Sometimes a trader places a buy or sell order, but the price changes just then. The system shows a message prompting the trader to select a new price. In such cases, the question arises: What is a requote in Forex, and why does it happen?

Many beginners, when faced with a requote for the first time, may think the broker has intentionally changed the price. However, several factors, like market volatility or slow internet connection speeds, can cause requotes in Forex. Understanding this is crucial. Understanding how requotes occur enables traders to avoid them and capitalise on better trading opportunities. Let’s explain everything in simple terms.

- Requote happens when your order is not executed at the chosen price, and the broker suggests a new price.

- This phenomenon often occurs during high market volatility or technical delays, potentially eliminating profitable opportunities.

- The broker type and execution model significantly impact the frequency of requotes. Market makers face more issues, while ECN/STP brokers are more transparent.

- Using tools like conditional orders, stop-loss, and choosing the right trading time are the best ways to manage this issue.

What is a Requote in Forex?

MetaTrader, but the price changes. The broker cannot execute the trade at the initial rate, so a requote message is triggered. Many traders then ask, what exactly is a requote, and why do they need to decide again?

In simple terms, a requote is a price offer from the broker. The broker notifies you that the rate has changed, and you must decide whether to accept the new price or cancel the order.

In MetaTrader, this appears as a specific notification, giving you a few seconds to respond. Unlike regular price changes, which cause the chart to fluctuate, a requote occurs when the broker cannot execute the order at the requested price. A requote is a brief pause in the execution of an order, allowing you to decide whether to trade at the new price.

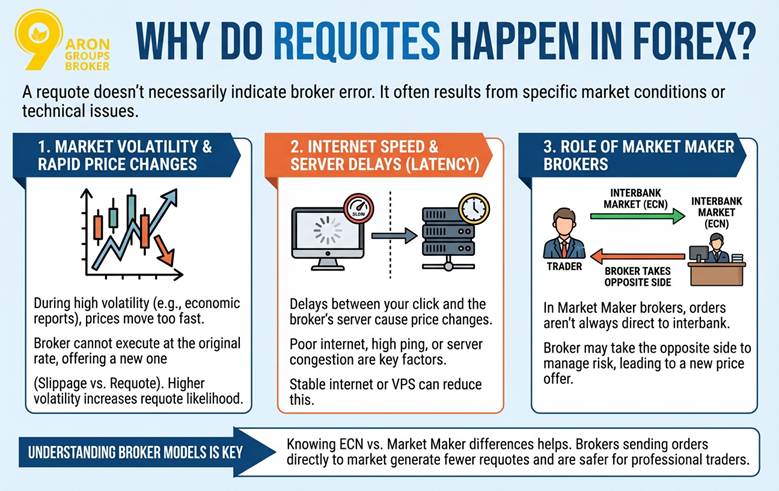

Why Do Requotes Happen in Forex?

A requote message doesn’t necessarily indicate a broker error. It often results from specific market conditions or technical issues.

Three main reasons for this occurrence are:

- Market volatility and rapid price changes

During events like economic reports, prices move quickly. Brokers can’t execute your order at the original rate. Instead, they offer a new price. This is what traders call slippage vs requote. Higher volatility increases the likelihood of a requote.

- The impact of internet speed and broker server delays

If there’s a few-second delay between clicking the order and it reaching the broker’s server, the price may change. Poor internet, high ping, or server congestion causes delays. A stable internet connection or a VPS near the broker can reduce this.

- The role of market maker brokers in requotes

In market maker brokers, orders are not always sent directly to the interbank market. The broker may take the opposite side of your trade. When this happens, the broker offers a new price to manage potential risk or loss.

Understanding broker models is key. Knowing the differences between ECN and market maker execution helps you understand where requotes are more common. Brokers that send orders directly to the market generate fewer requotes and are safer for professional traders.

Q: Is a requote always worse than slippage, or can it sometimes protect the trader?

A: A requote is not always negative. In some situations, it actually protects the trader from entering a position at an unexpectedly worse price. With a requote, the broker pauses execution and asks for confirmation, giving the trader the option to cancel. In contrast, slippage executes immediately, often at a worse price without consent. For risk-averse traders, a requote can act as a final decision checkpoint during fast markets.

Source Box:

According to forexfinancetips, some brokers use low-latency execution systems to reduce the chances of a requote. These systems are designed to execute orders as quickly as possible, minimizing the risk of new price offers.

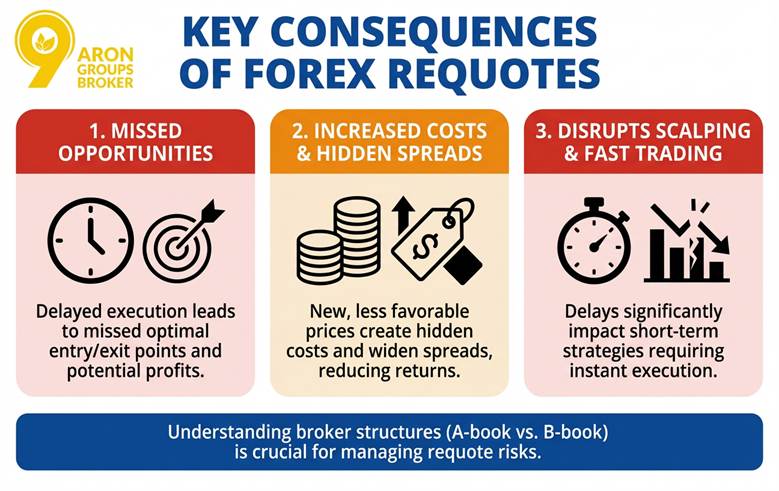

Consequences of Requotes for Traders

When an order isn’t executed at the initial price, and a new message appears, the impact can affect your financial performance and strategy. Some effects are immediately noticeable, while others show up hidden in your final profit and loss.

Loss of profitable trading opportunities

Suppose you’ve analysed a currency pair and are waiting for the right moment to enter. You click buy or sell, but a new message appears instead of execution. In just a few seconds, the market moves away from the optimal entry point.

This is where requotes in Forex can leave you missing golden opportunities. Sometimes, even closing a position on time to avoid loss is delayed, resulting in a different trade outcome than expected.

Increased transaction costs and hidden spreads

Another necessary consequence is that when the initial price isn’t available, the broker offers a new price, usually unfavourable to the trader. You end up paying a hidden cost when the rate changes. This cost isn’t always directly visible, as the spread may appear unchanged.

However, you must execute the trade at a higher or lower rate than expected. This slight difference can accumulate over time, significantly reducing your profits.

Impact of requotes on scalping and fast trading strategies

Traders using very short-term strategies need quick, delay-free execution. A requote message can change the entire outcome of their trade. That’s why scalpers always seek ways to avoid requotes, such as choosing brokers with direct market execution or high-speed accounts.

Understanding the difference between A book and B B-book broker helps make a better choice. In some structures, the likelihood of requotes is higher, posing a major risk for fast strategies.

Q: Do requotes affect long-term traders differently than short-term traders?

A: Yes. Long-term traders are generally less affected by requotes because entry precision is less critical to their strategy. However, for scalpers and intraday traders, even a slight execution delay can render the trade setup invalid. This difference explains why execution quality and requote frequency matter far more for short-term strategies than for position trading or swing trading.

Source Box:

According to forexgdp, accepting a new price can be a psychological blow. Repeated requotes can reduce a trader’s confidence, causing doubt or irrational reactions during critical market moments.

Methods for Detecting Requotes in Trading

Understanding when a requote occurs helps you make better decisions and protect your trading experience. Here are three methods:

Checking MetaTrader Notifications and Other Platforms

When placing an order in MetaTrader or similar platforms, a small window may appear asking if you accept the new price. Many new traders don’t realize that this message shows a requote.

It means the broker couldn’t execute the order at the original price and now offers a new one. If you accept the price, the trade is executed. If you don’t, the order is canceled.

Comparing the Broker’s Offered Price with Real-Time Market Prices

To detect requotes, compare the broker’s offered price with real-time rates from independent data sources. If there’s a significant difference, it’s likely a requote.

This is different from slippage. In slippage, the trade is executed at a price different from the requested one. In requotes, the broker offers a new price before execution.

| Feature | Requote | Slippage |

|---|---|---|

| What Happens? | Broker offers a new price before execution. | Trade is executed at a different price. |

| Timing | Before the trade is filled. | During the trade execution. |

| Your Choice | You can Accept or Reject. | Automatic (No choice). |

Using Delay Monitoring Tools

Sometimes the issue lies with the broker’s connection speed or infrastructure, not the market. Traders use tools like latency checkers or virtual private servers (VPS) to measure delays. If the delay is high, the likelihood of a requote increases. A VPS near the broker reduces delay and ensures faster order execution.

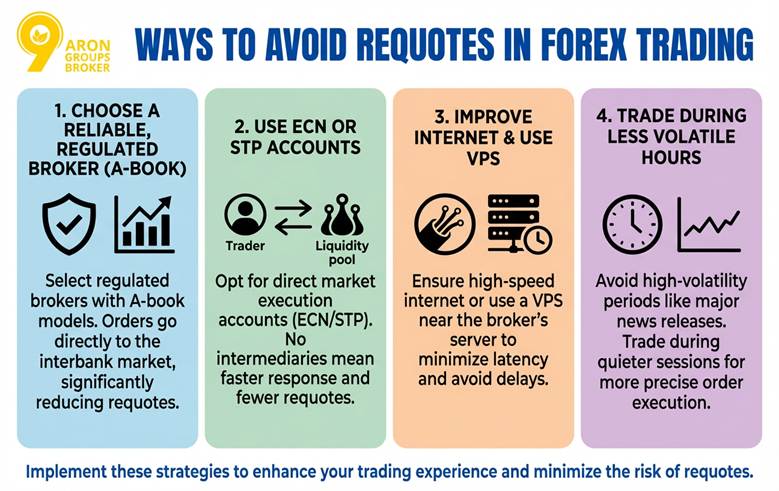

Ways to Avoid Requotes

If you want to avoid requotes while trading, you must take steps that reduce the chances of this issue. Here are some effective strategies to improve your trading experience:

Choosing a Reliable and Regulated Broker

The first step to avoid requotes is selecting the right broker. Brokers regulated by reputable financial authorities use stronger execution systems. These brokers usually operate on an A-book model, meaning orders are sent directly to the interbank market. This reduces the chance of requotes.

In contrast, B-book brokers take the opposite side of your trade, which can lead to price changes and requotes. Understanding the difference between A-book and B-book brokers can greatly reduce requotes.

Using an ECN or STP Account Instead of a Market Maker

The type of account you choose plays a significant role in reducing requotes. In ECN or STP accounts, orders go directly to liquidity sources without intermediaries. This execution model reduces response time and requotes. These accounts perform better during high volatility periods.

Improving Internet Speed and Using a VPS for Traders

Sometimes, the issue lies with the trader’s internet connection. Slow or unstable internet causes delays, resulting in price changes. Using high-speed internet or a VPS close to the broker’s server reduces delays and requotes.

Choosing Trading Hours with Less Market Volatility

The highest chance of requotes occurs when the market is highly volatile and prices change rapidly. Trading during quieter hours results in more precise order execution. Avoiding periods when major economic news is released also helps reduce requotes.

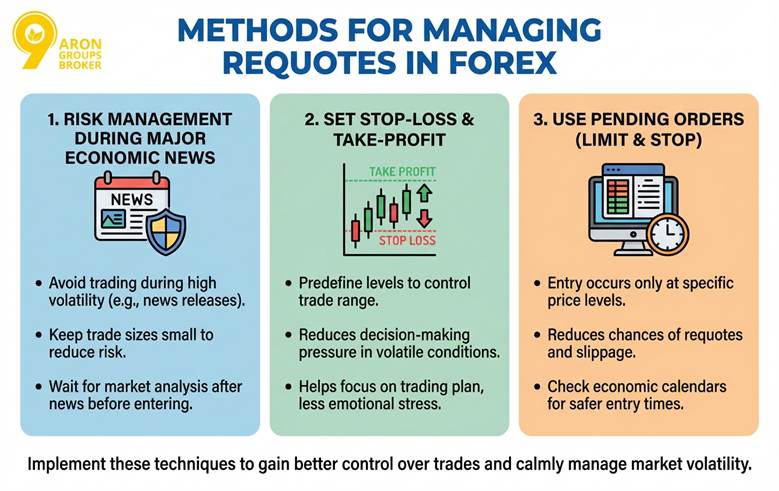

Methods for Managing Requotes in Forex

Sometimes, traders cannot prevent requotes, but they can reduce their impact with a few simple techniques. These methods help you have more control over trades and make decisions calmly when the market moves quickly.Risk Management During Major Economic News Releases

When important economic data is released, the market becomes highly unstable. Most requotes happen during this time as prices change quickly. To manage this, you can either:- Avoid entering trades during high volatility periods.

- Keep trade sizes very small to reduce the risk of requotes.

Setting Stop-Loss and Take-Profit to Reduce Requote Impact

Opening a trade with predefined stop-loss and take-profit levels reduces decision-making pressure in volatile conditions. These tools help ensure that the trade remains within a controlled range, even if there’s a delay. Key benefits include:- Helping you focus on the trading plan rather than worrying about requotes.

- Reducing the emotional pressure when the market is volatile.

Using Pending Orders to Avoid Requote

One of the most effective tools for managing requotes is using pending orders. When you use limit orders or stop orders, your entry occurs only when the price reaches a specific level. This method reduces the chances of requotes and slippage. Additionally:- Traders who use this method check economic calendars on websites like Forex Factory to find safer entry times.

- By aligning with economic events, they reduce the risk of encountering unexpected price changes.

Differences in Requotes Across Brokers

The experience of requotes in Forex largely depends on the type of broker you choose. In market maker brokers, requotes are more likely because they control prices and take the opposite side of trades, especially during volatile markets.

In contrast, with ECN and STP accounts, orders are sent directly to the market or liquidity providers. This makes trade execution faster and more transparent.

In these models, slippage is more common than requotes, and it’s often more acceptable. That’s why many traders prefer working with ECN brokers.

On the other hand, the broker’s business structure is also crucial. The difference between A-book and B-book brokers refers to this. In the A-book model, the broker is only an intermediary and earns a commission.

In the B-book model, there may be a conflict of interest because the broker’s profit comes from the trader’s loss. In such cases, the risk of requotes is higher.

Ultimately, choosing a properly regulated broker and understanding Forex order types leads to more transparent execution and reduces the likelihood of requotes.

Q: Do ECN brokers have requotes?

A: Generally, no. ECN brokers use Market Execution, meaning they fill your order at the best available price (causing slippage), but they rarely reject it with a requote.

Q: Why do Market Makers cause more requotes?

A: Market Makers often use Instant Execution. If the market moves faster than their system can verify, they must ask you for a new price to protect their own risk.

Q: Can requotes be a sign of poor broker quality rather than market conditions?

A:Yes, frequent requotes under normal market conditions may indicate weak execution infrastructure or a broker’s internal risk management practices. While occasional requotes during high volatility are normal, consistent requotes in calm markets often reflect slow servers, outdated technology, or heavy reliance on B-book execution. Traders should monitor requote frequency as a qualitative metric when evaluating broker reliability.

Source Box:

According to pippenguin, traders who prioritize fast execution should use ECN accounts. This model offers faster execution and provides real market depth, while STP may sometimes experience inconsistent execution and delays.

Conclusion

Forex is a fast-paced, volatile market, and requotes are just one of its challenges. What matters is the trader’s ability to stay calm and control the situation. A smart broker choice, the use of trading tools, and adherence to risk management principles prevent this phenomenon from hindering your path. Ultimately, success in the market comes from combining knowledge and discipline.