In the forex market, success does not depend only on analytical skills or accurate forecasts. Risk management plays a crucial role in achieving consistent profitability. That is why many traders face a key question when opening a trading account: should they choose a hedging account or a netting account? Both models provide a framework for managing trades, but their mechanisms and outcomes differ significantly.

With a hedging account, you can hold both buy and sell positions on the same currency pair at the same time and try to benefit from short-term price swings. In contrast, a netting account combines all trades on a given symbol into one net position, giving you a more straightforward overview of your overall exposure.

In the rest of the article (beyond this section), these two models are compared in practice, examining their advantages and disadvantages so you can choose the best option for your trading style.

- Your choice between netting and hedging effectively decides whether you manage one net exposure or a portfolio of separate positions on each symbol.

- Netting naturally pushes you toward trend-following, scale-in/scale-out behavior, while hedging supports multi-scenario trading on the same pair.

- Hedging shifts complexity from the chart to your risk and accounting layer, demanding stricter position sizing and monitoring discipline.

- Netting concentrates risk into a single line in your terminal, so one misaligned bias can outweigh the impact of several smaller tactical trades.

What Is Hedging in the Forex Market?

According to Investopedia, hedging is a protective strategy that uses offsetting positions to reduce risk in the forex market. It allows traders to open reverse or opposite positions at the same time as their main positions. In other words, they can simultaneously buy and sell the same currency pair.

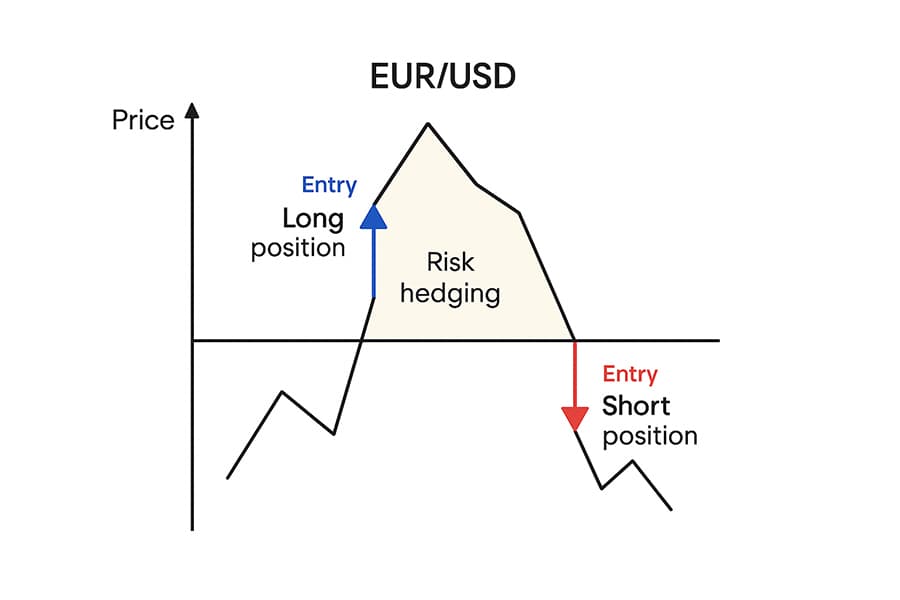

For example, when a trader believes the price of a currency pair will rise, they may open a long position, and at the same time open a short position on the same pair to balance out market risk.

As a risk management strategy, hedging focuses on creating offsetting trading positions to compensate for or neutralize the impact of adverse market movements on an open position. Traders commonly use this method to protect their capital against losses caused by sudden price moves in one particular direction.

For instance, suppose you have opened a long trade on the EUR/USD pair. If you are worried that the euro might weaken against the US dollar, you can hedge your position by opening a short trade on the same pair. In that case, if the euro falls, the loss on your long position will be partly offset by the profit on your short position.

So in a hedging approach, each buy or sell trade opens a new separate position, and you can have multiple open buy and sell trades on the same symbol.

Hedging and Netting

In the illustration above, you can see that the trader first opens a long position. Then the market moves against the initial forecast, and the price starts to fall. At that point, to cover the downside risk from the price drop, the trader opens a short position.

What is the goal of this type of hedge?

The aim is to prevent a large loss when the market moves against the initial position. The second (opposite) position acts like insurance: if the market falls sharply, it generates profit that can offset part of the loss on the first position.

As a result, this strategy helps the trader protect their open position during short-term market volatility without having to immediately close the original trade.

Types of Hedging Strategies in Forex

Traders use different hedging strategies in forex to manage risk. Below are the most common hedging methods used to protect open positions:

1. Simple Forex Hedge

This strategy involves opening a long position and a short position simultaneously on the same currency pair. The goal is to protect existing trades against price fluctuations.

Example:

You have an open long position on EUR/USD, but are worried the market might suddenly reverse and drop. To reduce potential losses, you open a short position on the same pair. If the price falls, the loss on your long trade is partially offset by the profit on your short trade.

2. Cross-Currency Hedge

In this method, the trader opens positions in other currency pairs that have a strong correlation with the pair they want to hedge. This correlation can help reduce the risk caused by price volatility.

Example:

You expect the US dollar to weaken, but you are not sure whether the euro or the Swiss franc will strengthen more. To hedge this risk, you open a long position on EUR/USD and a long position on USD/CHF at the same time. If one of them performs poorly, the other can partially offset the loss.

3. Options-Based Hedge

In this strategy, options contracts are used to protect against adverse price movements. Options allow traders to limit risk while still retaining the potential to benefit from favorable price moves.

Example:

You have a long position on GBP/USD and are worried the price might suddenly drop. To protect your capital, you buy a put option on the same pair. If the price falls sharply, the put option limits your loss on the underlying position.

4. Dynamic Hedging

In dynamic hedging, the trader continuously adjusts their positions based on changing market conditions in order to protect against potential risk. This strategy requires active monitoring and management.

Example:

You entered a long trade in an uptrend and have made a good profit so far. Now you see signs that the price may reverse. To protect your profit, you open a small short position so that if the market turns bearish, part of your gains are preserved.

5. Reverse Hedge

This strategy is similar to a simple hedge, but the sequence of positions is reversed. That means the trader opens a short position first and then opens a long position, or vice versa.

Example:

You have a short trade on EUR/USD, and the market has moved in your favor, giving you a solid profit. Now you suspect the price may start to rise again. To protect your profit, you open a long trade so that if the market reverses, your earlier gains are not completely wiped out.

6. Cash Flow Hedging

This type of hedge is used to protect future cash inflows or outflows against exchange rate movements. With cash flow hedging contracts, a trader or business can shield themselves from foreign exchange volatility.

Example:

If you know you must pay a certain amount in US dollars in three months, you can lock in the exchange rate now by buying dollar futures. This way, you fix the rate in advance and avoid the risk of unfavorable currency moves.

Comparison Table: Hedging vs Netting Accounts

| Feature | Hedging Account (Hedging) | Netting Account (Netting) |

|---|---|---|

| Position management | Each trade is opened as an independent position and can be managed separately. | All trades on the same symbol are merged into a single position at an average price. |

| Simultaneous trading | You can keep both long (buy) and short (sell) positions open simultaneously on one symbol. | It is not possible to hold buy and sell positions open at the same time on the same symbol. |

| Complexity | Higher, you need to manage multiple positions at the same time. | Lower; managing a single net position is simpler. |

What Is Netting in the Forex Market?

Netting is another method of risk management in the forex market, in which the trader does not open opposing positions. Instead of opening reverse trades, the trader consolidates their positions to obtain a more outcome-focused (net) exposure.

This approach is often known as “position management” and uses tools such as stop loss orders and take profit levels to help the trader handle market risk. In a netting system, you have only one open trade per symbol. If you increase your position size in the same direction, your entry price is averaged. If you open a trade in the opposite direction, the total open volume is reduced.

So, in contrast to hedging, netting refers to a way of accounting for trades where open positions in the same financial instrument are automatically combined, and only the net profit or loss is shown to the trader. In other words, instead of tracking and managing each trade separately, netting treats them as a single combined position.

Example:

Suppose you are trading the EUR/USD pair and open the following two buy trades:

- First trade: Buy 0.5 lot at 1.0810;

- Second trade: Buy 0.5 lot at 1.0850.

In a netting account, these two positions are not displayed separately. The trading platform automatically merges them and calculates an average entry price.

You have opened two buy trades with equal volume but at different prices. In a netting account, these trades are combined and shown as:

- Final volume: 1.0 lot (0.5 + 0.5);

- Final entry price:

(1.0810 + 1.0850) / 2 = 1.0830

So on your trading platform, you will see only one open position with the following details:

Buy 1.0 lot EUR/USD at 1.0830

This means you have one net open position, not two separate positions, and that is exactly the core idea of netting.

In a netting account, all orders on the same pair merge into one averaged position, so your SL, TP, and risk apply to a single master trade, making trend-following easier to manage but eliminating the flexibility of handling each entry separately.

Key Differences Between Hedging and Netting in Forex

Hedging and netting are two popular ways to manage open positions in the forex market. Each has its own advantages and drawbacks, and the right choice depends on your trading objectives and style. Here is a brief comparison between hedging and netting: Objective- Netting: The main goal of netting is to reduce the number of open trades and simplify position management. All open trades in a specific currency pair are merged into a single net position.

- Hedging: The main goal of hedging is to reduce trading risk by opening long and short positions simultaneously on the same currency pair.

- Netting: More commonly used for longer-term trades and in trending markets.

- Hedging: More commonly used for short-term trades and in volatile markets.

- Netting: Generally involves simpler accounting because there are fewer separate transactions.

- Hedging: Accounting is more complex due to multiple open positions.

- Netting: Usually results in lower trading costs, since the number of open trades is smaller.

- Hedging: Typically involves higher costs because of multiple simultaneous positions.

- Netting: Generally carries a higher risk than hedging, since all exposure in a given pair is concentrated in a single net position.

- Hedging: Typically involves lower risk because opposite positions partially offset each other.

Who Is Netting More Suitable For?

- If you are a trend follower and usually trade in only one direction (for example, only buying or only selling within a given period), a netting account is a better fit.

- Netting offers simpler position management, lower costs, and is suitable for medium- to long-term strategies.

- Traders who use classical technical analysis or automated trading algorithms usually find netting more convenient.

Who Is Hedging More Suitable For?

- If you are an active swing trader dealing with short-term market moves, hedging can be a powerful tool for controlling your risk.

- In volatile or unstable markets, hedging allows you to open offsetting positions to cover the risk of existing trades.

- This approach is better suited to traders who want more complex strategies, tighter risk control, and the ability to keep multiple positions open at the same time.

Don’t ask which is better: netting or hedging. Ask which fits your style: netting for cleaner, one-direction trends; hedging for choppy markets and multi-position flexibility.

Step-by-Step Comparison: One Trade in a Netting vs Hedging Account

To understand the difference between netting and hedging accounts more clearly, let’s walk through a simple example. Assume you want to place several trades on the EUR/USD pair. We’ll see what happens if your account is netting, and how the result looks if your account is hedging.

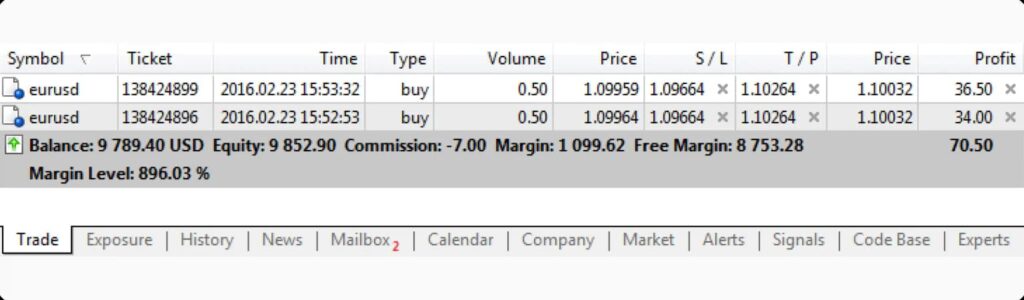

Scenario 1: Netting Account – Everything Is Consolidated

In a netting account, if you open several trades in the same direction on one symbol, they are automatically merged. Only one final position remains in the terminal.

Example:

- You buy 0.5 lot of EUR/USD at 1.0995;

- Then you buy another 0.5 lot at 1.0996.

MetaTrader automatically combines these two trades and shows only one position with a 1-lot volume and an average entry price.

Now, if you open a 0.5-lot sell trade, MetaTrader nets it against your previous buy positions, and the open volume is reduced to 0.5 lot. You still see only one position in the list.

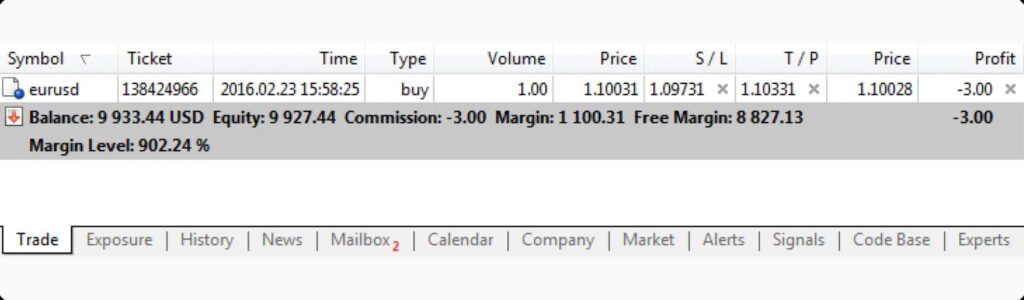

Scenario 2: Hedging Account – Every Position Stays Separate

In a hedging account, each trade you open remains independent, even if it is on the same symbol.

Example:

- You buy 0.5 lot of EUR/USD at 1.0995;

- Then you buy another 0.5 lot at 1.0996.

These two buys are shown in MetaTrader as two separate positions.

Then you open a 0.5-lot sell position. Now you have three separate positions:

- 2 buy positions;

- 1 sell position.

You can set individual stop loss and take profit levels for each of them independently.

Advantages and Disadvantages of Hedging

To better understand the overall impact of hedging, it helps to look at its key advantages and disadvantages separately.

Advantages of Hedging

The advantages of hedging include:

- Protection against sudden market shocks:

- By opening an opposite position, you can protect your main position against major economic news or unexpected political events. This can significantly neutralize your potential loss.

- Preserving unrealized profits:

- When your position is in profit, but there is a risk of trend reversal, hedging allows you to lock in a large part of that profit without fully closing the trade.

- Strategic flexibility:

- Hedging lets you stay active in the market and exploit short-term opportunities without closing your main long-term position.

- Potential to profit from volatility:

- Hedging is not only about loss reduction; in some cases, you can also generate additional returns from sharp price swings or price discrepancies.

Disadvantages of Hedging

The disadvantages of hedging include:

- Higher costs:

Opening multiple positions means paying more spreads and commissions, which can reduce your net profit. - Execution complexity:

Managing several positions and calculating the appropriate size for each one requires strong analytical skills and experience, and can be challenging for beginners. - Reduced profit potential:

Because the hedge position offsets part of the profit from the main position, your final profit may be lower than it would have been without using this strategy. - Risk of calculation errors:

Any mistake in determining the correct position size or entry and exit levels can lead to losses. - No absolute guarantee:

Even with hedging, you can still lose money, because markets can behave unexpectedly and, in some situations, both positions may move into a loss at the same time.

Advantages and Disadvantages of Netting

To understand the full impact of netting, it’s essential to look at both its advantages and its potential drawbacks.

Advantages of Netting

The advantages of netting include:

- Simpler trade management:

Instead of tracking dozens of separate trades, all of them are merged into a single net position. This keeps your trading terminal cleaner and makes management easier. - Lower costs:

Because trades are consolidated, you need to open and close fewer separate positions, which reduces total spreads and commissions. - Faster execution:

For high-volume trading or algorithmic strategies, a netting system operates more quickly and makes it easier to react to market changes. - Practical example:

Suppose you have a 0.1-lot buy position and a 0.2-lot sell position on EUR/USD. In a netting system, the platform will only show you one net short position of 0.1 lot.

Disadvantages of Netting

The disadvantages of netting include:

- Reduced risk control:

Since all positions are merged, you can no longer set separate stop loss or take profit levels for each initial entry. - Limitations for complex strategies:

Netting does not allow you to hold both long and short positions simultaneously on the same asset. If you try, the positions will be merged and may disrupt your strategy. - Lower transparency:

In this system, the detailed breakdown of each individual trade is not displayed, making it harder to analyze performance trade by trade. - Potential for larger losses:

If the market suddenly moves against your dominant net position, the resulting loss may exceed the profit from other trades and push the entire position into loss.

Legal Considerations and Broker Restrictions

- Hedging isn’t always allowed:

Although hedging is a key risk-management tool in forex, it’s not universally permitted. Some jurisdictions, especially the United States under NFA and CFTC supervision, impose strict rules on brokers. - FIFO rule in the US:

- Traders must close positions in the same order they were opened (First In, First Out – FIFO).

- In practice, this blocks holding both long and short positions on the same instrument simultaneously.

- Restrictions on direct hedging:

- Many US-regulated brokers do not allow direct hedging.

- Regulators see it as:

- Adding accounting complexity;

- Increasing systemic risk;

- Putting extra pressure on market liquidity.

- Practical impact on traders:

- US-based traders or those using US-regulated brokers usually have access only to netting accounts.

- To implement hedging-style protection, they must use alternatives such as:

- Derivatives (e.g., options, futures);

- Correlated currency pairs.

- Why broker choice matters:

- In many countries, hedging is a standard risk-management tool.

- In the US, it’s restricted by tighter regulation.

- So, traders must choose their broker and jurisdiction carefully to ensure available account types and rules match their strategy and risk objectives.

Conclusion

Choosing between a hedging account and a netting account is not just a technical matter; it is a strategic decision that should be made based on each trader’s style, risk tolerance, and individual goals.

If you want precise risk control and the ability to keep multiple positions open at the same time, hedging can be a powerful tool. But if your priorities are simpler trade management, lower costs, and higher operational efficiency, netting will likely be the better option.

However, it is essential to remember that broker-specific rules and the regulations of supervisory authorities in each country can determine which types of accounts you can actually use.

Therefore, before making a choice, you should not only review your own strategy but also carefully study your broker’s terms and regulatory framework to ensure they align with your trading objectives.

FAQ

1. What is the main difference between netting and hedging accounts?

- Netting account: Allows traders to hold one net position per symbol, typically used for one-directional, longer-term trades (either buy or sell).

- Hedging account: Allows traders to open positions in both directions (long and short) simultaneously on the same pair.

2. Which type of account is more suitable for beginner traders?

A netting account is generally more suitable for beginners due to its simplicity and the lower management burden, especially for those who are still learning the basics of forex trading.

3. Which type of account is better for professional traders: hedging or netting?

A hedging account is usually more appropriate for professional traders, as it offers greater flexibility and supports more complex trading and risk-management strategies—provided the trader has sufficient knowledge and experience.

4. Is there a risk of trade conflicts in a hedging account?

Yes. When a trader enters two opposing positions at the same time on the same market, there is an inherent conflict between those positions, which must be managed carefully.

5. Can you hold two positions on the same market in a hedging account?

Yes. In a hedging account, you can hold two different positions (one buy and one sell) on the same instrument at the same time.

6. Is a hedging account suitable for short-term trading?

Yes. Because it allows opening two different positions on the same market, a hedging account can be suitable for short-term and tactical trades.

7. Do financial resources influence the choice between netting and hedging?

Yes. In general:

- Traders with larger capital tend to favor netting accounts and longer-term strategies.

- Traders with smaller capital may lean toward hedging accounts and shorter-term trading, where they actively manage risk using opposing positions.