The Turnaround Tuesday Strategy targets a rebound move when broad Monday selling creates a clear reference low. You prepare on Monday, then trade on Tuesday only if the price reclaims key levels with controlled risk.

In this guide, you will learn the setup filters, entry timing, exits, and risk rules for basic and intermediate traders.

- Use a time filter: many valid rebounds show their strongest push in the first 60-120 minutes, then either consolidate or fade.

- Compare Tuesday’s move to Monday’s range: rebounds that recover a large share of Monday’s drop often have better follow-through.

- Watch volatility compression after Monday: when intraday swings narrow on Tuesday morning, it can signal that sellers are losing urgency.

- Prefer weeks where credit and yields are calm: equity rebounds tend to be cleaner when risk markets are not flashing stress.

- Keep a simple post-trade scorecard (close strength, breadth, and reclaim quality) to refine the setup without adding new indicators.

Understanding Turnaround Tuesday

Turnaround Tuesday is a weekly rebound idea: after a weak Monday, the price often stabilises and bounces on Tuesday. It is not a guarantee; treat it as a conditional setup, not a prediction. Your edge comes from clear invalidation, controlled risk, and repeatable filters.

How Monday Weakness Sets Up the Weekly Low

Many Turnaround Tuesday setups start with a strong Monday sell-off and a weak close near the day’s lows. This often happens when traders rush to reduce risk, not because new information changed the long-term outlook.

When selling pressure is heavy, the price can form a temporary weekly low area that traders watch on Tuesday. The key is to see whether Tuesday demand appears and starts to reclaim important levels.

Why Traders Watch Tuesday for Reversals

Tuesday often becomes a decision point after Monday’s repositioning. Some traders reduce exposure during Monday weakness, then re-enter when the price stops falling and starts to stabilise. Others buy on Tuesday because Monday has already absorbed the first wave of fear.

Most Tuesday moves are practical recovery trades, so plan them with realistic targets and defined risk.

Reliability of Turnaround Tuesday as a Weekly Pattern

Turnaround Tuesday is best treated as a conditional pattern, not a rule of nature. Academic research, such as SSRN, supports the existence of “day-of-the-week” return effects, but they vary across markets and over time. That is why a trader should rely on filters, risk limits, and backtests, not stories.

Why Tuesday Reversals Happen

Tuesday reversals often occur because Monday moves can be exaggerated by emotion, positioning, and risk controls. When that pressure eases, prices can bounce, even if the broader trend remains unclear.

This is why many traders watch Turnaround Tuesday after a heavy Monday decline.

Retail Panic Selling Early in the Week

Retail traders sometimes sell in clusters after bad weekend headlines or a painful Monday open. When they see red on the chart, they may exit quickly to limit losses. This can push prices below a fair short-term level for a few hours or one session.

This does not mean retail traders are wrong about risk. It means their timing can increase selling pressure, then fade when the rush ends. A Turnaround Tuesday trade tries to buy only after that pressure slows, with a clear stop.

Institutional Profit-Taking After Market Moves

Large funds often manage risk in a weekly routine, especially after strong or weak runs. After a strong prior week, some take profits on Monday, which adds to selling. After a weak Monday, some rebalance and buy back exposure at lower prices.

This does not happen every week, and it is never one single cause. But it can explain why Tuesday has more two-way trading than Monday. Two-way action matters because a Tuesday reversal needs buyers willing to absorb supply.

Short Covering That Fuels Quick Rebounds

Some fast rebounds happen because short sellers close trades, not because new long buyers step in. Short covering means buying back an asset to close a short position and lock in profits. When many shorts are covered simultaneously, the rebound can accelerate rapidly.

This matters because the move can be fast and spread-based, especially near key intraday levels. So execution quality, liquidity, and timing become more important than perfect chart patterns.

Market Sentiment Signals Driving Turnarounds

Market mood often shifts after a heavy down day, especially when fear was the main driver. “Risk-on” groups can rebound first when traders feel selling pressure is easing. That is why sentiment clues can support a Tuesday reversal read.

Keep the clues simple and observable. Look for weaker downside momentum and fewer fresh lows late on Monday. If the index stops making new lows and holds key levels on Tuesday, the reversal has better conditions.

How the Turnaround Tuesday Strategy Works

The Turnaround Tuesday Strategy uses Monday’s low as the key reference level for the week. If Tuesday holds above that level and reclaims important intraday prices, a rebound trade becomes valid. You define invalidation first, then enter a reclaim, and exit into the nearest recovery zones.

Identifying the Weekly Low Setup

A clean setup usually has three features:

- Monday closes weak, showing sellers controlled the session.

- The decline is decisive, not a flat or choppy session.

- There is a clear rebound path, meaning visible resistance levels above the current price.

The best setups have a clear Monday range and obvious levels for Tuesday to reclaim. If Monday is directionless, signals tend to be mixed and harder to trade cleanly. Also note that when volatility is extreme, levels can be less reliable.

Timing Entries for the Reversal

Most traders use one of these entry styles:

- Early entry: enter on Tuesday after the price stops falling and starts to stabilise.

- Confirmation entry: enter after price breaks a short-term resistance level.

Early entries can offer better risk-to-reward, but they can fail more often. Confirmation entries are safer, but you may enter later and earn less. Choose one style and use it consistently, so you can judge results fairly.

Confirmation Signals Traders Use

Use signals you can check quickly during live trading:

- Price reclaims a key intraday level, like the opening-range high or VWAP, and holds it.

- Breadth improves, meaning more stocks rise than fall as the index lifts.

- Volume supports the rebound, rising on up moves and easing on pullbacks.

You are not trying to prove that the market has been bullish for weeks. You are confirming that selling pressure has cooled and that identifying the Weekly Low Setup buyers can maintain control for a tradable bounce.

Best Technical Tools for Tuesday Trades

In the Turnaround Tuesday Strategy, technical tools should answer one question: Is Tuesday’s strength being accepted or rejected? You do not need many indicators, but you do need clear reference levels to judge the rebound. Choose tools that help you map support, resistance, and reclaim points quickly.

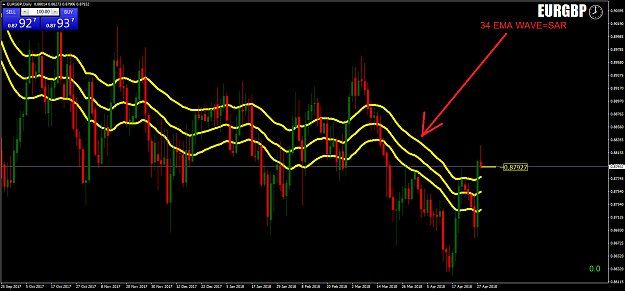

34-Day Moving Average as Dynamic Support

A moving average is a guide, not a guarantee. In a healthy uptrend, the price often pulls back toward a moving average and then finds buyers. A 34-day moving average is one way to see where that “normal pullback zone” may sit.

Use it as context, not as a buy signal in and of itself. If the price is far below the 34-day average, the market may be weakening. In that case, Turnaround Tuesday bounces can fail quickly because sellers still control the trend.

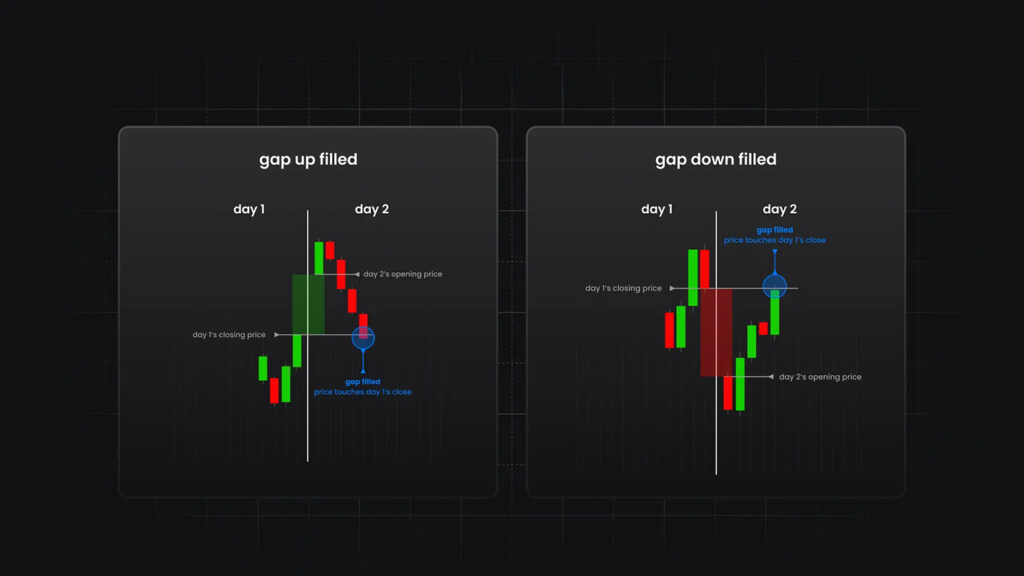

Gap Fill Strategy for Tuesday Opens

A gap is the space between Monday’s close and Tuesday’s open. Traders watch gaps because they show urgency from one session to the next. A “gap fill” idea expects the price may revisit the prior close during the day.

This fits the Turnaround Tuesday Strategy when Monday ends weakly, and Tuesday opens higher. Price may rise and “fill” part of Monday’s late sell-off.

Warning

Be cautious with big gaps caused by news, because they can keep running instead of filling.

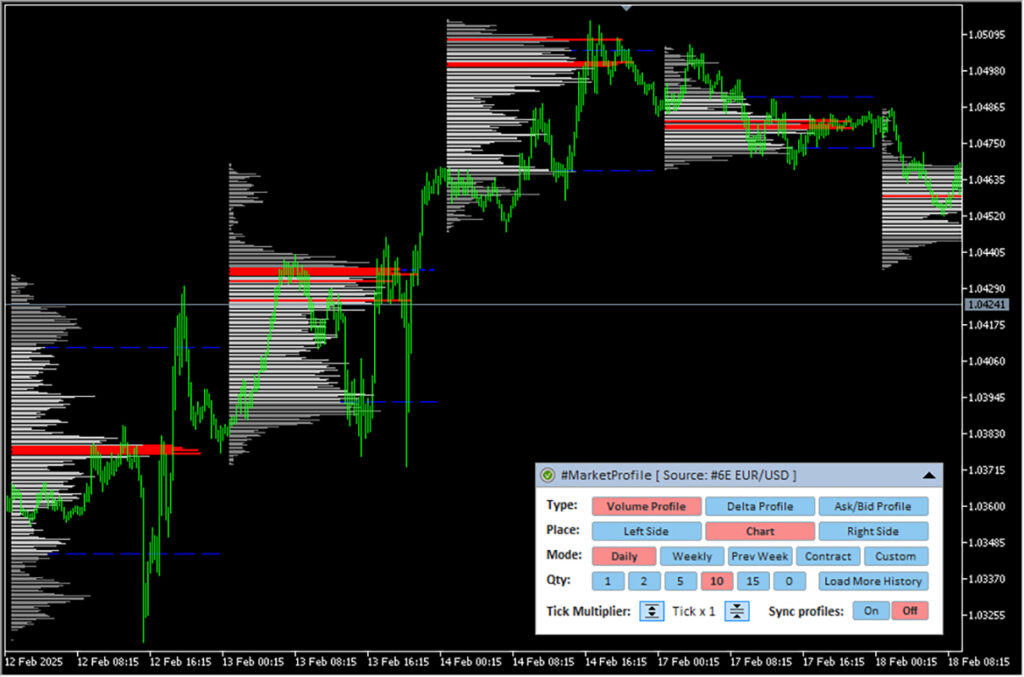

Weekly Market Profile for Key Support Zones

Market profile tools aim to find price zones where trading was heavy in the past. Heavy-trading areas can act as support because many traders remember those prices. If Tuesday reclaims one of these zones, the rebound often becomes more stable.

If you do not use the market profile, use simple weekly levels instead. Prior week low, prior week close, and major round numbers are usually enough. The best level is the one you can follow consistently without second-guessing.

Turnaround Tuesday as a Buy-the-Dip Strategy

The Turnaround Tuesday Strategy is a controlled way to buy weakness without pretending every dip is a bargain.

Contrarian Trading Principles

Turnaround Tuesday is contrarian because it looks for buying interest after a day of visible weakness. Contrarian does not mean buying any drop; it means buying only when risk is defined, and price behaviour improves.

The skill is not bravery; it is selectivity. You trade when the market starts to reclaim levels and shows stronger sector-wide participation. If price cannot reclaim key levels, the “dip” is often just the start of a deeper move.

Buying Weakness Safely

Dip-buying is only “safe” when the trade is built around execution reality:

- Trade liquid markets, where spreads stay tight during fast moves.

- Place invalidation below Monday’s low, not at a random distance.

- Target the nearest logical recovery zone, like Monday’s breakdown area.

If you need a big rally to justify the trade, your entry is late, or your stop is wrong. A good Turnaround Tuesday trade can pay from a modest rebound. That is the point of the trading structure.

Avoiding Failed Dip-Buy Setups

Use this checklist as your no-trade or exit filter for the Turnaround Tuesday Strategy:

- Weak participation: most stocks remain red while only a few large names lift the index.

- Reclaim fails: the price briefly reclaims a key level, then closes back below it.

- Weak Tuesday close: the market fades into the close and cannot hold gains.

- Volatility expands without progress: large swings appear, but the price cannot move higher.

If two or more signals appear, avoid new entries or reduce risk. If you are already in, exit when the structure breaks, even if the loss feels small but annoying. Avoid averaging down, because it increases exposure while the market rejects the rebound.

Step-by-Step Trade Plan

A solid trade plan acts as a roadmap for the trading day, guiding decisions from preparation to execution and exit. It outlines the overall workflow, starting with pre-market analysis, moving through precise entry techniques, and finishing with clearly defined profit targets and exit rules, so that each trade is approached systematically and consistently.

Pre-Market Prep & Stock Picks

Start by building a small watchlist you can actually monitor. Pick stocks or ETFs that moved with the broader market, not names dropping because of a company-specific shock. This keeps the Turnaround Tuesday Strategy linked to market flow, not one-off headlines.

Use these filters to narrow candidates:

- High average daily volume, so the chart behaviour is more consistent during the session.

- A clear Monday reference low for invalidation.

- A visible resistance level above, such as Monday’s breakdown area or a prior close.

Key Note:

Always check the economic calendar before you trade. High-impact releases can dominate price action and change behaviour around the open. If a major risk is scheduled, consider reducing the size, delaying entry, or skipping the setup.

Intraday Entry Techniques

Most traders use one of two simple entries for the Turnaround Tuesday Strategy. Both are designed to avoid buying while the price is still sliding.

- Reclaim entry: price breaks above a key level and holds it for a set time. This level can be the opening-range high, the VWAP, or a clear intraday swing level.

- Pullback entry: after the reclaim, wait for the first controlled pullback and enter on stabilisation. This often gives a cleaner stop location and avoids chasing a fast candle.

Key Point

Do not buy the first spike just because it looks strong. Let the market show it can keep gains without an instant sell-off. That patience reduces the number of entries that reverse against you within minutes.

Profit Targets and Exit Rules

Define exits before the entry, or your emotions will define them for you. A bounce trade needs realistic targets, because rebounds can stall quickly.

A simple exit structure is:

- Target 1: Prior close or the nearest resistance zone from Monday.

- Target 2: a larger level, like a partial gap fill or a prior swing high.

- Time stop: exit near the close if the price goes sideways and the momentum fades.

As price reaches targets, scale out or tighten stops to protect the trade. Do not turn a Turnaround Tuesday bounce into a long-term hold without a new reason. If the market stops pushing higher, your job is to leave, not to hope.

Risk Management for Turnaround Tuesday

The Turnaround Tuesday Strategy can win small and often, but one oversized loss can erase several good trades. So risk management is not a “nice extra”, it is the core of the setup. You define where you are wrong, size the trade to survive, and respect execution costs.

Placing Stops Below the Weekly Low

Stops should sit where your entry logic is clearly invalid, not where noise is likely. A practical approach is to use a volatility-based buffer, such as a fraction of the ATR, rather than a fixed number of points. This helps you stop adapting to quiet and fast markets.

Another method is structure-based placement, such as placing below the most recent intraday swing low after your entry. This keeps the stop tied to what price is actually doing, not to a random distance. Whichever method you choose, keep it consistent so your results are comparable.

Position Sizing for Counter-Trend Trades

Turnaround Tuesday is often a counter-trend trade, especially in a weak market. Counter-trend trades deserve smaller risk because they move against recent momentum. Until you have data, risk less than you would in a clean trend-following setup.

A simple approach is a fixed percentage risk per trade, so losses stay proportional to your account size. If you do not know your win rate, assume it is average and keep risk modest. Modest position sizing keeps you consistent enough to learn what works and what fails.

Managing Execution Risks: Spreads & Slippage

Execution is part of risk, especially on fast Tuesday moves. Wide spreads and slippage can turn a good entry into a poor fill, then your stop gets hit faster. This is why liquid ETFs, major indices, and high-volume stocks are usually safer.

Be extra careful around the open, because spreads often widen in the first minutes. If you trade stocks that can be squeezed, expect sudden spikes that break neat chart levels. When prices become jumpy, reduce position size, tighten the plan, and manage exits more actively.

Real Market Examples

Real examples help you understand what the Turnaround Tuesday Strategy looks like in live price action.

Index Reversals After Bearish Mondays

When Monday closes near the low after heavy selling, Tuesday sometimes rebounds as risk is added back.

S&P 500 – Monday sell-off, Tuesday rebound (Aug 5-6, 2024)

- Monday, Aug 5, 2024: the S&P 500 fell 3%, its worst day since September 2022. (Investopedia)

- Tuesday, Aug 6, 2024: the S&P 500 and Nasdaq ended about 1% higher, rebounding after the sell-off. (Reuters)

Q: How does it fit the Turnaround Tuesday Strategy template?

A: Monday defined the sell-off range and left the price stretched to the downside. Tuesday featured a recovery session in which buyers stepped back in and lifted the index back into the prior day’s range.

High-Volume Stock Setups with Gap Fill

High-volume stocks can show a cleaner Tuesday structure because they attract active traders and institutions. After a sharp Monday drop, Tuesday can retrace part of the decline and move back toward Monday’s close.

Nvidia – heavy Monday drop, strong Tuesday recovery (Jan 27-29, 2025)

- Monday, Jan 27, 2025: Nvidia fell about 17%, marking a record one-day market-value loss.

- Tuesday, Jan 28, 2025: Nvidia rebounded about 8.9% in the next session, retracing part of the prior day’s sell-off.

Q: How to read it for Tuesday trading

A: The usable signal is the reclaim behaviour: does price regain key intraday levels and hold them long enough to build a rebound structure. The story explains volatility, but the trade still needs a stop and a target based on levels, not headlines. (Reuters)

Lessons from Failed Tuesday Reversals

A failed Tuesday reversal often looks strong early, then fades and closes weakly. The close matters because it shows whether buyers could actually hold control until the end of the session.

S&P 500 – morning rebound fails, weak close (Apr 8, 2025)

- Tuesday, Apr 8, 2025: Reuters reports the S&P 500 reversed a strong morning rally and closed below 5,000 for the first time in almost a year. (Reuters)

Q: What failed here (practical readout)

A: The early rebound was not sustained, and the market sold off into the close after the rally failed. This is the type of day where “morning strength” is not confirmed by itself; a close location shows acceptance or rejection.

Pros and Cons of the Strategy

The Turnaround Tuesday Strategy can be useful, but only when you treat it as a rule-based setup, not a weekly promise. This section shows where it can work, and where it tends to break, so you can decide when to trade it.

Historical Edge and Statistical Performance

The appeal is simple: markets often show weekly habits, and Tuesday can bounce after heavy Monday selling. But any statistical edge can fade once conditions change, or once too many traders trade it the same way. So you must judge the strategy based on your market, timeframe, and real costs.

If you cannot backtest, reduce risk until you have enough live data. Small size is a practical way to protect your account while you learn the true behaviour. That is disciplined trading, not hesitation.

Optimal Market Conditions

Turnaround Tuesday tends to perform best when the market is not in a panic regime.

These conditions often improve the odds:

- The bigger trend is up, but Monday’s pullback is sharp rather than a full breakdown.

- Volatility is elevated, yet liquidity remains strong enough for clean execution.

- No major scheduled event is close enough to reset pricing and distort Tuesday flow.

In these conditions, Tuesday’s strength is more likely to follow through into nearby recovery levels.

Common Limitations and Risks

This strategy has structural limitations you should account for:

- The edge changes with market regime, especially in persistent trends.

- In strong downtrends, rebounds often fail quickly and show limited follow-through.

- Low liquidity conditions can distort price behaviour and reduce signal quality.

Because of these limits, results can vary across instruments and timeframes. This is why tracking outcomes and refining filters matter more than trading frequency. The goal is to trade fewer, cleaner setups.

Comparing Turnaround Tuesday With Other Dip-Buying Strategies

The main difference is timing: It is built around Monday selling and a Tuesday response. Comparing it to other approaches helps you choose the right tool for your schedule and risk tolerance.

Weekly Reversals vs Intraday Mean Reversion

Turnaround Tuesday is a weekly-timed setup, so trades often last part of Tuesday or up to two sessions. Intraday mean reversion is shorter and focuses on small snapbacks to the average within the same day. Weekly setups can feel clearer because you are watching fewer candles and less random movement.

The trade-off is overnight risk. A Tuesday position can face gaps from after-hours news or futures moves. Intraday traders often avoid this by closing before the session ends.

Comparing Tuesday Setups with Classic Buy-the-Dip Trades

A classic buy-the-dip usually targets pullbacks within a strong uptrend. The Turnaround Tuesday Strategy targets a specific window after Monday weakness, even if the trend is mixed. That timing can stop you from chasing dips every day, which is a real advantage.

But timing can also create tunnel vision. If the broader trend is down, Tuesday bounces may be weak and quickly sold. A practical filter is to trade on Tuesday only when the higher timeframe trend is not clearly bearish.

Combining Turnaround Tuesday With Multi-Day Approaches

Some traders enter on Tuesday and hold for several days when momentum continues. That can work, but you must define a new reason to hold beyond Tuesday. A useful “new reason” is to reclaim a weekly level and then hold it into the close.

Without that new reason, holding longer is often just avoiding the exit decision. Many winners turn into flat trades when you delay exits without a rule. If your holding period changes, your targets, stops, and trade logic must change too.

Conclusion

The Turnaround Tuesday Strategy becomes practical when you plan for Monday levels and execute them with discipline on Tuesday. Wait for a reclaim signal, aim for realistic recovery targets, and manage size so that one trade doesn’t ruin your week. Log each trade, including entry timing, close behaviour, and costs, then refine rules using your own data.