A significant part of success in investing depends on a clear understanding of the types of risks that can impact outcomes. When we recognize the difference between Systematic and Unsystematic Risks, it becomes easier to see which factors are beyond our control and which ones can be managed through more precise choices. This awareness helps investors make more calculated decisions and stay on track toward achieving sustainable returns. If you want to understand the role these two types of risk play in investing and how conscious risk management can help prevent major losses, I recommend staying with us until the end of this article.

- Systematic risk is always tied to overall economic and market conditions, and it cannot be eliminated even through diversification.

- Unsystematic risk is specific to a company or industry and can largely be managed through portfolio diversification.

- The key distinction between these two lies in their controllability: one is unavoidable, while the other can be reduced through smarter investment choices.

- In highly volatile markets such as Iran, combining diversification, hedging strategies, and thorough analysis can significantly enhance long-term returns for investors.

What Is Risk in Financial Markets and Why Does It Matter?

In financial markets, there is always the possibility that the outcome of an investment will differ from expectations. This difference is called risk, and it can result in either profit or loss.

Risk is generally divided into two main categories, known as Systematic and Unsystematic Risks. Systematic risk is tied to overall economic and market conditions and affects all assets. In contrast, unsystematic risk relates only to a specific company or industry and can be reduced through careful selection and portfolio diversification.

The direct relationship between risk and return shows that higher returns are only achieved when investors are willing to accept higher levels of risk. Well-known examples of systematic risk include the 2008 financial crisis, which shook global markets. In Iran, international sanctions represent a significant form of systematic risk, influencing the entire market.

Understanding different types of risk allows investors to design more reliable long-term strategies and manage their portfolios in a way that makes them more resilient to unexpected fluctuations and uncertainties.

What Is Systematic Risk?

Systematic risk refers to the type of risk that originates from overall economic and market conditions and affects nearly all assets. Factors such as changes in interest rates, inflation, or economic recessions are common examples of this risk. Since these conditions impact the entire market, even portfolio diversification cannot completely eliminate its effects. This is why, when comparing Systematic and Unsystematic Risks, only the unsystematic component is considered more manageable and controllable.

This risk is commonly measured using the beta (β) coefficient. Beta indicates how sensitive a stock or asset is to market fluctuations. Assets with a beta higher than one tend to experience greater price movements compared to the market, while those with a beta lower than one usually demonstrate more stability.

In the framework of the CAPM (Capital Asset Pricing Model), systematic risk plays a central role. The expected return of an asset is calculated based on the risk-free rate, the market premium, and its beta. For this reason, investors demand higher returns as compensation when they take on systematic risk.

The website efinancemanagement states: One of the major market sources of systematic risk is commodity prices, such as oil. When oil prices rise sharply, both energy-consuming companies and broad stock market indices come under pressure, not just specific industries.

Factors Affecting Systematic Risk

When discussing factors that influence the entire market, we are essentially referring to the conditions that drive systematic risk. Economic changes play a central role in this regard. Rising inflation or an increase in interest rates by central banks can reduce purchasing power, lower demand, and ultimately drive down stock values across multiple industries. A well-known example is the Federal Reserve’s interest rate hikes, which almost always have a direct impact on U.S. equity indices as well as global markets.

Read More: What is Interest rate risk?

Political issues can also amplify this type of risk. Wars, sanctions, or unexpected policy decisions put pressure on the broader economy, causing the entire capital market to react. This is precisely why systematic risk is different from unsystematic risk, since it is not limited to a single company or sector.

Global events such as the COVID-19 pandemic or the 2008 financial crisis further illustrate how one worldwide shock can simultaneously affect multiple markets. These examples prove that some risks cannot be fully eliminated, and investors must account for them when making strategic decisions.

According to CFI: Systematic risk is a component of total risk that arises from factors beyond the control of an individual company or investor. All investments are exposed to this type of risk, making it a non-diversifiable risk, and no amount of portfolio diversification can fully eliminate it.

Examples of Systematic Risk in Iranian and Global Markets

One of the most well-known examples of systematic risk worldwide was the 2008 financial crisis. During that period, the S&P 500 index lost nearly half of its value, and stock markets across the globe experienced sharp declines. This event clearly demonstrated how large-scale economic shifts can affect all investors, regardless of the type of assets they hold.

In Iran, a notable example was the reimposition of international sanctions in 2018. These restrictions reduced foreign investment, heightened political risk, and ultimately triggered a significant downturn in the Tehran Stock Exchange. Many companies struggled with severe currency fluctuations and difficulties in importing essential goods, which further eroded investor confidence.

Both of these cases highlight that systematic risk always extends beyond the control of any single company or industry. A proper understanding of the differences between Systematic and Unsystematic Risks enables investors to recognize which risks can be mitigated through diversification and which are unavoidable and must be factored into long-term planning.

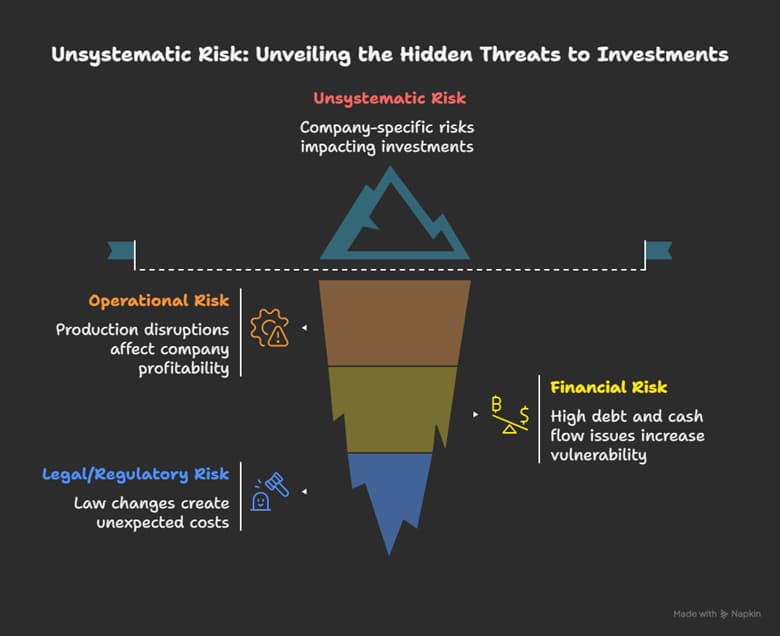

What Is Unsystematic Risk?

When a company faces managerial problems or a specific industry comes under intense competitive pressure, the type of risk that arises is called unsystematic risk. Unlike market-wide risks, this form of risk is not tied to the overall economy but instead affects only the company or industry in question. This is why, in the comparison between Systematic and Unsystematic Risks, the unsystematic side is considered narrower in scope and more controllable.

An important point is that investors are not compensated for bearing this type of risk, since it can be avoided. By diversifying a portfolio across different companies and industries, the impact of one firm’s or one sector’s difficulties will have little effect on the overall investment portfolio. For this reason, unsystematic risk is regarded as avoidable and is primarily linked to internal company decisions or conditions specific to an industry.

According to Wikipedia: Many studies show that in an investment portfolio containing around 25 to 30 different assets, a large portion of unsystematic risk is eliminated due to the low correlation between companies. This figure is slightly higher than what is mentioned in some examples.

Main Sources of Unsystematic Risk

The primary sources of unsystematic risk are usually linked to the internal conditions of a company or a specific industry. One of the most important of these is operational risk. When production is disrupted due to technical failures, supply chain interruptions, or weak management, a company’s profitability can be severely affected. This type of risk is especially common in manufacturing and technology sectors, where even small process disruptions can halt overall operations.

Another major source is financial risk. Companies burdened with high levels of debt or insufficient cash flow to cover expenses are more vulnerable during unfavorable economic conditions. In particular, if the debt is tied to variable interest rates, fluctuations in those rates can significantly increase repayment costs. This situation is an example of what is often referred to as floating rate risk.

In addition, legal or regulatory risk also plays an important role. Sudden changes in laws or government regulations, legal penalties, or lawsuits can create unexpected costs and may even restrict a company’s operations.

Understanding these sources enables investors to gain a clearer picture of the nature of unsystematic risk and to reduce its impact through effective portfolio diversification and thorough company analysis.

Examples of Unsystematic Risk in Stocks and Industries

Sometimes problems arise within a single company or industry that only affect that specific segment. This is what is known as unsystematic risk. For example, when a company carries excessive debt, high interest expenses can quickly erode its profitability. Similarly, weak management or poor product quality can create risks that are confined to that firm.

A prominent international case is the bankruptcy of WeWork. The company’s heavy debt load, unsustainable cost structure, weak business plan, and failure in marketing efforts led to a severe financial collapse and a sharp decline in its share value. Importantly, this issue was unique to WeWork and did not disrupt the broader market.

In Iran, the automotive industry provides a clear example. Companies have faced significant challenges due to difficulties in importing parts, rising production costs, and severe currency fluctuations, all of which led to declines in stock prices. However, the overall Tehran Stock Exchange was not equally affected.

These cases highlight that when investors consider the differences between Systematic and Unsystematic Risks, they can identify which investments are more vulnerable and how diversification in stock selection can reduce exposure to company-specific threats.

The Difference Between Systematic and Unsystematic Risks

Understanding the differences between Systematic and Unsystematic Risks helps investors make more accurate decisions in managing their portfolios. These two types of risk differ fundamentally in nature and in how they are managed:

Systematic Risk

- Related to the entire market and the overall economy

- Driven by factors such as interest rates, inflation, or recessions

- Cannot be eliminated even through portfolio diversification

- Measured using the beta (β) coefficient

- Within the CAPM framework, it is the only type of risk for which investors are compensated

Unsystematic Risk

- Specific to a single company or industry

- Caused by factors such as poor management, financial problems, or intense competition

- Can be reduced or eliminated through portfolio diversification

- Commonly measured by the specific variance of each security

- Investors are not rewarded for bearing this risk because it is avoidable

According to Modern Portfolio Theory (MPT) and the CAPM model, an optimal portfolio should be structured in a way that minimizes unsystematic risk while leaving only systematic risk, which is priced into long-term expected returns.

Methods of Managing and Reducing Risk

Recognizing Systematic and Unsystematic Risks is only the first step; more importantly, investors need to know how to manage and control them. A set of tools and strategies can help keep investment risk at a level that aligns with financial goals. This process is what is widely known in finance as risk management.

Diversification and Its Role in Reducing Unsystematic Risk

One of the simplest and most effective ways to reduce company- or industry-specific risk is diversification. Research has shown that if a portfolio includes around 20 stocks from different sectors, more than 60% of unsystematic risk can be eliminated. For example, holding a mix of technology stocks, raw materials, and bonds ensures that a decline in one area can be offset by gains in another. In practice, this is what investors refer to as portfolio diversification.

Hedging Strategies

Financial instruments such as futures contracts and options are commonly used to hedge risk. These instruments help investors protect themselves against extreme market fluctuations, especially those stemming from macroeconomic factors. For instance, buying call options on the VIX volatility index can generate profits when markets experience sharp downturns, offsetting part of the losses in a portfolio.

The Role of Fundamental and Technical Analysis in Anticipating Risks

Fundamental analysis helps investors identify unsystematic risks by examining financial statements, levels of debt, profitability, and the quality of management. On the other hand, technical analysis focuses on price patterns, trends, and trading volumes to provide signals about potential systematic risks. Combining these two approaches gives investors a clearer perspective on their overall portfolio risk and allows them to make more informed and strategic investment decisions.

Conclusion

Understanding Systematic and Unsystematic Risks is one of the most important steps for any investor aiming to make smarter decisions. This knowledge clarifies which parts of risk are unavoidable and must be accepted, and which can be managed or reduced. When an investor knows the differences between Systematic and Unsystematic Risks, they are better equipped to design a portfolio that minimizes exposure to uncontrollable market forces.

Simple strategies such as starting with portfolio diversification and conducting more thorough fundamental analysis provide an excellent foundation. Adding tools like technical analysis further enhances visibility into broader market conditions.

In markets like Iran, where volatility and unexpected economic changes are constant realities, this kind of knowledge empowers investors to manage risks more effectively and improve the long-term returns of their investments.