When you know the market is on the verge of a major move, but you are uncertain of its direction, the Strangle strategy can be an intelligent choice. In this method, instead of predicting the direction, you profit from price volatility. Traders typically use this strategy before significant events such as earnings reports or central bank decisions.

Success with a Strangle depends on risk management, proper timing, and a precise exit plan. Otherwise, instead of profiting from volatility, you will incur losses from waiting.

- The Strangle strategy is designed for highly volatile markets and generally performs poorly in calm markets.

- The best time to implement a Strangle is just before the release of important news or economic data.

- Professional traders often take partial profits early to reduce their remaining risk.

- Combining the Strangle with technical analysis (like identifying support and resistance levels) increases decision-making accuracy.

What is the Strangle Strategy and How is it Used?

According to Investopedia, the Strangle strategy is a well-known options trading strategy that profits from significant market volatility without predicting the direction of price movement.

In this strategy, a trader simultaneously opens two contracts on the same underlying asset with the same expiration date:

- One Call Option with a strike price higher than the current market price;

- One Put Option with a strike price lower than the current market price.

If the trader buys both contracts, it is called a Long Strangle. If they sell both, it is known as a Short Strangle.

Applications of the Strangle Strategy

The practical applications of the Strangle strategy are:

- Long Strangle: Used when a trader expects the price to experience sharp volatility soon (e.g., during a company’s earnings release or Federal Reserve decisions) but is unsure if the move will be upward or downward. In this case, a profit is made if the market moves significantly in either direction.

- Short Strangle: Suitable for times when the price is expected to remain within a specific range or when implied volatility is expected to decrease. In this method, the trader profits from time decay (theta), but with significant risk, as a substantial loss can occur if the price moves outside the range.

In summary, the Strangle strategy is a tool for traders who want to profit from market volatility, whether the market goes up or down, but who must also maintain precise risk management.

The Difference Between the Strangle and Straddle Strategies

Both the Strangle and Straddle are popular options trading strategies, and they share the same objective: profiting from market volatility without needing to predict the price direction. However, differences in their execution, risk profile, and initial cost make each strategy suitable for different conditions.

In a Straddle, the trader simultaneously buys a call option and a put option with the same strike price, typically at-the-money (near the current market price). In contrast, a Strangle involves two options with different strike prices that are “out-of-the-money” (OTM); the call option’s strike is higher than the current price, and the put option’s strike is lower.

This key difference makes the Strangle less expensive to establish. However, the trade-off is that the underlying asset must make a much larger price move for the Strangle to become profitable compared to the Straddle.

Professional traders often implement a Strangle when the market is currently calm, but they anticipate a potential for a sharp breakout. Conversely, when market volatility is already high, a Straddle is often considered the more appropriate strategy.

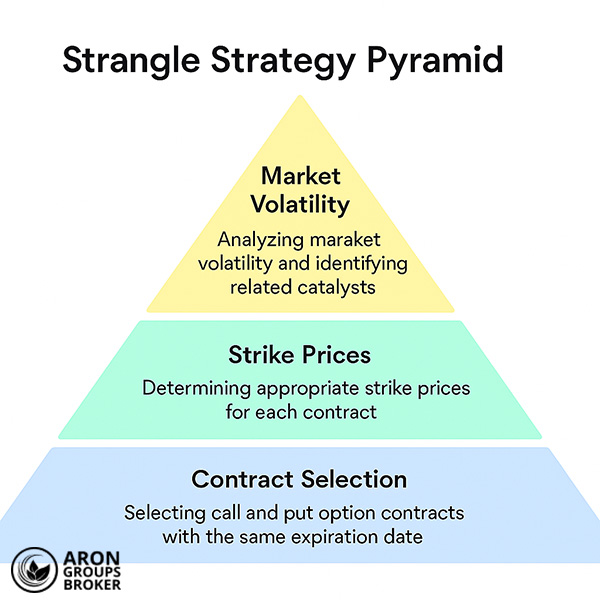

Key Components and Structure of the Strangle Strategy

To properly execute a Strangle strategy, three key components must be considered:

- Selecting Call and Put option contracts with the same expiration date;

- Determining the appropriate strike prices for each;

- Analyzing the market’s volatility status and its related indicators.

These three components are like the legs of a table; if one is selected incorrectly, the entire strategy loses its balance.

Selecting Call and Put Contracts with the Same Expiration Date

In a Strangle strategy, both contracts must be for the same underlying asset and share the same expiration date. This means the trader simultaneously holds a call option and a put option on the same asset, both concluding on the same date.

This ensures the strategy is precisely positioned to profit or lose from price movements within a defined timeframe. If the expiration dates differ, one contract will expire sooner, destroying the strategy’s structural balance.

Example:

Assume “ABC” stock is currently priced at $100. You believe an upcoming earnings report will cause significant volatility, but you are unsure of the direction.

Result: You buy a call option with a $105 strike and a put option with a $95 strike, both expiring in 30 days.

If either of these dates were different, it would no longer be a true Strangle.

How to Determine the Appropriate Strike Price

Selecting the strike prices is the most critical decision when constructing a Strangle. In this strategy, both options are typically chosen “out-of-the-money” (OTM), meaning the call strike is above the current market price, and the put strike is below it.

The wider the distance of these strikes from the current price, the lower the cost of entry (the total premium paid). However, this also means a larger price move is required to achieve profitability.

Example:

If XYZ stock is at $500, buying a call with a $520 strike (for a $5 premium) and a put with a $480 strike (for a $4 premium) results in a total debit of $9.

To be profitable at expiration, the price must move above $529 (520 strike + $9 premium) or below $471 (480 strike – $9 premium).

If this does not occur, the trader’s maximum loss is limited to the $9 premium paid.

The Role of Volatility and Market Indicators in the Strangle’s Success

The success of a Strangle is directly linked to implied volatility (IV). Implied volatility indicates the market’s expectation of future price swings.

When IV is low but expected to rise (e.g., before an earnings report), a long Strangle can be profitable. This is because a rise in IV increases the value of both options, even before a significant price move occurs.

However, if IV is high at the time of purchase and subsequently decreases (a “volatility crush”), the options’ prices will fall, potentially causing the trade to be unprofitable even if the underlying price does move.

Example:

Assume “DEF” stock is trading at $200 and volatility is currently low. You anticipate a major central bank decision will trigger sharp volatility. In this scenario, you might buy the $210 strike call and the $190 strike put.

If market volatility spikes after the news, or if the price moves significantly in either direction, your position will become profitable.

If implied volatility is already very high (meaning the market is already pricing in a big move), buying a Strangle can be prohibitively expensive. In such environments, experienced traders may opt to sell a Strangle instead, aiming to profit from the anticipated decrease in volatility.

Types of Strangle Strategies and Their Application

The Strangle strategy has two primary types:

- Long Strangle (Buying the Strangle);

- Short Strangle (Selling the Strangle).

Both are constructed using a combination of call and put options, but their objectives and risk profiles are completely different.

The Long Strangle: Conditions and How to Use It

In a Long Strangle, the trader buys both options (a call and a put). This means that for an asset expected to make a large jump soon, the trader acquires two contracts:

- A Call Option with a strike price above the current market price.

- A Put Option with a strike price below the current market price.

This position requires an initial cost (the premium paid). In return, if the price moves sharply in either direction, the trader’s profit can be substantial or even unlimited.

When is a Long Strangle Used?

Use a Long Strangle when you expect a significant event to cause massive volatility, but you are uncertain whether the price will move up or down. This includes events like:

- A major company’s earnings report;

- Central bank policy decisions;

- The release of inflation data.

- Advantage: Risk is limited to the initial premium paid.

- Disadvantage: If the price does not move significantly, both options can expire worthless, and the entire initial cost is lost.

Example: Assume “TECH” stock is currently trading at $100. A trader expects a large move next week following its earnings report. They decide to construct a Long Strangle:

- Buy a Call with a $105 strike (Premium: $3);

- Buy a Put with a $95 strike (Premium: $2);

- Total Cost: $5

If the price at expiration moves above $110 ($105 strike + $5 premium) or below $90 ($95 strike – $5 premium), the trader enters the profit zone. If the price remains within the $95 to $105 range, both contracts expire worthless, and the trader loses their $5 premium.

The Short Strangle and Its Associated Risks

In a Short Strangle, the trader does the opposite: they sell both options. The goal is to profit from price stability and a decrease in volatility.

In this method, the trader receives a premium from selling both contracts. If the asset’s price remains between the two strike prices at expiration, both options expire worthless, and the trader keeps the full premium as profit.

However, if the price moves sharply up or down, the loss can be very large and is potentially unlimited, especially if the price moves excessively upward (the loss on the short call is unlimited).

Conditions for Using a Short Strangle

The Short Strangle strategy is used when a trader predicts the market will remain calm in the short term or that volatility will decrease.

- Advantage: Generates a fixed profit from the premium received.

- Risk: Unlimited potential loss if the price experiences a sharp move.

Example: Assume “STABLE” stock is at $100, and it is predicted to have no significant volatility in the coming month. A trader decides to construct a Short Strangle:

- Sell a Call at $105 (Premium Received: $2);

- Sell a Put at $95 (Premium Received: $2).

The trader initially receives $4. If the price at expiration stays between $95 and $105, both options expire, and the trader keeps the $4 as profit.

However, if the price rises to $110, the loss will exceed the initial credit (a $5 loss on the call vs. $4 profit). If the price falls to $85, the loss will also be significant.

How to Choose the Strangle Type Based on Trading Goals

The choice between a Long and Short Strangle depends on your market outlook:

- If you expect a big price move, use a Long Strangle.

- If you expect the price to remain stable, use a Short Strangle.

You must also pay close attention to the level of Implied Volatility (IV):

- Low Implied Volatility (IV): Favorable for a Long Strangle (options are “cheap”).

- High Implied Volatility (IV): Favorable for a Short Strangle (options are “expensive,” providing a larger premium).

Example: Assume “EVENT” stock is priced at $50.

- If you believe significant news is coming that will cause a sharp jump (in either direction), a Long Strangle is your appropriate choice.

- If you believe the market has already priced in the news and no major change will occur, a Short Strangle is more logical.

The Process of Executing a Strangle Strategy in Live Trading

Executing a Strangle strategy involves more than just buying or selling two options. For this method to work correctly, you must follow a few simple but crucial steps. These steps help a trader control risk and properly capitalize on market volatility.

Market Analysis and Identifying the Right Opportunity

First and foremost, you must understand the current market condition:

- If you anticipate a significant price move, a Long Strangle is suitable.

- If you believe the market will remain calm, you can use a Short Strangle.

To confirm your thesis, also check the Implied Volatility (IV):

- Low IV suggests the market is calm and volatility may increase (favorable for a Long Strangle).

- High IV indicates the market is already volatile and may soon calm down (favorable for a Short Strangle).

Selecting the Underlying Asset and Expiration Date

The underlying asset (such as a stock or index) must have good liquidity to ensure you can enter and exit the trade easily.

Choose an expiration date that falls after the anticipated event (e.g., an earnings report or economic decision).

- If the expiration is too far out, the premium cost will be higher.

- If it’s too short, the price move may not happen in time.

Determining the Strike Prices

To build the Strangle, select two option contracts with different, out-of-the-money (OTM) strike prices:

- Call: A strike price higher than the current market price.

- Put: A strike price lower than the current market price.

The wider the distance these strikes are from the current price, the lower your entry cost, but a larger price move will be required to become profitable.

Executing the Trade

After selecting the strategy type, expiration date, and strike prices, open the position:

- For a Long Strangle: You buy both options (this is a debit trade; you pay a premium).

- For a Short Strangle: You sell both options (this is a credit trade; you receive a premium).

Monitoring and Risk Management

After entering the trade, monitor the market regularly:

- Track the asset’s price relative to your break-even points. Assess where the current price stands in comparison to the points at which your trade becomes profitable.

- Keep an eye on volatility levels. A rise or fall in IV will directly impact your profit or loss.

- If the market moves against your forecast, it is often best to exit the trade early or utilize a stop-loss.

- To mitigate risk, keep your position size small and do not over-leverage your account.

Timing the Exit

The timing for closing the position depends on three factors:

- Reaching the Profit Target: If you have hit your desired profit level, close the position.

- Changing Market Conditions: If your analysis is no longer valid, liquidate the trade.

- Approaching Expiration: As expiration nears, time decay (theta) accelerates, rapidly eroding the options’ value.

Common Trader Mistakes in the Strangle Strategy

According to CFI, the Strangle strategy appears simple on the surface, but small mistakes in timing, strike price, or contract selection can lead to significant losses. Below, we review the most critical errors that traders, especially novices, often make:

Choosing the Wrong Strategy for Market Conditions

The biggest mistake is entering a trade simply because the “Strangle looks appealing,” without considering the actual market conditions. If you fail to match the strategy to the environment correctly, you can lose money even if your price analysis is correct.

Ignoring Implied Volatility (IV)

Many traders focus only on price and pay no attention to implied volatility. However, volatility is what determines how “expensive” or “cheap” an option is.

Selecting the Wrong Strike Prices

Some traders, in an attempt to save on costs, choose strike prices that are too far from the current price (too far OTM). While this reduces the initial premium, the probability of the asset’s price ever reaching one of those strikes is extremely low.

As a result, the contracts often expire worthless, and the entire premium is lost. It is better to set the strike widths neither too wide nor too narrow, but rather to adjust them based on the magnitude of the volatility you expect.

Having No Exit Plan

A common error is implementing a Strangle without a clear plan for exiting the trade. Many traders enter a position without defining a profit target or a stop-loss, simply waiting for a “big profit” or, when facing a loss, holding on in the hope of a market reversal.

In contrast, professional traders know in advance that they will:

- Exit the trade if the profit reaches a certain target (e.g., 50% of the initial cost).

- Close the position if the loss hits a predetermined level, thereby controlling the risk.

Using Excessive Position Size

Sometimes, individuals allocate a large portion of their capital to a single Strangle. If the market does not move as anticipated, their entire account suffers. A sound rule is not to risk more than 2% to 5% of your capital on any single trade.

Trading in Illiquid Markets

If option contracts have low trading volume, the bid-ask spread will be wide. In this situation, you may be starting the trade at a loss before the market even moves. Therefore, always stick to assets that have high trading volume and liquidity (such as major indices or large-cap stocks).

Ignoring the Effect of Time Decay (Theta)

In a Long Strangle, the passage of time is always working against you, as the options lose extrinsic value every day. If the asset’s price does not move quickly (even if IV remains unchanged), your position’s value will decline. Therefore, you must time the trade so that the anticipated price move occurs well before the expiration date approaches.

Conclusion

The Strangle strategy is effective when you correctly manage three things: entry timing, strike prices, and risk exposure.

If you expect a major market move, a Long Strangle can be profitable, provided you control the initial cost. If the market is already highly volatile and is more likely to calm down, a Short Strangle is more logical, but only when accompanied by precise risk management and limited position sizing.