Investing goes far beyond simply choosing the best stock or asset. What truly matters just as much is the ability to recognize and manage potential risks. A portfolio represents a collection of assets, each with its own volatility and unique characteristics, and together they shape the overall level of risk. Gaining a clear understanding of how to calculate portfolio risk allows you to see how your total investments might be influenced by market fluctuations and what actions can be taken to reduce those risks. If you want to discover the formulas that professionals rely on to measure this risk and learn how to manage it with confidence, stay with us through this article as we explore the Portfolio Risk Formula and step into the different methods one by one.

- Portfolio risk is not the simple sum of individual asset risks; it depends on the correlations among them.

- Several approaches can be used to measure risk. Variance and standard deviation, beta, and Value at Risk (VaR) each highlight different dimensions of risk.

- Portfolio beta provides insight into the portfolio’s sensitivity to the overall market, while VaR focuses on estimating the maximum potential loss.

- The right method for applying the Portfolio Risk Formula depends on the investor’s objectives, market conditions, and individual risk tolerance.

What is Portfolio Risk?

A portfolio is a collection of assets, each carrying its own level of risk. However, when these assets are combined, they behave differently than they would on their own. The overall risk of a portfolio is essentially the volatility of its returns, which can be influenced by two main types of risk:

- Systematic risk;

- Unsystematic risk.

Systematic risk, often called market risk, comes from broad economic factors such as inflation, changes in interest rates, or economic recessions. This type of risk cannot be eliminated through diversification. In contrast, unsystematic risk is tied to the specific conditions of a company or industry and can be reduced by spreading investments across different assets. This is why the total risk of a portfolio is usually lower than the sum of individual asset risks, since different fluctuations can offset one another. Understanding this concept is fundamental for applying the Portfolio Risk Formula and gives investors a clearer view of how market movements might affect their overall capital.

The Difference Between Portfolio Risk and Single-Stock Risk

When you hold only one stock, all the fluctuations and potential problems of that single company directly impact your investment. This type of risk is largely driven by internal or company-specific factors and is referred to as unsystematic risk. In contrast, when you combine several different assets, the situation changes because the performance of those assets is interconnected.

Having a diversified investment portfolio allows potential losses in one stock to be offset by gains in others, which ultimately lowers the overall level of risk. This is why calculating portfolio risk is so important for investors. In most cases, portfolio risk is lower than the sum of the individual risks of each stock, providing a healthier balance between expected returns and the amount of risk being taken.

Portfolio Risk Formula

A clear understanding of overall portfolio risk comes from knowing how each asset contributes to the whole. This requires using mathematical relationships that show how asset weights, the volatility of each asset, and the interactions between them combine to determine total risk. This approach is what is commonly referred to as the Portfolio Risk Formula, and it serves as the foundation for decision-making among professional investors.

Key Components of the Portfolio Risk Formula

To measure portfolio risk, three core elements must be considered: the weight of each asset in the portfolio, the variance of each asset’s returns, and the relationship between assets measured through covariance. The basic variance formula for a two-asset portfolio is:

w₁²σ₁² + w₂²σ₂² + 2w₁w₂Cov₁₂

Here, w represents the weight of each asset within the portfolio, σ² is the variance of that asset, and Cov₁₂ is the covariance between their returns. This equation is a cornerstone of the Portfolio Risk Formula and forms the basis of the Portfolio Risk Formula calculation used in practice.

The Role of Covariance and Correlation

Covariance and correlation define how assets move in relation to one another. If two assets generally move in the same direction, portfolio risk increases. When the relationship is weak or negative, however, part of the volatility cancels out, leading to a reduction in overall portfolio risk.

According to Investopedia, when the correlation between assets is lower, diversification becomes more effective, leading to a meaningful reduction in overall portfolio risk.

Calculating Portfolio Risk with Variance and Standard Deviation

One of the most common ways to measure portfolio risk is through variance and standard deviation, a method rooted in Modern Portfolio Theory (MPT). This approach allows investors to quantify the volatility of portfolio returns in numerical terms. The process begins by calculating the portfolio variance (σₚ²) and then deriving the standard deviation (σₚ).

Steps for calculation:

Start by identifying the weight of each asset (wᵢ), then determine the variance of each asset (σᵢ²) and the covariance between assets (Covᵢⱼ). The formula for portfolio variance is:

σₚ² = Σ(wᵢ²σᵢ²) + ΣΣ(wᵢwⱼCovᵢⱼ)

The standard deviation is simply the square root of the variance, √σₚ².

Example:

Consider a portfolio with two stocks: Stock A has a weight of 0.6 and a standard deviation of 20%, while Stock B has a weight of 0.4 and a standard deviation of 30%. The covariance between them is 0.01. The portfolio variance is calculated as:

(0.6² × 0.04) + (0.4² × 0.09) + (2 × 0.6 × 0.4 × 0.01) = 0.0336

The standard deviation is √0.0336 ≈ 18.33%.

This method demonstrates how diversification lowers overall risk, making the total portfolio risk less than the average of the individual assets.

Calculating Portfolio Risk with Beta (β)

A straightforward way to gauge how the market influences overall returns is by using the beta coefficient. Beta tells investors how sensitive a portfolio is to changes in market indexes, which makes it an important part of the Portfolio Risk Formula.

Definition of Beta and Its Link to Systematic Risk

Beta measures how much an asset or an entire portfolio responds to market movements. A beta of 1 indicates that the portfolio moves in line with the market. A beta greater than 1 suggests higher volatility than the market, while a beta below 1 signals smoother, less volatile movements. Since beta reflects systematic risk, it cannot be eliminated through diversification, but understanding it enables investors to make more informed choices.

How to Calculate Portfolio Risk Using Weighted Average Beta

The portfolio beta is calculated using the weighted average of individual asset betas:

βₚ = Σ (wᵢ × βᵢ)

Here, wᵢ represents the weight of each asset, and βᵢ is the beta of that asset.

Example:

Suppose a portfolio contains two stocks. Stock A has a weight of 0.7 with a beta of 1.3, and Stock B has a weight of 0.3 with a beta of 0.9. The portfolio beta is:

(0.7 × 1.3) + (0.3 × 0.9) = 0.91 + 0.27 = 1.18

This result shows that the portfolio is slightly more volatile than the overall market.

Calculating Portfolio Risk with Value at Risk (VaR)

To measure investment risk more precisely, analysts often use Value at Risk, or VaR. This metric estimates the maximum potential loss a portfolio might face within a specific time frame and at a chosen confidence level. Understanding VaR gives investors a clearer picture of potential downside scenarios and plays an important role in overall risk management.

Introduction to VaR and Its Role in Risk Management

VaR represents the maximum expected loss of a portfolio at a given confidence level, such as 95%, over a defined period. For example, a one-day VaR of $100,000 at 95% confidence means there is only a 5% chance that the portfolio could lose more than $100,000 in a single day. This helps investors prepare for unfavorable conditions by quantifying risk in clear terms.

Methods for Calculating VaR

There are three primary approaches to calculating VaR:

- Parametric (Variance-Covariance): Uses the mean and standard deviation of returns under the assumption of normal distribution to estimate possible losses.

- Historical Method: Relies on past return data to show how the portfolio would have performed under similar market conditions.

- Monte Carlo Simulation: Creates thousands of random scenarios based on statistical models to simulate the probability distribution of potential losses.

Each method provides a different lens through which the Portfolio Risk Formula can be applied to assess downside exposure.

According to QuantInsti, methods of measuring risk such as VaR or beta fit within the broader risk–return framework and allow for more precise control over potential losses.

Tools for Calculating Portfolio Risk

To gain a clearer picture of potential risks in investing, a variety of tools are available, useful both for beginners and for more advanced investors. Each tool provides a simpler or more sophisticated way to perform a Portfolio Risk Formula calculation.

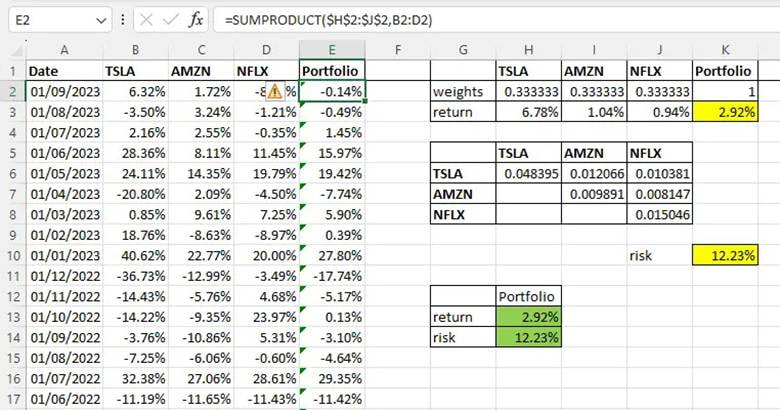

Excel

In Excel, functions such as VAR.S for variance and COVARIANCE.S for covariance can be used to build a variance–covariance matrix. By combining these with functions like SQRT and SUMPRODUCT, investors can calculate portfolio risk and get a precise view of asset volatility using their own data.

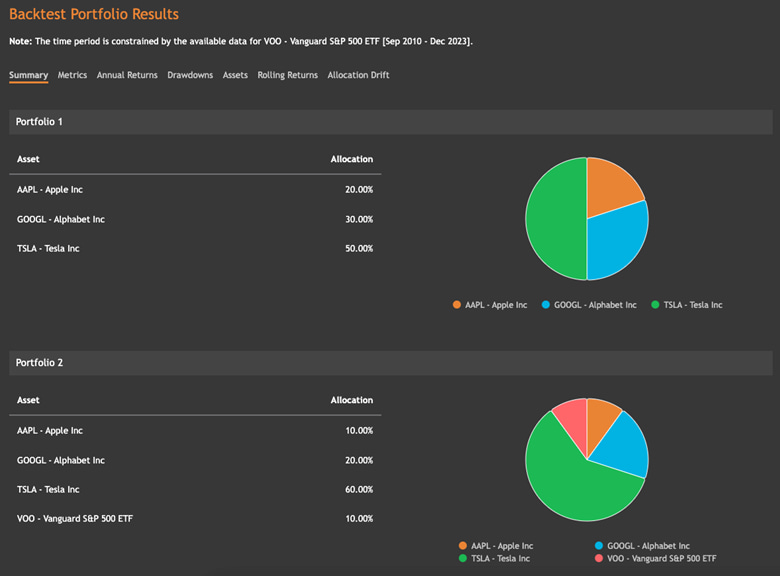

Financial Software and Platforms

For more advanced analysis, tools like MATLAB or platforms such as Portfolio Visualizer are widely used. These solutions support simulations, advanced optimization, and complex modeling, making them valuable for investors who require deeper insights and detailed portfolio risk assessments.

Online Calculators

Websites that offer financial calculators allow investors to quickly estimate metrics such as VaR or portfolio variance without doing the math manually. Reputable resources like Investopedia provide user-friendly calculators that help transform theory into practical results with just a few inputs.

Factors Affecting Portfolio Risk

Many elements influence the level of risk in investing, and understanding them helps investors make more informed decisions. Three of the most important factors are outlined below:

Asset Diversification and Number of Holdings

The more assets and stocks included in a portfolio, the lower the overall risk tends to be. Losses from one stock can be offset by gains from another. This principle, known as portfolio diversification, is one of the core foundations of effective investment management.

Correlation Between Assets

The correlation coefficient (ρ) measures how returns move in relation to one another. Lower or negative correlations reduce portfolio risk, since assets that behave independently can balance each other out. For instance, technology stocks and government bonds often show low correlation.

Market Conditions and Macroeconomic Volatility

External factors such as inflation, interest rate changes, or economic crises influence systematic risk. These factors, represented in the Portfolio Risk Formula through covariance, affect nearly all assets in the market and cannot be eliminated through diversification.

Conclusion

Risk assessment is more than just a numerical exercise; it is a way to bring clarity and foresight to the investment journey. When you know how much your portfolio could lose in the worst-case scenario, your decisions become more grounded and realistic. This awareness allows you not only to seize opportunities in the market but also to be prepared for periods of heightened volatility.

Focusing on the Portfolio Risk Formula shifts your perspective beyond impulsive choices and toward building a strategy aligned with your personal goals and risk tolerance. Ultimately, being a professional investor is not about predicting every outcome but about managing and controlling how those outcomes impact your overall capital.