One of the ongoing challenges traders face in financial markets is accurately determining the direction and strength of trends. Even the slightest delay in decision-making can result in the loss of profitable opportunities. In such cases, tools like the slope indicator can play a crucial role. This indicator shows the speed of price changes as a trend slope, helping predict the potential start or end of a trend.

This article covers the types of slope indicators, how to calculate and use them, and how they help identify buy and sell signals.

- The slope indicator is effective alone, but combining it with volume confirmation indicators like OBV or Volume Profile boosts analytical accuracy.

- Adjusting the threshold level in the slope indicator can help prevent false signals in volatile markets.

- Sudden steep slopes are often linked to news events or significant economic events and should not be overlooked without fundamental analysis.

- In higher timeframes, such as daily or weekly, the slope indicator performs more reliably in identifying sustainable trends.

What is the Slope Indicator and How Does It Work?

The Slope Indicator is a powerful technical analysis tool that identifies the direction and strength of market trends. It calculates the slope of regression lines or moving averages, helping traders better understand the current market trend and pinpoint optimal entry and exit points.

Think of the Slope Indicator as a speedometer for the market, measuring the rate of price change:

- A positive slope signals an uptrend, while a negative slope indicates a downtrend.

- The slope’s magnitude also reflects trend strength: the steeper the slope, the stronger the trend.

How is the Slope Indicator Calculated?

The Slope Indicator calculation measures the rate of change, or slope, between price points within a set time frame. Common types of slope indicators include:

- Slope of Moving Average;

- Linear Regression Slope;

- Slope Direction Line;

- TMA Slope True.

Each indicator has a unique calculation, and the choice depends on the trading strategy, market type, and time frame.

For a deeper understanding of the calculations behind the Slope Indicator, you can refer to the comprehensive guide on the Slope Indicator on StockCharts. In the following sections, we will discuss the calculation methods of two types of slope indicators in more detail.

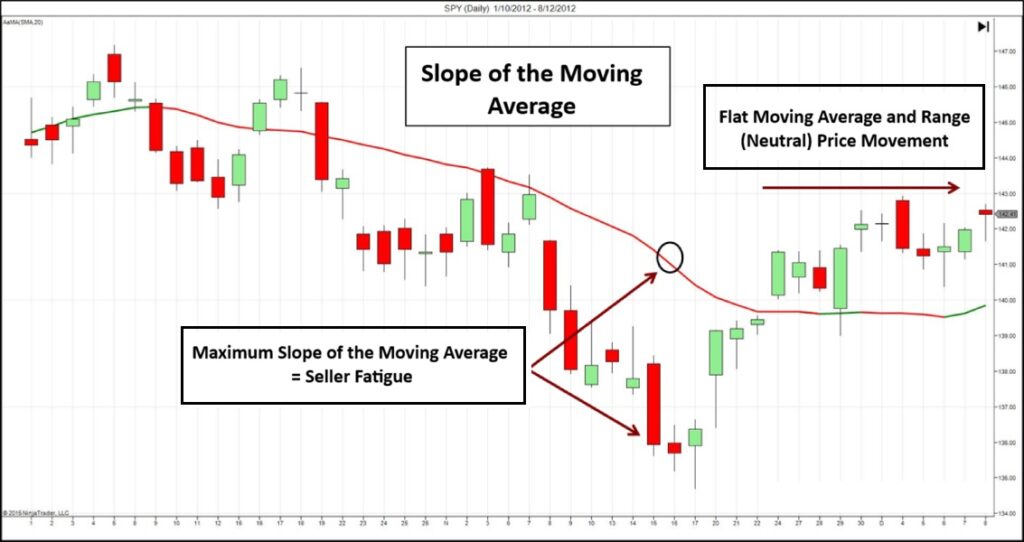

Slope of Moving Average

In this method, a simple moving average (SMA) or an exponential moving average (EMA) is first applied to the price data. Then, the slope of the moving average is calculated:

- SMA or EMA is used to smooth out price fluctuations, helping to identify the underlying trend.

- The slope indicates the direction and strength of the trend.

By calculating the slope of the moving average, traders can determine whether the market is in an uptrend, a downtrend, or a range.

Simple Formula:

Slope = (MA_current – MA_previous) / n

- MA current = current moving average value

- MA previous = value of the moving average from the previous candle

- n = number of candles or time period

The greater the difference, the steeper the slope and the stronger the trend.

For example:

- Current moving average (MA_current) = 150

- Previous moving average (MA_previous) = 145

- Number of candles or time period (n) = 5

Formula:

Slope = (150 – 145) / 5 = 5 / 5 = 1

The slope value is 1, indicating a moderately strong upward trend. If this number were, for instance, 3 or higher, it could suggest a strong upward trend.

Linear Regression Slope

In this method, a linear regression line is drawn on the price data over a specified period, and its slope (Slope = m) is calculated:

Linear Regression Slope Formula:

Slope (m) = [n(∑xy) – (∑x)(∑y)] / [n(∑x²) – (∑x)²]

Where:

- x = candle number (e.g., 1, 2, 3, …, n)

- y = price at each candle

- n = number of candles

This formula statistically measures the rate of price change relative to time.

Example:

Suppose the following data is related to the last three candles:

| x (Candle Number) | y (Price) |

|---|---|

| 1 | 100 |

| 2 | 105 |

| 3 | 110 |

- n = 3

- ∑x = 1 + 2 + 3 = 6

- ∑y = 100 + 105 + 110 = 315

- ∑xy = (1×100) + (2×105) + (3×110) = 100 + 210 + 330 = 640

- ∑x² = 1² + 2² + 3² = 1 + 4 + 9 = 14

- m = [3×640 – 6×315] / [3×14 – 6²]

- m = [1920 – 1890] / [42 – 36]

- m = 30 / 6 = 5

In this example, the slope of the regression line (m) was calculated to be 5. This figure indicates that, on average, the price has increased by 5 units per candle.

A significant positive slope, like a value of 5, indicates a strong and steady upward market trend.

Applications of the Slope Indicator in Market Trend Analysis

The slope indicator helps traders analyse market trends, showing price movement direction and strength, aiding in identifying entry and exit signals.

Identifying the Direction of the Trend Using the Slope Indicator

The slope indicator is one of the most effective tools for identifying the direction of the market trend. By using this indicator, it’s easy to determine whether the market is in an uptrend, a downtrend, or neutral:

- Positive Slope: When the slope indicator value is positive, it indicates an uptrend. In this case, the indicator line is typically displayed in green or blue.

- Negative Slope: When the slope indicator value is negative, it indicates a downtrend. The indicator line is usually displayed in red.

- Zero or Near Zero Slope: Zero or near-zero slope indicates a neutral market with no clear trend.

Q: Can the slope indicator be used to assess trend sustainability rather than just trend direction?

A: Yes. While the slope indicator is commonly used to identify direction, its real strength lies in evaluating trend sustainability.

By monitoring whether slope values remain stable, gradually increase, or begin to decay over time, traders can distinguish between healthy trends and short-lived impulses. A trend with a consistently positive but moderating slope often signals continuation, whereas erratic slope fluctuations usually precede trend exhaustion.

Warning:

While the slope indicator shows trend direction, it's crucial to account for external factors like news or economic data releases, which can cause sudden trend shifts and affect reliability.

Detecting Trend Reversal and Buy/Sell Signals with the Slope Indicator

The slope indicator can be used to identify trend reversals and generate buy and sell signals:

- Buy Signal:

- When the slope indicator crosses from the negative to the positive zone.

- When the indicator’s colour changes from red to green.

- When the slope significantly increases.

- Sell Signal:

- When the slope indicator crosses from the positive to the negative zone.

- When the indicator’s colour changes from green to red.

- When the slope significantly decreases.

Q: How can divergence between price and slope values provide early warning signals before traditional indicators react?

A: Slope–price divergence occurs when price continues to make higher highs or lower lows while the slope fails to confirm with proportional strength.

This mismatch often signals a deterioration in internal momentum, even when the price structure still appears intact. Unlike oscillators, slope divergence focuses on trend velocity rather than overbought or oversold conditions, making it a powerful early-warning tool before conventional indicators trigger reversals.

Advantages and Limitations of the Slope Indicator

Like other analytical tools, the slope indicator has its advantages and limitations. Here are the key benefits:

Advantages of the Slope Indicator:

- Ease of Use: The concept of slope is simple and easy to understand.

- Accurate Trend Identification: Effectively shows the direction and strength of the trend.

- Flexibility: Can be combined with various other indicators.

- Fewer False Signals: Compared to many other indicators, it generates fewer false signals.

- Customisability: Various parameters, such as time periods and threshold levels, can be adjusted to suit the trader’s needs.

Key Insight:

The threshold level is a value set as a boundary or limit to generate trading signals. In simple terms, the threshold level acts as a filter, showing only significant and meaningful market changes while ignoring minor and insignificant fluctuations.

Limitations of the Slope Indicator

The drawbacks of the slope indicator include:- Signal Delay: Like many trend-based indicators, it may generate signals with a delay.

- Low Effectiveness in Range Markets: In markets without a clear trend, it may produce conflicting signals.

- Need for Combination with Other Tools: For optimal results, it is best used in conjunction with other analytical tools.

- Sensitivity to Volatility: In highly volatile markets, it may produce false signals.

| Advantages | Limitations |

|---|---|

| Simple to use | Delayed signals |

| Accurate trend detection | Ineffective in neutral markets |

| Flexible with other indicators | Needs a combination with other tools |

| Fewer false signals | Sensitive to market volatility |

How to Add the Slope Indicator to a Chart in MetaTrader and TradingView

Next, let’s review how to add the Slope Indicator to charts in both MetaTrader and TradingView.

How to Add the Slope Indicator to a Chart in MetaTrader

To use the Slope Indicator in the MetaTrader 5 platform, follow these steps:

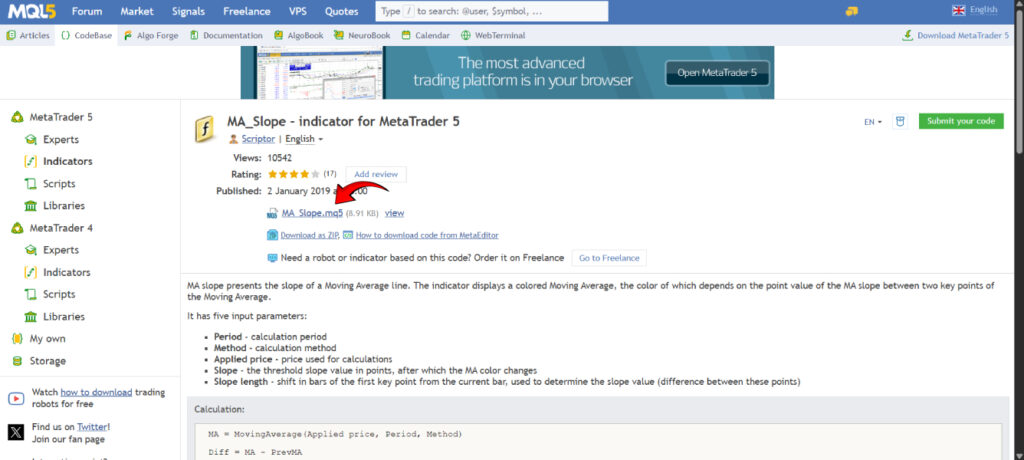

- Download the Indicator:

First, download the Slope Indicator file in .mq5 or .ex5 format from a reputable source such as MQL5.com

- Opening the MetaTrader Data Folder

To open the data folder in MetaTrader 5, follow these steps: - Launch MetaTrader 5 and navigate through the following menu:

File ⭢ Open Data Folder

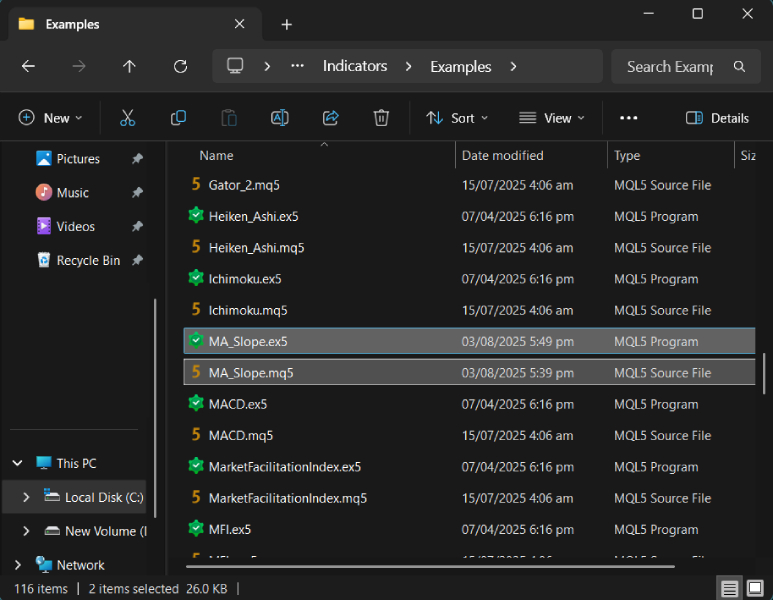

- Copying the Indicator File

In the opened window, follow this path:

MQL5 ⭢ Indicators ⭢ Examples

Then, paste the downloaded file into this folder.

- Loading the Indicator on the Chart

Restart MetaTrader to display the new indicator. Now, you can drag the slope indicator from the indicators list onto the chart and apply your desired settings.

How to Add the Slope Indicator to a Chart in TradingView

To use the Slope Indicator on the TradingView platform, follow these steps:

Step 1: Open the Indicators Window

Click on the “Indicators” option in the toolbar at the top of the page.

(As shown in the second image, the indicators search window will appear.)

Step 2: Search for the Slope Indicator

In the search box, type “Slope”. A list of related indicators will appear, such as:

- Slope [rthomson]

- MA Slope [EMA Magic]

- EMA Slope + Cross Strategy

- HMA Slope Variation

- RSI Slope Filtered Signals.

Choose one of the options, such as Slope 539, as shown in the image.

Step 3: Adding the Indicator to the Chart

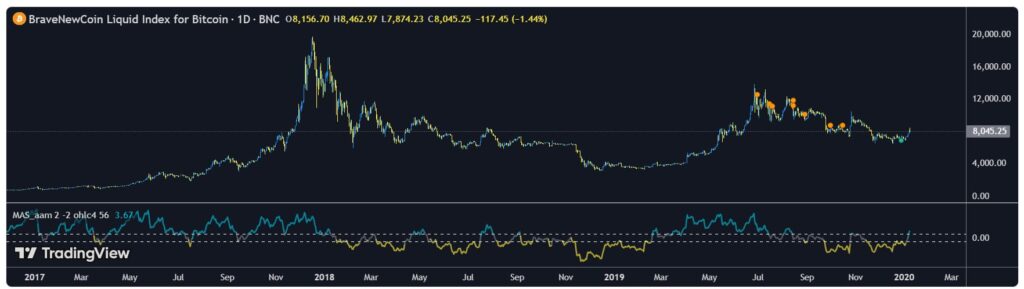

After clicking, the indicator will automatically be added to the chart. In the lower section of the chart (as shown in the first image), the output of the Slope Indicator is visible with green and red lines:

- Green Line: Positive slope (uptrend);

- Red Line: Negative slope (downtrend).

The current slope value is displayed in the bottom right corner (e.g., -0.22582).

Pro Tip:

Combine the Slope Indicator with tools like RSI or MACD to confirm signals and reduce false positives, especially in volatile markets.

Q: Can the slope indicator be used for position sizing and risk management decisions?

A: Yes. Slope magnitude can be incorporated into dynamic position-sizing models.

Stronger, more stable slopes justify wider profit targets and more aggressive scaling, while weak or flattening slopes call for reduced exposure and tighter risk limits.

Using slope as a contextual risk variable helps align position size with underlying trend quality, rather than relying solely on fixed percentage rules.

Conclusion

In summary, the Slope Indicator is a key technical analysis tool that measures the direction and strength of market trends by analysing the slope of lines, such as moving averages or regression lines.

Some of the common types of this indicator include:

- Linear Regression Slope

- Slope of Moving Average

- Slope Direction Line

- TMA Slope True.

Each of these tools can be effectively used depending on the trading strategy and market conditions.

To enhance the accuracy of your analysis, it is recommended to combine the Slope Indicator with other tools, such as moving averages and price action. Additionally, properly setting the time period (Period) and smoothing parameters plays a crucial role in its performance.