How many times has it happened that after a few successful trades, you suddenly felt invincible—like nothing could stop you? That’s exactly where overconfidence in trading sneaks in; a hidden enemy that lures many traders, right after a series of sweet profits, into risky decisions and costly mistakes.

If you want to learn how to recognize this psychological trap and rise above it, keep reading.

- Recent profits are not necessarily a sign of trading skill; sometimes they are merely the result of luck or temporary market conditions.

- Sticking to your trading plan and applying solid risk management remain the most powerful weapons against overconfidence in trading.

- Using tools such as backtesting, forward testing, and purposeful demo trading is the best way to strengthen mental discipline and prevent emotional decision-making.

What Is Overconfidence in Trading?

Overconfidence in trading is one of the most common psychological traps in financial markets, often affecting traders after a series of winning trades. In this state, a trader may start to believe that recent profits reflect superior skill and that they can predict or control the market with certainty. This false sense of mastery gradually leads them to ignore risk management rules, increase position sizes, or make decisions without proper analysis.

The core problem with overconfidence is that it deceives the trader’s mind. Past profits do not necessarily indicate high-level skill or guarantee future success—they can just as easily be the result of temporary market conditions or pure luck. When traders fail to recognize this reality, the first significant loss often wipes out a large portion of their gains and leaves them under heavy psychological pressure and frustration.

Genuine confidence in trading comes from experience, discipline, and strict adherence to a well-defined strategy, while overconfidence stems from the excitement of short-term gains. Recognizing this difference is essential for every trader in order to avoid self-deception and stay on the path toward sustainable success.

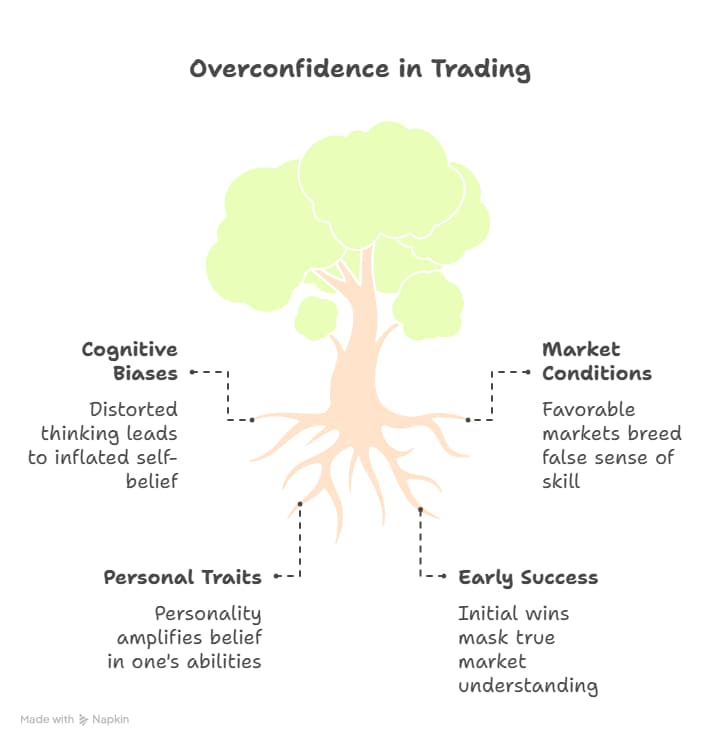

Roots and Causes of Overconfidence in Trading

Overconfidence in trading arises from a combination of cognitive biases, market conditions, and individual traits—a phenomenon that often pushes traders to act against sound risk management principles and logical strategies. To understand this issue more clearly, it’s essential to examine the key factors behind it.

Cognitive Biases and Mental Errors Driving Overconfidence

One of the most common roots of overconfidence is cognitive bias. For example, confirmation bias leads traders to focus only on information that supports their analysis or predictions while ignoring contradictory signals. Another example is the illusion of control, where a trader falsely believes they can directly influence or predict market movements. These mental errors create a dangerous sense of certainty, often driving traders into high-risk positions with unwarranted confidence.

Market Conditions and Their Role in Shaping Overconfidence

Sometimes specific market environments amplify overconfidence. For instance, in a strong bull market, almost every buy position appears profitable. In such conditions, even novice traders may generate consistent wins, which can give them the false impression that their skills are exceptional. However, once market conditions shift—whether through heightened volatility or the onset of a bear phase—the weaknesses in their strategies and decision-making become painfully obvious.

Individual Traits and Psychological Factors Contributing to Overconfidence in Trading

A trader’s personality and psychological makeup play a significant role in the development of overconfidence. For instance, traders with a high risk appetite or a strong inclination toward excitement are more likely to fall into this trap. Moreover, the inability to control emotions such as greed or fear can lead individuals—especially after a few small wins—to develop a false sense of power and control over the market.

Early Successes and the Impact of Incomplete Learning on Overconfidence

Many novice traders experience a string of profitable trades at the very beginning of their journey. Instead of teaching them the importance of risk management and discipline, these early wins often foster an illusion of superiority and mastery. In reality, because their learning process is incomplete and they haven’t yet faced significant losses or real market stress, they mistakenly believe their success is purely the result of skill. This cognitive error frequently pushes them toward taking on larger, riskier trades—decisions that rarely end well.

How to Identify Signs of Overconfidence in Trading

َAccording to Kaancaliskan, Overconfidence in trading often develops after a series of consecutive wins and can push traders toward high-risk decisions. The main warning signs include:

- Taking oversized positions while neglecting proper risk management.

- Ignoring stop-loss orders under the false assumption that the market will always reverse.

- Entering trades hastily and emotionally without a clear strategy.

- Misinterpreting recent profits and attributing them solely to personal skill.

Recognizing these signals helps traders adjust their behavior before significant losses occur and re-align with the core principles of risk management and capital preservation.

Common Mistakes Traders Make When They Fall Into Overconfidence

Overconfidence in trading often drives traders toward decisions that may seem logical on the surface but, in practice, put their capital at serious risk. The most common mistakes in this situation include:

- Excessive Use of Leverage

Traders influenced by recent profits often open positions with disproportionately high leverage. While this can amplify potential gains, it also dramatically increases the risk of a margin call and account wipeout. - Revenge Trading After a Series of Wins

According to ForexWink, revenge trading is an emotional reaction in financial markets where a trader, after experiencing a loss—or even after a string of profitable trades—jumps into impulsive, unplanned positions to quickly recover losses or boost profits. In such cases, decisions are driven not by rational analysis but by emotions like anger, greed, or pride.

The outcome is typically a loss of control over risk, oversized positions beyond the account’s tolerance, and ultimately heavier drawdowns. This is why revenge trading is considered one of the most dangerous psychological traps in trading. - Ignoring Trading Rules

When overconfidence takes over a trader’s mindset, they often begin to disregard their own strategy rules. Common habits at this stage include entering trades without proper signal confirmation or removing stop-loss orders altogether—both of which expose the account to unnecessary risk. - Trading on Rumors and News Without Analysis

Recent profits can lead traders to react impulsively to any market rumor or headline, without evaluating whether the news truly carries fundamental or technical significance. This behavior often results in poorly timed entries and unnecessary exposure to volatility. - Closing Profits Too Early or Holding Losing Positions Too Long

Overconfidence sometimes pushes traders to close winning trades prematurely, fearing a potential pullback, or conversely, to hold onto losing trades in the hope that prices will eventually reverse. Both actions undermine account stability and erode long-term profitability.

Practical Strategies for Controlling and Managing Overconfidence in Trading

To combat this psychological trap, traders need to adopt a set of practical and sustainable actions:

Develop and Follow a Consistent Trading Plan

Having a well-defined trading plan that outlines entry and exit conditions, risk management rules, and position sizing guidelines is the most effective defense against emotional and impulsive decisions.

Position Size Management

Trade size should always be aligned with account equity and acceptable risk levels. Professional traders rarely risk more than 1–2% of their capital on any single trade, ensuring long-term account sustainability.

Set Daily and Weekly Loss Limits

By defining a maximum daily or weekly drawdown limit, traders can avoid revenge trading and emotional decision-making. Once this limit is hit, trading activity should stop to allow time for mental reset.

Smart Use of Stop-Loss and Trailing Stop

Stop-loss orders and trailing stops help contain losses and lock in profits gradually. These tools are fundamental to risk management, especially in volatile market conditions.

Leverage Automation and Algorithmic Trading

Automated trading systems and algorithmic strategies can remove emotional interference from trading decisions. When trades are executed based on predefined rules, the risk of errors driven by overconfidence is significantly reduced.

Feedback System and KPIs Every Trader Should Track

One of the biggest challenges for traders struggling with false confidence is the lack of a structured feedback system. When trading data isn’t accurately recorded and analyzed, a trader can’t determine whether their recent success came from skill or just luck. Using Key Performance Indicators (KPIs) in trading helps you gain a clearer picture of the true quality of your decision-making and strategy.

Key Trading Performance Metrics

Maximum Drawdown:

Maximum drawdown shows the largest decline in your equity from a peak to a trough. It’s one of the best measures for assessing real risk in trading. If your drawdown is too high, even with a strong win rate, the chances of blowing up your account are significant.

Average Return per Trade:

This metric indicates the average percentage of profit or loss you generate per trade. For example, if over 100 trades your average return is 0.5%, it means your trading system has managed to deliver steady and reasonable returns over the long term.

Win Rate:

Win rate is the percentage of winning trades compared to the total number of trades. While a high win rate may sound appealing, it’s not a standalone measure of success. Combining win rate with the risk-to-reward ratio gives a much more accurate picture of strategy quality.

Expected Value per Trade:

Expected Value calculates whether your strategy is profitable over the long run. This KPI combines win rate with the average size of wins and losses, showing whether repeating the same strategy across many trades would result in a net positive or negative outcome.

The Role of Backtesting and Forward Testing in Controlling False Confidence in Trading

One of the most common reasons traders develop false confidence is relying on a handful of winning trades without any statistical or tested foundation. To turn a strategy into a reliable and profitable tool, its performance must be thoroughly evaluated under different market conditions. This is where the importance of backtesting and forward testing comes into play.

Backtesting means testing a strategy on historical market data. By doing this, a trader can see how the strategy would have performed in the past—whether it would have generated profit or loss. The results of a backtest help identify weaknesses in the trading system and prevent traders from relying on random, short-term outcomes.

On the other hand, forward testing is conducted in a demo account or with small real positions to assess the strategy’s performance in live market conditions. This stage is crucial because a strategy that worked in the past may lose effectiveness in the present due to changing market dynamics.

Practical Example

Imagine a beginner trader designs a simple strategy for trading GBP/USD:

- Every time the price crosses above the 50-period moving average (MA50), they enter a long position.

- The stop-loss is placed just below the most recent swing low.

Step 1: Backtest

The trader tests this strategy on the past 3 years of data, and the results look like this:

- Number of trades: 200

- Win rate: 60%

- Risk-to-reward ratio: 1:1.5

- Maximum drawdown: 15%

At first glance, these results look promising, and the trader feels they have built a strong strategy.

Step 2: Forward Test

To be more certain, they run the same strategy in a demo account for the next 2 months. This time they realize:

- The win rate has dropped to 45%.

- During major economic news releases (e.g., interest rate decisions or NFP reports), the strategy performed poorly, triggering multiple consecutive stop-losses.

- The drawdown increased to 20% in just a short period.

Conclusion from the Tests:

This comparison shows that while the strategy was acceptable under past market conditions, it isn’t effective enough in the current environment with higher volatility. If the trader had relied only on a few recent winning trades, they would have developed false confidence and entered real trades with heavy positions. But thanks to the backtest and forward test, they realized the strategy needs adjustments, such as:

- Using a higher time-frame filter for entries,

- Avoiding trades during major news events,

- Improving the risk-to-reward ratio (e.g., at least 1:2).

In this way, backtesting and forward testing act like a brake system, preventing impulsive decisions and protecting the trader from false confidence.

Combining backtesting and forward testing creates a psychological safety net for traders. When you know your strategy has proven itself both in the past and under current live conditions, you’re less likely to fall into the traps of overexcitement, greed, or false confidence.

Purposeful Demo Trading Under Pressure and Simulated Constraints to Control False Confidence in Trading

Many traders see demo accounts merely as a tool to get familiar with the trading platform or for basic practice. But the truth is, if demo trading is used purposefully—with real-life pressure and limitations—it can become one of the most effective tools for controlling false confidence in trading.

In a demo account, since no real capital is at risk, traders often trade carelessly, which leads to the development of bad habits. To prevent this, you need to simulate your demo environment so that it mirrors real market conditions as closely as possible. This includes:

- Setting daily or weekly loss limits in demo trading: Just like in a live account, establish financial boundaries for yourself. If you hit your loss limit, stop trading for the day.

- Managing position sizes based on simulated equity: Instead of opening oversized, unrealistic trades, adjust your lot sizes according to your assumed account balance.

- Trading during major news releases: By putting yourself in high-volatility situations (such as NFP or CPI announcements), you’ll learn how to make decisions without emotional overreactions.

- Limiting the number of trades per day: This simple rule prevents overtrading and pushes you toward selecting higher-quality setups.

Conclusion

False confidence in trading is more of a psychological trap than a technical error. It can easily override risk management rules and put your account at serious risk. However, with self-awareness, trade journaling, and strict adherence to principles, you can prevent it. A successful trader isn’t the one who always wins, but the one who remains logical and disciplined—even after several consecutive wins.