The Cyprus Securities and Exchange Commission (CySEC) is one of Europe’s most important financial regulators. Brokers operating under CySEC supervision must comply with the strict regulations of the European Union, such as MiFID II. They also have to be members of the Investor Compensation Fund (ICF) and provide transparent information. In fact, these three characteristics, compliance with regulations, capital security, and transparency, are what make brokers supervised by CySEC appealing to traders.

In the rest of this article, we’ve further introduced the Cyprus regulation so you can become fully familiar with its standards and understand why this regulation is so significant for investors and traders.

- CySEC focuses only on core financial services; other Cypriot authorities supervise activities like banking and insurance.

- The regulations regarding leverage with CySEC are stricter compared to offshore regulators.

- In the event of insolvency, the compensation process through the ICF may be slow and time-consuming.

- Some companies use their CySEC license to build credibility and attract clients, but they provide their main services through offshore entities.

What is CySEC Regulation?

CySEC (the Cyprus Securities and Exchange Commission) is the independent supervisory authority of the Republic of Cyprus for the capital market. It oversees Cypriot Investment Firms (CIFs), which include Forex and CFD brokers, investment funds and their managers, as well as regulated markets and trading platforms.

As Cyprus is a member of the European Union, the CySEC regulatory framework aligns with harmonized EU regulations, particularly MiFID II and MiFIR. This mandates common standards such as reporting transparency, Best Execution, and retail client protection.

Why is CySEC Licensing Important?

A CySEC license is important to traders for the following reasons:

Compliance with European Regulations (MiFID II/ESMA)

Brokers with a CySEC license must adhere to strict European Union regulations. These rules include leverage restrictions for retail clients, negative balance protection, and Best Execution of trades. They are also obligated to follow the directives of the European Securities and Markets Authority (ESMA), such as leverage caps for CFD trading.

Financial Protection (ICF and Segregation of Funds)

These brokers must be members of the Investor Compensation Fund (ICF). This fund covers up to €20,000 or 90% of the claims of each retail investor, whichever is less. Additionally, client funds must be held in segregated trust accounts, separate from the company’s own assets. (Note that this coverage is usually only for accounts held under the broker’s Cypriot structure.)

Transparency and Traceability

The company’s name, license status, and authorized services are publicly published on the official CySEC website. This transparency makes it easy for you to verify the authenticity of the broker and its official website domain.

International Credibility (Passporting in the European Economic Area)

Having a CySEC license allows a broker to offer its services in other European countries as well. This feature demonstrates high operational and regulatory standards, providing greater security for you compared to offshore jurisdictions.

The History and Evolution of CySEC

CySEC was established in 2001 to supervise the Cyprus capital market. Following Cyprus’s accession to the European Union in 2004, the organization was mandated to align its regulations with European financial standards.

From 2010 onwards, CySEC, in collaboration with ESMA, began to regulate CFD and Forex brokers more strictly. In 2018, the strict ESMA rules, including leverage restrictions, the prohibition of incentives, and negative balance protection, were fully implemented. One year later, CySEC permanently incorporated these regulations into its own legal framework. In the same year, the sale of binary options to retail clients was also banned.

In recent years, CySEC’s supervisory scope has expanded to include crypto-asset services. The organization acts as the supervisor for anti-money laundering (AML/CFT) regulations for crypto companies in Cyprus, and its rules are aligned with the European MiCA framework.

Why is a CySEC-Regulated Broker a Suitable Choice?

A CySEC-regulated broker is a suitable choice for the following reasons:

Client Protection and Dispute Resolution

In addition to Investor Compensation Fund (ICF) coverage, there is an official channel for handling complaints. You can first file your complaint with the broker itself, and then, if necessary, with the independent Financial Ombudsman of the Republic of Cyprus. This means that in the event of a dispute, you have a real tool to pursue and resolve the issue, not just regulations on paper.

Discipline and Reliable Performance

The presence of stringent requirements such as capital adequacy, segregation of client funds, anti-money laundering (AML) controls, and the confirmation of management qualifications minimizes a broker’s financial and operational risks and ensures their quality and accountability remain consistent.

Transparent Verification

The online CySEC registry allows you to easily verify the license status, authorized services, and official domains of any broker. This tool helps you ensure the authenticity of the broker and its website before making any deposit.

European Standards and Access

CySEC brokers operate under EU supervision and can passport their services to other European countries. This access is typically accompanied by higher operational and regulatory standards.

Duties and Powers of CySEC

CySEC, the Cyprus Securities and Exchange Commission, serves as the capital market regulator for the country. Its primary duties fall into three categories:- Licensing

- Supervision

- Enforcement

Licensing of Financial Firms and Brokers

CySEC issues licenses to Cypriot Investment Firms (CIFs) and specifies exactly which services each company is authorized to provide. This information is published on its public registry. When granting a license, the following are carefully evaluated:- Capital Adequacy: The company’s financial stability is assessed based on its business model (e.g., STP or Market Makers).

- Management: The qualifications and suitability of senior managers (including the CEO, Compliance Officer, and Risk Manager) are reviewed.

- Policies and Procedures: Key policies such as risk management, segregation of client funds, Best Execution of trades, and complaint handling procedures are evaluated.

- Infrastructure: The company’s operational and IT infrastructure, including trading platforms and data storage, is examined.

- Insurance Coverage: Membership in the Investor Compensation Fund (ICF) and the ability to meet reporting requirements are assessed.

Supervision of Trading Transparency and Financial Activities

CySEC enforces the strict implementation of MiFID II/MiFIR regulations and ESMA measures concerning CFDs, which means the following are mandated:- Protective Restrictions: The application of leverage restrictions for retail clients, negative balance protection, and the display of standard risk warnings on the website.

- Reporting: The recording and retention of all transaction and order records.

- Disclosure: Transparency in providing information on fees, conflicts of interest, and execution quality.

- Inspections: Conducting regular audits and specialized reviews in areas such as marketing, anti-money laundering (AML) rules, and segregation of funds.

Enforcement and Investor Protection

In case of a violation, CySEC can take the following actions:- Penalties: Issuing public warnings, imposing fines, or suspending or revoking a license.

- Restrictions: Applying operational limitations, such as halting new client onboarding until deficiencies are rectified.

- Corrective Requirements: Requiring the company to make structural reforms, compensate clients, or undergo an independent audit.

- Public Announcements: Publishing public warnings about unauthorized domains or scams.

Which Companies and Financial Entities Must Have a CySEC License?

CySEC supervises a wide range of capital market participants. Any financial entity that offers investment services from or through Cyprus, in most cases, requires a license or registration with this authority. These entities include:Cypriot Investment Firms (CIFs)

Forex and CFD brokers, and other investment firms that offer services like reception, execution, and transmission of orders, market-making (dealing on their own account), and investment advice, must be licensed by CySEC. Additionally, ancillary services such as the protection of client funds and compliance with anti-money laundering (AML) regulations are also under CySEC supervision. You can search for a list of these companies and their approved domains on the CySEC website.Funds and Asset Managers

UCITS and AIFM companies (fund managers) and the funds themselves are under CySEC supervision.Markets and Trading Platforms

Regulated markets like the Cyprus Stock Exchange and multilateral (MTF) or organized (OTF) trading facilities operating from Cyprus must have a CySEC license.Crowdfunding Service Providers (CSPs)

Crowdfunding platforms for businesses must also be licensed or registered with CySEC.Crypto-Asset Service Providers (CASPs)

Until the full implementation of the MiCA framework in Europe, these companies are registered under domestic CySEC regulations. With the implementation of MiCA, they must obtain the relevant license (until July 2026 for existing registrations).Other Entities

Administrative service providers and certain specialized registries also fall under CySEC’s supervisory umbrella.What is typically not under CySEC supervision?

For proper verification, it is important to know which entities are not supervised by this authority:- The Central Bank of Cyprus supervises payment and electronic money institutions.

- Insurance companies and insurance brokers are under the supervision of the Insurance Companies Control Service (ICCS).

Important Note for Traders and Businesses

Before engaging with any entity, be sure to search for its legal name in the CySEC registry and confirm that its website domain is listed under "approved domains." If your area of activity is related to crypto, also check its CASP status or MiCA license.

Complete Steps for Applying for and Obtaining a CySEC Regulatory License

Obtaining a license from CySEC is a rigorous process that requires thorough preparation. Below, we explain the main steps of this process in a step-by-step manner:- Preparation: First, assemble a specialized team with sufficient knowledge of CySEC regulations and financial services. This team must be able to manage the entire license application process from start to finish.

- Company Incorporation in Cyprus: You must register a legal entity in Cyprus, secure a registered address, and appoint experienced and qualified directors for the company.

- Document Preparation: Prepare a complete set of the required documents. These documents include:

- The official CySEC application form.

- Business plan (including strategy and operational methods).

- Financial statements to prove capital adequacy.

- Identification documents and records for directors and shareholders (KYC).

- Documents related to the professional qualifications of key personnel.

- Explanations of internal controls and risk management.

- Operational procedures for client onboarding, trade execution, and complaint handling.

- Submission and Review: Submit all documents to CySEC. During the review process, CySEC may contact you to request additional information or clarification.

- Interview and Decision: Key personnel from your company will likely be interviewed to assess their understanding of the regulations. Following the final review, CySEC will decide on issuing the license.

Timeline and Important Points

- Timeline: This process typically takes 3 to 6 months.

- Success Factors: To succeed, the documents must be complete and accurate. It is also very important to use professional consultants and maintain transparent communication with CySEC.

- Common Errors: Submitting incomplete documents and ignoring the requirements for capital and necessary infrastructure are common mistakes that cause delays or rejection of the application.

Costs, Documents, and Legal Requirements to Obtain a CySEC Regulatory License

The basic application fee for a CIF license is €7,000 upon document submission. This fee can increase up to €25,000 depending on the type of services requested. (Source: gk-lawfirm)Required Initial Capital

The company’s type of activity determines the minimum initial capital required to obtain a license:- €750,000: For companies that engage in dealing on their own account (market making) or underwriting.

- €75,000: For companies that provide order execution on behalf of clients, portfolio management, or investment advice (provided they do not hold client funds).

- €150,000: For other combined activities not falling into the above two categories.

Annual Fees After Obtaining the License

- Fixed Annual Fee: This amount ranges from €5,000 to €10,000.

- Variable Annual Fee: This fee is calculated based on the company’s turnover, starting at 0.75% for turnover up to €1 million and decreasing as turnover increases.

Fees Related to the Investor Compensation Fund (ICF)

- Membership Requirement: Membership in the ICF is a mandatory prerequisite for maintaining the license.

- Annual Contribution: The formula for calculating the annual contribution is determined by the level of the client’s eligible funds and securities and the quality of the auditor’s report. This rate is typically equivalent to 0.5% of the eligible funds and instruments.

- Fixed Annual ICF Fee: This fee is €700 for members who hold client funds and €100 for other members. (cysec.gov)

Documents and Legal Requirements

To obtain a license, the applicant must meet strict requirements. The most important of these are:- Company Registration and Physical Office: The company must be registered in Cyprus and have a fully operational physical office in the country.

- Organizational Structure: There must be at least three local directors in the physical office. Additionally, specialized staff in areas such as risk management, anti-money laundering (AML), and compliance must be employed on a full-time basis.

- Documents and Procedures: The applicant must provide CySEC with a business plan, internal operational procedures, and AML and risk management policies.

- ICF Membership: All licensed brokers must join the Investor Compensation Fund (ICF).

- Transparency: Applicants must own a dedicated website for online activities. The company’s name, license status, and approved domains are published on the online CySEC registry.

Limitations and Criticisms of CySEC

Although CySEC has tightened its regulations in recent years, it has also faced criticism throughout its history. These criticisms include:

Past Complaints about Binary Options

In the mid-2010s, due to an increase in complaints against binary options brokers, CySEC was criticized for its weak supervision. As a result of this pressure, CySEC developed a “supervisory action plan” and subsequently aligned with ESMA’s measures in Europe. Ultimately, in July 2019, CySEC permanently banned the sale of binary options to retail clients. (Source: karitzis)

Cross-Border Challenges and Subsidiary Companies

Another criticism relates to the circumvention of regulations by subsidiary companies in other countries. Some brokers provided their services through subsidiaries outside the European Economic Area (EEA) to bypass European restrictions (such as leverage limits). A €200,000 fine imposed on a broker by CySEC in 2024 indicates that this remains a significant challenge.

Historical Weakness in Consumer Protection

At the European Union level, concerns were raised regarding the cross-border services of Cypriot companies. This led to the formation of a joint task force, including CySEC, aimed at developing a plan for more stringent supervision of high-risk companies.

Low Compensation Ceiling

The existence of the ICF is a major advantage, but its compensation ceiling is up to €20,000, which may not be sufficient for high-capital investors in the event of a broker’s insolvency.

The Risk of Fake Websites

Despite CySEC’s progress in supervision, unauthorized and fraudulent websites continue to operate by exploiting the names of reputable brands. CySEC continuously publishes lists of approved domains and unauthorized websites, but the responsibility to verify and ensure the website’s authenticity lies with the user.

How to Verify the Credibility of a Broker with a CySEC License

To ensure the credibility of a broker supervised by CySEC, simply follow these steps:

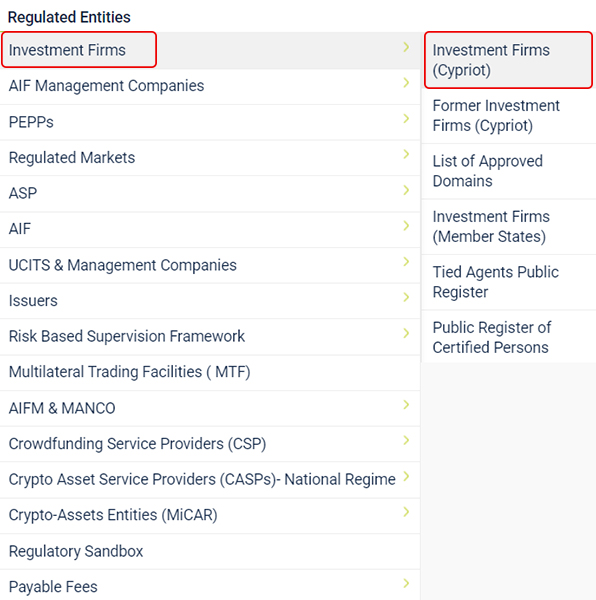

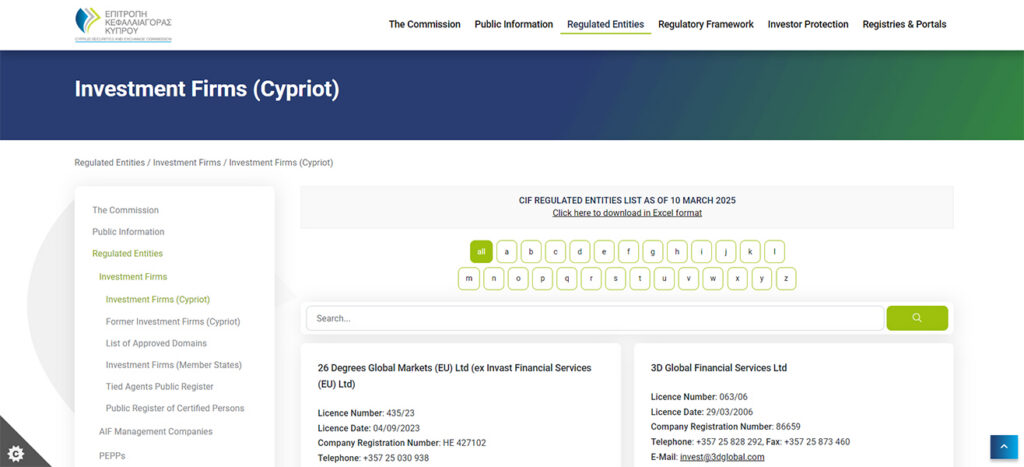

- Check the Company Registry: Go to the official CySEC website and, in the “Regulated Entities” section, navigate to “Investment Firms (Cypriot).” Then, search for the company’s name or license number to access its profile page. On this page, you can check the license status, authorized services, and the company’s official address.

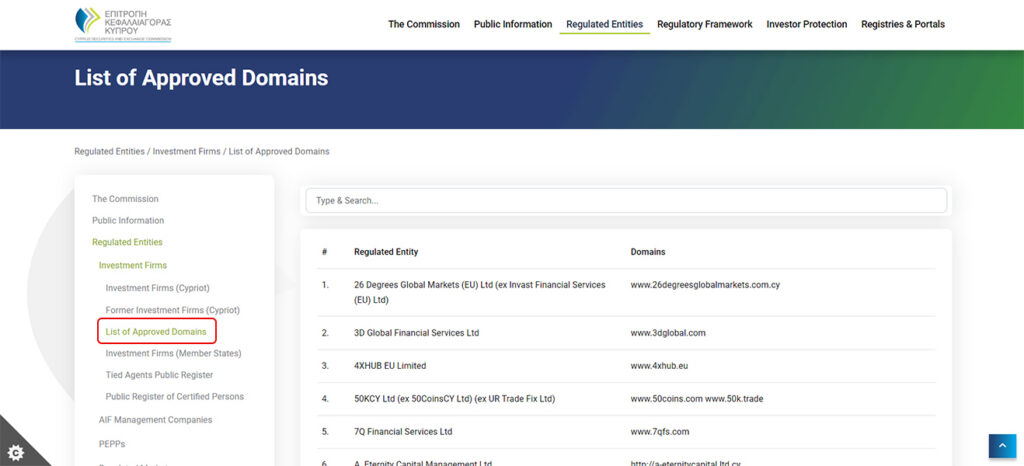

- Verify Authorized Domains: In the same section, go to the “List of Approved Domains.” Cross-reference the domain you intend to use with the official list. Any domain not on this list is considered unauthorized.

- Check CySEC Warnings: CySEC continuously issues warnings about unauthorized domains and fraudulent activities. Always check the list of unauthorized domains and avoid trading on them.

- Cross-Border Verification on ESMA: Check the ESMA Registers to see if the company is registered to provide services in other European countries (EEA). This step confirms that its credibility is also recognized internationally.

- Legal Verification (Optional): For added assurance, you can search for the company’s name or registration number in the Cyprus Company Registry to ensure its information matches the data from CySEC. This step helps you confirm the company’s legal existence.

Comparing CySEC Regulation with Other Regulators

CySEC in Cyprus can be compared with prominent regulators such as the FCA in the UK, ASIC in Australia, and the DFSA in Dubai. Each of these authorities has unique characteristics.

CySEC vs. FCA (UK) Regulation

- Jurisdiction: CySEC is located within the European Economic Area (EEA), and its licensed companies can passport their services to other member states. In contrast, following Brexit, the FCA is outside this region and does not have passporting capabilities.

- Compensation Coverage: CySEC provides coverage of up to €20,000 per retail client through the ICF, while the UK’s FSCS compensates up to £85,000 per person, which is a higher ceiling.

- CFD and Marketing Regulations: Both regulators have imposed strict rules for CFDs, including leverage restrictions, negative balance protection, and a ban on incentives. Additionally, the FCA has prohibited the sale of crypto derivatives to retail clients.

If a higher compensation ceiling and stricter advertising rules are important to you, the FCA is a better option. However, if access to the EU market is a priority, CySEC offers a greater advantage.

CySEC vs. ASIC (Australia) Regulation

- CFD Regulations: Both regulators have established similar rules to limit risk in CFD trading, including leverage caps and negative balance protection.

- Compensation: ASIC has a limited compensation scheme called the CSLR, which, in specific cases, provides coverage up to A$150,000 for certain products. This coverage is not as comprehensive as the ICF. In contrast, the ICF, with its €20,000 ceiling for CySEC-regulated companies, provides more defined coverage.

ASIC focuses on reducing leverage risk and service provider conduct, while CySEC also provides a specific compensation framework (ICF) and the advantage of passporting into the EU.

CySEC vs. DFSA (Dubai) Regulation

- Jurisdiction: The DFSA only supervises financial activities within the DIFC free zone, whereas CySEC is the nationwide regulator of Cyprus, and its companies can operate in other European countries as well.

- Client Protection: The DFSA, instead of a universal compensation fund, focuses on the segregation of client funds in separate accounts. Therefore, there is no automatic payment mechanism similar to CySEC or the FCA.

The DFSA is suitable for activities focused within the DIFC area with a strong emphasis on strict fund segregation, while CySEC is a better option for traders who need statutory compensation coverage and access to EU markets.

Conclusion

Ultimately, if you are looking for European standards, compensation coverage, and data transparency, choosing a broker with a CySEC license seems logical.

Therefore, before making any deposit, be sure to check the following through the official CySEC website:

- The authorized website domain;

- The company’s registration status;

- Warnings related to fraudulent websites.

Additionally, carefully review the rules regarding negative balance protection and leverage.