Imagine predicting explosive price movements in the Forex market and entering trades with more confidence. The vacuum block is a key concept in ICT trading. It helps identify price gaps caused by stop hunting and spot profitable market opportunities. These areas, formed by market maker actions and liquidity voids, can be crucial for your trading success. In this article, we’ll explain what a vacuum block is. We’ll also explore step-by-step how to analyze and trade using it. Join us to master this powerful strategy and elevate your trades to a professional level!

- Vacuum blocks create opportunities with controlled risk, offering precise entry and exit points for traders.

- Multi-timeframe analysis, combining higher and lower timeframe perspectives, increases the validity of price gaps.

- Stop hunting is a key method of creating vacuum blocks. Understanding it helps identify optimal entry points.

- Fake gaps can be distinguished from valid ones by analyzing volume, market structure, and price action.

What is a Vacuum Block and How is it Used in ICT?

A vacuum block is a key concept in the Inner Circle Trader (ICT) strategy, developed by Michael Huddleston. It refers to a price gap on a chart created by a lack of liquidity within a specific range. These gaps, often known as liquidity voids, are usually the result of actions by large institutions or smart money, targeting retail traders’ stop-loss orders through stop hunting.

This process creates an imbalance between supply and demand, leading to price gaps. Vacuum blocks help traders identify areas where explosive price movements are likely. In ICT, these zones are considered strategic entry or exit points for trades, as they represent areas targeted by large institutions to manipulate prices and collect liquidity.

Why Are Vacuum Blocks Important for Professional Traders?

Vacuum blocks are important for professional traders because they help predict large price movements. These blocks, often the result of stop hunting by large institutions, represent price gaps created due to a lack of liquidity. When institutions target retail traders’ stop-loss orders through stop hunting, the price moves quickly, creating liquidity voids and presenting trading opportunities.

These areas assist traders in finding more precise entry and exit points, as prices typically return to these gaps to restore market balance. Understanding liquidity in Forex is crucial for using this strategy effectively, as vacuum blocks highlight areas with low liquidity, exploited by large institutions. Professional traders can align their strategies with smart money and profit from explosive price movements by analyzing these blocks.

Types of Vacuum Blocks (Vacuum Block)

Vacuum blocks are divided into two main types: bullish and bearish. Each has unique characteristics and uses in Forex trading.

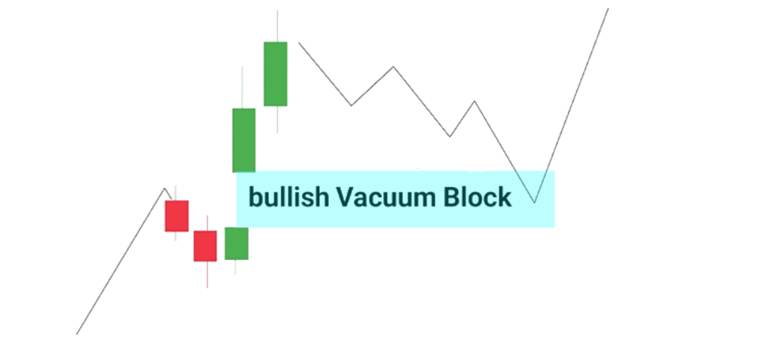

Bullish Vacuum Block

A bullish vacuum block forms when price rises quickly due to volatile events, like NFP reports or geopolitical news. These gaps usually result from stop hunting, where large institutions target stop-loss orders of sellers.

For example, in the EUR/USD pair, after the Federal Reserve’s interest rate announcement in March 2023, the price increased quickly. This created a bullish vacuum block due to higher demand for the dollar. Traders can enter buy trades when price returns to this gap.

Bearish Vacuum Block

A bearish vacuum block occurs when price drops quickly due to a lack of buyers or strong selling pressure. These gaps also result from stop hunting. For example, in the USD/JPY pair, after a geopolitical event in October 2024, the price dropped sharply. This was due to widespread selling of the yen, forming a bearish vacuum block. Traders can enter sell trades when price returns to this gap.

How Vacuum Blocks Form on the Chart

To understand how vacuum blocks form, traders must study key factors behind this phenomenon. These include liquidity flow, volatility, candle structure, and differences from similar zones like the Fair Value Gap (FVG). Let’s explore each element step by step.

The Role of Liquidity Flow and High Volatility

A vacuum block, also called a liquidity void, forms when price moves quickly without active trading within a specific range. In this zone, liquidity is absent, meaning no significant buy or sell orders exist. Such Forex price gaps often occur during high volatility events like NFP reports or FOMC announcements. Geopolitical events can also trigger these gaps and sudden market reactions.

Market makers may use stop hunting strategies to trigger retail stop-loss orders and create strong price movements. This activity forms vacuum blocks, which later attract price to rebalance the market. Therefore, vacuum block trading helps traders identify zones where explosive reversals are likely to happen.

Candle Characteristics and Visual Patterns in Vacuum Blocks

On price charts, vacuum blocks appear as large candles with no wicks or very small shadows. These candles represent quick and intense movements within a short period. They usually form in areas where no trading occurred, leaving clear liquidity voids behind.

Such visual patterns help traders detect these zones and use them within Smart Money Concepts (SMC) strategies. Here, price action plays a vital role since identifying these structures requires precise analysis of price movement and liquidity imbalances.

Fair Value Gap (FVG) vs Vacuum Block in ICT

A vacuum block is different from a Fair Value Gap (FVG) in structure and purpose. FVGs are smaller gaps caused by imbalances between supply and demand within three candles. Traders often use them to spot support and resistance zones.

In contrast, vacuum blocks are wider gaps created by stop hunting or major economic events. Within the ICT framework, these areas signal high volatility trading opportunities. They mark regions dominated by institutional activity where prices are likely to make sharp and aggressive moves.

How to Identify Vacuum Blocks on the Chart

One common question is how to identify vacuum blocks accurately. Spotting these gaps on Forex charts is essential for confident, professional decisions. Below are practical methods for finding vacuum blocks and filtering low-quality setups.

Best Timeframes for Accurate Vacuum Block Trading

To identify valid vacuum blocks, higher timeframes like H4 and Daily are usually the most reliable. Gaps on higher charts tend to reflect real institutional activity and cleaner Forex Price Gaps. These areas often form during sharp liquidity grabs and confirmed Stop Hunting Strategy behavior.

For precise entries, switch to lower timeframes like M15 or M5 after mapping the higher-timeframe zone. This approach improves timing and reduces noise during High Volatility Trading sessions. Multi-timeframe execution also aligns well with Smart Money Concepts (SMC) analysis.

How to Find Vacuum Blocks Using Price Action and Tools

You can identify vacuum blocks using price action plus a few simple tools. Use these tools to highlight gaps and confirm the surrounding structure and liquidity context.

- Horizontal Lines: Mark the start and end of the rapid move that left a clear gap. These lines often frame a Liquidity Void zone on the chart.

- Fibonacci Retracement: Apply Fibonacci to the impulse move that created the gap. Confluence with a vacuum zone strengthens many Vacuum Block Trading setups.

- Volume Indicators: Check volume around the gap and during the return into it. Rising volume on re-entry can validate institutional interest near Forex Price Gaps.

During events like NFP, these tools can support an NFP Trading Strategy focused on retracements into the gap. Always read structure first, then use tools for confirmation, not prediction.

How to Tell a Real Vacuum Block from Fake Gaps

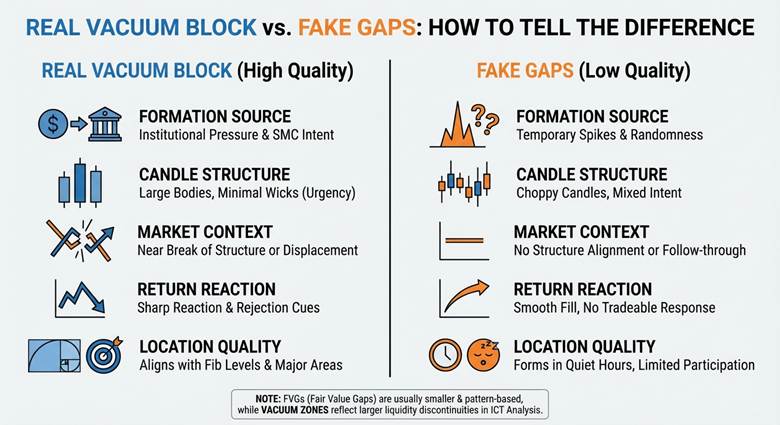

A valid vacuum block usually comes from a strong liquidity event, not random volatility. Fake gaps often appear during thin sessions and disappear without meaningful reaction. Use the checks below to separate high-quality gaps from noise.

- Formation Source: Real vacuum zones often form from one-sided institutional pressure and clear Smart Money Concepts (SMC) intent. Fake gaps often come from temporary spikes and low-timeframe randomness.

- Candle Structure: Valid gaps often show large bodies and minimal wicks, reflecting urgency and imbalance. Fake gaps typically show choppy candles and mixed intent.

- Market Context: Strong vacuum zones often appear near a break of structure or a clear displacement. Weak gaps appear without structure alignment and lack follow-through.

- Return Reaction: Price often reacts sharply when revisiting a valid vacuum zone and shows rejection or continuation cues. Fake gaps frequently fill smoothly and offer no tradeable response.

- Location Quality: Real zones often align with fib levels, prior liquidity sweeps, or major supply and demand areas. Low-quality gaps often form in quiet hours with limited participation.

Finally, compare context when studying Fair Value Gap (FVG) vs Vacuum Block zones in ICT analysis. FVGs are usually smaller and pattern-based, while vacuum zones reflect larger liquidity discontinuities.

Trading Strategies Using Vacuum Blocks

A vacuum block strategy helps traders use Forex Price Gaps to find high-probability setups. These gaps often reflect a Liquidity Void created by institutional activity. Below are practical ways to trade a vacuum block within ICT and Smart Money Concepts (SMC) frameworks.

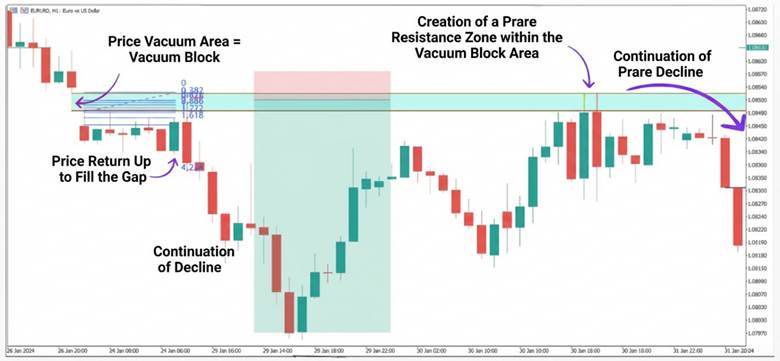

Entering Trades When the Price Gap Gets Filled

To trade a price gap, wait for price to return into the vacuum block zone. This return often happens after a Stop Hunting Strategy triggers retail stops and pulls price back for liquidity. Look for price action confirmation, such as pin bars or engulfing candles, before entering.

In a bullish setup, consider a buy after price revisits the vacuum block and shows a clear reversal signal. In a bearish setup, consider a sell after the revisit and bearish rejection confirmation. Waiting for confirmation reduces risk and improves Vacuum Block Trading consistency.

Setting Stop Loss and Take Profit Using Vacuum Block Logic

In a vacuum block plan, stop loss typically goes outside the gap boundary for protection. For buys, place the stop below the gap, and for sells, place it above. This placement limits risk if the market invalidates the gap narrative.

For take profit, target the next liquidity pool, prior swing levels, or key Fibonacci retracement zones like 61.8%.

Differences Between Vacuum Blocks and Other Common Market Gaps

Financial markets contain several types of price gaps, and each gap has a different purpose. A vacuum block is unique because it reflects a Liquidity Void caused by missing orders. It is heavily used in ICT and Smart Money Concepts (SMC) analysis for timing strong reversals.

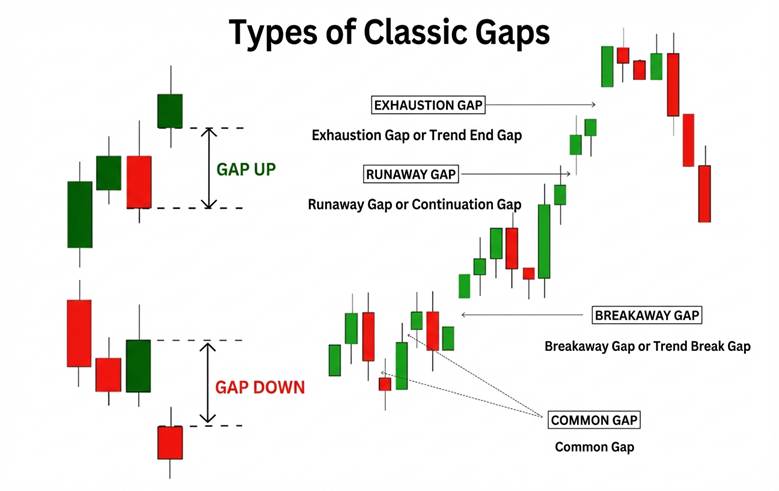

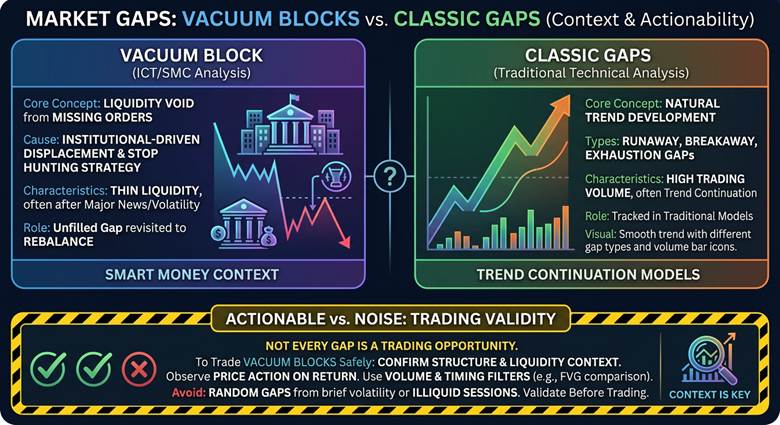

Comparison With Classic Gaps

Classic gaps include the Runaway Gap, Breakaway Gap, and Exhaustion Gap seen in many markets. These gaps usually form from natural trend development and often appear with high trading volume. They are commonly tracked in traditional technical analysis and trend continuation models.

In contrast, a vacuum block forms because of thin liquidity and institutional-driven displacement. These Forex Price Gaps often appear after major news and sudden volatility events. They frequently represent an unfilled Liquidity Void that price may revisit to rebalance.

The Role of Institutions in ICT-Driven Gaps

Institutions, or smart money, often use a Stop Hunting Strategy to create a vacuum block. They push price quickly to trigger retail stop-loss orders and collect liquidity efficiently. This creates sharp displacement and leaves behind clear gaps on the chart.

These gaps become actionable zones in ICT, especially when aligned with structure and liquidity targets. This is why Vacuum Block Trading focuses on context, not just the gap itself. It also explains why High Volatility Trading sessions create cleaner vacuum zones.

Are All Gaps a Trading Opportunity?

Not every gap is a tradeable opportunity, even if it looks attractive at first glance. Some gaps form from brief volatility and may not produce a meaningful return or reaction. Others occur during illiquid sessions and behave unpredictably after formation.

To trade a vacuum block safely, confirm structure, liquidity context, and price action on the return. Use volume and timing filters when comparing Fair Value Gap (FVG) vs Vacuum Block zones. This confirmation process helps separate valid vacuum zones from random gaps.

Valid vacuum blocks rarely form at retracement levels below 50%, because liquidity depth and order balance are usually insufficient in those areas to create a stable, sustained Liquidity Void that supports reliable Vacuum Block Trading setups.

Common Mistakes When Using Vacuum Blocks

Using a vacuum block in Forex requires precision, because common mistakes can quickly lead to losses. Below are three frequent errors traders make with Vacuum Block Trading setups.

Failing to Identify Fake and Invalid Gaps

A common mistake is trading gaps that form from short-lived volatility and weak market participation. Some Forex Price Gaps look clean, yet they lack real institutional displacement and a true Liquidity Void. Without confirmation, price may never return, making the setup unreliable.

To avoid this, validate the vacuum block with structure, timing, and liquidity context. Use volume behavior and reaction quality to separate valid gaps from noise. This filtering aligns better with Smart Money Concepts (SMC) logic.

Entering Too Early Without Structural Confirmation

Another mistake is entering immediately after spotting a vacuum block, without waiting for confirmation. A gap alone is not a signal, especially during High Volatility Trading conditions. Without price action confirmation, entries often get trapped by the next liquidity sweep.

Wait for clear confirmation, like reversal candles or a shift in internal structure. Combine price action with volume behavior to improve entry accuracy. This discipline strengthens consistency across Vacuum Block Trading scenarios.

Ignoring Higher Timeframes in Analysis

Ignoring higher timeframes like H4 or Daily often causes traders to misread the gap’s importance. Many valid vacuum block zones are only clear when viewed inside the higher-timeframe structure. Lower timeframes can exaggerate moves and create misleading gap formations.

Use multi-timeframe analysis to confirm the gap sits in a meaningful liquidity area. This approach helps avoid weak setups and supports better decisions under Stop Hunting Strategy conditions. It also clarifies Fair Value Gap (FVG) vs Vacuum Block behavior in ICT mapping.

On higher timeframes, vacuum blocks more often form near the 61.8% and 78.6% Fibonacci retracement zones, so not every gap qualifies as a valid vacuum block for reliable Vacuum Block Trading decisions.

Conclusion

In ICT analysis, a vacuum block is more than a simple price gap on a chart. It reflects intelligent liquidity interaction and deliberate market maker planning to control trend direction.

Accurately spotting a vacuum block, especially near key Fibonacci levels and after liquidity sweeps, creates high-quality opportunities. These areas often mark a Liquidity Void where price may return to rebalance efficiently. This framework supports Vacuum Block Trading with controlled risk and clearer trade planning.

Traders who detect these hidden structures and read price reaction during the return gain a real edge. They can benefit from explosive moves while improving mastery of Smart Money Concepts (SMC) and market behavior.