If you are looking for one of the most powerful reversal patterns in price action trading, the Three White Soldiers pattern is precisely what you need to know. Despite its simple appearance, this formation delivers a strong message: the market is preparing for a fresh rally.

By understanding the conditions under which this pattern forms, recognizing the differences between valid and invalid setups, and combining it with technical analysis indicators such as MACD and RSI, traders can achieve more reliable entries and increase the profitability of their trades.

In the rest of this article, you will gain a complete understanding of this pattern, its applications, and its limitations.

- The Three White Soldiers pattern signals a shift in market control from sellers to buyers.

- While the pattern is reliable on its own, combining it with indicators such as MACD or RSI significantly strengthens the trading signal.

- When trading based on the Three White Soldiers, always place your stop-loss below the first candlestick of the pattern or beneath the most recent support level.

What Is the Three White Soldiers Pattern?

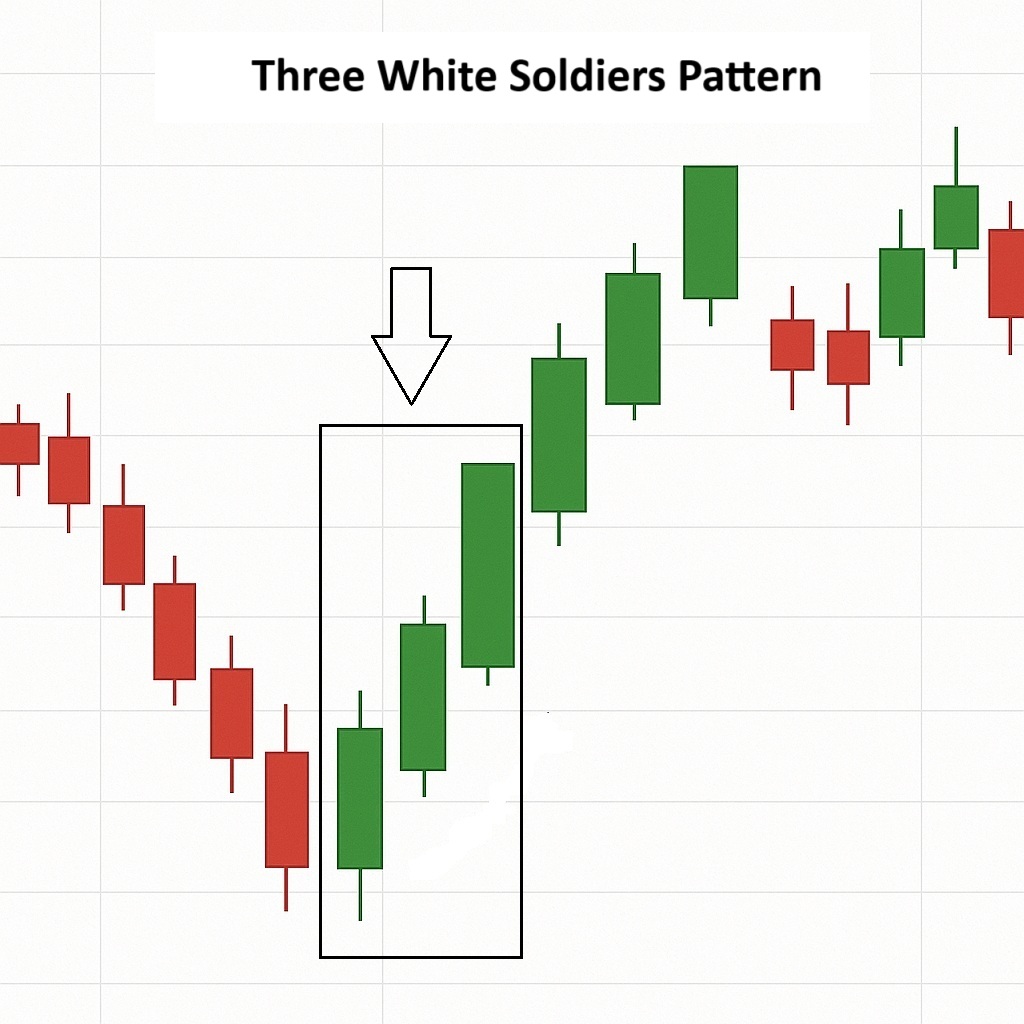

According to Investopedia, the Three White Soldiers pattern is one of the most powerful bullish candlestick reversal formations. It typically forms after a downtrend or a period of price consolidation, signaling the return of buying pressure to the market.

The pattern consists of three consecutive bullish candlesticks with relatively large bodies. Each candlestick opens within the body of the previous one and closes at a higher level, demonstrating consistent upward momentum. The upper shadows of these candles are usually short, indicating that buyers are in complete control of the market.

When this formation appears on the price chart, it suggests that selling pressure has weakened and the probability of a strong uptrend is increasing. Therefore, the Three White Soldiers pattern can serve as a reliable indication of a potential trend reversal and a signal to consider entering long positions.

Essential Requirements for the Three White Soldiers Candlestick Pattern

The Three White Soldiers pattern holds significant trading value only when it forms under specific market conditions and when its candlesticks exhibit certain characteristics. Below are the key conditions and features that validate this pattern:

Formation at the End of a Downtrend or Deep Correction

The most crucial factor for the reliability of the Three White Soldiers pattern is its appearance at the end of a downtrend or following a period of deep price correction. If the pattern develops at market tops or during a downtrend, it may produce misleading signals, causing traders to enter the market prematurely.

Strong Bullish Bodies

All three candlesticks that form the pattern should have large bullish bodies. The presence of strong bodies indicates sustained buying pressure and the fact that sellers have lost control of the market.

Opening Within the Previous Candle’s Body

The second and third candlesticks should open within the body of the previous candle and close above it. This stair-step pattern clearly reflects the continuation of buyer dominance and the growth of bullish momentum, signaling that buyers remain in control and the upward trend is strengthening.

Short Upper shadows

Additionally, the upper shadows of these candles should be short, indicating limited selling pressure during the formation of the pattern. Short upper shadows confirm that sellers are not yet strong enough to reverse the trend, further validating the bullish signal of the Three White Soldiers pattern.

High Trading Volume

When the formation of the Three White Soldiers coincides with an increase in trading volume, the probability of an actual trend reversal and the start of a strong bullish move rises significantly.

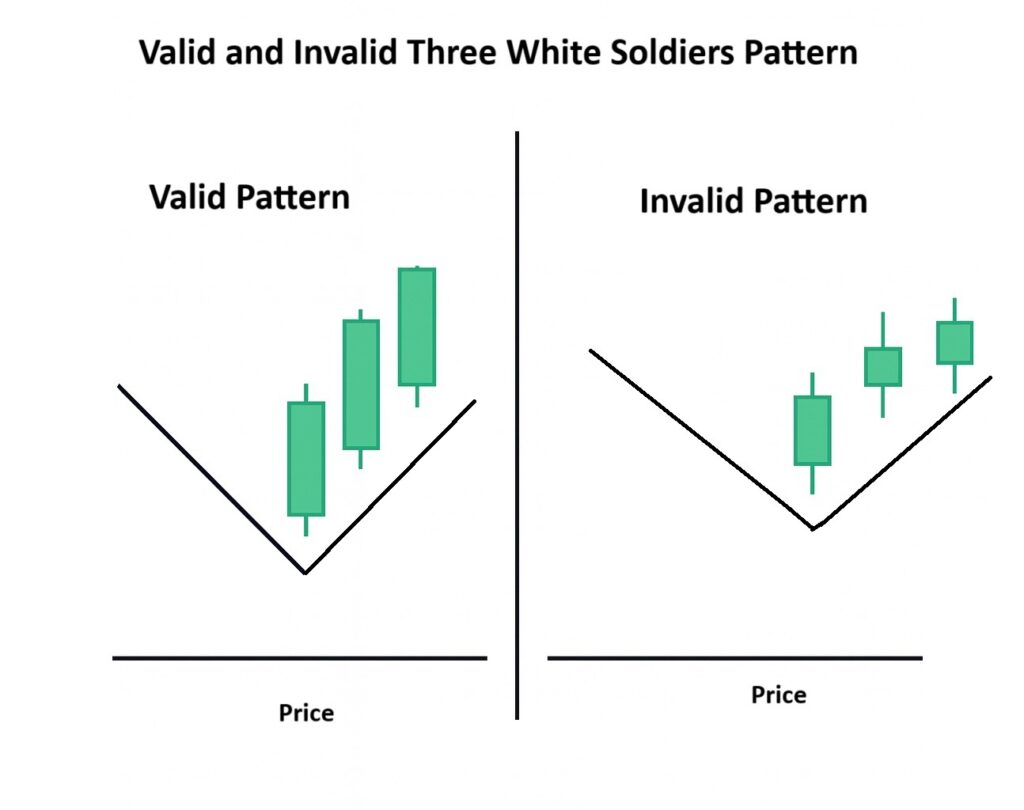

Valid vs. Invalid Three White Soldiers Candlestick Pattern

In the previous section, we reviewed the characteristics of a valid Three White Soldiers pattern. To improve identification and avoid false signals, it is equally important to understand the features that reduce the reliability of this formation.

Characteristics of an Invalid Three White Soldiers Pattern:

- The pattern often appears at the top of an uptrend or in overbought zones, reducing its reliability.

- Candlesticks have small bodies or are accompanied by long shadows, indicating weak bullish momentum.

- Candles open with significant gaps away from the previous candlestick, breaking the stair-step structure.

- Trading volume declines or remains stagnant during the formation, suggesting low market participation.

- The pattern frequently emerges near primary resistance levels, which can trigger a bearish reversal instead of a continuation.

| Feature | Valid Three White Soldiers Pattern | Invalid Three White Soldiers Pattern |

|---|---|---|

| Formation Location | Appears at the end of a downtrend or deep correction | Appears at the top of an uptrend or in overbought zones |

| Candlestick Bodies | Large and strongly bullish | Small bodies or accompanied by long shadows |

| Open and Close | Opens within the previous body and closes higher | Large gaps or abnormal distance from the previous candle |

| Trading Volume | Noticeable increase in trading volume | Low or stagnant volume during formation |

| Market Context | Forms near support and signals the start of a rally | Forms near resistance, often leading to bearish reversal |

Trader Psychology Behind the Three White Soldiers Candlestick Pattern

The psychology behind the Three White Soldiers pattern reflects a gradual shift in market sentiment—from fear, to confidence, and ultimately to enthusiasm. This collective mindset change is what often sparks the beginning of a sustainable bullish trend.

During a downtrend, the dominant emotion among traders is fear and pessimism. Sellers control the price action, while most buyers remain on the sidelines, waiting for the price to drop to lower levels. However, the formation of the first strong bullish candlestick ignites a spark of hope among market participants. This candle signals that sellers are losing strength and that buying pressure is slowly building.

The second and third candlesticks in the pattern play a crucial role. As they form, buyers gain greater confidence, and collective sentiment shifts from fear to greed. Inexperienced traders begin entering the market, while professional buyers add to their positions. At the same time, remaining sellers, faced with rapidly rising prices, are forced to exit or cover their short positions, further fueling buying pressure and supporting the continuation of the uptrend.

If the Three White Soldiers pattern forms near a key resistance level, the likelihood of a fake breakout increases, and traders should exercise caution.

How to Trade Using the Three White Soldiers Candlestick Pattern

The Three White Soldiers is one of the most reliable bullish reversal signals in price action trading, often marking the beginning of a new uptrend and an opportunity to enter long positions. However, to achieve the best results when trading this pattern, it is essential to pay close attention to entry rules, exit strategies, and proper risk management. Below, we outline the key steps for trading this setup.

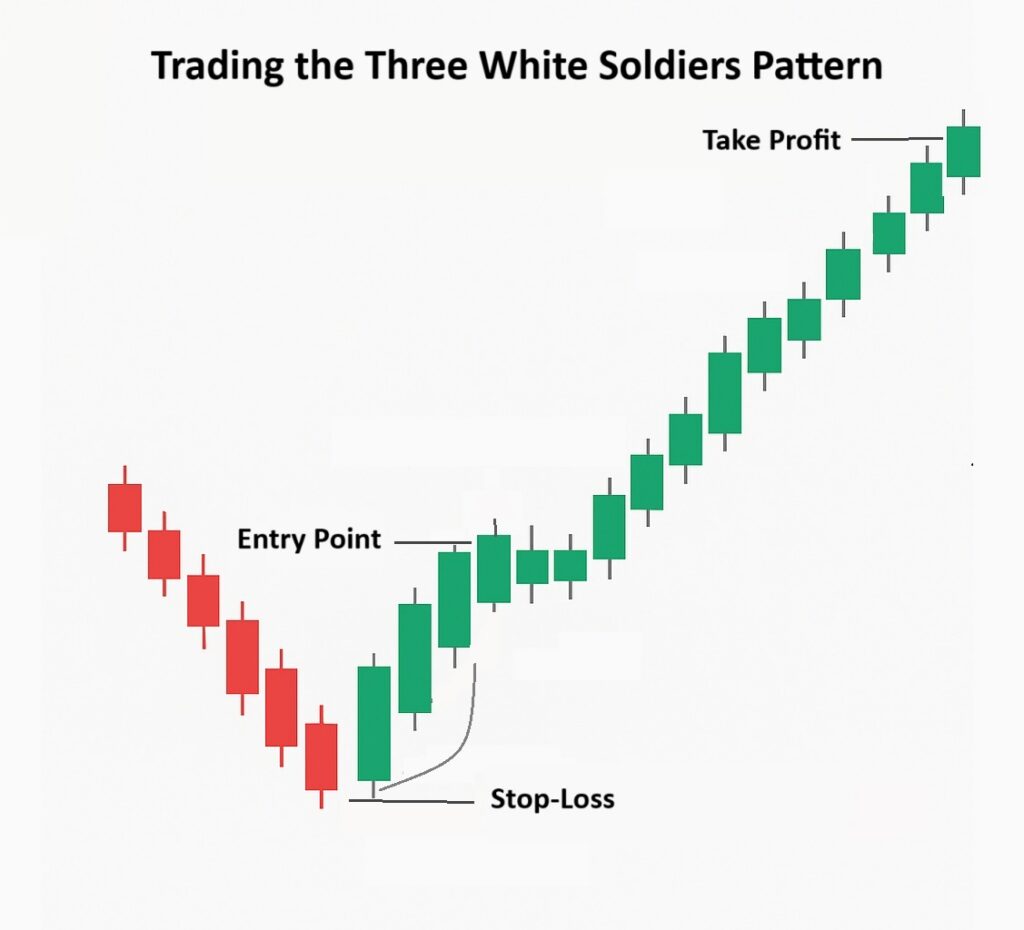

Trading Signals: When to Enter and Exit with the Three White Soldiers

After the formation of three consecutive bullish candlesticks, the most favorable entry point is usually at the close of the third candle or during the first minor pullback that follows. Entering at this stage enables you to align with the emerging trend and capitalize on the market’s bullish momentum.

- Entry Point: Enter a long position immediately after the close of the third candlestick.

- Exit Point: Set the initial profit target around previous resistance levels or key Fibonacci retracement zones.

According to Tradistate, since the Three White Soldiers pattern consists of three large bullish candlesticks, a portion of the uptrend has already unfolded before the pattern is fully formed. As a result, entering a trade based on this signal often occurs slightly later in the move.

How to Place a Stop-Loss in the Three White Soldiers Pattern

When trading the Three White Soldiers pattern, place the stop-loss just below the low of the first candlestick in the formation, or slightly beneath the most recent support zone or recent swing low.

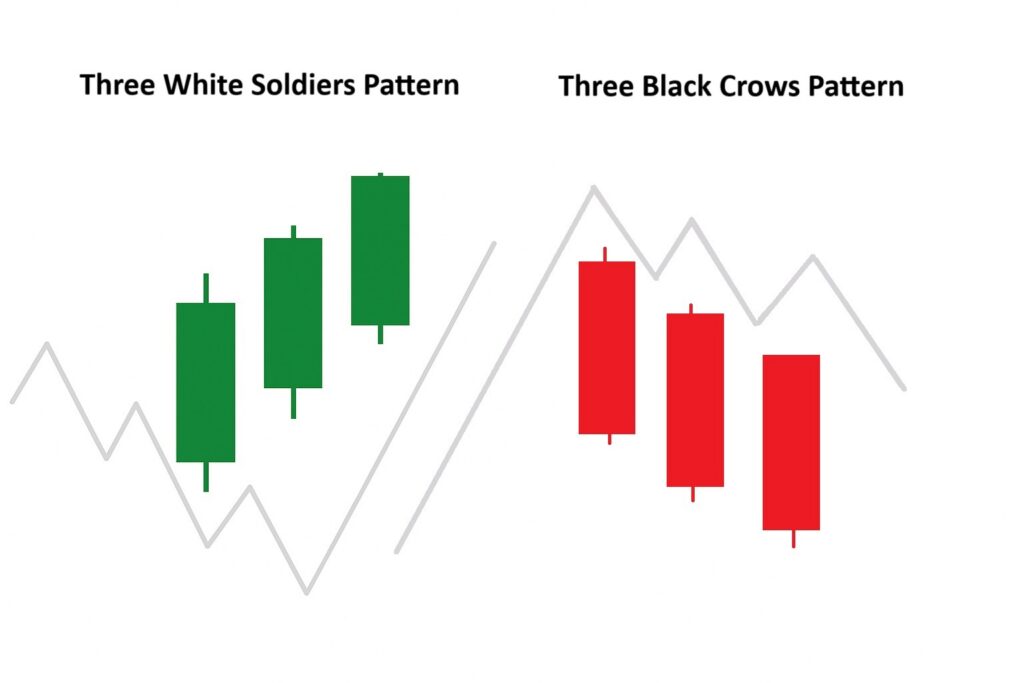

Key Differences Between the Three White Soldiers and Three Black Crows Candlestick Patterns

The Three Black Crows pattern is essentially the opposite of the Three White Soldiers and is recognized as a bearish reversal formation. The Three Black Crows consist of three long, consecutive bearish candlesticks that appear at the end of an uptrend. This pattern signals that sellers have gained control, increasing the likelihood of a trend reversal to the downside.

The key differences between these two patterns are as follows:

- Trend Direction: The Three White Soldiers indicate the end of a downtrend and the beginning of a bullish phase, while the Three Black Crows warn of the end of an uptrend and the start of bearish momentum.

- Market Sentiment: The Three White Soldiers reflect growing confidence and enthusiasm among buyers, whereas the Three Black Crows highlight fear and the dominance of sellers.

- Trading Application: The former is interpreted as a buy signal, while the latter serves as a warning to exit long positions or consider short entries.

| Feature | Three White Soldiers | Three Black Crows |

|---|---|---|

| Trend Direction | Signals the end of a downtrend and the start of a bullish phase | Signals the end of an uptrend and the beginning of a bearish move |

| Market Sentiment | Reflects rising confidence and enthusiasm among buyers | Highlights fear and the growing dominance of sellers |

| Trading Application | Acts as a buy signal and an entry opportunity | Serves as a warning to exit longs or consider short entries |

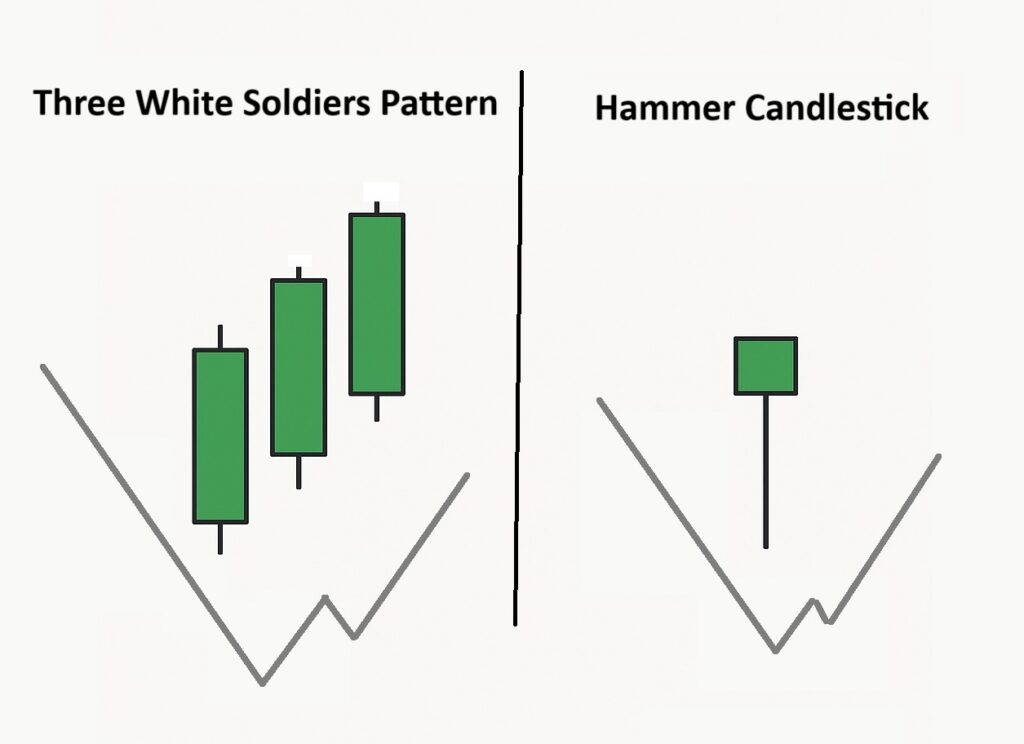

Three White Soldiers vs. Hammer Candlestick: Key Differences

Although both of these formations are reversal patterns that appear at the end of a downtrend, they have fundamental differences.

The key distinctions between the Three White Soldiers and the Hammer candlestick are as follows:

- Number of Candles: The Three White Soldiers is a multi-candle pattern consisting of three bullish candlesticks, while the Hammer is a single-candle formation.

- Signal Strength: The Three White Soldiers generally provide a stronger and more reliable reversal signal compared to the Hammer.

- Structure: In the Three White Soldiers, three consecutive large bullish bodies appear, whereas in the Hammer, a small real body with a long lower shadow is the defining feature.

- Need for Confirmation: The Three White Soldiers is often valid on its own, while the Hammer typically requires confirmation from subsequent candlesticks to validate the trend reversal.

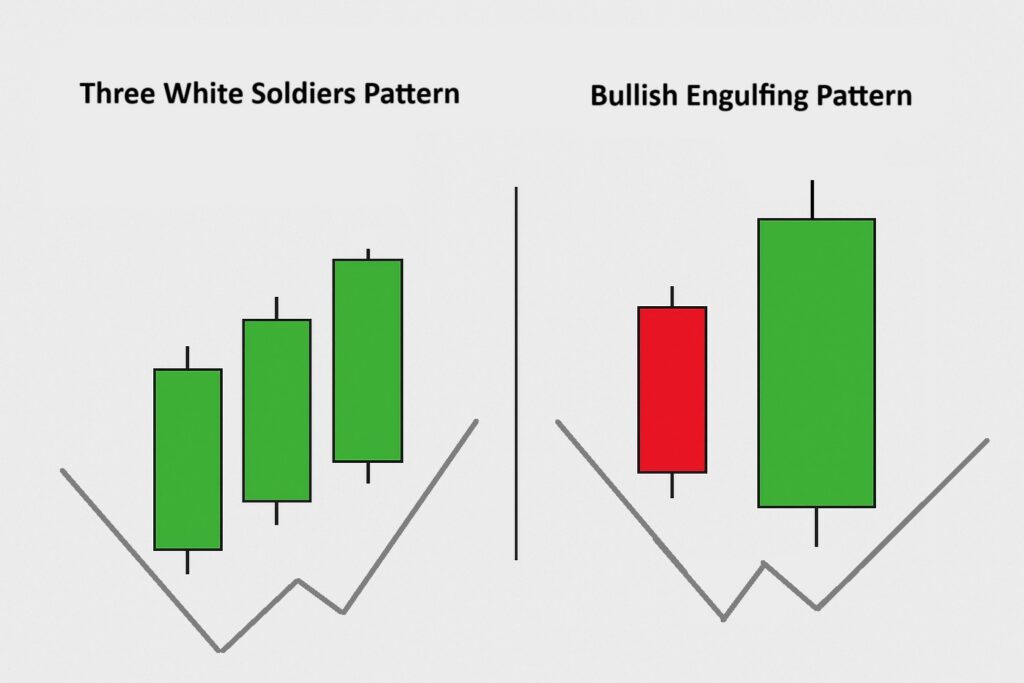

Three White Soldiers vs. Bullish Engulfing: Key Differences

The Three White Soldiers and the Bullish Engulfing are both significant reversal patterns in price action trading. Each signals strengthening buying pressure and the beginning of a new uptrend. However, they differ fundamentally in the number of candlesticks, structure, and signal strength—differences that are essential for traders to recognize.

The key distinctions between these two patterns are as follows:

- Number of Candles: The Three White Soldiers consist of three consecutive bullish candlesticks, while the Bullish Engulfing is a two-candle formation.

- Signal Strength: The Three White Soldiers typically generate a stronger and more sustainable bullish reversal signal, whereas the Bullish Engulfing often serves as an early indication of a potential reversal.

- Structure: In the Three White Soldiers, three large bullish bodies form in a stair-step sequence. In the Bullish Engulfing, one large bullish candle completely engulfs the body of the preceding bearish candle.

- Trading Application: The Three White Soldiers are used for more confident entries into a bullish trend, while the Bullish Engulfing acts more as an early warning and usually requires confirmation from subsequent candles.

Pros and Cons of the Three White Soldiers Candlestick Pattern

Like any other analytical tool, the Three White Soldiers pattern has its own strengths and weaknesses that traders should consider before relying on it.

Key Advantages of the Three White Soldiers Pattern

The key benefits of this pattern include:

- Powerful Reversal Signal: Indicates strong buyer dominance in the market and the beginning of a new bullish trend.

- High Reliability at the End of a Downtrend: When it forms after a downtrend or a deep correction, it often leads to a sustainable market reversal.

- Simplicity of Identification: With three consecutive large bullish candlesticks, even beginner traders can easily recognize it on the chart.

- Broad Applicability: Can be applied across all timeframes—from intraday trading to long-term investing—and in different markets such as forex, stocks, and cryptocurrencies.

If the third candlestick closes longer than the previous two but with lower volume, the likelihood of a short-term pullback following the pattern increases

Key Disadvantages and Limitations of the Three White Soldiers Pattern

The main drawbacks of this pattern are:

- Delayed Signal: Since three candles must complete before confirmation, part of the bullish move may already have occurred, leading to late entries.

- False Signals in Volatile Markets: Under unstable market conditions, the pattern may produce unreliable or misleading signals.

- Need for Confirmation: It is not always sufficient on its own; ideally, it should be confirmed with trading volume, support and resistance zones, or complementary indicators.

- Lower Risk-to-Reward Ratio: Because a portion of the move has already played out before entry, the potential reward relative to risk can be reduced in some trades.

Trading the Three White Soldiers Pattern with MACD Confirmation

Using the Three White Soldiers pattern in combination with the MACD indicator serves as a powerful confirmation for bullish reversal signals when:

- After the three bullish candlesticks form, the MACD line crosses above the signal line or moves above the zero line.

- A positive divergence between the price and MACD appears, signaling a strengthening of buying momentum.

Trading the Three White Soldiers Pattern with RSI Confirmation

Pairing the Three White Soldiers pattern with the Relative Strength Index (RSI) helps traders achieve more reliable trade entries. To confirm signals using RSI, consider the following:

- RSI Crossing Above 50: If RSI moves above the 50 level at the same time the pattern forms, it strongly indicates a momentum shift toward buyers and the start of a bullish trend.

- Avoiding Overbought Territory: The ideal scenario is when RSI has not yet entered above the 70 level. This condition indicates that there is still room for the bullish move to extend further.

- Positive Divergence: If, before the pattern forms, price makes lower lows while RSI prints higher lows, this divergence strengthens the validity of the bullish reversal signal.

Conclusion

The Three White Soldiers is one of the most reliable bullish candlestick patterns. When it appears under the right conditions and is confirmed with supporting tools, it can provide traders with an excellent entry point. However, proper risk management and consideration of complementary factors remain essential for successfully applying this pattern.