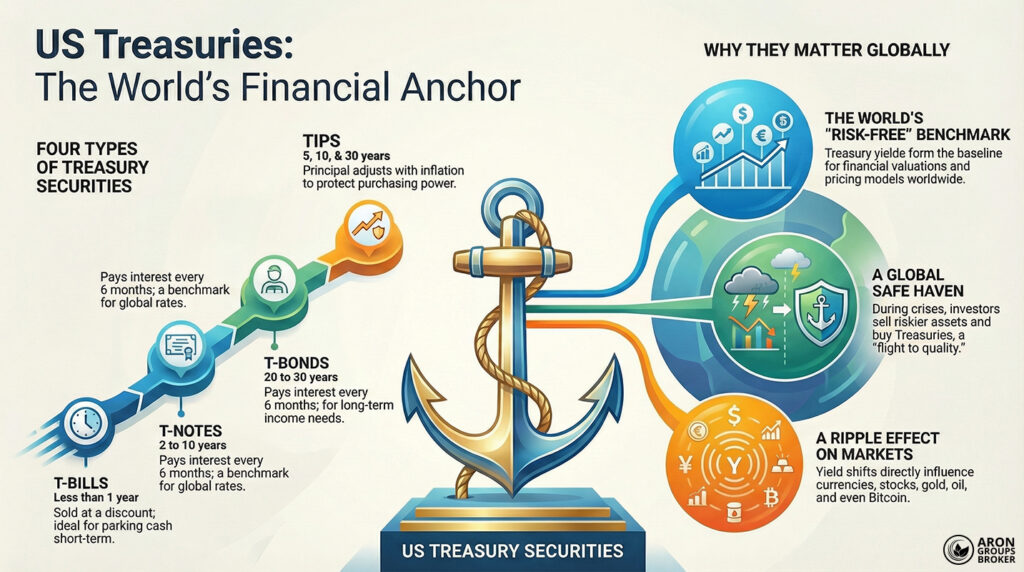

US Treasury bonds are among the most widely used financial instruments worldwide, and the US government uses them to fund spending. They are also treated as a key reference point in fundamental analysis across global markets.

These bonds directly influence interest-rate expectations and shape the US Dollar Index, especially through changes in Treasury yields. For international investors, they are widely seen as the safest asset during periods of economic stress.

Their importance is not limited to the United States, because yield moves can affect FX, equities, gold, oil, and even Bitcoin. That is why understanding how these securities work, and their main types, matters for both traders and long-term investors.

- US Treasury yields are widely used as the global risk-free rate, forming the baseline for many valuations and pricing models.

- Shifts in Treasuries can redirect international capital flows, triggering inflows into some countries and outflows from others.

- Professional traders read the US Treasury yield curve to gauge growth expectations and the risk of recession versus expansion.

- US Treasuries influence not only markets but also government policy choices and central-bank decisions across the global system.

What are US Treasury bonds?

According to Investopedia, US Treasury bonds, or Treasury securities, are debt obligations of the United States government issued to raise funds. They promise interest payments and repayment of principal at maturity, and their credit quality makes them the core benchmark for rates.

Types of US Treasury securities

US Treasury securities fall into four main categories, each with different features and uses for investors. Knowing these differences helps investors choose based on time horizon, risk tolerance, and financial objectives.

Treasury Bills (T-Bills)

Treasury bills, known as T-Bills, are short-dated instruments issued by the US Treasury.

Other key features of T-Bills include:

- Maturity: Less than one year, typically 4, 13, 26, or 52 weeks.

- Payment structure: No coupon payments; they are sold at a discount to face value and redeemed at par at maturity.

- Use case: Suitable for investors seeking a safe, short-term place to park cash, including corporates and low-risk funds.

Treasury Notes (T-Notes)

Treasury notes, known as T-Notes, are medium-term US government securities with regular coupon payments.

Other key features of T-Notes include:

- Maturity: 2, 3, 5, 7, or 10 years.

- Payment structure: Fixed coupon paid every six months.

- Use case: Widely used by institutions and individuals because they balance liquidity, yield, and risk effectively.

- Market benchmark: T-Note yields, especially the 10-year, are often the main benchmarks for interest rates.

Long-term Treasury Bonds (T-Bonds)

Long-term Treasury bonds, known as T-Bonds, are long-dated securities issued by the US Treasury.

Other key features of T-Bonds include:

- Maturity: 20 to 30 years.

- Payment structure: Fixed coupon paid every six months until maturity.

- Use case: Suitable for investors seeking long-term fixed income, such as pension funds and insurers.

- Risk and return: They carry greater price volatility than short-dated Treasuries, but typically offer higher yields.

Treasury Inflation-Protected Securities (TIPS)

These securities, also known as TIPS, have principal values adjusted for inflation.

Other key features of this category include:

- Maturity: Typically 5, 10, and 30 years.

- Special feature: The principal changes with inflation, helping preserve the real value of the investor’s money.

- Use case: Best for investors concerned about inflation and falling purchasing power, especially when inflation rises.

Why are US Treasury bonds important?

US Treasuries are more than a simple financial instrument and are widely seen as a cornerstone of the global financial system.

Below, we cover their role in funding the US government, their safe-haven status, and their impact on global investor confidence.

The role of US Treasuries in funding the government

The US government issues Treasury securities to cover spending, especially when tax revenues are insufficient to meet obligations. Buyers effectively lend to the US government, and the Treasury commits to repaying principal plus a specified return later.

For this reason, Treasuries are a primary tool for financing budget deficits and managing the United States’ substantial public debt. This process lets the government maintain cash flow without sharp tax rises or cutting essential expenditure.

US Treasuries as a safe-haven asset

US Treasuries have long been regarded as the world’s safest financial asset in periods of heightened uncertainty. This status reflects the United States’ economic and political backing and the dollar’s role as the leading global reserve currency.

When crises, wars, or market volatility increase fear, investors often sell risk assets and rotate into US Treasuries. As a result, Treasuries serve as a safe haven during stress and help support overall market confidence.

Key Point

During financial crises, Treasury prices can rise temporarily even with large US deficits, a dynamic called “flight to quality”.

How Treasuries influence global investor confidence

US Treasury yields are a key indicator for assessing the health of the US economy and, by extension, the global economy. Changes in yields are closely linked to the US Dollar Index (DXY) in many market regimes. In practice, higher Treasury yields often strengthen the dollar and attract foreign capital into dollar-denominated assets.

Q: How do US Treasuries relate to gold, and why does this matter for markets?

A: US Treasuries often move inversely to gold: when Treasury yields rise, gold can look less attractive, and vice versa. This relationship signals how Treasury moves can ripple into currencies and commodities, shaping global investor confidence.

The link between US Treasuries and interest rates

US Treasury securities mirror the Federal Reserve’s monetary policy, and even small rate moves can shift yields and prices.

The relationship between Treasury yields and Federal Reserve rate changes

Treasury yields are directly tied to Federal Reserve policy decisions and broader monetary conditions. When the Fed raises interest rates, new Treasury issuance typically offers higher yields to remain attractive to investors.

In this context, the yield curve is a key indicator for anticipating economic conditions. An upward-sloping curve suggests steady growth, while an inversion often signals an elevated recession risk.

Does a rise in interest rates reduce bond prices?

The relationship between interest rates and bond prices is inverse, so higher rates generally push bond prices down. When rates rise, older bonds with lower coupons become less attractive, and their market prices tend to fall.

By contrast, when rates fall, demand increases for older, higher-coupon bonds, and their prices usually rise. This basic mechanism is the main driver of bond price fluctuations in the secondary market.

The effect of interest rates on the dollar and international investment

Higher interest rates often strengthen the dollar because foreign investors are drawn to higher-yielding US Treasury assets. This can redirect global capital flows and directly impact the foreign exchange market.

Example:

When the US 10-year Treasury yield rises, demand for dollars often increases, which can weaken the euro or yen. That is why FX traders closely monitor interest-rate expectations and movements in Treasury yields.

Key Point:

Major pension funds and insurers widely use US Treasuries as a standard form of international collateral.

The impact of US Treasuries on the foreign exchange market

When US Treasury yields rise, foreign investors often convert assets into dollars to capture higher returns. This capital inflow into the United States typically supports the dollar and lifts its exchange rate.

Example:

If the US 10-year Treasury yield increases, the dollar is more likely to strengthen versus the euro (EUR/USD) or yen (USD/JPY). This happens because investors switch into dollars in pursuit of a higher yield.

The impact of US Treasuries on equity markets

When Treasury yields rise, especially on the 10-year and 30-year, many investors rotate from equities into bonds. This shift is often strongest in technology shares, where valuations are more sensitive to discount rates.

Treasuries offer predictable income and typically lower risk, so that capital can flow out of shares into government bonds. As a result, equity prices can fall, particularly in higher-risk sectors such as technology.

Example:

In recent years, rising 10-year yields reduced demand for technology stocks such as Apple and Tesla. Investors preferred a bond yield over taking uncertain future equity risk.

The impact of Treasuries on oil and global commodities

Rising Treasury yields often strengthen the dollar, reflecting higher relative returns on dollar-denominated assets. Because oil and most global commodities are priced in dollars, a stronger dollar makes them costlier for foreign buyers.

This higher effective price can reduce demand and put downward pressure on commodity prices.

Example:

In certain periods, higher yields have coincided with lower Brent crude or copper prices as non-US buying power fell.

US Treasuries and foreign investors

US Treasury securities are a core investment and reserve asset not only for individuals, but also for governments.

Why do countries invest a large share of reserves in US Treasuries?

To manage foreign exchange reserves, countries need assets that are both safe and quickly convertible into cash when required. US Treasuries offer exactly these features, backed by the US government and the dollar’s role as the leading reserve currency.

Beyond safety, they provide a predictable return, unlike holding cash, which generates no income. Treasuries can preserve reserve value while also delivering a defined stream of interest income to sovereign holders.

Q: Why do major central banks like China, Japan, and oil-exporting states hold large positions in US Treasuries?

A: They use Treasuries to strengthen financial stability and to help limit the risk that reserves lose value during inflation.

The role of China and Japan in buying US Treasuries

China and Japan are among the largest creditors of the US government, each holding hundreds of billions in Treasuries. These holdings offer two benefits: reserve security backed by the US and steady income rather than idle cash.

In addition, large-scale Treasury purchases can give these countries financial leverage in their economic relationship with the United States.

The consequences of large-scale Treasury sales by foreign countries

If countries such as China or Japan suddenly sell a large share of their Treasury holdings, supply rises, and prices fall. As prices drop, yields rise, which can put significant pressure on the dollar and unsettle global investor confidence.

Such an event could trigger instability across international markets because US Treasuries underpin much of the global system.

Key Point

The US yield curve also affects international lending rates, including European corporate loan pricing in euros or Swiss francs.

Risks of investing in US Treasuries

Despite Treasuries’ status as the world’s safest asset, investing in them is not risk-free. Economic and political factors can still affect Treasury prices, yields, and an investor’s realised returns.

Interest-rate risk and long-term price declines

The most important risk for Treasury bonds is rising interest rates. When the Federal Reserve raises rates, newly issued Treasuries typically offer higher yields to stay competitive.

Older bonds with lower coupons then become less attractive, so their prices fall in the secondary market. This is especially relevant for long-dated holdings, where price sensitivity can lead to capital losses.

Inflation risk and a fall in real returns

If inflation rises, fixed coupon income may fail to preserve the investor’s real purchasing power. In simple terms, bond income can lag behind the general price level, reducing the investment’s real value.

To address this, the US issues inflation-linked securities called Treasury Inflation-Protected Securities (TIPS). With TIPS, the principal is adjusted for inflation, helping to protect real returns over time.

Political risk and the heavy US debt burden

The United States is the world’s largest debtor, with public debt exceeding tens of trillions of dollars. Although Treasuries have remained highly trusted, a rising debt load could weaken confidence for some investors.

Q: How can US domestic politics affect the Treasury market?

A: Political tensions and budget disputes, such as debt-ceiling standoffs, can periodically unsettle markets. These episodes can raise global concern and sometimes undermine confidence in Treasury market stability.

Conclusion

At first glance, US Treasuries may look like a simple way for the government to finance itself. In practice, they have become a benchmark for assessing the global economy’s health.

For traders and investors, tracking Treasury yield moves can act like a compass for other markets’ direction. It can signal shifts across forex, equities, gold, oil, and even Bitcoin.

The key point is that Treasuries are not only a low-risk income opportunity, but also an economic warning signal. Investors who focus only on reliable yield may overlook hidden risks such as inflation or the US debt burden.

By contrast, investors who analyse Treasuries alongside other indicators can gain deeper macro insight. That broader view can support better decisions and more disciplined positioning across markets.