Stock market for beginners is the first step for successful stock market investing and trading.

The stock market is one of the financial markets where the most important companies in the country are public companies.

If you are looking for an investment or trading, the first financial market that is recommended to you is the stock market.

What is the stock market? And what are the most important things that you should know about the stock market?

In this article by Aron Groups Broker, we want to speak about the stock market, and all the essential information you need to know to enter this market whether as an investor or a trader.

Table of Contents

What Is The Stock Market For Beginners?

In this first part of the article with the title of “stock market for beginners”, we will introduce you to this fascinating financial market of the world.

A stock market is a place for buying and selling different stocks, these are securities that represent companies.

- Companies that are inside the stock market are public companies, they have a value and each of their stocks have a specific price

- By using an initial market offering known as IPO, companies can enter into the stock market, each company has a value that is called the market share of the company, and shares outstanding, are the number of total stocks belonging to a company

The prices of the stocks are variable due to daily demand and supply, there are many different factors affecting the stock market, and the companies that are on the stock market.

What are the top 10 essential information that beginners of the stock market should know about?

Top 10 Essential Information About The Stock Market That Beginners Should Know About

In this section, we want to speak about the top 10 essential information about the stock market that every beginner of the stock market should know about.

These are essential knowledge that you should know to be able to enter into the stock market.

1. Market Capitalization

Market capitalization is one of the most important concepts that you should know about the stock market.

- Market capitalization is the total value of the company that is changing daily due to changing nature of the supply and demand

- IPO is a very important term, this is a term that is used for introducing a new company to the stock market

- Based on the income, assets, and users of a company, a corporation is valued and then introduced to the stock market

- From there, demand and supply is determining the daily price of the stock of a company

Market capitalization is a very important term that you should know about any company before you want to buy its stocks.

We will speak about how to start investing in the stock market in the next section of this article, so we highly recommend you read this article till the end.

2. Shares Outstanding

Shares Outstanding is another important term in the stock market, this is the total number of stocks for a company.

- Shares Outstanding are determined in the IPO process and based on the value of a company

If you have the market capitalization of a company and divide it by the shares outstanding, you can only find the market price of a stock.

3. Market Price Of The Stock

The market price of a company is the single most important metric in the stock market for investors and traders.

- Many factors can fluctuate the market price of a stock, we will speak about these factors later in this article

- The market price of a stock is changing daily and is the price at which you can buy the stock of your selected company

The market price of a stock is displayed all the time and when the stock market is opened.

4. Earnings Per Share (EPS)

Earnings per share known by the abbreviated name of EPS is a very important metric for choosing and buying a stock.

- EPS is the amount of profit that a company is devoting to a stock

- The higher the EPS, the higher the profit that you will receive as a stock owner

EPS is used by investors and traders as a metric to choose a company, and see if the company is worth investing in and is profitable or not.

For investing and trading in the stock market, there are many metrics that you should consider before buying your stock.

5. Bull Market

A bull market is a term in the stock market that refers to a condition in which the prices of the stocks are growing and the market is green.

- In the bull market, prices of the different stocks are growing and their market value is increasing

- Also, a bull market means there are a lot of demands for buying stocks, the economy is doing very well, and people are eager to enter the stock market

Having a comprehensive grasp of the stock market and the economy is essential before entering into the stock market even when we have a bull market.

6. Bearish Market

A bearish market is the opposite of a bull market, this is also called a red market in which the prices of the different stocks in the stock market are decreasing and lowering in value.

- A bearish market is a negative sign for the stock market, showing that people and players are selling more than buying, and supply is exceeding the demand in the stock market

- There are a lot of reasons for the bearish market, if this red market is not short-term, then this can be a sign of recession in the economy as companies are not in the good position

7. Investing

There are two types of entering into the stock market, the first one is investing in the stock market, and the second one is trading in the stock market.

- Investing is a term used for investors to ho sell different stocks based on the fundamental analysis and for the midterm or the long-term

There are a lot of factors that you should consider for having a successful investment in the stock market, we will speak about them later in this article and also in other articles on the Aron Groups Broker website.

8. Trading

Trading is a term that is used for traders, these people or companies buy and sell different stocks for the short term, this can be for a day, some days, or a week.

- Traders using technical analysis strategies for trading in the stock market

Before trading in the stock market, you should gain the essential information, we will speak about them later in this article, and other articles.

9. Fundamental Analysis

There are two main types of analysis that players in the stock market use, the first one 8s fundamental analysis, and the other is technical analysis.

- Fundamental Analysis is about using economic and different financial metrics to evaluate the condition and the company for investing in a specific company and entering into the stock market

Fundamental Analysis is a very huge topic, there are a lot of sections that you should know about to be able to use this strategy for buying and selling stocks in the stock market.

To learn a time-tested approach to investing, read our article on Warren Buffett’s Strategies.

10. Technical Analysis

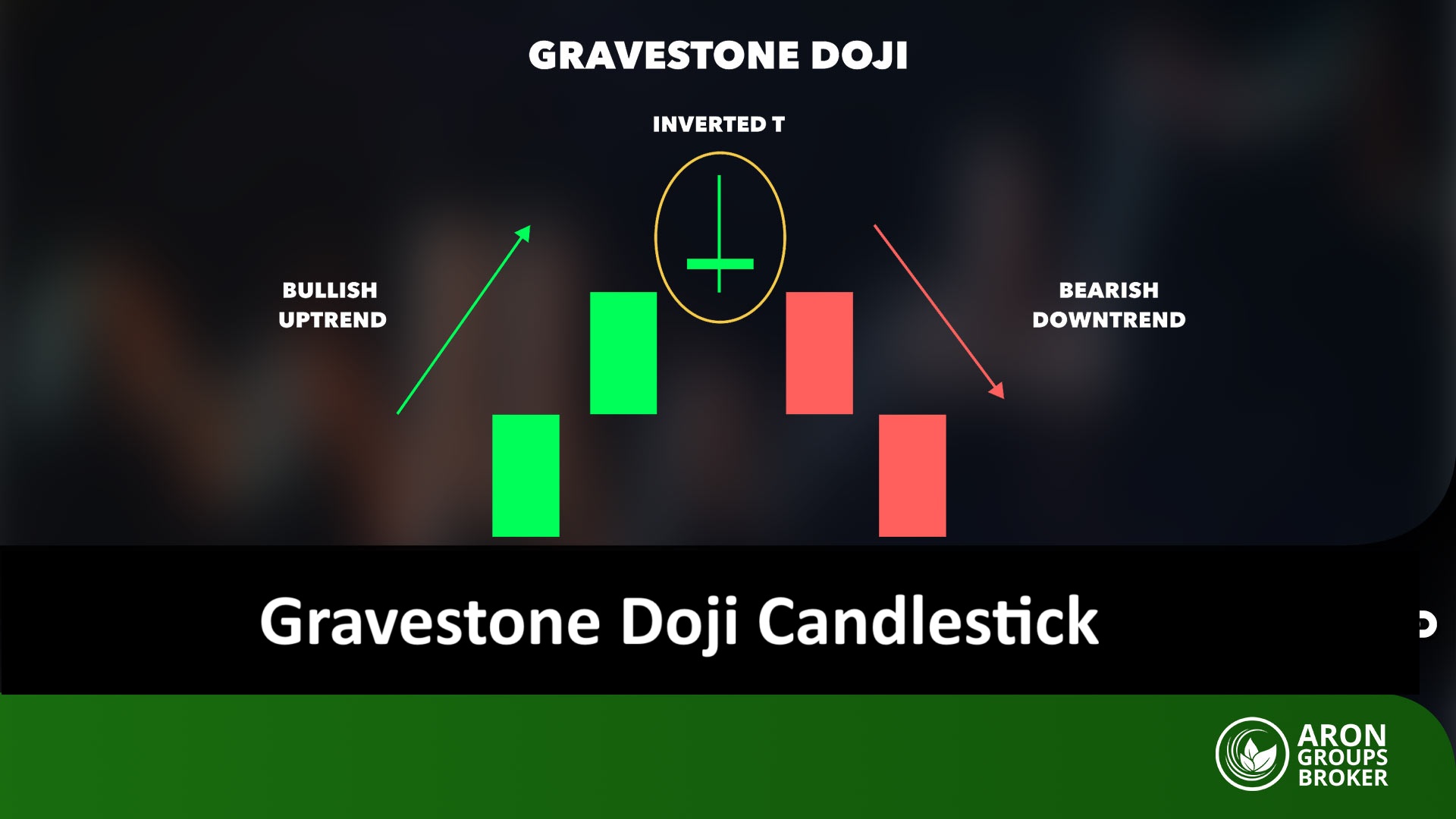

The other analysis is technical analysis, which is using charts for predicting future prices and movements of stock prices.

- There are many different strategies in the technical Analysis, traders use these strategies for buying and selling stocks and making money from the fluctuations of the stock market

Chars Dow is known as the father of technical analysis and ses charts for predicting the future movements of different stock prices.

For a niche example of stock trading, check out our article on Trading football club shares.

What Factors Are Important For The Stock Market?

In this section of the article for beginners of the stock market, we want to speak about the most important factors affecting the stock market.

There are a lot of factors that can affect the stock market.

For having a successful investment in the stock market, being aware of these important factors is essential for both beginners and professionals of the stock market.

These are the most important factors affecting the stock market that are essential for players of this market to know about them.

- Companies’ performance, is the most important factor, higher sales and profitability means more demand for the stocks of the company and higher prices

- Economic growth rate, GDP growth rate is a very important metric, shining growth is a positive sign for the stock market whereas negative growth sending a bad sign to the stocks market and can decrease the demand for different companies

- Interest rate, this rate is determined by the central banks, this is a rate at which banks lending each other overnight, high interest rate is a bad sign for the stock market whereas a lower interest rate is a positive sign and will increase the demand, the bull market is what you can expect when the interest rates are lower

- The inflation rate is also very important, a higher inflation rate can be good but also increase s and production expenses, this situation can have different consequences for different companies

- Employment rate, an increase in the creation of the new jobs will add to the value of the stock market while when the unemployment rate is increasing, this can affect the companies and the stock market negatively

- Geopolitical tensions such as sanctions, wars, and any tensions among countries will increase the risks, some companies may benefit from the situation but overall as risks are higher, a bearish market is happening in the stock market

- Any event affecting the company’s sales and profitability such as the Covid-19 pandemic, Russia-Ukraine war, or global warming is negative for the stock market, state same time, there may be companies that will experience growth in the crisis due to higher demand for their products and services by people or the government

As you can see, there are multiple factors affecting the stock market, and having experience and knowledge in this space is very important for success for beginners of the stock market.

To better understand the different assets available, read our guide on Different Types Of Stocks.

How To Enter Into The Stock Market

In this part of the article with the title “stock market for beginners” by Aron Groups Broker, we want to tell you how you can enter the stock market.

There are some important steps that you should follow if you want to enter the stock market successfully.

- Knowledge is power, before everything, you should start learning about the stock market, and use articles, books, courses, and different online pieces of training to learn about this market and grow your knowledge in this space

- Learn about companies, we highly recommend you learn about companies and learn using financial analysis to be able to choose the best companies for buying their stocks

- Choose your style, if you want to become an investor, using economic and financial analysis which is known as fundamental analysis is very important, and is highly recommended that you should focus on it to learning

- But if you want to become a trader, using technical analysis is very important and is your tool, you should focus on it to learn this tool before entering into the stocks market as a trader

- Choose a broker, these are companies offering you access to the different financial markets including the stocks market, also they offer different financial and educational services to traders and investors

Using these steps mentioned above, you will become ready to enter the stock market as a beginner and use different strategies as an investor or a trader for making money in one of the most important financial markets of the world.

Introducing Aron Groups Broker

We recommend using Aron Groups Broker for both beginners and professionals of the stock market.

Aron Groups Broker is one of the most active brokers in the world offering different services including access to the worldwide stocks market.

If you want to learn about Aron Groups Broker’s different services and start your journey in the international stocks market, we invite you to register with Aron Groups Broker.

The Bottom Line

The stock market is the most important financial market for any country, and for a beginner of a stock market, it is very important to use enough experience and knowledge about this market before entering into this market.

If you have any questions about the stock market or need a free consultation about Aron Groups Broker, please contact our experts using the phone numbers mentioned on the website.