The gold market is one of the most exciting and, at the same time, safest financial markets. However, entering it without a clear capital management plan can quickly wipe out your account. Extreme volatility, rapid reactions to news, and high sensitivity to indicators such as interest rates and the U.S. dollar have made it clear that only traders who master risk management in gold succeed.

This article is a comprehensive and practical guide that shows you how to use gold trading strategies and risk management tools to prevent heavy losses and put your capital on the path to sustainable profits.

- To follow proper money management principles in gold trading, never allocate more than 2% of your capital to a single position.

- Combining technical and fundamental analysis is the most effective way to execute a successful gold trading strategy.

- Sticking to your trading plan and avoiding emotional trades is one of the best methods of risk management in gold.

Why Is Risk and Capital Management Important in Gold Trading?

The gold market has always been regarded as one of the most attractive yet highly volatile financial markets. Many traders enter it due to the safe-haven nature and inherent value of this precious metal, but they often overlook the fact that these very sharp fluctuations can wipe out their capital in the shortest time. The reality is that without a well-defined strategy for capital management and risk management in gold trading, even the most accurate analyses and precise forecasts cannot prevent significant losses.

Risk management in gold trading acts as the backbone of a trading strategy. This essential skill helps you to:

- Avoid irreparable losses and protect your capital over the long term;

- Make rational, emotion-free decisions in highly volatile market conditions;

- Maintain discipline and consistency, following a path of steady profitability even when the market moves against your expectations.

Basic Principles of Capital Management in Gold Trading

Success in the gold market is not limited to technical analysis or following economic news. What truly distinguishes a professional trader from a beginner is their ability to manage capital in gold trading and adhere to the fundamental principles of risk management. Some of these principles, which protect your capital against sharp volatility, include:

Determining the Appropriate Position Size for Each Trade

One of the first steps in capital management is choosing the right position size. Entering the market with an oversized position can lead to substantial losses even during minor price fluctuations. Professional traders typically risk only a small portion of their capital (for example, 1% to 2% of total equity) in each trade. This approach ensures that if a single position fails, your entire account is not put at risk.

Calculating Risk per Trade

For every position, you should define in advance the maximum amount of loss you are willing to accept. This risk is usually calculated as a percentage of your total capital. For example, if you have $10,000 in capital and set your risk per trade at 2%, your maximum acceptable loss on any trade would be $200. This simple calculation prevents catastrophic losses.

Defining the Risk-to-Reward Ratio in Gold Trading

The risk-to-reward ratio (R/R) shows how much potential profit you expect in return for the risk you take. Professional traders never enter a position unless the risk-to-reward ratio is favorable.

Typically, a ratio of 1:2 or higher is recommended for gold trades. For instance, if you set your risk at $50, then with a 1:2 ratio your profit target should be at least $100. That means if you buy gold at $3,500, your target price could be $3,600 or higher. Even if only half of your positions end up successful, this type of risk management ensures long-term profitability.

Setting Stop-Loss and Take-Profit Levels Based on Capital and Strategy

A stop-loss is a price level at which your trade automatically closes to prevent further losses. Alongside it, setting a take-profit level is equally important, as it helps you lock in gains and avoid the temptation of greed. The most effective stop-loss and take-profit levels are those aligned with both your capital and your trading strategy.

For example, if you enter a trade at $3,500, a reasonable setup could be:

- Stop-loss at $3,450 (to limit the loss to about $50);

- Take-profit at $3,650 (to secure a $150 profit, maintaining a risk-to-reward ratio of 1:3).

Risk Management Strategies in Gold Trading

Risk management in the gold market goes beyond just setting stop-losses and determining position sizes. Professional traders employ more advanced strategies to enhance both survival and profitability. These methods allow them not only to avoid major losses but also to effectively protect their profits. In the following section, we will explore some of these strategies.

Using a Trailing Stop

A trailing stop is an intelligent tool for risk and money management in gold trading that helps traders lock in their profits in a highly volatile market. The key difference between a trailing stop and a fixed stop-loss is that the trailing stop dynamically adjusts with the market as the price moves in your favor.

For example, suppose you enter a gold buy position at $3,500 and set your initial stop-loss at $3,450. If the price of gold rises to $3,570, you can activate a trailing stop and move your stop-loss up to $3,520. In this case, even if the market reverses and drops, your trade will close with a guaranteed profit.

Diversifying the Trading Portfolio (Diversification)

One of the most important principles of risk management in gold trading is diversification. Diversification means spreading your risk across multiple positions or even different markets. For instance, if you invest your entire $10,000 capital solely in buying gold and the market moves against your analysis, your whole account is at risk. But if you allocate part of your capital to gold, part to currency pairs (such as EUR/USD), and another part to other assets, a potential loss in gold could be offset by gains in other markets.

Even within the gold market itself, you can diversify. For example, you might dedicate a portion of your capital to short-term trades on spot gold while allocating another portion to long-term positions or hedging strategies. This approach reduces psychological pressure and protects your capital from sudden market shocks.

Diversification acts like a defensive shield; while your short-term profits may seem smaller, in the long run, it guarantees the stability and preservation of your capital.

Managing Leverage in Gold Trading

One of the most critical factors in risk management for gold trading is how you use leverage. Leverage allows you to open larger positions in the market with a smaller amount of capital. While this feature may seem highly attractive at first glance, if used without proper management, it can wipe out your account within minutes.

To illustrate, imagine the global price of gold is around $3,500. If you trade with a $500 account and use 1:100 leverage, you can open a position worth $50,000. In this scenario, even a 1% market fluctuation (about a $35 change per ounce) could completely wipe out your capital.

The approach professional traders take is to always use leverage in a controlled manner. Experienced traders typically limit themselves to leverage ratios of 1:10 or 1:20 to keep risk manageable.

Following Trading Psychology Rules to Control Emotions

Even the best analytical systems and the most precise strategies are doomed to fail without mastery of trading psychology. This is especially true in the gold market, which is highly sensitive to economic and geopolitical news—where a single headline can cause price swings of tens of dollars within minutes. In such an environment, and to succeed in managing risk in gold trading, you must learn to control your emotions and stick to your predefined trading rules. Some key principles include:

- Respecting Your Stop-Loss: Never reopen a position after your stop-loss has been triggered, hoping the price will bounce back.

- Avoiding Revenge Trading: If a trade ends in a loss, don’t let frustration push you into jumping immediately into another trade.

- Managing Greed: When gold is rallying, the temptation to open multiple positions can be overwhelming. Remind yourself that overexposure can wipe out all your previous gains.

- Sticking to Your Trading Plan: Every professional trader enters the market with a clear plan that includes entry points, exit points, position size, and risk parameters—and they follow it regardless of emotional market conditions.

Professional Gold Analysis in the Forex Market

Gold has always been recognized as one of the most important assets in financial markets, and it holds a special place in the forex market as well. Many traders view gold (XAU/USD) as a “safe haven” during times of high risk. For this reason, having a clear understanding of the factors that influence gold prices is essential for trading success.

A professional gold analysis is not limited to studying technical charts alone—it is a combination of fundamental analysis, technical analysis, and market psychology.

The Impact of the U.S. Dollar Index (DXY) and Global Interest Rates on Gold Prices

One of the most important factors to consider when managing risk in gold trading and analyzing market trends is the U.S. Dollar Index (DXY) and global interest rates. These two indicators play a direct role in determining the value of gold, and every professional trader should incorporate them into their daily analysis.

U.S. Dollar Index (DXY)

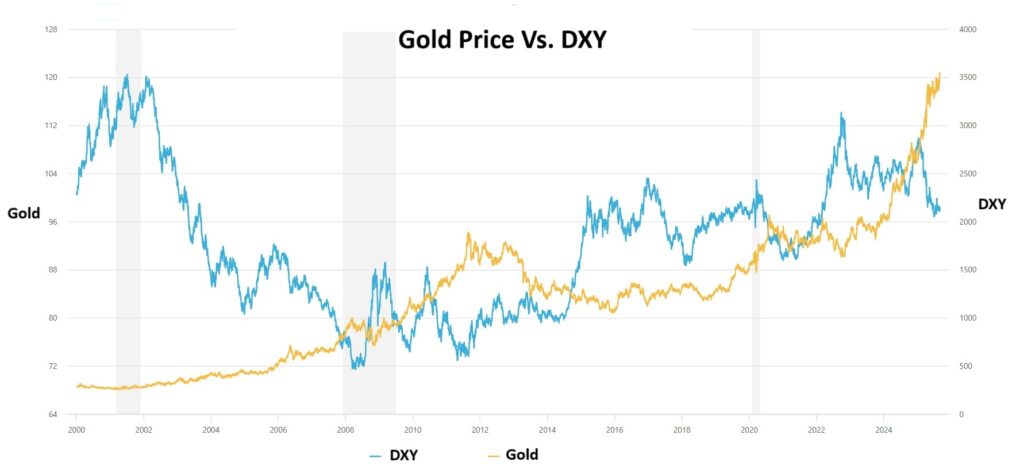

According to Investopedia, since gold is priced in U.S. dollars in global markets, fluctuations in the dollar’s value directly affect gold prices. Typically, there is an inverse relationship between gold prices and the Dollar Index. In other words, whenever the dollar weakens, gold becomes more attractive and demand rises. Conversely, a stronger dollar usually leads to a decline in gold prices.

For example, when the dollar loses value against major currencies, foreign buyers can purchase gold at a lower relative cost, which boosts demand and drives gold prices higher. On the other hand, when the dollar strengthens, gold becomes more expensive for international investors, leading to increased selling pressure in the market.

In the chart below, you can see a comparison illustrating the relationship between gold prices and the Dollar Index.

Global Interest Rates

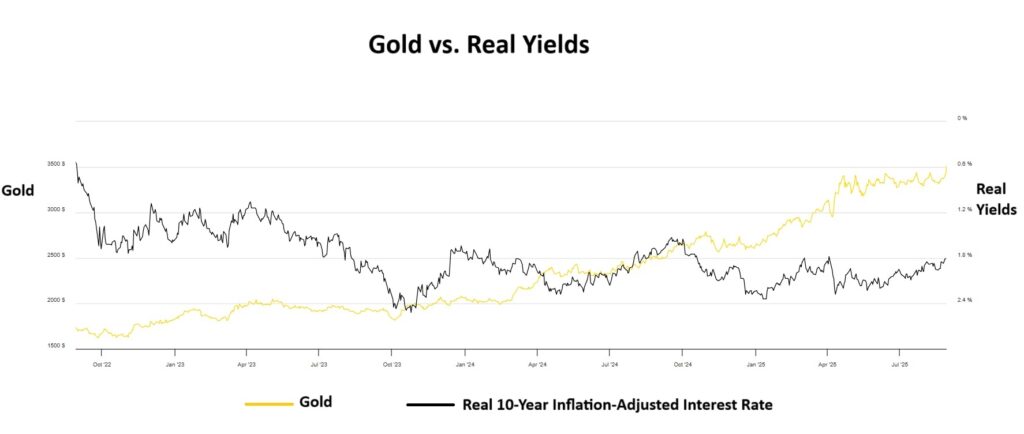

Decisions made by the Federal Reserve and other major central banks have a significant impact on gold’s attractiveness.

When interest rates are low, the opportunity cost of holding gold (an asset that doesn’t generate yield) decreases, attracting more investors to it. Conversely, rising interest rates increase the appeal of bonds and bank deposits, leading to reduced demand for gold. In particular, when real interest rates (adjusted for inflation) turn negative, gold gains a special role as a tool for preserving the value of money.

For example, in the chart below, you can see the relationship between gold prices and U.S. inflation-adjusted interest rates.

Analyzing Economic Data and News Affecting Gold Volatility

The gold market is highly sensitive to economic data and global news. These factors often determine the short-term and even medium-term trends in gold prices, playing a crucial role in both capital management and risk management in gold trading.

The most important data and news influencing gold volatility include:

- Inflation Index: Rising inflation typically boosts demand for gold as a hedge against inflation.

- Federal Reserve and Central Bank Interest Rates: Any change—or even the expectation of a change—in interest rates immediately impacts gold prices. Rate cuts usually drive gold prices higher.

- U.S. Employment Data (NFP): Strong jobs reports can strengthen the U.S. dollar and push gold prices down, while weak data often benefits gold.

- Geopolitical News: Political crises, wars, or global economic tensions consistently drive investors toward gold as a safe-haven asset.

The Use of Technical Analysis for Trading Gold in Forex

In technical analysis, professional traders rely on charts, patterns, and indicators to identify price trends and fine-tune their entry and exit points. Especially in a market like gold—where volatility is high and reactions to news are rapid—technical analysis is considered an essential tool alongside capital management and risk management in gold trading.

Identifying Key Support and Resistance Levels on the Gold Chart

One of the most fundamental tools in gold risk management is accurately identifying support and resistance levels. These are price zones where gold has previously reacted, and the likelihood of similar behavior repeating in the future is high. For this reason, many professional traders use these levels to determine their entry and exit points.

The Most Common Candlestick Patterns in Gold Analysis

Candlestick patterns are the language of the market. Some of the most widely used patterns in gold trading include:

- Hammer Pattern: A signal of bullish reversal after a downtrend;

- Shooting Star Pattern: A bearish reversal signal after an uptrend;

- Three White Soldiers: The beginning of a strong bullish trend;

- Bearish Engulfing Pattern: A warning of selling pressure and potential bearish momentum.

Recognizing and properly applying these patterns helps traders make more precise decisions during critical market moments.

The Best Technical Indicators and Tools for Analyzing Gold

To identify trends and trading signals in gold, the use of technical indicators and tools is essential. The most important ones include:

- Moving Averages (MAs): To identify trend direction (the MA50 and MA200 are the most common);

- RSI Indicator: To detect overbought and oversold zones;

- MACD Indicator: To assess trend strength and crossover signals;

- Fibonacci Retracement: To identify retracement levels and entry points.

Conclusion

Success in the gold market does not depend solely on correctly predicting trends—it relies on your ability to control emotions and precisely apply the best risk management practices in gold trading. By using tools such as stop-loss orders, portfolio diversification, and prudent use of leverage, you can safeguard your capital. Remember, the ultimate goal in a gold trading strategy is not just to generate profits, but to preserve your capital and ensure long-term participation in the market.