In the cryptocurrency market, Uniswap stands out as one of the leading decentralized exchanges (DEXs). But what exactly is Uniswap, and why is it so important? Simply put, Uniswap is a platform built on the Ethereum blockchain that enables users to trade various tokens directly, without the need for an intermediary. Unlike traditional exchanges, you maintain complete control over your assets.

This article is a comprehensive and practical guide to using Uniswap. We will explore what Uniswap is, how it operates, and how you can safely execute your first trade on the platform. If you’re looking to enter the exciting world of Decentralized Finance (DeFi), Uniswap is an excellent starting point.

- Uniswap is a decentralized exchange that requires no registration or KYC; all you need is a crypto wallet.

- Your assets never leave your wallet and remain under your control until the moment a trade is executed.

- Anyone can list a token on Uniswap, which is why you should always verify the token’s contract address through reliable sources before making a purchase.

- On Uniswap, you can access thousands of new tokens that have not yet been listed on major exchanges like Binance.

What Is Uniswap?

Uniswap operates like a marketplace with no central authority or intermediary, functioning completely autonomously. Unlike Centralized Exchanges (CEXs) such as Binance, which are custodial and require user registration, Uniswap is non-custodial. This means you always maintain complete control over your personal wallet and its contents.

Instead of employing a traditional order book system, the exchange utilizes an innovative technology known as an Automated Market Maker (AMM). Within this system, trades are executed directly against liquidity pools via smart contracts. This architectural design makes the process of performing token swaps on Uniswap exceptionally streamlined, efficient, and entirely permissionless, allowing anyone to participate.

How Does Uniswap Differ from Centralized Exchanges?

The fundamental differences between Uniswap and Centralized Exchanges (CEXs) like Binance or Coinbase lie in their approaches to user control, privacy, and operational structure. These distinctions can be summarized as follows:

- Self-Custody vs. Custodial Models: On a Centralized Exchange, users deposit their assets into a wallet controlled by the company, effectively ceding custody of their funds. In stark contrast, Uniswap is non-custodial. Your assets never leave your personal wallet; you retain sole ownership of your private keys and full control over your capital at all times.

- Permissionless Access vs. KYC Requirements: Centralized Exchanges are required to comply with regulations, mandating that users complete a Know Your Customer (KYC) process by submitting personal information and identification. Conversely, Uniswap is permissionless. It requires no user registration or KYC, allowing anyone with a cryptocurrency wallet to begin trading immediately.

- Permissionless vs. Vetted Asset Listings: On CEXs, the process for listing a new token is permissioned; it is often a complex procedure that requires approval from the exchange’s management. Uniswap, however, allows for permissionless listings. Anyone can introduce a new token to the market simply by creating a new liquidity pool for it. This model provides traders with much earlier access to emerging projects.

- On-Chain vs. Off-Chain Transparency: Every transaction and operation on Uniswap is recorded directly on the blockchain, making them publicly verifiable and fully transparent. In contrast, the internal operations of Centralized Exchanges are conducted off-chain within private ledgers, offering a significantly lower degree of transparency.

How Does Uniswap Work?

Unlike traditional exchanges that match buyers with sellers through an order book, Uniswap functions as a fully automated and intelligent marketplace. Its operation is built on two key and innovative concepts: the Liquidity Pool and the Automated Market Maker (AMM).

What Are Liquidity Pools and How Do They Function?

Imagine these pools as large, shared vaults containing a pair of two different tokens (for example, ETH and a stablecoin like USDC). These vaults are funded by users known as Liquidity Providers (LPs). When you want to execute a trade, instead of being matched with another individual, you interact directly with the pool: you deposit one token into it and withdraw the other.

The Automated Market Maker (AMM) Mechanism

The AMM is the core engine that governs the Uniswap protocol. Instead of a traditional order book, the AMM uses a deterministic pricing algorithm, most famously the constant product formula (x*y=k), to set the spot price for tokens. When a trade occurs, it alters the ratio of assets in the pool, and the AMM instantly and automatically recalculates the price based on this new ratio.

The Role of Liquidity Providers (LPs)

Liquidity Providers are the backbone of the protocol. By depositing a token pair into a pool, they provide the necessary liquidity that enables trades to occur. In return for their contribution, the protocol incentivizes them with rewards: LPs earn a proportional share of the trading fees generated from every transaction within their pool. This decentralized model completely removes the need for any central intermediaries.

How to Use Uniswap: A Step-by-Step Guide (with Illustrations)

Executing a trade on the Uniswap exchange is straightforward and involves three primary steps: installing a wallet, connecting it to the platform, and executing the trade. We will walk through this process step-by-step below.

Creating a Uniswap-Compatible Wallet (with Illustrations)

To interact with Uniswap, you first need a software wallet, which serves as your gateway to the world of Decentralized Applications (dApps). Two of the most popular and reputable options include:

- MetaMask: The leading choice for desktop browsers (such as Chrome and Firefox).

- Trust Wallet: A secure and user-friendly wallet for mobile devices.

After installing your chosen wallet, proceed to create a new one. The most critical step in this process is to securely back up your 12-word secret Phrase (also known as a Seed Phrase). Write it down and store it in a safe, offline location. This phrase is the master key to your funds; never share it with anyone.

Setting Up and Connecting MetaMask for Use with Uniswap

Step 1: Begin by visiting the App Store (for iOS devices) or the Google Play Store (for Android devices). Search for “MetaMask” and proceed to download and install the application.

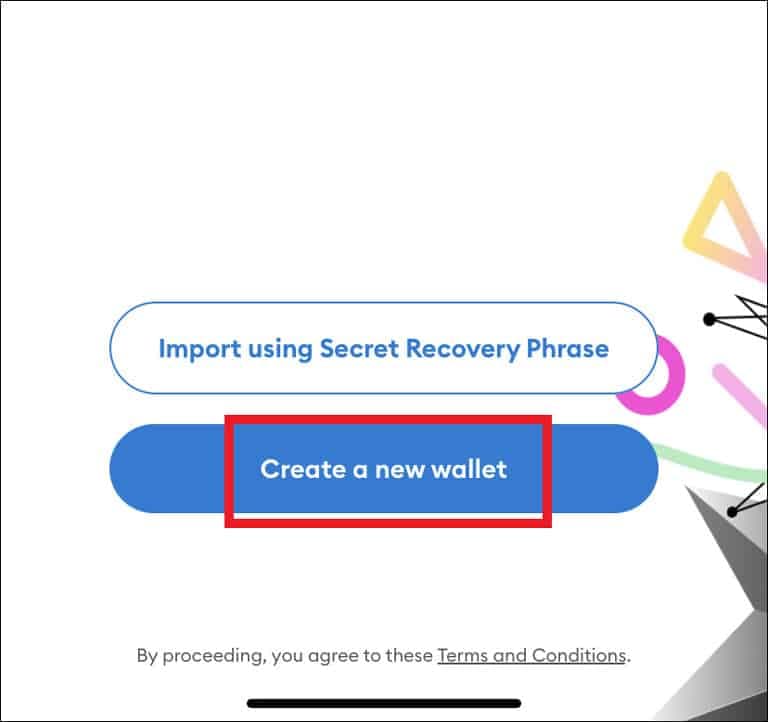

Step 2: Launch the application and tap “Get Started.” On the following screen, select “Create a Wallet” to set up a new wallet. If you have an existing wallet you wish to restore, choose the “Import Wallet” option.

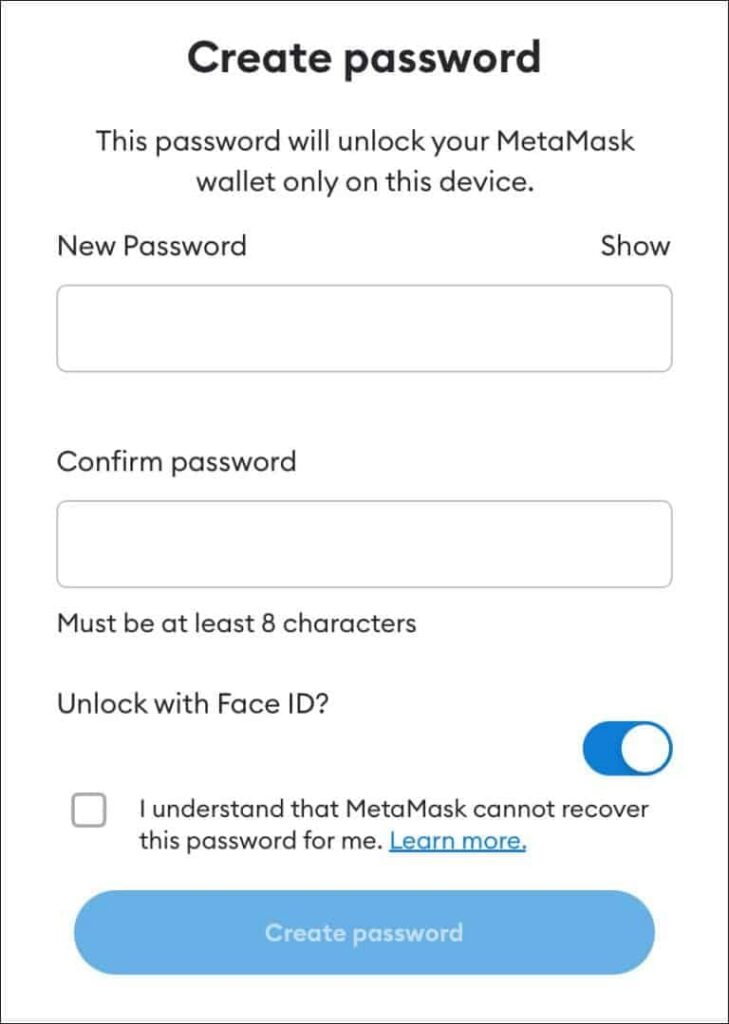

Step 3: You will now be prompted to set a strong password for your MetaMask wallet. Enter your password in the first field and repeat it in the second for confirmation. You can also enable biometric login (Face ID or Fingerprint). Finally, agree to the Terms and Conditions to proceed.

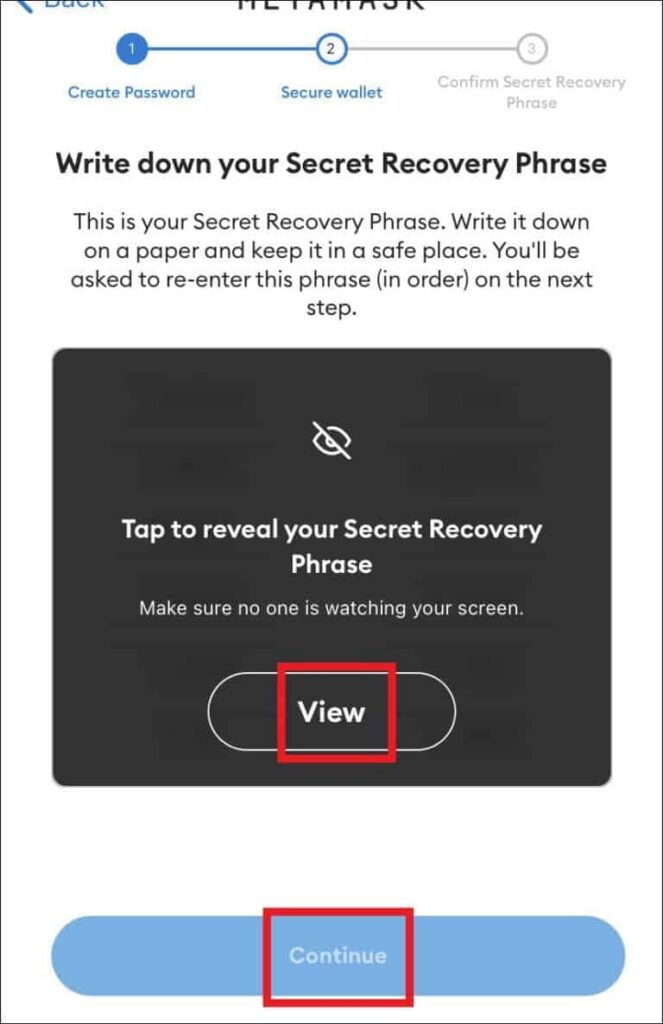

Step 4: After watching a brief security video on the next screen, tap “Start.” You will then be given the option to reveal your Recovery Phrase (also known as a Seed Phrase). You must write this phrase down on paper and store it in a highly secure location, as it is required to restore your wallet on a new or different device.

Step 5: Be aware that the Recovery Phrase is the only way to access your funds if you forget your password or need to reinstall your wallet. Losing this 12 or 24-word phrase will result in the permanent loss of your capital, with no possibility of recovery. To complete the setup, re-enter the words in the correct order and tap “Continue” to create your wallet.

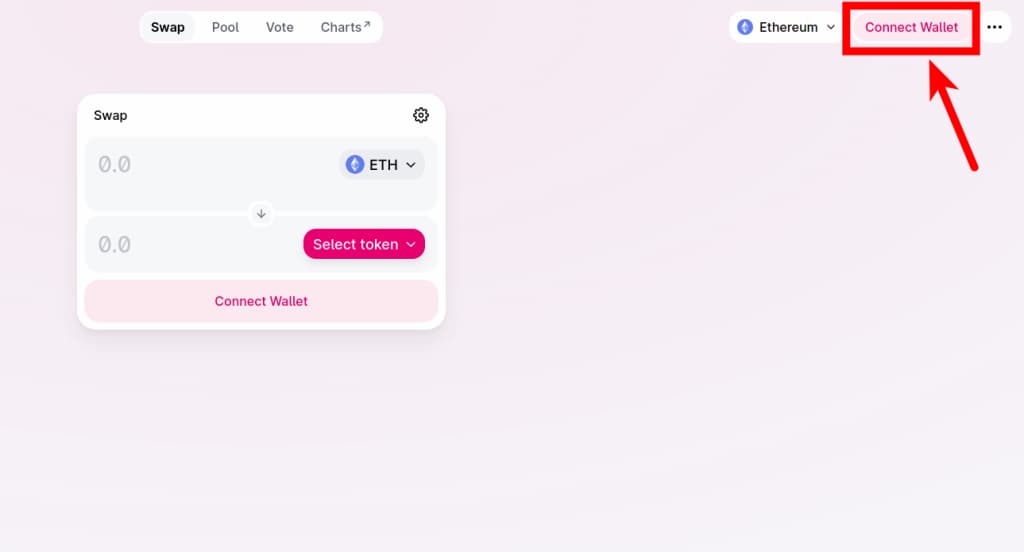

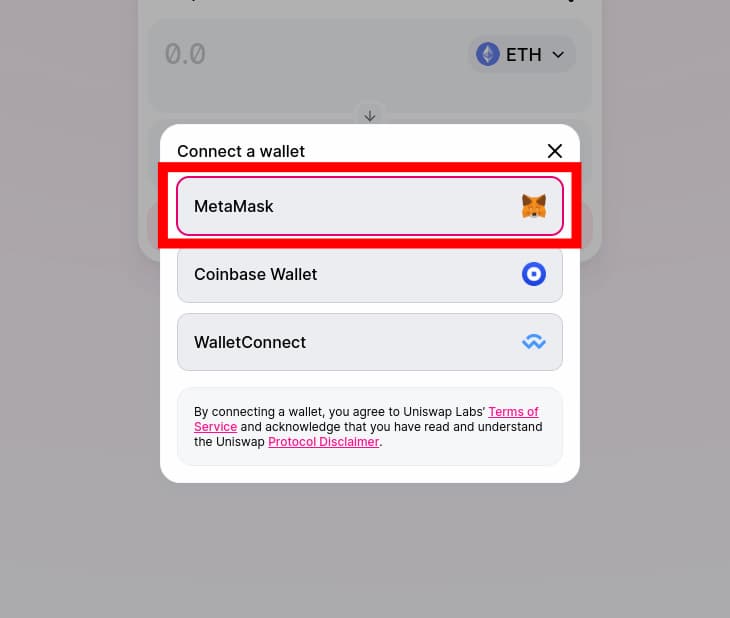

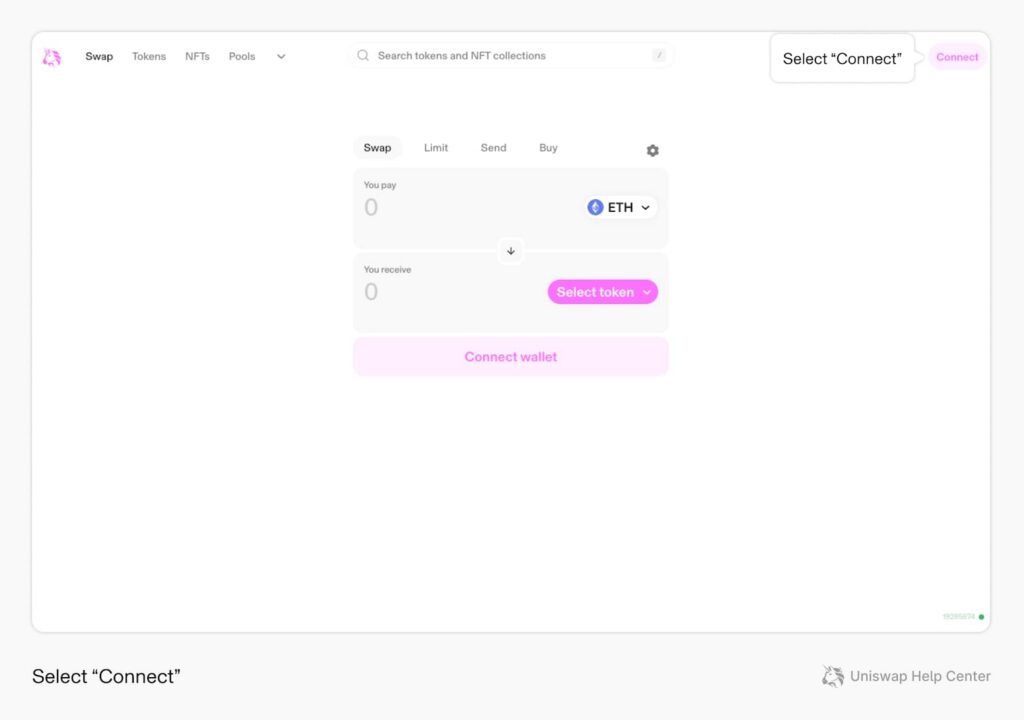

Step 6: To connect your wallet, navigate to the official Uniswap website (app.uniswap.org) and click the “Connect Wallet” button.

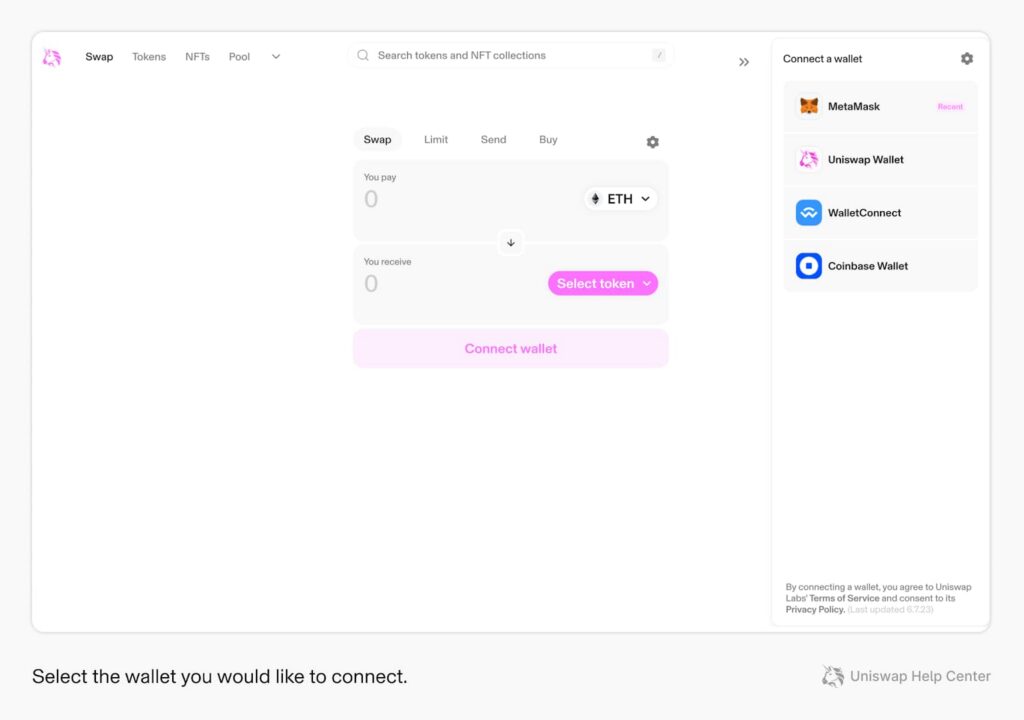

Step 7: From the list of available wallet options, select “MetaMask.”

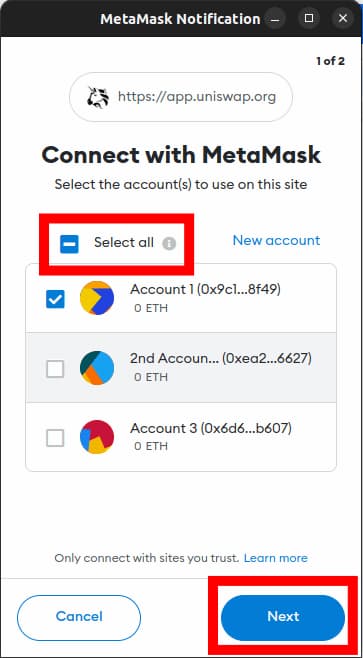

Step 8: A MetaMask pop-up window will appear. Select the account(s) you wish to connect to Uniswap, then click “Next.”

Security Note: If you wish to connect all accounts within your MetaMask wallet, you can choose "Select All" before clicking "Next." However, as a best practice, it is generally not recommended to connect all of your accounts to any single dApp. It is safer only to connect the specific account you intend to use.

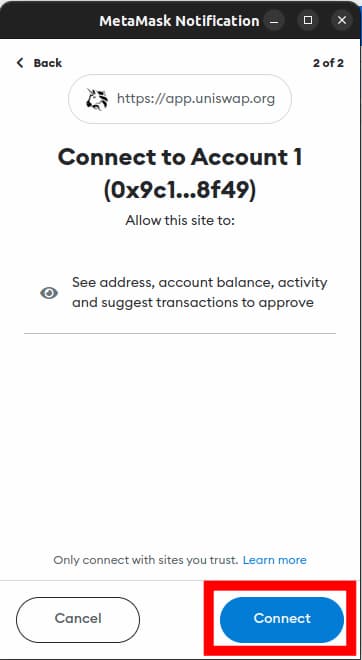

Step 9: Finally, click “Connect” to confirm the connection. Your MetaMask wallet will now be linked to the Uniswap exchange.

Setting Up and Connecting Trust Wallet for Use with Uniswap

Step 1: Go to the App Store (for iOS devices) or the Google Play Store (for Android devices). Search for “Trust Wallet” and proceed to download and install the application.

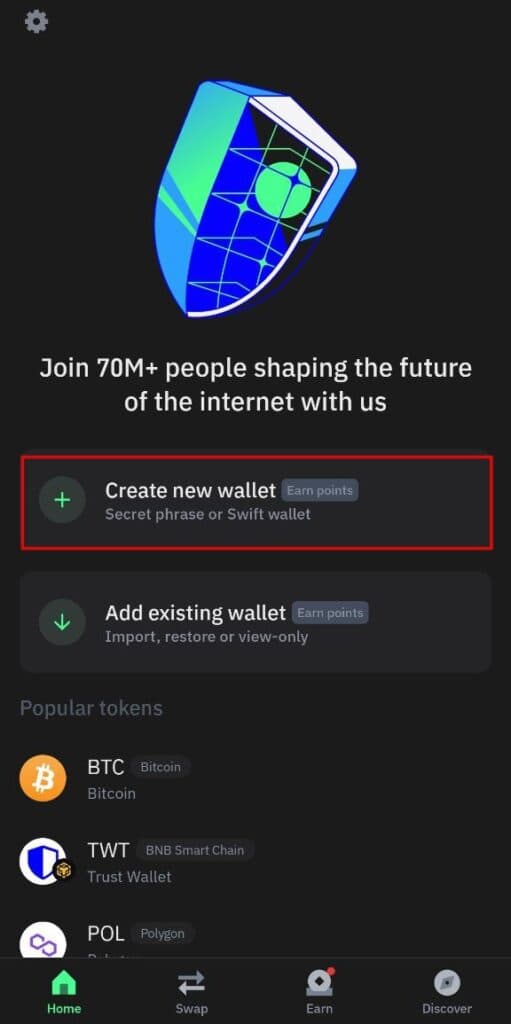

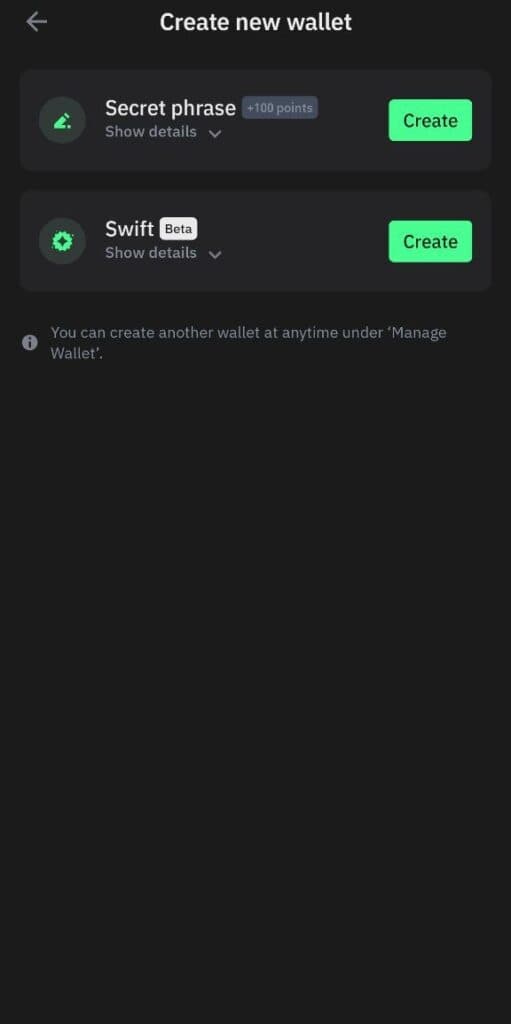

Step 2: Launch the application and select the “Create a New Wallet” option.

Step 3: At this stage, you will be presented with two options for creating your new Trust Wallet:

- Secret Phrase: This is the traditional method. The Recovery Phrase (or Secret Phrase) is a unique combination of 12, 18, or 24 words that acts as the master key to your digital assets, securing your wallet and enabling its recovery.

- Swift (Beta): This is a new, experimental method for wallet creation that eliminates the traditional 12-word Recovery Phrase. Instead, wallet access and recovery are managed via biometrics (Face ID or fingerprint) through Passkey technology. This option also allows you to pay transaction fees (gas fees) using over 200 different tokens.

Select one of the options above and follow the on-screen instructions provided by Trust Wallet to complete the setup.

Step 4: Navigate to the official Uniswap website (app.uniswap.org) and click the “Connect” button, typically located in the top-right corner.

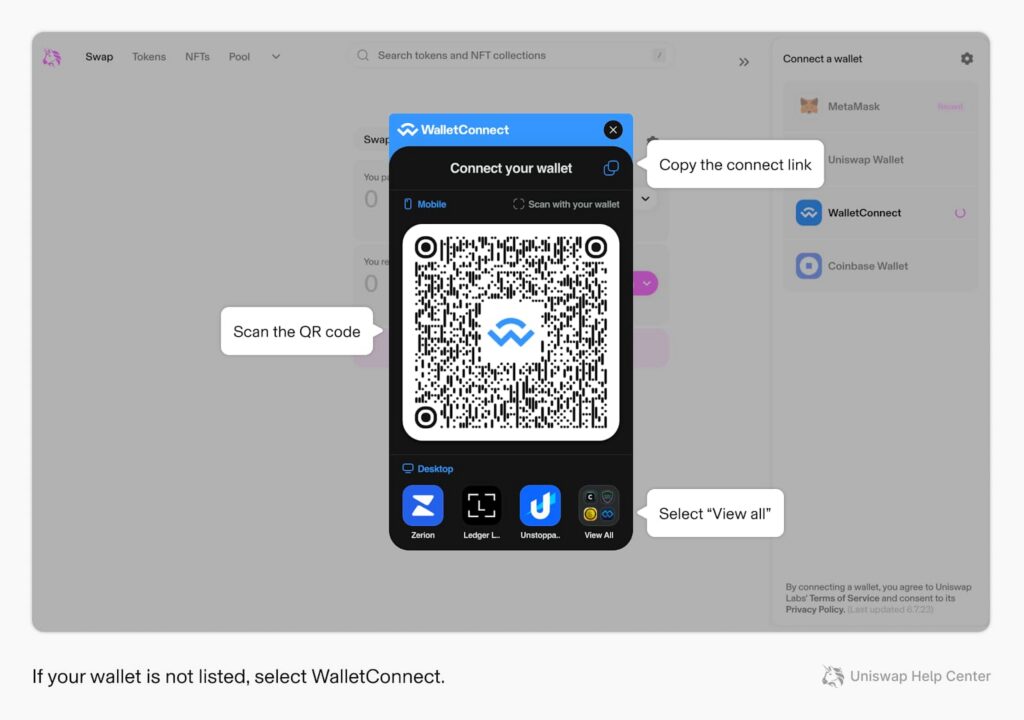

Step 5: Select the “WalletConnect” option. A QR code will be displayed on your screen. Open your Trust Wallet app, find the WalletConnect feature (often in Settings), and scan the QR code to link your wallet to the Uniswap interface securely.

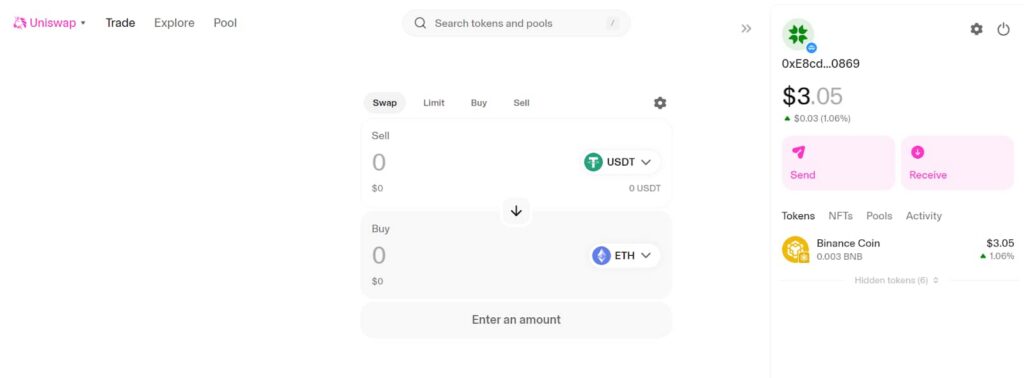

How to Execute a Token Swap on Uniswap

Once your wallet is successfully connected, performing a swap on Uniswap is a simple process:

- Select the Input Token (From): In the first field, choose the token you wish to sell or pay with (e.g., ETH). Your available balance for that token will be displayed.

- Select the Output Token (To): In the second field, select the token you wish to receive. You can search for it by name or, for maximum security, paste its official Contract Address copied from a reputable source like CoinGecko.

- Enter the Amount: Input the quantity of the token you are swapping. Uniswap will automatically calculate and display the estimated amount of the output token you will receive based on the current market rate.

- Review the Swap: Click the “Swap” button. A confirmation window will appear, displaying the final details of the trade, including the price, applicable fees, and the potential price slippage. Carefully review this information and confirm the swap.

- Final Confirmation in Your Wallet: Finally, a transaction prompt will appear in your wallet (e.g., MetaMask or Trust Wallet). You must give final approval within your wallet to authorize the transaction. Once confirmed, it will be broadcast to the network and should be completed within a few moments.

Essential Security Tips for Safe Trading on Uniswap

- Always Use the Official URL: To protect yourself from phishing attacks, bookmark the official Uniswap interface address: app.uniswap.org. Never interact with the protocol through unverified links sent via email or social media.

- Verify the Token Contract Address: Anyone can list a token on Uniswap, which creates a risk of impersonation. To avoid purchasing fraudulent tokens, always verify and paste the correct contract address from an official source, such as the project’s website or a trusted data aggregator like CoinGecko.

- Review Transaction Details Before Confirming: Before you approve the final transaction prompt in your wallet, take a moment to double-check all the details. Verify the amounts being sent and received, the estimated gas fees, and the slippage tolerance. Once confirmed on the blockchain, a transaction is irreversible.

How to Choose the Right Trading Pair on Uniswap

The most critical factor when selecting a trading pair on Uniswap is its liquidity. A pair with high liquidity results in better, more stable trades with lower associated costs. High liquidity directly mitigates slippage between the expected price of a trade and the price at which it is actually executed. Essentially, the higher the liquidity, the closer your final execution price will be to the quoted price.

Practical Tips for Choosing the Best Trading Pair

1. Prioritize Major Pairs: Pairs that include reputable, high-volume assets like ETH, USDC, DAI, or WBTC (e.g., ETH/USDC) typically have deep liquidity. These are generally safer and more efficient options for trading.

2. Check the Liquidity Data: Before executing a trade, analyze the pool’s data. You can check key metrics like Total Value Locked (TVL) and 24-hour trading volume on Uniswap’s own analytics interface or on third-party platforms like DEXTools. Higher numbers in both TVL and volume indicate healthier trading conditions.

3. Heed Platform Warnings: The Uniswap interface sometimes displays warnings for new, low-liquidity, or potentially high-risk tokens. Pay close attention to these alerts and proceed with caution.

Example: Imagine you want to acquire MANA tokens to purchase land in the metaverse. Your best strategy is to find the MANA trading pair with the deepest liquidity, which is typically the ETH/MANA pool. Choosing this pair ensures your trade is executed with minimal slippage, maximizing the amount of MANA you receive for your ETH.

In many DeFi projects, including MakerDAO and Yearn Finance, Uniswap’s price data is used as a backup oracle. In fact, Uniswap is not just an exchange—it has become an integral part of the decentralized market infrastructure.

What Is Slippage on Uniswap and How Does It Impact Trade Execution?

Slippage refers to the difference between the expected price of a trade (the price quoted when you initiate the transaction) and the execution price (the price at which the trade is actually completed). This is a natural market phenomenon that occurs because a small amount of time passes between when a transaction is submitted and when it is confirmed on the blockchain. During this interval, the asset’s price can change due to market volatility.

This price difference directly impacts the final quantity of tokens you receive. High slippage can result in receiving fewer tokens than anticipated when buying, or realizing a smaller profit or even a loss when selling.

How Can Slippage Be Managed?

Fortunately, the Uniswap protocol allows you to manage this risk by setting a “Slippage Tolerance” in your trade settings. This is typically configured as a percentage (e.g., 0.5% to 1%). By setting this value, you are defining the maximum rate of price change you are willing to accept for the trade to go through.

If the price moves beyond your specified tolerance while the transaction is being processed, the protocol will automatically cause the trade to revert (fail). This mechanism protects your assets from unfavorable price swings and unexpected losses.

Uniswap Fees: How Are Trade Costs Calculated?

When executing a trade on the Uniswap exchange, users will encounter two completely separate types of fees. Understanding the distinction between them is crucial:

Trading Fee (or Pool Fee)

This fee is a fixed percentage of your total trade value that is paid directly to the Liquidity Providers (LPs), the users who supply capital to the pool as a reward for their contribution. The specific percentage varies depending on the trading pool and typically falls into one of several tiers, such as 0.05%, 0.3%, or 1%. This cost is automatically deducted from the input token (the asset you are selling).

Example: Imagine you want to swap $1,000 worth of USDC for ETH in a pool with a 0.3% trading fee. In this scenario, $3.00 (which is 0.3% of $1,000) will be deducted as the trading fee for the transaction.

Network Fee (Gas Fee)

This fee is entirely unrelated to Uniswap. It is paid directly to the validators of the blockchain network (such as Ethereum) to cover the cost of processing, confirming, and recording your transaction on-chain. The amount is not fixed; it fluctuates based on real-time network congestion and traffic. The busier the network, the higher the gas fee will be. This fee must be paid in the native currency of the blockchain (e.g., ETH on the Ethereum network).

To significantly reduce costs, you can execute your trades on Layer 2 (L2) networks like Arbitrum or Polygon, which feature substantially lower network gas fees.

Pros and Cons of Using Uniswap

Like any platform, the Uniswap exchange has its own distinct set of strengths and weaknesses. It is advisable to understand these before you begin trading.

Advantages of Uniswap

Here are the key advantages that make Uniswap stand out:

- Full Self-Custody of Assets: Users always retain ownership of their private keys and capital. Funds are never deposited into an exchange-controlled wallet and remain in the user’s personal wallet at all times.

- Privacy and Permissionless Access: Uniswap does not require user registration or any Know Your Customer (KYC) verification. Anyone with a compatible wallet can access the platform and trade freely.

- Access to a Wide Range of Tokens: Compared to Centralized Exchanges (CEXs), new tokens and emerging projects become available for trading on Uniswap much more rapidly.

- Complete On-Chain Transparency: All trades and protocol activities are recorded on the blockchain, making them publicly visible and auditable by anyone.

- Opportunities for Passive Income: Users can contribute to liquidity pools and earn a share of the trading fees generated from those pools, creating a source of passive income.

Disadvantages of Uniswap

However, there are some key disadvantages to consider when using Uniswap:

- High Network Fees (Gas Fees): During periods of high network congestion on Ethereum, transaction costs can become prohibitively expensive, especially for smaller trades.

- Risk of Fraudulent Tokens: Due to its permissionless listing model, there is a heightened risk of encountering scam tokens. Users must perform thorough due diligence before trading.

- Trading Risks (Slippage): In low-liquidity pools, traders can experience significant price slippage, which increases the effective cost of a trade and results in a less favorable execution price.

- Complexity for Beginners: The platform can present a steep learning curve for newcomers. Concepts such as self-custody wallet management, securing a recovery phrase, and understanding risks like Impermanent Loss (for Liquidity Providers) can be challenging.

Uniswap was the first DeFi protocol to face a formal lawsuit from U.S. regulators in 2023, yet its operations continued uninterrupted due to its decentralized nature.

What Is the UNI Token and What Is Its Utility?

The UNI token is the official governance token of the Uniswap protocol. It can be thought of as analogous to shares in a corporation, granting holders voting rights and the ability to participate in key decision-making processes. Instead of being managed by a central entity, the future of Uniswap is shaped by its community of UNI token holders.

The primary utility of the UNI token is participation in the governance and future direction of the protocol. Holders of the token can:

- Vote on significant proposals related to the development and upgrading of the Uniswap protocol.

- Participate in decisions such as activating the protocol “fee switch” or modifying its fee structure.

- Influence and vote on how funds in the Uniswap treasury are allocated and used.

In simple terms, holding the UNI token gives you a direct say in the future trajectory of this leading exchange. It is important to note that holding the token does not grant any direct revenue sharing (such as receiving a portion of trading fees). Its primary value lies in its governance power and the ability to influence the protocol’s evolution.

Comparing Uniswap with Other Decentralized Exchanges (DEXs)

While Uniswap is recognized as a pioneer in the space, formidable competitors like SushiSwap and PancakeSwap have also emerged, each with its own unique features. Below, we examine their key differences.

Uniswap vs. SushiSwap

SushiSwap is fundamentally a fork of Uniswap’s original code and operates in a technically similar manner. However, their primary differences lie in the following areas:

- Incentive Models and Tokenomics: SushiSwap introduced an additional layer of incentives. Beyond the standard trading fees, it rewards Liquidity Providers (LPs) with its native SUSHI token to encourage greater participation. In contrast, Uniswap’s model directs all trading fees back to the LPs of that specific pool.

- Expanded Feature Set: SushiSwap has evolved into a more comprehensive DeFi ecosystem by integrating additional services like lending markets and a project launchpad. Uniswap, conversely, has maintained a sharper focus on optimizing the core trading experience and improving capital efficiency.

Uniswap vs. PancakeSwap

The most significant and fundamental difference between these two exchanges is the blockchain network on which they operate, a distinction that directly impacts the user experience:

- Blockchain Network: Uniswap is native to the Ethereum network and its Layer 2 (L2) scaling solutions (like Arbitrum and Polygon). In contrast, PancakeSwap is the dominant DEX on the BNB Smart Chain (BSC).

- Transaction Fees and Speed: Due to the different architectures of their underlying blockchains, transaction fees on PancakeSwap are typically far lower, and confirmation times are faster, than on the Ethereum mainnet version of Uniswap. This makes PancakeSwap particularly popular for smaller trades.

- Trading Volume and Liquidity: Generally, Uniswap commands a higher overall trading volume and offers deeper liquidity within the Ethereum ecosystem. PancakeSwap, however, is the unrivaled leader in volume and liquidity within the BNB Chain ecosystem.

Why Is Uniswap the Most Popular Decentralized Exchange (DEX)?

Uniswap’s immense popularity and its position as the market leader among Decentralized Exchanges (DEXs) is no accident. Its dominance is rooted in several key, interconnected factors that have earned significant trust within the user community:

- Pioneering Spirit and Continuous Innovation: Uniswap was the first protocol to successfully implement the Automated Market Maker (AMM) model at scale, fundamentally shaping the landscape of decentralized trading. The platform continues to remain at the forefront of innovation with new versions and consistent improvements.

- Simplicity and Superior User Experience: A key driver of Uniswap’s success is its remarkably simple and intuitive user interface. This simplicity has significantly lowered the barrier to entry, making the onboarding process for new users into the complex world of DeFi much easier.

- High Security and Proven Trust: Uniswap’s smart contract code has been rigorously audited multiple times by leading global security firms. The protocol has a stellar track record of securing user assets, which has built a strong foundation of trust throughout the crypto community.

- Deep Liquidity and the Network Effect: As a trusted pioneer, Uniswap attracted the largest volume of liquidity among all DEXs. This deep liquidity creates better trading conditions, more stable prices, and lower slippage. In turn, these favorable conditions attract more users and capital, creating a powerful virtuous cycle known as the network effect.

This combination of factors has solidified Uniswap’s position as the go-to platform for many users in the DeFi ecosystem, enabling it to command a significant market share with daily trading volumes consistently in the billions of dollars.

Contrary to popular belief, UNI is not merely a governance token; in major votes, it has effectively played a decisive role in the allocation of the protocol’s treasury, which is worth billions of dollars.

The Future of Uniswap and Its Role in the Evolution of DeFi

Uniswap is more than a simple exchange; the protocol has evolved into a piece of critical infrastructure and a core pillar of the Decentralized Finance (DeFi) world. Through continuous innovation, it is actively shaping the future of the sector.

Uniswap’s Current Position in the DeFi Ecosystem and DEX Market

As of September 2025, Uniswap stands as the undisputed and dominant leader in the Decentralized Exchange (DEX) market. Commanding the highest daily trading volume and the largest Total Value Locked (TVL), the platform serves as the gold standard within the DeFi ecosystem. Uniswap’s importance is such that many other projects, from lending platforms to metaverse applications, rely on its deep liquidity for their own proper functioning.

Key Innovations, Upgrades, and the Future Roadmap

Uniswap has a history of revolutionary evolution. Following the introduction of “Concentrated Liquidity” in v3, the upcoming v4 promises even greater efficiency with new features like “Hooks” (customizable plugins for liquidity pools) and a more optimized architecture, aiming for significant fee reductions and enhanced flexibility for traders. Furthermore, initiatives like UniswapX are paving the way for gasless transactions, which could dramatically simplify and improve the user experience.

Can Uniswap Become a Serious Competitor to Centralized Exchanges?

Yes, Uniswap already poses a very serious challenge to Centralized Exchanges (CEXs). With the proliferation of Layer 2 (L2) scaling solutions that increase speed and drastically reduce fees, Uniswap’s core advantages, such as full user self-custody over assets and enhanced privacy, have become more prominent than ever.

However, CEXs still hold an advantage in areas like providing seamless fiat on-ramps and off-ramps (e.g., purchasing crypto with USD or EUR) and offering dedicated customer support. In the future, it seems likely that these two types of exchanges will coexist as complements rather than direct replacements for one another. Nevertheless, the market share of DEXs is expected to continue its upward trend, driven by relentless innovation.

Conclusion

The Uniswap exchange is far more than a simple trading platform; the protocol stands as a symbol of the power of decentralization, innovation, and transparency in the world of finance. By providing an open and permissionless platform for the exchange of value, Uniswap has played a pivotal role in the growth and mainstream adoption of the DeFi ecosystem.

Understanding what Uniswap is and how it operates is essential for anyone interested in the future of decentralized finance. Despite ongoing challenges, Uniswap continues to remain at the forefront of the industry’s evolution through its relentless innovation. It is poised to shape an exciting future for decentralized financial exchange.