In volatile markets, maintaining portfolio equilibrium is often far more critical than predicting market direction. Smart Rebalance offers a solution to automatically and systematically manage this equilibrium. Relying on real-time data and precise algorithms, this strategy introduces mathematical discipline to investing, effectively replacing emotional decision-making.

In this article, we will examine the mechanics of Smart Rebalance, how to configure it on trading platforms, and how it differs from traditional methods. We will explore how leveraging Artificial Intelligence and automation can lead to a more balanced and sustainable portfolio.

- In markets with low trading volume, execution may experience slight latency as the bot awaits sufficient liquidity to secure the optimal price.

- In multi-asset accounts, Smart Rebalance can simultaneously equilibrate between cryptocurrencies and stablecoins to mitigate overall risk exposure.

- Smart Rebalance typically yields higher returns in ranging (sideways) markets compared to strongly trending markets, as it capitalizes on minor price fluctuations.

- Utilizing smart alerts alongside rebalancing ensures the user retains final decision-making authority before automated execution occurs.

What is Smart Rebalance and Why Does it Matter?

Smart Rebalance is a mechanism that automatically adjusts the asset allocation of your investment portfolio. As defined by the reputable financial resource Investopedia, “rebalancing” entails the process of buying or selling assets to restore a portfolio’s weighting to its original target allocation.

Imagine your portfolio consists of Bitcoin, Gold, and Equities. If the price of Bitcoin surges significantly, its weight relative to the total portfolio increases, inadvertently exposing you to higher volatility risk associated with that single asset. In this scenario, Smart Rebalance automatically liquidates a portion of the Bitcoin holdings and reallocates that capital to the other assets to preserve the intended equilibrium.

The core importance of this strategy lies in Risk Management. Through this method, the system automatically, without human sentiment, takes profits from outperforming assets and reinvests them in undervalued ones. Consequently, investment discipline is maintained, and emotional impulses are superseded by logical consistency.

Traditional vs. Automated Smart Rebalancing

Traditional Rebalancing requires the investor to manually monitor the markets, perform necessary calculations, and execute buy and sell orders to restore portfolio equilibrium. This process is time-consuming, prone to human error, and demands a high level of discipline to execute consistently.

Smart Rebalancing, conversely, fully automates this workflow. You define the initial parameters once (asset allocation percentages and rebalancing timing or thresholds) on a platform or trading bot, and the system automatically executes the necessary trades at the optimal moment. This automation significantly enhances the precision of portfolio management.

How Does Smart Rebalance Work?

Rather than focusing merely on investment goals, Smart Rebalance manages the operational process and execution steps within the portfolio.

- The system first measures the actual weight of each asset in the portfolio and compares it against the target weight.

- Utilizing advanced algorithms, it determines which assets must be liquidated (sold) or acquired (bought) to revert the allocations to the desired composition.

Operational Logic and Algorithms

The functionality of Smart Rebalance is based on real-time analysis of asset weights, risk exposure, and expected returns. This process involves calculating weight discrepancies, determining optimal trade sizes, and scheduling transaction execution.

Algorithms are typically designed to:

- Minimize Costs: Optimize trade volume to achieve the target composition while reducing transaction costs and slippage.

- Optimize Timing: Execute automated rebalancing at moments when market shifts offer the most significant impact.

- Maintain Flexibility: Adapt to the selected method (Time, Percentage, or Threshold) to manage assets effectively.

In essence, Smart Rebalance focuses on execution efficiency, allowing investors to keep their portfolios aligned with their target strategy without constant manual intervention.

Rebalancing Execution Methods

There are various methodologies for executing a rebalance, each with specific use cases and advantages:

1. Time-Based Rebalancing (Periodic)

In this method, the portfolio is reviewed and balanced automatically at fixed, pre-determined intervals (e.g., daily, weekly, or monthly), regardless of market volatility. This approach is simple and predictable, allowing investors to maintain asset ratios without the need for continuous market monitoring.

2. Percentage-Based Rebalancing (Proportional)

Here, each asset is monitored independently. Rebalancing is triggered when the actual weight of an asset deviates from its target percentage. The goal is strict adherence to the portfolio’s target composition.

Example: If the target weight for Stock X is 30% and the actual weight rises to 35%, the system automatically sells enough of Stock X to return it to 30%.

3. Threshold-Based Rebalancing (Drift-Based)

In this approach, rebalancing occurs only when the deviation of assets from the target weight hits a specific limit or threshold (e.g., ±5% or ±10%). This reduces the frequency of trades and consequently transaction fees, making it suitable for high-volatility portfolios or investors who wish to avoid micro-managing minor fluctuations.

Example: If the target for Stock X is 30% with a threshold of ±5%, rebalancing only triggers if the weight drops below 25% or exceeds 35%.

The Role of Data and Automation in Precision Execution

While the Smart Rebalance strategy is designed around intelligent adjustment and risk management, its success relies heavily on data accuracy and automation.

The Importance of Data:

Data inputs include market feeds, real-time pricing, trading volume, liquidity depth, and economic indicators. Accurate analysis of this data is crucial for intelligent decision-making. Without access to up-to-date and correct data, even the most sophisticated algorithms cannot identify optimal entry and exit points.

The Power of Automation:

Automation plays a key role in the rapid and precise execution of this strategy. By utilizing automated tools, the rebalancing process occurs without human intervention, ensuring that reactions to market volatility are immediate and human error is minimized. Furthermore, automation enables the execution of strategies across multiple timeframes and large trade volumes without the need for manual oversight.

Conclusion:

The combination of precise data and advanced automation optimizes the performance of Smart Rebalance, mitigates risks associated with emotional decision-making, and identifies profitable market opportunities more effectively. Data and automation constitute the backbone of a successful and sustainable rebalancing strategy.

What is a Smart Rebalance Bot and How Do You Use It?

A Smart Rebalance Bot is an automated tool designed to execute your portfolio balancing strategy. In this section, we will introduce these bots, explain how to configure their parameters, and review the platforms that offer this capability.

Introduction to Rebalance Bots vs. Manual Trading

A Smart Rebalance bot is a software solution integrated into cryptocurrency exchanges or third-party trading platforms that automatically executes portfolio rebalancing strategies.

The primary distinction between a bot and a manual trader lies in 24/7 execution and the elimination of emotional bias. A manual trader might succumb to fear during a market downturn and hesitate to buy, or fall prey to greed during a strong rally and refuse to realize profits. A Smart Rebalance bot operates inversely and systematically: it buys during downturns and sells during rallies.

Configuring Parameters and Portfolio Management

To utilize these bots effectively, you typically need to configure several key parameters:

- Asset Selection: Specifying which assets (e.g., Gold, Silver, Bitcoin, etc.) will constitute your portfolio.

- Percentage Allocation: Determining the capital weight assigned to each asset (the aggregate must equal 100%).

- Execution Condition: Selecting the rebalancing methodology (Time-based, Percentage-based, or Threshold-based).

Once configured, the bot automatically manages your portfolio; however, periodic performance monitoring is still recommended to ensure alignment with your broader financial goals.

Top Platforms and Exchanges with Smart Rebalancing Features

Today, many major international cryptocurrency exchanges and specialized portfolio management platforms offer Smart Rebalance tools. When selecting a provider, consider factors such as bot transaction fees, minimum capital requirements, and the diversity of supported assets.

Here are some of the leading platforms and exchanges offering smart rebalancing:

Coinbase

- Offers automated rebalancing for investment profiles;

- User-friendly interface suitable for beginners;

- High security standards and a reputable global track record.

- Binance

- Enables portfolio rebalancing for both Spot and Futures assets;

- Provides advanced tools tailored for professional investors;

- Supports a wide spectrum of cryptocurrencies.

- Kraken

- Features automated rebalancing for diverse portfolios;

- Places a special emphasis on security and asset custody;

- Delivers detailed reporting and rebalancing performance analytics.

- Bitpanda

- Allows for weekly or monthly scheduled rebalancing;

- Suitable for intermediate and novice investors;

- Features an intuitive and visual user interface.

- eToro

- Offers Smart Portfolio and CopyPortfolio tools with automated rebalancing capabilities;

- Provides professional portfolio management and high asset diversity;

- Facilitates passive investing without the need for constant monitoring.

Advantages and Disadvantages of the Smart Rebalance Strategy

Like any financial instrument, the Smart Rebalance strategy possesses a distinct set of strengths and weaknesses. Understanding these nuances is essential for determining whether this strategy aligns with your specific portfolio objectives.

The Advantages of Smart Rebalance

Advantages of Smart Rebalancing include:

- Automated Risk Management: This is the primary benefit. Smart Rebalance prevents a single asset from dominating your portfolio and inadvertently increasing your risk exposure. By reverting the portfolio to its initial target percentages, risk remains consistently controlled.

- Total Elimination of Emotional Bias: This strategy removes human sentiments such as “fear” and “greed” from trading equations. The bot automatically sells at high prices (countering greed) and buys at low prices (countering fear). This ensures absolute trading discipline.

- Systematic Profit Taking and “Buying the Dip”: This strategy enforces regular profit realization. When an asset appreciates, the bot sells a portion to lock in gains. It then reallocates those profits to acquire undervalued assets within the portfolio, effectively automating the fundamental “buy low, sell high” principle.

The Disadvantages of Smart Rebalance

Disadvantages of Smart Rebalancing include:

- Transaction Costs: Every rebalancing event triggers at least one buy and one sell order, both of which incur fees. If the strategy is configured with excessive sensitivity (high frequency), these transaction costs can significantly erode your net returns.

- Price Slippage in Low-Liquidity Markets: If your portfolio includes assets with low trading volumes (low liquidity), the bot may fail to execute orders at the precise target price. This price differential, known as slippage, directly reduces profitability.

- Underperformance in Strong Bull Trends: In a powerful, parabolic bull market, a simple “Buy and Hold” strategy often yields higher returns. This is because Smart Rebalance continuously sells the outperforming asset to maintain equilibrium, thereby capping your participation in that asset’s full upside potential.

Step-by-Step Guide to Executing a Smart Rebalance Strategy

Implementing the Smart Rebalance strategy entails asset selection, allocation weighting, defining execution parameters (such as time or threshold), and subsequent performance evaluation and optimization. Throughout this process, understanding the critical impact of transaction fees and liquidity on net profitability is essential.

Asset Selection and Portfolio Weighting

The first step is selecting assets with a high conviction of profitability (e.g., a mix of established “stable” assets like Bitcoin and high-potential assets like altcoins). Next, based on your risk tolerance, define the specific weight (percentage) for each.

Example: 50% BTC, 30% ETH, 20% ADA.

Setting Rebalancing Intervals and Conditions

Determine the trigger mechanism that activates the rebalance:

- Time-Based (Periodic): e.g., “Every 7 days.”

- Threshold-Based (Drift-Based): e.g., “If any asset’s allocation drifts by more than 5%.”

The Threshold method is generally more suitable for volatile markets (such as cryptocurrency) to prevent over-trading and the accumulation of excessive fees.

Performance Evaluation and Strategy Optimization

How do you validate the bot’s efficiency and improve it? This is executed in two phases:

- Performance Evaluation (Benchmarking): You must determine if the strategy is generating value. The simplest method is to benchmark your bot’s return against a standard Buy and Hold (HODL) strategy.

Example: Did the bot generate a 5% return, while simply holding would have yielded 10%? (In this case, the bot underperformed). Conversely, did the bot mitigate drawdown more effectively during a bearish trend?

- Strategy Optimization (Refinement): Markets are dynamic. If you observe a shift into a strong trend (strongly bullish or bearish), your initial parameters may become obsolete. You must update the bot’s configuration (such as allocation percentages or rebalancing thresholds) to align with the prevailing market regime.

The Impact of Transaction Fees and Liquidity

Two specific factors can erode your bot’s profitability: fees and price slippage.

- Transaction Fees: Every rebalancing event involves buy and sell orders, incurring trading fees.

The Risk: If the bot is configured with excessive sensitivity (e.g., triggering hourly or on a minor 1% drift), the sheer volume of trades can generate fees that consume your entire profit margin.

- Liquidity: Liquidity refers to the ease with which an asset can be bought or sold without impacting its price.

The Risk: Trading assets with low volume (thin liquidity) exposes you to Slippage.

The Reality: The bot attempts to sell at $100, but due to a lack of buyers (insufficient order book depth), it is forced to fill the order at $99. This price differential directly subtracts from your bottom line.

According to Zeebu’s analysis of liquidity depth, to ensure optimal performance, avoid hyper-active settings (to minimize fee erosion) and limit exposure to high-volume, established assets (to ensure deep liquidity).

Comparing Smart Rebalance with Other Portfolio Management Methodologies

Smart Rebalance represents a portfolio management strategy with fundamental distinctions from conventional methods such as “Holding” (HODL), “Dollar-Cost Averaging” (DCA), or “Manual Trading.” Grasping these nuances is essential for selecting the appropriate instrument aligned with your investment objectives.Smart Rebalance vs. HODL (Buy and Hold)

- HODL: A strictly passive strategy. You acquire an asset and retain it for an extended horizon, regardless of price appreciation or depreciation.

- Smart Rebalance: An active or semi-active strategy. It automatically intervenes during market volatility, liquidating appreciated assets (taking profits) and acquiring depreciated ones to maintain portfolio risk at a pre-defined threshold.

- Key Difference: HODL relies on patience, whereas Rebalancing operates on discipline and risk management.

Smart Rebalance vs. Dollar-Cost Averaging (DCA)

- Dollar-Cost Averaging: An accumulation and acquisition strategy. You deploy a fixed capital amount (e.g., $100) at regular intervals (e.g., monthly) irrespective of price action. The focus is exclusively on entry.

- Smart Rebalance: A strategy for managing an existing portfolio. This methodology involves both buying and selling to preserve the asset allocation percentages.

- Key Difference: DCA is utilized to construct a portfolio over time, whereas Rebalancing is employed to manage and equilibrate a pre-established portfolio.

Smart Rebalance vs. Copy Trading and Manual Trading

- Manual / Copy Trading: Highly active strategies predicated on speculation and forecasting. You (or the trader you copy) analyze the market to predict entry and exit points, attempting to “beat the market.” Success is heavily contingent on skill and emotional control.

- Smart Rebalance: A rules-based and automated strategy. It makes no attempt to forecast market direction. Instead, it reacts mechanically to price fluctuations to strictly enforce your determined allocations.

- Key Difference: Trading implies an attempt to predict the future, while Rebalancing implies the automated execution of a rule regardless of future movements.

Advantages of Smart Rebalance Over Passive and Active Approaches

Smart Rebalance synthesizes the benefits of both methodologies while mitigating their respective downsides:- Advantage over Passive Methods (e.g., HODL): Active Risk Control is the paramount benefit. In a HODL strategy, if a single asset rallies 500%, it may suddenly constitute 90% of your portfolio, drastically increasing concentration risk. Rebalancing prevents this skew; by automatically selling, it locks in realized gains and re-equilibrates risk exposure.

- Advantage over Active Methods (e.g., Manual Trading): 1.Total Elimination of Emotion: This is the key differentiator. In manual trading, “fear” often drives capitulation at market bottoms, while “greed” prevents profit-taking at tops. Rebalancing operates inversely; it automatically sells into strength (high prices) and buys into weakness (low prices) purely because it adheres to logic rather than sentiment. 2. 24/7 Discipline: The bot requires no rest, ensuring your strategy is executed continuously around the clock.

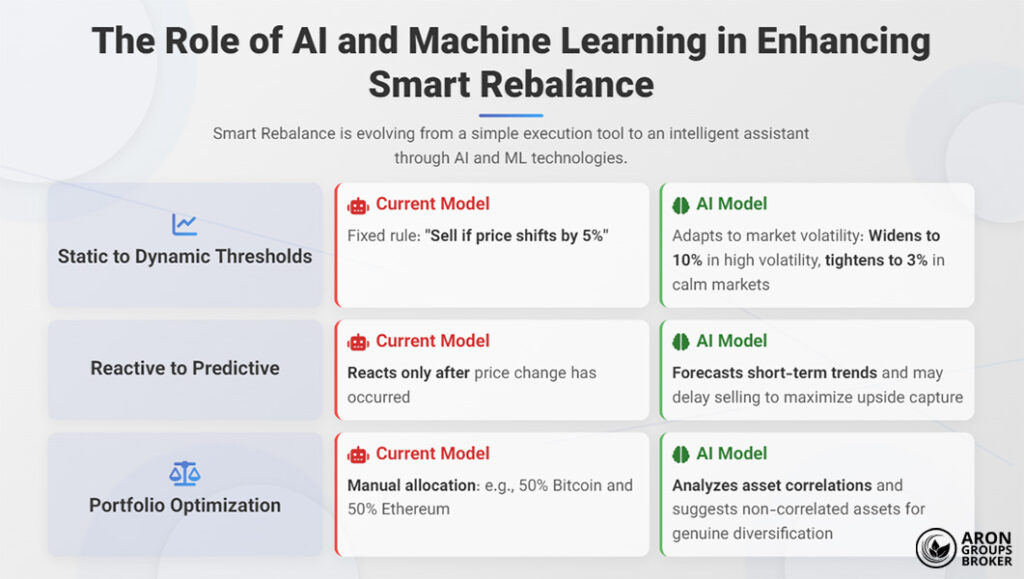

The Role of AI and Machine Learning in Enhancing Smart Rebalance

Currently, Smart Rebalance operates primarily as an obedient, automated execution bot. You provide it with a static rule (e.g., “Rebalance every 7 days” or “Rebalance if Bitcoin drifts by 5%”), and the bot executes it without emotion or deviation.

However, Artificial Intelligence (AI) and Machine Learning (ML) are elevating this strategy from a mere execution tool to an intelligent, analytical assistant.

AI and ML can enhance rebalancing performance in the following ways:

Transitioning from Static to Dynamic Thresholds

- Current Model: You dictate, “Sell if the price shifts by 5%.”

- AI Model: The AI learns the market volatility. If it detects high volatility, it automatically widens the threshold (e.g., to 10%) to prevent over-trading and excessive fees. Conversely, in a calm market, it tightens the threshold (e.g., to 3%) to capture micro-gains.

Shifting from Reactive to Predictive

- Current Model: The bot reacts only after the price change has occurred.

- AI Model: ML algorithms can forecast short-term trends. For instance, if the AI anticipates a strong breakout or uptrend for an asset, it may delay the sale slightly to maximize upside capture (unlike a simple bot that sells immediately upon hitting the target).

Automated Portfolio Optimization

- Current Model: You decide manually that your portfolio should be 50% Bitcoin and 50% Ethereum.

- AI Model: AI continuously analyzes asset correlations. If it determines that Bitcoin and Ethereum are moving in perfect lockstep (offering no real risk reduction), it might suggest reducing Ethereum and adding a non-correlated asset to achieve genuine diversification.

In essence, instead of blindly executing a rule, AI grants the rebalancing bot "decision-making power" based on market data learning, making your strategy smarter, more cost-efficient, and adaptive to real-time market conditions.

The Future of Automated Investing: From Rebalancing Bots to Autonomous Portfolios

The evolutionary trajectory of automated investing is moving from current tools like “Rebalancing Bots” toward “Autonomous Portfolios.”

Current systems are merely “automated” and “reactive.” They execute static, user-defined rules (such as maintaining a 50/50 allocation) without questioning the underlying strategy.

In contrast, the next phase, driven by AI and Machine Learning, will be “Intelligent,” “Forward-Looking,” and “Dynamic.” These autonomous portfolios will go beyond simple execution; they will independently analyze market data, news sentiment, and macroeconomic indicators.

They will have the agency to generate or adjust strategies (such as introducing new assets or de-risking the portfolio) and optimize performance through continuous learning. This marks a paradigm shift from systems that simply “execute” to systems that “analyze, learn, and manage independently.”

Conclusion

The Smart Rebalance strategy is a powerful instrument for risk management and the elimination of emotional bias within the volatile cryptocurrency markets. By utilizing a Smart Rebalance bot, investors can enforce trading discipline and automatically maintain portfolio equilibrium against severe market fluctuations.

While this method is not a guarantee of profit, it provides a logical, mathematical framework for balancing digital asset portfolios and securing long-term financial objectives.