Swing trading futures can be a lucrative strategy for many traders, but it’s not without its unique challenges. While some market participants thrive on long-term positions, others may wonder, “Can you swing trade futures?” The answer is yes, but there are specific considerations and risks to understand before diving in.

In this post, we’ll break down the key strategies for futures swing trading, explore hidden costs that can erode profits, and provide insights into how you can manage risk effectively. If you want to make informed decisions while exploring this trading strategy, read on.

- Swing trading futures requires understanding overnight margin and its impact on capital.

- Contract expiration and rollovers can disrupt long-term trend strategies and incur hidden costs.

- Futures CFDs offer flexibility and lower capital requirements, making them an attractive alternative to physical futures.

- Swap-free accounts can eliminate overnight costs when trading longer-term futures positions.

Understanding Swing Trading Futures: Definition and Meaning

Swing trading futures is a trading style where positions are held for several days to weeks to capture price swings. Unlike day trading, which closes positions within a single session, futures swing traders accept overnight and multi‑day risk. This strategy targets short‑ to medium‑term moves using technical and trend‑based setups.

Futures markets were created for hedgers to manage price risk in commodities and financial instruments. Commercial producers and consumers use futures to lock in prices, not to hold speculative positions long‑term.

Retail traders adapted swing approaches to benefit from short‑term trends and volatility in these markets.

Swing trading in futures generally uses technical analysis, such as moving averages or momentum indicators. Traders aim to enter when a trend confirms and exit before it weakens, optimising gains from price swings. Because of overnight risk, sound risk management is vital in futures swing trading.

Q: Why are futures markets less ideal for retail swing traders?

A: According to Wikipedia, futures were designed mainly for hedgers and involve significant overnight exposure and margin requirements.

Can You Swing Trade Futures? The Real Answer for Traders

According to MetroTrade: Yes, you can swing trade futures, but success depends on capital size, risk planning, and market structure. Futures swing trading relies on holding positions over several days to weeks to capture medium‑term price swings.

Trades must withstand overnight risk and leverage effects that can stress small accounts. Futures markets offer deep liquidity and leverage, which can help capture larger trends.

However, exchanges and brokers enforce overnight margin requirements, often much higher than intraday margins. This means speculative swing traders need more capital than many realise.

Capital adequacy is crucial. Traders need enough funds to cover margin demands, potential market fluctuations, and technical drawdowns. Without this, a promising swing strategy might fail due to a forced close or margin call.

How Capital Size Affects Futures Swing Trading

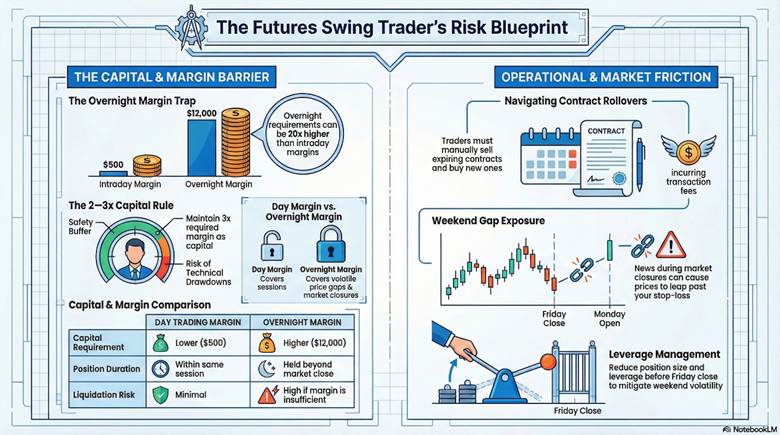

Most brokers require a higher margin to hold futures positions overnight. For example, micro contracts may need a few thousand dollars, but full‑size contracts can require $10,000 or more.

Adequate capital lets you handle price swings without early liquidation. Too small an account risks forced exits and loss of potential profit. Keeping 2–3× the overnight margin as actual risk capital can reduce margin call risks.

Why Skill Alone Isn’t Enough

Swing trading futures uses trend following, technical analysis, and volatility metrics to find entry and exit points. Even the best setup can fail if the account cannot absorb drawdowns or overnight moves.

Liquid markets help, but leverage increases both gains and losses, making risk management essential.

Key Point:

Strategy profitability is meaningless if capital is blocked or wiped out overnight by margin demands beyond your account’s size.

The Overnight Margin Trap: Futures Traders Often Miss

Futures margin refers to the collateral required to open and maintain positions. It protects brokers against losses on open contracts, and margin requirements are set by exchanges.

- Day trading margin is typically lower, allowing traders to open positions with less capital for positions that will close by the end of the session.

- Overnight margin is much higher, as brokers require more funds to cover potential price swings and gaps that may occur when the market is closed.

For example, traders might need $500 to day trade an S&P 500 contract, but to hold it overnight, the required margin could be $12,000 or more. This stark difference can catch swing traders off guard.

What Is Day Trading Margin vs Overnight Margin?

Day trading margin is generally set lower by brokers, as positions are expected to close before the market session ends.

Once a contract is held past the daily close, an overnight or maintenance margin applies. This is usually the full exchange requirement.

Overnight margin must cover potential price swings and gap risk that can occur when markets are closed.

Why the Margin Difference Matters for Swing Traders

Swing trading futures means holding positions for days or weeks. To keep those positions open, you must meet overnight margin, not just day trading margin.

If you lack sufficient funds to cover overnight requirements, your broker can close the position, even if the trend is favourable. This can wipe out profits and capital, especially during volatile sessions or gaps.

| Feature | Day Trading Margin | Overnight Margin |

|---|---|---|

| Capital Requirement | Lower (e.g., $500 for E‑mini S&P 500) | Higher (e.g., $12,000 for E‑mini S&P 500) |

| Risk Exposure | Limited to the trading day | Covers price gaps and overnight volatility |

| Position Duration | Open and close within the same session | Positions held beyond market close (overnight) |

| Purpose | Allows short-term speculation | Secures positions against market changes overnight |

| Forced Liquidation Risk | Minimal, as positions close before the session ends | High, if margin requirements aren’t met for overnight positions |

| Margin Changes | Typically low and set by brokers | Based on exchange requirements |

| Example Contract | E‑mini S&P 500, micro contracts | Full-size S&P 500 futures or any contract held overnight |

Q: Why is the overnight margin higher than the day trading margin?

A: Overnight margin covers the risk of price gaps and volatility outside regular trading hours, so exchanges set higher requirements.

Futures Contract Expiration and Rollover Explained for Swing Traders

Futures contracts have a fixed expiration date, typically monthly or quarterly. When positions are held past that date, traders must perform a rollover.

This involves selling the expiring contract and opening a new one for the next expiration period.

For example, if you hold oil futures and want to maintain exposure for the next three months, you need to rollover your position monthly.

This process ensures you’re continuously exposed to the market. However, rollover costs can add up, including transaction fees and slippage, especially when market liquidity is low.

Rollover costs are hidden expenses that can disrupt a trader’s strategy. They occur because of the buying and selling of contracts, which may create unexpected losses or misaligned analysis.

The transition between contracts also affects market liquidity, often widening bid/ask spreads and increasing execution costs.

The process can distort trend-following strategies, especially when liquidity drops, which makes accurate technical analysis harder.

As contracts roll over, these market distortions can impact price accuracy, making it challenging for traders to follow established trends.

Q: Why is the rollover process important for futures traders?

A: According to Investopedia, it allows traders to maintain their position without taking delivery, but it also comes with transaction costs and liquidity risks.

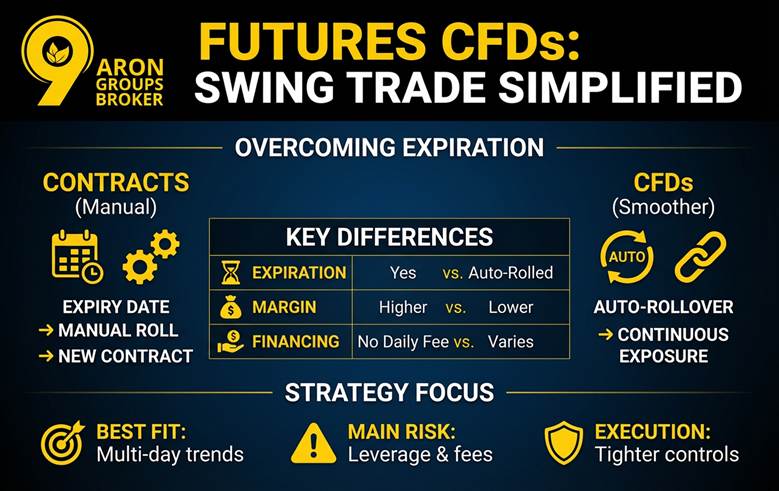

Are Futures CFDs the Best Way to Swing Trade?

If you ask, “Can you swing trade futures?”, the answer can change depending on the product structure. Traditional futures contracts expire, which forces rollovers during longer holds.

A futures CFD can reduce that friction by letting you trade the price move without owning the contract.

A Contract for Difference (CFD) is a derivative where you speculate on price changes without owning the underlying asset.

That matters for futures swing trading, because you often hold positions for days or weeks. When you want to learn how to swing trade futures, product mechanics can matter as much as technical signals.

Why do futures CFDs help with expiration and rollover

Exchange-traded futures have fixed expiry dates, and traders often “roll” into the next contract month.

By contrast, many brokers support automatic rollover for CFDs on futures, so exposure can continue without manual re-entry.

This can reduce operational mistakes during trend periods, especially in volatile markets.

Capital efficiency, leverage, and overnight costs

CFDs are often marketed as capital-efficient because they use margin and leverage.

However, leverage increases exposure to market volatility, so stop-loss placement becomes non-negotiable.

UK regulators repeatedly warn that CFDs are complex and can produce rapid losses for retail clients.

Real futures typically avoid daily “swap” charges, but they can require heavier overnight margin. Futures CFDs often lower the entry barrier, yet introduce overnight financing that compounds over longer holds.

- Best fit: trend following over days, where you want continuity through contract rolls.

- Main risk: Financing costs plus leverage can erode a slow-moving trade.

- Execution focus: tighter risk controls and smaller sizing than intraday trading.

| Feature | Futures Contracts | Futures CFDs |

|---|---|---|

| Expiration | Yes | Often auto-rolled by the broker |

| Overnight margin | Typically higher | Often lower, broker-dependent |

| Swap / overnight financing | Usually no daily swap fee | Often yes, varies by provider |

| Capital efficiency | Lower flexibility for small accounts | Higher flexibility, higher leverage risk |

Key Point:

A strong strategy can still fail if funding costs and margin rules overwhelm your account.

Understanding Swaps and the Swap-Free Advantage in Swing Trading

When you swing trade futures via CFDs, you face “Swap” fees. A swap is the interest cost for holding a position overnight. While traditional futures use high overnight margin, CFDs charge this daily fee instead.

For long-term futures swing trading strategies, these costs can slowly drain your profits. If your trade lasts weeks, the accumulated interest might outweigh your market gains. This makes calculating the “cost of carry” essential for any trend following approach.

To solve this, many traders use Islamic (Swap-Free) accounts. These accounts remove the interest charge entirely. This allows you to hold trades on Gold or Oil indefinitely without worrying about daily fees.

According to IG, keeping a CFD open after the cut-off triggers an interest adjustment for overnight funding.

Weekend Gaps in Futures: How Swing Traders Can Manage Gap Risk

Most major futures trade nearly 23 hours per day, but the week still has a weekend closure. That closure creates gap risk, where price jumps without trading in between. Many futures swing trading setups hold trades for days or weeks, including weekends.

If major news breaks during the closure, the market can reopen at a very different level.

This can create slippage, meaning orders fill at worse prices than expected.

A stop-loss is useful, but it is not a guaranteed fill price during fast moves. According to Investopedia, stop orders can execute at a different price due to slippage.

This is why stop-loss placement must consider weekend volatility and liquidity conditions

Key Point:

Weekend gaps can overwhelm leverage and margin, even when your analysis is correct.

Here is a practical checklist for how to swing trade futures with lower weekend risk. Use these steps without adding complexity to your strategy. They focus on controllable variables:

- Reduce position size before the Friday close to limit gap damage.

- Avoid max leverage, because gaps can exceed planned risk quickly.

- Recheck overnight margin rules, because holding risk is higher outside active hours.

- Prefer liquid contracts, since thin liquidity increases slippage risk.

Q: What is the simplest way to reduce weekend gap risk in futures swing trading?

A: Reduce size and leverage before the weekend, and ensure margin buffers are comfortable.

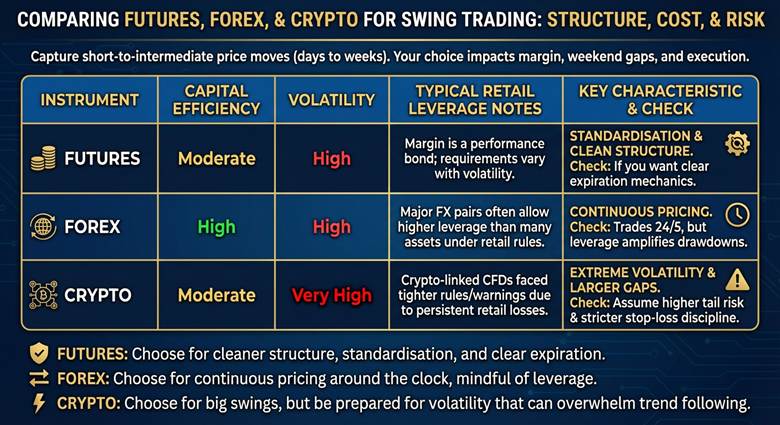

Comparing Futures, Forex, and Crypto for Swing Trading

Swing trading aims to capture short-to-intermediate price moves over several days to weeks. So, when traders ask whether you can swing trade futures, the real decision is structure, cost, and risk tolerance.

Your instrument choice changes margin rules, weekend gap exposure, and execution quality.

Forex is the deepest global market by turnover, with heavy institutional participation. Retail access often comes via leveraged products, so leverage and margin controls matter more than signals.

Crypto is structurally different because volatility can be extreme, and gaps can be larger. If you ask, “Can you swing trade crypto?”, assume higher tail risk and stricter stop-loss placement discipline.

Leverage can magnify liquidation risk during fast moves, especially on weekend news.

Use these checks before choosing your market:

- If you want a cleaner structure, futures offer standardisation and clear expiration mechanics.

- If you want continuous pricing, forex trades around the clock, but leverage can amplify drawdowns.

- If you want big swings, crypto offers them, but volatility can overwhelm trend following quickly.

Conclusion

Successful swing trading is not only about calling direction, but about choosing a structure that lets your plan survive real-world constraints. If you ask can you swing trade futures, the practical answer depends on margin rules, contract expiration, rollover friction, and weekend gap risk.

A strategy can be statistically profitable, yet fail if overnight requirements force liquidation or costs quietly erode returns. The best approach is to match your holding period to the right product, model every cost, and size positions for volatility, not confidence. Choosing the wrong product can destroy a profitable strategy.