Entering the world of cryptocurrency without understanding its fundamental concepts is like navigating uncharted waters without a map. One of the most critical concepts every investor and trader must know is the difference between the various types of a cryptocurrency’s supply. Terms like Circulating Supply, Total Supply, and Max Supply are often used interchangeably, but each has a unique meaning that provides vital information about a project’s value and potential.

In this guide, we will clearly explain these three key concepts and show you how to use this data to perform fundamental analysis on a digital asset. If you want to invest smarter, this is essential reading.

- Never be deceived by a token's low price; a token with a supply in the trillions can have a massive market capitalization, making it very expensive.

- Cryptocurrencies with a fixed supply cap, like Bitcoin, have greater potential to become a long-term store of value.

- Reducing supply through token burning creates scarcity and potentially increases value, while inflation (an increasing supply) erodes value.

What is Circulating Supply?

Circulating Supply refers to the number of coins or tokens that have been mined or minted and are currently available to the public and tradable on the open market. Simply put, it’s the amount of a cryptocurrency that is actively being held and transacted in the wallets of investors, traders, and general users.

This metric excludes tokens that are locked, reserved by the development team, or have been burned. For this reason, circulating supply is a critical indicator for measuring the real-time, effective value of a project.

Example: Imagine a crypto project called “AronCoin” that has created 1,000,000 tokens. Of this amount:

- 600,000 tokens are available on the market for buying and selling.

- 300,000 tokens are locked by the founding team for future project development.

- 100,000 tokens have been permanently burned and removed from circulation.

In this scenario, the circulating supply is 600,000 AronCoin tokens. This is the figure used to calculate the project’s Market Cap.

Why is Circulating Supply Important for a Cryptocurrency’s Price?

Circulating supply directly impacts a cryptocurrency’s market capitalization. The formula for calculating market cap is:

Market Cap = Current Price per Coin × Circulating Supply

This metric helps investors understand the true size and valuation of a project. A cryptocurrency with a lower circulating supply requires less capital inflow to achieve a higher price per coin. Consequently, projects that have a large portion of their tokens locked may experience significant selling pressure and a potential price decrease as these tokens are gradually released (an event known as a token unlock), thereby increasing the circulating supply.

What is Total Supply?

Total Supply refers to the sum of all coins that have been created (mined or minted) to date, minus any coins that have been permanently burned. This figure includes both the coins in circulation and those that are locked for various reasons such as private investments, team reserves, or staking programs and are therefore not tradable on the public market.

Example: A gaming company launches a new online game called “CryptoRaiders” and creates a token for it named “RaiderCoin (RDC).”

The company initially creates a total of 10 million RDC tokens. However, their allocation plan is as follows:

- 4 million tokens are released to the market for public sale and as in-game rewards for players. (This is the Circulating Supply).

- 3 million tokens are allocated to the development team but are locked for two years to ensure the team’s long-term commitment to the project.

- 2 million tokens are held in the company’s treasury for future partnerships and marketing initiatives and are not currently tradable.

- 1 million tokens are burned at the project’s inception to increase the token’s value.

In this scenario, the Total Supply is calculated as the total number of created coins minus the burned coins:

10,000,000 − 1,000,000 = 9,000,000 RDC

Therefore, the total supply of RaiderCoin is 9 million.

The Formula and Method for Calculating a Cryptocurrency’s Total Supply

The formula for calculating total supply is straightforward:

Total Supply = Circulating Supply + Locked Tokens

This formula highlights that the difference between circulating supply and total supply lies precisely in the tokens that exist but are not currently tradable on the open market.

Let’s apply this formula using the “CryptoRaiders” game example:

- Circulating Supply: 4,000,000 RDC tokens (the tokens held by players and investors).

- Locked Tokens: 5,000,000 RDC tokens (the combined total from the team’s and the treasury’s allocations).

Calculation:

Total Supply = 4,000,000 + 5,000,000 = 9,000,000 RDC

As you can see, the result perfectly matches the initial definition. This calculation shows us that while 9 million RaiderCoin tokens exist in total, only 4 million are currently available for trading on the market. Understanding this distinction helps investors recognize that an additional 5 million tokens have the potential to enter the market in the future.

Total Supply vs. Circulating Supply: Which is the More Accurate Metric?

Asking which metric is more “accurate” is like asking whether a speedometer or a fuel gauge is more important for driving. The answer is that both are vital for different purposes, and ignoring either one can be risky.

Circulating supply and total supply function in the same way; neither is superior to the other, but they answer two different and equally important questions.

- Circulating Supply is the better metric for gauging a project’s current market capitalization and liquidity because it only considers coins that are actually tradable on the market. This figure reflects the project’s present-day economic reality.

- Total Supply provides a broader perspective on potential future inflation and associated risks by showing the entire existing coin supply.

Factors Affecting Changes in Total Supply Over Time

A cryptocurrency’s total supply is not a static figure; much like a country’s population, it can increase or decrease over time. These changes are typically controlled by two primary mechanisms:

- Mining or Staking: This process increases the total supply by creating new coins. It occurs in two main ways:

- Mining: Computers solve complex puzzles to earn newly created coins as a reward (e.g., Bitcoin).

- Staking: Users lock up their assets on the network to help secure it and, in return, receive new coins as interest (e.g., Cardano).

- Token Burning: This process decreases the total supply by permanently destroying existing tokens. The main goal is to create scarcity, which can potentially increase the value of the remaining tokens. This is accomplished by sending tokens to an inaccessible wallet, removing them from circulation forever.

What is Max Supply?

Max Supply refers to the maximum number of coins or tokens that will ever exist for a specific cryptocurrency. This number is hard-coded into the protocol and cannot be changed. Once the total supply reaches the max supply, no new coins can be mined or created.

Max Supply in Projects with a Fixed Coin Limit

The existence of a max supply is a deflationary feature that creates scarcity. The most famous example is Bitcoin, which has its max supply permanently capped at 21 million coins. This inherent limitation is a primary reason Bitcoin is often referred to as “digital gold.” As demand increases while the final supply remains fixed, its value tends to appreciate over the long term.

Max Supply vs. Unlimited Supply in Cryptocurrencies like Ethereum

Some cryptocurrencies, such as Ethereum, do not have a defined max supply. However, this does not imply infinite inflation. Ethereum controls its inflation rate through mechanisms like transaction fee burning (as introduced in EIP-1559). During certain periods, its supply may even decrease, making it temporarily deflationary. Nonetheless, there is no ultimate hard cap defined in its code.

The Impact of Max Supply on Long-Term Value and Price Behavior

Max supply is a powerful psychological and economic factor.

- Projects with a fixed supply cap create a sense of scarcity and urgency among investors, which can help preserve and increase value over the long term.

- In contrast, projects with an unlimited supply must implement robust economic mechanisms to control inflation and build investor confidence. Instead of relying on a simple rule (like a 21 million cap), these projects use a dynamic economic system involving tools like token burning and staking.

In conclusion, while projects like Bitcoin derive their value from the simple and immutable principle of scarcity, projects like Ethereum build trust through active and intelligent economic management aimed at balancing new supply with market demand.

The Difference Between Circulating, Total, and Max Supply in Cryptocurrency

To understand the difference between these three key concepts, let’s use a simple analogy: baking a pizza.

- Max Supply – The Pizza Recipe: This figure is like your pizza recipe, which states you can make a maximum of one 8-slice pizza. It’s impossible for a ninth slice to suddenly appear.

- Total Supply – The Baked and Sliced Pizza: In our example, the total supply is like the complete pizza that has been baked and cut into 8 slices. All 8 slices exist, but perhaps not all of them have been placed on the table to be eaten yet.

- Circulating Supply – The Slices on the Table: Suppose you’ve placed 6 slices on the table for your guests and kept 2 slices in the kitchen for later. In this case, the circulating supply is 6 slices.

| Feature | Max Supply | Total Supply | Circulating Supply |

|---|---|---|---|

| Simple Definition | The absolute maximum number of coins that will ever exist. | All coins ever created (minus any burned coins). | The number of coins publicly available and actively traded. |

| What It Includes | All existing coins and all coins that will be mined/minted in the future. | Circulating Supply + all locked tokens (team, treasury, staking). | Coins in investor wallets and on exchanges. |

| What It Excludes | Excludes no potential tokens. | Only permanently burned tokens. | Locked, reserved, and burned tokens. |

| Main Use for Analysis | To measure scarcity and long-term value potential. | To assess future inflation risk and potential selling pressure. | To calculate the current Market Cap and liquidity. |

| Can It Change? | No, it is hard-coded and (usually) fixed. | Yes, increases with new minting/mining, decreases with burns. | Yes, increases with token unlocks, decreases with burns. |

| The Pizza Analogy | The recipe that dictates the pizza can have a maximum of 8 slices. | The entire pizza, cooked and sliced (including pieces in the kitchen). | The slices of pizza served on the table for guests. |

Applying Supply Differences in Fundamental Analysis and Valuation

A savvy analyst uses the differences between these supply metrics as signals to evaluate a project’s health and potential:

Signal 1: The Gap Between Circulating and Total Supply

A large gap between these two numbers is a red flag. It means a significant number of coins are locked and held by the team, early investors, or the project’s foundation. An analyst must immediately investigate the project’s “token unlock schedule.” If this massive volume of coins is set to be released in the near future, it could create heavy selling pressure and cause a sharp price decline.

Signal 2: The Gap Between Total and Max Supply (Future Inflation Rate)

This difference shows us how many more coins are scheduled to be mined or minted in the future.

- In a project like Bitcoin, this gap is very small, meaning its inflation rate (the creation of new coins) is very low and approaching zero. This feature makes it a suitable store of value.

- In a new project, this gap is usually large, indicating high future inflation. This inflation can hinder price appreciation unless the demand for the token grows at a faster rate.

Signal 3: The Absence of a Max Supply (The Importance of Tokenomics)

For projects like Ethereum that do not have a hard cap, an analyst must look at other economic mechanisms. The most important question is: “Is there a mechanism to control inflation?” In Ethereum’s case, the fee-burning mechanism plays a key role. If the rate of token burning is close to or exceeds the rate of new token issuance, the currency can become deflationary and preserve its value.

Common Mistakes Traders Make When Interpreting Supply Data

Many investors, especially newcomers, make costly mistakes due to a misunderstanding of supply data:

Mistake 1: Focusing on a Low Price Per Coin (The “Cheap” Trap)

Many think a token priced at $0.001 is “cheap” and a buying opportunity. This is one of the biggest fallacies. A project’s true value is measured by its market capitalization (Price × Circulating Supply). A token with a supply in the hundreds of trillions can have a massive market cap and little room for growth, even with a very low price. Always compare market caps, not the price per coin.

Mistake 2: Ignoring Locked Supply (Team and Investor Tokens)

A trader might get excited about a project with a low market cap but fail to check that 90% of the total supply is held by the team and early investors, set to be unlocked in the coming months. These token unlocks are usually followed by large-scale sell-offs and sharp price drops. Always read the whitepaper and the tokenomics section of a project.

Mistake 3: Having a Black-and-White View on Max Supply

Some traders mistakenly believe that any project without a fixed supply cap, like Bitcoin, is worthless. As mentioned, projects like Ethereum can manage inflation effectively with robust economic mechanisms like fee burning. What matters is the overall economic model, not just the presence or absence of a hard cap.

The Importance of Supply in Fundamental Analysis and Cryptocurrency Valuation

A project’s supply structure is a cornerstone of fundamental analysis in the crypto space. These metrics help us assess the economic health, sustainability, and growth potential of a project.

Analyzing the Relationship Between Supply, Demand, and Price Volatility

Basic economics dictates the following principles:

- If demand remains constant and supply increases, the price will fall.

- If demand remains constant and supply decreases (e.g., through token burning), the price will rise.

- If supply is limited and demand increases, the price will rise sharply.

The extreme volatility in the crypto market is often a result of sudden shifts in this supply-and-demand equilibrium.

The Role of Supply Structure in the Valuation and Economic Stability of Crypto Projects

A project’s supply structure is like its genetic blueprint; it largely determines its long-term success or failure.

- Fair Distribution and Preventing Centralization: If a vast portion of the tokens is held by the founding team or a few early investors, it poses a significant risk. These individuals could manipulate the price by selling off their holdings en masse (a “dump”), thereby harming the project. A wide distribution among the user community indicates decentralization and greater economic health.

- Logical Unlock Schedule: A reputable project locks the tokens allocated to its team and early investors for a specified period (e.g., 2 to 4 years). This ensures their interests are aligned with the long-term success of the project and prevents immediate sell-offs after launch.

- Transparent Monetary Policy: A stable project has a completely transparent and predictable monetary policy (whether it is inflationary or deflationary). For example, Bitcoin’s halving schedule, which cuts the production rate in half every four years, is a transparent policy that allows investors to plan for the future.

Does Lower Supply Always Mean Higher Value?

No, absolutely not. This is one of the most common and costly misconceptions among novice investors. A project’s true value lies in its market capitalization, not in the price of a single token.

Market cap gives us a complete picture of a project’s overall size and value, whereas the per-unit price alone can be highly misleading.

Practical Example:

Consider two hypothetical projects, Project A and Project B:

Project A (Low Supply, High Price):

- Circulating Supply: 1 million tokens

- Price per Token: $1,000

- Market Cap: 1,000,000 × $1,000 = $1 Billion

Project B (High Supply, Low Price):

- Circulating Supply: 10 billion tokens

- Price per Token: $0.10 (10 cents)

- Market Cap: 10,000,000,000 × $0.10 = $1 Billion

Analysis: Although the price of a Project A token ($1,000) is 10,000 times higher than that of a Project B token ($0.10), the total market value of both projects is identical at $1 billion.

The low price of Project B is merely a psychological trap that makes it appear “cheap,” but in reality, its overall valuation is no different from Project A’s. Therefore, a lower supply alone offers no advantage; what matters is the balance between supply, demand, and the resulting market capitalization.

How to Verify Cryptocurrency Supply Data from Reliable Sources (with a Practical Example)

When researching supply data, never rely on screenshots from social media or claims from anonymous sources. Always consult primary, reputable data aggregators that compile information from multiple exchanges.

Two of the most trusted and widely used resources for this purpose are:

- CoinMarketCap.com

- CoinGecko.com

Below is a step-by-step example of how to check the supply data for Cardano (ADA) on CoinMarketCap.

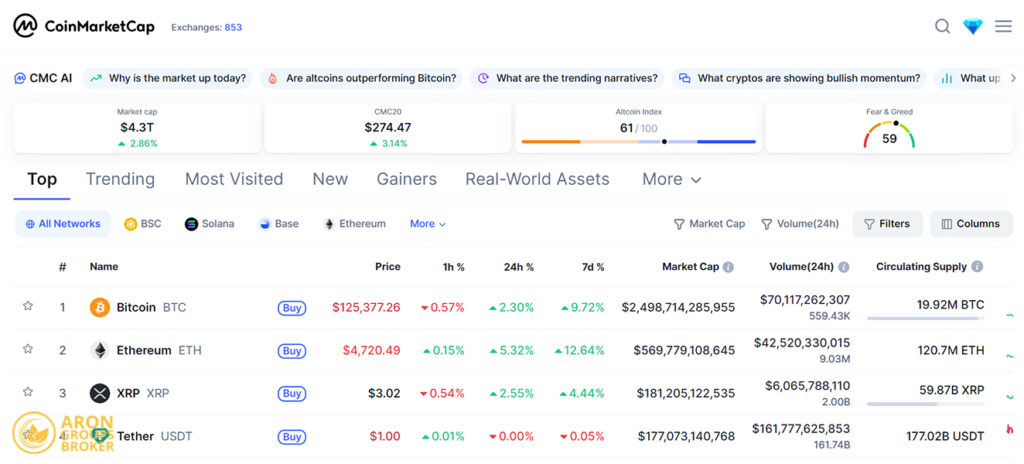

Step 1: Go to the Website

Open your web browser and navigate to CoinMarketCap.com.

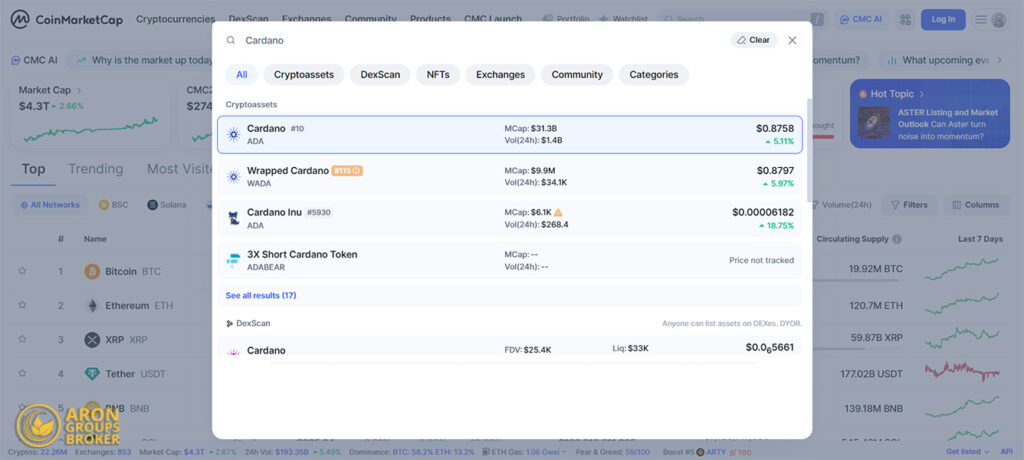

Step 2: Search for the Cryptocurrency

Use the search bar at the top of the page to type in the name of the cryptocurrency (“Cardano”) or its ticker symbol (“ADA”). Click on the correct result to go to its dedicated page.

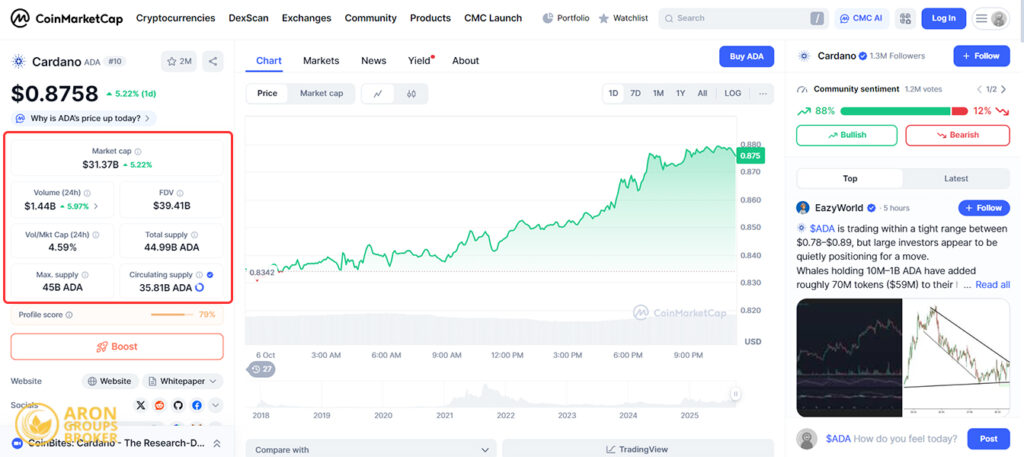

Step 3: Locate the Supply Statistics Section

Once on the Cardano page, look for the information panel, typically located on the right-hand side. This section contains key metrics such as price, market cap, and, most importantly, the supply data.

Step 4: Interpret the Data

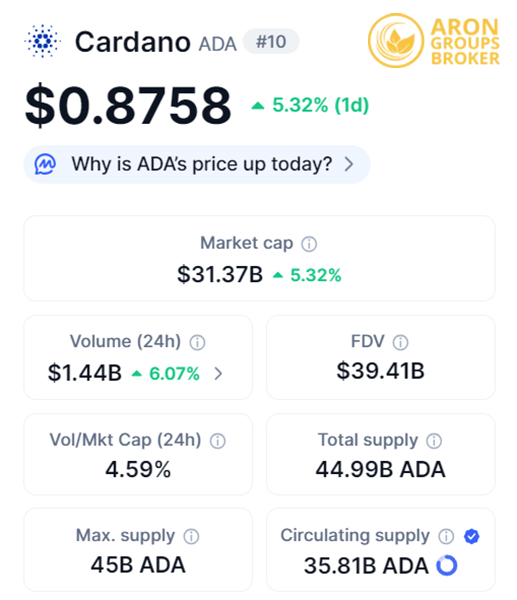

In this section, you will clearly see the three main supply metrics. Based on the provided image, you would find the following:

- Circulating Supply: This figure (e.g., 35 billion ADA) shows how many coins are currently tradable on the open market.

- Total Supply: This number (e.g., 45 billion ADA) indicates how many coins have been created to date.

- Max Supply: This figure (45 billion ADA) is the final, unchangeable cap on the number of Cardano coins that will ever exist, signifying that its supply is finite.

Additional Tips for a More Thorough Check:

- Verified Supply Tick (✓): You may sometimes see a blue checkmark next to the “Circulating Supply” figure. This indicates that the project’s team has officially submitted and verified the supply data with CoinMarketCap, which is a positive sign of transparency.

- Infinity Symbol (∞): If you see this symbol in the “Max Supply” section, it means the cryptocurrency does not have a fixed supply cap (e.g., Ethereum or Dogecoin).

By following these simple steps, you can quickly and confidently verify the supply data for any cryptocurrency yourself, avoiding reliance on unverified information.

Conclusion

Understanding the difference between circulating, total, and max supply is a fundamental skill for any cryptocurrency investor. These three metrics tell the story of a project’s economic foundation.

Armed with this knowledge, you can avoid common mistakes, perform more accurate analysis, and invest with greater confidence in this exciting and volatile market. Always remember to personally verify this data from credible sources before making any investment decisions.