When discussing the relationship between the dollar and oil, the petrodollar system is a key concept. This explains how the U.S. dollar became the primary currency in oil transactions, influencing the global economy.

Understanding what the petrodollar is and its role in global economic and energy policies helps us grasp the dollar’s dominance. If you want to know how this connection formed and its consequences, continue reading. You’ll gain a clearer view of its future role and importance.

- Petrodollars refer to U.S. dollars received by oil-exporting countries in exchange for selling oil.

- For many OPEC members and other oil exporters, petrodollars are the primary source of income.

- Oil sellers settle transactions in dollars, as it is the most widely used currency and facilitates investment of export earnings.

- Some oil exporters, like Russia, China, and Venezuela, facing U.S. sanctions or geopolitical tensions, seek alternatives to the petrodollar system.

What is the Petrodollar and Why Does it Matter?

When oil-exporting countries sell oil to global markets, they receive U.S. dollars in return. This is why these earnings are called petrodollars.

Why is the Petrodollar Important?

Receiving dollars for oil sales is not just a simple exchange; it creates an extensive network of economic and financial relations. The impact of this system is felt globally. Below, we explain some of its effects on the global economy.

Global Demand for the Dollar

The use of the dollar in oil transactions ensures constant demand for this currency. Even countries with no direct ties to the U.S. must obtain dollars to buy oil. This has made the dollar the world’s primary reserve currency.

U.S. Economic and Political Power

The petrodollar cycle allows the U.S. to more easily finance its trade and budget deficits. Countries return their petrodollars to U.S. financial markets, boosting America’s financial strength and political influence.

Influence on Energy and Financial Markets

Any change in oil pricing, such as a country selling oil in euros or yuan, can impact the dollar’s value and global market stability. This is why the “end of the petrodollar” or “new competitors to the petrodollar” are always sensitive geopolitical topics.

Role of the Petrodollar in Oil-Producing Countries’ Currency Reserves

Countries like Saudi Arabia, the UAE, or Russia hold a large portion of their reserves in dollars. These reserves not only give them economic leverage but also create dependence on the dollar.

History of the Petrodollar System

The history of the petrodollar traces back to the economic changes after World War II. In 1944, the Bretton Woods system was established at a conference with 44 countries. This system pegged the U.S. dollar to gold at a fixed rate of $35 per ounce, while other currencies were tied to the dollar.

This system worked well until the 1960s, but rising U.S. budget deficits, the Vietnam War, and declining gold reserves put pressure on the dollar.

In 1971, President Richard Nixon announced the Nixon Shock, ending the dollar’s convertibility into gold. This led to the collapse of the Bretton Woods system and a decline in the dollar index. This move, made due to a lack of gold to back circulating dollars, set the stage for significant changes.

In 1973, following the Yom Kippur Oil Crisis, the U.S. signed a historic agreement with Saudi Arabia. According to this deal, Saudi Arabia agreed to sell oil only in dollars, while the U.S. provided military and political support. This model quickly spread to other OPEC countries, forming the petrodollar system.

By 1975, all OPEC members priced oil in US dollars, restoring global dollar demand and reinforcing its role as the world’s dominant trade currency. This agreement, designed by Henry Kissinger, was a pivotal moment in the petrodollar’s history, strengthening U.S. financial dominance.

How Does the Petrodollar System Work?

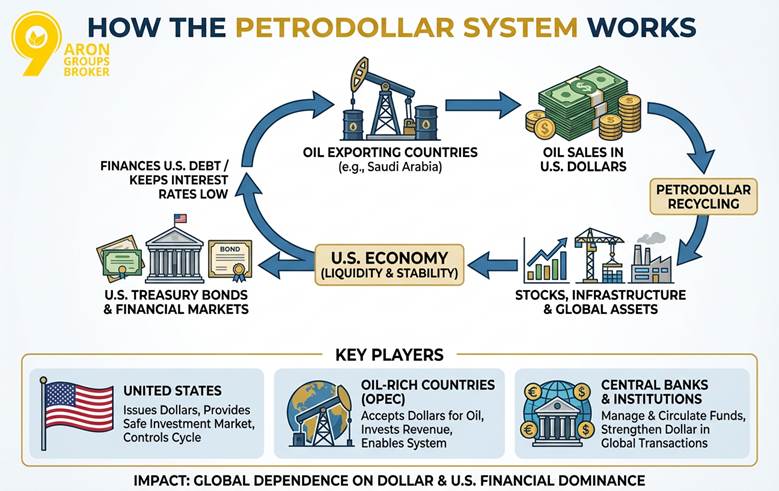

Understanding the petrodollar system helps explain why the U.S. dollar remains central in global trade. Oil is traded only in dollars, creating a constant demand for the currency and solidifying U.S. power in the global economy.

The impact of this process is not limited to the energy market. It also affects monetary policies and even inflation indicators. When petrodollars are reinvested in the U.S. economy, they directly influence liquidity and financial stability.

Source Box

According to Investopedia, despite challenges like increased investment in renewable energy and de-dollarization efforts, the dollar remains strong in global reserves. Its stability is tied not only to oil transactions but also to the overall credibility of U.S. financial markets.

The Petrodollar Cycle Between Countries

Oil-rich countries, such as Saudi Arabia, receive their oil revenues in U.S. dollars, which then enter the petrodollar system. Instead of holding these funds, they invest them in U.S. Treasury bonds or global financial markets. This process, known as petrodollar recycling, returns liquidity to the U.S. economy and helps keep interest rates low.

For example, in the 1970s, OPEC invested billions of dollars from oil sales in U.S. bonds, helping finance the country’s budget deficit. This cycle has made the global economy more dependent on the dollar and strengthened the United States’ financial stability.

Key Players in the Petrodollar System

To understand this system’s resilience, it is essential to consider the roles of key players. The United States is at the core of the cycle, providing a safe investment market and issuing the dollar.

Oil-rich countries, especially Saudi Arabia and other OPEC members, support the system by pricing their oil sales in dollars. In addition, central banks and international financial institutions manage and circulate these funds, further reinforcing the dollar’s dominance in global transactions.

The Role of Petrodollar Recycling

To better understand the petrodollar, it is essential to examine the process of petrodollar recycling. Oil-producing countries invest the U.S. dollars earned from oil sales into U.S. Treasury bonds, stocks, or infrastructure projects. This process, explained in reputable sources like Investopedia, increases liquidity in U.S. financial markets and helps mitigate inflation.

For example, sovereign wealth funds, such as Qatar’s, allocate a significant portion of their oil revenues to global assets. While this recycling helps finance U.S. debt at low costs, it also deepens oil-exporting countries’ reliance on the dollar.

Q: How do fluctuations in petrodollar recycling affect global infrastructure investments?

A: Petrodollar recycling, when oil-exporting countries invest dollar earnings, directly funds international infrastructure projects. If these flows slow due to geopolitical tensions or sanctions, large-scale projects in developing regions may face delayed financing, higher borrowing costs, or cancelled investments.

Thus, petrodollar liquidity indirectly shapes global infrastructure development and regional economic growth opportunities.

Economic and Political Impacts of the Petrodollar on the World

The U.S.’s influence in the global economy is dependent mainly on a system called the petrodollar. When oil is traded worldwide only in dollars, countries are forced to hold dollar reserves to purchase energy.

This constant flow has allowed the U.S. to meet its financial needs and maintain lower interest rates. Such conditions have also played a role in controlling domestic inflation and enabling better economic management in Washington.

The consequences of this system are not limited to the economic sector. The U.S. has used the petrodollar to wield powerful political tools. Financial sanctions against certain countries are a clear example.

Access to the dollar network is essential for any nation that exports or imports oil. This dollar dependency has increased the U.S.’s geopolitical influence and enabled it to apply economic pressure alongside its political policies.

For oil-rich countries, the role of the petrodollar has created both opportunities and limitations. On one hand, oil revenues allow investments in sovereign wealth funds and global financial markets.

On the other hand, these countries have become heavily reliant on the dollar’s stability. Any fluctuations in its value can impact their domestic economies.

As a result, the petrodollar has not only stabilised the U.S.’s economic position but has also turned into an important political tool. By balancing energy and money, this system has shaped the global economic structure and influenced many political and geopolitical decisions.

Understanding the petrodollar system helps explain why the U.S. dollar remains central in global trade. Oil is traded only in dollars, creating a constant demand for the currency and solidifying U.S. power in the global economy.

The impact of this process is not limited to the energy market. It also affects monetary policies and even inflation indicators. When petrodollars are reinvested in the U.S. economy, they directly influence liquidity and financial stability.

Challenges and the Future of the Petrodollar System

The petrodollar system has shaped the global economy for decades, but it now faces challenges that make its future uncertain. The petrodollar’s history shows that this system was based on political and economic agreements, such as the 1973 U.S.-Saudi pact.

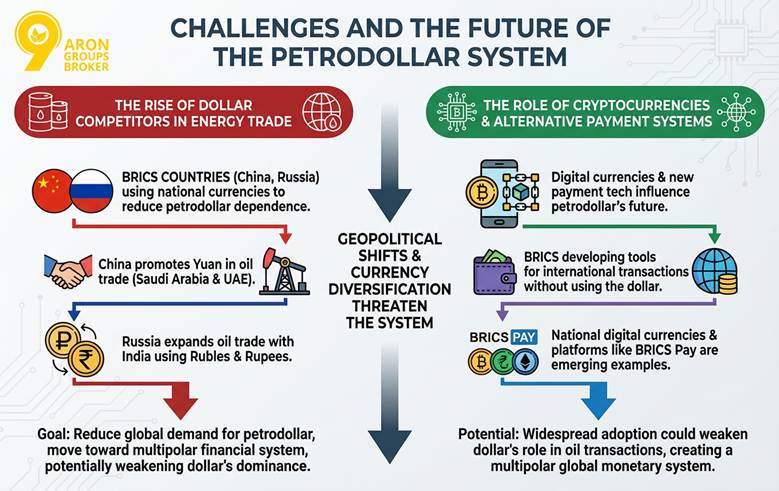

However, geopolitical shifts, currency diversification, and reduced reliance on oil are threatening the system. Below, we examine the rise of dollar competitors and the role of new technologies in transforming this system.

The Rise of Dollar Competitors in Energy Trade

BRICS countries, such as China and Russia, are moving toward using their national currencies to reduce reliance on the petrodollar. Since 2023, China has taken significant steps by promoting the Yuan in oil transactions with Saudi Arabia and the UAE. Meanwhile, Russia has expanded its oil trade with India using Rubles and Rupees following Western sanctions.

These initiatives, along with BRICS plans to create a common regional currency, are gradually reducing global demand for the petrodollar. These developments signal a shift toward a multipolar financial system that could weaken the dollar’s dominance in international energy trade.

Source Box

According to InvestingNews, BRICS countries are not only looking to use national currencies like the yuan or rupee for oil but are also planning to create a blockchain-based common currency to gradually reduce the dollar’s dominance in the long term.

The Role of Cryptocurrencies and Alternative Payment Systems

Another factor shaping the future of the petrodollar system is the rise of digital currencies and innovative payment technologies. Countries, especially BRICS members, are developing tools that enable international transactions without relying on the U.S. dollar. National digital currencies and platforms like BRICS Pay are prime examples of these efforts.

In this context, understanding what the petrodollar is goes beyond a simple definition. It should be seen as an evolving phenomenon shaped by new technologies and policies.

If these alternative systems become widely adopted, they could reduce the dollar’s dominance in oil trading and pave the way for a more multipolar global monetary system.

Q: How could blockchain-based petrocurrency systems alter international trade dynamics?

A: If oil-exporting nations adopt blockchain-based currencies, cross-border transactions could bypass traditional dollar settlements. This may reduce transaction costs, increase transparency, and allow faster settlement times, but it also introduces volatility and regulatory challenges. Traders and policymakers must monitor these developments to adapt strategies and maintain market stability.

Q: Can shifts in the petrodollar system influence renewable energy adoption?

A: Yes. When oil exporters diversify reserves away from dollars, financing for oil-dependent technologies may be reduced, making renewables more attractive.

Countries seeking alternatives to the petrodollar often invest in energy transition initiatives domestically and abroad, accelerating renewable adoption and technological innovation. Therefore, the evolution of the petrodollar system indirectly drives global energy transition strategies.

Source Box

According to MarketWatch, despite rumors about the end of the petrodollar era, the system remains flexible. Without fundamental changes in political-economic agreements, it is unlikely to disappear quickly.

Conclusion

The petrodollar system has been a significant financial development, strengthening the U.S. economy and influencing global finance. As the dollar became the main currency in oil transactions, it solidified America’s role in international politics. However, challenges like currency competitors, new payment technologies, and geopolitical shifts threaten its dominance.

Understanding the petrodollar is crucial for analysing macro trends in financial markets. Recognising its impact helps explain why the dollar remains central to global decision-making and why its future changes are likely. Awareness of these shifts is key to understanding the direction of the global economy.