Institutional order flow is the force behind many of the cleanest moves in forex, yet most retail traders only see the shadow of it on a price chart — so the real question is: do you know what institutional buying and selling looks like in practice, or are you reacting to noise and calling it smart money after the fact?

- Institutional order flow in forex is the net result of large participants executing size while managing liquidity, slippage, and market impact.

- FX is mostly OTC and decentralised, so you rarely see the full order book. You infer institutional flow from behaviour and from partial venue data.

- Institutions typically split big orders (e.g. TWAP-style slicing) to reduce market impact and avoid signalling intent.

- Buying pressure vs selling pressure is not a vibe. It is an order flow imbalance problem: one side consumes liquidity faster than the other side can provide it.

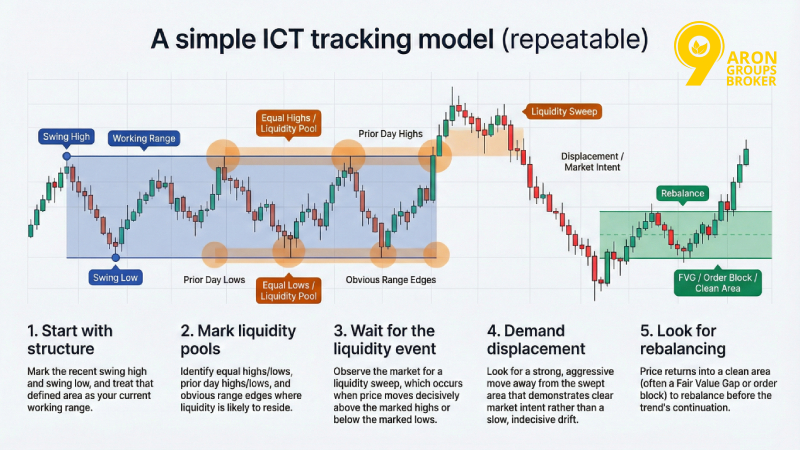

- In an ICT lens, you track liquidity objectives and market structure (highs/lows, dealing ranges, displacement), then refine entries with repeatable drills.

- Your edge improves when you stop asking who moved it? and start asking where the liquidity was, and how the price reacts after it was accessed?

Understanding Institutional Order Flow in Forex

To trade institutional order flow ICT style (or any smart-money approach), you first need a clean definition. Order flow is not a secret code. It is simply the sequence of buying and selling that gets executed through dealers and venues. In FX, that happens across a network of OTC relationships and platforms, not one central exchange.

Definition and Key Concepts of Institutional Order Flow

What is institutional order flow in forex?

It is the net impact of large participants executing meaningful size while balancing three constraints. BIS describes these three constraints:

- Liquidity access: finding enough counterparties without moving price too much.

- Market impact: reducing the price damage caused by their own size.

- Execution objective: completing a buy/sell programme within time, risk, and cost limits.

Who are the institutional participants (simple map):

- Buy-side: asset managers, hedge funds, pension funds, insurers, corporates hedging currency exposure.

- Sell-side: banks and dealers that quote prices, warehouse risk, and route flow via venues.

Key terms you should actually use:

- Large order execution: how size is worked into the market (often sliced).

- Liquidity objective: where liquidity is easiest to access (often around obvious highs/lows and busy sessions).

- Order flow imbalance: when one side overwhelms available depth, and price must adjust.

How Institutional Orders Differ from Retail Trading

Retail trading is usually single-ticket and direct. Institutions rarely trade like that.

Main differences:

- Size and signalling: a large ticket advertises intent. So institutions often split it into smaller child orders.

- Execution style: they may execute through dealers, RFQs, or order-book style venues, depending on the pair, time, and objective.

- Cost focus: they care about market impact and slippage as much as being right.

This matters for you because it changes what real order flow looks like on the chart. It often appears as:

- Displacement away from a level (urgency).

- Then a controlled retracement (rebalancing).

- Then continuation toward the next liquidity pool.

The Role of Smart Money in Forex Market Movements

Smart money is a useful label if you define it properly. In practice, it means participants who:

- Move size.

- Manage execution.

- Use liquidity efficiently.

From an ICT perspective, you typically cannot see the full institutional tape in forex. So you use market structure and liquidity behaviour as proxies:

- Where did price take liquidity (high/low runs)?

- Where did it reprice (displacement)?

- Where did it rebalance (retracement zones inside a dealing range)?

This is the foundation for later tools like an institutional order flow entry drill: you’re training your eyes to recognise repeatable behaviour, not trying to guess the bank.

Mechanics and Market Impact of Institutional Orders

Institutional flow matters because it changes how price moves. Large orders interact with liquidity in ways that create spikes, sweeps, and sharp expansions. In FX, execution can happen directly with dealers or via different venue types (e.g. RFQ platforms or anonymous order books), each serving different participants.

Large Order Execution and Its Market Effects

Institutions often avoid dumping a full position at once. A common approach is algorithmic trading execution that slices orders over time.

A widely cited example is TWAP-style execution, which breaks a large order into smaller pieces and spaces them out to reduce market impact.

What this tends to create on a chart:

- Less obvious footprints (because intent is hidden).

- More two-step moves (push → pause/rebalance → push).

- Sensitive reactions around high-liquidity areas (session opens, obvious swing levels).

And here is the key: the market does not need a conspiracy to hunt stops. It only needs a large participant who prefers to execute where liquidity is thick.

Order Flow Imbalance: Buying Pressure vs Selling Pressure

According to the Federal Reserve, when traders say buying pressure, they mean buy-side aggression is consuming offers faster than new offers appear. Selling pressure is the opposite.

In market microstructure terms, order flow imbalance can amplify price moves, especially when market depth is fragile.

What you can apply immediately:

- If an imbalance hits in a thin moment (quiet session), price can jump more violently.

- If an imbalance hits into a well-known liquidity pool (prior high/low), you often see a fast sweep and then a decision: accept above/below or reject.

Important note:

Imbalance explains speed. Structure explains directional context. You need both.

Institutional Liquidity Objectives and Market Participation

Institutions usually trade with a liquidity objective. That means they care about where they can get filled with minimal damage.

Common objectives (practical, not theoretical):

- Get filled without moving price too far (minimise impact).

- Execute during liquid windows or via venues suited to their counterparty type.

- Align with a benchmark or schedule (time matters as much as price for many programmes).

Buy-side vs sell-side in one sentence:

- Buy-side wants exposure (buy/sell).

- Sell-side facilitates and intermediates, often providing quotes and liquidity access.

This is where how to see institutional order flow becomes practical: you stop looking for a single footprint and instead monitor:

- Where liquidity is likely pooled (highs/lows, range edges).

- How price behaves after liquidity is accessed (acceptance vs rejection).

- Whether participation supports the move (speed + follow-through + clean repricing).

Writer’s signature:

Institutions don’t need to be predictable. Their constraints are predictable.

ICT Techniques for Observing Institutional Order Flow

In forex, you rarely see the full institutional tape. So ICT-style reading focuses on what institutions must do: access liquidity, move price with displacement, then rebalance inside a defined structure. Your job is to spot those three behaviours consistently.

ICT Methods for Tracking Institutional Order Flow

If you’re asking how to see institutional order flow, here is the practical ICT answer: track where liquidity sits and how price behaves after it is taken.

What you’re really tracking:

- Liquidity objective: what price was reached for.

- Market reaction: acceptance (holds) vs rejection (snaps back).

- Follow-through: whether the move continues or fails fast.

Remember:

Don’t hunt institutions. Hunt the footprints of their constraints: liquidity, displacement, rebalancing.

Entry Drill Techniques for Institutional Orders

An institutional order flow entry drill should train decision-making, not prediction. Keep it short. Do it daily. Use the same steps until they become automatic.

15-minute entry drill (daily routine):

- Pick one pair and one session window (London session or New York).

- Mark the most recent clear swing high/low on a higher timeframe.

- Mark the closest obvious liquidity (equal highs/lows, prior session high/low).

- Wait for a liquidity sweep. No sweep, no trade idea.

- After the sweep, identify the first clear displacement leg.

- Draw your working deal range on that displacement leg (high/low).

- Mark the equilibrium (midpoint). Decide premium vs discount.

- Drop to a lower timeframe and mark the clean PD array inside the retrace (OB or FVG).

- Only plan an entry if price returns to the PD array and reacts (rejection + follow-through).

- Log it with one screenshot and three lines: liquidity taken / entry model / target.

What this drill teaches fast:

- You stop entering mid-range.

- You stop trading without a liquidity reason.

- You stop confusing consolidation with smart money.

Institutional Order Flow Inside the ICT Dealing Range

A dealing range is simply a defined high and low that price trades within before it expands. Inside that range, institutional flow often shows up as a sequence of runs and returns.

How to read order flow within the range:

- Range high / range low: where stops and breakout orders cluster.

- Internal levels: where price rebalances (often after displacement).

- External levels: the obvious extremes where liquidity is easiest to access.

- Equilibrium: the midpoint that often acts as a decision line.

Common institutional behaviours within a dealing range:

- Sweep one side of the range (take liquidity).

- Reprice back through EQ (shift in control).

- Expand toward the opposite side (draw on liquidity).

You’re not trying to predict every rotation. You’re trying to align with the clean move: sweep → displacement → retrace → continuation.

Don’t forget:

Inside a dealing range, patience is the edge. You get paid after the sweep, not before it.

Trading Strategies Based on Institutional Order Flow

Once you can track institutional order flow, strategy becomes simpler. You’re trading behavioural templates, not indicators. You only need a few templates. You need to execute them well.

Patterns of Institutional Buying and Selling

Institutional buying and selling often appear as structured accumulation and distribution, not random clicks.

High-probability patterns to study:

- Sell-side sweep → bullish reversal: price runs lows, rejects, then displaces up.

- Buy-side sweep → bearish reversal: price runs highs, rejects, then displaces down.

- Mitigation continuation: price displaces, retraces into a prior OB/FVG, then continues.

- Range-to-expansion: price compresses, takes one side, then expands hard to the other side.

A good filter: the best patterns show clean displacement. If it’s messy, treat it as noise.

Timing Trades Using Time & Price Theory and Order Flow

Time & price theory is simple: the best trades happen when timing and location align.

Time (when):

- Focus on active windows (session opens, overlaps, major news windows).

- Avoid dead periods where spreads widen, and moves are random.

Price (where):

- Execute at locations that make sense: extremes, premium/discount zones, and clean PD arrays.

Order flow (what):

- A liquidity event + displacement gives you a reason.

- A retrace into a PD array gives you a location.

- A reaction gives you a trigger.

Analysing Institutional Order Flow Across Multiple Timeframes

Institutional activity expresses itself across timeframes. Your read should too.

A clean multi-timeframe workflow:

- Higher timeframe (bias): define the narrative. Where is liquidity likely next?

- Mid timeframe (structure): identify the dealing range and displacement leg.

- Lower timeframe (execution): enter from a clear OB/FVG after confirmation.

Use this rule to stay consistent:

- A higher timeframe decides directional idea.

- Lower timeframe decides entry timing.

- Never reverse those roles.

Small guide:

| Timeframe role | What you do | What you avoid |

|---|---|---|

| Higher TF | Bias + key liquidity | Micro entries |

| Mid TF | Range + displacement | Overfitting |

| Lower TF | Trigger + execution | Changing the story |

Risk Management in Institutional Trade Execution

If you want to trade institutional order flow, you must manage risk like an execution problem. Not a hope problem.

Practical risk rules (tight and usable):

- Stop goes where the idea is wrong: beyond the sweep, extreme or beyond clear acceptance.

- Size matches volatility: smaller size on fast, news-driven conditions.

- One target is not enough: take partials at logical liquidity pools (EQ, prior swing, opposite range edge).

- Use a time stop: if price stalls too long after entry, reduce exposure or exit. Stalls are information.

Common execution mistakes:

- Entering before displacement (too early).

- Moving stops to survive a bad entry.

- Trading in the middle of a range with no liquidity logic.

Important note:

The best order-flow trades are clean. If you’re constantly managing the trade, your entry model is the issue.

Case Studies and Practical Examples of Institutional Order Flow

The best way to learn institutional order flow trading is to study repeatable cause → effect sequences. In forex trading, you won’t see one central order book. You infer forex institutional order flow from structure, liquidity, and follow-through in the most liquid windows.

Smart Money Order Flow in Trending Markets

In a healthy trend, institutional flow often shows up as a rhythm: impulse → rebalance → continuation. That rhythm is consistent with how large orders get executed (often split to reduce market impact and signalling).

What to look for on the chart (simple and visual):

- A clear displacement leg (price moves with urgency).

- A controlled retracement into a logical zone (rebalancing).

- Continuation towards the next obvious liquidity pool (recent high/low).

A practical trend checklist for institutional order flow forex:

- The trend is clear on the higher timeframe.

- Retracements are shallow and orderly, not chaotic.

- Pullbacks repeatedly respect discount/premium logic within the swing.

- Breaks hold. They do not instantly fail.

Spotting Liquidity Zones and Institutional Stops

When traders say institutional stops, think about where size can be filled. In FX, the market is decentralised and much activity is not visible to everyone, so you focus on where liquidity clusters and how price reacts when it reaches those clusters.

High-probability liquidity zones (where stops often cluster):

- Prior swing highs/lows (obvious to most participants).

- Equal highs / equal lows.

- Session highs/lows (especially around active opens).

- Range edges (dealing range high/low).

How to separate a liquidity grab from random volatility:

- The level was obvious.

- Price swept it fast.

- Then price either rejects hard (returns back into range) or accepts (holds above/below and builds).

That acceptance/rejection is the usable information.

Real-World Market Impact by Institutional Orders

Large directional flow can move price more aggressively when liquidity is thin. In microstructure terms, when buy/sell imbalances collide with reduced depth, price moves can be amplified.

What this looks like in real trading conditions:

- News windows: sudden repricing, wider spreads, faster swings.

- Quiet hours: smaller orders can move price more than expected.

- High-liquidity overlaps (London/NY): According to Investopedia, these periods are characterised by tighter spreads and cleaner execution, but price moves can travel further because participation is high.

Execution reality that matters for you:

- Institutions often slice orders (execution algorithms / staged execution) to reduce impact. That makes footprints less obvious, but the phases remain: push, rebalance, push.

Example: Applying Institutional Order Flow Concepts in a Live Trade

This is a live-style walkthrough. It is educational, not a recommendation.

Context (HTF):

- You mark a recent ICT dealing range on EUR/USD (range high/low).

- You note external liquidity above the range high (clean swing highs).

Step 1 — Liquidity objective:

- Price runs above the dealing range high during the London/NY overlap (active liquidity window).

Step 2 — Confirmation through behaviour:

- Instead of holding above the high, price snaps back inside the range with a strong displacement candle.

- That shift suggests the sweep was used to access liquidity, not to start a clean breakout.

Step 3 — Build the execution plan (LTF):

- Mark the displacement leg.

- Identify the first clean decision zone created by that displacement (often an order-block-like area or imbalance zone).

- Wait for price to retrace into that zone inside the dealing range.

Step 4 — Entry logic (the drill):

You only execute if you see:

- Return to the zone.

- Rejection (price fails to re-accept above the swept high).

- Follow-through (price begins moving towards the opposite side of liquidity inside the range).

Step 5 — Invalidation and targets:

- Invalidation goes where the idea is clearly wrong (e.g. acceptance back above the swept high and hold).

- Targets are mapped to the next liquidity pools (internal first, then the opposite side of the range).

Conclusion

What is institutional order flow in forex? It is the market impact of large participants executing size under liquidity constraints. In FX, you rarely get perfect visibility because the market is decentralised and fragmented. So the practical skill is not spotting the bank. It is learning how to see institutional order flow through repeatable effects: liquidity objectives, displacement, dealing-range behaviour, and multi-timeframe alignment. When you treat order flow as execution + liquidity, your trades become cleaner: fewer guesses, more evidence, and tighter invalidation.