Every one to three months, review a report on your biases. Measure your rate of “cutting winners short” and “letting losers run” to identify and correct your destructive patterns.

Implement Risk Management with a Numerical Framework

- Set a risk cap per trade: Limit the maximum risk for each trade to a fixed percentage of your capital (e.g., 0.5% to 1%).

- Have rebalancing rules: Establish clear rules for rebalancing your portfolio and managing your overall account risk so that no single trade can determine the fate of your entire capital.

- Use fixed frameworks: Using fixed ratios for capital allocation can help minimize the emotional impact of temporary losses.

Conclusion

Loss aversion is a natural bias in the human mind, but its naturalness is no reason to surrender to it. Prospect Theory tells us that we become cautious when in profit and adventurous when in a loss. This behavioral shift can destroy our profitability, especially when it leads to holding on to losses and closing profitable trades too soon.

However, with three simple yet powerful strategies, adhering to a stop-loss, analyzing your trading journal, and applying quantitative risk management, you can take control of your trades. By doing so, you can transform the fear of losing into the discipline of preserving capital.