In the world of cryptocurrencies, there is no overseer, no bank approves transactions, and no authority guarantees network security. So what motivates thousands worldwide to spend electricity, hardware, and capital around the clock adding blocks to the network?

The answer is a simple yet vital concept called the block reward (Block Reward). The block reward is not merely a prize. It is the fuel that keeps the blockchain engine running, secures the network, and drives the cryptocurrency economy.

If you want to know why miners spend millions of dollars to earn it, we strongly recommend reading on.

- The block reward is the incentive that motivates miners or validators to invest time, energy, and resources in securing a blockchain network.

- Its design encourages cooperation and rule compliance, while deviations like selfish mining reduce network rewards and cause miner losses.

- Block rewards usually have two parts: newly minted coins and transaction fees paid by users.

- Blockchain security depends on block rewards; declining rewards can lower miner income, reduce hashrate, and threaten network security.

What Is a Block Reward?

A block reward is the incentive a blockchain network gives to miners for adding a new block. These participants are usually miners, such as those operating on the Bitcoin network. In some newer networks like Ethereum, validators perform this role instead of miners.

When a participant creates and adds a new block, the network rewards them as encouragement. This reward typically has two components.

One part is newly issued coins generated by the network, such as bitcoins created every ten minutes.

The other part consists of transaction fees paid by users.

Block rewards encourage participants to commit resources and maintain network security. For this reason, the concept plays a critical role in the survival of blockchain systems.

According to CoinTracker, a block reward consists of both the newly minted coins and the transaction fees from that block, and in Proof-of-Stake systems (like Ethereum), validators receive these rewards for validating blocks instead of miners

Block Reward Structure and Calculation Methods

Block rewards usually consist of two main components:

- Newly issued coins

- Transaction fees

The size of each component depends on the network protocol design and consensus algorithm.

Transparent, predefined network rules govern these values. In blockchains using Proof of Work, such as Bitcoin, miners must solve complex mathematical problems.

Whoever solves the problem first adds a new block and receives the reward. In this model, each Bitcoin block reward includes newly created bitcoins plus transaction fees within that block.

In networks using Proof of Stake, such as the newer version of Ethereum, solving complex puzzles is unnecessary. Instead, participants lock a specific amount of cryptocurrency, a process known as staking.

Selected validators who correctly confirm new blocks receive rewards. These rewards can include newly issued coins and transaction fees.

How Are Block Rewards Calculated Across Different Networks?

Block reward calculations are based on several key parameters:

- Coin Emission Rate: Determines how many new coins are issued per block, usually decreasing over time to control inflation.

- Total Transaction Fees: All fees collected from transactions in a block are added to the validator or miner’s reward.

- Dynamic Network Adjustments: Some blockchains adapt rewards based on conditions like mining difficulty or transaction volume.

- Payment Scheduling: Certain networks delay rewards through vesting or lockups to discourage harmful behaviour.

- Consensus Algorithm Parameters: The consensus model directly affects reward calculation, allocation, and distribution.

Therefore, block reward calculation combines protocol rules, market conditions, and technical architecture.

This design balances economic incentives for miners and validators while maintaining network security.

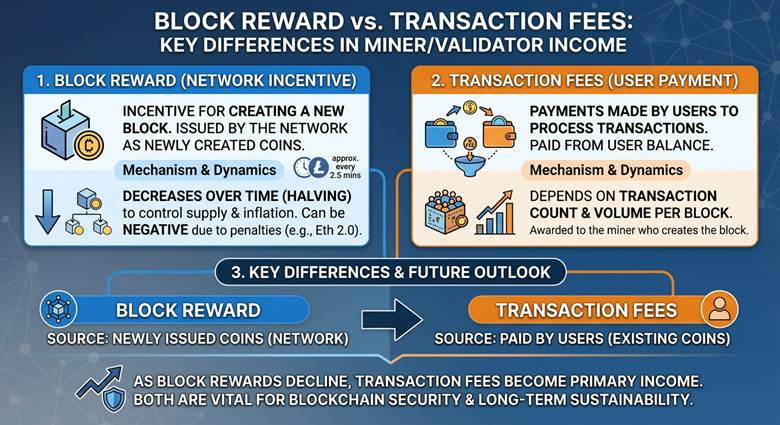

Difference Between Block Reward and Transaction Fees

The difference between block rewards and transaction fees is a key blockchain concept for understanding miner and validator income. Below, the differences are explained clearly and precisely.

Block Reward

As we told, a block reward is the incentive a blockchain network gives miners for creating and adding a new block.

For example, in the Litecoin blockchain, a new block is created approximately every two and a half minutes. The miner who produces the block receives newly issued litecoins as a reward.

Like Bitcoin, this reward decreases over time through halving events to prevent excessive supply and inflation.

In conditions such as high refund fees or validator penalties on networks like Ethereum 2.0, a block’s income can turn negative.

| Feature | Block Reward (Subsidy) | Transaction Fees (Tips) |

|---|---|---|

| Source | The Network (Inflation). | The Users (Market Demand). |

| Trend | Decreases over time (Halving). | Increases as network gets busier. |

| Role | Bootstraps the network early on. | Sustains the network long-term. |

| Example | 3.125 BTC per block. | 0.0005 BTC to send funds. |

Transaction Fees

Transaction fees are payments users make to process their transactions on the network. When sending cryptocurrency, users must pay a small fee from their balance. This fee is awarded to the miner who creates the block containing the transaction.

Key Differences

The main difference lies in the source of payment.

- Block rewards are issued by the network as newly created coins.

- Transaction fees are paid by users and depend on transaction count and volume per block.

In the future, as block rewards decline or reach zero, transaction fees will become miners’ primary income source. Therefore, both play a vital role in blockchain security and long-term network sustainability.

Types of Block Rewards

Block rewards vary by blockchain type and the consensus algorithm in use. Each reward model affects network security, inflation, and long-term economic sustainability differently.

These models include:

- Fixed reward

- Decreasing reward

- Proof of Stake–based reward

- Hybrid or multilayer rewards in newer blockchains

Each model is explained in detail below.

Fixed Reward

In some networks, the block reward amount remains constant over time. Whether the first block or the millionth is mined, the reward stays the same.

For example, on the Dogecoin network, miners always receive 10,000 DOGE per block. This model is simple and makes coin issuance predictable for participants. However, it can cause long-term inflation because coin production never stops.

Decreasing Reward

In blockchains like Bitcoin and Litecoin, block rewards decrease over time based on a predefined schedule.

For example, Bitcoin’s block reward halves every 210,000 blocks. This model aims to control supply and prevent excessive coin creation. Over time, this scarcity can potentially increase the asset’s long-term value.

Proof of Stake–Based Reward

In Proof of Stake networks, there are no miners. Instead, participants called validators lock a specific amount of coins to validate blocks.

Their rewards depend on the staked amount and participation duration. In networks like Ethereum 2.0 or Cardano, higher staking usually leads to higher rewards. This method consumes far less energy than mining and is more environmentally friendly.

Hybrid or Multilayer Rewards in Newer Blockchains

Some newer blockchains, such as Kaspa, use hybrid reward models. Here, block rewards are not limited to new coins or transaction fees.

The protocol adjusts rewards based on factors like participation level or processing performance. This structure is more complex but offers greater flexibility. It better discourages harmful behaviour and helps protect network security and performance.

| Block Reward Type | How It Works | Main Advantage | Main Risk |

|---|---|---|---|

| Fixed Reward | A constant reward is paid for every block, regardless of time or network growth. | Predictable issuance and simple economic model. | Long-term inflation due to unlimited coin supply. |

| Decreasing Reward | Block rewards decline over time based on a predefined schedule, such as halving events. | Controls supply and supports long-term scarcity. | Miner revenue pressure as rewards shrink. |

| Proof of Stake Reward | Validators earn rewards based on staked coins and participation instead of mining. | Low energy usage and environmentally friendly design. | Centralization risk if large holders dominate validation. |

| Hybrid / Multilayer Reward | Rewards adjust dynamically using multiple factors like participation, workload, or network conditions. | Flexible incentives and stronger resistance to harmful behaviour. | Higher complexity and harder economic predictability. |

The Halving Process and Its Impact on Block Rewards

Halving is a key mechanism in some blockchains designed to control new coin issuance. It operates automatically according to a predefined schedule embedded in the blockchain’s source code, reducing the block reward by half.

Some attackers analyse block timing and reward intervals to target specific blocks, similar to MEV attacks on Ethereum.

Simply put, halving acts like a gradual brake on new coin production. In blockchains like Litecoin and Bitcoin, halving occurs after a fixed number of blocks are mined. For example, in 2019, Litecoin’s block reward dropped from 25 LTC to 12.5, then halved again in 2023, reaching 6.25.

In Bitcoin, following the April 2024 halving, the block reward fell from 6.25 BTC to 3.125. The next halving is expected in 2028, again cutting the reward in half. This process continues until the total supply reaches 21 million, expected around the year 2140. After that point, no new bitcoins are created, and the block reward becomes zero.

The Future of Block Rewards After Halving

As mentioned earlier, in networks like Bitcoin and Litecoin, block rewards decrease over time with each halving event. But if new coin rewards disappear, will miners still continue operating?

The answer is that transaction fees will become miners’ only income source. These fees are paid by users to include their transactions in blocks. Under these conditions, two critical factors become increasingly important.

- First, transaction fees gain importance as the sole financial incentive for miners.

- Second, network activity becomes vital for sustaining mining profitability.

High user activity and transaction volume increase fees and keep mining profitable. Low activity may push miners out, potentially weakening network security. Therefore, the future of block rewards after halving depends on users, transaction volume, and smart economic design.

If managed correctly, networks can remain secure, active, and profitable without new coin issuance.

Impact of Block Rewards on Blockchain Economics

Block rewards are not just simple incentives but foundational pillars of blockchain economies. They play several key roles within the network’s economic structure.

1. Miner Incentives and Network Security

Block rewards are the primary reason miners participate in the network. They motivate miners to invest time, energy, and powerful hardware into securing transactions.

Higher network hashrate makes attacks more difficult and expensive.

2. Supply Control and Inflation Prevention

Block rewards decrease over time, slowing the creation of new coins.

This reduction helps prevent inflation and limits overall supply growth.

Scarcity can increase market value, similar to assets with limited supply like gold.

3. Impact on Price and Market Dynamics

Historically, prices often rise after halving events reduce block rewards. Lower supply combined with stable or rising demand drives prices upward.

This effect can help maintain miners’ revenue despite reduced rewards. Halving events also attract investor and trader attention, increasing market activity.

4. Growing Dependence on Transaction Fees

As block rewards approach zero, miners rely entirely on transaction fees. If fees fail to cover costs, some miners may exit the network. This shift can affect network security and increase costs for users.

Note:

In blockchains like Polkadot or Cosmos, block rewards are not immediately withdrawable and are unlocked after a waiting or unbonding period.

5. Competitive Pressure and Mining Industry Consolidation

As block rewards decline, only miners with cheaper electricity or more advanced equipment can remain profitable. Smaller miners may exit the market, allowing large mining farms with greater resources to gain dominance.

This trend can threaten decentralisation and disrupt healthy competitive balance across the network.

6. Impact on Investment and Broader Adoption

Block rewards and halving cycles have positioned Bitcoin-like assets as scarce and inflation-resistant investments.

This perception attracts institutional capital and supports blockchain integration into traditional financial markets. However, as economic structures evolve, developers must continually refine reward systems and security to ensure long-term viability.

According to Investopedia coverage on Bitcoin’s future, after the total supply cap is reached, miners may still remain economically viable if network adoption is high and transaction fees increase sufficiently to compensate for the lack of new coin issuance.

Comparison of Bitcoin and Ethereum Block Rewards

Although Bitcoin and Ethereum share the goal of securing the network, their block reward structures differ fundamentally. These differences appear in consensus algorithms, reward distribution, and overall economic design.

Bitcoin uses Proof of Work, where miners earn rewards by solving complex mathematical puzzles. The reward includes newly issued bitcoins plus transaction fees. Every four years, the Bitcoin block reward is reduced through a halving event.

Ethereum, after transitioning to version 2.0, now operates under Proof of Stake. Validators earn rewards by locking 32 ETH and correctly validating blocks. Ethereum rewards depend on validator count, total staked ETH, and validator performance. After the EIP-1559 upgrade, part of the Ethereum transaction fees is burned.

This change significantly differentiates Ethereum’s economic model from Bitcoin’s.

Key Differences Between Bitcoin and Ethereum Block Rewards:

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Consensus Algorithm | Proof of Work (PoW) | Proof of Stake (PoS) |

| Block Reward in 2025 | 3.125 BTC per block after halving | Staking rewards, no mining block reward |

| Average Block Time | Approximately 10 minutes | Approximately 12 seconds |

| Reward Structure | Block reward plus transaction fees | Staking rewards plus transaction fees |

| Supply Cap | Fixed supply of 21 million BTC | No fixed maximum supply |

| Halving Impact | Block reward halves every ~4 years | Not applicable |

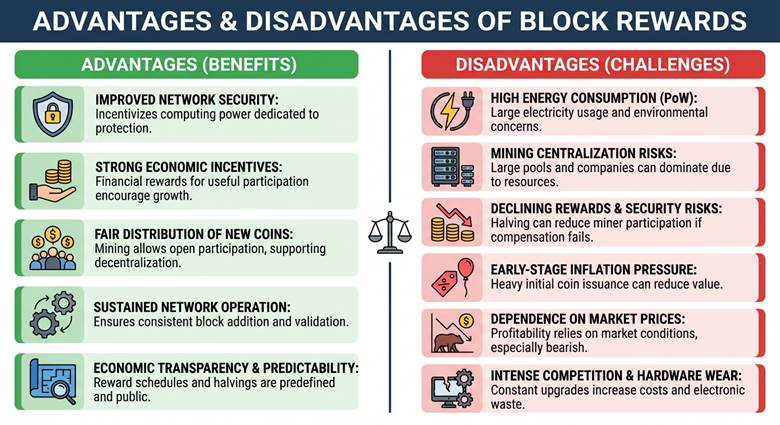

Advantages and Disadvantages of Block Rewards

Like any economic mechanism, block rewards have both benefits and drawbacks. Each is explained clearly below.Advantages of Block Rewards

The main advantages of block rewards include:- Improved network security: Block rewards incentivise miners to dedicate computing power to cryptographic puzzles and network protection.

- Strong economic incentives: Miners or validators receive financial rewards for useful participation, encouraging broader involvement and network growth.

- Fair distribution of new coins: Unlike ICOs, mining allows open participation, supporting decentralisation of coin ownership.

- Sustained network operation: Block rewards ensure participants remain willing to add blocks and validate transactions consistently.

- Economic transparency and predictability: In networks like Bitcoin, reward schedules and halvings are predefined and publicly known.

Disadvantages of Block Rewards

Key challenges and disadvantages of block rewards include:- High energy consumption: Proof of Work mining requires powerful hardware and large amounts of electricity usage, raising environmental and operational concerns.

- Mining centralisation risks: Large companies and mining pools may dominate due to cheaper power and better equipment.

- Declining rewards and security risks: Halving events can reduce miner participation if prices or fees fail to compensate for losses.

- Early-stage inflation pressure: Heavy initial coin issuance can reduce the value and concern early investors.

- Dependence on market prices: Miner profitability directly depends on cryptocurrency market prices, especially during bearish conditions.

- Intense competition and hardware wear: Constant upgrades increase costs, electronic waste, and exclude smaller participants.

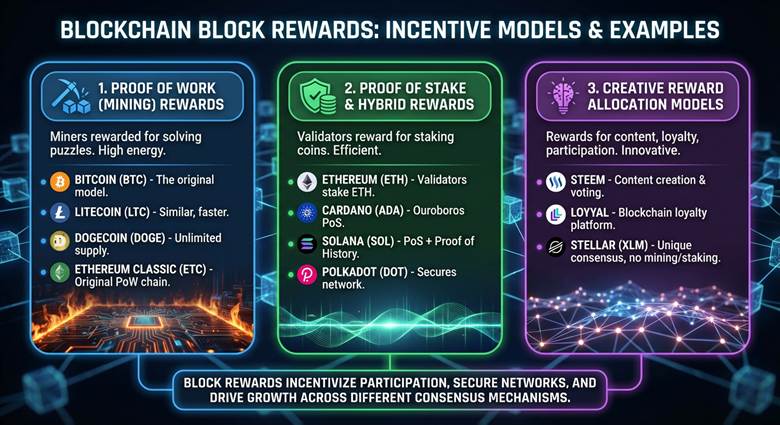

Examples of Blockchains Using Block Rewards

Below are notable blockchains that use block rewards as part of their incentive systems.

Blockchains Using Mining and Proof of Work Rewards

The most well-known Proof of Work blockchains include:

- Bitcoin: The first cryptocurrency, widely known for its block reward–based security model.

- Litecoin: An early altcoin with a reward structure similar to Bitcoin and halving every 210,000 blocks.

- Bitcoin Cash: A 2017 Bitcoin fork focused on faster and cheaper transactions, still using Bitcoin’s reward model.

- Dogecoin: A popular and lighthearted cryptocurrency using block rewards without a fixed maximum supply.

- Ethereum Classic: The original Ethereum chain that still uses Proof of Work and miner block rewards.

Blockchains Using Proof of Stake and Hybrid Reward Models

Major Proof of Stake and hybrid blockchains include:

- Ethereum: After the Merge upgrade, rewards go to validators who stake ETH instead of miners.

- Cardano: Uses the Ouroboros Proof of Stake algorithm to reward stakers and staking pool operators.

- Polkadot: Rewards validators through a Proof of Stake system designed to secure the network.

- Solana: Combines Proof of Stake with Proof of History to distribute validator rewards efficiently.

- Tezos: Uses Liquid Proof of Stake to reward users who stake their tokens.

- Cosmos: Operates with the Tendermint Proof of Stake algorithm and rewards validators accordingly.

- Avalanche: A fast and scalable blockchain distributing rewards through a Proof of Stake model.

- Stellar: Uses a unique consensus protocol based on group agreement rather than mining or staking.

This model avoids high energy use while still incentivising active network participation.

Networks Using Creative Reward Allocation Models

Some blockchains use innovative reward mechanisms beyond traditional mining or staking.

- Steem: A social blockchain rewarding users for content creation and community voting.

- Loyyal: A blockchain-based loyalty platform rewarding users and businesses for ecosystem participation.

According to Wikipedia, Hybrid chains like Peercoin implemented early PoS mechanisms and show how mixed reward and issuance structures can intentionally target stable inflation rather than fixed supply caps.

Conclusion

The block reward is the heartbeat of blockchain networks. It not only incentivises block production and network security but also establishes the economic order of blockchains.

As rewards gradually decline and networks adopt new participation models, blockchain futures depend heavily on precise design and economic balance. Innovation in reward mechanisms becomes increasingly critical for long-term sustainability.

Ultimately, without rewards, there is little incentive left to protect and secure the network.